Professional Documents

Culture Documents

Global Economic Outlook1

Uploaded by

Harry CerqueiraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global Economic Outlook1

Uploaded by

Harry CerqueiraCopyright:

Available Formats

w

Global Economic Outlook and Scenarios

sigma research, 5 September 2017

Kurt Karl Economic growth in the US remains on track this year to be close to 2%, an

Kurt_Karl@swissre.com improvement over last year's dismal performance of 1.5%. The short-term

Irina Fan indicators have been mixed recently, with the manufacturing PMI up to a robust

Irina_Fan@swissre.com

58.8 in August, but industrial production barely climbing. Job growth slowed last

Astrid Frey

month to 156,000 jobs from a downwardly revised 189,000 in July, but

Astrid_Frey@swissre.com

consumer confidence rose. On the policy front, the Administration is now pushing

for tax reform before year-end, but it remains to be seen if it can be successful.

US economic growth is close to Needed more urgently is an increase in the debt ceiling and a budget by end-

2%, an improvement over last September to avoid a government shutdown. Real GDP growth is still forecast to be

year's 1.5% gain. 2.1% in 2017 and 2.2% in 2018, but the yield on the 10-year Treasury is now

expected to be only 2.6% by end-2017 and 3.2% by end-2018.

Economic activity in the Euro area The manufacturing PMI for the Euro area rose from 56.6 in July to 57.4 in August,

continues to be robust and the UK a robust reading. The services PMI dipped to 54.7 from 55.4 in July, but this is also

is doing okay also. strong. Real GDP growth is now expected to be one notch stronger at 2%,

compared to 1.9% last month. In the UK, the PMI for manufacturing improved to

56.9 from 55.3 in July, while the services PMI slipped to 53.2 from 53.8. In both

the Euro area and the UK, the interest rate outlook has been lowered in response to

the lower yields in the US.

China's economy will grow by Despite the risk from rising debt levels, China continues to be resilient and will grow

about 6.5% this year and next, 6.6% this year and 6.4% next year. Growth is unlikely to be allowed to slow before

while Japan will perform well also the 19th National Congress of the Communist Party of China, which will be held in

with 1.4% growth this year and

October. Nevertheless, corporate debt continues to rise generally at a faster pace

nearly 1.0% next year.

than nominal GDP, so the risk of a hard landing remains at 20%. Real GDP growth

in Japan has been revised up to 1.4% from 1.0% last month after a strong first half

performance, mostly from business investment and consumer spending. Inflation

and interest rates are unchanged from last month.

The Fed policy for this year is fairly The Federal Reserve is likely to announce the program to begin reducing the size of

clear announcement on its its balance sheet in September, and is expected to raise rates one more time in

balance sheet in September and December by 25 basis points. There is greater uncertainty about the pace and

rate hike in December, but next

quantity of rate hikes next year, however. The forecast currently has three rate

year is much less certain.

hikes, but the outcome will be data-dependent if wages begin to rise more

aggressively, more than three hikes are possible, but if wages are weak, it could be

less. The ECB and the BoJ will continue their highly accommodative monetary

policies, and the BoE is likely to be on hold until Brexit uncertainty clears.

Political risks are plentiful, but The key political risk comes from the US Administration and its aggressive stance

prospects for growth continue to on trade relations. A trade war would lower global growth significantly. Also, a

improve. conflict with North Korea cannot be ruled out. Euro area risks have abated, but the

risk of a China hard-landing is still 20%. Emerging markets are vulnerable to sharp

hikes from the Fed, but this seems unlikely for now. Political risks are plentiful, but

global growth prospects continue to improve.

History Forecast Annual Data

US Forecast Summary: The 17Q1 17Q2 17Q3 17Q4 18Q1 18Q2 18Q3 2015 2016 2017 2018

forecast for GDP growth is Real GDP, % Change, SAAR 1.2 3.0 2.5 2.3 1.9 2.0 2.0 2.9 1.5 2.1 2.2

unchanged, but interest rates are % Change, Year Ago 2.0 2.2 2.1 2.3 2.4 2.2 2.0

lower with only three Fed fund

CPI, % Change, SAAR 3.1 -0.3 1.7 3.8 3.3 1.3 1.7 0.1 1.3 2.1 2.4

hikes next year and the yield on

% Change, Year Ago 2.6 1.9 1.9 2.1 2.1 2.5 2.5

the 10-year T-note also down a bit.

Core CPI, % Change, SAAR 2.5 0.6 2.4 2.7 2.7 2.0 2.1 1.8 2.2 2.0 2.3

% Change, Year Ago 2.2 1.8 1.9 2.0 2.1 2.5 2.4

End of period

Fed Funds Rate (Target mid-range) 0.875 1.125 1.125 1.375 1.375 1.625 1.875 0.375 0.625 1.375 2.125

3-Month Treasury Bill 0.8 1.0 1.0 1.3 1.4 1.6 1.9 0.2 0.5 1.3 2.1

5-Year Treasury Note 1.9 1.9 1.9 2.2 2.3 2.5 2.7 1.8 1.9 2.2 2.9

10-Year Treasury Note 2.4 2.3 2.3 2.6 2.7 2.9 3.0 2.3 2.5 2.6 3.2

sigma research | Swiss Re Institute 5 September 2017 1

Global Economic Outlook and Scenarios

Euro area Forecast Summary:

Forecast > Annual data

Growth is likely to be a bit higher, 17Q1 17Q2 17Q3 17Q4 18Q1 18Q2 18Q3 2015 2016 2017 2018

inflation a bit lower this year,

Real GDP, % Change, SAAR 2.0 2.5 1.4 1.6 1.6 1.6 1.6 1.9 1.7 2.0 1.6

while long-term yields are lower % Change, Year Ago 1.9 2.2 2.1 1.9 1.8 1.6 1.6

this year and next, pulled down by

CPI, % Change, NSAAR 0.0 4.0 -0.8 2.0 -0.4 4.5 0.0 0.0 0.2 1.5 1.3

lower US yields. % Change, Year Ago 1.8 1.5 1.5 1.3 1.2 1.3 1.5

Refi Rate 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.05 0.00 0.00 0.00

3-Month Euribor -0.3 -0.2 -0.1 0.0 0.1 0.1 0.1 -0.1 -0.3 0.0 0.2

5-year Government note -0.4 -0.2 0.0 0.2 0.3 0.4 0.4 0.0 -0.5 0.2 0.5

10-Year Gov. Bond Yield (Germany) 0.3 0.5 0.4 0.6 0.7 0.8 1.0 0.6 0.1 0.6 1.0

10-Year Gov. Bond Yield (France) 1.0 0.8 0.8 1.0 1.0 1.1 1.3 1.0 0.7 1.0 1.3

UK Forecast Summary: Growth and

History Forecast > Annual data

inflation are the same as last 17Q1 17Q2 17Q3 17Q4 18Q1 18Q2 18Q3 2015 2016 2017 2018

month, but the yields on 5 and 10-

year gilts have been lowered along Real GDP, % Change, SAAR 0.9 1.2 1.2 1.2 1.6 1.6 2.0 2.2 1.8 1.6 1.5

% Change, Year Ago 2.0 1.7 1.5 1.1 1.3 1.4 1.6

with the US yields.

CPI, % Change, NSAAR 1.8 4.8 2.4 2.4 2.0 3.6 2.0 0.0 0.7 2.7 2.6

% Change, Year Ago 2.1 2.7 2.9 2.9 2.9 2.6 2.5

Bank rate 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.50 0.25 0.25 0.25

3-Month LIBOR 0.3 0.3 0.3 0.4 0.4 0.4 0.4 0.6 0.4 0.4 0.4

5-year Government note 0.6 0.7 0.6 0.7 0.9 1.0 1.1 1.3 0.5 0.7 1.1

10-Year Government Bond Yield 1.1 1.2 1.2 1.3 1.4 1.5 1.5 2.0 1.2 1.3 1.6

Japan Forecast Summary: Growth History Forecast Annual Data

in 2017 has been revised up by 17Q1 17Q2 17Q3 17Q4 18Q1 18Q2 18Q3 2015 2016 2017 2018

0.4 ppt, due to strong domestic Real GDP, % Change, SAAR 1.5 4.0 -2.6 1.2 1.4 3.4 -2.4 1.1 1.0 1.4 0.9

% Change, Year Ago 1.4 2.1 1.1 1.0 1.0 0.8 0.9

demand.

CPI, % Change, SAAR -0.3 -0.1 0.4 3.7 0.0 -0.9 0.3 0.8 -0.1 0.6 0.8

% Change, Year Ago 0.3 0.4 0.6 0.9 1.0 0.8 0.8

End of Period

Overnight Call Rate -0.07 -0.06 0.0 0.0 0.0 0.0 0.0 0.0 -0.1 0.0 0.0

3-Month Tibor 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.2 0.1 0.1 0.1

10-Year JGB Avg Yield 0.0 0.1 0.1 0.1 0.1 0.1 0.1 0.3 0.1 0.1 0.1

China Forecast Summary: The History Forecast Annual Data

forecast is unchanged from last 17Q1 17Q2 17Q3 17Q4 18Q1 18Q2 18Q3 2015 2016 2017 2018

month. Real GDP, ytd, % change, year ago 6.9 6.9 6.8 6.6 6.2 6.2 6.3 6.9 6.7 6.6 6.4

Real GDP, yoy, % change, year ago 6.9 6.9 6.5 6.2 6.2 6.2 6.4

CPI, % change, year ago 1.4 1.4 2.2 2.8 2.4 2.4 2.4 1.4 2.0 2.0 2.4

17Q1 17Q2

PBoC's benchmark lending rate: 1 year 4.35 4.35 - - - - - 4.35 4.35 - -

3-Month Shibor 4.08 4.47 - - - - - 3.09 3.27 - -

10-Year government bonds Avg Yield 3.31 3.55 - - - - - 3.40 2.88 - -

This document, prepared by Swiss Res sigma research, Swiss Re Institute, is for information purposes only. It is not intended as an offer or solicitation for the

purchase or sale of any financial instrument. The information contained in this document has been obtained from sources believed to be reliable; however, its

accuracy and completeness cannot be guaranteed. The views reflected herein are subject to change without notice.

sigma research | Swiss Re Institute 5 September 2017 2

You might also like

- Australia and New ZealandDocument11 pagesAustralia and New ZealandedgarmerchanNo ratings yet

- Crisil Global Economy - Dec21Document4 pagesCrisil Global Economy - Dec21HarshNo ratings yet

- QU GhanaDocument13 pagesQU Ghanaouattara dabilaNo ratings yet

- Westpac WeeklyDocument10 pagesWestpac WeeklysugengNo ratings yet

- Swiss Re Canada Economic Outlook 3Q19Document2 pagesSwiss Re Canada Economic Outlook 3Q19Fox WalkerNo ratings yet

- The World EconomyDocument12 pagesThe World EconomyeconstudentNo ratings yet

- Global Economy HeadwindsDocument10 pagesGlobal Economy HeadwindsKhushboo NagpalNo ratings yet

- Monthly Economic Outlook 06082011Document6 pagesMonthly Economic Outlook 06082011jws_listNo ratings yet

- Ashmore Weekly Commentary 27 Jan 2023Document3 pagesAshmore Weekly Commentary 27 Jan 2023Jordanata TjiptarahardjaNo ratings yet

- Euromonitor Forecasts GEF2019-Q3Document33 pagesEuromonitor Forecasts GEF2019-Q3asolteiroNo ratings yet

- MI WP YearAhead2023 PDFDocument13 pagesMI WP YearAhead2023 PDFJNo ratings yet

- 2011-06-02 DBS Daily Breakfast SpreadDocument7 pages2011-06-02 DBS Daily Breakfast SpreadkjlaqiNo ratings yet

- The Outlook For The US Economy: White PaperDocument8 pagesThe Outlook For The US Economy: White PaperJustin FungNo ratings yet

- JUL 07 Wells Fargo Eco OutlookDocument6 pagesJUL 07 Wells Fargo Eco OutlookMiir ViirNo ratings yet

- AUG 04 DBS Daily Breakfast SpreadDocument6 pagesAUG 04 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Ashmore Weekly Commentary 5 Jan 2024Document3 pagesAshmore Weekly Commentary 5 Jan 2024bagus.dpbri6741No ratings yet

- Economic Outlook Colombia 2Q19Document52 pagesEconomic Outlook Colombia 2Q19eduardo sanchezNo ratings yet

- Mid-Year Investment Outlook For 2023Document14 pagesMid-Year Investment Outlook For 2023ShreyNo ratings yet

- India - Country OverviewDocument2 pagesIndia - Country OverviewVivekanandNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- Weekly Economic and Markets Review: International & MENADocument2 pagesWeekly Economic and Markets Review: International & MENAVáclav NěmecNo ratings yet

- Country Economic Forecasts - ThailandDocument10 pagesCountry Economic Forecasts - ThailandSireethus SaovaroNo ratings yet

- Economic OutlookDocument10 pagesEconomic OutlookedgarmerchanNo ratings yet

- AUG 06 DBS Daily Breakfast SpreadDocument7 pagesAUG 06 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- India Investment Strategy - November 18Document26 pagesIndia Investment Strategy - November 18shahavNo ratings yet

- JPM Global Data Watch Se 2012-09-21 946463Document88 pagesJPM Global Data Watch Se 2012-09-21 946463Siddhartha SinghNo ratings yet

- Barclays On Brexit UK Themes Presentation Sit Tight and Keep CalmDocument54 pagesBarclays On Brexit UK Themes Presentation Sit Tight and Keep CalmZerohedgeNo ratings yet

- Bangladesh Economic Review 2019Document366 pagesBangladesh Economic Review 2019Galiv VaiNo ratings yet

- SEB Report: Asian Recovery - Please Hold The LineDocument9 pagesSEB Report: Asian Recovery - Please Hold The LineSEB GroupNo ratings yet

- Sagicor Sigma's Vital Signs - April 2023Document18 pagesSagicor Sigma's Vital Signs - April 2023Dready BunksNo ratings yet

- March 2021Document15 pagesMarch 2021RajugupatiNo ratings yet

- Global Economics: The Year of The CutDocument8 pagesGlobal Economics: The Year of The CutllaryNo ratings yet

- Global Data Watch: Bumpy, A Little Better, and A Lot Less RiskyDocument49 pagesGlobal Data Watch: Bumpy, A Little Better, and A Lot Less RiskyAli Motlagh KabirNo ratings yet

- Saudi Macroeconomic Forecast 2019 - 2023 - SambaDocument23 pagesSaudi Macroeconomic Forecast 2019 - 2023 - SambaTeofilo Gonzalez MarzabalNo ratings yet

- SADC Regional Economic Performance Report For 2020Document42 pagesSADC Regional Economic Performance Report For 2020CityPressNo ratings yet

- Philippines - Briefing Sheet, Aug 2019: EIU - Country SummaryDocument2 pagesPhilippines - Briefing Sheet, Aug 2019: EIU - Country SummaryAmethyst TurgaNo ratings yet

- LSR China BoomDocument2 pagesLSR China BoomfatalisticfundsNo ratings yet

- Insights Weekly A 2020 US Slowdown Near Recession ScenarioDocument9 pagesInsights Weekly A 2020 US Slowdown Near Recession ScenarioHandy HarisNo ratings yet

- Insights Weekly A 2020 US Slowdown Near Recession ScenarioDocument9 pagesInsights Weekly A 2020 US Slowdown Near Recession ScenarioHandy HarisNo ratings yet

- Macro Scenario Brazil Special: Damage ControlDocument3 pagesMacro Scenario Brazil Special: Damage ControlMatheus AmaralNo ratings yet

- Premia Insights Feb2020 PDFDocument6 pagesPremia Insights Feb2020 PDFMuskan mahajanNo ratings yet

- Central Bank-Monetary Policy ReviewDocument6 pagesCentral Bank-Monetary Policy ReviewAda DeranaNo ratings yet

- CH 01Document51 pagesCH 01Laurentiu SterescuNo ratings yet

- Economic Update December 2022Document12 pagesEconomic Update December 2022M A Khan FarazNo ratings yet

- DR Nariman Behravesh WorldFlash0222Document3 pagesDR Nariman Behravesh WorldFlash0222Swapnil PatilNo ratings yet

- Economic Outlook 4Q23Document24 pagesEconomic Outlook 4Q23Ade NugrohoNo ratings yet

- Emerging Markets Economics Daily: Latin AmericaDocument7 pagesEmerging Markets Economics Daily: Latin AmericaBetteDavisEyes00No ratings yet

- Global Economic ResearchDocument6 pagesGlobal Economic ResearchAndyNo ratings yet

- Frontaura - Quarterly - Letter - 2022Q2 - Exit ReasonsDocument26 pagesFrontaura - Quarterly - Letter - 2022Q2 - Exit ReasonsqazimusaddeqNo ratings yet

- Week in Pictures 10 17 22 1666106256Document13 pagesWeek in Pictures 10 17 22 1666106256Barry HeNo ratings yet

- Elevated Inflation May Linger, But Earnings Should Drive Equities HigherDocument7 pagesElevated Inflation May Linger, But Earnings Should Drive Equities HigherMaria Virginia MarquinaNo ratings yet

- Economic Update June 2022Document15 pagesEconomic Update June 2022Lahori MundaNo ratings yet

- QET 2022Q4 ReportDocument21 pagesQET 2022Q4 ReportSNamNo ratings yet

- Westpack JUN 14 Weekly CommentaryDocument7 pagesWestpack JUN 14 Weekly CommentaryMiir ViirNo ratings yet

- Van Hoisington Letter, Q3 2011Document5 pagesVan Hoisington Letter, Q3 2011Elliott WaveNo ratings yet

- Fitch Ratings - Global Economic Outlook March 2024Document33 pagesFitch Ratings - Global Economic Outlook March 2024Prashant SrivastavaNo ratings yet

- Peru EconomicDocument68 pagesPeru EconomicJose AndresNo ratings yet

- Global Real GDP Growth Is Currently Tracking A 3Document18 pagesGlobal Real GDP Growth Is Currently Tracking A 3Mai PhamNo ratings yet

- EI 18 2020 China Rural InsuranceDocument2 pagesEI 18 2020 China Rural InsuranceHarry CerqueiraNo ratings yet

- World Insurance: Riding Out The 2020 Pandemic StormDocument40 pagesWorld Insurance: Riding Out The 2020 Pandemic StormHarry CerqueiraNo ratings yet

- Sonar Publication 2020Document60 pagesSonar Publication 2020Harry CerqueiraNo ratings yet

- Data-Driven Insurance: Ready For The Next Frontier?Document52 pagesData-Driven Insurance: Ready For The Next Frontier?Harry CerqueiraNo ratings yet

- Data-Driven Insurance: Ready For The Next Frontier?Document52 pagesData-Driven Insurance: Ready For The Next Frontier?Harry CerqueiraNo ratings yet

- Mexico Country ReportDocument13 pagesMexico Country ReportHarry CerqueiraNo ratings yet

- EY Effective Cost Analysis For The Financial Services SectorDocument50 pagesEY Effective Cost Analysis For The Financial Services SectorHarry CerqueiraNo ratings yet

- Natural Catastrophes and Man-Made Disasters in 2015:: Asia Suffers Substantial LossesDocument52 pagesNatural Catastrophes and Man-Made Disasters in 2015:: Asia Suffers Substantial LossesHarry CerqueiraNo ratings yet

- World Insurance in 2016:: The China Growth Engine Steams AheadDocument60 pagesWorld Insurance in 2016:: The China Growth Engine Steams AheadHarry CerqueiraNo ratings yet

- Who Are The AgeingDocument12 pagesWho Are The AgeingHarry CerqueiraNo ratings yet

- Etherisc Whitepaper 0.3Document40 pagesEtherisc Whitepaper 0.3Harry CerqueiraNo ratings yet

- Sigma4 2014 enDocument36 pagesSigma4 2014 enHarry CerqueiraNo ratings yet

- Insuring The Frontier MarketsDocument35 pagesInsuring The Frontier MarketsHarry CerqueiraNo ratings yet

- Sigma6 2015 enDocument43 pagesSigma6 2015 enHarry CerqueiraNo ratings yet

- Underinsurance of Property Risks:: Closing The GapDocument40 pagesUnderinsurance of Property Risks:: Closing The GapHarry CerqueiraNo ratings yet

- Global Insurance+ Review 2012 and Outlook 2013 14Document36 pagesGlobal Insurance+ Review 2012 and Outlook 2013 14Harry CerqueiraNo ratings yet

- The Mathematics of Chinese CalendarDocument27 pagesThe Mathematics of Chinese CalendarHarry Cerqueira100% (1)

- Article 19.1 DSU CommentaryDocument17 pagesArticle 19.1 DSU CommentaryAkshat KothariNo ratings yet

- Crimson Skies (2000) ManualDocument37 pagesCrimson Skies (2000) ManualJing CaiNo ratings yet

- TpaDocument11 pagesTpaVijay SinghNo ratings yet

- Cat 86200516 PDFDocument58 pagesCat 86200516 PDFAnonymous TPVfFif6TONo ratings yet

- Corporate Advisory Service Integra GroupDocument24 pagesCorporate Advisory Service Integra GroupJimmy InterfaxNo ratings yet

- CORPO Case Doctrines Lex TalionisDocument20 pagesCORPO Case Doctrines Lex TalionisJustin YañezNo ratings yet

- UC Express 3.0 Softphone GuideDocument4 pagesUC Express 3.0 Softphone Guideb1naryb0yNo ratings yet

- Module 1Document11 pagesModule 1Karelle MalasagaNo ratings yet

- Cost of Capital 2Document29 pagesCost of Capital 2BSA 1A100% (2)

- Adarsh Comp ConsDocument7 pagesAdarsh Comp ConsAmanNo ratings yet

- Leonilo Sanchez Alias Nilo, Appellant, vs. People of The Philippines and Court of AppealsDocument6 pagesLeonilo Sanchez Alias Nilo, Appellant, vs. People of The Philippines and Court of AppealsRap BaguioNo ratings yet

- The Sumitomo Copper FraudDocument4 pagesThe Sumitomo Copper FraudAlan ZhouNo ratings yet

- Yamaha Digital Multi-Function Command Link Tachometer, Square 6y8-8350t-01-00 EbayDocument1 pageYamaha Digital Multi-Function Command Link Tachometer, Square 6y8-8350t-01-00 EbayYoises SolisNo ratings yet

- LALON Mixed MathDocument9 pagesLALON Mixed MathZia UddinNo ratings yet

- Dlsu Exam 2nd Quiz Acccob2Document4 pagesDlsu Exam 2nd Quiz Acccob2Chelcy Mari GugolNo ratings yet

- Tresspass To Land As A Civil TortDocument4 pagesTresspass To Land As A Civil TortFaith WanderaNo ratings yet

- HEAVYLIFT MANILA V CADocument2 pagesHEAVYLIFT MANILA V CAbelly08100% (1)

- BS 1139-6-2005 Metal Scaffolding. Specification For Prefabricated Tower Scaffolds Outside The Scope of BS en 1004, But Utilizing Components From Such SystemsDocument16 pagesBS 1139-6-2005 Metal Scaffolding. Specification For Prefabricated Tower Scaffolds Outside The Scope of BS en 1004, But Utilizing Components From Such SystemsHiệpBáNo ratings yet

- The Kartilya of The KatipunanDocument2 pagesThe Kartilya of The Katipunanapi-512554181No ratings yet

- The Art of Using Paper Space in AutoCAD, All Secrets of Using Layout Tab and Paper Space in AutoCAD 2010 To 2020 PDFDocument218 pagesThe Art of Using Paper Space in AutoCAD, All Secrets of Using Layout Tab and Paper Space in AutoCAD 2010 To 2020 PDFKyaw ZinNo ratings yet

- Police Power Case Issue Ruling AnalysisDocument10 pagesPolice Power Case Issue Ruling AnalysisCharlene Mae Delos SantosNo ratings yet

- Peraturan Skim Pemeriksaan Khas BIDocument56 pagesPeraturan Skim Pemeriksaan Khas BIahmad exsanNo ratings yet

- Powers of The PresidentDocument4 pagesPowers of The Presidentlabellejolie100% (1)

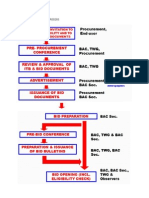

- Bidding Process For Procurement Process and DPWHPDFDocument9 pagesBidding Process For Procurement Process and DPWHPDFGerardoNo ratings yet

- Matungao, Lanao Del NorteDocument2 pagesMatungao, Lanao Del NorteSunStar Philippine NewsNo ratings yet

- NOTICE TO PRINCIPAL IS NOTICE TO AGENT Right To Travel CasesDocument6 pagesNOTICE TO PRINCIPAL IS NOTICE TO AGENT Right To Travel CasesNotarys To Go100% (1)

- Douglas County School District Board of Education Meeting Safety and Security ProtocolsDocument4 pagesDouglas County School District Board of Education Meeting Safety and Security ProtocolsMichael_Roberts2019No ratings yet

- Instructions: Personal History Statement FILE NODocument6 pagesInstructions: Personal History Statement FILE NONichole Dianne Dime DiazNo ratings yet

- Critical Analysis of Anti-Competitive AgreementDocument13 pagesCritical Analysis of Anti-Competitive AgreementAddyAdityaLadha100% (1)