Professional Documents

Culture Documents

Red and A Bit of Blue

Uploaded by

Hari MenonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Red and A Bit of Blue

Uploaded by

Hari MenonCopyright:

Available Formats

University of Toronto ECO100: Introductory Economics

Department of Economics Robert Gazzale, PhD

Solved Problems: Economists Way of Thinking

Version With Solutions

1. You have a credit at the iTunes store expiring today. Realizing that your music collection

is woefully lacking in jazz classics, you decide to use this credit to purchase jazz albums. In

preparation for spending your iTunes credit, you wrote down Table 1, which indicates the

enjoyment value (in dollars) you would get from each of 5 albums.

Artist Album Value

Ella Fitzgerald and Louis Armstrong Ella and Louis $11

The Thelonious Monk Quartet Monks Dream $13

The Dave Brubeck Quartet Time Out $15

Charles Mingus Ah Um $17

John Coltrane Blue Train $19

Table 1: Your enjoyment values for a number of the best jazz albums of all time.

Assume that each album costs $10. Further assume that that the only reason you are pur-

chasing music is because you have this credit: due to the fact that you are a poor University

student, you are not willing to spend any other money you may have on music. We of course

assume that you are perfectly rational as defined by an economist.

(a) Thinking you have $20 in credit, what albums do you place in your shopping cart?

Suggested Solution: You choose the two albums with the largest enjoyment value:

Coltranes Blue Train and Mingus Ah Um.

(b) Before checking out, you realize that you actually have $30 in credit. What albums do

you now have in your shopping cart?

Suggested Solution: You add the album with the next highest enjoyment value,

Brubecks Time Out, to the albums already in your cart (Coltranes Blue Train and

Mingus Ah Um).

(c) You are just about to purchase the albums you identified in the previous question when

you remember Prof. Gazzale telling you that no music collection is complete without

Miles Davis Kind of Blue.1 What is the (opportunity) cost of following Prof. Gazzales

advice and purchasing Miles Davis Kind of Blue?

Suggested Solution: $15. To answer this question, we need to identify what you

rationally give up in order to purchase Miles Davis Kind of Blue. You must remove

1 of the albums from your shopping cart, and you are of course going to remove the

album giving you the smallest enjoyment value: Brubecks Time Out. (Alternatively, if

you purchase Kind of Blue, you only have $20 to spend. In question 1a, you found that

you would purchase Coltranes Blue Train and Mingus Ah Um if you only had $20 to

spend.)

(d) Helpful to Think About I Prof. Gazzale has been accused of writing wordy problem

set questions. Why was it necessary for him to specify that the credit expires today

in order for you to be able to answer these questions? (Translation: What might you do

if the credit does not expire today?)

1

For the record, no music collection is complete without Miles Davis Kind of Blue.

20160927: Page 1 Economists Way of Thinking: Problems: Solutions

University of Toronto ECO100: Introductory Economics

Department of Economics Robert Gazzale, PhD

Suggested Solution: If the credit does not expire today, you might choose to save

some of your credit for later use. For example, if you know that an album with an

enjoyment value of $20 will be released next week and you are reasonably patient, you

would only purchase 2 albums now.

(e) Helpful to Think About II Why was it necessary for him to specify that you are

rationally only willing to purchase music with the iTunes credit (i.e., you will not use

any other money you have)?

Suggested Solution: If this is the case, you might rationally purchase more than

three albums. For example, if Prof. Gazzale also told you that the total enjoyment value

of the last 5 coffees you consume in a month was $14 (and each coffee costs $2), then

the opportunity cost of purchasing Davis Kind of Blue would be $14, as you would keep

Brubecks Time Out in your shopping cart and instead cut back on coffee.

By assuming that you rationally would only use the iTunes credit to purchase music, we

are assuming that the enjoyment value you get from any $10 of real money is at least

$15.

2. Assume each glass of wine costs $10. Assume Table 2 gives the enjoyment benefit (i.e., value

as assessed by a consumer) of each glass of wine consumed in a given month. Thus while the

first glass of wine each month is valued at $18, the second glass is valued at $16, the third at

$14, etc.

Marginal Total Average

Quantity Benefit Benefit Benefit

1 $18 $18 $18

2 $16 $34 $17

3 $14

4 $12

5 $10

6 $8

7 $6

8 $4

9 $2

10 $0

Table 2: Benefit (i.e., value assessed by consumer) of each glass of wine.

(a) If the consumer purchases 2 glasses of wine in a month:

i. What is the net benefit of the second glass of wine?

ii. What is the consumers total net benefit from two glasses of wine?

Suggested Solution: First glass: $18-$10=$8. Second glass: $16-$10=$6. Two

glasses: $8+$6=$14.

Alternatively: ($18 + $16) ($10 + $10) = |{z}

$14

| {z } | {z }

total benefits total costs net benefit

(b) Assume the consumer is perfectly rational and follows the rule keep doing something

as long as the benefit is at least as large as the cost.

20160927: Page 2 Economists Way of Thinking: Problems: Solutions

University of Toronto ECO100: Introductory Economics

Department of Economics Robert Gazzale, PhD

i. How many glasses of wine does she drink every month?

ii. What is the consumers total net benefit from wine?

Suggested Solution:

i. She drinks 5 glasses each month.

ii. Total net benefit=$8+$6+$4+$2+$0=$20

(c) Suppose instead that the consumer followed the rule keep doing something as long as

the average benefit is at least as large as the average cost. What would be her total

net benefit if she followed this rule?

Suggested Solution: For any quantity, average cost equals $10. When the consumer

consumes 9 glasses of wine, her average benefit equals to $10. This means her total

benefit equals 9 $10 = 90, while her total costs equal 9 $10 = 90. Her net benefit is

thus zero. Clearly, this is not a good rule to live by . . .

(d) Assume now that wine need not be purchased in discrete increments. (Translation: it is

now possible to purchase 1.99873979 glasses of wine.)

i. What is the equation for the marginal benefit schedule presented in Table 2? (That

is, what is the equation for M B(Q) that gives me $18 for Q = 1, $16 for Q = 2,

etc.)

ii. If each glass costs $10, what is the equation for marginal cost, M C(Q)?

Suggested Solution:

i. M B(Q) = 20 2Q

ii. M C(Q) = 10

(e) Using the equations from question 2d:

i. In a graph with $ on the vertical axis and Q on the horizontal axis, sketch M C(Q)

and M B(Q).

ii. Solve for Q , the quantity where M C(Q ) = M B(Q ).

iii. Solve for the area between the M C(Q) and M B(Q) lines. (Translation: Find the

consumers total net benefit from wine if she consumes Q units.)

Suggested Solution:

i. See Figure 1.

Figure 1: Marginal benefits and costs.

20160927: Page 3 Economists Way of Thinking: Problems: Solutions

University of Toronto ECO100: Introductory Economics

Department of Economics Robert Gazzale, PhD

ii.

M C(Q ) = M B(Q ) (1)

10 = 20 2Q (2)

2Q = 10 (3)

Q =5 (4)

bh 510

iii. 2 = 2 = 25

(f) Explain why Q maximizes her total net benefit. That is, explain why

i. Purchasing more than Q units decreases her total net benefit; and

ii. Purchasing fewer than Q units decreases her total net benefit.

Suggested Solution:

i. For any unit greater than Q = 5, the cost exceeds the benefit, and we would thus

need to subtract this area from the area shaded in grey.

ii. For any unit less than Q = 5, the benefits exceed the cost, and thus consuming this

units would add to net total benefit. Graphically, if she stopped consuming before

Q = 5, the shaded area in Figure 1 would be smaller than it currently is.

3. You arrive at the $50 Store with $50 gift card that will expire at the end of the day, but no

cash and no credit/debit cards. The price of everything at the $50 Store is $50. You see a pair

of jeans which would give you $70 in enjoyment value; a sweater which would give you $80 in

enjoyment value; and a pair of shoes with would give you $90 in enjoyment value. Everything

else is pretty vile, and you are a busy person who cannot return to the store before the gift

card expires. We of course assume perfect rationality as defined by the economist.

(a) While the next few questions will have you analyze the situation more formally, I do

hope that the more formal analysis supports your answer to this question: What do you

leave the $50 store with?

A Your soon-to-expire $50 gift card.

B The pair of jeans

C The sweater

D The shoes

Suggested Solution: D.

(b) What is the cost2 of using the gift card to purchase the jeans?

Suggested Solution: Buying the jeans means you give up buying the sweater whose

value is 80 and the shoes whose value is 90. Finding the opportunity cost requires finding

the value of the best alternative: if you do not buy the jeans, you would choose the shoes

over the sweater. Thus the opportunity cost is 90.

(c) What is the cost of using the gift card to purchase the sweater?

Suggested Solution: Buying the sweater means you give up buying the jeans whose

value is 70 and the shoes whose value is 90. Finding the opportunity cost requires finding

the value of the best alternative: if you do not buy the jeans, you would choose the shoes

over the jeans. Thus the opportunity cost is 90.

2

We are economists, cost includes any and all opportunity costs . . .

20160927: Page 4 Economists Way of Thinking: Problems: Solutions

University of Toronto ECO100: Introductory Economics

Department of Economics Robert Gazzale, PhD

(d) What is the cost of using the gift card to purchase the shoes?

Suggested Solution: Buying the shoes means you give up buying the jeans whose

value us 70 and the sweater whose value is 80. Finding the opportunity cost requires

finding the value of the best alternative: if you do not buy the jeans, you would choose

the sweater over the jeans. Thus the opportunity cost is 80.

(e) Use the do it as long as the benefit outweighs the cost rule to explain the contents of

your shopping bag as you exit the $50 Store.

Suggested Solution: As the shoes are the only item whose benefit exceeds its costs,

it is the only thing in your bag.

20160927: Page 5 Economists Way of Thinking: Problems: Solutions

You might also like

- Dna Groove Template User ManualDocument27 pagesDna Groove Template User ManualEdward Osei Yaw AkotoNo ratings yet

- Sample - African Independence and CoordinationDocument9 pagesSample - African Independence and CoordinationMatt D FNo ratings yet

- Integrate Reading Writing Basic 3 Students BookDocument114 pagesIntegrate Reading Writing Basic 3 Students BookWong Cheung100% (2)

- Saad Karimi (Assignment 2)Document5 pagesSaad Karimi (Assignment 2)pakistan100% (1)

- 3850 Certificate in Mathematics - Sample Paper Stage 3: Candidate Name (First, Middle, Last)Document20 pages3850 Certificate in Mathematics - Sample Paper Stage 3: Candidate Name (First, Middle, Last)shan100% (1)

- Lux Aeterna Edward Elgar PDFDocument11 pagesLux Aeterna Edward Elgar PDFAnton Alexis-HallgrenNo ratings yet

- Summative Assessment of MYP 1 MathDocument20 pagesSummative Assessment of MYP 1 MathJerry D100% (1)

- Hard Times Short SummaryDocument3 pagesHard Times Short SummarySanja GorgievaNo ratings yet

- Musical Scales Are Based On Fibonacci NumbersDocument3 pagesMusical Scales Are Based On Fibonacci NumbersAaheli MaityNo ratings yet

- EXPT 6 - LABORATORY MANUAL: Simulation of Helical Antenna Using AN-SOF Antenna SimulatorDocument9 pagesEXPT 6 - LABORATORY MANUAL: Simulation of Helical Antenna Using AN-SOF Antenna SimulatorKim Andre Macaraeg100% (1)

- ItalianMadrigalVerse EinsteinDocument18 pagesItalianMadrigalVerse EinsteinAlessandra Rossi100% (1)

- Intermediate Microeconomics and Its Application 12th Edition Nicholson Snyder Test BankDocument7 pagesIntermediate Microeconomics and Its Application 12th Edition Nicholson Snyder Test Bankrodney100% (28)

- Intermediate Microeconomics and Its Application 12th Edition Nicholson Test BankDocument7 pagesIntermediate Microeconomics and Its Application 12th Edition Nicholson Test BankMrRichardRodrigueztqokj100% (10)

- Antonin Artaud: 1896-1948 This Image by Man Ray Taken in 1926Document38 pagesAntonin Artaud: 1896-1948 This Image by Man Ray Taken in 1926ed_scheer9252No ratings yet

- Rethink the Bins: Your Guide to Smart Recycling and Less Household WasteFrom EverandRethink the Bins: Your Guide to Smart Recycling and Less Household WasteNo ratings yet

- ECO100SolvedProblemsThinkingEconomist2 PDFDocument3 pagesECO100SolvedProblemsThinkingEconomist2 PDFSteffy LoNo ratings yet

- Tutorial 6Document13 pagesTutorial 6Zhaslan HamzinNo ratings yet

- Misbehaving Economics AddendumDocument28 pagesMisbehaving Economics AddendumnotoriousnoahNo ratings yet

- Midterm 1 Vrs 1Document12 pagesMidterm 1 Vrs 1Papa FrankuNo ratings yet

- CH 10Document3 pagesCH 10Veysel KabaNo ratings yet

- Unit Rates Comparing 1Document2 pagesUnit Rates Comparing 1rosela labosNo ratings yet

- Managerial Economics and Business Strategy 8th Ed Chpt. 4 QuestionsDocument2 pagesManagerial Economics and Business Strategy 8th Ed Chpt. 4 QuestionsBoooNo ratings yet

- Econ Chap1Document13 pagesEcon Chap1hcimtdNo ratings yet

- ECO101 PS1 Questions and SolutionsDocument13 pagesECO101 PS1 Questions and SolutionsshenyounanNo ratings yet

- ECO 100Y Introduction To Economics Midterm Test # 1: Last NameDocument16 pagesECO 100Y Introduction To Economics Midterm Test # 1: Last NameexamkillerNo ratings yet

- 110spring19 PS2Document4 pages110spring19 PS2Alaina AndersonNo ratings yet

- Practice Exam ADocument11 pagesPractice Exam Aaksi_28No ratings yet

- Eco 100 Solved Problems Thinking Economist SolutionsDocument10 pagesEco 100 Solved Problems Thinking Economist SolutionsSteffy LoNo ratings yet

- (G7 Unit 4) CRIT B FormativeDocument2 pages(G7 Unit 4) CRIT B FormativeMustak NakhwaNo ratings yet

- Intermediate Microeconomics and Its Application 12th Edition Nicholson Test BankDocument8 pagesIntermediate Microeconomics and Its Application 12th Edition Nicholson Test Banktiffanystewart16111992tac100% (47)

- Krugman2e Solutions CH10Document16 pagesKrugman2e Solutions CH10Ayten MajidovaNo ratings yet

- 66288580Document8 pages66288580Mike TranNo ratings yet

- Problem SheetDocument7 pagesProblem Sheetwelfare0% (1)

- Problem Solving With Excel Spreadsheets Part 2Document7 pagesProblem Solving With Excel Spreadsheets Part 2SFDC TESTNo ratings yet

- Put All Types of Questions To The Following Sentence:: II. Choose The Correct VariantDocument6 pagesPut All Types of Questions To The Following Sentence:: II. Choose The Correct VariantThu PhươngNo ratings yet

- Tutorial 1Document2 pagesTutorial 1lightsoul91No ratings yet

- Actuarial 68 Answer KeyDocument1 pageActuarial 68 Answer KeyAkirah McEwenNo ratings yet

- ECO101 Fall 2022 Midterm 1 A Questions and SolutionsDocument13 pagesECO101 Fall 2022 Midterm 1 A Questions and Solutionschuyue jinNo ratings yet

- Words ProblemsDocument3 pagesWords Problemsapi-322448561No ratings yet

- Intermediate Microeconomics and Its Application 12th Edition Nicholson Test BankDocument8 pagesIntermediate Microeconomics and Its Application 12th Edition Nicholson Test BankmanhkieraebyzNo ratings yet

- Problem 1Document2 pagesProblem 1scaret198No ratings yet

- Preparatory Work For Microeconomics EC202Document7 pagesPreparatory Work For Microeconomics EC202JohnNo ratings yet

- Test Bank For Intermediate Microeconomics and Its Application 12Th Edition Nicholson Snyder 1133189024 978113318902 Full Chapter PDFDocument28 pagesTest Bank For Intermediate Microeconomics and Its Application 12Th Edition Nicholson Snyder 1133189024 978113318902 Full Chapter PDFryan.boyd506100% (13)

- Qa 40Document16 pagesQa 40ambrosialnectarNo ratings yet

- ECONu6.2 CH 15 Problem SetDocument5 pagesECONu6.2 CH 15 Problem SetPoly GallantNo ratings yet

- Slope-Intercept Form Lesson SlidesDocument44 pagesSlope-Intercept Form Lesson Slidesapi-735539036No ratings yet

- Actuarial00 2afles1rep1pieDocument1 pageActuarial00 2afles1rep1pieHirenkumar ShahNo ratings yet

- Economics For Beginners SeriesDocument16 pagesEconomics For Beginners SeriesteoNo ratings yet

- ps06 1291621965Document5 pagesps06 1291621965daler12345No ratings yet

- Final Math Revision Sheet g6 ANSWER KEYDocument12 pagesFinal Math Revision Sheet g6 ANSWER KEYsara ahmedNo ratings yet

- Unit Rates Comparing 2Document2 pagesUnit Rates Comparing 2KHUSHI SHAHNo ratings yet

- Utility of $Document37 pagesUtility of $Max SaubermanNo ratings yet

- ME Problem Set-1 (2019)Document2 pagesME Problem Set-1 (2019)pikuNo ratings yet

- Micro Economics QuestionsDocument51 pagesMicro Economics QuestionsKai Pac100% (1)

- Document 1633069535Document18 pagesDocument 1633069535vuongthanhthanh911516No ratings yet

- Assignment 2Document1 pageAssignment 2adnan ameerNo ratings yet

- EC1000 Tutorial 3 PDFDocument3 pagesEC1000 Tutorial 3 PDFSabin Sadaf0% (2)

- Chapter 2 Utility and ChoiceDocument6 pagesChapter 2 Utility and ChoiceIsabella NovakNo ratings yet

- Intermediate Microeconomics and Its Application 12th Edition Nicholson Test BankDocument7 pagesIntermediate Microeconomics and Its Application 12th Edition Nicholson Test BankTimothy Marrero100% (34)

- QuestionsDocument3 pagesQuestionsVin PheakdeyNo ratings yet

- Saad Nadeem 20171-22922Document12 pagesSaad Nadeem 20171-22922saadNo ratings yet

- Smaple QuestionsDocument1 pageSmaple QuestionsAsad HayatNo ratings yet

- Basic 2 Exit TestDocument5 pagesBasic 2 Exit TestNestor Colquehuanca Capquequi0% (1)

- TB Chapter 12Document20 pagesTB Chapter 12Elisa TrisnaNo ratings yet

- How to Calculate Interest Earned on Money? Or, Does Money Grow on Trees?: SHORT STORY # 45. Nonfiction series #1 - # 60.From EverandHow to Calculate Interest Earned on Money? Or, Does Money Grow on Trees?: SHORT STORY # 45. Nonfiction series #1 - # 60.No ratings yet

- Common Cents: How the Economy Really Works--from the Global Market to the SupermarketFrom EverandCommon Cents: How the Economy Really Works--from the Global Market to the SupermarketRating: 2.5 out of 5 stars2.5/5 (4)

- Verbos en InglesDocument17 pagesVerbos en InglesEma Orellana100% (1)

- Rs and CMC Important Questions For II Mid and Prefinal ExamsDocument3 pagesRs and CMC Important Questions For II Mid and Prefinal ExamsMEETSARAT1No ratings yet

- Gatecounsellor: Ec: Electronics & Communication EngineeringDocument17 pagesGatecounsellor: Ec: Electronics & Communication EngineeringRoshan JayswalNo ratings yet

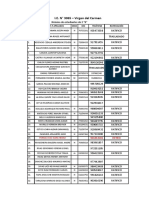

- Registro de Notas - MoisesDocument16 pagesRegistro de Notas - MoisesJazmin PalominoNo ratings yet

- Panggung Sandiwara - Score and PartsDocument6 pagesPanggung Sandiwara - Score and PartsAldy Alfan FazzNo ratings yet

- Speech Choir PresentationDocument15 pagesSpeech Choir Presentationshey mahilumNo ratings yet

- 「愛之死」的構圖:三島由紀夫的〈憂國〉、電影《憂國》與華格納的《崔斯坦與伊索德》Document25 pages「愛之死」的構圖:三島由紀夫的〈憂國〉、電影《憂國》與華格納的《崔斯坦與伊索德》孫永貞No ratings yet

- Roger PDFDocument82 pagesRoger PDFjimNo ratings yet

- Solo Artist Profile - Sanskriti JainDocument12 pagesSolo Artist Profile - Sanskriti JainSanskriti JainNo ratings yet

- Can't Help Falling in Love (Tab)Document3 pagesCan't Help Falling in Love (Tab)Courtney DizonNo ratings yet

- s7 200Document6 pagess7 200anh tuNo ratings yet

- Popularity of Radio Advertising On Food Supplement Among Senior CitizenDocument19 pagesPopularity of Radio Advertising On Food Supplement Among Senior CitizenJohn Patrick Tolosa NavarroNo ratings yet

- FM Transmitter: General HD Upgrade FM Signal-To-Noise RatioDocument2 pagesFM Transmitter: General HD Upgrade FM Signal-To-Noise RatioJose Hugo Sosa SalasNo ratings yet

- Vomm-Vecc PDF 1700825998Document34 pagesVomm-Vecc PDF 1700825998rahulsdudhakaNo ratings yet

- EchoStar 2002 Annual ReportDocument103 pagesEchoStar 2002 Annual ReportDragon RopaNo ratings yet

- NICCOLO PAGANIN-WPS OfficeDocument2 pagesNICCOLO PAGANIN-WPS OfficeMark Rienzo HingpisNo ratings yet

- English File: Grammar, Vocabulary, and PronunciationDocument3 pagesEnglish File: Grammar, Vocabulary, and PronunciationMirian Apaza100% (1)

- Compositional Processes From An Ecological Perspective: Keller, DamianDocument7 pagesCompositional Processes From An Ecological Perspective: Keller, DamiansophochaNo ratings yet

- Impact of Interference On Multi-Hop Wireless Network PerformanceDocument14 pagesImpact of Interference On Multi-Hop Wireless Network PerformanceJayeta BiswasNo ratings yet

- Federico - Master ThesisDocument87 pagesFederico - Master Thesispnkc80No ratings yet

- AX-Synth MIDI Imple eDocument16 pagesAX-Synth MIDI Imple eZeferinixNo ratings yet