Professional Documents

Culture Documents

Cash Flow New

Uploaded by

Ankur Goyal0 ratings0% found this document useful (0 votes)

45 views4 pageshttps://www.scribd.com/mobile/document/250543670/Prasanna-Chandra-Chapter-6-Solution

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenthttps://www.scribd.com/mobile/document/250543670/Prasanna-Chandra-Chapter-6-Solution

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

45 views4 pagesCash Flow New

Uploaded by

Ankur Goyalhttps://www.scribd.com/mobile/document/250543670/Prasanna-Chandra-Chapter-6-Solution

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

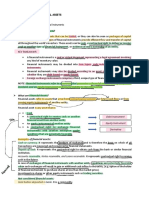

Q.1 The following are Balance Sheet and Income Statement of Jivan Adarsh limited.

Liabilities 1.1.06 31.12.06 Assets 1.1.06 31.12.06

Share capital 1,80,000 2,22,000 Fixed Assets:

Creditors 75,900 81,900 Building 24,000 48,000

Profit & loss A/c 1,20,000 1,17,000 Land 1,80,000 2,88,000

Provision for tax 12,000 24,000 Current Assets:

Outstanding Expenses 6,000 6,600 Advances 30,000 36,000

Prov. for Dep. on building 60,000 66,000 Debtors 84,000 93,000

Stock 1,32,000 48,000

Cash 3,900 4,500

4,53,900 5,17,500 4,53,900 5,17,500

Profit And Loss A/C

For year ended 31.3.06

Particular RS Particular RS

To Cost of sales 8,90,000 By Net sales 12,60,000

To Wages & salaries 1,20,000

To Gross profit c/d 2,50,000

12,60,000 12,60,000

To Operating Exp. 40,000 By Gross profit 2,50,000

To Depreciation 30,000 By Profit on sale of Building 6,000

To Provision for tax 44,000

1,42,00

To Net profit 0

2,56,000 2,56,000

To proposed Dividend 36,000 By Balance b/d 75,900

1,42,00

To balance Carried to 81,900 By Net Profit (transf.) 0

balance sheet

1,17,900 1,17,900

Q.2 Following are the balance sheets of a Visaka Steel Ltd.:

Liabilities 1105 311205 Assets 1105 311205

Creditors 36,000 41,000 Cash 4,000 3,600

Bills Payable 20,000 Debtor 35,000 38,400

Loan from Bank 30,000 25,000 Stock 25,000 22,000

Capital 1,00,000 1,10,000 Land 20,000 30,000

Profit & Loss Account 48,000 39,000 Building 50,000 55,000

Machinery 80,000 86,000

2,14,000 2,35,000 2,14,000 2,35,000

During the year Rs. 26,000 paid as dividend. The provision made for depreciation against machinery as on 1.1.05 was Rs. 27,000 and

on 31.12.05 Rs 36,000.

Prepare a cash flow statement.

Q.3 The summarized balance sheet of B0ombay Dyeing Ltd. as on 31.12.05 and 31.12.2006 are as follows:

Liabilities 2005 2006 Assets 2005 2006

Share capital 4,50,000 4,50,000 Fixed asset 4,00,000 3,20,000

General Reserve 3,00,000 3,10,000 Investment 50,000 60,000

P & L A/C 56,000 68,000 Stock 2,10,000 1,70,000

Creditors 1,68,000 1,34,000 Debtor 2,10,000 4,55,000

Tax provision 55,000 10,000 Bank 1,30,000 1,77,000

Mortgage loan 2,40,000 Cash Equivalent 19,000 20,000

Propsed Dividend 20,000 30,000 Cash Balance 30,000 40,000

10,49,000 12,42,000 10,49,000 12,42,000

Additional Details:

You are required to purepare a cash flow statement

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Fund Flow Statement WorksheetDocument3 pagesFund Flow Statement WorksheetAnish AroraNo ratings yet

- Tutorial On Ratio AnalysisDocument4 pagesTutorial On Ratio AnalysisRajyaLakshmiNo ratings yet

- Financial Statement Analysis Funds FlowDocument15 pagesFinancial Statement Analysis Funds FlowSAITEJA ANUGULANo ratings yet

- CashFlowStatement AssignmentDocument15 pagesCashFlowStatement AssignmentAnanta Vishain0% (1)

- Cash Flow Statement from Financial StatementsDocument7 pagesCash Flow Statement from Financial StatementsS. Chakrabarty MeconNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Accounting For Managers Trimester 1 Mba Ktu 2016Document3 pagesAccounting For Managers Trimester 1 Mba Ktu 2016Mekhajith MohanNo ratings yet

- Acc hw2Document5 pagesAcc hw2pujaadiNo ratings yet

- FSA Vertical FormatDocument10 pagesFSA Vertical FormatMayank BahetiNo ratings yet

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- RATIO ANALYSIS Q 1 To 4Document5 pagesRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- Accountant 17-07-2023Document3 pagesAccountant 17-07-2023mrsiranjeevi44No ratings yet

- Proposed DividebdDocument34 pagesProposed DividebdPiyush SrivastavaNo ratings yet

- Cash Flow StatementDocument9 pagesCash Flow StatementPiyush MalaniNo ratings yet

- CashFlowStatement ProblemsDocument19 pagesCashFlowStatement Problems8qyyyhy7jdNo ratings yet

- Sba1501 Management Accounting Unit IiiDocument71 pagesSba1501 Management Accounting Unit Iiisandhya lakshmanNo ratings yet

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- AccountsDocument4 pagesAccountsVencint LaranNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- "Knowledge Is Superior To Marks",: PrefaceDocument12 pages"Knowledge Is Superior To Marks",: PrefaceTapan BarikNo ratings yet

- Cash Flow 8 AprilDocument17 pagesCash Flow 8 AprilMayank MalhotraNo ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakNo ratings yet

- Cash Flow Question Paper1 PDF FreeDocument10 pagesCash Flow Question Paper1 PDF Freelakshayajasuja2No ratings yet

- Class Activity 1 Cash Flow StatementDocument2 pagesClass Activity 1 Cash Flow StatementHacker SKNo ratings yet

- Trial Balance Adjustments FinancialsDocument2 pagesTrial Balance Adjustments FinancialsMichelle BabaNo ratings yet

- Final AccountsDocument9 pagesFinal AccountsAbhinav Kumar YadavNo ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- Fund Flow StatementDocument41 pagesFund Flow StatementMahima SinghNo ratings yet

- Solution of Q.18 and Q.19-19Document2 pagesSolution of Q.18 and Q.19-19Manjam6ri AgarwalNo ratings yet

- Cash Flow Statement ProblemsDocument19 pagesCash Flow Statement ProblemsSubbu ..No ratings yet

- Review Answer SheetDocument13 pagesReview Answer SheetKeycee Rhaye RivasNo ratings yet

- Net Working Capital Current Assets - Current LiabilitiesDocument11 pagesNet Working Capital Current Assets - Current LiabilitiesRahul YadavNo ratings yet

- 02 Edu91 FM Practice Sheets QuestionsDocument77 pages02 Edu91 FM Practice Sheets Questionsprince soniNo ratings yet

- Question Bank - Financial Reporting and AnalysisDocument8 pagesQuestion Bank - Financial Reporting and AnalysisSagar BhandareNo ratings yet

- 6 Following Are The: (A) Sales (B) Sundry Debtors (C) Closing Stock (D) Sundry Creditors (E) Fixed AssetsDocument5 pages6 Following Are The: (A) Sales (B) Sundry Debtors (C) Closing Stock (D) Sundry Creditors (E) Fixed Assetsvaibhav_kapoor_6No ratings yet

- TrialBal (1) - 2Document1 pageTrialBal (1) - 2shreygautam12No ratings yet

- 2021 Business AccountingDocument5 pages2021 Business AccountingVISHESH 0009No ratings yet

- Gabriel T. Soniel COA 2E financial statementsDocument5 pagesGabriel T. Soniel COA 2E financial statementsGabriel Trinidad SonielNo ratings yet

- MA Sem-4 2018-2019Document23 pagesMA Sem-4 2018-2019Akki GalaNo ratings yet

- Buscom SeatworkDocument3 pagesBuscom SeatworkTintin AquinoNo ratings yet

- Schedule 3Document8 pagesSchedule 3Hilary GaureaNo ratings yet

- Accounts Receivable and AFBDDocument18 pagesAccounts Receivable and AFBDeia aieNo ratings yet

- CMPC 131 SolutionsDocument3 pagesCMPC 131 SolutionsNhel AlvaroNo ratings yet

- Soal AKM 2015Document24 pagesSoal AKM 2015Siti Armayani RayNo ratings yet

- 12th cbse accounts paper 10 06 2017Document2 pages12th cbse accounts paper 10 06 2017Harpreet Singh SainiNo ratings yet

- Cash Flow Statement-ExampleDocument18 pagesCash Flow Statement-ExampleAnakha RadhakrishnanNo ratings yet

- 05 Corporate LiquidationDocument4 pages05 Corporate LiquidationEric CauilanNo ratings yet

- Solutions For Cash Flow Sums OnlyDocument11 pagesSolutions For Cash Flow Sums OnlyS. GOWRINo ratings yet

- Funds and Flow Statements AnalysisDocument14 pagesFunds and Flow Statements Analysis75 SHWETA PATILNo ratings yet

- F M ADocument11 pagesF M AAjay SahooNo ratings yet

- Accounts DDocument13 pagesAccounts DRahit MitraNo ratings yet

- Financial Statement Analysis QuestionsDocument4 pagesFinancial Statement Analysis QuestionsAsad RehmanNo ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- Description: Tags: 668appgDocument2 pagesDescription: Tags: 668appganon-829526No ratings yet

- Cash flow problemsDocument9 pagesCash flow problemsSharu BsNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- AmalgamationDocument3 pagesAmalgamationSowmya Upadhya G SNo ratings yet

- Entrepreneurship - For StudentsDocument111 pagesEntrepreneurship - For StudentsAdrian Jay BeloyNo ratings yet

- ch04 (2) - DikonversiDocument64 pagesch04 (2) - DikonversiJimmy ManurungNo ratings yet

- Aws Lab Manual Sap b1Document53 pagesAws Lab Manual Sap b1virgar8No ratings yet

- FR Compiler 4.0 - CA Final - by CA Ravi AgarwalDocument1,312 pagesFR Compiler 4.0 - CA Final - by CA Ravi Agarwalaella shivani100% (1)

- Afar.3202 Corporate LiquidationDocument6 pagesAfar.3202 Corporate Liquidationruel c armillaNo ratings yet

- Intangible AssetsDocument26 pagesIntangible Assetslee jong suk100% (1)

- Q Mar22Document9 pagesQ Mar22user mrmysteryNo ratings yet

- Ambit - Cera Sanitaryware - Initiation - Focused On The Inner Scorecard - 27feb2020Document46 pagesAmbit - Cera Sanitaryware - Initiation - Focused On The Inner Scorecard - 27feb2020Sriram Ranganathan100% (2)

- Intoduction To Financial Assets and Financial Assets at Fair ValueDocument11 pagesIntoduction To Financial Assets and Financial Assets at Fair ValueKin Lee100% (2)

- Cash basis PPE accountingDocument6 pagesCash basis PPE accountingCristine MayNo ratings yet

- Cap2 (Exercicios) PDFDocument3 pagesCap2 (Exercicios) PDFPablo MoreiraNo ratings yet

- Organizational Study of BharatPe: Enabling Digital Payments for SMEsDocument43 pagesOrganizational Study of BharatPe: Enabling Digital Payments for SMEsMohammed WasimNo ratings yet

- Auditing A Risk Based Approach To Conducting A Quality Audit 10th Edition Johnstone Solutions ManualDocument28 pagesAuditing A Risk Based Approach To Conducting A Quality Audit 10th Edition Johnstone Solutions Manualsamuelfintanult1jj100% (27)

- Tupas Business PlanDocument8 pagesTupas Business PlanDarwin AniarNo ratings yet

- CfasDocument32 pagesCfasLouiseNo ratings yet

- Working Paper AnalysisDocument10 pagesWorking Paper AnalysisHannaniah PabicoNo ratings yet

- Apple Valuation Exercise - AAPL Financials (Annual) July 31 2020Document44 pagesApple Valuation Exercise - AAPL Financials (Annual) July 31 2020/jncjdncjdnNo ratings yet

- Vishal Mega MartDocument56 pagesVishal Mega MartTarun100% (1)

- Apollo Shoes, Inc.: Prepared by Reviewed byDocument3 pagesApollo Shoes, Inc.: Prepared by Reviewed byArista Yuliana SariNo ratings yet

- Case 14-4 Accounting at MacCloud WineryDocument4 pagesCase 14-4 Accounting at MacCloud WineryPriya Darshini50% (2)

- Partnership Operation Learning ExercisesDocument26 pagesPartnership Operation Learning ExercisesAndrea Beverly TanNo ratings yet

- Final Exam - Fall 2007Document9 pagesFinal Exam - Fall 2007jhouvanNo ratings yet

- Comprehensive Problem Comprehensive Problem 1Document2 pagesComprehensive Problem Comprehensive Problem 1marisaNo ratings yet

- Financial Statement Analysis: K.R. SubramanyamDocument46 pagesFinancial Statement Analysis: K.R. SubramanyamKiki AmeliaNo ratings yet

- Igcse Depreciation - QuestionsDocument50 pagesIgcse Depreciation - QuestionsMuhammad MunaamNo ratings yet

- P.R. Cements LTD Fixed Assets ManagementDocument71 pagesP.R. Cements LTD Fixed Assets ManagementPochender vajrojNo ratings yet

- Assignment - Accounting For Special TransactionsDocument4 pagesAssignment - Accounting For Special TransactionssunshineNo ratings yet

- 2021 FGN Approved Budget DetailsDocument1,563 pages2021 FGN Approved Budget DetailsDavid Hundeyin100% (1)

- Solution Manual Advanced Financial Accounting 8th Edition Baker Chap015 PDFDocument54 pagesSolution Manual Advanced Financial Accounting 8th Edition Baker Chap015 PDFYopie ChandraNo ratings yet