Professional Documents

Culture Documents

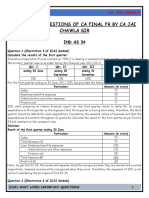

Commodity Outlook - Oct - 06 TH

Uploaded by

Om PrakashOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commodity Outlook - Oct - 06 TH

Uploaded by

Om PrakashCopyright:

Available Formats

Commodity Outlook

Precious Metals | Base Metals | Energy Oct 06 2017

PRECIOUS METALS

MARKET ROUNDUP

PRECIOUS METALS MARKET WATCH Precious metals prices dipped on

Thursday after strong U.S. economic

data lifted the dollar and underlined

Precious Metals Contract Open High Low Close Change % Chng expectations that U.S. interest rates

MCX Gold Rs. DEC7 29367 29430 29310 29337 47 0.16 would be hiked.

COMEX Gold $ DEC7 1277.5 1281.6 1268.5 1273.2 -3.6 -0.28

MCX Silver Rs. DEC7 39049 39320 39005 39172 86 0.22

COMEX Silver $ DEC7 16.61 16.65 16.61 16.63 -0.01 -0.05

LONDON FIXING

A.M. FIXING P.M. FIXING IN FOCUS

Gold 1278.4 1274.5

SPDR Gold Trust GLD, the world's

Silver Fix AM

largest gold-backed exchange-

traded fund, said its holdings

US $ INDEX

stood at 856.08 tonnes, remain

Close % Change unchanged from previous

US $ INDEX 93.46 0.54 business day.

Holdings of the largest silver-

ETF HOLDINGS AS ON PREVIOUS CLOSE

backed exchange-traded-fund

ETF In tonnes Change (ETF), New York's iShares Silver

Trust SLV, stood at 10129.51 down

SPDR Holding 856.08 00.00

29.37 tonnes, from previous

iShares Holding 10129.51 29.37

business day.

FOREX MARKET WATCH

Currency Open High Low Close Change % Chng

USD/INR 65.1 65.2 64.98 65.15 0.12 0.18

USD/JPY 112.77 112.94 112.42 112.77 0.06 0.05

EUR/USD 1.18 1.18 1.17 1.18 0 -0.41

FUNDAMENTAL OUTLOOK

Precious metals are trading lower on COMEX today. We expect prices to

trade range bound for the day, ahead of key U.S. jobs data later in the day,

with prices curbed as the U.S. dollar stood firm near a seven-week high.

http://www.nirmalbang.com |Daily Commodity Outlook 1

Commodity Outlook

Precious Metals | Base Metals | Energy Oct 06 2017

BASE METALS

MARKET ROUNDUP

BASE METALS MARKET WATCH Industrial metal zinc prices ran out

of steam on Thursday after hitting a

10-year high, although the metal

Base Metals Contract Open High Low Close Change % Chng

found support from declining

MCX Copper Rs. Nov -07 428 439.8 427.55 439.6 12.9 3.02 inventories and strong demand.

LME Copper $ 3M 6570 6700 6554 6700 179 2.74

MCX Zinc Rs. Oct-07 214.65 217.4 214.5 216.85 1.8 0.84

LME Zinc $ 3M 3296 3294 3288 3288 -14 -0.42

MCX Nickel Rs. Oct-07 692.7 697.2 685 690.3 1.4 0.2

IN FOCUS

LME Nickel $ 3M 10620 10600 10535 10535 -80 -0.75

MCX Lead Rs. Oct-07 165.55 169.2 165.35 168.9 3 1.81 The U.S. Commerce Department

LME Lead $ 3M 2558 2592 2557 2592 32 1.25 said on Thursday it would defer

MCX Aluminum Oct-07 139.8 140.7 139.05 140.65 0.7 0.5

issuing its preliminary

determination in an anti-dumping

LME Aluminum 3M 2149 2171 2147 2171.5 5.5 0.25

duty probe into imports of

aluminum foil from China.

SHANGHAI MARKET WATCH INDICES

Plans to reopen one of the world's

Metals Close Change %Chng Index Close Change biggest copper mines, shut by a

Aluminum 16280 -70 -0.43 Baltic Dry Index 1382 62 civil war on the Pacific Island of

Copper 50360 20 0.04 CRB Index 2912.81 4.39 Bougainville in 1989, have run

Zinc 26055 -30 -0.12 DJ Commodity - -

into trouble. The quarter of a

million people of Bougainville are

LME WAREHOUSE STOCK INDICES tentatively scheduled to vote on

independence from Papua New

Metals Prev. Net Total Metals L/W* C/W* Change

Guinea in June 2019, and revenue

Copper 298525 -2450 296075 Copper 227550 68525 -1250 from the reopening of the

Zinc 251750 -675 251075 Zinc 113475 137600 -950 Panguna mine is essential for the

Nickel 387828 -606 387222 Nickel 251634 135588 -1494

otherwise impoverished island to

have any chance of flourishing if

Lead 156400 -875 155525 Lead 100500 55025 -875

it becomes the world's newest

Aluminium 1251700 -2350 1249350 Aluminium 1004925 244425 -2350

nation.

FUNDAMENTAL OUTLOOK

Industrial metals are trading mix on International bourses today. We expect

prices to trade range bound for the day, amid holiday-thinned trading in

Asia, but prices were curbed by a strong U.S. dollar.

http://www.nirmalbang.com |Daily Commodity Outlook 2

Commodity Outlook

Precious Metals | Base Metals | Energy Oct 06 2017

ENERGY

MARKET ROUNDUP

Crude oil prices rose about 2

ENERGY MARKET WATCH

percent on Thursday as signs Saudi

Energy Contract Open High Low Close Change % Chng

Arabia and Russia would limit

production through next year

MCX Crude OCT-07 3287 3304 3248 3266 -45 -1.38

pushed the U.S. benchmark back

NYM Crude NOV-07 49.88 51.22 49.85 50.79 0.81 1.62

above $50 a barrel.

MCX Natgas OCT-07 191 194.5 189.7 192.1 1.4 0.73

NYM Natgas NOV-07 2.93 3 2.89 2.92 -0.02 -0.58

IN FOCUS

INDICES EXCHANGE VOLUME

Saudi Arabia made no firm

pledge on Thursday to extend a

Index Close Change Exchange Volume (in crores)

deal between OPEC, Russia and

Dirty Tanker Index 766 6 MCX 19230.20 other producers on cutting

Clear Tanker Index 617 -5 NCDEX 1830.57 supplies but said it was "flexible"

regarding Moscow's suggestion to

ENERGY INDICATORS prolong the pact until the end of

2018.

Date Time Energy Data Country Prior Consensus Actual

04-Oct 8.00pm Crude Stock U.S. -1.846 -0.756 -6.023 TransCanada Corp abandoned its

04-Oct 8.00pm Gasoline Stock U.S. 1.107 1.088 1.644 C$15.7 billion ($12.52 billion)

04-Oct 8.00pm Distillate Stock U.S. -0.814 -1.813 -2.606 cross-country Energy East

04-Oct 8.00pm Refinery Utilisation U.S. 5.4 -0.5 pipeline on Thursday amid

Stocks at Cushing mounting regulatory hurdles,

04-Oct 8.00pm Oklahama U.S. 1.181 1.525

Natural Gas dealing a blow to the country's oil

04-Oct 8.00pm Inventory U.S. 58 51 42 export ambitions.

Asian spot prices for liquefied

natural gas (LNG) edged to their

highest level since January this

week, as the market gradually

tightened ahead of the peak-

demand winter heating season

and as consumption in China

soars amid its huge gasification

programme.

FUNDAMENTAL OUTLOOK

President Tayyip Erdogan said on

Crude oil is trading lower on NYMEX today. We expect prices to trade range Thursday that Turkey would

bound for the day as traders monitored a tropical storm heading for the Gulf soon close its border with

of Mexico and as China remained closed for a week-long public holiday. northern Iraq and shut its air

space in response to last week's

Kurdish independence

referendum.

http://www.nirmalbang.com |Daily Commodity Outlook 3

Commodity Outlook

Precious Metals | Base Metals | Energy Oct 06 2017

RESEARCH TEAM

NAME DESIGNATION E-MAIL

Kunal Shah Head of Research kunal.shah@nirmalbang.com

Devidas Rajadhikary Sr. Technical Analyst devidas.rajadhikary@nirmalbang.com

Harshal Mehta Sr. Technical Analyst harshal.mehta@nirmalbang.com

Mohammed Azeem Technical Analyst mohammed.gaziani@nirmalbang.com

Ravi Dsouza Research Analyst ravi.dsouza@nirmalbang.com

Smit Bhayani Research Associate smit.bhayani@nirmalbang.com

Shrishty Agarwal Research Associate shrishty.agarwal@nirmalbang.com

Disclaimer:

This Document has been prepared by N.B. Commodity Research (A Division of Nirmal Bang Commodities Pvt.

Ltd). The information, analysis and estimates contained herein are based on N.B. Commodities Research

assessment and have been obtained from sources believed to be reliable. This document is meant for the use of

the intended recipient only. This document, at best, represents N.B. Commodities Research opinion and is

meant for general information only. N.B. Commodities Research, its directors, officers or employees shall not in

any way be responsible for the contents stated herein. N.B. Commodities Research expressly disclaims any and

all liabilities that may arise from information, errors or omissions in this connection. This document is not to be

considered as an offer to sell or a solicitation to buy any securities. N.B. Commodities Research, its affiliates

and their employees may from time to time hold positions in securities referred to herein. N.B. Commodities

Research or its affiliates may from time to time solicit from or perform investment banking or other services for

any company mentioned in this document.

Address: Nirmal Bang Commodities Pvt. Ltd., B2, 301 / 302, 3rd Floor, Marathon Innova, Opp. Peninsula

Corporate Park, Ganpatrao Kadam Marg, Lower Parel (W), Mumbai - 400 013, India

http://www.nirmalbang.com |Daily Commodity Outlook 4

You might also like

- Precious Metals Advance as Stimulus Bets Fuel Safe-Haven DemandDocument4 pagesPrecious Metals Advance as Stimulus Bets Fuel Safe-Haven DemandSomendraNo ratings yet

- Commodity Outlook Precious, Base Metals & Energy Nov 2020Document4 pagesCommodity Outlook Precious, Base Metals & Energy Nov 2020crazyman2009No ratings yet

- MCX Gold May Note Choppy Trade, Silver May See Some GainsDocument4 pagesMCX Gold May Note Choppy Trade, Silver May See Some GainsAmeya PagnisNo ratings yet

- Metals Buzz DailyDocument4 pagesMetals Buzz DailySandeep Aanand ShawNo ratings yet

- FINMET MarketWatch - GOLD Sees Losses As NY Manufacturing Activity Improves !!Document2 pagesFINMET MarketWatch - GOLD Sees Losses As NY Manufacturing Activity Improves !!P DNo ratings yet

- IBJA - Bullion Daily Report - 14-10-2022Document6 pagesIBJA - Bullion Daily Report - 14-10-2022Sweety MukatiNo ratings yet

- Gold BeESDocument17 pagesGold BeESNeha SureshNo ratings yet

- Commodities Daily: Focus: SHFE-LME Zinc - Arbitrage Opportunities?Document5 pagesCommodities Daily: Focus: SHFE-LME Zinc - Arbitrage Opportunities?Mahmudul Hasan MahimNo ratings yet

- The Economic Monitor U.S.Document13 pagesThe Economic Monitor U.S.phatrsamonNo ratings yet

- A Comparative Study On Investing in Gold Related AssetsDocument5 pagesA Comparative Study On Investing in Gold Related AssetsLakskmi Priya M CNo ratings yet

- IBJA - Bullion Daily Report 29 - 12 - 2021 PDFDocument6 pagesIBJA - Bullion Daily Report 29 - 12 - 2021 PDFAkash SinghNo ratings yet

- Precious Metals: Silver: Outperforming GoldDocument3 pagesPrecious Metals: Silver: Outperforming GoldAnurag NauriyalNo ratings yet

- IBJA - Bullion Daily Report - 01-03-2024Document6 pagesIBJA - Bullion Daily Report - 01-03-2024thunderbuddy2222No ratings yet

- MO Commodities Daily ReportDocument4 pagesMO Commodities Daily ReportAkshay WaghmareNo ratings yet

- SPDR Gold Shares GLD: ObjectiveDocument2 pagesSPDR Gold Shares GLD: ObjectiveManikanta Sai KumarNo ratings yet

- Miner Valuation RBC October 2010Document16 pagesMiner Valuation RBC October 2010courvbcNo ratings yet

- Daily Commodity Market Outlook Views & Report As ofDocument9 pagesDaily Commodity Market Outlook Views & Report As ofPrabhu G UmadiNo ratings yet

- Today Gold and Silver Market UpdatesDocument9 pagesToday Gold and Silver Market UpdatesRahul SolankiNo ratings yet

- Daily Commodity Trend: Commodity Insight Precious MetalsDocument3 pagesDaily Commodity Trend: Commodity Insight Precious MetalspraveenkumarNo ratings yet

- Daily Bullion Market Report Highlights Strength in Gold and Silver Despite Recent DeclinesDocument6 pagesDaily Bullion Market Report Highlights Strength in Gold and Silver Despite Recent DeclinesazaiahNo ratings yet

- Copper InsightDocument3 pagesCopper InsightPramod ManeNo ratings yet

- Free Online Commodity Market Trading TipsDocument9 pagesFree Online Commodity Market Trading TipsRahul SolankiNo ratings yet

- Commodity MantraDocument4 pagesCommodity MantraAkshay YawaleNo ratings yet

- Long Term Commodity Trading TipsDocument9 pagesLong Term Commodity Trading TipsRahul SolankiNo ratings yet

- Daily India Spot Market Rates Gold and Silver 999 WatchDocument6 pagesDaily India Spot Market Rates Gold and Silver 999 WatchSomendraNo ratings yet

- The Economic Monitor U.K.: Free EditionDocument6 pagesThe Economic Monitor U.K.: Free EditionInternational Business TimesNo ratings yet

- Commodity Daily Report (Metals & Energy) 26th February, 2021Document3 pagesCommodity Daily Report (Metals & Energy) 26th February, 2021Jey AnandNo ratings yet

- Market Update 25th Sept 2018Document1 pageMarket Update 25th Sept 2018Anonymous FnM14a0No ratings yet

- Content: Market Highlights Day's Overview Outlook Important Events For TodayDocument3 pagesContent: Market Highlights Day's Overview Outlook Important Events For Todayhitesh315No ratings yet

- Weekly Gold ETF MonitorDocument6 pagesWeekly Gold ETF MonitorRakesh VNo ratings yet

- GoldDocument12 pagesGoldNirav JoshiNo ratings yet

- Gold & Silve Market UpdatesDocument9 pagesGold & Silve Market UpdatesRahul SolankiNo ratings yet

- Indian Commodity Bullion and Agri Market NewsDocument9 pagesIndian Commodity Bullion and Agri Market NewsRahul SolankiNo ratings yet

- Metals Weekly - A Weekly Report On Base MetalsDocument5 pagesMetals Weekly - A Weekly Report On Base MetalsabhishekNo ratings yet

- Building Materials: Near-Term Outlook "Steel" Good - 29/03/2010Document4 pagesBuilding Materials: Near-Term Outlook "Steel" Good - 29/03/2010Rhb InvestNo ratings yet

- Gold subdued as dollar firms, investors seek more Fed cues, (AKD Commodities vantage, Mar 27 2024)Document5 pagesGold subdued as dollar firms, investors seek more Fed cues, (AKD Commodities vantage, Mar 27 2024)Awais KhalidNo ratings yet

- IBJA - Bullion Daily Report 24-05-2021Document6 pagesIBJA - Bullion Daily Report 24-05-2021SomendraNo ratings yet

- Daily Morning Commodity Report - 20 Sept - 20-09-2023 - 10Document6 pagesDaily Morning Commodity Report - 20 Sept - 20-09-2023 - 10anuputaneNo ratings yet

- Gold holds firm as investors look to inflation data, (AKD Commodities vantage, Feb 28 2024)Document5 pagesGold holds firm as investors look to inflation data, (AKD Commodities vantage, Feb 28 2024)Awais KhalidNo ratings yet

- Precious Metal Weekly Commodity Outlook::-Gold Price Closed Higher Last Week in Further Buildup ToDocument8 pagesPrecious Metal Weekly Commodity Outlook::-Gold Price Closed Higher Last Week in Further Buildup ToThe red RoseNo ratings yet

- Commodity Daily: Global Market Round UpDocument6 pagesCommodity Daily: Global Market Round UpOm PrakashNo ratings yet

- Precious Metals FinalDocument54 pagesPrecious Metals FinalsmritakachruNo ratings yet

- Free Indian Commodity Market Data and Charts For Trading PDFDocument9 pagesFree Indian Commodity Market Data and Charts For Trading PDFRahul SolankiNo ratings yet

- HSBC Precious Metals OutlookDocument64 pagesHSBC Precious Metals OutlookafonteveNo ratings yet

- Tru Fact SheetDocument2 pagesTru Fact Sheetnatasha-elisabeth-8530No ratings yet

- Volatility in Gold PricesDocument63 pagesVolatility in Gold PricesAshwini ShettyNo ratings yet

- Gold Supply 2023Document5 pagesGold Supply 2023Pauline ChongNo ratings yet

- Initial JoblInitial Jobless Claims and Commodity Tradingess Claims and Commodity TradingDocument2 pagesInitial JoblInitial Jobless Claims and Commodity Tradingess Claims and Commodity Tradingsreelu42No ratings yet

- Gold Price Settled Up For The Week and Month As A Federal: Weekly Commodity UpdateDocument8 pagesGold Price Settled Up For The Week and Month As A Federal: Weekly Commodity UpdateAnil ParidaNo ratings yet

- Miraj International Investment Limited: The Benefits of Gold Equities For Portfolio DiversificationDocument42 pagesMiraj International Investment Limited: The Benefits of Gold Equities For Portfolio DiversificationauguimkNo ratings yet

- Equilibrium Phases in Cast AlloysDocument52 pagesEquilibrium Phases in Cast AlloysAkshayaa BalajiNo ratings yet

- Gambier Gold Corporate Presentation Sept-2020Document29 pagesGambier Gold Corporate Presentation Sept-2020Michael BlanchardNo ratings yet

- 2021.Q1 Goehring & Rozencwajg Market CommentaryDocument30 pages2021.Q1 Goehring & Rozencwajg Market Commentarygal3fcNo ratings yet

- Gold plows to record high after Powell's remarks, (AKD Commodities vantage, Apr 04 2024)Document5 pagesGold plows to record high after Powell's remarks, (AKD Commodities vantage, Apr 04 2024)Awais KhalidNo ratings yet

- How Lease Rates Impact Precious Metals MarketsDocument3 pagesHow Lease Rates Impact Precious Metals MarketsAmol KulkarniNo ratings yet

- Global Monetary Policies Daily Research ReportDocument12 pagesGlobal Monetary Policies Daily Research ReportAromaNo ratings yet

- Intelligent Investor UK Edition January 17 2011Document7 pagesIntelligent Investor UK Edition January 17 2011International Business TimesNo ratings yet

- Des Jar Dins - Metals and Mining WeeklyDocument14 pagesDes Jar Dins - Metals and Mining WeeklyDan ParkerNo ratings yet

- Investing in Precious Metals: A Comprehensive Guide to Buying, Storing, and Selling Gold, Silver, and BeyondFrom EverandInvesting in Precious Metals: A Comprehensive Guide to Buying, Storing, and Selling Gold, Silver, and BeyondNo ratings yet

- Nif 0908Document2 pagesNif 0908Om PrakashNo ratings yet

- Market DataDocument2 pagesMarket DataOm PrakashNo ratings yet

- NifDocument2 pagesNifOm PrakashNo ratings yet

- Nif 0708Document2 pagesNif 0708Om PrakashNo ratings yet

- NifDocument2 pagesNifOm PrakashNo ratings yet

- NifDocument2 pagesNifOm PrakashNo ratings yet

- NifDocument2 pagesNifOm PrakashNo ratings yet

- NifDocument2 pagesNifOm PrakashNo ratings yet

- Nifty DataDocument2 pagesNifty DataOm PrakashNo ratings yet

- NiftyDocument2 pagesNiftyOm PrakashNo ratings yet

- NifDocument2 pagesNifOm PrakashNo ratings yet

- BK NifDocument2 pagesBK NifOm PrakashNo ratings yet

- GANN SQUARE For TradersDocument1 pageGANN SQUARE For TradersOm PrakashNo ratings yet

- FearandGreedJPM0922 PDFDocument16 pagesFearandGreedJPM0922 PDFOm PrakashNo ratings yet

- Law 0514Document6 pagesLaw 0514Om PrakashNo ratings yet

- Smithson Rediscovering W.D. Gann - S MethodDocument6 pagesSmithson Rediscovering W.D. Gann - S MethodHarsh DixitNo ratings yet

- NifDocument2 pagesNifOm PrakashNo ratings yet

- Personal Trading BehaviourDocument5 pagesPersonal Trading Behaviourapi-3739065No ratings yet

- 10 Mins 14.11.17Document2 pages10 Mins 14.11.17Om PrakashNo ratings yet

- NifDocument2 pagesNifOm PrakashNo ratings yet

- WD Gann's Mathematical Formula for Market PredictionsDocument10 pagesWD Gann's Mathematical Formula for Market Predictionsjohn2031100% (3)

- Ncdex Sugar Jun Aug2016Document2 pagesNcdex Sugar Jun Aug2016Om PrakashNo ratings yet

- Trading MathDocument29 pagesTrading MathOm Prakash100% (5)

- Trading Doc Market Cycles Fibonacci Gann Elliott Benner Cycles Financial Astrology Philip RioDocument12 pagesTrading Doc Market Cycles Fibonacci Gann Elliott Benner Cycles Financial Astrology Philip Rioapi-373285133% (3)

- Trading Doc Market Cycles Fibonacci Gann Elliott Benner Cycles Financial Astrology Philip RioDocument12 pagesTrading Doc Market Cycles Fibonacci Gann Elliott Benner Cycles Financial Astrology Philip Rioapi-373285133% (3)

- Three Turns On The Pivot Point by William Greenspan PDFDocument4 pagesThree Turns On The Pivot Point by William Greenspan PDFOm Prakash100% (1)

- EvsDocument2 pagesEvsOm PrakashNo ratings yet

- Mathematics of AstrologyDocument37 pagesMathematics of Astrologyxkaliberlord100% (15)

- Emis NoticeDocument1 pageEmis NoticeOm PrakashNo ratings yet

- Requirement of Base Minimum Capital (BMC)Document3 pagesRequirement of Base Minimum Capital (BMC)Om PrakashNo ratings yet

- Economy of The Early Roman EmpireDocument19 pagesEconomy of The Early Roman EmpireDC1992100% (1)

- Ind As 34Document3 pagesInd As 34qwertyNo ratings yet

- ROLLNO-20DM011 Where Were The Board and Its Independent Directors?Document4 pagesROLLNO-20DM011 Where Were The Board and Its Independent Directors?saswat mohantyNo ratings yet

- TYPES OF RISKS EXPLAINEDDocument7 pagesTYPES OF RISKS EXPLAINEDsanu gawaliNo ratings yet

- Tax Law 1 ProjectDocument22 pagesTax Law 1 ProjectJashaswee MishraNo ratings yet

- Cpu May StatmenetDocument122 pagesCpu May StatmenetSolomon TekalignNo ratings yet

- Tradinghub MenteesDocument94 pagesTradinghub MenteesAbdul Rozak (BTN)No ratings yet

- 2024DAO ReportDocument79 pages2024DAO ReportmatyasherrmannNo ratings yet

- BoP Answers: Current Account and UK Trade DeficitDocument1 pageBoP Answers: Current Account and UK Trade DeficitTiffany100% (1)

- Exercise Chapter 14Document9 pagesExercise Chapter 14hassah fahadNo ratings yet

- Foreign ExchangeDocument35 pagesForeign ExchangeHafiz Ahmed33% (3)

- Electric Vehicles OverviewDocument5 pagesElectric Vehicles OverviewHannu JaaskelainenNo ratings yet

- 600136659Document2 pages600136659subhamsavailable4714No ratings yet

- Notepayable QuizDocument5 pagesNotepayable Quizkhalil rebatoNo ratings yet

- Achieving Financial Success: An Essential Guide For Small Business (New Zealand)Document89 pagesAchieving Financial Success: An Essential Guide For Small Business (New Zealand)akita_1610No ratings yet

- GHAILDocument227 pagesGHAILShariful Islam ShaheenNo ratings yet

- WATEENDocument40 pagesWATEENimranbinzakir0% (1)

- Mcq-Income TaxesDocument7 pagesMcq-Income TaxesRandy Manzano100% (1)

- Chapter 6 ParcorDocument10 pagesChapter 6 Parcornikki syNo ratings yet

- Objectives & Functions of IMF: Presented by Swarochis PandeyDocument9 pagesObjectives & Functions of IMF: Presented by Swarochis PandeySwarochis PandeyNo ratings yet

- Benefits of Mutual FundsDocument5 pagesBenefits of Mutual FundschitkarashellyNo ratings yet

- Ligasure Vessel Sealing Generator Service ManualDocument164 pagesLigasure Vessel Sealing Generator Service Manualamson-baluNo ratings yet

- Yes 2015 ProgrammeDocument8 pagesYes 2015 Programmeapi-287998547No ratings yet

- Fact Pack Financial Services KenyaDocument12 pagesFact Pack Financial Services KenyaCatherineNo ratings yet

- UK Taxation GuideDocument26 pagesUK Taxation GuideAnton BessonovNo ratings yet

- 3 - Example Problems Ch. 9 10 1Document35 pages3 - Example Problems Ch. 9 10 1danjay2792100% (9)

- Lecture Notes - Financial Statement AnalysisDocument56 pagesLecture Notes - Financial Statement AnalysisRajnishKumarRohatgiNo ratings yet

- TallyDocument4 pagesTallyNisarg Khamar100% (1)

- New Phil Health Contribution Schedule 2012Document2 pagesNew Phil Health Contribution Schedule 2012Al PendatunNo ratings yet

- Ankur TripathiDocument2 pagesAnkur TripathiThe Cultural CommitteeNo ratings yet