Professional Documents

Culture Documents

Sample One Pager

Uploaded by

Abdullah Al-RezwanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample One Pager

Uploaded by

Abdullah Al-RezwanCopyright:

Available Formats

Stock

Name (ticker) Student Name

RECOMMENDATION: BUY DATE: 3/9/2016

VOLUME: $3.6M STOCK PRICE: $31.97

EMAIL:

Target Price:

______________

12-Month Performance vs. S&P500

xxx@cornell.edu Date Earnings Price Forecast

P/E

SECTOR:

12/2014 $0.75 $26.82 35.8x

12/2015 $0.96 $29.09 30.3x

Healthcare 12/2016(e) $1.19 $35.7 30.0x

(*) Price on 12/2016 determined using Cap IQ

Industry:

EV/Rev estimate and existing shares outstanding

Cardio Catheter

Manufacturers

Company Description

Vascular Solutions (VASC) designs tools for interventional cardiologists for both therapeutic and diagnostic

purposes. VASC largest and most profitable segment is its cardio catheter division, which accounts for 81% of

revenues and 90% of profits. Companies in the Cardio Catheter Industry make money by selling catheters and

supporting devices to hospitals and healthcare centers to be utilized by cardiovascular surgeons. This industry

has experienced strong growth by offering less invasive products that improve recovery rates.

Investment Thesis

Through investment in R&D (16.1% of revenue compared to the industry median of 14.5%), VASC will

expand its number of products 20% in 2015. VASCs strong patent protection and efficient sales network

provide VASC with a sustainable competitive advantage over its rivals. VASCs most recent 10-K

confirms that VASC is continuing to reinvest its cash flow in new products; VASC continues to grow

both sales and profits (at an accelerating rate). VASC remains undervalued. As the fastest growing

company in its industry and the only company with no debt, VASC represents an attractive acquisition

target for a competitor such as Medtronic (which has lost catheter market share since 2010). Despite a

higher cost of capital due to a higher beta, VASCs intrinsic value has increased as international sales

growth has accelerated. Since costs will remain consistent with revenues, new sales growth will

continue to increase VASCs profits and EPS

Risks and Opportunities

VASC relies on new products to maintain sales growth. Although the company has a pipeline of new

products for the next two years, growth may slow as the pipeline is depleted. VASC continues to lead the

industry with the highest percentage of R&D spending (% of revenue in 2015), but continued growth is

required to support the stocks current PE multiple, which has begun to contract along with Cardio

Catheter micro industry.

Financial Summary

2013 2014 2015 2016(e) 2017(e)

Sales Revenue $90.0 $124.7 $147.2 $163.42 $182.85

EBITDA $19.0 $21.6 $31.7 $33.4 $39.0

ROA 11.1% 10.6% 12.1% 12.7% 14.0%

P/E 26.3x 35.8x 30.3x 30.0x 30.0x

EV/Rev 2.6x 3.4x 4.0x 3.0x 3.0x

Net Debt ($30.8) ($36.5) ($45.8) ($54.9) ($76.0)

Numbers (besides ratios and percentages) in millions.

You might also like

- Satistical Process Control Study: Data Collections:-Sample D2 A2 D4Document1 pageSatistical Process Control Study: Data Collections:-Sample D2 A2 D4cqi9nNo ratings yet

- Private Companies (Very Small Businesses) Key Financial DifferencesDocument50 pagesPrivate Companies (Very Small Businesses) Key Financial DifferencesFarhan ShafiqueNo ratings yet

- 1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678Document18 pages1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678X.r. GeNo ratings yet

- IDT Corp. (NYSE: IDT) : Unlocking Value With One of The World's Best Capital AllocatorsDocument55 pagesIDT Corp. (NYSE: IDT) : Unlocking Value With One of The World's Best Capital Allocatorsatgy1996No ratings yet

- Merger Model - Blank Template: Control Panel Outputs Sensitivities Model Comps Data Diluted Shares CalculationDocument49 pagesMerger Model - Blank Template: Control Panel Outputs Sensitivities Model Comps Data Diluted Shares CalculationGugaNo ratings yet

- Commercial Accounmts ManualDocument137 pagesCommercial Accounmts ManualRK K100% (3)

- LBO Model Cash Flow AnalysisDocument38 pagesLBO Model Cash Flow AnalysisBobbyNicholsNo ratings yet

- Early-Stage Companies and Financing Valuations - The Venture Capital MethodDocument15 pagesEarly-Stage Companies and Financing Valuations - The Venture Capital MethodMartín MaturanaNo ratings yet

- Blue Dart Express LTD.: CompanyDocument5 pagesBlue Dart Express LTD.: CompanygirishrajsNo ratings yet

- Mergers and Acquisitions Strategy AnalysisDocument13 pagesMergers and Acquisitions Strategy AnalysisAnmol GuptaNo ratings yet

- Boston Scientific PrimerDocument2 pagesBoston Scientific PrimerZee MaqsoodNo ratings yet

- Equity Research Report ExpediaDocument18 pagesEquity Research Report ExpediaMichelangelo BortolinNo ratings yet

- Sector Specific Ratios and ValuationDocument10 pagesSector Specific Ratios and ValuationAbhishek SinghNo ratings yet

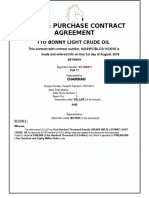

- Sales & Purchase Contract for Bonny Light Crude OilDocument17 pagesSales & Purchase Contract for Bonny Light Crude OilnurashenergyNo ratings yet

- Reverse Discounted Cash FlowDocument11 pagesReverse Discounted Cash FlowSiddharthaNo ratings yet

- 50 AAPL Buyside PitchbookDocument22 pages50 AAPL Buyside PitchbookkamranNo ratings yet

- Sales Promotion Process DTI DAO 2 Series of 1993 Consumer Act of The PhilippinesDocument12 pagesSales Promotion Process DTI DAO 2 Series of 1993 Consumer Act of The PhilippinesJanette Toral100% (3)

- Financial Statement AnalysisDocument24 pagesFinancial Statement AnalysisDawn Zoleta100% (1)

- PDD Holdings (PDD) - Addressing Key Investor Debates Post Upgrade Domestic Ad Growth Outlook & Temu Risks The Key Focuses BuyDocument20 pagesPDD Holdings (PDD) - Addressing Key Investor Debates Post Upgrade Domestic Ad Growth Outlook & Temu Risks The Key Focuses BuyYuqingNo ratings yet

- Harnischfeger Corporation ResearchDocument2 pagesHarnischfeger Corporation Researchkynang0% (1)

- Balanced Scorecard APADocument8 pagesBalanced Scorecard APAdavidasaya50% (4)

- Brand Positioning StrategiesDocument7 pagesBrand Positioning StrategiesdeepaksahilNo ratings yet

- AdvanceAutoPartsConference Call Presentation101613Document18 pagesAdvanceAutoPartsConference Call Presentation101613aedcbf123No ratings yet

- VP Manufacturing Supply Chain in Denver CO Resume Reynold GobrisDocument2 pagesVP Manufacturing Supply Chain in Denver CO Resume Reynold GobrisReynold GobrisNo ratings yet

- Marketing ManagementDocument159 pagesMarketing ManagementpunithajobsNo ratings yet

- VC and IPO NumericalDocument16 pagesVC and IPO Numericaluse lnctNo ratings yet

- Gartner Critical Capabilites RPA 2019Document35 pagesGartner Critical Capabilites RPA 2019Budiartha PrakosaNo ratings yet

- Sullivan Ford Auto WorldDocument12 pagesSullivan Ford Auto WorldVignesh RV100% (2)

- Online jewellery startup Bareeki targets university studentsDocument20 pagesOnline jewellery startup Bareeki targets university studentsheena zubairNo ratings yet

- RetailDocument15 pagesRetailJacqueline TomNo ratings yet

- Activity Based CostingDocument52 pagesActivity Based CostingraviktatiNo ratings yet

- Stock Pitch TemplateDocument13 pagesStock Pitch TemplateRyland Eric100% (1)

- Metabical-Forecasting, Pricing and Packaging StrategyDocument4 pagesMetabical-Forecasting, Pricing and Packaging StrategyVinit Vijay Sankhe100% (1)

- Abrams Company Case Study - MADocument2 pagesAbrams Company Case Study - MAMuhammad Zakky AlifNo ratings yet

- Wyeth ValuationDocument54 pagesWyeth ValuationSaurav GoyalNo ratings yet

- The Joint Corp: A Franchise Concept With Significant Growth RunwayDocument38 pagesThe Joint Corp: A Franchise Concept With Significant Growth RunwayJerry HsiangNo ratings yet

- Godrej AgrovetDocument37 pagesGodrej AgrovetBandaru NarendrababuNo ratings yet

- BCG Online Case Assessment User Guide 2023Document13 pagesBCG Online Case Assessment User Guide 2023aytansuleymanNo ratings yet

- CVA AVA Candidate HandbookDocument23 pagesCVA AVA Candidate HandbookMahmoud ȜliNo ratings yet

- Ugba103 1 F15Document210 pagesUgba103 1 F15MotherfuckerBitch100% (1)

- Eco ProjectDocument29 pagesEco ProjectAditya SharmaNo ratings yet

- NYSF Practice TemplateDocument22 pagesNYSF Practice TemplaterapsjadeNo ratings yet

- BAV Model v4.7Document27 pagesBAV Model v4.7Missouri Soufiane100% (2)

- Small Bank Pro Forma Model: Balance Sheets Thousand $Document5 pagesSmall Bank Pro Forma Model: Balance Sheets Thousand $jam7ak3275No ratings yet

- WK - 7 - Relative Valuation PDFDocument33 pagesWK - 7 - Relative Valuation PDFreginazhaNo ratings yet

- A Hybrid Stock Selection Model Using Genetic Algorithms and Support Vector Regression PDFDocument12 pagesA Hybrid Stock Selection Model Using Genetic Algorithms and Support Vector Regression PDFspsberry8100% (1)

- GM Layered AuditsDocument13 pagesGM Layered Auditselyes50% (2)

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Research Affiliates Pitfalls in Smart BetaDocument35 pagesResearch Affiliates Pitfalls in Smart BetaJoshua BayNo ratings yet

- Quiz1 PDFDocument45 pagesQuiz1 PDFShami Khan Shami KhanNo ratings yet

- Safal Niveshak Stock Analysis Excel Version 5 0Document47 pagesSafal Niveshak Stock Analysis Excel Version 5 0Yati GargNo ratings yet

- RJR Nabisco LBODocument14 pagesRJR Nabisco LBONazir Ahmad BahariNo ratings yet

- Relative ValuationDocument29 pagesRelative ValuationOnal RautNo ratings yet

- Case StudyDocument15 pagesCase StudyReynaldo NyotoNo ratings yet

- Financial Analysis K-ElectricDocument7 pagesFinancial Analysis K-ElectricFightclub ErNo ratings yet

- External Environment of AmazonDocument2 pagesExternal Environment of AmazonEr SarangiNo ratings yet

- HSBC Isf Multi AlphaDocument46 pagesHSBC Isf Multi AlphaEmanuil SirakovNo ratings yet

- Corporate RestructuringDocument62 pagesCorporate RestructuringAkshata AyreNo ratings yet

- SwapsDocument30 pagesSwapsRashmiroja SahuNo ratings yet

- WhiteMonk HEG Equity Research ReportDocument15 pagesWhiteMonk HEG Equity Research ReportgirishamrNo ratings yet

- Minor Project Report on Financial ModelingDocument104 pagesMinor Project Report on Financial ModelingFarhan khanNo ratings yet

- DCF ModellDocument7 pagesDCF ModellziuziNo ratings yet

- BAV Model v4.7Document26 pagesBAV Model v4.7jess236No ratings yet

- Cost of Capital Webinar 0110Document54 pagesCost of Capital Webinar 0110blibayNo ratings yet

- Investment Decision MethodDocument44 pagesInvestment Decision MethodashwathNo ratings yet

- Kevin Buyn - Denali Investors Columbia Business School 2009Document36 pagesKevin Buyn - Denali Investors Columbia Business School 2009g4nz0No ratings yet

- SN Smsa ToolDocument56 pagesSN Smsa ToolFabio Alexander Novoa RamirezNo ratings yet

- RC Equity Research Report Essentials CFA InstituteDocument3 pagesRC Equity Research Report Essentials CFA InstitutetheakjNo ratings yet

- M&a - Retail StoresDocument186 pagesM&a - Retail Storesvaibhavsinha101No ratings yet

- Initiating Coverage Maruti SuzukiDocument13 pagesInitiating Coverage Maruti SuzukiAditya Vikram JhaNo ratings yet

- Seed Marketing in IndiaDocument12 pagesSeed Marketing in Indiaaki16288No ratings yet

- RTN Connect Dfa Dfa PDFDocument24 pagesRTN Connect Dfa Dfa PDFKishanNo ratings yet

- FCFF Valuation Model: Before You Start What The Model Doe Inputs Master Inputs Page Earnings NormalizerDocument34 pagesFCFF Valuation Model: Before You Start What The Model Doe Inputs Master Inputs Page Earnings Normalizernikhil1684No ratings yet

- Chapter 13Document13 pagesChapter 13IUSNo ratings yet

- Financial Accounting - MGT101 Power Point Slides Lecture 44Document29 pagesFinancial Accounting - MGT101 Power Point Slides Lecture 44Advance KnowledgeNo ratings yet

- Summer Internship ProjectDocument23 pagesSummer Internship ProjectJoni GoelNo ratings yet

- EliseaielloresumeDocument2 pagesEliseaielloresumeapi-309210028No ratings yet

- SWOT Analysis of Les Maisonnettes Eco-Tourism BusinessDocument2 pagesSWOT Analysis of Les Maisonnettes Eco-Tourism BusinessAlvaro CamposNo ratings yet

- Case Study On Supply Chain Management RajDocument5 pagesCase Study On Supply Chain Management RajGhule VinayakNo ratings yet

- The Product Life CycleDocument8 pagesThe Product Life CycleMundondoNo ratings yet

- Report On FlexituffDocument30 pagesReport On FlexituffTanmay AgrawalNo ratings yet

- Chapter 11Document39 pagesChapter 11joyabyssNo ratings yet

- Intelligent Guide To Buyer PersonasDocument32 pagesIntelligent Guide To Buyer PersonasifeniyiNo ratings yet

- Abdul Rahman Dalupang Romuros: ObjectivesDocument2 pagesAbdul Rahman Dalupang Romuros: ObjectivesSarip Sharief SaripadaNo ratings yet

- Accounting 1, Chapter 5Document4 pagesAccounting 1, Chapter 5Akademik PPMA JordanNo ratings yet

- Strama ReportDocument5 pagesStrama ReportElaine MorenoNo ratings yet

- A Theory of Demand For Products PDFDocument21 pagesA Theory of Demand For Products PDFSoukunNo ratings yet

- Masar InvoiceDocument1 pageMasar InvoiceyasirNo ratings yet

- McDonald's Marketing Management AnalysisDocument7 pagesMcDonald's Marketing Management AnalysisVishal VijNo ratings yet

- Communication Process With Reference To AdvertisingDocument11 pagesCommunication Process With Reference To Advertisingapi-291598576No ratings yet