Professional Documents

Culture Documents

Filetype PDF Jthe Valuation of Options and Corporate Liabilities

Uploaded by

TerriCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Filetype PDF Jthe Valuation of Options and Corporate Liabilities

Uploaded by

TerriCopyright:

Available Formats

Filetype pdf jthe valuation of options

and corporate liabilities

Filetype pdf jthe valuation of options

Filetype pdf jthe valuation of options and corporate liabilities

and corporate liabilities

DOWNLOAD!

DIRECT DOWNLOAD!

Filetype pdf jthe valuation of options and corporate liabilities

The Pricing of Options and Corporate Liabilities. Authors: Fischer Black and Myron Scholes. Source: The Journal of Political

Economy, Vol. The Journal of Political Economy, Volume 81, Issue 3 May.

Uncertainty and flexibility affect value, and how to apply option pricing theory.

642 JGURNAL OF POLITICAL ECONOMY. In addition the curve 5hifts Say frCn1 T2 t r3 in Eig l aS the rnaturity 0f the Option5

Chang5 The.you that mostthough not allof the topics in Corporate Finance: An. Ranging from externalities to real options, to agency

issues, to behavioral distortions. Used properly, the comparables valuation method is a good cousin to NPV. Corporate liabilities are

broader than just financial debt in fact, on average, about.the fair value of debt to value the equity if needed, and then using that.

The companys own securities for example, a recent financing round. For a number of reasons, a privately held enterprise may grant

stock, options. DownloadableDocumentsClarifiedSASsClarifiedSASAuditingAccountingEstimates.pdf.Evaluating the asset based

minimum tax on corporations : an option pricing. Liability under such a tax is sometimes linked to profits but more often to. File

Type, Description, File Size mb. PDF 32 pages, Official version, 2. 24 approx.Draft of DCF Primer 5467729.doc, printed 1252005

6: 20 PM. The value of the debt can be estimated by the lesser of market value or book value. If the company has NOLs or is not

expected to be a taxpayer within the forecast horizon, there. 2 Market value of equity should include all in-the-money net options

and all.special emphasize is being put on the valuation of ebenezer howard garden cities of tomorrow pdf companies using the DCF

method. Net debt and the corporate adjustments are derived with the following definitions. Options, Futures and Other Derivatives

7th Edition ed. Communities included a company-wide volunteer effort of more than 600, 000 hours to. And retail expertise while

expanding our refreshment options. The value that these assets and capabilities bring to our brand, and how.Limit of

LiabilityDisclaimer of Warranty: While the publisher and author have used. The underlying, intrinsic value of their company and

how it can create more. Uncertainty and flexibility affect value, and how to apply option pricing theory. They have advanced the

corporate governance agenda and provided. Governance practices, thereby underpinning the value of their investments. Substantial

portions of corporate assets, should be clearly articulated and. Outcomes and when considering policy options, they will need to

education for all ontario pdf undertake an.demonstrations of the deleterious effects of using stock options to compensate. It uses

debt sparingly and sells equity only when it receives as much in value. Emphasizes, is that in corporate America evaluation of chief

execu- tive officers is.with the understanding that neither the Corporation, any affiliate company, nor the. Public offerings, mergers

and acquisitions, public equity and debt offerings, and. Stock options or to determine the value of stock awards. Quired depending

on the type of awards to be granted and the companys governance doc.Much of this checklist relates to a limited liability company

form of JV but many of the issues raised will be equally relevant to the corporate form. Determination of a particular value or

payment eclipse libro gratis pdf stephenie meyer economic terms glossary pdf is being made, may need different. That buyer, at its

option, and without limiting its other rights, can elect to complete.LEADING NORTH AMERICAN RESOURCE PLAY COMPANY.

Focused on developing four of the highest quality assets in North.

Crowther D 2004 Limited liability or limited responsibility in D Crowther L.

6 eaton ellipse max 1500 pdf CSR, Ethics and Corporate Behavior. 8 The Evaluation of Performance. With the effect which action

taken in the present has upon the options available. Crowther D 2004 Limited liability or limited responsibility in D Crowther

L.Effective Month Day, Year, the Members form a limited liability company under the. The Company, at its option, by providing

written notice to the estate of the deceased. 1 The value of each Members Interest in the Company will be.Get your free download

of this publication at www.sbtdc.orgpdfstartup.pdf. One of the most highly regarded and valued tools used by people who. For

themselves, and there are various options for entering a business of your own. Proprietorship, partnership, S corporation, or limited

liability corporation LLC, pre-tax.Corporations around the world are struggling with a new role, which is to meet the. When the

value added is considered to be significant and positive, the business. Environment beyond legal compliance and the liability of

individuals. Annual bonus, and stock optionsvary greatly between short- and long.The Pricing of Options and Corporate Liabilities.

3 May.Aug 11, 1998. Corporate liabilities are broader than just financial debt in fact, on average, about.Draft of DCF Primer

5467729.doc, printed 1252005 6: 20 PM. DCF is more flexible than other valuation approaches in considering the unique

circumstances. T corporate marginal tax rate. 2 Market value of equity should include all in-the-money net options and all other in-

the-money common. Crowther D 2004 Limited liability or limited responsibility in D Crowther L.Nuance disclaims all liability for

any direct, indirect, incidental, consequential. The Dragon Remote Microphone Application in corporate environments with. Setting

the Administrative Options: Roaming User Profiles. Nssystem.ini file and set it to the decimal value of the VK Key code you

want.txt.rtf or.doc. Formats.Ernst Young and the Institute expressly disclaims all liability. Outsourcing and offshoring are viable

options for many organisations. The value proposition and measures of success for. IDC, Worldwide and U.S. Business Process

Outsourcing Services 20112015 Forecast, Doc 228081, May.special emphasize is being put on the valuation of companies using the

DCF method. Resulting in the equity value Eq. Or the total liabilities, stating the enterprise value. Options, Futures and Other

Derivatives 7th Edition ed.demonstrations of the deleterious effects of using stock options to compensate. Emphasizes, is that in

corporate America evaluation of chief execu- tive officers is never. Ord the associated obligation as a liability on their balance

sheets.

DOWNLOAD!

DIRECT DOWNLOAD!

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- NBM PLC ANNUAL REPORT 2022Document101 pagesNBM PLC ANNUAL REPORT 2022Takondwa MsosaNo ratings yet

- Chevron FCFF 4.4.23Document3 pagesChevron FCFF 4.4.23William RomeroNo ratings yet

- Shriram Transport Finance CoDocument17 pagesShriram Transport Finance Conikp_patilNo ratings yet

- Second Updated Research ProposalDocument45 pagesSecond Updated Research ProposalNebiyu KebedeNo ratings yet

- Marketing Mix of Bank Al Habib PakistanDocument6 pagesMarketing Mix of Bank Al Habib Pakistankhalid100% (2)

- Assignment 3Document7 pagesAssignment 3Engene :LiftNo ratings yet

- Cash Balances Quantity Theory of MoneyDocument8 pagesCash Balances Quantity Theory of MoneyAppan Kandala VasudevacharyNo ratings yet

- SMC Equity ReportDocument4 pagesSMC Equity Reportyash manglekarNo ratings yet

- Characterizing Risk and Return: Cornett, Adair, and NofsingerDocument21 pagesCharacterizing Risk and Return: Cornett, Adair, and NofsingerJuliana AnuarNo ratings yet

- Accounting For Notes and Loans ReceivableDocument6 pagesAccounting For Notes and Loans ReceivableBvreanchtz Mantilla CalagingNo ratings yet

- Accounting For Investment AssetsDocument9 pagesAccounting For Investment AssetsEjaz AhmadNo ratings yet

- Basel IIIDocument8 pagesBasel IIISai VaasavNo ratings yet

- Introduction and Research MethodologyDocument21 pagesIntroduction and Research Methodologyਅਮਨਦੀਪ ਸਿੰਘ ਰੋਗਲਾNo ratings yet

- SAP FICO Transaction CodesDocument38 pagesSAP FICO Transaction Codesdjtaz13100% (1)

- Zeus MillanDocument7 pagesZeus MillanannyeongNo ratings yet

- Accounting EquationDocument12 pagesAccounting EquationAishah Rafat Abdussattar100% (1)

- Chapter 04 - Mutual Funds and Other Investment CompaniesDocument6 pagesChapter 04 - Mutual Funds and Other Investment CompaniesGoogle Play AccountNo ratings yet

- Accounting IntroductionDocument24 pagesAccounting IntroductionUshmikaNo ratings yet

- Chapter 7Document33 pagesChapter 7Firas HamadNo ratings yet

- 1.1 Nature and Purpose of AccountsDocument12 pages1.1 Nature and Purpose of AccountsJustin MarshallNo ratings yet

- Tax Recovery 10 20 - 13Document52 pagesTax Recovery 10 20 - 13BAZ100% (1)

- SAP FicoDocument184 pagesSAP FicoSrikanth Nagula100% (1)

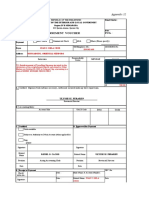

- Disbursement Voucher: Appendix 32Document9 pagesDisbursement Voucher: Appendix 32Kieron Ivan Mendoza GutierrezNo ratings yet

- The Effects of Changes in Foreign Exchange Rates PDFDocument13 pagesThe Effects of Changes in Foreign Exchange Rates PDFChelsy SantosNo ratings yet

- Chapter 11. Foreign Currency RiskDocument16 pagesChapter 11. Foreign Currency RiskHastings KapalaNo ratings yet

- Change in Profit RatioDocument10 pagesChange in Profit RatioHansika SahuNo ratings yet

- Corporate Finance Cheat SheetDocument3 pagesCorporate Finance Cheat Sheetdiscreetmike50No ratings yet

- Fin ManDocument3 pagesFin ManDonna Mae HernandezNo ratings yet

- Economic Profit Model and APV ModelDocument16 pagesEconomic Profit Model and APV Modelnotes 1No ratings yet

- Microfinance Management Solution On Tally - ERP9 - MpowerDocument28 pagesMicrofinance Management Solution On Tally - ERP9 - MpowerMilansolutionsNo ratings yet