Professional Documents

Culture Documents

Ir 1121 e

Uploaded by

adamlin6Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ir 1121 e

Uploaded by

adamlin6Copyright:

Available Formats

[Completed application form can be faxed to 2519 6896 or posted to P.O.

Box 28487, Gloucester Road Post Office, Hong Kong]

Enquiry Hotline: 187 8011

Application for Holdover of 2016/2017 Provisional Tax

To: Commissioner of Inland Revenue

File No.: Date:

Charge No.: Postal Address:

Due Date :

Day-time Contact Tel. No.:

I apply for holdover of provisional tax for the year of assessment 2016 / 2017 on the following grounds:

Salaries Tax

1 . a. Income received by me from April 2016 to ____________ (end of last month) $___________________

b. Estimated income to be received by me from ___________ (current month) to March 2017 $___________________

(Note 1)

Estimated total income for the year 2016/17 $ _________________ _

c. Reasons for reduction : Unemployed / retired / salary reduction / others (please specify )*

2 . I claim Married Persons Allowance as I was married on and my spouse has no income from

employment during the year. Name and Hong Kong Identity Card No. of spouse are : .

3 . I claim allowance(s) for the following dependant(s), which has / have NOT been granted in the notice for payment of

provisional salaries tax and I understand that my spouse / relative has not claimed such allowance(s)

Child / Dependent Brother or Dependent Sister Allowance

Name (in BLOCK letters) Date of Birth Relationship

Dependent Parent/Grandparent Allowance Name (in BLOCK letters) Date of Birth HK Identity Card No.

Residing with me

NOT residing with me

4 . I claim Disabled Dependant Allowance in respect of the dependant who is eligible to claim an allowance under the

Governments Disability Allowance Scheme during the year -

Name of dependant: Relationship: Spouse / Child / Parent / Grandparent / Brother / Sister*

5 . I claim Elderly Residential Care Expenses -

a. Full name of parent / grandparent :

b. Hong Kong Identity Card Number of parent / grandparent :

c. Estimated elderly residential care expenses for the parent / grandparent for the year : $

6 . I claim Home Loan Interest - Self Spouse

a. Location of Property: (see Note 2 below)

b. Estimated total interest payments on property from 1 April 2016 to 31 March 2017 $ $

(Note 1)

Property Tax

My property has been/ will be vacant / self-occupied / let with rent reduction / sold*.

The estimated rental income received for the period from 1 April 2016 to 31 March 2017 is $ .

Property address:

Profits Tax (Note 1)

The estimated profits for the year is $ / The business has already ceased or will cease during the year

(the date of cessation is )*.

(Please attach draft certified accounts and a tax computation for the above period.)

Supplementary information:

Note 1 : Apart from cessation of employment, business or property ownership during the year, to be eligible for holdover of

provisional tax, the estimated income / profits / rental income must be less than 90% of that previously assessed.

Note 2 : If you are nominated by your spouse to

claim Home Loan Interest deduction, your

spouse must sign here to indicate agreement.

Signature of Applicant: Signature of spouse:

Name of Applicant: Name of spouse:

* Please delete where inappropriate Please tick the appropriate box

The Department will use the information provided by you for tax purposes and may give some of the information to other parties authorized by law to receive it. Except where there is an

exemption provided under the Personal Data (Privacy) Ordinance, you have the right to request access to and correction of your personal data. Such request should be addressed to the

Assessor.

IR1121 (7/2013)

You might also like

- Innocent Spouse Relief: How You May Not Have To Pay Your Taxes!From EverandInnocent Spouse Relief: How You May Not Have To Pay Your Taxes!No ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- US Internal Revenue Service: f2350 - 1992Document2 pagesUS Internal Revenue Service: f2350 - 1992IRSNo ratings yet

- US Internal Revenue Service: f2350 - 2001Document3 pagesUS Internal Revenue Service: f2350 - 2001IRSNo ratings yet

- US Internal Revenue Service: f2350 - 1999Document2 pagesUS Internal Revenue Service: f2350 - 1999IRSNo ratings yet

- PHFA Housing Assistance FormDocument5 pagesPHFA Housing Assistance FormPedro G. SotoNo ratings yet

- US Internal Revenue Service: f2350 - 2003Document3 pagesUS Internal Revenue Service: f2350 - 2003IRSNo ratings yet

- US Internal Revenue Service: f2350 - 2002Document3 pagesUS Internal Revenue Service: f2350 - 2002IRSNo ratings yet

- AX Rganizer: File Your Taxes in Just Simple Steps!Document9 pagesAX Rganizer: File Your Taxes in Just Simple Steps!Anonymous Lwhi0VzNo ratings yet

- Form of Application For Final Payment of Genmeral Provident Fund BalanceDocument7 pagesForm of Application For Final Payment of Genmeral Provident Fund Balancegggsss57No ratings yet

- US Internal Revenue Service: fw4 - 1993Document2 pagesUS Internal Revenue Service: fw4 - 1993IRSNo ratings yet

- Tab Banking Form With Income Undertaking11111Document5 pagesTab Banking Form With Income Undertaking11111Mahakaal Digital Point100% (1)

- Declaration For InvestmentsDocument6 pagesDeclaration For InvestmentsAnonymous EkFiHy0QoNo ratings yet

- Tenant Application FormDocument6 pagesTenant Application Formogey oNo ratings yet

- Investment and tax saving proofs for 2017-18Document5 pagesInvestment and tax saving proofs for 2017-18vishalkavi18No ratings yet

- Rent 1: - Claim For Rent Relief For Private Rented AccommodationDocument4 pagesRent 1: - Claim For Rent Relief For Private Rented AccommodationvkabatchNo ratings yet

- Financial Affidavit BlankDocument10 pagesFinancial Affidavit BlankNicole FloresNo ratings yet

- Tax Credit Claim Form 2018: For Donation Claims OnlyDocument2 pagesTax Credit Claim Form 2018: For Donation Claims OnlyasdfNo ratings yet

- Tax Savings Declaration Form 2010-11Document1 pageTax Savings Declaration Form 2010-11Priyanka KhemkaNo ratings yet

- US Internal Revenue Service: f2350 - 1996Document2 pagesUS Internal Revenue Service: f2350 - 1996IRSNo ratings yet

- Individual Tax Filing Guide for 2017Document8 pagesIndividual Tax Filing Guide for 2017deejay217No ratings yet

- Circular Ay 2010 11Document4 pagesCircular Ay 2010 11shaitankhopriNo ratings yet

- AST EST Niversity Fall 2020: A F F ADocument4 pagesAST EST Niversity Fall 2020: A F F ATanvir ChowdhuryNo ratings yet

- Bond Refund FormDocument2 pagesBond Refund FormJofamu100% (1)

- AVM Tax-Individual Tax Notes 2016Document8 pagesAVM Tax-Individual Tax Notes 2016asgaarrrNo ratings yet

- Time For TaxDocument108 pagesTime For TaxCj johnson100% (1)

- Application For Permanent Account Number (Pan) : IndividualsDocument3 pagesApplication For Permanent Account Number (Pan) : IndividualsBharat PangeniNo ratings yet

- DR602-A Affidavit of IncomeDocument3 pagesDR602-A Affidavit of IncomeRyan Tsubasa RivasNo ratings yet

- The Branch Manager, Bank of Baroda,: Loan Application Form For Baroda AshrayDocument6 pagesThe Branch Manager, Bank of Baroda,: Loan Application Form For Baroda AshrayNitin BhatnagarNo ratings yet

- 656 Offer in Compromise: Attach Application Fee and Payment Here. IRS Received DateDocument4 pages656 Offer in Compromise: Attach Application Fee and Payment Here. IRS Received DateRonell D. MooreNo ratings yet

- INCOME TAX DECLARATIONDocument6 pagesINCOME TAX DECLARATIONSandeep KatrevulaNo ratings yet

- Full Name of Party Filing Document Mailing Address (Street or Post Office Box) City, State and Zip Code Telephone Email AddressDocument16 pagesFull Name of Party Filing Document Mailing Address (Street or Post Office Box) City, State and Zip Code Telephone Email AddressfreeNo ratings yet

- Tax Investments Format 2010-11Document2 pagesTax Investments Format 2010-11mcnavineNo ratings yet

- Life Certificate for PensionersDocument6 pagesLife Certificate for PensionersVenkateswarlu YadavalliNo ratings yet

- Form11 PDFDocument36 pagesForm11 PDFAashkaNo ratings yet

- 133304Document3 pages133304Sharon Downing OstremNo ratings yet

- IRS Form 1040 Return DelinquencyDocument2 pagesIRS Form 1040 Return DelinquencyCh StoneNo ratings yet

- Great American Forms FILL OUT 2020Document2 pagesGreat American Forms FILL OUT 2020Max Power100% (1)

- NatWest Current Account Application Form Non UK EU ResDocument17 pagesNatWest Current Account Application Form Non UK EU ResL mNo ratings yet

- f1040 DFTDocument3 pagesf1040 DFTCNBC.com100% (1)

- NF1845 NRI Account Opening FormDocument6 pagesNF1845 NRI Account Opening FormpowargauravNo ratings yet

- Financial StatementDocument10 pagesFinancial Statementmike.david1306No ratings yet

- PDF FileDocument2 pagesPDF FileRowena PiniliNo ratings yet

- Fillable W-8BEN 2023Document2 pagesFillable W-8BEN 2023marioNo ratings yet

- Tenancy Application Form: 1. To Be Completed by Letting Agent OnlyDocument5 pagesTenancy Application Form: 1. To Be Completed by Letting Agent OnlyCarolinaMoisaNo ratings yet

- Form of Application For Final Payment of General Provident Fund BalanceDocument6 pagesForm of Application For Final Payment of General Provident Fund BalanceSurampudi Adivenkata RamanaNo ratings yet

- Floating Rate Saving BondDocument6 pagesFloating Rate Saving Bondmanoj barokaNo ratings yet

- Failure To Provide Bank Account Details May Result in A Delay in Your RefundDocument2 pagesFailure To Provide Bank Account Details May Result in A Delay in Your RefundTerry Lollback100% (2)

- 2019 TaxReturn PDFDocument6 pages2019 TaxReturn PDFdavid barrow100% (2)

- Investment Proof Submission Form23 24Document6 pagesInvestment Proof Submission Form23 24Bindu madhaviNo ratings yet

- Withdrawal Great American Life FormsDocument13 pagesWithdrawal Great American Life FormsMax PowerNo ratings yet

- Installment Plan Application 2019Document1 pageInstallment Plan Application 2019SSNo ratings yet

- ONGC House Building Advance FormDocument3 pagesONGC House Building Advance Formrahul100% (1)

- HLF058 Bvs-Da V03Document1 pageHLF058 Bvs-Da V03James CaberaNo ratings yet

- Tax credit claim form guideDocument2 pagesTax credit claim form guideVivian KongNo ratings yet

- EWU Financial Aid Application GuideDocument4 pagesEWU Financial Aid Application GuideAreef Mahmood IqbalNo ratings yet

- Adjustment of Status ChecklistDocument7 pagesAdjustment of Status ChecklistSteve MacarioNo ratings yet

- How To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreFrom EverandHow To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreNo ratings yet

- 04 Income Expense ForecastDocument1 page04 Income Expense Forecastadamlin6No ratings yet

- Arup Appraisal GuideDocument18 pagesArup Appraisal Guideadamlin6No ratings yet

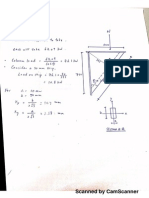

- Project Calcs For Design Data Of: Calculation SheetDocument1 pageProject Calcs For Design Data Of: Calculation Sheetadamlin6No ratings yet

- Statistical Analysis of Test ResultsDocument5 pagesStatistical Analysis of Test Resultsadamlin6No ratings yet

- PLGC SunMyungMoon 0911Document372 pagesPLGC SunMyungMoon 0911adamlin6No ratings yet

- Foundation Code 2017Document111 pagesFoundation Code 2017Cheung Lee100% (1)

- 04 - Tender & Contract Documents - Q&ADocument21 pages04 - Tender & Contract Documents - Q&Aadamlin6No ratings yet

- Foundation Code 2017Document111 pagesFoundation Code 2017Cheung Lee100% (1)

- Bearing Capacity of FootingDocument1 pageBearing Capacity of Footingadamlin6No ratings yet

- CH17 - Welding For Site 2Document1 pageCH17 - Welding For Site 2adamlin6No ratings yet

- 382 HT Formwork DesignDocument16 pages382 HT Formwork Designadamlin6No ratings yet

- Ram SetsDocument32 pagesRam Setsadamlin6No ratings yet

- Stiffner LoadingDocument1 pageStiffner Loadingadamlin6No ratings yet

- 1996 0001Document1 page1996 0001adamlin6No ratings yet

- Scheduled Are As 3 ADocument9 pagesScheduled Are As 3 Aadamlin6No ratings yet

- Img-703173253 (Commented by HTA)Document1 pageImg-703173253 (Commented by HTA)adamlin6No ratings yet

- Ho Tin & Associates:, Filename: D:/Adam/11071.Tel Graphical Results - LD Case 2 Dead Load EngineerDocument1 pageHo Tin & Associates:, Filename: D:/Adam/11071.Tel Graphical Results - LD Case 2 Dead Load Engineeradamlin6No ratings yet

- Oust An Ding IssuesDocument1 pageOust An Ding Issuesadamlin6No ratings yet

- Condition Classification For New GST ConditionsDocument3 pagesCondition Classification For New GST ConditionsVenugopal PNo ratings yet

- CHAPTER 16-Inventories: Far SummaryDocument3 pagesCHAPTER 16-Inventories: Far SummaryFuturamaramaNo ratings yet

- Costco - Supplier Code of ConductDocument6 pagesCostco - Supplier Code of ConductalmariveraNo ratings yet

- Exploring The Experiences of Digital Native Entrepreneurs Participating in Online BusinessDocument87 pagesExploring The Experiences of Digital Native Entrepreneurs Participating in Online BusinessAlyssa May LaydaNo ratings yet

- India's Central Bank Reserve Bank of India Regional Office, Delhi, Foreign Remittance Department. New Delhi: 110 001, India, 6, Sansad MargDocument2 pagesIndia's Central Bank Reserve Bank of India Regional Office, Delhi, Foreign Remittance Department. New Delhi: 110 001, India, 6, Sansad MargvnkatNo ratings yet

- Starbucks PDFDocument14 pagesStarbucks PDFanimegod100% (1)

- Barilla-SpA CaseStudy Short Reaction PaperDocument3 pagesBarilla-SpA CaseStudy Short Reaction Papersvk320No ratings yet

- T I C A P: HE Nstitute of Hartered Ccountants of AkistanDocument2 pagesT I C A P: HE Nstitute of Hartered Ccountants of AkistanaskermanNo ratings yet

- HR offer letter for Systems Engineer role at InfosysDocument10 pagesHR offer letter for Systems Engineer role at InfosysAtul SharmaNo ratings yet

- 80957667-Dissertation MSC DFSMDocument98 pages80957667-Dissertation MSC DFSMSanjay JamwalNo ratings yet

- Contract Close-OutDocument3 pagesContract Close-OutParents' Coalition of Montgomery County, MarylandNo ratings yet

- Lgu Naguilian HousingDocument13 pagesLgu Naguilian HousingLhyenmar HipolNo ratings yet

- DRT Rules. Forms - 2015Document30 pagesDRT Rules. Forms - 2015Sumit SrivastavaNo ratings yet

- 02062019105858t13pdxmwzeiag20kby Estatement 052019 997 PDFDocument3 pages02062019105858t13pdxmwzeiag20kby Estatement 052019 997 PDFNikhil KumarNo ratings yet

- Incoterms QuestionsDocument6 pagesIncoterms Questionsndungutse innocent100% (1)

- Assessment Information Plan WorkshopDocument4 pagesAssessment Information Plan WorkshopLubeth CabatuNo ratings yet

- Rotisserie Affair Deli Marketing PlanDocument41 pagesRotisserie Affair Deli Marketing PlanAri EngberNo ratings yet

- EMBMDocument14 pagesEMBMapi-19882665No ratings yet

- Cathay Pacific v. VasquezDocument2 pagesCathay Pacific v. Vasquezrgtan3No ratings yet

- BSC Hospital 1Document24 pagesBSC Hospital 1sesiliaNo ratings yet

- Pizza BillDocument2 pagesPizza BillManjunatha APNo ratings yet

- MS CAL Licensing Cheat SheetDocument1 pageMS CAL Licensing Cheat SheetbitoogillNo ratings yet

- Emerson Electric Financial Statement AnalysisDocument6 pagesEmerson Electric Financial Statement Analysismwillar08No ratings yet

- Consumers Research MethodsDocument20 pagesConsumers Research MethodsEunice AdjeiNo ratings yet

- SCM Presentation - Improving Warehouse Operations DigitallyDocument17 pagesSCM Presentation - Improving Warehouse Operations DigitallyvaisakhgokulNo ratings yet

- Understanding Hotel Valuation TechniquesDocument0 pagesUnderstanding Hotel Valuation TechniquesJamil FakhriNo ratings yet

- Sesi 14 - Pemodelan Berbasis Agen - 2Document20 pagesSesi 14 - Pemodelan Berbasis Agen - 2nimah tsabitahNo ratings yet

- Eligibility of Claiming Input Tax Credit on Imported Stock under GSTDocument5 pagesEligibility of Claiming Input Tax Credit on Imported Stock under GSTUtkarsh KhandelwalNo ratings yet

- CRM of HardeesDocument6 pagesCRM of Hardeeshamza_butt88No ratings yet

- Denali Investors Partner Letter - 2014 Q2Document6 pagesDenali Investors Partner Letter - 2014 Q2ValueInvestingGuy100% (1)