Professional Documents

Culture Documents

OBE Taxation SYLLABUS JRivera

Uploaded by

K-Cube Morong80%(5)80% found this document useful (5 votes)

3K views5 pagesThis document provides an overview of a course on Transfer and Business Taxation/Income Taxation. The 3-credit course introduces principles of taxation and statutory provisions on income taxation. Topics covered include sources of revenue, determining income from various sources, deductions, capital gains/losses, tax computation, and tax administration. The course meets for 3 hours per week and has no prerequisites. Course objectives are to explain taxation concepts, apply Philippine tax law, describe the tax system, and explain different entity taxation. The document outlines a 15-week schedule detailing weekly topics, learning outcomes, assessments, and teaching materials. Exams and assignments comprise the grading system.

Original Description:

taxation

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an overview of a course on Transfer and Business Taxation/Income Taxation. The 3-credit course introduces principles of taxation and statutory provisions on income taxation. Topics covered include sources of revenue, determining income from various sources, deductions, capital gains/losses, tax computation, and tax administration. The course meets for 3 hours per week and has no prerequisites. Course objectives are to explain taxation concepts, apply Philippine tax law, describe the tax system, and explain different entity taxation. The document outlines a 15-week schedule detailing weekly topics, learning outcomes, assessments, and teaching materials. Exams and assignments comprise the grading system.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

80%(5)80% found this document useful (5 votes)

3K views5 pagesOBE Taxation SYLLABUS JRivera

Uploaded by

K-Cube MorongThis document provides an overview of a course on Transfer and Business Taxation/Income Taxation. The 3-credit course introduces principles of taxation and statutory provisions on income taxation. Topics covered include sources of revenue, determining income from various sources, deductions, capital gains/losses, tax computation, and tax administration. The course meets for 3 hours per week and has no prerequisites. Course objectives are to explain taxation concepts, apply Philippine tax law, describe the tax system, and explain different entity taxation. The document outlines a 15-week schedule detailing weekly topics, learning outcomes, assessments, and teaching materials. Exams and assignments comprise the grading system.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

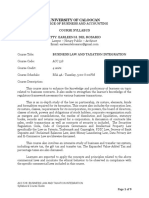

Course Name TRANSFER and BUSINESS TAXATION/INCOME TAXATION

Course Credits Lec: 3 units Lab:

This course introduces the general principles of taxation and statutory provisions

on income taxation including pertinent revenue regulations. The main topics that

will be covered include: the general principles of taxation, sources of revenue and its sub-

Course Description

topics, determining income from employment, income from business, and income from property,

deductions from business and property income, capital gains and

losses, other income and deductions, computation of taxable income and tax administration.

Contact Hours per

3 lectures hours per week

Week

Pre-Requisites None

At the end of the course, the students are expected to:

Explain the sources, nature and purpose of taxation.

Apply the basic principles and policies of Philippine Income Tax Law.

Course Objectives

Describe the general structure of the Philippine Income Taxation system.

Explain and contrast the manner in which different entities are taxed.

WEEK/TIME INTENDED OUTCOME- CONTENT TEACHING AND RESOURCE

ALLOTMENT LEARNING BASED LEARNING MATERIALS

OUTCOMES (ILO) ASSESSMENT ACTIVITIES

(OBA) (TLAs)

Week 1 - Explain and Written exercises Introduction and overview Exercises

Discuss the History/origin of Taxes Lecture & questionnaire,

Introduction, Introduction to Internal Discussion ballpens, situs tax

overview, history Revenue Taxes Graphic organizers table

and origin of taxes Sources of Revenue from

-Understand the Internal Revenue Tax

introduction of Situs of Taxation

revenue taxes.

- Identify the

sources of revenue

& revenue tax

-Distinguish situs of

taxation

Week 2 -Analyze the Exercises/Essay Transfer Taxes and Basic Lecture & Exercises

transfer taxes and Case study Succession Discussion questionnaire,

classify the basic Nature of Transfer Taxes Problem solving ballpens,

succession Basis of Estate Tax calculators,

-Determine the Basis of Succession testate & intestate

nature of transfer table

taxes and the basis

of estate tax

-calculate and solve

the value/amount of

estate tax

Week 3 -Explain what is Exercises/Case Gross Estate Lecture/Discussion Exercises

gross estate study Composition & Valuation of Graphic organizers questionnaire,

-Identify the Gross Estate Problem solving ballpens,

composition and calculators

calculate the value

of gross estate

Week 4 -Identify and Written exercises Deductions from Gross Estate Lecture/Discussion Exercises

determine all Case study Nature & Category questionnaire,

deductions from ballpens,

gross estate.

-Classify the nature

and category of

gross estate

Prelim Exam

Week 5 -Define estate tax Case study Estate Tax Lecture/Discussion Exercises

-Identify all factors Practical test Problem solving questionnaire,

affecting estate tax ballpens,

-Calculate and solve calculators

the value of estate

tax

Week 6 -Explain what Essay Donor's Tax Lecture/Discussion Exercises

donors tax is. Case study Nature, Kinds, Characteristics questionnaire,

-Identify and classify Written test and Essentials ballpens,

the nature, kinds, calculators

characteristics and

essentials of donors

tax

Week 7 and -Explain what Case study Business Taxes Lecture/Discussion Exercises

8 business taxes are. Written test The VAT Reform Law Problem solving questionnaire,

-Discover the Vat ballpens,

Reform Law and

give an opinion on

this law.

Midterm

Exam

Week 9 -Classify the Written test Business Transfer and Lecture/Discussion Exercises

business transfer Exchange Transactions questionnaire,

and exchange ballpens,

transaction and

explain its nature.

Week 10 and -Explain what value Case Study Value-Added Tax Lecture/Discussion Exercises

11 added tax is. Essay Special VAT Problems and Problem solving questionnaire,

-Calculate and find Cases ballpens,

the amount of VAT calculators

-Analyze and

discuss special vat

problems and

compare/relate it to

the given cases.

Week 12, 13, -Explain, Define and Case study Percentage Taxes Lecture/Discussion Exercises

14 Solve percentage, Practical test Excise Taxes questionnaire,

and 15 excise, local and Local Taxes ballpens,

documentary stamp Documentary Stamp Tax calculators

tax.

Final Exams

I. TEXTBOOKS/REFERENCES: Transfer and Business Taxation

REFERENCES Edwin Valencia/Gregorio Roxas

Income Taxation Books

Ma. Perpetua Arcilla-Serapio

RESA reviewer handouts and practice sets

https://en.wikipedia.org/wiki/Tax

http://www.investopedia.com/terms/t/taxation.asp

II. COURSE POLICIES:

1. Students must come to class on time, prepared and participate actively in the discussions; all requirements must

be submitted on time. Late submission will receive deductions.

2. No text messaging or entertaining of phone calls during class hours unless call is emergency. Using of

headphones during class hour is also prohibited. Please be courteous, turn off your cell phone while inside the

classroom.

3. Students with 3 consecutive absences will automatically be dropped from the class roll.

4. Students who wished to drop the course must do so officially and not just stop coming to class.

5. Academic dishonesty: Any form of cheating or plagiarism in this course will result in zero on the exam, assignment

or project. Allowing others access to your work potentially involves you in cheating. Working with others to

produce very similar reports is plagiarism regardless of intent.

6. Problems encountered with the subject must be discussed to the instructor. Such consultation may be made in

person during designated time and at designated place.

III. Grading System:

Examination 40%

Attendance 20%

Quizzes/Exercises 20%

Activities/Recitation 20%

IV. Consultation Period:

DAY TIME PLACE

Saturday 1:00 2:00 PM Faculty Room

You might also like

- TAX1 OBTL Syllabus 1s 20-21Document12 pagesTAX1 OBTL Syllabus 1s 20-21Paula Rodalyn MateoNo ratings yet

- LEGAL - REGULATORY FRAMEWORK & LEGAL ISSUES IN BUSINESS (Ok)Document3 pagesLEGAL - REGULATORY FRAMEWORK & LEGAL ISSUES IN BUSINESS (Ok)Jowjie TV79% (14)

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document23 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo Gironella100% (4)

- Philippine Women'S University: College DepartmentDocument3 pagesPhilippine Women'S University: College DepartmentJui Provido100% (2)

- Taxation 1-Course-SyllabusDocument6 pagesTaxation 1-Course-SyllabusArmalyn Cangque0% (1)

- ACCO 20083 Syllabus On Financial MarketsDocument7 pagesACCO 20083 Syllabus On Financial MarketsJenelle88% (8)

- Syllabus in Capital Market Management 2Document10 pagesSyllabus in Capital Market Management 2Christine LealNo ratings yet

- Transfer and Business Taxation SyllabusDocument5 pagesTransfer and Business Taxation SyllabusamqqndeahdgeNo ratings yet

- FM 2 and ELECT 2 Financial Analysis and Reporting OBE SyllabusDocument12 pagesFM 2 and ELECT 2 Financial Analysis and Reporting OBE SyllabusJay Bee Salvador83% (6)

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document12 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo Gironella0% (1)

- COURSE SYLLABUS (Reporting and Financial Analysis 2020)Document6 pagesCOURSE SYLLABUS (Reporting and Financial Analysis 2020)Armalyn CangqueNo ratings yet

- Syllabus For Partnership and CorporationDocument4 pagesSyllabus For Partnership and Corporationsan dem gNo ratings yet

- Syllabus - Auditing in CIS EnvironmentDocument4 pagesSyllabus - Auditing in CIS Environmentgeee hoonNo ratings yet

- Basic Accounting SyllabusDocument16 pagesBasic Accounting SyllabusMerdzNo ratings yet

- Syl-Cba-O68 - Acctg102 - Fundamentals of Accounting p2 (Partnership and Corporation)Document9 pagesSyl-Cba-O68 - Acctg102 - Fundamentals of Accounting p2 (Partnership and Corporation)Maria Anne Genette Bañez100% (3)

- Public Finance CourseoutlineDocument13 pagesPublic Finance CourseoutlineDuay Guadalupe Villaestiva0% (1)

- Bachelor of Science in Accountancy: Program Curriculum Ay 2020 - 2021Document10 pagesBachelor of Science in Accountancy: Program Curriculum Ay 2020 - 2021AZGH HOSPITAL /Cyberdyne PhilippinesNo ratings yet

- Economic DevelopmentDocument5 pagesEconomic DevelopmentSophia ConcepcionNo ratings yet

- International Trade SyllabusDocument7 pagesInternational Trade Syllabuskhatedeleon100% (1)

- Syllabus Business LawDocument4 pagesSyllabus Business Lawanton100% (3)

- Public Finance Course OutlineDocument2 pagesPublic Finance Course Outlinetuffoman100% (1)

- Train Law QuestionsDocument14 pagesTrain Law QuestionsGilleane100% (2)

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document14 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo Gironella67% (6)

- Syllabus UCC Business Law and RegulationsDocument7 pagesSyllabus UCC Business Law and RegulationsArki Torni100% (1)

- AE2 - Business Laws and RegulationsDocument9 pagesAE2 - Business Laws and Regulationsgly escobarNo ratings yet

- Syllabus Capital MarketsDocument4 pagesSyllabus Capital MarketsAdnan MasoodNo ratings yet

- Bs AccountancyDocument239 pagesBs AccountancyMarites Mayo Cuyos80% (5)

- Conceptual Framework Basic Acctngt 1 OBE SyllabusDocument6 pagesConceptual Framework Basic Acctngt 1 OBE SyllabusPatricia may RiveraNo ratings yet

- Syllabus UCC Business Law and Taxation IntegrationDocument9 pagesSyllabus UCC Business Law and Taxation IntegrationArki Torni100% (1)

- Financial Management SyllabusDocument7 pagesFinancial Management SyllabusAireen Rose Rabino Manguiran0% (1)

- Feasibility Study Course OutlineDocument3 pagesFeasibility Study Course Outlinetortomato100% (6)

- Cangque A Bapf 103 Ba Module 1 For CheckingDocument27 pagesCangque A Bapf 103 Ba Module 1 For CheckingArmalyn Cangque100% (1)

- Syllabus in GovernanceDocument9 pagesSyllabus in GovernanceChristine Leal - EstenderNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document10 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo Gironella100% (1)

- Obe Syllabus Strategic ManagementDocument4 pagesObe Syllabus Strategic ManagementLorienel100% (3)

- PA 131 Sample Syllabus 2018Document4 pagesPA 131 Sample Syllabus 2018mitzi samsonNo ratings yet

- Syllabus ACP 312 Accounting For Business CombinationsDocument9 pagesSyllabus ACP 312 Accounting For Business CombinationsirahQNo ratings yet

- ADMU Financial Management SyllabusDocument4 pagesADMU Financial Management SyllabusPhilip JosephNo ratings yet

- Syllabus Managerial EconomicsDocument4 pagesSyllabus Managerial Economicspcp10No ratings yet

- Updates in Managerial AccountingDocument15 pagesUpdates in Managerial Accountingstudentone50% (2)

- Gross Income: Module No. 3-4 Inclusive Week: August 23-27, 2021 Module Overview Reference / Research LinksDocument13 pagesGross Income: Module No. 3-4 Inclusive Week: August 23-27, 2021 Module Overview Reference / Research LinksHeigh Ven100% (1)

- Syllabus in Cost ManagementDocument9 pagesSyllabus in Cost ManagementChristine LealNo ratings yet

- Course Syllabus in Personal Finance PDFDocument7 pagesCourse Syllabus in Personal Finance PDFAbigail InaoNo ratings yet

- LAW 1301 - Business Laws and Regulations 2Document17 pagesLAW 1301 - Business Laws and Regulations 2Kristine Lirose BordeosNo ratings yet

- National Teachers College: Code No. Course SyllabusDocument10 pagesNational Teachers College: Code No. Course SyllabusJeline Lensico100% (1)

- Financial Analysis and Reporting SyllabusDocument9 pagesFinancial Analysis and Reporting SyllabusJpoy Rivera100% (4)

- BSA 3104 - Governance, Business Ethics, Risk Management and Internal ControlDocument17 pagesBSA 3104 - Governance, Business Ethics, Risk Management and Internal ControlGERWIN REQUIROSO100% (1)

- BSA 2105 - Business TaxDocument12 pagesBSA 2105 - Business TaxSherwin Benedict SebastianNo ratings yet

- Investment and Portfolio Management - Course Syllabus 2018Document5 pagesInvestment and Portfolio Management - Course Syllabus 2018Aki Lou Bats67% (3)

- Unit 4 - Inclusions & Exclusions To Gross Comp IncomeDocument8 pagesUnit 4 - Inclusions & Exclusions To Gross Comp IncomeJoseph Anthony RomeroNo ratings yet

- Syllabus in Capital Market ManagementDocument10 pagesSyllabus in Capital Market ManagementChristine LealNo ratings yet

- Actg 10 Accounting For Governmental, Not-for-Profit Entities and Specialized IndustriesDocument3 pagesActg 10 Accounting For Governmental, Not-for-Profit Entities and Specialized IndustriesVanessa L. VinluanNo ratings yet

- Taxation Questions With AnswersDocument7 pagesTaxation Questions With AnswersYeovil Pansacala100% (2)

- Bachelor of Science in Accountancy: Program Curriculum Ay 2020 - 2021Document5 pagesBachelor of Science in Accountancy: Program Curriculum Ay 2020 - 2021beaNo ratings yet

- OBE Auditing SYLLABUS JRiveraDocument6 pagesOBE Auditing SYLLABUS JRiveraK-Cube MorongNo ratings yet

- Bachelor of Science in Accounting Information System: Bulacan Polytechnic CollegeDocument9 pagesBachelor of Science in Accounting Information System: Bulacan Polytechnic CollegeReena BoliverNo ratings yet

- Course Prefix/Number Course Title Course Units Course Total Expected Hours Course DescriptionDocument7 pagesCourse Prefix/Number Course Title Course Units Course Total Expected Hours Course DescriptionJerauld BucolNo ratings yet

- Phil, Tax System & Income TaxDocument4 pagesPhil, Tax System & Income TaxREYNOLD BABOR0% (1)

- Second Semester, AY 2014-2015Document11 pagesSecond Semester, AY 2014-2015hyosungloverNo ratings yet

- Course Prefix/Number Course Title Course Units Course Total Expected Hours Course DescriptionDocument9 pagesCourse Prefix/Number Course Title Course Units Course Total Expected Hours Course DescriptionJerauld BucolNo ratings yet

- Cav Fillable Form 9 - 13Document1 pageCav Fillable Form 9 - 13K-Cube MorongNo ratings yet

- 2018 TWSP QM - From TesdaDocument1 page2018 TWSP QM - From TesdaK-Cube MorongNo ratings yet

- Mother Butler Guild: Diocese of AntipoloDocument3 pagesMother Butler Guild: Diocese of AntipoloK-Cube MorongNo ratings yet

- A4uv ManualDocument17 pagesA4uv ManualK-Cube MorongNo ratings yet

- Statistical Analysis IT ProfessionalsDocument10 pagesStatistical Analysis IT ProfessionalsK-Cube MorongNo ratings yet

- Circular 038-2016 Job LinkagesDocument5 pagesCircular 038-2016 Job LinkagesK-Cube MorongNo ratings yet

- 19 San Ignacio St. Brgy Kapitolyo PasigDocument2 pages19 San Ignacio St. Brgy Kapitolyo PasigK-Cube MorongNo ratings yet

- Marketing 1 Course SyllabusDocument6 pagesMarketing 1 Course SyllabusK-Cube MorongNo ratings yet

- Philippine Lit. 1Document4 pagesPhilippine Lit. 1K-Cube MorongNo ratings yet

- Long Quiz Physics 1 Newton Laws of MotionDocument1 pageLong Quiz Physics 1 Newton Laws of MotionK-Cube MorongNo ratings yet

- Vectors and Scalars: AP Physics BDocument13 pagesVectors and Scalars: AP Physics BK-Cube MorongNo ratings yet

- CMO-No.-77-s.-2017 Foundation of Special and Inclusive EducationDocument84 pagesCMO-No.-77-s.-2017 Foundation of Special and Inclusive EducationK-Cube Morong92% (37)

- School Form 5 Report On Promotion and Learning Progress AchievementDocument8 pagesSchool Form 5 Report On Promotion and Learning Progress AchievementK-Cube MorongNo ratings yet

- Obe Csit 222Document5 pagesObe Csit 222K-Cube MorongNo ratings yet

- OBE Auditing SYLLABUS JRiveraDocument6 pagesOBE Auditing SYLLABUS JRiveraK-Cube MorongNo ratings yet

- Pe 2Document9 pagesPe 2K-Cube MorongNo ratings yet

- PhiloDocument5 pagesPhiloK-Cube MorongNo ratings yet

- Buss ComDocument3 pagesBuss ComK-Cube MorongNo ratings yet

- Obe Database 2Document5 pagesObe Database 2K-Cube MorongNo ratings yet

- Bread and Pastry ProductionDocument11 pagesBread and Pastry ProductionK-Cube Morong67% (6)

- Price Lists 07072017new ZheirDocument21 pagesPrice Lists 07072017new ZheirK-Cube MorongNo ratings yet

- Art Appreciation Introduction To The Humanities 1: Session 5 To 10 of Painting Movie Quiz Seat Work Discussion ReportingDocument3 pagesArt Appreciation Introduction To The Humanities 1: Session 5 To 10 of Painting Movie Quiz Seat Work Discussion ReportingK-Cube MorongNo ratings yet

- Certification, Authentication and Verification (CAV) Application FormDocument2 pagesCertification, Authentication and Verification (CAV) Application FormK-Cube Morong0% (1)

- Revised Tesda-Sop-Co-07-F21 Application Form - Rev1 (Application Date Po Ay 10 Days Ealier Sa Assessment Date)Document2 pagesRevised Tesda-Sop-Co-07-F21 Application Form - Rev1 (Application Date Po Ay 10 Days Ealier Sa Assessment Date)K-Cube Morong0% (1)

- Revised TESDA-SOP-CO-07-F21 Application Form - Rev1 (APPLICATION DATE PO AY 10 DAYS EALIER SA ASSESSMENT DATE)Document2 pagesRevised TESDA-SOP-CO-07-F21 Application Form - Rev1 (APPLICATION DATE PO AY 10 DAYS EALIER SA ASSESSMENT DATE)K-Cube MorongNo ratings yet

- Scalar Quantity Magnitude: Vectors and ScalarsDocument89 pagesScalar Quantity Magnitude: Vectors and ScalarsK-Cube MorongNo ratings yet

- Catalogue Maltep en PDFDocument88 pagesCatalogue Maltep en PDFStansilous Tatenda NyagomoNo ratings yet

- DIN EN 16842-1: in Case of Doubt, The German-Language Original Shall Be Considered AuthoritativeDocument23 pagesDIN EN 16842-1: in Case of Doubt, The German-Language Original Shall Be Considered AuthoritativeanupthattaNo ratings yet

- Introduction To Mechanical Engineering Si Edition 4Th Edition Wickert Lewis 1305635752 9781305635753 Solution Manual Full Chapter PDFDocument36 pagesIntroduction To Mechanical Engineering Si Edition 4Th Edition Wickert Lewis 1305635752 9781305635753 Solution Manual Full Chapter PDFwilliam.munoz276100% (13)

- Further Investigations of Glucose-6-Phosphate Dehy PDFDocument7 pagesFurther Investigations of Glucose-6-Phosphate Dehy PDFrabin1994No ratings yet

- Chemical Formula Sheet Class 9: Matter in Our SurroundingDocument4 pagesChemical Formula Sheet Class 9: Matter in Our SurroundingMadan JhaNo ratings yet

- Dirt Bikes Financial and Sales DataDocument7 pagesDirt Bikes Financial and Sales Datakhang nguyenNo ratings yet

- Playing Djembe PDFDocument63 pagesPlaying Djembe PDFpbanerjeeNo ratings yet

- ArcSight Profiler IntegrationDocument8 pagesArcSight Profiler IntegrationemveNo ratings yet

- The Daily Jinx 0 - ENG-3 (1) - 1Document3 pagesThe Daily Jinx 0 - ENG-3 (1) - 1NoxNo ratings yet

- Kristen Tillett: ContactDocument2 pagesKristen Tillett: ContactYtibNo ratings yet

- Hard Rock Miner - S Handbook - Jack de La Vergne - Edition 3 - 2003Document330 pagesHard Rock Miner - S Handbook - Jack de La Vergne - Edition 3 - 2003Adriel senciaNo ratings yet

- Mercury and The WoodmanDocument1 pageMercury and The WoodmanLum Mei YeuanNo ratings yet

- Finman CH 18 SolmanDocument32 pagesFinman CH 18 SolmanJoselle Jan Claudio100% (1)

- Baby Romper Pattern and Sewing Tutorial 2014Document18 pagesBaby Romper Pattern and Sewing Tutorial 2014Carolina Ribeiro100% (1)

- NM Rothschild & Sons (Australia) LTD. V Lepanto Consolidated Mining CompanyDocument1 pageNM Rothschild & Sons (Australia) LTD. V Lepanto Consolidated Mining Companygel94No ratings yet

- Kenneth Dean Austin v. Howard Ray, Warden, Jackie Brannon Correctional Center and Attorney General of The State of Oklahoma, 124 F.3d 216, 10th Cir. (1997)Document8 pagesKenneth Dean Austin v. Howard Ray, Warden, Jackie Brannon Correctional Center and Attorney General of The State of Oklahoma, 124 F.3d 216, 10th Cir. (1997)Scribd Government DocsNo ratings yet

- Indus River Valley Civilization ObjectivesDocument4 pagesIndus River Valley Civilization ObjectivesArslan AsifNo ratings yet

- Exotic - March 2014Document64 pagesExotic - March 2014Almir Momenth35% (23)

- Rule 110 CasesDocument102 pagesRule 110 Casesアブドゥルカリム エミールNo ratings yet

- Dior Product Development PresentationDocument59 pagesDior Product Development PresentationSade WycheNo ratings yet

- Choco Cherry BonbonDocument2 pagesChoco Cherry BonbonYarina MoralesNo ratings yet

- Indian Banking - Sector Report - 15-07-2021 - SystematixDocument153 pagesIndian Banking - Sector Report - 15-07-2021 - SystematixDebjit AdakNo ratings yet

- Exams With Proctorio Students 2603Document1 pageExams With Proctorio Students 2603Nicu BotnariNo ratings yet

- EY Global Hospitality Insights 2016Document24 pagesEY Global Hospitality Insights 2016Anonymous BkmsKXzwyKNo ratings yet

- Syllabus Tourism Laws CKSCDocument6 pagesSyllabus Tourism Laws CKSCDennis Go50% (2)

- BY DR Muhammad Akram M.C.H.JeddahDocument32 pagesBY DR Muhammad Akram M.C.H.JeddahMuhammad Akram Qaim KhaniNo ratings yet

- Amazon PrimeDocument27 pagesAmazon PrimeMohamedNo ratings yet

- Essay On Stamp CollectionDocument5 pagesEssay On Stamp Collectionezmt6r5c100% (2)

- Sow English Year 4 2023 2024Document12 pagesSow English Year 4 2023 2024Shamien ShaNo ratings yet

- 06 - Wreak Bodily HavokDocument40 pages06 - Wreak Bodily HavokJivoNo ratings yet