Professional Documents

Culture Documents

Surrender Request Form PDF

Uploaded by

sharonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Surrender Request Form PDF

Uploaded by

sharonCopyright:

Available Formats

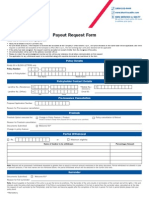

Phoenix Life Insurance Company Mail to: Full Surrender Request

PHL Variable Insurance Company PO Box 8027

Phoenix Life and Annuity Company Boston MA 02266-8027 OR

Fax: 816-221-9674

A. Account Information

Policy/Contract Number Insured/Annuitant Name(s): Please print full name

11188147 Gerald & Sue Friedman

Daytime Telephone Number (Include area code) Advisors Telephone Number (Include area code)

B. Transaction Type

Full Surrender

Direction to Pay A Third Party (Financial Institution Only. This does not constitute a 1035 Exchange.)

Please indicate name and address of Financial Institution

Name ______________________________________________________________________________________

Address ____________________________________________________________________________________

City/State/ZIP Code ____________________________________________________________________________

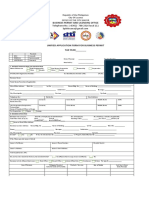

C. Taxes (If no election is made we will withhold Federal taxes at a minimum rate of 10%)

Do Not withhold taxes Withhold taxes at 10% Withhold taxes at a rate of ______% (minimum of 10%)

The distributions paid from your contract may be subject to Federal Income Tax. The Company is required by the Internal

Revenue Code to withhold 10% Federal Income Tax on distributions deemed to be taxable, unless you meet certain

requirements and elect not to have withholding apply. If you do not have sufficient Federal Income Tax withheld from your

distribution, you may incur penalties under the estimated tax rules. Phoenix will not withhold Federal Taxes on Pensions, Profit

Sharing, Keogh Plans or Annuities owned in IRA accounts outside Phoenix.

I am aware that there may be tax consequences resulting from this transaction. Under penalty of perjury, I certify that the

correct Social Security/Taxpayer Identification Number is shown below.

Your Social Security / Taxpayer Identification Number is REQUIRED;

Social Security Number: _____ / ____ / _________ or Taxpayer Identification Number: _____ / _______________

D. Tax-Sheltered Annuity Contract Additional Requirements

(Must be completed for all Section 403(b) Tax-Sheltered Annuities)

The Internal Revenue Code limits the conditions under which a distribution may be made from a Section 403(b) annuity

contract. Surrender or partial withdrawal is only permitted when: (please check one)

The employee attains age 59, has a severance from employment, dies or becomes disabled. (Documentation and

completed form OL3049 required.)

(Documentation for age includes birth certificate, passport, drivers license; documentation for severance from employment

includes written materials from employer sponsoring 403(b) Plan referencing severance, resignation, retirement.)

A hardship exists. (Employer approval and completed form OL4395 required.)

(The amount distributed in a hardship case cannot include any income earned under the contract.)

Distributions not paid directly to an eligible retirement plan (including an IRA) in a direct rollover are subject to 20-percent

mandatory income tax withholding. See Special Tax Notice Regarding Section 403(b) Tax-Sheltered Annuity Plan Payments

for more information and other exceptions relating to the withholding requirement. The mandatory withholding and

surrender/partial withdrawal restrictions are required under the Internal Revenue Code and Phoenix is required to abide by

these guidelines.

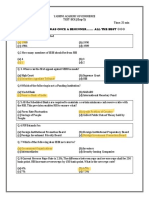

20150617141545823000

Business Use Only: __________________________________________

11188147

Policy/Contract Number: ______________________________________

Form Void If Altered

OL4212 3 of 4 2-15

You might also like

- FS Form 5188Document3 pagesFS Form 51882Plus100% (4)

- Short Sale Information Packet: Please Send The Completed Packet As Well As All Required DocumentationDocument10 pagesShort Sale Information Packet: Please Send The Completed Packet As Well As All Required DocumentationSue HudsonNo ratings yet

- Torque Converter Lock-Up FunctionDocument2 pagesTorque Converter Lock-Up Functioncorie132100% (1)

- Sbi Home Loan Application FormDocument5 pagesSbi Home Loan Application FormDhawan SandeepNo ratings yet

- CSP Study Course 2 Willard StephensonDocument137 pagesCSP Study Course 2 Willard Stephensonsamer alrawashdehNo ratings yet

- Sav 5188Document3 pagesSav 5188sopor,es painNo ratings yet

- 05 - SRX NatDocument44 pages05 - SRX NatLuc TranNo ratings yet

- How To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditFrom EverandHow To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditNo ratings yet

- PPP Loan Forgiveness Application Form 3508S EXP DEC 2023Document2 pagesPPP Loan Forgiveness Application Form 3508S EXP DEC 2023JoniTay802No ratings yet

- 580N 580SN 580SN WT 590SN With POWERSHUTTLE ELECTRICAL SCHEMATICDocument2 pages580N 580SN 580SN WT 590SN With POWERSHUTTLE ELECTRICAL SCHEMATICEl Perro100% (1)

- Policy Fund Withdrawal Form: FWP/FSC CodeDocument2 pagesPolicy Fund Withdrawal Form: FWP/FSC CodeEra gasperNo ratings yet

- Discharge Voucher ULIP End V6.1 RevisedDocument3 pagesDischarge Voucher ULIP End V6.1 Revisedsunny0908No ratings yet

- Np2 AnswerDocument13 pagesNp2 AnswerMarie Jhoana100% (1)

- DT Question BankDocument193 pagesDT Question BankSangamUpadhayayNo ratings yet

- PPP Loan Forgiveness Application (Revised 6.16.2020)Document5 pagesPPP Loan Forgiveness Application (Revised 6.16.2020)LaurenNo ratings yet

- Maturity FormDocument3 pagesMaturity FormNashitNo ratings yet

- Supplier ContarctarDocument7 pagesSupplier ContarctarAbdiaziz M. YusoufNo ratings yet

- Credit ApplicationDocument3 pagesCredit ApplicationALSIRAT CONTRACTINGNo ratings yet

- HBSI Verso Benefit Claim - New - 2022Document6 pagesHBSI Verso Benefit Claim - New - 2022famrawbNo ratings yet

- Paycheck Protection Program: Business Legal Name ("Borrower") DBA or Tradename, If ApplicableDocument3 pagesPaycheck Protection Program: Business Legal Name ("Borrower") DBA or Tradename, If ApplicableJanon Fisher100% (2)

- SA Form Filling GuidelinesDocument9 pagesSA Form Filling Guidelinesd128128No ratings yet

- Thomson East Coast Line, Work Injury Compensation FormDocument3 pagesThomson East Coast Line, Work Injury Compensation FormbankerjudisNo ratings yet

- RFQ No. 25-2020 - Psychological Test Materials For Recruitment of Personnel in The GPPB-TSODocument4 pagesRFQ No. 25-2020 - Psychological Test Materials For Recruitment of Personnel in The GPPB-TSOHannah MadridNo ratings yet

- New Application For Surrender of Policy 151212 (CTFN)Document2 pagesNew Application For Surrender of Policy 151212 (CTFN)Ramkumar KumarNo ratings yet

- Form 1594777111Document1 pageForm 1594777111Evcillove Mangubat100% (1)

- Description: Tags: FP0705AttFAppPNoteStandardDocument18 pagesDescription: Tags: FP0705AttFAppPNoteStandardanon-23498No ratings yet

- Cancellation FormDocument2 pagesCancellation FormAkash TebaliyaNo ratings yet

- Absa Consultants and Actuaries Afrimat Pension Fund (Withdrawal) - 101456903 PDFDocument3 pagesAbsa Consultants and Actuaries Afrimat Pension Fund (Withdrawal) - 101456903 PDFAlvin JantjiesNo ratings yet

- Partial Withdrawal FormDocument2 pagesPartial Withdrawal FormPinkys Venkat100% (1)

- 20/12/2009 Pao Hyderabad (HQR) Telangana Abdul Aleem Ahmed Mohd AGRI/21462 Emp Id:2133025Document2 pages20/12/2009 Pao Hyderabad (HQR) Telangana Abdul Aleem Ahmed Mohd AGRI/21462 Emp Id:2133025Agri AdilabadNo ratings yet

- Policy Amendment Request Form: GO StampDocument3 pagesPolicy Amendment Request Form: GO StampPritam sarkarNo ratings yet

- Small Business Loan Application Form For Individual - Sole - BDODocument2 pagesSmall Business Loan Application Form For Individual - Sole - BDOjunco111222No ratings yet

- 5062 Policy Payout FormDocument2 pages5062 Policy Payout Formbpd21No ratings yet

- GST Reg ChecklistDocument35 pagesGST Reg ChecklistShaik MastanvaliNo ratings yet

- Vat 05Document3 pagesVat 05Hirojit GhoshNo ratings yet

- Postpone Mortgage (Single Borrower) Unemployed 2020Document1 pagePostpone Mortgage (Single Borrower) Unemployed 2020Ng Yen YoongNo ratings yet

- The Revised VAT Forms, Which Are Now Operative Under The Punjab VAT Act & Rules, 2005Document6 pagesThe Revised VAT Forms, Which Are Now Operative Under The Punjab VAT Act & Rules, 2005Dinamite ThestrikerNo ratings yet

- Policy Cancellation Form NewDocument2 pagesPolicy Cancellation Form Newteja_praveenNo ratings yet

- Link ClickDocument2 pagesLink ClickSukh BrarNo ratings yet

- POLICY SERVICING REQUEST 2 - With StandardDocument3 pagesPOLICY SERVICING REQUEST 2 - With Standardsarwar shamsNo ratings yet

- FACTA-CRS Non Individual Declaration FormDocument1 pageFACTA-CRS Non Individual Declaration FormGSTMS ANSARINo ratings yet

- GOJ Client Banking Info FormDocument3 pagesGOJ Client Banking Info FormDamion CampbellNo ratings yet

- Claim For Lost, Stolen, or Destroyed United States Savings BondsDocument6 pagesClaim For Lost, Stolen, or Destroyed United States Savings BondsMister Nobody0% (1)

- Customer Details and Policy Feature Change Request Form Version 2.0 - tcm47-60089Document2 pagesCustomer Details and Policy Feature Change Request Form Version 2.0 - tcm47-60089UserNED100% (2)

- Home Loan Application FormDocument2 pagesHome Loan Application Formanon_300020848No ratings yet

- VRF-UNITY - NewDocument6 pagesVRF-UNITY - NewMohamad ChaudhariNo ratings yet

- ICICI Name & Signature DeletionDocument2 pagesICICI Name & Signature DeletionRajiv Kumar100% (1)

- Withdrawal Great American Life FormsDocument13 pagesWithdrawal Great American Life FormsMax PowerNo ratings yet

- Blank NPS FormDocument6 pagesBlank NPS FormSurender TanwarNo ratings yet

- Application FOR Unemployment Benefits Under RA 8291: DateDocument2 pagesApplication FOR Unemployment Benefits Under RA 8291: DateGianJyrellAlbertoCorletNo ratings yet

- Motor ClaimDocument4 pagesMotor Claimsndakshin@gmail.comNo ratings yet

- CHANGE REQUEST FORM With NCD-20200909164219Document2 pagesCHANGE REQUEST FORM With NCD-20200909164219Ajijur Rahman0% (1)

- General Instruction (S) : Self-Certification Form - IndividualDocument4 pagesGeneral Instruction (S) : Self-Certification Form - IndividualMuhammadNo ratings yet

- Accreditation FormDocument2 pagesAccreditation Formrowena balaguerNo ratings yet

- Payout Request FormDocument2 pagesPayout Request FormSATHISHLATEST2005100% (11)

- Employee Leasing Company Initial Registration of Client CompaniesDocument2 pagesEmployee Leasing Company Initial Registration of Client CompaniesHirenSitaparaNo ratings yet

- 05/06/1980 Medchal Dto Naveen Kumar Sangi POL/149389 Emp Id:2556726Document2 pages05/06/1980 Medchal Dto Naveen Kumar Sangi POL/149389 Emp Id:2556726Naveen Kunar SangiNo ratings yet

- Business Permit and Licensing Office: Telephone No. (+6342) - 788-2316 Local 111Document2 pagesBusiness Permit and Licensing Office: Telephone No. (+6342) - 788-2316 Local 111Ren Michelle Villaverde PaleracioNo ratings yet

- Transfer of Ownership PDFDocument1 pageTransfer of Ownership PDFSachin DivateNo ratings yet

- Pag-IBIG Housing Loan ApplicationDocument2 pagesPag-IBIG Housing Loan Applicationjcprado3No ratings yet

- Public Records Filing For New Business Entity: State of New Jersey Division of RevenueDocument4 pagesPublic Records Filing For New Business Entity: State of New Jersey Division of RevenueGJHPENo ratings yet

- Moral HazardDocument1 pageMoral HazardYogesh Babu100% (2)

- 002 - Bidder QuestionnaireDocument6 pages002 - Bidder QuestionnaireSon DDarrellNo ratings yet

- Policy Fund Withdrawal Form v2Document2 pagesPolicy Fund Withdrawal Form v2Julius Harvey Prieto BalbasNo ratings yet

- (English) 362L Stereoselective Wittig Reaction - Synthesis of Ethyl Trans-Cinnamate (#7) (DownSub - Com)Document6 pages(English) 362L Stereoselective Wittig Reaction - Synthesis of Ethyl Trans-Cinnamate (#7) (DownSub - Com)moNo ratings yet

- S No. Store Type Parent ID Partner IDDocument8 pagesS No. Store Type Parent ID Partner IDabhishek palNo ratings yet

- Architectural Challenges in Agile PracticeDocument4 pagesArchitectural Challenges in Agile PracticePranab PyneNo ratings yet

- Arba Minch University Institute of Technology Faculty of Computing & Software EngineeringDocument65 pagesArba Minch University Institute of Technology Faculty of Computing & Software Engineeringjemu mamedNo ratings yet

- Uploading, Sharing, and Image Hosting PlatformsDocument12 pagesUploading, Sharing, and Image Hosting Platformsmarry janeNo ratings yet

- Rules and Regulations of Asian Parliamentary Debating FormatDocument2 pagesRules and Regulations of Asian Parliamentary Debating FormatmahmudNo ratings yet

- BCK Test Ans (Neha)Document3 pagesBCK Test Ans (Neha)Neha GargNo ratings yet

- AMAZONS StategiesDocument2 pagesAMAZONS StategiesPrachi VermaNo ratings yet

- Address All Ifrs 17 Calculations Across The Organization W Ith A Unified PlatformDocument4 pagesAddress All Ifrs 17 Calculations Across The Organization W Ith A Unified Platformthe sulistyoNo ratings yet

- Assignment Mid Nescafe 111173001Document5 pagesAssignment Mid Nescafe 111173001afnan huqNo ratings yet

- Cortex - M1: Technical Reference ManualDocument174 pagesCortex - M1: Technical Reference ManualSzilárd MájerNo ratings yet

- Role of SpeakerDocument11 pagesRole of SpeakerSnehil AnandNo ratings yet

- Reliability EngineerDocument1 pageReliability EngineerBesuidenhout Engineering Solutions and ConsultingNo ratings yet

- Brief On Safety Oct 10Document28 pagesBrief On Safety Oct 10Srinivas EnamandramNo ratings yet

- D13A540, EU4SCR - Eng - 01 - 1499912Document2 pagesD13A540, EU4SCR - Eng - 01 - 1499912javed samaaNo ratings yet

- Installing Oracle Fail SafeDocument14 pagesInstalling Oracle Fail SafeSantiago ArgibayNo ratings yet

- Python BarchartDocument34 pagesPython BarchartSeow Khaiwen KhaiwenNo ratings yet

- UntitledDocument1 pageUntitledsai gamingNo ratings yet

- NATIONAL DEVELOPMENT COMPANY v. CADocument11 pagesNATIONAL DEVELOPMENT COMPANY v. CAAndrei Anne PalomarNo ratings yet

- Link Belt Rec Parts LastDocument15 pagesLink Belt Rec Parts LastBishoo ShenoudaNo ratings yet

- Option - 1 Option - 2 Option - 3 Option - 4 Correct Answer MarksDocument4 pagesOption - 1 Option - 2 Option - 3 Option - 4 Correct Answer MarksKISHORE BADANANo ratings yet

- Lab - Report: Experiment NoDocument6 pagesLab - Report: Experiment NoRedwan AhmedNo ratings yet

- ADocument2 pagesAẄâQâŗÂlïNo ratings yet

- Vigi Module Selection PDFDocument1 pageVigi Module Selection PDFrt1973No ratings yet

- JJDocument119 pagesJJAnonymous 5k7iGyNo ratings yet