Professional Documents

Culture Documents

Fabm Practice Set

Uploaded by

Raez Rodillado0 ratings0% found this document useful (0 votes)

15 views1 pagepractice set

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentpractice set

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views1 pageFabm Practice Set

Uploaded by

Raez Rodilladopractice set

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

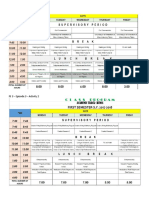

Adjusting Entries

Office supplies original cost $4,320.

Prepaid rent of $36,000 was paid for the months January, February and March.

The equipment costing $80,000 has useful life of 5 years and its estimated salvage value is

$14,000.

The interest rate on $20,000 note payable is 9%. Accrue the interest for one month.

The adjusting entries of Company A are:

Date Account Debit Credit

Jan31 Supplies Expense 18,480

Office Supplies 18,480

Supplies Expense = $22,800 $4,320 = $18,480

Jan31 Rent Expense 12,000

Prepaid Rent 12,000

Rent Expense = $36,000 3 = $12,000

Jan31 Depreciation Expense 1,100

Accumulated Depreciation 1,100

Depreciation Expense = ($80,000 $14,000) (5 12) = $1,100

Explanation: Cost of Equipment is $80,000 less $14 000 salvage value or scrap

value which is the depreciation expense. We are here to record just for the month

of January 2010.

Estimated useful life of Equipment is 5 years. We are going to compute how much

do the equipment depreciate every month.

Computation: ($80,000 $14,000) (5years 12 months) = $1,100

Jan31 Interest Expense 150

Interest Payable 150

Interest Expense = $20,000 (9% 12) = $150

Jan31 Unearned Revenue 3,000

Service Revenue 3,000

You might also like

- Account Summary: Statement 12/22/2019 Account Number Username Invoice Number Due Date Matthew RogersDocument1 pageAccount Summary: Statement 12/22/2019 Account Number Username Invoice Number Due Date Matthew RogersRaez RodilladoNo ratings yet

- ACCOUNT SUMMARY As of May 25, 2021Document2 pagesACCOUNT SUMMARY As of May 25, 2021Raez RodilladoNo ratings yet

- 2018 Sirius XMBillDocument1 page2018 Sirius XMBillRaez RodilladoNo ratings yet

- Your Payment This Month Plan Status: Started Dec 18Document3 pagesYour Payment This Month Plan Status: Started Dec 18Raez RodilladoNo ratings yet

- Account Summary: Statement 08/01/2020 Account Number Username Invoice Number Susie ChappleDocument1 pageAccount Summary: Statement 08/01/2020 Account Number Username Invoice Number Susie ChappleRaez RodilladoNo ratings yet

- You're Enrolled in Auto Pay:: Shop AccessoriesDocument4 pagesYou're Enrolled in Auto Pay:: Shop AccessoriesRaez RodilladoNo ratings yet

- Qualitative Investigation of PortfolioDocument328 pagesQualitative Investigation of PortfolioRaez RodilladoNo ratings yet

- Hello Frank N Tsamoutales,: Your Bill at A GlanceDocument4 pagesHello Frank N Tsamoutales,: Your Bill at A GlanceRaez Rodillado100% (1)

- Fs4 Episode1 1 1 Exploring The CurriculuDocument3 pagesFs4 Episode1 1 1 Exploring The CurriculuRaez RodilladoNo ratings yet

- Field Study 5 Answer SheetDocument29 pagesField Study 5 Answer SheetCarl JustineNo ratings yet

- MR Bradford Elins 35 Jefferson DR MONROE NY 10950-5135: Your Monthly StatementDocument4 pagesMR Bradford Elins 35 Jefferson DR MONROE NY 10950-5135: Your Monthly StatementRaez Rodillado0% (1)

- To PrintDocument1 pageTo PrintRaez RodilladoNo ratings yet

- Differentiating Instruction in The PrimaDocument168 pagesDifferentiating Instruction in The PrimaRaez RodilladoNo ratings yet

- Print Billing DetailsDocument1 pagePrint Billing DetailsRaez RodilladoNo ratings yet

- 102 SyllabusDocument6 pages102 SyllabusJohn Van Dave TaturoNo ratings yet

- Qualitative Investigation of PortfolioDocument328 pagesQualitative Investigation of PortfolioRaez RodilladoNo ratings yet

- Qualitative Investigation of PortfolioDocument328 pagesQualitative Investigation of PortfolioRaez RodilladoNo ratings yet

- Some Answers For FS4 Episode 9 To 12Document13 pagesSome Answers For FS4 Episode 9 To 12Raez Rodillado93% (15)

- Field Study 5 Answer SheetDocument29 pagesField Study 5 Answer SheetCarl JustineNo ratings yet

- Qualitative Investigation of PortfolioDocument328 pagesQualitative Investigation of PortfolioRaez RodilladoNo ratings yet

- First Day of SchoolDocument2 pagesFirst Day of SchoolRaez RodilladoNo ratings yet

- To PrintDocument1 pageTo PrintRaez RodilladoNo ratings yet

- Business Ethics P. 93-104Document3 pagesBusiness Ethics P. 93-104Raez RodilladoNo ratings yet

- Qualitative Investigation of PortfolioDocument328 pagesQualitative Investigation of PortfolioRaez RodilladoNo ratings yet

- english for (1к)Document7 pagesenglish for (1к)Anonymous bCbsifxuNo ratings yet

- Field Study 2 JeanDocument4 pagesField Study 2 JeanRaez RodilladoNo ratings yet

- FS 4Document92 pagesFS 4nissi guingab87% (15)

- General Guidelines Part 1Document11 pagesGeneral Guidelines Part 1Raez RodilladoNo ratings yet

- Field Study 1 JeanDocument10 pagesField Study 1 JeanRaez RodilladoNo ratings yet

- SheetDocument1 pageSheetRaez RodilladoNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)