Professional Documents

Culture Documents

AUG 06 NBC Financial Group US Watch Hot Charts

Uploaded by

Miir ViirOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AUG 06 NBC Financial Group US Watch Hot Charts

Uploaded by

Miir ViirCopyright:

Available Formats

August 6, 2010– (Vol. XI, No.

98)

U.S. Watch

Non-farm payroll employment decreased 131,000 in

U.S.: Consumption is supported by the wage bill

July with the loss of 143K temporary Census jobs. The

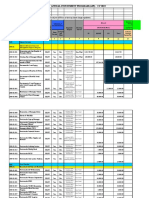

Private-sector payrolls and 3-month moving average Private sector wage bill and

private sector created only 71K jobs. This is personal consumption expenditures

disappointing from our standpoint since we were

% (q/q, annual rate)

expecting twice this amount of private job creation. 10

300 Thousands (m/m)

However, the July job report must be put into

200 Private payrolls Consumption

perspective. Private average weekly hours rose 0.3% 8 Wage bill

while private average hourly earnings were up 0.1%. It 100

may seem small numbers at first glance but these 6

apply to 107.7 millions of U.S. private workers. This 0

means that despite the poor headline number, the -100 4

U.S. wage bill was up a strong 0.5% m/m in July. As 3-month M.A.

-200 2

today’s Hot Charts shows, with only one month in the

quarter, the wage bill is already growing at a 2.3% clip -300

0

in Q3, meaning no retrenchment in consumption. That -400

said, the 3-month moving average of private job

-500 -2

creation slowed down from 150K recently to only 50K …the wage bill is

in July. To avoid a disinflationary environment, the 2.3%

-600

Even if private payrolls -4 growing

U.S. economy must create more jobs than the

increases in labour force in order to bring back down -700 disappointed in July…

-6

the unemployment rate. Recent private job creations -800

are simply not high strong enough to achieve this goal. -900 -8

While this morning’s report does not point to a double- 07M01 07M07 08M01 08M07 09M01 09M07 10M01 10M07 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010

dip of the U.S. economy, it certainly gives the Fed

more reasons to seek further boosting the economy. NBF Economy & Strategy (data via BLS)

Yanick Desnoyers

NBF Economics & Strategy Group (514) 879-2529

Stéfane Marion, Chief Economist and Strategist

General: National Bank Financial (NBF) is an indirect wholly owned subsidiary of National Bank of Canada. National Bank of Canada is a public company listed on Canadian stock exchanges. ♦ The particulars contained herein were obtained from sources which we believe to be reliable but are not guaranteed by us

and may be incomplete. The opinions expressed are based upon our analysis and interpretation of these particulars and are not to be construed as a solicitation or offer to buy or sell the securities mentioned herein. ♦Canadian Residents: In respect of the distribution of this report in Canada, NBF accepts

responsibility for its contents. To make further inquiry related to this report or effect any transaction, Canadian residents should contact their NBF Investment advisor. ♦ U.S. Residents: NBF Securities (USA) Corp., an affiliate of NBF, accepts responsibility for the contents of this report, subject to any terms set out

above. Any U.S. person wishing to effect transactions in any security discussed herein should do so only through NBF Securities (USA) Corp. UK Residents: In respect of the distribution of this report to UK residents, NBF has approved this financial promotion for the purposes of Section 21(1) of the Financial

Services and Markets Act 2000. NBF and/or its parent and/or any companies within or affiliates of the National Bank of Canada group and/or any of their directors, officers and employees may have or may have had interests or long or short positions in, and may at any time make purchases and/or sales as principal or

agent, or may act or may have acted as market maker in the relevant securities or related financial instruments discussed in this report, or may act or have acted as investment and/or commercial banker with respect thereto. The value of investments can go down as well as up. Past performance will not necessarily be

repeated in the future. The investments contained in this report are not available to private customers. This report does not constitute or form part of any offer for sale or subscription of or solicitation of any offer to buy or subscribe for the securities described herein nor shall it or any part of it form the basis of or be

relied on in connection with any contract or commitment whatsoever. This information is only for distribution to non-private customers in the United Kingdom within the meaning of the rules of the Regulated by the Financial Services Authority. ♦ Copyright: This report may not be reproduced in whole or in part, or

further distributed or published or referred to in any manner whatsoever, nor may the information, opinions or conclusions contained in it be referred to without in each case the prior express written consent of National Bank Financial.

You might also like

- 2020 J.P. Morgan Blockchain and Crypto Primer PDFDocument74 pages2020 J.P. Morgan Blockchain and Crypto Primer PDFDavid LoveNo ratings yet

- Enabling Long Term Infrastructure Finance in Local Currency GuarantCoDocument13 pagesEnabling Long Term Infrastructure Finance in Local Currency GuarantCoMohammed BusariNo ratings yet

- Auditing Problems TheoryDocument40 pagesAuditing Problems TheoryRod Lester de Guzman100% (2)

- Sanction LetterDocument7 pagesSanction LetterPrimon KarmakarNo ratings yet

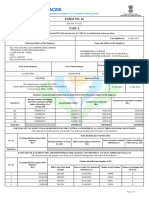

- Form No. 16 Part A (2020)Document2 pagesForm No. 16 Part A (2020)Dharmendra ParmarNo ratings yet

- Banking System A Database Project ReportDocument31 pagesBanking System A Database Project Reportstrmohan85% (34)

- Spa For 40000 Metric Tonnes AgoDocument7 pagesSpa For 40000 Metric Tonnes AgoABUBAKARNo ratings yet

- AUG 06 Danske FlashComment NonfarmDocument3 pagesAUG 06 Danske FlashComment NonfarmMiir ViirNo ratings yet

- Individual Assignment - Week - 3Document6 pagesIndividual Assignment - Week - 3Hoàng Thiên Lam100% (1)

- Weekly Economic Financial Commentary JuneDocument8 pagesWeekly Economic Financial Commentary JunehellbustNo ratings yet

- Pmi's Monthly Analysis of Economic, Housing, and Mortgage Market ConditionsDocument14 pagesPmi's Monthly Analysis of Economic, Housing, and Mortgage Market ConditionsHousingStormNo ratings yet

- Sept 09 BLS Numbers WMDocument30 pagesSept 09 BLS Numbers WMmultifamilyNo ratings yet

- Employment in Oregon - January 2023Document5 pagesEmployment in Oregon - January 2023Sinclair Broadcast Group - EugeneNo ratings yet

- The Urgent Need For Job CreationDocument10 pagesThe Urgent Need For Job CreationCenter for Economic and Policy ResearchNo ratings yet

- Labor Situation: Office of ResearchDocument7 pagesLabor Situation: Office of ResearchcbaruzziNo ratings yet

- SBA PPP Loan Calculator - CARES ActDocument2 pagesSBA PPP Loan Calculator - CARES ActJay Mike100% (2)

- The Us Consumer in 2009Document7 pagesThe Us Consumer in 2009Denis OuelletNo ratings yet

- Okun's Law and The Unemployment Surprise of 2009: July 2010Document6 pagesOkun's Law and The Unemployment Surprise of 2009: July 2010K60 HOÀNG THU TRANGNo ratings yet

- This Study Resource Was: ACC/280 Week 3 Individual AssignmentDocument2 pagesThis Study Resource Was: ACC/280 Week 3 Individual AssignmentMiya 76No ratings yet

- AUG 04 NBC Financial Group US Watch Hot ChartsDocument1 pageAUG 04 NBC Financial Group US Watch Hot ChartsMiir ViirNo ratings yet

- Employment in Oregon - May 2023 - Press ReleaseDocument5 pagesEmployment in Oregon - May 2023 - Press ReleaseKaitlin AthertonNo ratings yet

- 2011-06-03 Danske Flash US - Nonfarm Payroll Weak, But Probably Too WeakDocument5 pages2011-06-03 Danske Flash US - Nonfarm Payroll Weak, But Probably Too WeakkjlaqiNo ratings yet

- Scottish Employment Index: October/NovemberDocument13 pagesScottish Employment Index: October/Novembers1jobs ScotlandNo ratings yet

- Cura PearlMae TPDocument3 pagesCura PearlMae TPSilentPicker 03No ratings yet

- T E S - F 2010: HE Mployment Ituation EbruaryDocument39 pagesT E S - F 2010: HE Mployment Ituation EbruaryNathan MartinNo ratings yet

- Edgard Romero Nava - Fedecamaras CTV Set To Meet Today To Discuss Wage Increases - The Daily Journal 07.12.1989Document1 pageEdgard Romero Nava - Fedecamaras CTV Set To Meet Today To Discuss Wage Increases - The Daily Journal 07.12.1989Edgard Romero NavaNo ratings yet

- Jan 909Document7 pagesJan 909International Business TimesNo ratings yet

- Sept 2019 Release Pack DETRDocument17 pagesSept 2019 Release Pack DETRZac SlotemakerNo ratings yet

- AIP Summary FormDocument10 pagesAIP Summary FormRolly SinoyNo ratings yet

- Ee Job CreationDocument2 pagesEe Job CreationTomas KiddNo ratings yet

- Create A Trial Balance Part 1Document1 pageCreate A Trial Balance Part 1Shaira ManalastasNo ratings yet

- Requirement 1 Amo Unt $ Type of Adjusting Entry Assumptions Taken and CalculationsDocument11 pagesRequirement 1 Amo Unt $ Type of Adjusting Entry Assumptions Taken and CalculationsNgọc BíchNo ratings yet

- November National Economic Trends Report - by Richard Lynch - From EntergyDocument4 pagesNovember National Economic Trends Report - by Richard Lynch - From EntergyCharlie FoxworthNo ratings yet

- Responsive Data 1Document6 pagesResponsive Data 1Scott Johnson100% (1)

- Blog 1Document3 pagesBlog 1Luna TremeniseNo ratings yet

- EmpsitDocument39 pagesEmpsitVeronica SilveriNo ratings yet

- AIP Summary FormDocument12 pagesAIP Summary Formrolly sinoyNo ratings yet

- Econ 304 HW 11Document3 pagesEcon 304 HW 11Pulki Mittal100% (1)

- Macro Economics Mankiwscarth6e - ch07 SolutionsDocument12 pagesMacro Economics Mankiwscarth6e - ch07 SolutionsZhichang ZhangNo ratings yet

- T E S - S 2010: HE Mployment Ituation EptemberDocument39 pagesT E S - S 2010: HE Mployment Ituation EptemberNathan MartinNo ratings yet

- Employment in OregonDocument5 pagesEmployment in OregonAngela YamamotoNo ratings yet

- Knowledge Organiser 2.5Document3 pagesKnowledge Organiser 2.5Gupi PalNo ratings yet

- International Musician 1935 12Document16 pagesInternational Musician 1935 12Luis Angel Antonio MartinezNo ratings yet

- PRUlink Q2 2013 Newsletter ENGDocument8 pagesPRUlink Q2 2013 Newsletter ENGBowo SetyawanNo ratings yet

- Gig EconomyDocument3 pagesGig EconomyMehnaz MashreenNo ratings yet

- Economic DashboardsDocument34 pagesEconomic DashboardsmdorneanuNo ratings yet

- Employer Costs For Employee Compensation - September 2023Document19 pagesEmployer Costs For Employee Compensation - September 2023rebekkah28341No ratings yet

- Unit 2.macromeasures PDFDocument3 pagesUnit 2.macromeasures PDFGwyneth MalagaNo ratings yet

- Bridges - Winter 2004Document12 pagesBridges - Winter 2004Federal Reserve Bank of St. LouisNo ratings yet

- Art 3 FullDocument19 pagesArt 3 FullFrank A. Cusumano, Jr.No ratings yet

- Budget 2011-2012Document4 pagesBudget 2011-2012selvalntpNo ratings yet

- 5 - Feats - 3.18 2Document1 page5 - Feats - 3.18 2tamccuneNo ratings yet

- Art 1 FullDocument20 pagesArt 1 FullDeliajrsNo ratings yet

- Monthly New Residential Construction, August 2021: Release Number: CB21 152Document7 pagesMonthly New Residential Construction, August 2021: Release Number: CB21 152Cynthia MoranNo ratings yet

- Module 06: Contemporary Economic Issues Facing The Filipino EntrepreneurDocument9 pagesModule 06: Contemporary Economic Issues Facing The Filipino EntrepreneurChristian ZebuaNo ratings yet

- WEEK-5 Grade 11Document7 pagesWEEK-5 Grade 11Jannelle Kylie LeonoNo ratings yet

- Employment Situation OctoberDocument39 pagesEmployment Situation OctoberNathan MartinNo ratings yet

- Chapter 7 Unemployment and The Labor MarketDocument8 pagesChapter 7 Unemployment and The Labor MarketMD. ABDULLAH KHANNo ratings yet

- EDD Press ReleaseDocument4 pagesEDD Press ReleaseJustin BedecarreNo ratings yet

- T E S - D 2010: Transmission of Material in This Release Is Embargoed Until 8:30 A.M. (EST) Friday, January 7, 2011Document42 pagesT E S - D 2010: Transmission of Material in This Release Is Embargoed Until 8:30 A.M. (EST) Friday, January 7, 2011Nathan MartinNo ratings yet

- The Connecticut Economic Outlook: December 2013Document10 pagesThe Connecticut Economic Outlook: December 2013Patricia DillonNo ratings yet

- 9-March 2019 Job Opportunity Cost of WarDocument2 pages9-March 2019 Job Opportunity Cost of WarZuhair A. RehmanNo ratings yet

- Tax, Budget, InterstDocument10 pagesTax, Budget, InterstNegese MinaluNo ratings yet

- Unfunded LiabilityDocument4 pagesUnfunded LiabilityTodd BenoitNo ratings yet

- W E & F C: Eekly Conomic Inancial OmmentaryDocument8 pagesW E & F C: Eekly Conomic Inancial OmmentaryInternational Business TimesNo ratings yet

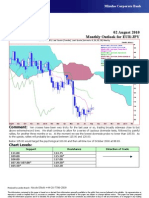

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- IAS 7 - Grand Thornton PDFDocument36 pagesIAS 7 - Grand Thornton PDFrisxaNo ratings yet

- Resume of Deliagonzalez34 - 1Document2 pagesResume of Deliagonzalez34 - 1api-24443855No ratings yet

- Model DTP For SSNNL PDFDocument106 pagesModel DTP For SSNNL PDFNdkkdfkNo ratings yet

- Market Wizard Newsletter Issue 66 - Sip BasketDocument81 pagesMarket Wizard Newsletter Issue 66 - Sip Basketsudheera cNo ratings yet

- Bank Transfer Receipt TemplateDocument1 pageBank Transfer Receipt TemplateFerdee FerdNo ratings yet

- Mobile BankingDocument11 pagesMobile Bankingsuresh aNo ratings yet

- Euro Zone Crisis QDocument70 pagesEuro Zone Crisis Qtarungupta2001No ratings yet

- Imfpa TempleteDocument4 pagesImfpa TempleteQip RainzhaNo ratings yet

- Iifl Gold LoanDocument79 pagesIifl Gold LoanDavid Wright0% (1)

- Application/ Activity Question and AnswerDocument5 pagesApplication/ Activity Question and AnswerApril Joy ObedozaNo ratings yet

- Money MarketDocument10 pagesMoney Marketswe1234No ratings yet

- Privy League - Client PresentationDocument24 pagesPrivy League - Client PresentationRaj Maisheri100% (1)

- Why Study Financial Markets and Institutions?: By: Ms. Ana Rose H. Mahilum, Cpa, MBADocument42 pagesWhy Study Financial Markets and Institutions?: By: Ms. Ana Rose H. Mahilum, Cpa, MBALannie Mae SamayangNo ratings yet

- Impact of Monetary Policy On Interest RateDocument97 pagesImpact of Monetary Policy On Interest Raterajib1chowdhury1mushNo ratings yet

- Nivetha.V 531900782 ProjectDocument73 pagesNivetha.V 531900782 ProjectDeepuNo ratings yet

- CBO Attachement (1) - 1-1Document18 pagesCBO Attachement (1) - 1-1Gemechis cherinet BedadaNo ratings yet

- Help Document On CRILCDocument40 pagesHelp Document On CRILCaditya_kundra123100% (1)

- Banks Initiation June 21Document220 pagesBanks Initiation June 21anil1820No ratings yet

- List of Licensed Commercial Banks in NepalDocument2 pagesList of Licensed Commercial Banks in Nepalnocadmin100% (1)

- Credit Financing Options of Local Government UnitsDocument3 pagesCredit Financing Options of Local Government UnitsPao InfanteNo ratings yet

- Accounting and Reporting Practice of Micro and Small Enterprises in West Oromia Region, EthiopiaDocument8 pagesAccounting and Reporting Practice of Micro and Small Enterprises in West Oromia Region, Ethiopiagezahagn EyobNo ratings yet

- STABULL 2005 CompleteDocument512 pagesSTABULL 2005 CompleteKhayc Chiedu MbonuNo ratings yet

- Kee - Digest.bancofilipino V BSPDocument2 pagesKee - Digest.bancofilipino V BSPApple Ke-eNo ratings yet