Professional Documents

Culture Documents

Frb-Operating Circular 1 Appendices PDF

Uploaded by

Ben HillOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Frb-Operating Circular 1 Appendices PDF

Uploaded by

Ben HillCopyright:

Available Formats

Operating Circular 1

Account Relationships

Appendices

Revised July 2009

To: Federal Reserve Bank of _________________ Appendix 1

_______________________________________ Office

Attention: _______________________________________ Department

Master Account Agreement

The Institution named below agrees to the provisions of Operating Circular 1, Account Relationships, of the Federal

Reserve Bank named above, and to the provisions of all operating circulars of each Federal Reserve Bank from

which the Institution obtains services, as the circulars may be amended from time to time. The transactions and fees

for services obtained will be settled in the master account unless the Institution requests otherwise by submitting a

Transaction and Service Fee Settlement Authorization (Operating Circular 1, Appendix 5) and/or a Letter of

Agreement for Obtaining Advances Through a Correspondent (Operating Circular 10).

For:

______________________________________ ______________________________

Official Signature Name of Institution

______________________________________ _________________________________

Printed Name and Title Street Address

______________________________________ _________________________________

Date City, State, Zip Code

__________________________________ _________________________________

Anticipated Account Opening Date Routing (ABA) Number

Questions regarding the account Alternate:

should be directed to:

_______________________________________ _________________________________

Printed Name and Title Printed Name and Title

_______________________________________ _________________________________

Telephone Number Telephone Number

_______________________________________ _________________________________

Email Address Email Address

Processing may take 5-7 business days. Please contact the Federal Reserve Bank to confirm the date that the master account will be

established.

FRB use only: Date Received: _____________________ Signature. Verification Completed By:_______________________________________________

Processed By::______________________________________ DI Contact: ___________________________________ Date Contacted: ________________

Effective Date: ______________ Number Called/EXT: ___________

Revised July 2009

To: Federal Reserve Bank of ____________________ Appendix 2

__________________________________________ Office

Attention: __________________________________________ Department

Subaccount Designations

We designate the following routing (ABA) number(s) to be a subaccount(s) of our master account. (Attach additional sheets as

needed.)

________________________________ By: __________________________ ________________________

Name of Institution (Master Account) Official Signature Date

________________________________ ______________________________

Street Address Printed Name and Title

________________________________ ______________________________

City, State, Zip Code Telephone Number

________________________________ ______________________________

Routing (ABA) Number Requested Effective Date

Subaccount Subaccount Name Subaccount Address Contacts for Questions about Subaccount

Routing Used for Activity

Number Funds Please print the address

Transfers? Please state the name of each Please print the name, title, and telephone

for each subaccount and

subaccount and indicate number for each contact, and indicate if this

indicate if this represents

whether you are adding, represents a change.

a change.

changing, or deleting it.

1. Yes/No

Add, Change, Delete? Change? Change?

2. Yes/No

Add, Change, Delete? Change? Change?

3. Yes/No

Add, Change, Delete? Change? Change?

4.

Yes/No

Add, Change, Delete? Change? Change?

5. Yes/No

Add, Change, Delete? Change? Change?

Processing may take 5-7 business days. Please contact the Federal Reserve Bank to confirm the date that the above subaccount(s) will be

established, changed or deleted.

FRB use only: Date Received: _____________________ Signature. Verification Completed By:_______________________________________________

Processed By::______________________________________ DI Contact: ___________________________________ Date Contacted: ________________

Effective Date: ______________ Number Called/EXT: ___________

Revised July 2009

To: Federal Reserve Bank of __________________ Appendix 3

_______________________________________Office

Attention: _______________________________________ Department

Pass-Through Agreement

The Institutions named below agree to the provisions of Operating Circular 1, Account Relationships, of the Federal Reserve

Bank named above, and the provisions of all operating circulars of each Federal Reserve Bank from which the Institutions obtain

services, as the circulars may be amended from time to time.

Respondent Agreement

We elect to maintain our required reserve balances on a pass-through basis with the correspondent named below.

Correspondent Agreement

We agree to serve as correspondent for the respondent named below. The required reserve balances for this respondent will be

commingled in our master account at the Reserve Bank.

Respondent Correspondent

_____________________________________ _____________________________________

Name of Institution Name of Institution

_____________________________________ _____________________________________

Street Address Street Address

_____________________________________ _____________________________________

City, State, Zip Code City, State, Zip Code

By: _____________________________________ By: _____________________________________

Official Signature (Date) Official Signature (Date)

_____________________________________ _____________________________________

Printed Name and Title Printed Name and Title

____________________________________ _____________________________________

Telephone Number Telephone Number

_____________________________________ _____________________________________

Routing (ABA) Number Routing (ABA) Number

Processing may take 5-7 business days. Please contact the Federal Reserve Bank to confirm the date that the above pass-through

arrangement will be in effect.

FRB use only: Date Received: _____________________ Signature. Verification Completed By:_______________________________________________

Processed By::______________________________________ DI Contact: ___________________________________ Date Contacted: ________________

Effective Date: ______________ Number Called/EXT: ___________

Revised July 2009

To: Federal Reserve Bank of __________________ Appendix 4

_______________________________________ Office

Attention: _______________________________________ Department

Certificate and Official Signature Card for Fed Funds Checks

I certify that the following is a true copy of a resolution adopted by the Board of Directors of _________________

Name of

____________________________, at a meeting of the Board duly held on ________________, at which a quorum was

Institution Date

present and acting throughout, and that such resolution is in conformity with the provisions of the charter and by-laws of the

Institution, and that this resolution has not been modified and remains in effect.

Resolved, that any of the ________ officers listed below is authorized to sign checks (Fed Funds Checks) drawn on

Number of

the Institutions master account at the Federal Reserve Bank of ___________________________.

Certified by:

For:

____________________________________ _________________________________

Signature of Certifying Officer* Name of Institution

____________________________________ ____________________________________

Name and Title Routing (ABA) Number

____________________________________ ____________________________________

Telephone Number Street Address

____________________________________ ____________________________________

Date City, State, Zip Code

____________________________________

Signature of Second Certifying Officer*

____________________________________

Name and Title

____________________________________

Telephone Number

____________________________________

Date

* The certifying officer must be the cashier, comptroller, secretary, or other officer of similar or higher rank, must have the

authority to certify the statements in this document, and may not be a person listed below. If the Institution has a limited number

of officers, then this latter requirement will be waived if two officers of the Institution execute this Certificate.

Official Signatures

RULE OUT UNUSED SPACES

PLEASE TYPE NAMES IN THIS SPACE PLEASE SIGN IN THIS SPACE

________________________________ WILL SIGN __________________________________ TITLE ________________________________

________________________________ __________________________________ ________________________________

________________________________ __________________________________ ________________________________

________________________________ __________________________________ ________________________________

Processing may take 5-7 business days. Please contact the Federal Reserve Bank to confirm the date that the Fed Funds Checks may be

drawn against the master account.

FRB use only: Date Received: _____________________ Signature. Verification Completed By:_______________________________________________

Processed By::______________________________________ DI Contact: ___________________________________ Date Contacted: ________________

Effective Date: ______________ Number Called/EXT: ___________

Revised July 2009

To: Federal Reserve Bank of ______________________ Appendix 5

____________________________________________ Office

Attention: ____________________________________________ Department

TRANSACTION AND SERVICE FEE SETTLEMENT AUTHORIZATION

The Institutions named below agree to the provisions of Operating Circular 1, Account Relationships, of the Federal Reserve Bank named above and the

provisions of all operating circulars of each Federal Reserve Bank from which the Institutions obtain services, as the circulars may be amended from time to

time.

The Federal Reserve Bank is authorized to settle debits and credits to the account of the correspondent named below for financial transactions and service

charges for the respondent named below for the selected service categories. For your Billing service charges, the Federal Reserve Bank's preferred method of

settlement is to automatically default settlement for all service charges to the correspondent listed below unless otherwise noted by individually selecting

Service Charge Categories. A separate settlement authorization is required for each correspondent used.

Financial transactions related to the Custodial Inventory Program, Fedwire Funds and Securities, and Fed Funds Checks may not be settled through a

correspondent.

If you are an account holder, financial transactions and service fees for the services listed below will automatically settle in your own account unless you

have indicated on this form that you want them to settle in the correspondent's account.

The correspondent named below authorizes the use of its earnings credits to offset the service charges selected for the respondent named below.

Respondents earnings credits may not be used to offset service charges settling through a correspondent.

Transaction settlement authorization for Loans requires submission of Exhibit 1 of Appendix 5 of Operating Circular 10 (Form of Letter of Agreement for

Obtaining Advances through a Correspondent).

Transaction Settlement Service Fee Settlement

Check the appropriate box: Check the appropriate box:

Do not make any changes to my current Transaction settlement. Do not make any changes to my current Service Fee settlement.

Discontinue all current Transaction Settlement arrangements and have Discontinue all current Billing Service Fee settlement arrangements

all transactions settle in my own account. and have the service charges settle in my own account.

Settle only the Transaction categories selected below with the Settle only the Billing service categories selected below with the

correspondent named below. correspondent named below.

Discontinue all current Transaction Settlement arrangements for the Discontinue all current Billing Service Fee arrangements for the

Respondent named below. The correspondent is responsible for notifying Respondent named below. The correspondent is responsible for notifying the

the respondent of the termination prior to submission of this form. (This respondent of the termination prior to submission of this form. (This option

option is applicable to only the correspondent and does not require the is applicable to only the correspondent and does not require the

respondents signature.) respondents signature.)

Select all Transaction Select all Billing Service

that Transaction Description Category1 that apply2 Service Charge Description Area1

apply

All Service Charge Categories below 9999

Other Treasury or Government Agency Service 08 Electronic Access3 1210

Forward Checks (other than Fed Funds Checks) 15 Forward Checks (other than Fed Funds Checks) 1501, 1521

Return Checks 30 Return Checks 3001, 3021

Redemption or Interest on Govt. or Agency Securities 20 or 27 Payor Bank Services 1505

Treasury Investment Program and Paper Tax System 59 Check Transportation 1507

ACH 57 Check Float 1508

Currency/Coin and Cash Cross Shipping (other than ACH 5701

Custodial Inventory Transactions) 63

Capital Stock 66 Currency/Coin and Cash Cross Shipping 6301, 6302, 6303

70 Fedwire Funds 1001

Savings Bond

Net Settlement 1002

Account Charges and Payments (other than service 84 Fedwire Securities 2001

charges) Accounting Information Services 8401

1

The transaction category is the first two digits of the transaction code shown on your Statement of Account. Billing Service Areas are listed on your Statement of Service Charges.

2

If Service Charge Categories are not selected, the correspondent selected for your Transaction Settlement will become the default for all Billing service charges

3

The Electronic Access service charge category will default to the correspondent named below if any other priced service category is selected.

It is requested that the above Transaction Settlement authorization begin on _________________________ (month, date and year) and Service Fee Settlement

authorization begin with ________________________ (billing month and year). On the dates that such settlements begin, this authorization will supersede any

previously executed authorization by the named respondent for each service category selected above.

Respondent: Correspondent:

______________________________________ ___ ______________________________________ ___

Name of Institution Name of Institution

______________________________________ ___ ______________________________________ ___

Street Address Street Address

__________________________________________ ______________________________________ ___

City, State, Zip Code City, State, Zip Code

______________________________________ ___ ______________________________________ ___

Official Signature (Date) Official Signature (Date)

______________________________________ ___ ______________________________________ ___

Printed Name and Title Printed Name and Title

______________________________________ ___ ______________________________________ ___

Telephone Number Telephone Number

______________________________________ ___ ______________________________________ ___

Routing (ABA) Number Routing (ABA) Number

The completed form should be e-mailed to sys.ccc.appendix5@mpls.frb.org, faxed to (877) 281-3647, or mailed to the Federal Reserves Customer

Contact Center at P.O. Box 219416, Kansas City, MO 64121-9416. This form must be received by the last business day of the requested month for

settlement of service charges. Processing may take 5-7 business days. Please contact the Federal Reserve Bank to confirm the date that the settlement

authorization will go into effect.

Revised July 2009

You might also like

- Governing Board GuidebookDocument5 pagesGoverning Board GuidebookBen HillNo ratings yet

- As A Man Thinketh PDFDocument28 pagesAs A Man Thinketh PDFBen HillNo ratings yet

- Charter School FilesDocument12 pagesCharter School FilesBen HillNo ratings yet

- 160-4-9-.06 Charter Authorizers, Financing, and ManagementDocument3 pages160-4-9-.06 Charter Authorizers, Financing, and ManagementBen HillNo ratings yet

- How To Create Your Own Promissory Notes Video TranscriptDocument8 pagesHow To Create Your Own Promissory Notes Video TranscriptBen Hill71% (7)

- Graphing Coordinate Plane PDFDocument1 pageGraphing Coordinate Plane PDFBen HillNo ratings yet

- 2007 Nul Soba Exc SummaryDocument7 pages2007 Nul Soba Exc Summarymdwilson1100% (2)

- 160-4-9-.05 Charter Schools Petition ProcessDocument2 pages160-4-9-.05 Charter Schools Petition ProcessBen HillNo ratings yet

- Amazon Herb CompanyDocument32 pagesAmazon Herb CompanyIfalase FagbenroNo ratings yet

- Geometric FormulasDocument1 pageGeometric FormulasBen HillNo ratings yet

- Formula Reference Sheet: Shape Formulas For Area (A) and Circumference (C)Document2 pagesFormula Reference Sheet: Shape Formulas For Area (A) and Circumference (C)Ben HillNo ratings yet

- How To Create Your Own Promissory Notes Video TranscriptDocument8 pagesHow To Create Your Own Promissory Notes Video TranscriptBen Hill71% (7)

- Donald Trump - Marketing - Make Money - 9 Income Streams No Waiting !! PDFDocument3 pagesDonald Trump - Marketing - Make Money - 9 Income Streams No Waiting !! PDFBen HillNo ratings yet

- Proof of Delivery COVER LETTERDocument1 pageProof of Delivery COVER LETTERBen Hill100% (1)

- How To Deal With The Sheriff of The Court - MTDocument8 pagesHow To Deal With The Sheriff of The Court - MTAnonymous uAhvA5fkDFNo ratings yet

- Letter To Accompany Promissor NoteDocument1 pageLetter To Accompany Promissor NoteBen HillNo ratings yet

- The Burson Center StoryDocument13 pagesThe Burson Center StoryBen HillNo ratings yet

- Private Bond Instructions Letter v1 1Document1 pagePrivate Bond Instructions Letter v1 1gordon scottNo ratings yet

- Governing Board GuidebookDocument5 pagesGoverning Board GuidebookBen HillNo ratings yet

- CCGPS Math 6 6thgrade Unit1SEDocument20 pagesCCGPS Math 6 6thgrade Unit1SEBen HillNo ratings yet

- Amazon Herb CompanyDocument32 pagesAmazon Herb CompanyIfalase FagbenroNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Carlos Hidalgo (Auth.) - Driving Demand - Transforming B2B Marketing To Meet The Needs of The Modern Buyer-Palgrave Macmillan US (2015)Document200 pagesCarlos Hidalgo (Auth.) - Driving Demand - Transforming B2B Marketing To Meet The Needs of The Modern Buyer-Palgrave Macmillan US (2015)Marko Grbic100% (2)

- Sefer Yetzirah PDFDocument32 pagesSefer Yetzirah PDFWealthEntrepreneur100% (1)

- HB Nutrition FinalDocument14 pagesHB Nutrition FinalJaoNo ratings yet

- Place of Provision of Services RulesDocument4 pagesPlace of Provision of Services RulesParth UpadhyayNo ratings yet

- (Part B) APPLICATION LETTER, COVER LETTER, CV, RESUME & JOB INTERVIEW - Google Forms-1Document10 pages(Part B) APPLICATION LETTER, COVER LETTER, CV, RESUME & JOB INTERVIEW - Google Forms-1adNo ratings yet

- Understanding Culture, Society and PoliticsDocument3 pagesUnderstanding Culture, Society and PoliticsแซคNo ratings yet

- Class Xi BST Chapter 6. Social Resoposibility (Competency - Based Test Items) Marks WiseDocument17 pagesClass Xi BST Chapter 6. Social Resoposibility (Competency - Based Test Items) Marks WiseNidhi ShahNo ratings yet

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Document6 pagesBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Doughty IncNo ratings yet

- Week 1 and 2 Literature LessonsDocument8 pagesWeek 1 and 2 Literature LessonsSalve Maria CardenasNo ratings yet

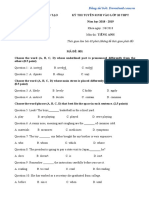

- Đề thi tuyển sinh vào lớp 10 năm 2018 - 2019 môn Tiếng Anh - Sở GD&ĐT An GiangDocument5 pagesĐề thi tuyển sinh vào lớp 10 năm 2018 - 2019 môn Tiếng Anh - Sở GD&ĐT An GiangHaiNo ratings yet

- Influencing Decisions: Analyzing Persuasion TacticsDocument10 pagesInfluencing Decisions: Analyzing Persuasion TacticsCarl Mariel BurdeosNo ratings yet

- Vas Ifrs Event enDocument2 pagesVas Ifrs Event enDexie Cabañelez ManahanNo ratings yet

- International HR Management at Buro HappoldDocument10 pagesInternational HR Management at Buro HappoldNishan ShettyNo ratings yet

- Comillas Elementary Class Program Modular Distance LearningDocument24 pagesComillas Elementary Class Program Modular Distance Learningbaldo yellow4No ratings yet

- New Funding Pushes Convoy Valuation To $3.8 BillionDocument3 pagesNew Funding Pushes Convoy Valuation To $3.8 BillionTrang BùiNo ratings yet

- Guidelines For ValuationDocument6 pagesGuidelines For ValuationparikhkashishNo ratings yet

- Dr. Thi Phuoc Lai NguyenDocument3 pagesDr. Thi Phuoc Lai Nguyenphuoc.tranNo ratings yet

- Student Majoriti Planing After GrdaduationDocument13 pagesStudent Majoriti Planing After GrdaduationShafizahNurNo ratings yet

- Nifty Technical Analysis and Market RoundupDocument3 pagesNifty Technical Analysis and Market RoundupKavitha RavikumarNo ratings yet

- Pub. 127 East Coast of Australia and New Zealand 10ed 2010Document323 pagesPub. 127 East Coast of Australia and New Zealand 10ed 2010joop12No ratings yet

- Bernardo Motion For ReconsiderationDocument8 pagesBernardo Motion For ReconsiderationFelice Juleanne Lador-EscalanteNo ratings yet

- Journalism of Courage: Wednesday, January 11, 2023, New Delhi, Late City, 24 PagesDocument24 pagesJournalism of Courage: Wednesday, January 11, 2023, New Delhi, Late City, 24 PagesVarsha YenareNo ratings yet

- Apollo 11tech Crew DebriefDocument467 pagesApollo 11tech Crew DebriefBob AndrepontNo ratings yet

- Non Disclosure Agreement - 3Document3 pagesNon Disclosure Agreement - 3Atthippattu Srinivasan MuralitharanNo ratings yet

- Ceramic EthnoarchaeologyDocument336 pagesCeramic EthnoarchaeologyAhmad adelNo ratings yet

- B SDocument36 pagesB SkeithguruNo ratings yet

- Applied Crypto HardeningDocument111 pagesApplied Crypto Hardeningadr99No ratings yet

- Murder in Baldurs Gate Events SupplementDocument8 pagesMurder in Baldurs Gate Events SupplementDavid L Kriegel100% (3)

- Quicho - Civil Procedure DoctrinesDocument73 pagesQuicho - Civil Procedure DoctrinesDeanne ViNo ratings yet