Professional Documents

Culture Documents

Sbi Magnum Taxgain Scheme Factsheet (March-2017!3!1)

Uploaded by

Saranya KrishnamurthyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sbi Magnum Taxgain Scheme Factsheet (March-2017!3!1)

Uploaded by

Saranya KrishnamurthyCopyright:

Available Formats

NET ASSET VALUE LAST DIVIDENDS

Option NAV (`) Record Date Dividend Nav (`)

(in `/Unit)

Reg-Plan-Growth 122.0198 11-Mar-16 (Reg Plan) 4.00 36.4523

11-Mar-16 (Dir Plan) 5.00 45.2369

Reg-Plan-Dividend 43.8705

27-Mar-15 (Reg Plan) 5.50 51.8907

Dir-Plan-Dividend 54.7629 27-Mar-15 (Dir Plan) 7.00 64.2735

28-Mar-14 (Reg Plan) 3.50 34.5688

Investment Objective Dir-Plan-Growth 124.7844 28-Mar-13 (Reg Plan) 3.50 30.8878

The prime objective of this scheme is to 22-Mar-12 3.50 31.52

deliver the benefit of investment in a 18-Mar-11 4.00 34.26

portfolio of equity shares, while offering

deduction on such investments made in the Face value: `10

scheme under Section 80 C of the Income- Pursuant to payment of dividend, the NAV of Dividend Option of

tax Act, 1961. It also seeks to distribute schemes/plans would fall to the extent of payout and statutory levy, if

income periodically depending on applicable.

distributable surplus.

Type of Scheme

TOP 10 HOLDINGS PORTFOLIO CLASSIFICATION BY

An Open - Ended Equity Linked Savings

ASSET ALLOCATION (%)

Scheme (%) Of

Stock Name

Date of Allotment Total AUM

2.99% 2.18%

31/03/1993 STATE BANK OF INDIA 6.53

Report As On ICICI BANK LTD. 5.14

28/02/2017 HDFC BANK LTD. 5.02

AAUM for the Month of February 2017 26.32%

INFOSYS LTD. 4.71

` 5,177.98 Crores

ITC LTD. 4.56

AUM as on February 28, 2017

TATA MOTORS LTD. 3.97

` 5,242.87 Crores 68.51%

RELIANCE INDUSTRIES LTD. 3.50

Fund Manager

Mr. Dinesh Balachandran CESC LTD. 3.21

Managing Since Large Cap Midcap

LARSEN & TOUBRO LTD. 3.17

Sep-2016

MAHINDRA & MAHINDRA LTD. 3.01 Cash & Other Current Small Cap

Total Experience Assets

Over 15 years Grand Total 42.81

Benchmark

S&P BSE 100 Index

Exit Load PORTFOLIO CLASSIFICATION BY

NIL INDUSTRY ALLOCATION (%)

Entry Load FINANCIAL SERVICES 30.43

N.A. CONSUMER GOODS 12.13

AUTOMOBILE 9.59

Plans Available

IT 8.87

Regular

PHARMA 8.47

Direct

Options ENERGY 6.71

Growth CONSTRUCTION 5.76

Dividend SERVICES 5.11

SIP CEMENT & CEMENT PRODUCTS 3.44

Weekly - Minimum ` 500 & in multiples of FERTILISERS & PESTICIDES 2.54

` 500 thereafter for a minimum of 6

instalments. Monthly - Minimum ` 500 & INDUSTRIAL MANUFACTURING 1.83

in multiples of ` 500. TEXTILES 1.83

Minimum Investment CHEMICALS 1.10

` 500 & in multiples of ` 500

Additional Investment

` 500 & in multiples of ` 500

Quantitative Data

Standard Deviation# : 14.94%

Beta# : 0.95

Sharpe Ratio# : 0.81

Portfolio Turnover* : 0.61

SBI Magnum Taxgain Scheme

#

Source: CRISIL Fund Analyser This product is suitable for investors who are seeking^:

*Portfolio Turnover = lower of total sale or total Riskometer

purchase for the last 12 months upon Avg. AUM of Long term capital appreciation

trailing twelve months. Investment in a portfolio of equity shares,

FBIL Overnight Mibor rate (6.05% as on 28th Hig

February 2017) Basis for Ratio Calculation: 3 w while offering deduction under Section 80 C

Lo h

Years Monthly Data Points of IT Act, 1961.

LOW HIGH

Investors understand that their principal

will be at Moderately High risk

^Investors should consult their financial advisers if in doubt about whether the product is

suitable for them. 14

Investment under the Scheme has a lock-in period of 3 years.

You might also like

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Financial Accounting CycleDocument55 pagesFinancial Accounting CycleAbhishek VermaNo ratings yet

- The Ownership of The Federal Reserve As Exposed by Congressional Committee 1976Document8 pagesThe Ownership of The Federal Reserve As Exposed by Congressional Committee 1976Space_Hulker100% (1)

- Notice of Annual Meeting With Proxy Form (Non-Person)Document2 pagesNotice of Annual Meeting With Proxy Form (Non-Person)Nancy VelascoNo ratings yet

- Sample Strategy MapsDocument10 pagesSample Strategy MapsAimon ItthiNo ratings yet

- VivendiDocument28 pagesVivendiPartha Sarathi Roy100% (1)

- SBI-Small-and-Mid-Cap-Fund-Factsheet-Document1 pageSBI-Small-and-Mid-Cap-Fund-Factsheet-final bossuNo ratings yet

- Sbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFDocument1 pageSbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFavinash sengarNo ratings yet

- Cas Summary Report 2024 03 21 064120Document5 pagesCas Summary Report 2024 03 21 064120Arun KumarNo ratings yet

- Sbi Focused Equity Fund Factsheet (May-2019!25!1)Document1 pageSbi Focused Equity Fund Factsheet (May-2019!25!1)Chandrasekar Attayampatty TamilarasanNo ratings yet

- SBI Small Cap PDFDocument1 pageSBI Small Cap PDFJasmeet Singh NagpalNo ratings yet

- SBI Bluechip Fund - One PagerDocument1 pageSBI Bluechip Fund - One PagerjoycoolNo ratings yet

- AC Penetration Accross CountriesDocument21 pagesAC Penetration Accross Countrieshh.deepakNo ratings yet

- Kotak Small Cap Fund - 20220201190020276Document1 pageKotak Small Cap Fund - 20220201190020276Kunal SinhaNo ratings yet

- DPTC CMF C P16995 Client 31052023 MonDocument8 pagesDPTC CMF C P16995 Client 31052023 Monsiddhant jainNo ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectmohanchinnaiya7No ratings yet

- STXDIV MDD November 2023Document2 pagesSTXDIV MDD November 2023mkhize.christian.21No ratings yet

- Kotak India - Daily 20200326Document70 pagesKotak India - Daily 20200326abhinavsingh4uNo ratings yet

- Quant Tax Plan - Fact SheetDocument1 pageQuant Tax Plan - Fact Sheetsaransh saranshNo ratings yet

- INF090I01569 - Franklin India Smaller Cos FundDocument1 pageINF090I01569 - Franklin India Smaller Cos FundKiran ChilukaNo ratings yet

- Inf200k01t28 - Sbi SmallcapDocument1 pageInf200k01t28 - Sbi SmallcapKiran ChilukaNo ratings yet

- ValueResearchFundcard HDFCRetirementSavingsFund HybridEquityPlan RegularPlan 2019mar04Document4 pagesValueResearchFundcard HDFCRetirementSavingsFund HybridEquityPlan RegularPlan 2019mar04ChittaNo ratings yet

- ValueResearchFundcard UTIMultiAssetFund DirectPlan 2018nov02Document4 pagesValueResearchFundcard UTIMultiAssetFund DirectPlan 2018nov02ravisankarNo ratings yet

- 07april 2021 India DailyDocument65 pages07april 2021 India DailyMaruthee SharmaNo ratings yet

- ValueResearchFundcard MotilalOswalMOStFocusedMulticap35Fund RegularPlan 2017may03Document4 pagesValueResearchFundcard MotilalOswalMOStFocusedMulticap35Fund RegularPlan 2017may03vigneshNo ratings yet

- 28october 2020 India DailyDocument169 pages28october 2020 India DailyPraveen MathewNo ratings yet

- Fundcard: Axis Treasury Advantage Fund - Direct PlanDocument4 pagesFundcard: Axis Treasury Advantage Fund - Direct PlanYogi173No ratings yet

- SBI Small Cap Fund FactsheetDocument1 pageSBI Small Cap Fund FactsheetPalam PvrNo ratings yet

- SBI Contra Fund FactsheetDocument1 pageSBI Contra Fund FactsheetAman VermaNo ratings yet

- Ind Niftymidcap100Document2 pagesInd Niftymidcap100Vinodh KumarNo ratings yet

- SBI Contra FundDocument2 pagesSBI Contra FundScribbydooNo ratings yet

- Midcap FactsheetDocument2 pagesMidcap FactsheetShubhashish SaxenaNo ratings yet

- ATRAM Global Technology Feeder Fund Fact Sheet Jan 2020Document2 pagesATRAM Global Technology Feeder Fund Fact Sheet Jan 2020anton clementeNo ratings yet

- Infosys Technologies Ltd. Equity: Filing & Other Info Peer Group ChartingDocument26 pagesInfosys Technologies Ltd. Equity: Filing & Other Info Peer Group Chartinglaxmantej77No ratings yet

- L&TEmerging Businesses FundDocument4 pagesL&TEmerging Businesses FundKrishnan ChockalingamNo ratings yet

- ValueResearchFundcard ReligareContra 2010dec12Document6 pagesValueResearchFundcard ReligareContra 2010dec12Sivaraman SenapathiNo ratings yet

- ValueResearchFundcard FranklinIndiaUltraShortBondFund SuperInstitutionalPlan DirectPlan 2017oct11Document4 pagesValueResearchFundcard FranklinIndiaUltraShortBondFund SuperInstitutionalPlan DirectPlan 2017oct11jamsheer.aaNo ratings yet

- Fundcard: Edelweiss Low Duration Fund - Direct PlanDocument4 pagesFundcard: Edelweiss Low Duration Fund - Direct PlanYogi173No ratings yet

- ValueResearchFundcard L&TInfrastructureFund DirectPlan 2017nov23Document4 pagesValueResearchFundcard L&TInfrastructureFund DirectPlan 2017nov23ShamaNo ratings yet

- IIFL Focused Equity Fund - Regular Plan Rating: Above Average Risk Return: AverageDocument4 pagesIIFL Focused Equity Fund - Regular Plan Rating: Above Average Risk Return: AverageChittaNo ratings yet

- ValueResearchFundcard QuantumTaxSaving 2011mar15Document6 pagesValueResearchFundcard QuantumTaxSaving 2011mar15Ankit GulatiNo ratings yet

- HDFC Sec Note - MF Category Analysis - ELSS - Dec 2017-201712121306016401224Document8 pagesHDFC Sec Note - MF Category Analysis - ELSS - Dec 2017-201712121306016401224Aravind SureshNo ratings yet

- Divgi TorqTransfer Systems IPO Note Axis Capital PDFDocument12 pagesDivgi TorqTransfer Systems IPO Note Axis Capital PDFKyle KonjeNo ratings yet

- Fund Facts - HDFC TaxSaver - February 2022Document2 pagesFund Facts - HDFC TaxSaver - February 2022Tarun TiwariNo ratings yet

- INF204K01HY3 - Reliance Smallcap FundDocument1 pageINF204K01HY3 - Reliance Smallcap FundKiran ChilukaNo ratings yet

- Dmart Ultratech LTI Oil Gas BrookfieldDocument80 pagesDmart Ultratech LTI Oil Gas BrookfieldRick DasNo ratings yet

- Sbi Large and Midcap Fund Factsheet (June-2021!2!1)Document1 pageSbi Large and Midcap Fund Factsheet (June-2021!2!1)Gaurav NagpalNo ratings yet

- Axis Dynamic Equity Fund Review - Regular PlanDocument4 pagesAxis Dynamic Equity Fund Review - Regular PlanChittaNo ratings yet

- BlackRock Global Tech FundDocument4 pagesBlackRock Global Tech FundJace OngNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Prasad ChowdaryNo ratings yet

- HDFC Mid-Cap Opportunities Fund(G) Performance SummaryDocument1 pageHDFC Mid-Cap Opportunities Fund(G) Performance SummaryKiran ChilukaNo ratings yet

- ValueResearchFundcard MiraeAssetTaxSaverFund DirectPlan 2019mar08Document4 pagesValueResearchFundcard MiraeAssetTaxSaverFund DirectPlan 2019mar08pqwertyNo ratings yet

- Fundcard: Indiabulls Bluechip FundDocument4 pagesFundcard: Indiabulls Bluechip FundashokarunachalamNo ratings yet

- 50 NiftyindDocument2 pages50 Niftyindconnect.worldofworldcupNo ratings yet

- UTI Monthly Income Scheme - Growth - June 2017Document2 pagesUTI Monthly Income Scheme - Growth - June 2017yaglarNo ratings yet

- L&T India Value Fund Performance ReportDocument1 pageL&T India Value Fund Performance Reportjaspreet AnandNo ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100Rajesh KumarNo ratings yet

- Fundcard: ICICI Prudential Multi Asset Fund - Direct PlanDocument4 pagesFundcard: ICICI Prudential Multi Asset Fund - Direct Planmanoj_sitecNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50SumitNo ratings yet

- JSFB Financials FY 2020 21Document48 pagesJSFB Financials FY 2020 21Riya SinghNo ratings yet

- Ind Nifty 500Document2 pagesInd Nifty 500Mihir DoshiNo ratings yet

- ValueResearchFundcard BarodaPioneerShortTermBondFund DirectPlan 2017may16Document4 pagesValueResearchFundcard BarodaPioneerShortTermBondFund DirectPlan 2017may16Achint KumarNo ratings yet

- Nike PIB 2021Document222 pagesNike PIB 2021Emperor OverwatchNo ratings yet

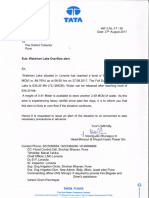

- Flood Alert Message From Walwhan Lake 27.08.2017Document1 pageFlood Alert Message From Walwhan Lake 27.08.2017Saranya KrishnamurthyNo ratings yet

- What Is Inflation?: Inflation Is Defined As A Sustained Increase in The General Level of Prices For Goods andDocument7 pagesWhat Is Inflation?: Inflation Is Defined As A Sustained Increase in The General Level of Prices For Goods andSaranya KrishnamurthyNo ratings yet

- 4148 Ibm Placement Exam Download Previous Years Question Papers Ibm Placement Sample Paper 1Document5 pages4148 Ibm Placement Exam Download Previous Years Question Papers Ibm Placement Sample Paper 1Arun SampathNo ratings yet

- 10th Science English-2Document90 pages10th Science English-2Jansy RaniNo ratings yet

- DWH DownloadedDocument169 pagesDWH DownloadedThyagaraj LayamNo ratings yet

- Principles and Best Practices For Hedge Fund Investors PDFDocument68 pagesPrinciples and Best Practices For Hedge Fund Investors PDFSteve KravitzNo ratings yet

- Synthesis Paper - Bookkeeping and Financial StatementsDocument2 pagesSynthesis Paper - Bookkeeping and Financial StatementsJeremie GloriaNo ratings yet

- Parrino 2e PowerPoint Review Ch04Document34 pagesParrino 2e PowerPoint Review Ch04Khadija AlkebsiNo ratings yet

- Session 32 TestDocument3 pagesSession 32 TestAnshik BansalNo ratings yet

- Shane O Callaghan 109819851Document2 pagesShane O Callaghan 109819851ShaneocallaNo ratings yet

- 132-142 Corp DoctrinesDocument2 pages132-142 Corp DoctrinesKrishianne LabianoNo ratings yet

- Barclays Annual Report 2020Document380 pagesBarclays Annual Report 2020Helen LeonoraNo ratings yet

- Benefits of Joint Stock CompanyDocument2 pagesBenefits of Joint Stock CompanyMaria ShahidNo ratings yet

- Financial Management: "Any Fool Can Lend Money, But It Takes A Lot of Skill To Get It Back"Document11 pagesFinancial Management: "Any Fool Can Lend Money, But It Takes A Lot of Skill To Get It Back"N ArunsankarNo ratings yet

- Dividend Changes and FutureDocument23 pagesDividend Changes and FutureMifta HunadzirNo ratings yet

- SEBI Order On Jet-EtihadDocument17 pagesSEBI Order On Jet-EtihadBar & BenchNo ratings yet

- Assignment Chapter 15Document4 pagesAssignment Chapter 15Ibrahim AbdallahNo ratings yet

- Product of EdelweissDocument5 pagesProduct of EdelweissNavneet Singh100% (1)

- Fundamental AnalysisDocument27 pagesFundamental AnalysisMuntazir HussainNo ratings yet

- Tribune Publishing FilingDocument11 pagesTribune Publishing FilingAnonymous 6f8RIS6No ratings yet

- Balance SheetDocument7 pagesBalance SheetKashyap PandyaNo ratings yet

- Lowe's Stock Analysis for 35-Year-Old InvestorDocument10 pagesLowe's Stock Analysis for 35-Year-Old InvestorDani Alvarez100% (1)

- Joan Carmencita E. Astoveza Mathematics in The Modern WorldDocument9 pagesJoan Carmencita E. Astoveza Mathematics in The Modern WorldJc AstovezaNo ratings yet

- Final - NFC Perpetual Bonds - Prospectus - Clean PDFDocument90 pagesFinal - NFC Perpetual Bonds - Prospectus - Clean PDFCharlie PhillipsNo ratings yet

- Team 14 - Boeing 7E7 - Very GoodDocument10 pagesTeam 14 - Boeing 7E7 - Very GoodXiaoTing HuangNo ratings yet

- Ham4e - Textbook Errata - 032119 PDFDocument16 pagesHam4e - Textbook Errata - 032119 PDFAstha GoplaniNo ratings yet

- 2010 07 06 - 010528 - Byp1 4Document3 pages2010 07 06 - 010528 - Byp1 4Muhammad RamadhanNo ratings yet

- Ipca Labs Result UpdatedDocument12 pagesIpca Labs Result UpdatedAngel BrokingNo ratings yet

- Exide InformationDocument28 pagesExide Informationshashi kumarNo ratings yet

- REVISI P2.1 SD P2.12Document24 pagesREVISI P2.1 SD P2.12yusufahriza25No ratings yet