Professional Documents

Culture Documents

Solar Water Heater Installation in GAP' Housing: The Business Case

Uploaded by

Cassandra StapelbergOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solar Water Heater Installation in GAP' Housing: The Business Case

Uploaded by

Cassandra StapelbergCopyright:

Available Formats

Solar Water Heater

Installation in GAP Housing:

the business case

__________________________________________________________________________

Introduction

Solar water heaters (SWHs) are one of the most viable energy efficiency technologies in the country. Many

municipalities have set household SWH targets within their energy and climate change strategies. But

implementation remains a challenge.

New developments, where the choice can be made between installing a SWH instead of a traditional electric

geyser, provide a particularly good opportunity for installation of SWHs. Under the current electricity prices, with

a 15-20% discount on the units from Eskom DSM and a creative financing scheme, SWHs can be installed at no

or very little additional cost to the end user.

The business scenarios in this study make the case for installing 150l SWHs in place of 150l geysers in GAP

housing developments in South Africa. A SWH will typically reduce household water heating electricity use by

40-60%. This, along with the offsetting of the SWH cost with that of the traditional geyser and the Eskom

subsidy, enables the combined cost of the monthly bond repayment and electricity payments under the SWH

scenario to be less than that under a conventional geyser scenario and ensures feasibility of the intervention.

Three scenarios are presented. Each scenario will be implemented by a SWH Implementing Agent (IA) who

will pull together financing, SWH technology and plumbers/installers and present an attractive monthly

repayment option to the end user.

Cities have an important catalysing role. They can strongly encourage developers/banks of municipal housing

projects to adopt the model and support the development of local SWH Implementing Agents.

Although the business case stands as is, additional subsidies may also make the various scenarios more

attractive. Municipalities could seek donor funding for this, or encourage business to establish a trust fund that

would support SWH installation and explore possible ways of generating BEE points to incentivize such

schemes.

Scenario 1: Developer/Bank as Implementing Agent: The SWH is included in the development (in place of

the traditional geyser) and added to the clients home loan.

Scenario 2: Not for Profit Organization as Implementing Agent: the IA (in this case a not for profit

organization) co-ordinates the financing and installation of SWHs. The bank contributes the amount it would

have paid for provision and installation of an electric geyser towards the SWH (i.e. bond unchanged as per

standard GAP house).Attractive development financing is applied by the IA. Additional benefits for low income

household energy poverty alleviation also come from this scenario.

Scenario 3: Private Business as Implementing Agent: The IA co-ordinates the financing and installation of

SWHs. The bank contributes the amount it would have paid for provision and installation of an electric geyser

towards the SWH (i.e. bond unchanged as per standard GAP house). Attractive short term financing is applied

by the implementing agent.

Sustainable Energy Africa 1

All three scenarios will result in more sustainable GAP housing development projects and contribute to municipal

electricity conservation.

Ekurhuleni get SWH models moving

Ekurhuleni Metropolitan Municipality (EMM) has been working, through its Electricity and Energy

department, to get a SWH mass implementation mechanism established. To this end they have developed,

and are soon to release, a Request for Proposals (RFP) which will facilitate the establishment of private (city

endorsed) SWH implementing agents, who will provide attractive financed SWH solutions to homeowners.

Within its Environmental department an opportunity to use Danida Urban Environmental Management

Programme funds to fit 2000 new-build GAP houses in Albert Luthuli has been identified. The housing

project is being developed by ABSA bank.

EMM would like to see this funding opportunity as a chance to support and catalyse the service delivery

mechanism being pursued at the broad municipal level. This process is currently in progress.

Assumptions for Business Model

Electricity rates are based on the July 2008 rates for Ekurhuleni Metropolitan Municipality (EMM) of

R0.62/kWh including VAT. These rates are comparable to other cities around the country.

Electricity savings per year are calculated given that the cost of electricity to run a SWH is approximately

60% of the cost of electricity to run an electric geyser.

The SWH cost of R11094 is an average of the 150 litre vacuum tube SWHs from Eskoms Solar Water

Heating Accredited Suppliers List retrieved from

http://www.eskomdsm.co.za/sites/default/files/u1/Accredited_participating_suppliers_list.pdf.

The electric geyser cost of R4500 was determined in discussions with the EMM Housing Department

and is based on a high pressure 150 litre tank.

Sustainable Energy Africa 2

Scenario 1: Developer/Bank as implementing Agent

In this scenario the bank will include the additional cost of a SWH into the bond. The end user will experience

additional monthly repayments on the bond, but a significant decrease in monthly electricity costs. Viewed from

this perspective, the end user realizes overall monthly savings from year 2 onwards, while the bank benefits from

larger bond repayments.

Scenario 1a: No additional subsidy

This scenario is applicable for cities that have no access to additional funding. Although the electricity savings

per year do not exceed the SWH payments (i.e. higher bond repayment) until year two, it only costs an additional

R10.5 per month for that first year. It is not until the second year that the electricity savings surpass the financing

payments, resulting in a savings of R9/month.

Combined capital and operating costs for a SWH and an electric geyser for

low to mid income households with financed payments

(no city subsidy)

30,000

Cum Rands paid (discounted)

25,000

20,000

15,000

10,000

5,000

0

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19

Year

Electric geyser financed SWH financed

Assumptions: SWH system costs R11094 installed (after Eskom subsidy), based on a 150 litre vacuum tube

SWH. 150 litre Electric geyser system costs R4500. Both are financed over 20 years @ 12% p.a. An electricity

price increase of 10% p.a. is used, along with a discount rate of 20%. The cost of electricity is based on low-

usage residential supplies.

Sustainable Energy Africa 3

Scenario 1b: GAP houses equipped with SWHs with R3500 per unit municipal (donor)

subsidy

This scenario proposes that 150l SWHs be installed utilizing a municipal subsidy of R3500 per unit.

The bond required will increase by R3094 (the cost of an electric geyser subtracted from the new cost of a

SWH), but the electricity savings per year are R1361 and immediately exceed the financing payments of R1017

for this portion of the bond, resulting in savings of R344 for the first year.

Combined capital and operating costs for a SWH and an electric geyser for

low to mid income households with financed payments

and an additional R3500 subsidy

30,000

Cum Rands paid (discounted)

25,000

20,000

15,000

10,000

5,000

0

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19

Year

Electric geyser financed SWH financed

Assumptions: SWH system costs R7594 installed (after Eskom and municipal subsidies), based on a 150 litre

vacuum tube SWH. 150 litre Electric geyser system costs R4500 Both are financed over 20 years @ 12% p.a.

An electricity price increase of 10% p.a. is used, along with a discount rate of 20%. The cost of electricity is

based on low-usage residential supplies.

Sustainable Energy Africa 4

Scenario 2: Not for Profit Company as Implementing Agent

This business model has been put forward by Enerkey Solutions (ES), a Section 21 Company (not for profit)

which is focusing on implementing solutions which emerge from the Enerkey project, a combined energy

research/implementation project with the Cities of Ekurhuleni, Tshwane and Joburg, the University of

Johannesburg, Eskom, CSIR and German partners. ES has access to development funding which is interest

free for the first five years. This benefit can be directly passed onto the end user of the SWH. ES plans to use

any profit from repayments to finance low income household energy efficiency solutions, focusing primarily on

safe and clean-burning stoves.

ES will install the SWHs at their expense. The bank will provide a standard home loan including the cost of an

electric geyser. However, this additional amount will be paid over to ES as loan finance towards the capital cost

of the SWH. The bank will collect the monthly repayment for the SWH on behalf of Enerkey Solutions for the first

5 years, and pass it on. This monthly payment will equal the electricity saved by the SWH.

Scenario 2a: GAP houses equipped with SWHs with interest free payments for the first

five years of financing with no additional subsidy

This scenario is financially viable to both the homeowner and Implementing Agent. The monthly payments for

the first five years will equal the savings in electricity. Beginning in year 6, payments will be made on the

principle for the SWH until year 20. These payments (R269 in year 6) are immediately less than the electricity

savings per year (R881), resulting in a savings of R611 to the homeowner for that year. The most substantial

difference that results in this case is that the financing takes the full 20 years to be completed and the

Implementing Agent does not receive the full return on investment until then.

Combined capital and operating costs for a SWH and an electric geyser for

low to mid income households with interest free payments for the first 5 years

(no additional subsidy)

25,000

Cum Rands paid (discounted)

20,000

15,000

10,000

5,000

0

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19

Year

Electric geyser financed SWH financed

Sustainable Energy Africa 5

Assumptions: SWH system costs R11094 installed (after Eskom subsidy), based on a 150 litre vacuum tube

SWH, and is financed from years 6 to 20 @ 12% p.a. 150 litre Electric geyser system costs R4500 and is

financed over 20 years at 12%p.a. An electricity price increase of 10% p.a. is used, along with a discount rate of

20%. The cost of electricity is based on low-usage residential supplies.

Sustainable Energy Africa 6

Scenario 2b: GAP houses equipped with SWHs with interest free payments for the first

five years of financing with additional R2500 subsidy per unit

For this case, the SWH will have been paid for upon completion of the first five years, and no payments will have

to been made for years 6 through 20. For this model R1000 from the initial 5 year repayment was taken to fund a

clean fuel stove, and will be recovered in the final bonded amount.

This scenario uses a subsidy of R2500 per household. The balance will be used by ES for business plan

development, awareness raising and marketing and M and E. With this R2500 rand, a household is able to use

the savings in electricity to pay off the SWH in the five years of interest free payments, and incurs an electricity

savings of R666 in the final year. Electricity savings per year (R881) will immediately benefit the owner in year

six.

Combined capital and operating costs for a SWH and an electric geyser for

low to mid income households with interest free payments for the first 5 years

(includes additional R5 million subsidy)

30,000

Cum Rands paid (discounted)

25,000

20,000

15,000

10,000

5,000

0

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19

Year

Electric geyser financed SWH financed

Assumptions: SWH system costs R8594 installed (after Eskom and municipal subsidies), based on a 150 litre

vacuum tube SWH, and is financed from years 6 to 20 @ 12% p.a. 150 litre Electric geyser system costs R4500

and is financed over 20 years at 12%p.a. An electricity price increase of 10% p.a. is used, along with a discount

rate of 20%. The cost of electricity is based on low-usage residential supplies.

Sustainable Energy Africa 7

Scenario 3: Private business as implementing agent

This business model is based on a private company sourcing financing and coordinating the installation of the

2000 SWHs. The bank will provide a standard home loan including the cost of an electric geyser; however, this

additional cost will have been paid to the implementing agent to reduce the capital cost of the SWH. The

implementing agent will add 10% to the capital cost of the SWH in order to make a profit.

Scenario 3a: Gap houses equipped with SWHs with no additional subsidy, 10% profit,

financing at 12%

This scenario is still financially viable to the homeowner and to an Implementing Agent even where an additional

subsidy is not available. The only difference is that financing is completed over 11 years rather than 5 years

where the subsidy is included, making the case less attractive to both parties. The savings in electricity are

R1361 for the first year, exceeding the financing payments of R1162 and resulting in a savings of R63 for that

year.

Combined capital and operating costs for a SWH and an electric geyser for

low to mid income households with financed payments at 12% p.a. and no

additional subsidy (10% profit)

30,000

Cum Rands paid (discounted)

25,000

20,000

15,000

10,000

5,000

0

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19

Year

Electric geyser financed SWH financed

Assumptions: SWH systems cost R11094 installed (after Eskom subsidy), based on a 150 litre vacuum tube

SWH, 150, financed over 14 years @ 12% p.a. 150 litre electric geyser system costs R4500, financed on bond

over 20 years at 12%p.a. An electricity price increase of 10% p.a. is used, along with a discount rate of 20%.

The cost of electricity is based on low-usage residential supplies.

Sustainable Energy Africa 8

Scenario 3b: GAP houses equipped with SWHs with R3500 municipal subsidy, 10%

profit, financing at 12%

The R7 million municipal subsidy is included. This scenario is appealing to both the homeowner and the SWH

supplier since the financing can be completed over 5 years. Immediate savings are also seen in this case where

the electricity savings per year start at R1361 for year 1, exceeding the financing payments of R1166 and

resulting in a savings of R195 for that year.

Combined capital and operating costs for a SWH and an electric geyser for

low to mid income households with financed payments at 12% and an additional

R3500 subsidy (10% profit)

30,000

Cum Rands paid (discounted)

25,000

20,000

15,000

10,000

5,000

0

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19

Year

Electric geyser financed SWH financed

Assumptions: SWH systems cost R7594 installed (after Eskom and municipal subsidies), based on a 150 litre

vacuum tube SWH, 150, financed over 5 years @ 12% p.a. 150 litre electric geyser system costs R4500,

financed on bond over 20 years at 12%p.a. An electricity price increase of 10% p.a. is used, along with a

discount rate of 20%. The cost of electricity is based on low-usage residential supplies.

Sustainable Energy Africa 9

Summary and Conclusion

The table below provides the benefits to the homeowners for the 3 scenarios with and without subsidies:

Municipal

SWH Financing Terms Subsidy Benefit to homeowners (R discounted)

Scenario Years of financing Financing Rate per Household Year 1 Year 6

1a 20 12% 0 -125 284

1b 20 12% R3500 344 472

2a 15 12% 0 0 611

2b 5 12% R2500 0 881

3a 11 12% 0 63 359

3b 5 12% R3500 195 881

Scenario 1 is the least complicated approach, with only the bank to be brought on board. It will be more

attractive to the bank as the home loan value will increase by R3094, thereby securing more income for the

bank. If implemented, this scenario can set the tone for future bank-as-developer housing development projects.

Scenarios 2 and 3 have the benefits of not being linked to a specific bank / housing project, and allow for

creative financing solutions outside of traditional banking structures. The finance rate of 12% used for these

scenarios is therefore very conservative, and assumes a worst case scenario. Like scenario 1, both scenarios 2

and 3 also make sense without subsidization. Creative financing solutions for these businesses may include

development bank loans which could be as low as 5%.

It is important to note that Scenario 2 carries the additional benefit of cross subsidizing a clean stove solution for

a low income house. This scenario therefore will have a greater environmental and energy poverty relief impact

on any city as a whole.

This business case report underlines the benefit of installing solar water heaters in any South African city. Any of

the 3 scenarios are attractive and make business sense. Depending on the specific resources available in

particular cities, the appropriate business case can be selected for implementation.

Sustainable Energy Africa, September 2008

Sustainable Energy Africa 10

You might also like

- Microsoft Excel-Based Tool Kit for Planning Hybrid Energy Systems: A User GuideFrom EverandMicrosoft Excel-Based Tool Kit for Planning Hybrid Energy Systems: A User GuideNo ratings yet

- The Photovoltaic Tariff For The Peruvian Electric Rural Expansion MREVOLODocument18 pagesThe Photovoltaic Tariff For The Peruvian Electric Rural Expansion MREVOLOcyrinusNo ratings yet

- HYDRO FactsheetDocument2 pagesHYDRO FactsheetTony CarrollNo ratings yet

- Objectives of The SchemeDocument4 pagesObjectives of The SchemeAvish ThakralNo ratings yet

- Financial Report of Mini Hydro Power ProjectDocument4 pagesFinancial Report of Mini Hydro Power ProjectUmar KhanNo ratings yet

- Bee Exp 12Document13 pagesBee Exp 12Dhwani PatelNo ratings yet

- PEDA - Renewable Energy Rules Punjab GovtDocument16 pagesPEDA - Renewable Energy Rules Punjab GovtApoorv MahajanNo ratings yet

- Vitalis Electronics CC Business Plan: Household, Business and Productive Use Solar SystemsDocument23 pagesVitalis Electronics CC Business Plan: Household, Business and Productive Use Solar SystemsRabsNo ratings yet

- The National Rooftop Solar Programme: Presentation at Anglophone African Regional WorkshopDocument25 pagesThe National Rooftop Solar Programme: Presentation at Anglophone African Regional Workshopmichael AmponsahNo ratings yet

- Small PV Power PlantDocument6 pagesSmall PV Power PlantAbeer ElhadyNo ratings yet

- Sustainable Energy Handbook - On-Grid Rural Electrification - Copy - Part4Document2 pagesSustainable Energy Handbook - On-Grid Rural Electrification - Copy - Part4jausahaslkNo ratings yet

- Format 16 Guidelines To Consumers1Document18 pagesFormat 16 Guidelines To Consumers1raj sekharNo ratings yet

- Solar Energy in PakistanDocument8 pagesSolar Energy in PakistanEngr Dilawar HussainNo ratings yet

- 2016-153+RC Iseco PDFDocument8 pages2016-153+RC Iseco PDFlesly ann victorianoNo ratings yet

- BondaaaDocument4 pagesBondaaahamzadaud032No ratings yet

- Soorya Bala SangramayaDocument4 pagesSoorya Bala SangramayaSaurabh Himkar100% (1)

- 10 KW Solar Power Plant: Business ProposalDocument30 pages10 KW Solar Power Plant: Business ProposalChristopher VenturaNo ratings yet

- Cost Effectiveness of Installing A Photovoltaic (PV) System For A HouseDocument11 pagesCost Effectiveness of Installing A Photovoltaic (PV) System For A HouseDilanka S GunasinghaNo ratings yet

- National Portal For Rooftop Solar - Ministry of New and Renewable EnergyDocument4 pagesNational Portal For Rooftop Solar - Ministry of New and Renewable EnergykamalmuraNo ratings yet

- Highlights of Tamilnadu Solar Energy Policy 2012Document3 pagesHighlights of Tamilnadu Solar Energy Policy 2012Swinlife WinlifeNo ratings yet

- Draft MP Net Metering Policy - 4.11Document11 pagesDraft MP Net Metering Policy - 4.11Anand PuntambekarNo ratings yet

- File f-1664883789129Document8 pagesFile f-1664883789129Manjeet RanaNo ratings yet

- Proposta Comercial - 01Document15 pagesProposta Comercial - 01manuel machavaNo ratings yet

- Chapter 9 Financial Aspect For Sustainable Rural Electrification IDocument24 pagesChapter 9 Financial Aspect For Sustainable Rural Electrification IagusnurcahyoNo ratings yet

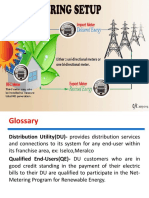

- Solar Net-Metering and Grid Tie SystemDocument30 pagesSolar Net-Metering and Grid Tie SystemBilly Twaine Palma Fuerte100% (1)

- National Electricity Support Tariff MechanismDocument72 pagesNational Electricity Support Tariff MechanismMathiasNo ratings yet

- Assignment 02 EES Business Case 1Document14 pagesAssignment 02 EES Business Case 1SuNil GoWdaNo ratings yet

- Jakeda: Jammu and KashmirDocument17 pagesJakeda: Jammu and Kashmirfiona alamNo ratings yet

- Assignment - Renewable Energy 14 ME ESE 01Document15 pagesAssignment - Renewable Energy 14 ME ESE 01Samiullah QureshiNo ratings yet

- 6 The Carbon Savings SocietyDocument13 pages6 The Carbon Savings SocietyCarbon Co-opNo ratings yet

- Micro-Hydropower Component Project (MHCPP) Project SummaryDocument6 pagesMicro-Hydropower Component Project (MHCPP) Project SummaryOrodi OdhiamboNo ratings yet

- Austin Energys Residential Solar RateDocument14 pagesAustin Energys Residential Solar RateAlda EnglandNo ratings yet

- Mini-Micro Hydro Power Projects KPKDocument17 pagesMini-Micro Hydro Power Projects KPKNaeem-Iqbal50% (2)

- Off Grid Solar Power SupplyDocument7 pagesOff Grid Solar Power SupplyAli AdnanNo ratings yet

- Mahboob Sarwar-E-Kainat - Solar Mini Grid Based RAPSS ProjectDocument18 pagesMahboob Sarwar-E-Kainat - Solar Mini Grid Based RAPSS ProjectADB_SAEN_ProjectsNo ratings yet

- 1 Background: Terms of Reference For OBA AuditorDocument12 pages1 Background: Terms of Reference For OBA AuditorCliantha AimeeNo ratings yet

- Analysis of The NSW FiTDocument3 pagesAnalysis of The NSW FiTWarwick JohnstonNo ratings yet

- Solar Rooftop - 3DECDocument8 pagesSolar Rooftop - 3DECWais AlemiNo ratings yet

- Understanding The Bill As of 2014 q1Document29 pagesUnderstanding The Bill As of 2014 q1Miko GorospeNo ratings yet

- Draft Net Metering Policy and FormatsDocument53 pagesDraft Net Metering Policy and FormatsAli Imran NaqviNo ratings yet

- 6KW Hybrid Haneef BhaiiDocument13 pages6KW Hybrid Haneef Bhaiizaka chNo ratings yet

- The Impact of SSEG On Municipal RevenueDocument9 pagesThe Impact of SSEG On Municipal RevenueTommy LombardNo ratings yet

- Solarking BrochureDocument8 pagesSolarking Brochureryat6df9shNo ratings yet

- Case Study 1 Ent 600Document14 pagesCase Study 1 Ent 600Hazim SanusiNo ratings yet

- Order,+ERC+Case+No +2015-017+RCDocument14 pagesOrder,+ERC+Case+No +2015-017+RCAlNo ratings yet

- EEHC Annual Report 2014-2015Document56 pagesEEHC Annual Report 2014-2015MohamedNo ratings yet

- Floating Solar Power PlantDocument24 pagesFloating Solar Power PlanttuanphamNo ratings yet

- Project Calculation For Rooftop PV Installations - 2015 - Energy Office - VF - 1603215Document14 pagesProject Calculation For Rooftop PV Installations - 2015 - Energy Office - VF - 1603215Xplore EnggNo ratings yet

- Doe Net MeteringDocument18 pagesDoe Net MeteringLanz ValdezNo ratings yet

- Pv-Battery and Diesel Hybrid System For Irrigation of A Farm in PatagoniaDocument6 pagesPv-Battery and Diesel Hybrid System For Irrigation of A Farm in PatagoniajamesNo ratings yet

- Cyprus Household PhotovoltaicsDocument4 pagesCyprus Household PhotovoltaicsScottNo ratings yet

- Symposium On The Lift and Escalator Technologies: Is The Gearbox Dead?Document4 pagesSymposium On The Lift and Escalator Technologies: Is The Gearbox Dead?freddyjoertyNo ratings yet

- Economics & Marketing of Photovoltaic Systems: Learning OutcomesDocument13 pagesEconomics & Marketing of Photovoltaic Systems: Learning OutcomesMehmet KayaNo ratings yet

- Final Thesis Chap 2. Edited VersionDocument16 pagesFinal Thesis Chap 2. Edited VersionUmer Bin ZubairNo ratings yet

- ST Helena Tariff - Review - and - Justification - Paper - 2022-23Document18 pagesST Helena Tariff - Review - and - Justification - Paper - 2022-23Mark NabongNo ratings yet

- Wiren Romania - Smart City Green Infrastructire - APR21 - ENDocument31 pagesWiren Romania - Smart City Green Infrastructire - APR21 - ENGabriel AvacariteiNo ratings yet

- Inflation Reduction Act Summary PDF FINALDocument8 pagesInflation Reduction Act Summary PDF FINALRYAN HUESEMANNo ratings yet

- Business Plan For Project KaragweDocument34 pagesBusiness Plan For Project KaragweAli SandhuNo ratings yet

- Math Economy Bibat 1Document14 pagesMath Economy Bibat 1Cams SenoNo ratings yet

- Logistics 25 FreeDocument11 pagesLogistics 25 FreeCassandra StapelbergNo ratings yet

- 70-1718 AdvertDocument1 page70-1718 AdvertCassandra StapelbergNo ratings yet

- Retail 50 FreeDocument11 pagesRetail 50 FreeCassandra Stapelberg100% (1)

- Holy Bible: Modern Literal VersionDocument437 pagesHoly Bible: Modern Literal VersionCassandra StapelbergNo ratings yet

- Tender Manager - Architectural and Multi-Disciplinary Firm in Johannesburg!Document6 pagesTender Manager - Architectural and Multi-Disciplinary Firm in Johannesburg!Cassandra StapelbergNo ratings yet

- EMSB - Regulatory and Financial Incentives For Scaling Up Concentrating Solar Power in Developing CountriesDocument165 pagesEMSB - Regulatory and Financial Incentives For Scaling Up Concentrating Solar Power in Developing CountriesCassandra StapelbergNo ratings yet

- Tender KPIDocument2 pagesTender KPICassandra StapelbergNo ratings yet

- Anne Boulet - ERENDocument7 pagesAnne Boulet - ERENCassandra StapelbergNo ratings yet

- Project Roadmap TemplateDocument3 pagesProject Roadmap TemplateCassandra StapelbergNo ratings yet

- Afrison Solar CatalogueDocument53 pagesAfrison Solar CatalogueCassandra StapelbergNo ratings yet

- Proactive Work Behavior Forward-Thinking and ChangDocument72 pagesProactive Work Behavior Forward-Thinking and ChangCassandra StapelbergNo ratings yet

- Commissioning of Lighting Systems2Document20 pagesCommissioning of Lighting Systems2Cassandra StapelbergNo ratings yet

- Lesons Learned QuestionnaireDocument1 pageLesons Learned QuestionnaireCassandra StapelbergNo ratings yet

- Methodologies and Life CyclesDocument8 pagesMethodologies and Life CyclesCassandra StapelbergNo ratings yet

- DOE Solar Parks Project 2016Document4 pagesDOE Solar Parks Project 2016Cassandra StapelbergNo ratings yet

- Water Pumps Get in On The Balancing ActDocument3 pagesWater Pumps Get in On The Balancing ActCassandra StapelbergNo ratings yet

- IARU Guide To Green UniversitiesDocument148 pagesIARU Guide To Green UniversitiesCassandra StapelbergNo ratings yet

- Ecostar - European Concentrated Solar Thermal Road-MappingDocument144 pagesEcostar - European Concentrated Solar Thermal Road-MappingCassandra StapelbergNo ratings yet

- CIE - Road Light Calculations - CIE140-2000 PDFDocument36 pagesCIE - Road Light Calculations - CIE140-2000 PDFCassandra StapelbergNo ratings yet

- How To Calculate PV - FV - Annuity - PerpetuityDocument41 pagesHow To Calculate PV - FV - Annuity - PerpetuityHassane AmadouNo ratings yet

- Quiz 3 - Bonds PayableDocument9 pagesQuiz 3 - Bonds PayableJam SurdivillaNo ratings yet

- FAR.2936 - Non-Financial Liabilities Summary (DIY) .Document5 pagesFAR.2936 - Non-Financial Liabilities Summary (DIY) .Edmark LuspeNo ratings yet

- Cost of Capital 1Document23 pagesCost of Capital 1shaahmookhanNo ratings yet

- Washington International School: Examinee Code: Date of Exam: Score/EquivalentDocument6 pagesWashington International School: Examinee Code: Date of Exam: Score/EquivalentGenelle Mae MadrigalNo ratings yet

- Course ContentDocument74 pagesCourse ContentKishore YlaNo ratings yet

- Caiib Demo NotesDocument18 pagesCaiib Demo NotesSaahil Singla100% (1)

- VakrangeeDocument32 pagesVakrangeePriti UpadhyayNo ratings yet

- Assignment - Time ValueDocument8 pagesAssignment - Time ValueOssama FatehyNo ratings yet

- Blue Star Systems and Solutions LLC Financial Statements 2020Document39 pagesBlue Star Systems and Solutions LLC Financial Statements 2020hamzaNo ratings yet

- AES Case PresentationDocument13 pagesAES Case PresentationClaire Marie Thomas67% (3)

- Compound Interest Example ProblemsDocument2 pagesCompound Interest Example ProblemsMicah Aila MallariNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument10 pagesCambridge International General Certificate of Secondary EducationCikgu kannaNo ratings yet

- Emerging Markets Cost of Equity 2015 JACF1Document20 pagesEmerging Markets Cost of Equity 2015 JACF1Niso AbuafNo ratings yet

- p7-10 HelpDocument8 pagesp7-10 HelpAJ SuttonNo ratings yet

- Economy TermsDocument90 pagesEconomy TermsSabyasachi SahuNo ratings yet

- FactoringDocument74 pagesFactoringkritiavasthi100% (1)

- Muddy Waters Capital LLC: Director of Research: Carson C. BlockDocument34 pagesMuddy Waters Capital LLC: Director of Research: Carson C. BlockYash BhojwaniNo ratings yet

- Capital Budgeting - PrestestDocument3 pagesCapital Budgeting - PrestestJade TanNo ratings yet

- V2 Exam 1 AMDocument30 pagesV2 Exam 1 AMNeerajNo ratings yet

- Wrigley CaseDocument12 pagesWrigley Caseresat gürNo ratings yet

- Daftar Akun Pt. Manunggal (Hilma)Document4 pagesDaftar Akun Pt. Manunggal (Hilma)Adhitya RamadhanNo ratings yet

- Ifrs 15Document37 pagesIfrs 15Ayoush kumarNo ratings yet

- Lahore School of Economics Financial Management I Time Value of Money - 3 Assignment 4Document2 pagesLahore School of Economics Financial Management I Time Value of Money - 3 Assignment 4Ahmed ZafarNo ratings yet

- Test 1809Document26 pagesTest 1809sundarsap100% (1)

- Chapter 8 - CFA - QDocument3 pagesChapter 8 - CFA - QPatricia Melissa AdisuryaNo ratings yet

- Practice Problem Set #3: Time Value of Money Theoretical and Conceptual Questions: (See Notes or Textbook For Solutions)Document3 pagesPractice Problem Set #3: Time Value of Money Theoretical and Conceptual Questions: (See Notes or Textbook For Solutions)raymondNo ratings yet

- 06 Receivable FinancingDocument10 pages06 Receivable Financingsharielles /No ratings yet

- Fundamentals of Corporate Finance 3rd Edition Parrino Solutions Manual DownloadDocument47 pagesFundamentals of Corporate Finance 3rd Edition Parrino Solutions Manual DownloadSamuel Hobart100% (23)

- Allama Iqbal Open University, Islamabad: (Department of Mathematics)Document3 pagesAllama Iqbal Open University, Islamabad: (Department of Mathematics)ilyas muhammadNo ratings yet

- Principles of Welding: Processes, Physics, Chemistry, and MetallurgyFrom EverandPrinciples of Welding: Processes, Physics, Chemistry, and MetallurgyRating: 4 out of 5 stars4/5 (1)

- The Aqua Group Guide to Procurement, Tendering and Contract AdministrationFrom EverandThe Aqua Group Guide to Procurement, Tendering and Contract AdministrationMark HackettRating: 4 out of 5 stars4/5 (1)

- A Place of My Own: The Architecture of DaydreamsFrom EverandA Place of My Own: The Architecture of DaydreamsRating: 4 out of 5 stars4/5 (242)

- Real Life: Construction Management Guide from A-ZFrom EverandReal Life: Construction Management Guide from A-ZRating: 4.5 out of 5 stars4.5/5 (4)

- Civil Engineer's Handbook of Professional PracticeFrom EverandCivil Engineer's Handbook of Professional PracticeRating: 4.5 out of 5 stars4.5/5 (2)

- Post Weld Heat Treatment PWHT: Standards, Procedures, Applications, and Interview Q&AFrom EverandPost Weld Heat Treatment PWHT: Standards, Procedures, Applications, and Interview Q&ANo ratings yet

- Estimating Construction Profitably: Developing a System for Residential EstimatingFrom EverandEstimating Construction Profitably: Developing a System for Residential EstimatingNo ratings yet

- Pressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedFrom EverandPressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedRating: 5 out of 5 stars5/5 (1)

- Building Physics -- Heat, Air and Moisture: Fundamentals and Engineering Methods with Examples and ExercisesFrom EverandBuilding Physics -- Heat, Air and Moisture: Fundamentals and Engineering Methods with Examples and ExercisesNo ratings yet

- The Complete HVAC BIBLE for Beginners: The Most Practical & Updated Guide to Heating, Ventilation, and Air Conditioning Systems | Installation, Troubleshooting and Repair | Residential & CommercialFrom EverandThe Complete HVAC BIBLE for Beginners: The Most Practical & Updated Guide to Heating, Ventilation, and Air Conditioning Systems | Installation, Troubleshooting and Repair | Residential & CommercialNo ratings yet

- How to Estimate with RSMeans Data: Basic Skills for Building ConstructionFrom EverandHow to Estimate with RSMeans Data: Basic Skills for Building ConstructionRating: 4.5 out of 5 stars4.5/5 (2)

- 1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideFrom Everand1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideRating: 3.5 out of 5 stars3.5/5 (7)

- Sustainable Design and Build: Building, Energy, Roads, Bridges, Water and Sewer SystemsFrom EverandSustainable Design and Build: Building, Energy, Roads, Bridges, Water and Sewer SystemsNo ratings yet

- Practical Guides to Testing and Commissioning of Mechanical, Electrical and Plumbing (Mep) InstallationsFrom EverandPractical Guides to Testing and Commissioning of Mechanical, Electrical and Plumbing (Mep) InstallationsRating: 3.5 out of 5 stars3.5/5 (3)

- The Complete Guide to Building With Rocks & Stone: Stonework Projects and Techniques Explained SimplyFrom EverandThe Complete Guide to Building With Rocks & Stone: Stonework Projects and Techniques Explained SimplyRating: 4 out of 5 stars4/5 (1)

- Building Construction Technology: A Useful Guide - Part 1From EverandBuilding Construction Technology: A Useful Guide - Part 1Rating: 4 out of 5 stars4/5 (3)

- Essential Building Science: Understanding Energy and Moisture in High Performance House DesignFrom EverandEssential Building Science: Understanding Energy and Moisture in High Performance House DesignRating: 5 out of 5 stars5/5 (1)

- Fire Protection Engineering in Building DesignFrom EverandFire Protection Engineering in Building DesignRating: 4.5 out of 5 stars4.5/5 (5)

- The Complete Guide to Alternative Home Building Materials & Methods: Including Sod, Compressed Earth, Plaster, Straw, Beer Cans, Bottles, Cordwood, and Many Other Low Cost MaterialsFrom EverandThe Complete Guide to Alternative Home Building Materials & Methods: Including Sod, Compressed Earth, Plaster, Straw, Beer Cans, Bottles, Cordwood, and Many Other Low Cost MaterialsRating: 4.5 out of 5 stars4.5/5 (6)

- Starting Your Career as a Contractor: How to Build and Run a Construction BusinessFrom EverandStarting Your Career as a Contractor: How to Build and Run a Construction BusinessRating: 5 out of 5 stars5/5 (3)

- The Complete Guide to Building Your Own Home and Saving Thousands on Your New HouseFrom EverandThe Complete Guide to Building Your Own Home and Saving Thousands on Your New HouseRating: 5 out of 5 stars5/5 (3)

- An Architect's Guide to Construction: Tales from the Trenches Book 1From EverandAn Architect's Guide to Construction: Tales from the Trenches Book 1No ratings yet