Professional Documents

Culture Documents

LTR DTD Sept 14 2015 Mr. Castillejo Jr. Triplex Ent. Inc.

Uploaded by

Bplo Caloocan0 ratings0% found this document useful (0 votes)

9 views6 pagesv

Original Title

Ltr Dtd Sept 14 2015 Mr. Castillejo Jr. Triplex Ent. Inc.

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentv

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views6 pagesLTR DTD Sept 14 2015 Mr. Castillejo Jr. Triplex Ent. Inc.

Uploaded by

Bplo Caloocanv

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 6

‘Tagqpagtaguyod ng Tapat, Responsable at Makabuluhang Pag-tingat

REPUBLIC OF THE PHILIPPINES.

BUREAU OF LOCAL GOVERNMENT FINANCE

DEPARTMENT OF FINANCE a

8th Floor EDPC Building, Bangko Seotal ng Pilipinas Complex

Roxas Boulevatd, Manila 1004 * Telefax Nos. 527-2780 527-2790

Email’ igtihlet gounh Ofiial Website; wwwblafz0v ph

September 14, 2015

Mr. Virgilio B. Castillejo, Jr.

Accountant

Triplex Enterprises Incorporated

2244 Chino Roses Ave.,

Makati City

Sir

This refers to your letter dated June 19, 2015 seeking advice on the Letter of

‘Authority (LOA) of Parafiaque City classifying the warehouse of Triplex Enterprises

Incorporated (Triplex for brevity) as a manufacturing plant subject to business taxes.

Representations are made that Triplex principal office is located in Makati City

where all sales and marketing are done. Hence, the request for opinion on the

following issues:

1. Triplex warehouse in Parafiaque is doing cutting and sheeting of Paper rolls

it imports from abroad and buys from local paper manufacturer. Triplex does

not pu/add oF process anything on the said paper except to cut it to the size

requirement of its customer as part of its sales service. With the above

procedure, is it right that Triplex be classified as a manufacturer?

2. When Triplex put its brand or label on said cut paper, is it considered

manufacturing?

3. Triplex never does any sales or manufacturing in Parafiaque, except

warehousing and cutting facilities. With the above activity, can Triplex be

legally compelled to pay local taxes to Parafiaque when the sales involved

are already taxed and paid in Makati?

4. Is it not that Section 150(b) applicable only to manufacturers with factories

project plants and plantations on the pursuit of their business outside of the

locality where the principal office is located.

5, Isn't it very clear that a company is classified and defined as manufacturer

in Section 134(20) “Only if by any process it alters the form and exterior of

any prodact."? -

Jaman at Pagtatasa ng Pamahalaang Lokal”

Said letter was referred to the City Treasurer of Paranaque for comment under

at Indorsement dated June 25, 2015.

Ina reply-letter dated July 27, 2015, copy enclosed, the City Treasurer submits

as follows:

BLM

4. Triplex stated in their letter dated June 19, 2045 that their warehouse in

poe smaque City is “doing cutting and sheeting of Paper rolls we import from

‘Abroad and buy from Local Paper manulaclutt © Thus, there is no doubt

tho the warehouse activity of Triplex involves ihe physical means of cutting

pat Sheeting of paper rolls which has altered the exterior from the said

paper rolls which is clearly the raw material used. There is the need for the

pehing and sheeting to prepare the paper rols '0 be sold to customers as

Triplex cannot possibly sell to its customers uncut and not sheeted paper

rolls. Clearly, the activity of Triplex’s warehouer is manufacturing as defined

trSection 134(0) of Republic Act No. 7160. ‘also known as the Local

Government Code of 1997, to quote:

(0) "Manufacturer includes every person who, by physical or

chemical process, alters_the exterior texture_or form or inner

substance of any raw material_or manufactured_or partially

ve pufactured product in such manner as 1o-prepers iL for special

use_or uses to ‘which it could not have been put in original

uS6 tans, oF who Dy any Such process, alters the ‘quality of any

eich raw material or manufactured OF partially manufactured

products so as to reduce it to marketable shape or prepare it for

ny of the use of industry, of who by any ‘such process, combines

any such raw material or manufactured partially manufactured

products with other materials oF products of the same or of

vifferent kinds and in such manner that the finished products of

Such process or manufacture can be pul {0 8 special use of uses

to which such raw material oF ‘manufactured or partially

+0 snufacturad in their original condition could not have been put,

sg who in addition, alters such raw material OF manufactured oF

partially manufactured _products._¢F combines _the_same_to

produce such finished products for the purpose of their sale_or

istribution to others and nol for his "own use or consumption;

(Underscoring supplied)

2. Since Triplex's warehouse is engage i? manufacturing, the putting of its own

Brand or label on the cut paper necessarily fone part of the manufacturing

process so that Triplex can sell the fnighed paper products to others and

not for its own consumption.

3, Since Triplex’s warehouse Is engaged in the manufacturing of paper

products, 70% of the local business tox must be paid to the City of

Parafiaque as stated in Section 160 of the ‘Local Government Code of 1991

215.917 (Sits, Warelou PLEX, Makati Pari) Page?

‘And since Triplex’s warehouse is engaged in manufacturing, it is in the

S same category as a factory, project office, plant or plantation. Thus, uncler

the abovectted law, Triplex should pay 70% local business tax to the City of

Parafaque where the warehouse is located

4. Thus, the delinquency assessment made on Triplex js therefore in

accordance with law. The assessments include delinquent regulatory fees

which they incurred when these failed to disclose their activity of fabrication

of their raw materials in their warehouse,

In this connection, Triplex submitted a letter dated September 15, 2015 to

supplement its letter-query dated June 19, 2018. As an additional information, Triplex

cae pees religiously paying about ninety percent (90%) of its local tax in Makati City

and never considered its warehouse in Parafiaque City as engaged in manufacturing

or treated it in the same category as a factory, project office, plant or plantation.

However, sometime in year 2015, Triplex received a letter from the City of

Paranaque recuiring it to pay additional business tax (deficiency), including

Surcharges and penalties for the years 2010-2014 for a total “amount of

Phpt1,303,462.54, based on their findings that Triplex’s warehouse iS engaged in

manufacturing, Hence, Triplex sought a reconsideration which was denied citing

Section 150 of the LGC.

Triplex contends that if the position by the City of Parafiaaue is correct then

starting year 2016, Triplex will be forced to declare (and be classified) its warehouse

in that Cty 2s manufacturer. Further, Triplex will be requesting for 2 tax refund from

Makati for the amount which Parafiaque is charging as tax deficiencies for the last five

(5) years based on the principle of “Solutio Indebiti’

Triplex likewise submitted the following adcitional information:

Makati Office:

a. All sales and invoicing are done, received and dectared at the Makati Office

b. Makati Office is also being utilized for warehousing. No cutting, slitting

and/or packaging activity is done here

Paraiiaque Site:

a. Parafiaque warehouse is purely utilized for warehousing. It is where cutting,

slitting and/or packing is being done

b. The cutting andior siting consist of cutting the paper rolls into different

sizes as needed by ur customers without any process of either adding or

altering its composition or substance.

REM - 2015.0817 1Sits, Warehouse-Play TRIPLEX, Maki Praia) Page

c. Triplex also sells paper/paper rolls to ts customers in their original state

{irom the suppliers to warehouse qustomers) without any changes OF

rfervention, not even cutting or siting

Triplex is a manufacturer. ;

In rosolving the issue of whether of Nol Triplex operations in Parafiague City be

considered as that of a manufacturer, the provisions of Section 131 of the LGC is

quoted once more for ready reference

(0) "Manufacturer includes every person who, by physical or

Shemical process, alters_the_extenior texture_or form or inner

Substance of any_faw_material_OF manufactured _or_partially

ranufactured product in such manner 2S. to prepare it for special

lise_or uses fo which L could My have been put jn is oriainal

conditions, or who by any such process, alters the quality of any

such raw material OF manufactured or partially manufactured

products so as to reduce it to orarketable shape or prepare It for

Bny of the use of industry, oF who by any such process, combines

any such raw material OF manufactured or partially manufactured

products with other materials oF products of the same oF of

Siferent kinds and in such manner ‘hat the finished products of

uch process or manufacture can Be put to a special use of Uses

to which such raw material oF manufactured of partially

anufactured in their original condition ‘could not have been pul,

‘and who in addition, alters such 12st material or manufactured oF

partially manufactured _produets.—cr ‘combines _the_same_to

produce such finished products for the purpose of their sale or

Freibution to_others_and not for his own use of consumption:

(Underscoring supplied)

Based on the representations made that Triplex warehouse in Parafagve ©

doing the cutting and sheeting of Paper veils it imports from abroad and Buys, from

Toca! paper manufacturer, aside from putting brand name of abel on the finish

product, we therefore agree wth the position of the City Treasurer of Parafiaque

Ainich is hereby being re-stated for emphasis’

thus, there is no doubt thal the warehoroe activity of Triplex involves

the physical means of cutting and Sheeting of paper rolls which has

ditered the exterior from the said Pepe tolls which is clearly the raw

ator used. There is the need for the ‘cutting and sheeting to prepare

the paper rolls o be sold to customers “riplex cannot possibly sell to

ite customers uncut and not sheeted Pept Tolls. Clearly, the activity of

Triplex’ warehouse is manufacturing ‘defined in Section 131(0) of

Republic Act No. 7160, also known 2S the Local Government Code of

4991 XXX"

LM 20154 c-plant TRIPLEX. kot ara Powe

1 ¢sinus_Wareho

In view thereof, the warehouse in Parafaque shall be considered a

manufacturing “plant a5 defined in Webster's Third New International Dictionary

(1986 ed.) as follows 7

“plant® — the land, building machinery, apparatus, and fixtures employed in

carrying on a trade or mechanical or other industrial business; a factory or

workshop for the manufacture of a particular product; the total facilities

available for production or service in a particular country or place.

In this connection and for purposes of local taxation the 30%70% sales

allocation pursuant to Article 243(bX3) implementing Section 150 (bX(1) of the Lec,

quoted hereunder shall apply:

“(b) Sales Allocation ~ (1) xxx

(3) In cases where there is a factory, project office, plant

or plantation in pursuit of business, thiry percent (30%) of all

sales recorded in the principal office shall be taxable by the city or

municipality where the principal office is located and seventy

percent (70%) of all sales recorded in the principal office shall be

taxable by the city or municipality where the factory, project office,

plant or plantation is located. LGUs where only experimental

farms are located shall not be entitied to the sales allocation

herein provided for. (Underscoring ours)

Claim for refund/tax credit

In view of the claim that Triplex has been religiously paying about ninely

percent (90%) ofits local tax in Makati, Triplex may therefore file a writen claim for tax

Fofundicredit with the City Treasurer of Makati. However the two-year prescription

period shall not apply for the simple reason that the taxpayer cannot be faulted for the

prescription of the tax refund claim. When the tax claimed to be refunded is illegally or

croneausly collected, the principle of solutio indebiti shall govern and not the twa (2).

year prescriptive period provided under Section 196 of the LGC. The principle of

yeutio indebifi should apply in the case at bar, thus, “In any case, a taxpayer should

oot be held fo suffer loss by his good Intention to comply with what he believes is his

fagal obligation, where such obligation does not really exist.” (Ramie Textiles v. Hon.

Ismael Mathay Sr., G.R. L-32364, 30 April 1979)

Furthermore, Article 2154 under the principle of solutio indebiti, which Is

classified as quasi-contract under Section 2, Chapter |, both of the Civi Code,

provides that “[]f something is received when there is no right to demand it, and

seyuas unduly delivered through mistake, the obligation to return it arises.” And

Mince the collection was illegal, the obligation to return or refund the same

\aauld be in the nature of solutio indebiti, which by the Civil Code, prescribes in

6 years.” (Victorias Milling Co., Inc. vs. Central Bank of the Phillppines, GR. No. L-

17798 March 31, 1965)

BLM - 2015.017 (Sis Warehouse-Phnt TRIPLEX, Makati, Parfiague) Pags

Conclusively, this Bureau is of the view that Triplex’s application for tax credit

is meritorious and should be given due course and the running of the prescriptive

period applicableis Article 1144 of the Civil Code, supra. Provided, however, that the

claim is duly supported by evidence of payment (e.g., official receipts and such other

proof evidencing payment),

Triplex is likewise considered as a wholesaler or retailer.

On the basis of the claim of Triplex that it also sells paperipaper rolls to its

customers in their original state (from the suppliers to warehouse to customers)

without any changes or intervention, not even culting or slitting, the warehouse in

Parafiaque Cily shall likewise be considered as a Sales Office and 100% of such

sales recorded thereat shall be taxable by said City on the basis of the rates imposed

on wholesaler or retailer under its duly-enacted ordinance.

‘We hope that this will help clarify matters.

Very truly yours,

Se 22)

——

SALVADOR. ELCASTILLO

IC-Executive Director

Copy furnished:

The City Treasurer

Parafaque City

The City Treasurer

Makati City

BLM «2015-0817 (Situ Warchouse Plan TRIPLEX, Mukati Parotaqued

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Eo 11 FRMDocument4 pagesEo 11 FRMBplo CaloocanNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Act 296Document6 pagesAct 296Bplo CaloocanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Small General Business Occupancy Checklist Cal 2022 Danerva Nail SpaDocument4 pagesSmall General Business Occupancy Checklist Cal 2022 Danerva Nail SpaBplo CaloocanNo ratings yet

- BP Top 05-015911Document2 pagesBP Top 05-015911Bplo CaloocanNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- EXTENSIONDocument2 pagesEXTENSIONBplo CaloocanNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Adobe Scan Jan 20, 2023Document1 pageAdobe Scan Jan 20, 2023Bplo CaloocanNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- FakeDocument4 pagesFakeBplo CaloocanNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Esh Inspection 11112021Document8 pagesEsh Inspection 11112021Bplo CaloocanNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Spidc Job Request AmendmentDocument2 pagesSpidc Job Request AmendmentBplo CaloocanNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Esh Inspection 07222021Document9 pagesEsh Inspection 07222021Bplo CaloocanNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- CDC Manufacturing Corp - Melawares - 1652754762Document19 pagesCDC Manufacturing Corp - Melawares - 1652754762Bplo CaloocanNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- BP Top 21-M0601-00006Document1 pageBP Top 21-M0601-00006Bplo CaloocanNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Npo Hiring FINAL001Document5 pagesNpo Hiring FINAL001Bplo CaloocanNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- SSC20220323-001 The Finest Gourmet Group Restaurants Inc (Yellowcab)Document1 pageSSC20220323-001 The Finest Gourmet Group Restaurants Inc (Yellowcab)Bplo CaloocanNo ratings yet

- Img20210427 17270777Document1 pageImg20210427 17270777Bplo CaloocanNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- HOTELS in GCQDocument4 pagesHOTELS in GCQBplo CaloocanNo ratings yet

- Cebu - DumagueteDocument4 pagesCebu - DumagueteBplo CaloocanNo ratings yet

- Comments On The Findings Re On Site Inspection Dated 26 May 2022Document2 pagesComments On The Findings Re On Site Inspection Dated 26 May 2022Bplo CaloocanNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Complianant's Position Paper (Prayers Amended)Document10 pagesComplianant's Position Paper (Prayers Amended)Bplo CaloocanNo ratings yet

- MLQHS - Certification - List of EstablishmentsDocument2 pagesMLQHS - Certification - List of EstablishmentsBplo CaloocanNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- LBPF No. 2 - Budget Estimate 2020Document2 pagesLBPF No. 2 - Budget Estimate 2020Bplo CaloocanNo ratings yet

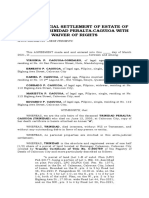

- Extrajudicial Settlement of Estate of The Late Trinidad PeraltaDocument3 pagesExtrajudicial Settlement of Estate of The Late Trinidad PeraltaBplo CaloocanNo ratings yet

- Promissory NoteDocument1 pagePromissory NoteBplo CaloocanNo ratings yet

- Affidavit of Adverse ClaimDocument2 pagesAffidavit of Adverse ClaimBplo CaloocanNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Memorandum of AgreementDocument5 pagesMemorandum of AgreementBplo Caloocan100% (2)

- Annex F - PPAs 2020Document1 pageAnnex F - PPAs 2020Bplo CaloocanNo ratings yet

- Hon. Rebecca A. Ynares: Provincial Governor, Province of RizalDocument1 pageHon. Rebecca A. Ynares: Provincial Governor, Province of RizalBplo CaloocanNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)