Professional Documents

Culture Documents

Pick Out Your Trading Trend

Uploaded by

diglemarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pick Out Your Trading Trend

Uploaded by

diglemarCopyright:

Available Formats

Stocks & Commodities V. 18:4 (62-68): Picking Out Your Trading Trend by Martin J.

Pring

CLASSIC TECHNIQUES

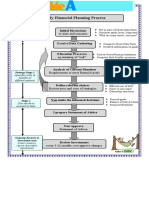

Pick Out Your PRIMARY TREND

Trading Trend

Bull market Bear market

9-months -2 years 9-months -2 years

There are three kinds of trends: short, intermediate, and long

term. This veteran trader and analyst explains how you can Approximately 4-years

spot them and use them.

by Martin J. Pring

FIGURE 1: PRIMARY TREND. The classic four-year trend is broken almost equally into

echnical analysis assumes that all bull and bear modes.

the knowledge, hopes, and fears of

T both active and inactive market trend (Figure 1) is often referred to as a bull or bear market.

participants are reflected in one Bulls go up and bears go down. Typically, they last from

thing: the price. Even if I am in a about nine months to two years, while the bear market

cash position, I am still influenc- troughs are separated by just under four years. These trends

ing the price because it would be revolve around the business cycle and tend to repeat. This is

higher if my cash were invested. true whether the weak phase of the cycle is an actual recession

Thus, prices are determined by or there is no recession or growth.

psychology. This would just be an interesting observation, A fourth category, the secular trend, embraces several

except that psychology moves in trends, and so do prices. primary trends and lasts between 10 and 25 years. An ex-

Most of the technical tools we use are aimed at identifying ample using US bond yields between the 1930s and the 1990s

trend reversals at an early stage. We ride on trends until the can be seen in Figure 2.

weight of the evidence shows or proves that the trend has Primary trends are not straight-line affairs, but consist of

reversed in this case, the number of reliable technical a series of rallies and reactions. Those rallies and reactions

indicators all pointing in

the same direction. US GOVERNMENT BOND PRICES

Hence, the greater the

number of indicators sig-

naling a reversal, the

greater the probability

that a reversal will take Secular downtrend

place. It is important to

remember that technical

analysis only deals in

probabilities, never cer-

tainties. Unfortunately, Secular uptrend

there is no known method

of forecasting the dura-

tion and magnitude of a

trend with any degree of

consistency. Identifying

reversals is hard enough.

METASTOCK (EQUIS INTERNATIONAL)

What is a trend? How

long do they last? Before

the advent of intraday

charts, there were three

generally accepted dura-

tions primary, inter-

mediate, and short-term. FIGURE 2: SECULAR BOND TRENDS. In 1982, the downtrend in bond prices broke along with inflation, setting off the greatest stock bull

The main or primary market in history.

Copyright (c) Technical Analysis Inc.

Stocks & Commodities V. 18:4 (62-68): Picking Out Your Trading Trend by Martin J. Pring

are known as intermediate trends and are represented in be better prepared for the nature of the intermediate rallies

MARCI RASMUSSEN

Figure 3 by the solid blue line. They can vary in length from and reactions that will unfold.

as little as six weeks to as much as nine months the length Classic technical theory holds that each bull market con-

of a very short primary trend. Intermediate trends typically tains three intermediate cycles, as does each primary bear

develop as a result of changing perceptions concerning eco- market (Figure 4). I would use this only as a guide, since

nomic, financial, or political events. many primary trends are not easily classified this way. Thus,

It is important to have some understanding about the if you are waiting for that third intermediate cycle in a bull

direction of the main or primary trend. This is because rallies market, it may never materialize.

in bull markets are strong and reactions weak, as shown in In turn, intermediate trends can be broken down into short-

Figure 3. On the other hand, bear market reactions are strong term trends that last from as little as two weeks to as much as

while rallies are short, sharp, and generally unpredictable. If five or six weeks. They can be seen in Figure 5, represented

you have a fix on the underlying primary trend, then you will by the dashed red lines.

Copyright (c) Technical Analysis Inc.

Stocks & Commodities V. 18:4 (62-68): Picking Out Your Trading Trend by Martin J. Pring

CALCULATING THE KST

The suggested parameters for short,

intermediate and long term can be

found in sidebar Figure 1. There Short-term (D) 10 10 1 15 10 2 20 10 3 30 15 4

are three steps to calculating the Short-term (W) 3 3E 1 4 4E 2 6 6E 3 10 8E 4

KST indicator. First, calculate the Intermediate-term (W) 10 10 1 13 13 2 15 15 3 20 20 4

four different rates of change. Re- Intermediate-term (W) 10 10E 1 13 13E 2 15 15E 3 20 20E 4

calling the formula for rate of Long-term (M) 9 6 1 12 6 2 18 6 3 24 9 4

change (ROC) is todays closing Long-term (W) 39 26E 1 52 26E 2 78 26E 3 104 39E 4

price divided by the closing price n

days ago. This result is then multi- It is possible to program all KST formulas into MetaStock and the CompuTrac SNAP module.

(D) Based on daily data. (W) Based on weekly data. (M) Based on monthly data. (E) EMA.

plied by 100. Then subtract 100 to

obtain a rate of change index that SIDEBAR FIGURE 1: The ROC column is the rate of change. The MA column is the moving average value,

uses zero as the center point. Sec- and E after the moving average value indicates that the moving average is an exponential moving average.

ond, smooth each ROC with either a Multiply each smoothed ROC by its weight prior to summing the four smoothed ROCs.

simple or exponential moving av-

erage (EMA). Third, multiply each smoothed ROC by its Cell G20 is a six-week ROC:

prospective weight and sum the weighted smoothed ROCs. =((B20/B15)*100)-100

The formula for an exponential moving average (EMA)

requires the use of a smoothing constant () alpha. The Cell H20 is a six-week EMA:

constant used to smooth the data is found using the formula =H19+0.29*(G20-H19)

2/(n+1). For example, for n=3, then = 2/(3+1)=0.50. The

formula for the EMA is: Cell I20 is a 10-week ROC:

=((B20/B11)*100)-100

E2 = E1 + (P2 - E1)

where: Cell J20 is an eight-week EMA:

E2 = New exponential average =J19+0.22*(I20-J19)

E1 = Prior exponential average

P2 = Current price

Finally, cell K20 is the summed weighted smoothed ROCs.

Please note the first days calculation does not have a prior Each smoothed ROC is weighted according to sidebar

exponential average. Consequently, you just use the first Figure 1 and summed:

days price and begin the smoothing process the next day.

Figure 2 is a spreadsheet example of the short-term weekly =D20+(2*F20)+(3*H20)+(4*J20)

KST using exponential moving averages for the smoothing.

Column C is the three-week rate of change. The formula for Editor

cell C20 is:

=((B20/B18)*100)-100

A B C D E F G H I J K

1 Date S&P 500 3 week 3 Week 4 Week 4 week 6 Week 6 week 10 Week 8 week Summed

The three-week rate of change is smoothed with a 2 920103 419.34 ROC EMA ROC EMA ROC EMA ROC EMA Weighted

3 920110 415.10 ROC

three-week EMA. The constant used to smooth the 4 920117 418.86 -0.11

data is found using the formula 2/(n+1). For n=3, 5 920124 415.48 0.09 -0.92

6 920131 408.78 -2.41 -2.41 -1.52

then, the constant equals 2/(3+1)=0.50, and thus, the 7 920207 411.09 -1.06 -1.73 -1.86 -1.97

8 920214 412.48 0.91 -0.41 -0.72 -0.72 -0.63

formula for cell D20 is: 9 920221 411.46 0.09 -0.16 0.66 -0.17 -1.77

1 0 920228 412.70 0.05 -0.05 0.39 0.05 -0.67

=D19+0.5*(C20-D19) 1 1 920306 404.44 -1.71 -0.88 -1.95 -0.75 -1.06 -3.55

1 2 920313 405.84 -1.66 -1.27 -1.37 -0.99 -1.28 -1.28 -2.23

1 3 920320 411.30 1.70 0.21 -0.34 -0.73 -0.29 -0.99 -1.80

1 4 920327 403.50 -0.58 -0.18 -0.23 -0.53 -1.93 -1.26 -2.88

Courtesy Microsoft Excel

Cell E20 is a four-week ROC: 1 5 920403 401.55 -2.37 -1.28 -1.06 -0.74 -2.70 -1.68 -1.77

=((B20/B17)*100)-100 1 6

1 7

920410

920416

404.29

416.05

0.20

3.61

-0.54

1.54

-1.70 -1.13

3.11 0.57

-0.04 -1.20

2.52 -0.13

-1.65

0.87 0.87

1 8 920424 409.02 1.17 1.35 1.86 1.08 -0.55 -0.25 -0.59 0.54

1 9 920501 412.53 -0.85 0.25 2.04 1.47 2.24 0.47 -0.04 0.42 6.26

Cell F20 is a four-week EMA: 2 0 920508 416.05 1.72 0.99 0.00 0.88 3.61 1.38 2.87 0.96 10.71

=F19+0.4*(E20-F19) SIDEBAR FIGURE 2: SPREADSHEET FOR SHORT-TERM WEEKLY KST.

Here, the KST is calculated using exponential moving averages.

Copyright (c) Technical Analysis Inc.

Stocks & Commodities V. 18:4 (62-68): Picking Out Your Trading Trend by Martin J. Pring

INTERMEDIATE TREND

THE MARKET CYCLE MODEL Corrections

are mild

Now that all three trends have been discussed, a

couple of points are worth making. First, as an inves- Reactions

are strong

tor, it is best to accumulate when the primary trend is

in the early stages of reversing from down to up and Rallies

liquidating when the trend is reversing in the opposite are strong

Rallies

direction (Figure 6). are short

Second, as traders, we are better off if we position

ourselves from the long side in a bull market, since

that is the time when short-term trends tend to have the

greatest magnitude. By the same token, it does not

usually pay to short in a bull market because declines

can be quite brief and reversals to the upside unexpect-

edly sharp. If you are going to make a mistake, it is

FIGURE 3: INTERMEDIATE TREND. Pulsating in the midst of primary trends are shorter,

more likely to come from a countercyclical trade intermediate trends, giving charts a stairstep appearance.

(Figure 7). This is where the market cycle model

comes into play.

USING THE MARKET CYCLE MODEL INTEGRATION OF PRIMARY AND INTERMEDIATE TRENDS

How can you put this into practice? My favorite

method is to plot three smoothed momentum indica- Classic bull market Classic bear market

tors to mimic the three trends. An example can be seen has 3 intermediate 3 has 3 intermediate

cycles cycles

in Figure 8 using the KST indicator, originally intro-

duced in STOCKS & COMMODITIES in the early 1990s.

2

The formulas for the three trends can be seen in the 1

sidebar, The KST.

Its also possible to substitute other smoothed mo- 2

mentum indicators. For example, three suggested

sets of parameters are displayed in Figure 9 for the 1

stochastic indicator. This arrangement is far from

perfect, but it does provide a framework that offers

the trader and investor a road map of the current

3

convergence of the short-, intermediate-, and long-

term trends. As always, it is important to ensure that

other indicators in the technical toolbox also support FIGURE 4: THREE INTERMEDIATE CYCLES. An idealized market cycle would have

three waves up and three waves down.

this type of analysis.

This market cycle model approach can be applied to

intraday analysis. Obviously, the time frames will dif-

fer radically from the primary, intermediate, and short-

term varieties we looked at previously, but the principle MARKET CYCLE MODEL

still applies. If you know that a powerful three- to four-

day rally is under way, it would be madness to short a

four-hour countercyclical move. Clearly, trading from

the long side would be more appropriate, but you would Short-term

only know this if you had identified the bullish intraday trend

primary trend in the first place. I will cover these

shorter-term aspects in another article.

IN SUMMARY

There are three generally accepted trends: short-,

intermediate-, and long-term or primary. Secular, or

very long-term, trends also make up several primary

trends and can last between 10 and 25 years. At the

other end of the spectrum, intraday data now provides

us with trends of even shorter time spans lasting as

FIGURE 5: MARKET CYCLE MODEL. Inside the intermediate cycles are short-term cycles

little as 10 to 15 minutes. that last from two to six weeks.

Copyright (c) Technical Analysis Inc.

Stocks & Commodities V. 18:4 (62-68): Picking Out Your Trading Trend by Martin J. Pring

MARKET CYCLE MODEL MARKET CYCLE MODEL

Time to Go long rallies Short reactions

but do not but do not

liquidate short reactions go long rallies

Time to

accumulate

FIGURE 6: ACCUMULATE/DISTRIBUTE. Naturally, the best time to load up on stocks FIGURE 7: DONT FIGHT THE TREND. When trading in and out during a primary trend,

is when a cycle bottom is at hand. Approaching the top, its time to distribute your holdings. go in the direction of the primary trend, not against it.

It is important for investors to have some idea of the smoothed momentum indicator such as the stochastics or KST.

direction and maturity of the main trend. Working on the

assumption that a rising tide lifts all boats, traders should also Veteran trader and technician Martin J. Pring founded the

try to understand the direction of the main trend even though International Institute for Economic Research in 1981. Pring

they themselves are only concerned with a short time horizon. is the author of several books, including the classic Techni-

A convenient way to chart longer-term trends is to use a cal Analysis Explained.

MOODYS AAA BOND YIELDS AND THREE KSTs

Moodys AAA bond yield

Short-term

KST

Intermediate

KST

PRIMARY TRENDS

Long-term KST

FIGURE 8: KST. This indicator, developed by Pring in the early 1990s, is generally reliable in picking out trends.

Copyright (c) Technical Analysis Inc.

Stocks & Commodities V. 18:4 (62-68): Picking Out Your Trading Trend by Martin J. Pring

MOODYS AAA BOND YIELDS AND THREE STOCHASTICS

AAA yield

Stochastic (3x3x3)

Stochastic (10x10x6)

Stochastic (39x26x23) PRIMARY TRENDS

FIGURE 9: STOCHASTIC SMOOTHING. Stochastics of differing-length parameters also pick up trends. You can smooth with any of a variety of

momentum indicators.

RELATED READING _____ [1985]. Technical Analysis Explained, McGraw-Hill

International Institute for Economic Research. Internet: http: Book Co.

// www.pring.com/. _____ [1992]. Rate Of Change, Technical Analysis of

Pring, Martin J. [1992]. The All-Season Investor, John Wiley STOCKS & COMMODITIES, Volume 10: August.

& Sons. _____ [2000]. Trendline Basics, Technical Analysis of

_____ [1993]. Martin Pring On Market Momentum, Interna- STOCKS & COMMODITIES, Volume 18: March.

tional Institute for Economic Research. See Traders Glossary for definition S&C

Copyright (c) Technical Analysis Inc.

You might also like

- The Special K: Trends, Triggers, and ReversalsDocument5 pagesThe Special K: Trends, Triggers, and ReversalsVishvanath JawaleNo ratings yet

- Chande T.S.-Adapting Moving Averages To Market Volatility (1992) PDFDocument12 pagesChande T.S.-Adapting Moving Averages To Market Volatility (1992) PDFNguyễn Hoàng PhongNo ratings yet

- Trend Trading for a Living: Learn the Skills and Gain the Confidence to Trade for a LivingFrom EverandTrend Trading for a Living: Learn the Skills and Gain the Confidence to Trade for a LivingRating: 5 out of 5 stars5/5 (1)

- Understanding KSTDocument28 pagesUnderstanding KSTAforArijit BforBanerjeeNo ratings yet

- Portfolio of Trading Systems: Path of Least Resistance to Consistent ProfitabilityFrom EverandPortfolio of Trading Systems: Path of Least Resistance to Consistent ProfitabilityNo ratings yet

- Combine MACD and Relative Strength To Time TradesDocument3 pagesCombine MACD and Relative Strength To Time Tradesemirav2No ratings yet

- For Guppy Mma OscillatorDocument22 pagesFor Guppy Mma Oscillatorbasri388100% (1)

- Anchored Momentum Indicator Study by Rudy StefenelDocument10 pagesAnchored Momentum Indicator Study by Rudy StefenelSimon RobinsonNo ratings yet

- 5 Moving Average Signals That Beat Buy and Hold - Backtested Stock Market SignalsDocument39 pages5 Moving Average Signals That Beat Buy and Hold - Backtested Stock Market Signalsআম্লান দত্ত100% (2)

- 246 SchaDocument2 pages246 SchaDestiny Brown100% (1)

- Intermarket Analysis and The Bussiness Cycle (Martin J. Pring)Document115 pagesIntermarket Analysis and The Bussiness Cycle (Martin J. Pring)Glorious Trilogy100% (2)

- Cut LossDocument3 pagesCut LossAnonymous sDnT9yuNo ratings yet

- Bobble Pattern Ebook PDFDocument12 pagesBobble Pattern Ebook PDFmiralemh100% (1)

- DMI LectureDocument24 pagesDMI Lecture_karr99No ratings yet

- Diversified Pitchbook 2015Document14 pagesDiversified Pitchbook 2015Tempest SpinNo ratings yet

- (Trading) Tips Using Fibonacci Ratios and Momentum (Thom Hartle, 2001, Technical Analysis Inc) (PDF)Document6 pages(Trading) Tips Using Fibonacci Ratios and Momentum (Thom Hartle, 2001, Technical Analysis Inc) (PDF)sivakumar_appasamyNo ratings yet

- Dave Landry Trailing StopsDocument6 pagesDave Landry Trailing Stopsdebbie_shoemaker100% (1)

- John J. Murphy - Simple Sector TradingDocument34 pagesJohn J. Murphy - Simple Sector TradingMike Ng67% (3)

- ADXDocument7 pagesADXsathish bethriNo ratings yet

- RSI The Complete Guide John HaydenDocument21 pagesRSI The Complete Guide John HaydenSaeed Alahmari100% (1)

- David Weis' Charts PDFDocument32 pagesDavid Weis' Charts PDFOmar Cendron100% (2)

- The Stiffness IndicatorDocument10 pagesThe Stiffness IndicatorMiguel Sanchez GuerreroNo ratings yet

- Chuck LeBeau - ADX (Average Directional Index Presentation)Document31 pagesChuck LeBeau - ADX (Average Directional Index Presentation)apandev88% (8)

- Leader of The Macd PDFDocument6 pagesLeader of The Macd PDFshlosh7No ratings yet

- Adx PDFDocument32 pagesAdx PDFPrashantPatilNo ratings yet

- George Lane-Father of StochasticsDocument4 pagesGeorge Lane-Father of StochasticsbearsqNo ratings yet

- Using Multiple MADocument7 pagesUsing Multiple MABock Dharma100% (2)

- Identifying Powerful Breakouts EarlyDocument13 pagesIdentifying Powerful Breakouts Earlykosurug100% (1)

- A Practical Guide To Indicators 12 PgsDocument12 pagesA Practical Guide To Indicators 12 PgsAntonio C S LeitaoNo ratings yet

- Canslim PullbacksDocument4 pagesCanslim Pullbacksfredtag4393No ratings yet

- Weis Wave Indicators Instructions TSDocument6 pagesWeis Wave Indicators Instructions TSlequangtruong1602No ratings yet

- Volatility StopsDocument5 pagesVolatility Stopspderby1No ratings yet

- ConnorsRSI Pullbacks Guide PDFDocument46 pagesConnorsRSI Pullbacks Guide PDFbillthegeekNo ratings yet

- Bloomberg - Technical Analysis Handbook PDFDocument129 pagesBloomberg - Technical Analysis Handbook PDFLina100% (1)

- Chuck LeBeau - Indicators Are Not SystemsDocument3 pagesChuck LeBeau - Indicators Are Not SystemsGreg McKennaNo ratings yet

- Andrew Abraham - Trading The Trend PDFDocument3 pagesAndrew Abraham - Trading The Trend PDFJ4NY4R100% (1)

- Trend Indicator KATSANOSDocument13 pagesTrend Indicator KATSANOSMiguel Sanchez Guerrero100% (1)

- Traders Expo Las Vegas Intensive Workshop November 2011 Pocket PivotsDocument38 pagesTraders Expo Las Vegas Intensive Workshop November 2011 Pocket PivotsteppeiNo ratings yet

- Kaufman's Adaptive Moving Average (KAMA) Strategy: How To Improve Signal ConsistencyDocument9 pagesKaufman's Adaptive Moving Average (KAMA) Strategy: How To Improve Signal ConsistencyBhavesh Shah0% (1)

- MACD Moving Average Convergence DivergenceDocument2 pagesMACD Moving Average Convergence DivergencestashastashaNo ratings yet

- The Secular Trend and Cyclical Outlook For Bonds, Stocks and CommoditiesDocument69 pagesThe Secular Trend and Cyclical Outlook For Bonds, Stocks and Commoditiescommodi21No ratings yet

- TD SequentialDocument8 pagesTD SequentialOxford Capital Strategies LtdNo ratings yet

- Book New Science of Technical Analysis Thomas R Demark EngDocument1 pageBook New Science of Technical Analysis Thomas R Demark EngElena Lupea25% (4)

- Donchian Trading GuidelinesDocument9 pagesDonchian Trading GuidelinesIzzadAfif1990No ratings yet

- Dawn Bolton-Smith (2001) - On Trading Systems (5 P.)Document5 pagesDawn Bolton-Smith (2001) - On Trading Systems (5 P.)FrankNo ratings yet

- Factor Update, April 19, 2015Document20 pagesFactor Update, April 19, 2015Peter L. BrandtNo ratings yet

- MAgic of MADocument245 pagesMAgic of MAswetha reddy100% (3)

- ETF StrategiesDocument6 pagesETF StrategiesValery Scancella0% (1)

- Trader's JournalDocument5 pagesTrader's JournalAadon PeterNo ratings yet

- The Power of The ST50 ListDocument13 pagesThe Power of The ST50 Listivanhoff capitalNo ratings yet

- Trend-Quality Indicator: Oving Averages and YouDocument3 pagesTrend-Quality Indicator: Oving Averages and YouRogerio AraujoNo ratings yet

- Defining The Bull & BearDocument8 pagesDefining The Bull & BearNo NameNo ratings yet

- Testing Point FigureDocument4 pagesTesting Point Figureshares_leoneNo ratings yet

- Relative Momentum Index PDFDocument7 pagesRelative Momentum Index PDFalexmorenoasuarNo ratings yet

- Bollinger Bands & ADX: This Lesson Is Provided byDocument4 pagesBollinger Bands & ADX: This Lesson Is Provided bymjmariaantonyrajNo ratings yet

- Stocks & Commodities Traders Tips Archives - Page 2 of 2 - AIQ TradingExpert ProDocument11 pagesStocks & Commodities Traders Tips Archives - Page 2 of 2 - AIQ TradingExpert ProTony BertoniNo ratings yet

- Elder On ADX IndicatorDocument16 pagesElder On ADX IndicatorJulio Suavita100% (5)

- Gerald Appel - MACD TutorialDocument7 pagesGerald Appel - MACD Tutorialraininseattle100% (2)

- 225090990-Operations Management Tema-7-I PDFDocument29 pages225090990-Operations Management Tema-7-I PDFdiglemarNo ratings yet

- 5 Min 4R SystemDocument10 pages5 Min 4R SystemdiglemarNo ratings yet

- 198 English Paragraphs - Vaughan Systems For Varied English ExercisesDocument35 pages198 English Paragraphs - Vaughan Systems For Varied English ExercisespequexoubaNo ratings yet

- Check Your Vocabulary For IELTS Examination - WyattDocument125 pagesCheck Your Vocabulary For IELTS Examination - Wyattminhvanyeudoi100% (7)

- 2017 Taurus CatalogDocument40 pages2017 Taurus CatalogCătălina Brsc0% (1)

- P551 Installation Guide: 55" LCD DisplayDocument10 pagesP551 Installation Guide: 55" LCD DisplaydiglemarNo ratings yet

- (Trading) Ichimoku Kinko CloudsDocument36 pages(Trading) Ichimoku Kinko Cloudsdiglemar100% (1)

- Ben Laurie - An Efficient Distributed Currency PDFDocument5 pagesBen Laurie - An Efficient Distributed Currency PDFgeckxNo ratings yet

- (Trading) John L Person - Swing Trading Using Candlestick Charting With Pivot PointDocument16 pages(Trading) John L Person - Swing Trading Using Candlestick Charting With Pivot Pointdiglemar100% (1)

- Carolyn Boroden - Trading Markets - How I Use Fibonacci To Identify Key Support and Resistance LevelsDocument5 pagesCarolyn Boroden - Trading Markets - How I Use Fibonacci To Identify Key Support and Resistance LevelsdiglemarNo ratings yet

- Neural Prediction of Weekly Stock Market IndexDocument18 pagesNeural Prediction of Weekly Stock Market IndexsynquestNo ratings yet

- Ben Laurie - An Efficient Distributed Currency PDFDocument5 pagesBen Laurie - An Efficient Distributed Currency PDFgeckxNo ratings yet

- (Trading) Merriman The Ultimate Book On Stock Market Timing (Raymond Merriman, 2001, MmaDocument227 pages(Trading) Merriman The Ultimate Book On Stock Market Timing (Raymond Merriman, 2001, Mmadiglemar67% (6)

- Stock Books 030-Jorda and Marcellino-Modeling High-Frequency FX Data Dynamics PDFDocument32 pagesStock Books 030-Jorda and Marcellino-Modeling High-Frequency FX Data Dynamics PDFdiglemarNo ratings yet

- Heikin AshiDocument3 pagesHeikin AshiLoni Scott100% (1)

- (Trading) Fibonacci Trader - The Professional Gann Swing Plan 2002 - Robert KrauszDocument15 pages(Trading) Fibonacci Trader - The Professional Gann Swing Plan 2002 - Robert Krauszdiglemar67% (3)

- Tech Analysis - Martin PringDocument149 pagesTech Analysis - Martin Pringapi-374452792% (13)

- (Trading) DTB An Entry Technique For Trending Price Action (1999, Daytradersbulletin)Document6 pages(Trading) DTB An Entry Technique For Trending Price Action (1999, Daytradersbulletin)diglemarNo ratings yet

- (Trading) Deaton, Mark - A Fibonacci Trading System (2007)Document13 pages(Trading) Deaton, Mark - A Fibonacci Trading System (2007)diglemar100% (1)

- Stock Books 057-Options Trading Primer by Marketwise Trading School PDFDocument61 pagesStock Books 057-Options Trading Primer by Marketwise Trading School PDFdiglemarNo ratings yet

- Stock Books 053-Xetra XXL The New Dimension PDFDocument33 pagesStock Books 053-Xetra XXL The New Dimension PDFdiglemarNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- DeMark Indicators On Bloomberg PresentationDocument75 pagesDeMark Indicators On Bloomberg PresentationBillyNo ratings yet

- (Trading) Price Action Setups 181212Document4 pages(Trading) Price Action Setups 181212diglemar100% (1)

- Stock Books 023-Jake Bernstein - Market MastersDocument91 pagesStock Books 023-Jake Bernstein - Market MastersdiglemarNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Stock Books 011-De Jong, Nijman and Roell-A Comparison of The Cost of Trading French Shares On The Paris Bourse and On Seaq International PDFDocument25 pagesStock Books 011-De Jong, Nijman and Roell-A Comparison of The Cost of Trading French Shares On The Paris Bourse and On Seaq International PDFdiglemarNo ratings yet

- Stock Books 039-Oliver Velez - Swing Trading TacticsDocument1 pageStock Books 039-Oliver Velez - Swing Trading Tacticsdiglemar100% (1)

- Stock Books 024-Jake Bernstein - The Compleat Day Trader Vol IIDocument260 pagesStock Books 024-Jake Bernstein - The Compleat Day Trader Vol IIdiglemarNo ratings yet

- FIN F311 - Derivative and Risk Management (2) - CMSDocument6 pagesFIN F311 - Derivative and Risk Management (2) - CMSSaksham GoyalNo ratings yet

- Questions 1 Through 4Document8 pagesQuestions 1 Through 4ssregens82No ratings yet

- Project Report On Marketing Strategy For BbaDocument78 pagesProject Report On Marketing Strategy For BbaNeera Tomar75% (8)

- E BrokingDocument45 pagesE BrokingAbhishekKaushikNo ratings yet

- Customer Behavior Regarding Mutual Fund at Axis BankDocument63 pagesCustomer Behavior Regarding Mutual Fund at Axis BankHardikNo ratings yet

- Real - Estate - Marketing PDFDocument13 pagesReal - Estate - Marketing PDFTuhina RayNo ratings yet

- Investment Corporation of BangladeshDocument5 pagesInvestment Corporation of BangladeshNaimul DipNo ratings yet

- Chapter 4 - Introduction To Risk ManagementDocument60 pagesChapter 4 - Introduction To Risk Managementcalun12100% (1)

- Green Ox CaseDocument1 pageGreen Ox Caseasj91992No ratings yet

- Financial ServicesDocument12 pagesFinancial ServicesarmailgmNo ratings yet

- Arbitrage and Law of One PriceDocument5 pagesArbitrage and Law of One Pricearmando.chappell1005No ratings yet

- Reflecting Credit and Funding Adjustments in Fair ValueDocument44 pagesReflecting Credit and Funding Adjustments in Fair ValuevalentbrNo ratings yet

- Institutional Design and Liquidity at Stock Exchanges Around The WorldDocument39 pagesInstitutional Design and Liquidity at Stock Exchanges Around The WorldEleanor RigbyNo ratings yet

- Comparative Study of Capital MarketDocument80 pagesComparative Study of Capital MarketHassan Ali KhanNo ratings yet

- Effects of Barings Collapse On The Banking IndustryDocument4 pagesEffects of Barings Collapse On The Banking IndustryinterzoNo ratings yet

- Assignment No 1: "Analysis of Demand & Supply"Document10 pagesAssignment No 1: "Analysis of Demand & Supply"Amna MasudNo ratings yet

- Presentation On Scam in Stock MarketDocument16 pagesPresentation On Scam in Stock Marketsachincool0100% (2)

- British Columbia Box Limited Case Study - G2 - Sec FDocument6 pagesBritish Columbia Box Limited Case Study - G2 - Sec FIsha DwivediNo ratings yet

- LevisDocument15 pagesLevisAzhar Shaikh100% (6)

- Trading Course DetailsDocument7 pagesTrading Course DetailskinjalinNo ratings yet

- Treasury Management & Global Scenario..Document16 pagesTreasury Management & Global Scenario..sonam sharmaNo ratings yet

- Securitization, Shadow Banking, and FinancializationDocument54 pagesSecuritization, Shadow Banking, and FinancializationjoebloggsscribdNo ratings yet

- Shekhar Final Project Report On Share MarketDocument63 pagesShekhar Final Project Report On Share MarketSanket VaidyaNo ratings yet

- Managerial Economics Syllabus Manoj MishraDocument3 pagesManagerial Economics Syllabus Manoj MishraVishal KapurNo ratings yet

- Pricing and Revenue Management in The Supply Chain 17Document20 pagesPricing and Revenue Management in The Supply Chain 17niruthir100% (1)

- Kotler MM 14e 08 IpptDocument15 pagesKotler MM 14e 08 IpptMayank KumarNo ratings yet

- BAB 7 Market Structure and Output Pricing DecisionsDocument19 pagesBAB 7 Market Structure and Output Pricing DecisionsEunice TzpNo ratings yet

- MarketingDocument2 pagesMarketingSuryam GNo ratings yet

- Merchant BankingDocument38 pagesMerchant BankingBhargavKevadiyaNo ratings yet

- Private Placement & Venture CapitalDocument18 pagesPrivate Placement & Venture Capitalshraddha mehtaNo ratings yet