Professional Documents

Culture Documents

RR 20-2002

Uploaded by

Anton Mercado0 ratings0% found this document useful (0 votes)

8 views1 pageDigest

Original Title

RR_20-2002

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDigest

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageRR 20-2002

Uploaded by

Anton MercadoDigest

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

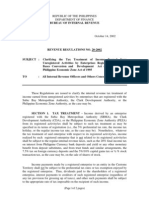

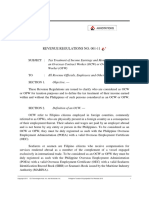

REVENUE REGULATIONS NO.

20-2002 issued on November 25, 2002 clarifies the

tax treatment of income earned from unregistered activities by enterprises registered

under the Bases Conversion and Development Act of 1992 and the Philippine Economic

Zone Act of 1995.

Income derived by an enterprise registered with the Subic Bay Metropolitan

Authority (SBMA), the Clark Development Authority (CDA), or the Philippine

Economic Zone Authority (PEZA) from its registered activity/ies shall be subject to such

tax treatment as may be specified in its term of registration.

Income realized by such registered enterprises that is not related to its registered

activity/ies shall, however, be subject to the regular internal revenue taxes, such as the

20% final Income Tax on interest from Philippine Currency bank deposits and yield or

any other monetary benefit from deposit substitutes, and from trust funds and similar

arrangements, the 7.5% tax on foreign currency deposits and the 5%/10% Capital Gains

Tax or % stock transaction tax, as the case may be, on the sale of shares of stock.

Income payments made by a registered enterprise to an entity in the Customs

Territory shall not be subject to the preferential tax rates or tax exemption enjoyed by the

registered enterprise. Thus, dividends paid to the shareholders of a registered enterprise,

interest payments to creditors of such registered enterprise, and other such payments shall

be subject to the appropriate rate of tax imposable on the recipient of such income.

You might also like

- RR 20-02Document2 pagesRR 20-02saintkarriNo ratings yet

- ITAD Ruling No 018-09Document11 pagesITAD Ruling No 018-09Peggy SalazarNo ratings yet

- Digest Bir Ruling 30-00, 19-01Document3 pagesDigest Bir Ruling 30-00, 19-01Jonathan Ocampo BajetaNo ratings yet

- Philippine Corporate TaxDocument3 pagesPhilippine Corporate TaxRaymond FaeldoñaNo ratings yet

- MODULE 6 PREFERENTIAL TAX RATES of CORPORATIONSDocument9 pagesMODULE 6 PREFERENTIAL TAX RATES of CORPORATIONSangclaire47No ratings yet

- RMC 55-80Document1 pageRMC 55-80matinikkiNo ratings yet

- RMC 55 80 - CompressDocument1 pageRMC 55 80 - CompressMarinella ReyesNo ratings yet

- Bir Ruling No. 743-18Document5 pagesBir Ruling No. 743-18Jaerelle HernandezNo ratings yet

- 02 Corporate Income TaxDocument10 pages02 Corporate Income TaxbajujuNo ratings yet

- 1999 BIR RulingsDocument74 pages1999 BIR Rulingschris cardinoNo ratings yet

- RR 16-99Document6 pagesRR 16-99matinikkiNo ratings yet

- BPRT RR 55-80Document2 pagesBPRT RR 55-80HADTUGINo ratings yet

- AS ReviewerDocument2 pagesAS ReviewerPem AndoyNo ratings yet

- Tax Treatment of Dividend ReceivedDocument10 pagesTax Treatment of Dividend ReceivedmukeshNo ratings yet

- RR 2-98Document85 pagesRR 2-98Elaine LatonioNo ratings yet

- Marubeni v. CIR DigestDocument4 pagesMarubeni v. CIR DigestStradivariumNo ratings yet

- Marubeni Corporation VS Commissioner ofDocument3 pagesMarubeni Corporation VS Commissioner ofMarjorie C. Sabijon-VillarinoNo ratings yet

- 2001 Bir RulingsDocument12 pages2001 Bir RulingsSarah Jeane CardonaNo ratings yet

- Group 5 HandoutDocument11 pagesGroup 5 HandoutKarla Marie TumulakNo ratings yet

- MARUBENI Vs CIR TAXDocument2 pagesMARUBENI Vs CIR TAXLemuel Angelo M. EleccionNo ratings yet

- Rulings1998 DigestDocument29 pagesRulings1998 DigestsophiegenesisNo ratings yet

- Tax On Foreign IndividualsDocument2 pagesTax On Foreign IndividualsSron OirubNo ratings yet

- Rulings2000 DigestDocument21 pagesRulings2000 DigestArriane MartinezNo ratings yet

- Bir Rulings Compilation 2022Document2 pagesBir Rulings Compilation 2022RANADA John BernardNo ratings yet

- Withholding Tax Bir Issuances & ProvisionsDocument22 pagesWithholding Tax Bir Issuances & ProvisionsJm CruzNo ratings yet

- Income Tax Revenue Memo and ResolutionDocument104 pagesIncome Tax Revenue Memo and ResolutionjufaedelNo ratings yet

- Updated RR 2-98 Sec 2.57.1 (E) Resident Foreign Corporation Passive IncomeDocument2 pagesUpdated RR 2-98 Sec 2.57.1 (E) Resident Foreign Corporation Passive IncomeJaymar DetoitoNo ratings yet

- TaxDocument6 pagesTaxBirs BirsNo ratings yet

- Revenue Regulations No 2-98Document70 pagesRevenue Regulations No 2-98azzy_km100% (1)

- RR 1-11 Tax Treatment of OCW or OFWDocument5 pagesRR 1-11 Tax Treatment of OCW or OFWKriszanFrancoManiponNo ratings yet

- Income Tax Part IIIDocument6 pagesIncome Tax Part IIImary jhoyNo ratings yet

- Changes Due To CREATE Law Corporate Income Tax (CIT) Reforms Under CREATE ActDocument7 pagesChanges Due To CREATE Law Corporate Income Tax (CIT) Reforms Under CREATE ActYietNo ratings yet

- Domestic Corporations Not Subject To MCITDocument3 pagesDomestic Corporations Not Subject To MCITMeghan Kaye LiwenNo ratings yet

- Categories of Income and Tax RatesDocument5 pagesCategories of Income and Tax RatesRonel CacheroNo ratings yet

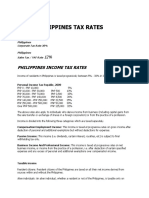

- Philippines Tax RatesDocument7 pagesPhilippines Tax RatesRonel CacheroNo ratings yet

- Highlights of The CREATE LawDocument3 pagesHighlights of The CREATE LawChristine Rufher FajotaNo ratings yet

- RR 2-98Document41 pagesRR 2-98matinikki100% (2)

- March BIR RulingsDocument13 pagesMarch BIR Rulingscarlee014No ratings yet

- Pedrocillo, Anne Abbygail V. CREATE LAWDocument2 pagesPedrocillo, Anne Abbygail V. CREATE LAWAnne Abbygail PedrocilloNo ratings yet

- CIR V Puregold 760 SCRA 96 (2015)Document2 pagesCIR V Puregold 760 SCRA 96 (2015)Maica MahusayNo ratings yet

- Chapter 3Document7 pagesChapter 3cerayNo ratings yet

- Income Tax Topic: Case Number: Case Name:: GR No. 76573 Marubeni Vs CIRDocument2 pagesIncome Tax Topic: Case Number: Case Name:: GR No. 76573 Marubeni Vs CIRJohn Dexter FuentesNo ratings yet

- Canvas Activity 2Document10 pagesCanvas Activity 2Micol VillaflorNo ratings yet

- Philippines Tax RatesDocument7 pagesPhilippines Tax RatesJL GEN0% (1)

- Passive IncomeDocument5 pagesPassive IncomeRandom VidsNo ratings yet

- RR 2-98Document21 pagesRR 2-98Joshua HorneNo ratings yet

- 247 1671580773536executive Summary Corporate Tax by Adepts CAsDocument5 pages247 1671580773536executive Summary Corporate Tax by Adepts CAsJohnNo ratings yet

- A Guide To Taxation in The PhilippinesDocument5 pagesA Guide To Taxation in The PhilippinesNathaniel MartinezNo ratings yet

- Philippines Income Tax RatesDocument6 pagesPhilippines Income Tax RatesKristina AngelieNo ratings yet

- Cir V Ayala Cir v. WanderDocument4 pagesCir V Ayala Cir v. WanderPhilip Frantz Guerrero100% (1)

- BIR RULING NO. 157-81 (Connected To Marubeni Case) Doctrine: PDocument1 pageBIR RULING NO. 157-81 (Connected To Marubeni Case) Doctrine: PChiiNo ratings yet

- Taxation of CorporationsDocument26 pagesTaxation of CorporationsjolinaNo ratings yet

- Chapter 5 - Final Income TaxationDocument13 pagesChapter 5 - Final Income TaxationBisag AsaNo ratings yet

- Create Act: Corporate Recovery & Tax Incentives For EnterprisesDocument6 pagesCreate Act: Corporate Recovery & Tax Incentives For EnterprisesDanica RamosNo ratings yet

- RR 2-98Document74 pagesRR 2-98Richard CaneteNo ratings yet

- Sir Lectures Final TaxDocument12 pagesSir Lectures Final TaxCrystal KateNo ratings yet

- JK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineFrom EverandJK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineNo ratings yet

- 2020 Revised Rules of Procedure For Intellectual Property Rights CasesDocument35 pages2020 Revised Rules of Procedure For Intellectual Property Rights CasesGabriel EmersonNo ratings yet

- Application Information CSD-ODI FORM 1 (Revised 2019)Document1 pageApplication Information CSD-ODI FORM 1 (Revised 2019)Anton MercadoNo ratings yet

- Another Day 53LRODocument1 pageAnother Day 53LROAnton MercadoNo ratings yet

- Legality of Checkpoints in PHDocument2 pagesLegality of Checkpoints in PHAnton MercadoNo ratings yet

- RFIDDocument1 pageRFIDAnton MercadoNo ratings yet

- Midterms CodalDocument10 pagesMidterms CodalAnton MercadoNo ratings yet

- Note On Canons of Claim InterpretationDocument9 pagesNote On Canons of Claim InterpretationAnton MercadoNo ratings yet

- EviSyl (2017) PDFDocument14 pagesEviSyl (2017) PDFNester MendozaNo ratings yet

- Lagman v. MedialdeaDocument6 pagesLagman v. Medialdeaquasideliks100% (3)

- Hallevy Volume 22Document37 pagesHallevy Volume 22Anton MercadoNo ratings yet

- 11.1 Treaty Provisions Right To LifeDocument6 pages11.1 Treaty Provisions Right To LifeAnton MercadoNo ratings yet

- Digests 3Document17 pagesDigests 3Anton MercadoNo ratings yet

- Robots Sept 20 PLusDocument1 pageRobots Sept 20 PLusAnton MercadoNo ratings yet

- Robots Sept 20 PLusDocument1 pageRobots Sept 20 PLusAnton MercadoNo ratings yet

- Lazarte SUPREME COURT CASEDocument14 pagesLazarte SUPREME COURT CASEAnton MercadoNo ratings yet

- Do We Need Robot LawDocument2 pagesDo We Need Robot LawAnton MercadoNo ratings yet

- Atty Sapalo Patent Digests Set 1Document26 pagesAtty Sapalo Patent Digests Set 1Anton MercadoNo ratings yet

- Lagman v. MedialdeaDocument6 pagesLagman v. Medialdeaquasideliks100% (3)

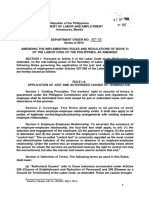

- Dept Order No - 147-15Document1 pageDept Order No - 147-15Anton MercadoNo ratings yet

- Loving V VirginiaDocument10 pagesLoving V VirginiaAnton MercadoNo ratings yet

- Origs 3Document135 pagesOrigs 3Anton MercadoNo ratings yet

- In Re Valenzuela and Vallarta DigestDocument2 pagesIn Re Valenzuela and Vallarta DigestTrina Donabelle Gojunco100% (7)

- Art. 428 Civil Code Paras, 2016 Page 89Document1 pageArt. 428 Civil Code Paras, 2016 Page 89Anton MercadoNo ratings yet

- Memorial For Sta. Maria Cup 2014Document4 pagesMemorial For Sta. Maria Cup 2014Anton MercadoNo ratings yet

- History 166 Midterm ReviewerDocument34 pagesHistory 166 Midterm ReviewerAnton Mercado100% (1)

- Labor JurisdictionDocument2 pagesLabor JurisdictionAnton MercadoNo ratings yet

- The Six Thinking Hats Exercise GuideDocument1 pageThe Six Thinking Hats Exercise GuideAnton MercadoNo ratings yet

- Is Morality A Relative Term? or Is There A Standard To Morality?Document3 pagesIs Morality A Relative Term? or Is There A Standard To Morality?Anton MercadoNo ratings yet

- The Philosophy of Human NatureDocument2 pagesThe Philosophy of Human NatureAnton MercadoNo ratings yet