Professional Documents

Culture Documents

MAF620 Test 1 - Nov 2011

Uploaded by

Nur IfaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MAF620 Test 1 - Nov 2011

Uploaded by

Nur IfaCopyright:

Available Formats

CONFIDENTIAL AC/NOV 2011/MAF620

UNIVERSITI TEKNOLOGI MARA

PROGRESS TEST 1

COURSE : CORPORATE FINANCE

COURSE CODE : MAF 620

DATE : 24 November 2011

TIME : 2 HOURS

INSTRUCTION TO CANDIDATES

1. This question paper consists of four (4) Questions. Answer all questions.

2. Do not bring any material into the examination room unless permission is given by the

invigilator.

This examination paper consists of printed pages

Hak Cipta Universiti Teknologi MARA 1 CONFIDENTIAL

CONFIDENTIAL AC/NOV 2011/MAF620

QUESTION 1

A. Data pertaining to the performance of the shares of three public listed companies at Bursa Malaysia

was complied by a consultant is presented below:

State of Economy Returns on MSB Bhd Returns on Sime Returns on Protec

Shares Bhd Shares Bhd Shares

Recession 3% -10% 17%

Normal 10% 18% 8%

Boom 15% 25% -6%

The possibility of the occurrence, based on past record indicates a probability of 0.25, 0.40 and 0.35

each of the economic condition to occur. Mr. Roland is interested to invest in the above shares and

due to limited fund, he has asked your help to analyse which possible combination of shares to

choose. In order to assist Mr. Roland to decide on his investment, you are required to furnish him

with the following additional information:

1.

The expected returns of the above shares

2.

The variance of the above shares

3.

The standard deviation of each of the share

4.

The covariance and correlation of the possible pair of the above securities

5.

Mr. Roland is to choose his investment portfolio based on the following proportions:

a. 60% in MASB Bhd and 40% in Sime Bhd

b. 30% in Sime Bhd and 70% in Protec Bhd

c. 45% in Protec Bhd and 55% in Msb Hhd

In order to assist Mr. Roland, you are required to calculate the expected return,

variance and standard deviation of the proposed portfolio based on the above

proportions.

6. Advice Mr. Roland which of the above portfolio is the best for him to invest and why?

(12 marks)

(Total: 12 marks)

QUESTION 2

A. Encik Haneef is evaluating six (6) companies for investment purposes. The Treasury

Bills is 4% and the Market Risk Premium is 7%. As of September 2011, the betas and

expected returns for the six companies are provided below:

Company Beta Expected Return

Selasih 1.20 15%

Melur 1.30 12%

Chempaka 0.75 12%

Lotus 0.60 13%

Rose 1.50 16.5%

Oregano 0.50 6.5%

Assume that the capital-asset pricing model is valid.

Required:

a) Calculate the required rate of return for the ordinary shares of each of the above

companies. Which of these shares are underpriced, overpriced or correctly priced? Advise

Encik Haniff what actions to be taken in the investment. (12 marks)

b) If Encik Haneef bought an equal Ringgit amount of each of these stocks,

Hak Cipta Universiti Teknologi MARA 2 CONFIDENTIAL

CONFIDENTIAL AC/NOV 2011/MAF620

i. Determine the beta of his portfolio. Comment whether his portfolio is more or less risky

compared to market portfolio.

ii. Determine the required return on his portfolio. (4 marks)

B. Azeldeen hassome excess cash and approached you for some advice with the following

information.

Security Average Standard Beta Correlation

Return Deviation Coefficient Coefficient of

return on security

with the market

Belang Berhad 16% (i) 0.9 0.72

Rimba Berhad 20% 16% 1.3 (ii)

Market 15% 12% (iii) (iv)

Treasury Bills 8% 0% (v) (vi)

Required:

Determine the missing values in the table. (4 marks)

(Total: 20 marks)

QUESTION 3

A. Miss Ana is planning to form an equally weighted portfolio of stocks. Assuming that, a two

factor model describes the returns on each of these stocks. She was informed that in the

stock market, there are many stocks that all have the same beta with respect to two factors

that is beta 1.3 for the first factor and beta 0.8 for the second factor.

Required:

If the expected return of all the stocks is 10%,

i. Express the returns on Miss Anas portfolio in an equation form if she plans to place only

5 stocks in it.

ii. Express the returns on Miss Anas portfolio in an equation form if she places in it a

very

large number of stocks. (4 marks)

B. As an investor in Royal Sdn. Bhd, Ryan expected the following events to take place:

i. The interest rates would increase by 3%. The returns of Royal are negatively related to

interest rates.

ii. A new product would be launched soon by Royal Sdn Bhd.

iii. Inflation would rise by 2%. The returns of Royal Sdn Bhd are negatively related to

inflation.

iv. GNP would decrease by 2%. The returns of Royal Sdn Bhd are positively related to

GNP.

The following events actually occurred:

Hak Cipta Universiti Teknologi MARA 3 CONFIDENTIAL

CONFIDENTIAL AC/NOV 2011/MAF620

i. Bank Negara issued a directive requiring all banks to increase interest rates by 2%.

ii. The new product was launched as planned.

iii. Inflation rose by 1.3%.

iv. GNP decrease by 1%.

Required:

i. Discuss how each of the actual events affects the return of Ryan shares in Royal Sdn

Bhd.

ii. For each event, identify whether it represents systematic risk or unsystematic.

(6 marks)

(Total: 10 marks)

Hak Cipta Universiti Teknologi MARA 4 CONFIDENTIAL

CONFIDENTIAL AC/NOV 2011/MAF620

SOLUTIONS

QUESTION 1

A.

1. The expected returns:

= 0.25(0.03) + 0.40(0.10) + 0.35(0.15) = 0.10 @ 10%

= 0.25(-0.10) + 0.40(0.18) + 0.35(0.25) = 0.1345 @ 13.45%

= 0.25(0.17) + 0.40(0.08) + 0.35(-0.06) = 0.0535 @ 5.35%

2. Variance of each share:

= 0.25(0.03 0.10 + 0.40(0.10 0.10 + 0.35(0.15 - 0.10 = 0.0021

= 0.25(- 0.10 0.1345 + 0.40(0.18 - 0.1345 + 0.35(0.25 - 0.1345 = 0.00192445

= 0.25(0.17 0.0535 + 0.40(0. 80 0.0535 + 0.35(- 0.06 - 0.0535 = 0.00818275

3. Standard deviation of each share:

= = 0.04582576 @ 5.5825%

= = 0.1387 @ 13.87%

= = 0.09045 @ 9.045%

4. Covariance for each pair:

= 0.25(0.03 0.10 (- 0.10 0.1345 + 0.40(0.10 0.10 (0.18 - 0.1345 + 0.35(0.15 -

0.10 (0.25 - 0.1345 = 0.006125

= 0.25(0.03 0.10 (0.17 0.0535 + 0.40(0.10 0.10 (0. 80 0.0535 + 0.35(0.15 -

0.10 (- 0.06 - 0.0535 = - 0.004025

= 0.25(- 0.10 0.1345 (0.17 0.0535 + 0.40(0.18 - 0.1345 (0. 80 0.0535 + 0.35

(0.25 - 0.1345 (- 0.06 - 0.0535 = - 0.01093575

Hak Cipta Universiti Teknologi MARA 5 CONFIDENTIAL

CONFIDENTIAL AC/NOV 2011/MAF620

Correlation:

= = 0.963562244

= = - 0.9709736

= = - 0.871688979

5. Investment portfolio:

a. 60% M, 40% S

= 0.60(0.10) + 0.40(0.1345) = 0.1138 @ 11.38%

+ 2 +

= (0.60 (0.1345) + 2(.60)(0.40)(0.006125) + (0.40 (0.0192445) = 0.00677516

= = 0.08231136 @ 8.23%

b. 30% S, 70% P

= 0.30(0.0021) + 0.70(0.0535) = 0.0778 @ 7.78%

+ 2 +

= (0.30 (0.00192445) + 2(.30)(0.70)( - 0.01093575) + (0.70 (0.00818275) =

0.00114856

= = 0.033896 @ 3.39%

c. 45% P, 55% M

= 0.450(0.0535) + 0.55(0.10) = 0.0791 @ 7.91%

+ 2 +

= (0.45 (0.00818275) + 2(.45)(0.55)( - 0.004025) + (0.55 (0.0021) =

0.000299881

Hak Cipta Universiti Teknologi MARA 6 CONFIDENTIAL

CONFIDENTIAL AC/NOV 2011/MAF620

= = 0.017317022 @ 1.73%

Decision: Choose C (45% P, 55%M), moderate returns but the lowest risk (standard

devistion).

B. Tests of semi-strong form of EMH event studies, record of mutual fund

C. i. Possible ii. Not possible iii. Not possible

QUESTION 2:

Expected

A. Return_ Action

a. Selasih = 4% + 1.20(7%) = 12.4% 15% Underpriced Buy

Melor = 4% + 1.30(7%) = 13.1% 12% Overpriced Sell

Chempaka = 4% + 0.75(7%) = 9.25% 12% Underpriced Buy

Lotus = 4% + 0.60(7%) = 8.20% 13% Underpriced Buy

Rose = 4% + 1.50(7%) = 14.5% 16.5% Underpriced Buy

Oregon = 4% + 0.50(7%) = 7.50% 6.5% Overpriced Sell

b. Beta of Portfolio

0.16(1.20) + 0.16(1.30) + 0.16(0.75) + 0.16(0.60) + 0.16(1.50) + 0.16(0.50) = 0.936

Portfolio is less risky compare to market portfolio because beta of portfolio is less than 1.

Required return on the Portfolio:

0.16(12.40%) + 0.16(13.1%) + 0.16(9.25%) + 0.16(8.20%) + 0.16(14.5%) + 0.16(7.50%) = 10.39%

B. The missing values:

i. = =

0.9 x 0.12 = 0.72 x =

0.108 = 0.72

= 0.108/0.72 = 0.15 @ 15%

i. = =

Hak Cipta Universiti Teknologi MARA 7 CONFIDENTIAL

CONFIDENTIAL AC/NOV 2011/MAF620

1.3 x 0.12 = =

0.156 =

= 0.156/0.16 = 0.975

ii. 1

iii. 1

iv. 0

v.0

QUESTION 3

A.

i. = 10% + 1.3 + 0.8 + 1/5( + + + + )

ii. = 10% + 1.3 + 0.8

B. i.

a. Actual interest rate increased by 2% to 5%, since return of Royal is negatively relate to interest,

the return of Royal will decrease

b. A new product of Royal is launch as expected, this will have no impact on the return of Royal

since this event has been anticipated

c. Actual inflation rose by 1.3% which is less than anticipated, and since return of Royal is

negatively relate to inflation, the return of Royal will increase

d. Actual GDP decreased by 1% which is less than anticipated, and since return of Royal is positively

relate to GDP, the return of Royal will decrease slightly

ii. Interest rate Systematic risk

New productUnsystematic risk

Inflation Systematic risk

GDP Systematic risk

Hak Cipta Universiti Teknologi MARA 8 CONFIDENTIAL

You might also like

- Assignment Law 485Document6 pagesAssignment Law 485Nur IfaNo ratings yet

- Maf 620 Dutch LadyDocument9 pagesMaf 620 Dutch LadyNur IfaNo ratings yet

- IBM Report EditedDocument10 pagesIBM Report EditedNur IfaNo ratings yet

- PBL Session 2 ReportDocument10 pagesPBL Session 2 ReportNur IfaNo ratings yet

- Report TrienekensDocument2 pagesReport TrienekensNur IfaNo ratings yet

- Case Study Ais510: PBL Session 1 A) What Kind of Information Do You Think Tesci Gathers?Document15 pagesCase Study Ais510: PBL Session 1 A) What Kind of Information Do You Think Tesci Gathers?Nur IfaNo ratings yet

- Article Review MafDocument5 pagesArticle Review MafNur IfaNo ratings yet

- PCI Case Study Maf680Document23 pagesPCI Case Study Maf680Nur Ifa100% (26)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Development CommunicationDocument253 pagesDevelopment CommunicationEsther Hle KhiaNo ratings yet

- Jzanzig - Acc 512 - Chapter 12Document27 pagesJzanzig - Acc 512 - Chapter 12lehvrhon100% (1)

- Thought Arbitrage Research InstituteDocument2 pagesThought Arbitrage Research InstitutesmitadoNo ratings yet

- Savran y Tonak - Productive and Unproductive LabourDocument40 pagesSavran y Tonak - Productive and Unproductive LabourraúlNo ratings yet

- Grade - 11 Micro Economics Ch:03 Demand IDocument14 pagesGrade - 11 Micro Economics Ch:03 Demand IShubham GoelNo ratings yet

- Urban Informal Sector: A Case Study of Street Vendors in KashmirDocument4 pagesUrban Informal Sector: A Case Study of Street Vendors in KashmirMikoNo ratings yet

- An Overview of ITPFDocument3 pagesAn Overview of ITPFnurul000No ratings yet

- Mirco IIDocument87 pagesMirco IIChristine KaberaNo ratings yet

- Include Us Out - Economic Development and Social Policy N The Creative IndustriesDocument20 pagesInclude Us Out - Economic Development and Social Policy N The Creative Industries2lieNo ratings yet

- Personnel Economics LazerDocument157 pagesPersonnel Economics LazerAmit Sharma33% (3)

- Financial Markets and InstitutionsDocument19 pagesFinancial Markets and InstitutionsMapuia Lal PachuauNo ratings yet

- A Crazy Methodology - On The Limits of Macro-Quantitative Social Science ResearchDocument32 pagesA Crazy Methodology - On The Limits of Macro-Quantitative Social Science ResearchIan RonquilloNo ratings yet

- Money SupplyDocument15 pagesMoney Supplyhasan jamiNo ratings yet

- Economics ISC 11Document2 pagesEconomics ISC 11Sriyaa SunkuNo ratings yet

- Collective Efficiency and Increasing Returns: by Hubert SchmitzDocument28 pagesCollective Efficiency and Increasing Returns: by Hubert SchmitzFakhrudinNo ratings yet

- Global Supply Chain Disruptions Evolution, Impact, Outlook BISDocument9 pagesGlobal Supply Chain Disruptions Evolution, Impact, Outlook BISJae Hee LeeNo ratings yet

- Quiz No 2Document1 pageQuiz No 2Geriq Joeden PerillaNo ratings yet

- Samsung Electronics IN Thailand: Final CaseDocument25 pagesSamsung Electronics IN Thailand: Final Caselipzgalz9080No ratings yet

- 10 Fs Discount Rate in Project AnalysisDocument6 pages10 Fs Discount Rate in Project AnalysisMohammed HeshamNo ratings yet

- Mgt211 Updated Quiz 1 2021 We'Re David WorriorsDocument18 pagesMgt211 Updated Quiz 1 2021 We'Re David WorriorsDecent RajaNo ratings yet

- Economics Notes HindiDocument77 pagesEconomics Notes HindiYashwant Singh RathoreNo ratings yet

- Analyzing Common StockDocument47 pagesAnalyzing Common StockBang Topa50% (2)

- Measuring Exchange Rate MovementsDocument10 pagesMeasuring Exchange Rate Movementsmuhammad ahmadNo ratings yet

- ECON 200 F. Introduction To Microeconomics Homework 3 Name: - (Multiple Choice)Document11 pagesECON 200 F. Introduction To Microeconomics Homework 3 Name: - (Multiple Choice)Phan Hồng VânNo ratings yet

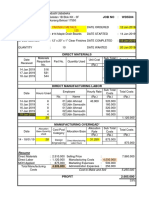

- COST SHEET Atau JOB COSTDocument1 pageCOST SHEET Atau JOB COSTWiraswasta MandiriNo ratings yet

- Market Failure and The Case of Government InterventionDocument16 pagesMarket Failure and The Case of Government InterventionCristine ParedesNo ratings yet

- Solution Manual For Microeconomics 8Th Edition Pindyck Rubinfeld 013285712X 9780132857123 Full Chapter PDFDocument36 pagesSolution Manual For Microeconomics 8Th Edition Pindyck Rubinfeld 013285712X 9780132857123 Full Chapter PDFwalter.collins464100% (16)

- Claudio Lucarelli CV-2018Document5 pagesClaudio Lucarelli CV-2018ignacioillanesNo ratings yet

- Hoff Kritik Der Klassischen Politischen Okonomie-Science SocietyDocument14 pagesHoff Kritik Der Klassischen Politischen Okonomie-Science SocietyManuel CáceresNo ratings yet

- Did Quaker Oats Make An Error in Buying Snapple or Did They Manage It BadlyDocument1 pageDid Quaker Oats Make An Error in Buying Snapple or Did They Manage It BadlyDeavanjan RanjanNo ratings yet