Professional Documents

Culture Documents

Small Scale Canadian LNG Projects Quietly Growing As An Alternative Power Source

Uploaded by

Pawan ChaturvediOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Small Scale Canadian LNG Projects Quietly Growing As An Alternative Power Source

Uploaded by

Pawan ChaturvediCopyright:

Available Formats

Small-Scale Canadian LNG Projects Quietly

Growing as an Alternative Power Source

By Michael Laffin and Paul Blyschak

The development of Canadas liquefied natural gas (LNG) export industry

has attracted much attention in recent years as large and mid-scale LNG

export projects in British Columbia and Eastern Canada have shifted from

a surge in initial project development to increased uncertainty in the face

of depressed global LNG prices. What has attracted less attention over

this time is the slow but continuous growth of Canadas domestic LNG

market as LNG gains traction as an alternative power source for both

remote resource projects and remote communities.

LNG AS AN ENERGY SOURCE FOR

REMOTE AREAS

A

report submitted by ICF International to the According to the ICF Report, these remote energy

Canadian Gas Association in 2016, titled markets are off-grid regions of Canada that are not

Economic and GHG Emissions Benefits of LNG connected to the North American electrical grid or to

for Remote Markets in Canada (ICF Report), surveyed natural gas distribution pipelines. This includes both

the Canadian market potential for smaller-scale LNG remote communities and remote industrial energy users,

projects and operations as a source for power generation such as mines. In these remote regions, reliable and

in remote areas. cost-effective energy supply is a challenge for

communities and industry, and serves as a barrier to

The ICF Report addressed the areas where LNG economic development.

could be used as a substitute for other fuels like diesel

for power generation and reasoned why LNG can be an The ICF Report found that these remote communities

attractive alternative to such traditional fuels. It found and industry typically rely on diesel, propane, or other

that approximately 200,000 people live in nearly 300 fuel oils for heating and to generate their own electricity,

remote communities spread across Canada that are all of which have to be shipped in by truck, rail, or marine

disconnected from central energy supplies. vessel and that many are increasingly considering LNG

as an option to meet their energy requirements:

Blake, Cassels & Graydon LLP | February 2017 | blakes.com

A brief example is illustrative. One of the more common

project structures for Canadian large-scale LNG export

Advances in the technology used to liquefy, projects is that of the integrated project model, which

transport, and re-vaporize natural gas, have made is typified by multiple project proponents owning a

LNG a viable option for remote customers. . . . consistent percentage of different components along the

Although LNG has many advantages, including LNG value chain. For example, four energy companies

environmental and safety benefits, cost savings may create a series of joint ventures pursuant to which

are the primary driver of its adoption. In recent each of them:

years, due to low natural gas prices, LNG has

emerged as an affordable alternative to diesel or Owns a 25 per cent interest in the projects upstream

fuel oil in remote communities and mining sites. natural gas production

Owns a 25 per cent interest in the pipelines and

processing facilities linking the upstream production to

the liquefaction or export terminal

For energy lawyers, the growth of small-scale LNG in

Canada therefore begs the following two questions: Owns a 25 per cent interest in the liquefaction or

export terminal

1. To what extent does the value chain in small-scale,

local LNG operations differ from the value chain in Is entitled to 25 per cent of the LNG offtake from the

large-scale LNG export projects? terminal, which they then either sell to downstream

purchasers or use as feedstock in their own

2. To what extent do such differences impact power-generation facilities.

considerations relevant to the various contracts

comprising the small-scale LNG value chain compared Small-scale LNG projects and value chains are likely to be

to the various contracts comprising the value chain of less complex on a number of levels.

large-scale LNG export projects? First, upstream natural gas production will not factor

into small-scale LNG operations in the same way as a

A COMPARISON OF LARGE- AND SMALL-SCALE large-scale LNG export project. Small-scale LNG projects

LNG PROJECTS will require natural gas production, but such natural gas

will not be produced for the primary purpose of feeding

As discussed in our June 2016 Blakes Whitepaper: LNG production. Rather, such feedstock will typically be

Canadian LNG from a Global Perspective, different intended to feed general regional market demand for

international jurisdictions have witnessed the natural gas, of which liquefaction into LNG for small-scale

development of varied formulations of LNG projects and sales arrangements will be only one of a myriad of

value chains. In other words, LNG export projects can potential uses.

take various forms or project structures and involve

different combinations of upstream natural gas producers, Second, while small-scale LNG projects and operations

pipeline companies, liquefaction facility owners, maritime will require natural gas pipelines and processing facilities

transportation companies and downstream utilities, to transport the natural gas from the point of production

each with their own set of objectives and potentially to the point of liquefaction, it is unlikely that the great

complementary or conflicting interests. Therefore, a point majority of such pipelines and processing facilities will be

of stark contrast between large-scale LNG export projects new-build infrastructure as is the case with large-scale

and small-scale, local LNG operations is the degree of LNG export projects. Rather, small-scale LNG operations

complexity involved. are likely to take advantage of existing natural gas

Blake, Cassels & Graydon LLP | blakes.com 2

transportation and processing infrastructure, with the small-scale, local LNG operations, including to ensure

possible exception of new-build small-scale liquefaction continuity of LNG supply and avoid disruptions in power

facilities at strategic locations along such existing generation.

infrastructure.

Therefore, just as is the case in large-scale LNG export

Third, small-scale LNG offtake arrangements are likely to arrangements, buyers of LNG in small-scale transactions

be of shorter terms and involve less complex conditions will want to ensure that their transportation service

than offtake arrangements from large-scale LNG export provider is obligated to:

projects. Offtake agreements in large-scale LNG

export projects commonly involve minimum terms Meet all delivery/receipt windows and schedules

of 15, 20 or 25 years, such extended terms being established under the LNG PSA

necessary to underwrite the large capital expenditures Keep its vehicle delivery fleet in good repair and

necessary to build the projects liquefaction facility and maintain minimum levels of insurance coverage

other infrastructure. It is also common for LNG offtake

arrangements from large-scale LNG projects to involve Comply with the LNG sellers loading protocols and

destination restrictions that only allow buyers to transport other safety regulations and policies

the LNG to pre-determined regasification facilities or

Regularly communicate with both the buyer and seller

specified regional markets. Such restrictions also go

as required to ensure timely receipt and delivery of

toward project viability and project sponsors desire to

LNG, including to inform the buyer of any breach by

prevent downstream buyers from indirectly competing

the seller of its obligations under the LNG PSA or any

with the project. Offtake arrangements in small-scale LNG

other development that could adversely impact receipt

projects are unlikely to be nearly as lengthy or restrictive,

and delivery schedules.

given that the LNG purchase and sale arrangement will

unlikely be underwriting large capital expenditures, and The LNG buyer will also want to

the purchaser will likely be seeking to supply a single LNG

include appropriate indemnities

off-grid project, development or community without and other risk allocation

interest in any forward sales or other market opportunities. provisions, including with regard

to any liabilities or damages

LESSONS FROM LARGE-SCALE LNG PROJECTS that would result from delivery interruptions that are

the transporters fault (e.g., related to interruptions in

Despite these differences, there are many lessons from production at the LNG buyers mine).

large-scale LNG export projects that can be applied in

small-scale, local LNG operations. Indeed, much of the Second, both the LNG seller and buyer will want to ensure

large-scale LNG virtual pipeline composed of that the terms of the LNG PSA meet their commercial

longer-term purchase and sale arrangements and objectives without exposing them to undue risks or

maritime transportation arrangements remains applicable unreasonable costs. Furthermore, just as is the case in

to the small-scale LNG virtual pipeline composed large-scale LNG export arrangements, this calculation

of shorter-term purchase and sale arrangements and as well as the specific contractual terms and conditions

overland vehicle transportation arrangements. by which it is achieved will depend on the particular

circumstances of both the LNG buyer and seller.

First, close coordination of the terms of the LNG

purchase and sale agreement (LNG PSA) and the LNG The buyer, for example, may wish to build in a certain

transportation agreement will be essential to the LNG amount of flexibility into its demand profile, whether in

buyer in both large-scale LNG export projects and the form of a staged increase of its consumption at the

Blake, Cassels & Graydon LLP | blakes.com 3

front end of the LNG PSAs term (e.g., as the operations allocation (e.g., 70 per cent as to seller and 30 per cent as

of the buyers mine are progressively brought online) or in to buyer). Risk allocation can be staggered or subject to

the form of lower demand over the back end of the LNG other variability (e.g., once the LNG seller has missed four

PSAs term (e.g., by which time alternate LNG suppliers deliveries in any quarterly period its share of responsibility

are expected to have entered the local market). will increase to 100 per cent until it re-establishes reliable

delivery for a minimum period of time).

The buyer may also want to build in flexibility within

the quarterly delivery periods comprising a contract

year within the LNG PSAs overall term (e.g., because it CONCLUSION

anticipates seasonal variability in the amount of LNG it At the overall project level, there is much that

will require due to temperature fluctuations). A potential distinguishes small-scale, local LNG operations from

solution in such circumstances will be the option for the large-scale LNG export projects, with the latter being

buyer to schedule as little as 15 per cent or as much as 35 subject to potentially far more complicated project

per cent of its annual offtake during any particular quarter, structures and project dynamics among the various

provided it commits to scheduling the entirety of its potential project participants. Nonetheless, there is much

annual offtake across all four quarters. to be learned from large-scale LNG export projects that

The LNG seller, by contrast, will likely want the buyer can be applied in small-scale, local LNG operations,

to commit to receiving its annual offtake commitments particularly regarding the coordination of the terms of LNG

on a take or pay basis, including to ensure it is not PSAs with the terms of associated LNG transportation

prejudiced for reserving output capacity to an LNG buyer agreements, and the different LNG PSA terms and

when it could be dedicating its LNG supply to alternative conditions that can assist both LNG buyers and sellers

market opportunities. Another key question for the in meeting their commercial objectives while minimizing

seller is whether the LNG buyer will be permitted to exposure to undue risks or unreasonable costs.

re-schedule LNG volumes it did not take delivery of, but

has paid for under the take or pay principle, as well as

whether the buyer should be able to roll over such LNG

credit volumes indefinitely over the term of the LNG PSA

or for a limited amount of time (e.g., no more than two LNG

quarterly delivery periods).

Third, the LNG seller will want to consider achievable

limitations on its liability for failing to make LNG available

at scheduled delivery times, whether by stipulating

that liability will only accrue once a minimum number

of missed LNG deliveries have occurred (e.g., three or

more in any quarterly delivery period) or by stipulating

that responsibility for extra costs incurred by the LNG

buyer stemming from missed deliveries will be shared

among the buyer and seller pursuant to a predefined

CONTACT US

Michael Laffin Paul Blyschak

403-260-9692 403-260-9704

michael.laffin@blakes.com paul.blyschak@blakes.com

Blake, Cassels & Graydon LLP | blakes.com

You might also like

- DPSB Cir Not 2023 24 001Document2 pagesDPSB Cir Not 2023 24 001Pawan ChaturvediNo ratings yet

- Plasma and OxifuelDocument20 pagesPlasma and OxifuelPawan ChaturvediNo ratings yet

- ThesisDocument128 pagesThesisPawan ChaturvediNo ratings yet

- DPSB Cir Not 2022 23 019Document2 pagesDPSB Cir Not 2022 23 019Pawan ChaturvediNo ratings yet

- AIGA 046 - 08 Periodic Inspection of Static Cryogenic Vessels - Reformated Jan 12Document13 pagesAIGA 046 - 08 Periodic Inspection of Static Cryogenic Vessels - Reformated Jan 12aliNo ratings yet

- Unit 1 - A - Improper IntegralDocument8 pagesUnit 1 - A - Improper IntegralPawan ChaturvediNo ratings yet

- DPSB Cir Not 2023 24 001Document2 pagesDPSB Cir Not 2023 24 001Pawan ChaturvediNo ratings yet

- Class 5BDocument1 pageClass 5BPawan ChaturvediNo ratings yet

- Mutual Fund Tracker IndiaDocument979 pagesMutual Fund Tracker IndiaMahesh NaikNo ratings yet

- Astm B88 2009 PDFDocument7 pagesAstm B88 2009 PDFAntonio JNo ratings yet

- AssignmentDocument1 pageAssignmentPawan ChaturvediNo ratings yet

- Claim Form PDFDocument5 pagesClaim Form PDFmeghaNo ratings yet

- OIL Cleanliness FundamentalsDocument43 pagesOIL Cleanliness FundamentalsPawan ChaturvediNo ratings yet

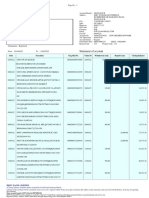

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancePawan ChaturvediNo ratings yet

- Is 1200 15Document12 pagesIs 1200 15ramachandra_20012040No ratings yet

- Foster BUTYLAR NXT PDS R1019Document2 pagesFoster BUTYLAR NXT PDS R1019Pawan ChaturvediNo ratings yet

- SC119 - Umoja Plant Maintenance Overview - CBT PPT - V5Document67 pagesSC119 - Umoja Plant Maintenance Overview - CBT PPT - V5graemesquires85No ratings yet

- 90 Tips & Tricks Every SAP Super User Should KnowDocument90 pages90 Tips & Tricks Every SAP Super User Should Knowkumar N100% (2)

- A648Document4 pagesA648Hanibale Nuril HakimNo ratings yet

- API 571 Training CourseDocument140 pagesAPI 571 Training Courseapply1984237197% (29)

- Hydraulic Hoses V2Document96 pagesHydraulic Hoses V2Taufiq WibawaNo ratings yet

- Ecan 19112QZ00NDocument2 pagesEcan 19112QZ00NPawan ChaturvediNo ratings yet

- General Partner Information and Project Scope Definition Natural Gas TransmissionDocument6 pagesGeneral Partner Information and Project Scope Definition Natural Gas TransmissionPawan Chaturvedi100% (1)

- Astm A420a420m 16Document6 pagesAstm A420a420m 16Chistian AcostaNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancePawan ChaturvediNo ratings yet

- Mechanical Maintennace PlansDocument168 pagesMechanical Maintennace PlansPawan ChaturvediNo ratings yet

- ARPM Handbook Rev April 2015 PDFDocument194 pagesARPM Handbook Rev April 2015 PDFKavir RamdassNo ratings yet

- Fine Filter BrochureDocument6 pagesFine Filter BrochurePawan ChaturvediNo ratings yet

- Using BOM's To Gain Planning & Scheduling Efficiencies: Jeff SmithDocument27 pagesUsing BOM's To Gain Planning & Scheduling Efficiencies: Jeff SmithPawan ChaturvediNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- PHB 55n03lta Logic Level FetDocument15 pagesPHB 55n03lta Logic Level FetyusufwpNo ratings yet

- 2.2 Access CT Networking Rev20150728Document5 pages2.2 Access CT Networking Rev20150728F CNo ratings yet

- Fast Ethernet Switch at-FS705L (Data Sheet) - EngDocument2 pagesFast Ethernet Switch at-FS705L (Data Sheet) - EngBaroszNo ratings yet

- Advance NewsletterDocument14 pagesAdvance Newsletterapi-206881299No ratings yet

- 2 - Brief Report On Logistics Workforce 2019Document39 pages2 - Brief Report On Logistics Workforce 2019mohammadNo ratings yet

- Tough Turkish TBM Moves Through Fractured and Faulted Rock: Issue 1 + 2014Document8 pagesTough Turkish TBM Moves Through Fractured and Faulted Rock: Issue 1 + 2014sCoRPion_trNo ratings yet

- Introduction To Circuit LabDocument8 pagesIntroduction To Circuit LabDaudKhanNo ratings yet

- Bank AlfalahDocument62 pagesBank AlfalahMuhammed Siddiq KhanNo ratings yet

- Intangible Capital: Key Factor of Sustainable Development in MoroccoDocument8 pagesIntangible Capital: Key Factor of Sustainable Development in MoroccojournalNo ratings yet

- 12V Laptop ChargerDocument12 pages12V Laptop ChargerSharon Babu0% (1)

- Cobas B 123 POC System: Instructions For Use, Version 13.0 Software Version 4.17Document354 pagesCobas B 123 POC System: Instructions For Use, Version 13.0 Software Version 4.17zelNo ratings yet

- Data Sheet 3VA2225-5HL32-0AA0: ModelDocument7 pagesData Sheet 3VA2225-5HL32-0AA0: ModelJENNYNo ratings yet

- Pakistan Relations With EnglandDocument4 pagesPakistan Relations With Englandpoma7218No ratings yet

- The Eco-Core SnowboardDocument51 pagesThe Eco-Core SnowboardmoisesmoronsolerNo ratings yet

- Andhra Pradesh Land Reforms (Ceiling On Agricultural Holdings) (Amendment) Act, 2009Document3 pagesAndhra Pradesh Land Reforms (Ceiling On Agricultural Holdings) (Amendment) Act, 2009Latest Laws TeamNo ratings yet

- Spjc/Lim Lima-Callao, Peru: .Radar - Minimum.AltitudesDocument41 pagesSpjc/Lim Lima-Callao, Peru: .Radar - Minimum.AltitudesVicente PortocarreroNo ratings yet

- Ds Gigavue FM Fabric ManagerDocument9 pagesDs Gigavue FM Fabric ManagerMARCELOTRIVELATTONo ratings yet

- 3 Axis AccelerometerDocument9 pages3 Axis AccelerometerResearchDesignLabNo ratings yet

- Product Bulletin VHP7104GSI S5Document2 pagesProduct Bulletin VHP7104GSI S5Wiliam SeguraNo ratings yet

- A New High Drive Class-AB FVF Based Second Generation Voltage ConveyorDocument5 pagesA New High Drive Class-AB FVF Based Second Generation Voltage ConveyorShwetaGautamNo ratings yet

- TeramisoDocument1 pageTeramisoNasriyah SolaimanNo ratings yet

- Ramdump Modem 2021-06-26 00-06-27 PropsDocument15 pagesRamdump Modem 2021-06-26 00-06-27 PropsKoikoiNo ratings yet

- Official Sponsorship LetterDocument3 pagesOfficial Sponsorship LetterWinona Marie Borla100% (1)

- Time Division Muliple AccessDocument4 pagesTime Division Muliple AccessAbhishek RanaNo ratings yet

- Revision Question 2023.11.21Document5 pagesRevision Question 2023.11.21rbaambaNo ratings yet

- Long Vowel SoundsDocument15 pagesLong Vowel SoundsRoselle Jane PasquinNo ratings yet

- Factors for Marketing Success in Housing SectorDocument56 pagesFactors for Marketing Success in Housing SectorNhyiraba Okodie AdamsNo ratings yet

- Section 3 Evidence Act 1950Document3 pagesSection 3 Evidence Act 1950ayesyaNo ratings yet

- Case Study ExamplesDocument18 pagesCase Study ExamplesSujeet Singh BaghelNo ratings yet

- Breadtalk AR 2011Document158 pagesBreadtalk AR 2011Wong ZieNo ratings yet