Professional Documents

Culture Documents

On January 2

Uploaded by

Chris Tian FlorendoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

On January 2

Uploaded by

Chris Tian FlorendoCopyright:

Available Formats

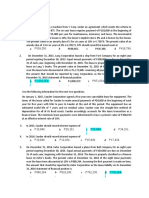

1. On January 2, 2013, Gold Star Leasing Company leases equipment to Brick Co.

with 5

equal annual payments of $80,000 each, payable beginning December 31, 2013. Brick

Co. agrees to guarantee the $50,000 residual value of the asset at the end of the lease

term. Bricks incremental borrowing rate is 10%, however it knows that Gold Stars

implicit interest rate is 8%. What journal entry would Gold Star make at January 2, 2013

assuming this is a directfinancing lease?

PV Annuity Due PV Ordinary Annuity PV Single Sum

8%, 5 periods 4.31213 3.99271 .68508

10%, 5 periods 4.16986 3.79079 .62092

a. Lease Receivable 450,000

Equipment 450,000

b. Lease Receivable 319,416

Loss 130,584

Equipment 450,000

c. Lease Receivable 334,310

Equipment 334,310

d. Lease Receivable 353,671

Equipment 353,671

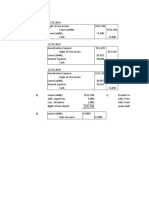

2. Mays Company has a machine with a cost of $600,000 which also is its fair value on the

date the machine is leased to Park Company. The lease is for 6 years and the machine

is estimated to have an unguaranteed residual value of $60,000. If the lessor's interest

rate implicit in the lease is 12%, the six beginning-of-the-year lease payments would be

a. $138,541.

b. $123,698.

c. $117,270.

3. On January 2, 2013, Gold Star Leasing Company leases equipment to Brick Co. with 5

equal annual payments of $80,000 each, payable beginning December 31, 2013. Brick

Co. agrees to guarantee the $50,000 residual value of the asset at the end of the

lease term. Bricks incremental borrowing rate is 10%, however it knows that Gold

Stars implicit interest rate is 8%. What journal entry would Brick Co. make at

December 31, 2013 to record the first lease payment?

PV Annuity Due PV Ordinary Annuity PV Single Sum

8%, 5 periods 4.31213 3.99271 .68508

10%, 5 periods 4.16986 3.79079 .62092

a. Lease Liability 80,000

Cash 80,000

b. Lease Liability 51,706

Interest Expense 28,294

Cash 80,000

c. Lease Liability 46,570

Interest Expense 33,430

Cash 80,000

d. Lease Liability 16,570

Interest Expense 33,430

Cash 50,000

You might also like

- Crypto Cash : 8 top Strategies to Make Money With Cryptocurrency in 2023 to 2024From EverandCrypto Cash : 8 top Strategies to Make Money With Cryptocurrency in 2023 to 2024No ratings yet

- Cape Law: Text and Cases: Contract Law, Tort Law and Real PropertyFrom EverandCape Law: Text and Cases: Contract Law, Tort Law and Real PropertyNo ratings yet

- 23232424Document15 pages23232424JV De Vera100% (1)

- Intacc2-Quiz ExamDocument10 pagesIntacc2-Quiz ExamCmNo ratings yet

- Leases Set CDocument12 pagesLeases Set CbessmasanqueNo ratings yet

- On January 1Document2 pagesOn January 1Chris Tian FlorendoNo ratings yet

- Example Exercise Lease Acctg With AnsDocument28 pagesExample Exercise Lease Acctg With AnsPrince Avena AquinoNo ratings yet

- Far 2 q05 MP Long QuizDocument2 pagesFar 2 q05 MP Long QuizanndyNo ratings yet

- 6988 Finance Lease LesseeDocument2 pages6988 Finance Lease LesseeFREE MOVIESNo ratings yet

- Activity Debt Restructuring LeaseDocument2 pagesActivity Debt Restructuring LeaseLory Dela PeñaNo ratings yet

- Problem 1Document5 pagesProblem 1Garp BarrocaNo ratings yet

- If The Lease Were NonrenewableDocument2 pagesIf The Lease Were NonrenewableChris Tian FlorendoNo ratings yet

- St. Paul University PhilippinesDocument4 pagesSt. Paul University PhilippinesGarp BarrocaNo ratings yet

- 21 Finance Lease LesseeDocument3 pages21 Finance Lease LesseeTinNo ratings yet

- 65Document25 pages65Mark RevarezNo ratings yet

- De Matta, Nicka Suzane-Bsa22a1-Case-Problems-Lease-ModificationsDocument3 pagesDe Matta, Nicka Suzane-Bsa22a1-Case-Problems-Lease-ModificationsNita Costillas De MattaNo ratings yet

- This Study Resource Was: Fellowship Baptist College College of Business and AccountancyDocument5 pagesThis Study Resource Was: Fellowship Baptist College College of Business and AccountancyNah HamzaNo ratings yet

- A Professional Business School Financial Accounting and Reporting Exercises On Leases Finance Lease - LesseeDocument4 pagesA Professional Business School Financial Accounting and Reporting Exercises On Leases Finance Lease - LesseeDaryl Dizon Cabanza100% (1)

- Lobrigas Unit5 Topic1 AssessmentDocument3 pagesLobrigas Unit5 Topic1 AssessmentClaudine LobrigasNo ratings yet

- ACC314 A31 ProblemsDocument12 pagesACC314 A31 ProblemsaceNo ratings yet

- Week 05 2022 Topic 5 Lecture Leases Part CDocument11 pagesWeek 05 2022 Topic 5 Lecture Leases Part CErnest LeongNo ratings yet

- 6833 Finance Lease LesseeDocument2 pages6833 Finance Lease LesseeJeslyn Kris Alobba SaguiboNo ratings yet

- 23 Operating Lease LeasebackDocument3 pages23 Operating Lease LeasebackAllegria AlamoNo ratings yet

- FAR Problem Quiz 2 !Document6 pagesFAR Problem Quiz 2 !Ednalyn CruzNo ratings yet

- Assignment Problems On LeasesDocument4 pagesAssignment Problems On LeasesEllah Sharielle SantosNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument14 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionheyheyNo ratings yet

- Lease Practical Accounting ProblemsDocument2 pagesLease Practical Accounting ProblemsCamille BonaguaNo ratings yet

- Mock Phinma Exam: Intermediate Accounting 3 Name: Date: Section: Rating: General DirectionsDocument16 pagesMock Phinma Exam: Intermediate Accounting 3 Name: Date: Section: Rating: General DirectionsKATHRYN CLAUDETTE RESENTENo ratings yet

- Audprob Answer 9 and 10Document2 pagesAudprob Answer 9 and 10venice cambryNo ratings yet

- MC Questions For LeaseDocument6 pagesMC Questions For LeaseJPNo ratings yet

- SEATWORK 04 - Leases: Multiple ChoiceDocument9 pagesSEATWORK 04 - Leases: Multiple ChoiceLilii DsNo ratings yet

- Ia Vol 2 Chap 10-15Document31 pagesIa Vol 2 Chap 10-15Miko ArniñoNo ratings yet

- Right-of-Use Assets Lease LiabilityDocument10 pagesRight-of-Use Assets Lease LiabilityMoe ChurappiNo ratings yet

- Assignment 02 Leases-SolutionDocument10 pagesAssignment 02 Leases-SolutionJaziel SestosoNo ratings yet

- Tutorial 6 SolutionsDocument5 pagesTutorial 6 SolutionsVanshika TilakNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument15 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionGabrielle100% (1)

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument11 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionGabrielleNo ratings yet

- Week 05 2022 Topic 5 Lecture Leases Part BDocument19 pagesWeek 05 2022 Topic 5 Lecture Leases Part BErnest LeongNo ratings yet

- Financial Accounting and Reporting: 1 Open Preboard Examination, Batch 3Document14 pagesFinancial Accounting and Reporting: 1 Open Preboard Examination, Batch 3Merliza JusayanNo ratings yet

- Icare Far First Preboard Examinations Batch 3Document14 pagesIcare Far First Preboard Examinations Batch 3Merliza Jusayan100% (1)

- Use The Following Information To Answer Items 1 To 4Document4 pagesUse The Following Information To Answer Items 1 To 4Chris Jay LatibanNo ratings yet

- PRELEC1 Final ExamDocument4 pagesPRELEC1 Final ExamAramina Cabigting BocNo ratings yet

- This Study Resource Was: Accounting For BondsDocument4 pagesThis Study Resource Was: Accounting For BondsSeunghyun ParkNo ratings yet

- DocxDocument5 pagesDocxSherri BonquinNo ratings yet

- ACCT203 LeaseDocument4 pagesACCT203 LeaseSweet Emme100% (1)

- St. Mary'S University Department of Accounting Advanced Accounting MID EXAM (30%)Document7 pagesSt. Mary'S University Department of Accounting Advanced Accounting MID EXAM (30%)temedebereNo ratings yet

- Asset For A Period of Time in Exchange For Consideration (IFRS #16)Document6 pagesAsset For A Period of Time in Exchange For Consideration (IFRS #16)Its meh SushiNo ratings yet

- LeasesDocument5 pagesLeasesCamille BacaresNo ratings yet

- This Study Resource Was: F-ACADL-01Document8 pagesThis Study Resource Was: F-ACADL-01Marjorie PalmaNo ratings yet

- PDF Info 1 DLDocument28 pagesPDF Info 1 DLEdrickLouise DimayugaNo ratings yet

- Add'l Problems - Lessee AccountingDocument14 pagesAdd'l Problems - Lessee AccountingPoru Senpii100% (1)

- Financial AccountingDocument7 pagesFinancial AccountingCristineNo ratings yet

- Module 7-Lessee Accounting - (OTHER ACCTG ISSUES)Document10 pagesModule 7-Lessee Accounting - (OTHER ACCTG ISSUES)Jeanivyle CarmonaNo ratings yet

- Bonds Payable 4docx PDF FreeDocument6 pagesBonds Payable 4docx PDF FreeKurumi KunNo ratings yet

- Bonds Payable 4Document6 pagesBonds Payable 4charlene kate bunaoNo ratings yet

- Finance Lease Exercise 1Document13 pagesFinance Lease Exercise 1Jenyl Mae NobleNo ratings yet

- Intacc Finals Sw&QuizzesDocument57 pagesIntacc Finals Sw&QuizzesIris FenelleNo ratings yet

- PF (B) - Compound, Notes, Debt Restruct, LeasesDocument4 pagesPF (B) - Compound, Notes, Debt Restruct, LeasesVencint LaranNo ratings yet

- The Independent Filmmaker's Law and Business Guide: Financing, Shooting, and Distributing Independent and Digital FilmsFrom EverandThe Independent Filmmaker's Law and Business Guide: Financing, Shooting, and Distributing Independent and Digital FilmsRating: 4.5 out of 5 stars4.5/5 (2)

- Mastering Samsung Galaxy - Galaxy S10e, S10, S10 Plus Ultimate User GuideFrom EverandMastering Samsung Galaxy - Galaxy S10e, S10, S10 Plus Ultimate User GuideNo ratings yet

- Ethics EthicsDocument3 pagesEthics EthicsChris Tian FlorendoNo ratings yet

- Medical Ethics Also Enter Into The QuestionDocument2 pagesMedical Ethics Also Enter Into The QuestionChris Tian FlorendoNo ratings yet

- HNSNNRFHDocument4 pagesHNSNNRFHChris Tian FlorendoNo ratings yet

- Ethics Ethics Ethics EthicsDocument3 pagesEthics Ethics Ethics EthicsChris Tian FlorendoNo ratings yet

- FSDHDocument3 pagesFSDHChris Tian FlorendoNo ratings yet

- KDocument4 pagesKChris Tian FlorendoNo ratings yet

- If The Lease Were NonrenewableDocument2 pagesIf The Lease Were NonrenewableChris Tian FlorendoNo ratings yet

- Harter Company Leased Machinery To Stine Company On July 1Document2 pagesHarter Company Leased Machinery To Stine Company On July 1Chris Tian FlorendoNo ratings yet

- 4 VNFCGFKMDocument1 page4 VNFCGFKMChris Tian FlorendoNo ratings yet

- Notes Ayable: Non-Interest Bearing NoteDocument1 pageNotes Ayable: Non-Interest Bearing NoteChris Tian FlorendoNo ratings yet

- If The Lease Were NonrenewableDocument2 pagesIf The Lease Were NonrenewableChris Tian FlorendoNo ratings yet

- Use-Case DiagramDocument1 pageUse-Case DiagramChris Tian FlorendoNo ratings yet

- 3.4 System Design3.4.1 Context DiagramDocument5 pages3.4 System Design3.4.1 Context DiagramChris Tian FlorendoNo ratings yet

- 3.4 System Design3.4.1 Context DiagramDocument1 page3.4 System Design3.4.1 Context DiagramChris Tian FlorendoNo ratings yet

- CH 07 SMDocument34 pagesCH 07 SMChris Tian FlorendoNo ratings yet

- Oil and Gas Roundtable Members 29-5-15Document30 pagesOil and Gas Roundtable Members 29-5-15Quang Huy TrầnNo ratings yet

- Unit 3-Time Value of MoneyDocument12 pagesUnit 3-Time Value of MoneyGizaw BelayNo ratings yet

- Hull OFOD10e MultipleChoice Questions and Answers Ch20Document6 pagesHull OFOD10e MultipleChoice Questions and Answers Ch20Kevin Molly Kamrath0% (1)

- Myntra Designs PVT LTDDocument6 pagesMyntra Designs PVT LTDIndia Business ReportsNo ratings yet

- PMCourse Fall2022-2023 CH3Document35 pagesPMCourse Fall2022-2023 CH3شاكر احمدNo ratings yet

- Lucien Barrière Case We Are in Mid 2010. You Are An Analyst in The M&A Department of A Large InvestmentDocument5 pagesLucien Barrière Case We Are in Mid 2010. You Are An Analyst in The M&A Department of A Large InvestmentZexi WUNo ratings yet

- GEM LOPEZ TransactionsDocument12 pagesGEM LOPEZ TransactionsRon83% (6)

- Q3F - Investment in Associate - 2ndsem 2019-202Document6 pagesQ3F - Investment in Associate - 2ndsem 2019-202Geoff Macarate100% (1)

- Mission Australia Annual Report 2011Document68 pagesMission Australia Annual Report 2011Gaurav NaharNo ratings yet

- Shadow PriceDocument10 pagesShadow PriceMahendra ChhetriNo ratings yet

- Ratio Analysis Notes - SATANDocument26 pagesRatio Analysis Notes - SATANinsomniac_satanNo ratings yet

- 1825872849class Xi Economices PDFDocument89 pages1825872849class Xi Economices PDFSameer BakshiNo ratings yet

- Final ProjectDocument80 pagesFinal ProjectPankaj VyasNo ratings yet

- Sas Customer Intelligence Retail OverviewDocument4 pagesSas Customer Intelligence Retail OverviewJames ChowNo ratings yet

- Bindura Nickel Corporation Limited PDFDocument1 pageBindura Nickel Corporation Limited PDFBusiness Daily ZimbabweNo ratings yet

- International Business EnvironmentDocument305 pagesInternational Business EnvironmentMohak NihalaniNo ratings yet

- C ! ! " # $C$ #%) C (# $C$ #%: M M M ! " # $ % " M$ & $ " MDocument4 pagesC ! ! " # $C$ #%) C (# $C$ #%: M M M ! " # $ % " M$ & $ " MPardeep KumarNo ratings yet

- FINC 430 TA Review Session 1 Solutions: Marco SammonDocument9 pagesFINC 430 TA Review Session 1 Solutions: Marco Sammonishuch24No ratings yet

- Management Discussion and Analysis Disclosure GuideDocument33 pagesManagement Discussion and Analysis Disclosure GuideKetz NKNo ratings yet

- Essay 1: How To Scan For Quality Gold Producers Using Goldnerds ProDocument4 pagesEssay 1: How To Scan For Quality Gold Producers Using Goldnerds PromentorgurusNo ratings yet

- Maskeliya Plantations PLC and Kahawatta Plantations PLC (1199)Document22 pagesMaskeliya Plantations PLC and Kahawatta Plantations PLC (1199)Bajalock VirusNo ratings yet

- Section 112 - Tax On Long-Term Capital GainsDocument2 pagesSection 112 - Tax On Long-Term Capital GainsParth UpadhyayNo ratings yet

- $ocia Curre Curre AL Ency Ency: Why Brands Need To Build Need To Build and Nurture Social CurrencyDocument35 pages$ocia Curre Curre AL Ency Ency: Why Brands Need To Build Need To Build and Nurture Social Currencyapi-26213054No ratings yet

- Joint Ventures in Construction Firms in Saudi ArabiaDocument18 pagesJoint Ventures in Construction Firms in Saudi ArabiaEngrAbeer ArifNo ratings yet

- Rothschild - The Hidden Sovereign Power Behind BISDocument1 pageRothschild - The Hidden Sovereign Power Behind BISquartzstatisticsNo ratings yet

- A Project Report ON "Indian Banking System"Document34 pagesA Project Report ON "Indian Banking System"Prasant SamantarayNo ratings yet

- Stakeholder Relations Guideline 2012 en (FMGT)Document4 pagesStakeholder Relations Guideline 2012 en (FMGT)SalmaAlnofaliNo ratings yet

- Summary Chapter 8Document6 pagesSummary Chapter 8Zahidul AlamNo ratings yet

- Exploring The Viability of Equity Crowdfunding As A Fundraising Instrument 2019Document9 pagesExploring The Viability of Equity Crowdfunding As A Fundraising Instrument 2019Raphael_BragaNo ratings yet

- Novation of ContractDocument2 pagesNovation of ContractZaman Ali100% (1)