Professional Documents

Culture Documents

1

Uploaded by

tengkukieyraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1

Uploaded by

tengkukieyraCopyright:

Available Formats

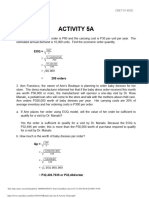

PAM3033 MANAGEMENT ACCOUNTING II

CHAPTER 3: STANDARD COSTING AND VARIANCE ANALYSIS

Amber Sdn Bhd manufactures a single product known as XY. The product requires a single operation and the standard cost

for this operation is given in a standard cost card below:

Standard cost card for XY

Direct materials: RM

2 kg of A at RM1.00 per kg 2.00

1 kg of B at RM3.00 per kg 3.00

Direct labour (3 hours at RM3.00 per hour) 9.00

Variable overhead (3 hours at RM2.00 per DLH) 6.00

Total standard variable cost 20.00

Standard contribution margin 20.00

Standard selling price 40.00

Amber plans to produce 10,000 units of XY in April and the budgeted costs based on the information contained in the standard

cost card as follows:

RM RM RM

Sales 400,00.00

Direct materials:

A (20,000 kg at RM1.00 per kg) 20,000.00

B (10,000 kg at RM3.00 per kg) 30,000.00 50,000.00

Direct labour 90,000.00

(30,000 hours at RM3.00 per hour)

Variable overheads

(30,000 hours at RM2.00 per DLH) 60,000.00 200,000.00

Budgeted contribution 200,000.00

Fixed overheads 120,000.00

Budgeted profit 80,000.00

Annual budgeted fixed overheads are RM1,440,000.00 and are assumed to be incurred evenly throughout the year. Amber

uses a variable costing system for internal profit measurement purposes.

The actual results for April were:

RM RM

Sales (9,000 units at RM42.00) 378,000.00

Direct materials:

A (19,000 kg at RM1.10 per kg) 20,900.00

B (10,100 kg at RM2.80 per kg) 28,280.00

Direct labour (28,500 hours at RM3.20 per hour) 91,200.00

Variable overheads 52,000.00 192,380.00

Contribution margin 185,620.00

Fixed overheads 116,000.00

Profit 69,620.00

Manufacturing overheads are charged to production on the basis of direct labour hours. Actual production and sales for the

period were 9,000 units.

Required:

(a) Prepare all relevant variances

(b) Prepare an operating statement which reconciles the actual with the budgeted profits

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Petries Case StudyDocument3 pagesPetries Case Studytengkukieyra67% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- TEMPLATE EXCEL Material Requirement PlanningDocument6 pagesTEMPLATE EXCEL Material Requirement PlanningYakinnNo ratings yet

- Case 3 - TransmileDocument16 pagesCase 3 - TransmileSumirah Maktar100% (1)

- Case 3 - TransmileDocument16 pagesCase 3 - TransmileSumirah Maktar100% (1)

- 01 BE AccountingDocument20 pages01 BE AccountingKhadeer Akbar100% (1)

- Introduction to Cost Accounting FundamentalsDocument21 pagesIntroduction to Cost Accounting FundamentalsLeslieNo ratings yet

- Determinants of Cash Waqf Giving in MalaysiaDocument15 pagesDeterminants of Cash Waqf Giving in MalaysiatengkukieyraNo ratings yet

- 5 - Nur Shahida Binti Ab FatahDocument9 pages5 - Nur Shahida Binti Ab FatahtengkukieyraNo ratings yet

- Internal Liquidity RatiosDocument6 pagesInternal Liquidity RatiostengkukieyraNo ratings yet

- Internal ProcessDocument1 pageInternal ProcesstengkukieyraNo ratings yet

- AssignmentDocument2 pagesAssignmenttengkukieyraNo ratings yet

- Astro + MediaDocument3 pagesAstro + Mediatengkukieyra0% (1)

- Astro + MediaDocument3 pagesAstro + Mediatengkukieyra0% (1)

- ConvertDocument122 pagesConverttengkukieyraNo ratings yet

- ManAcc 6e Solutions Ch031Document40 pagesManAcc 6e Solutions Ch031Abir AllouchNo ratings yet

- Syllabus: Managerial AccountingDocument7 pagesSyllabus: Managerial AccountingAnonymous EAhdEfPK0kNo ratings yet

- Kuis UTS Genap 21-22 ACCDocument3 pagesKuis UTS Genap 21-22 ACCNatasya FlorenciaNo ratings yet

- Target CostDocument6 pagesTarget CostZoya KhanNo ratings yet

- Part 1 - Section D Cost Management 1.1 Cost Drivers and Cost FlowsDocument114 pagesPart 1 - Section D Cost Management 1.1 Cost Drivers and Cost FlowsGaleli PascualNo ratings yet

- Managerial Accounting Exam CHDocument17 pagesManagerial Accounting Exam CH808kailuaNo ratings yet

- FM 2 ADocument150 pagesFM 2 APurnima KapoorNo ratings yet

- CVP AnalysisDocument11 pagesCVP AnalysisVincent Gazo SanchezNo ratings yet

- Multiple Choice Questions ReviewDocument46 pagesMultiple Choice Questions ReviewMarylorieanne CorpuzNo ratings yet

- Thirty Percent of Overhead Is Fixed at Any Production Level From 80,000 Units To 90,000 Units The Remaining 70% of Annual Overhead Cost Are Variable With Respect To VolumeDocument14 pagesThirty Percent of Overhead Is Fixed at Any Production Level From 80,000 Units To 90,000 Units The Remaining 70% of Annual Overhead Cost Are Variable With Respect To Volume?????50% (2)

- MAS Quizzers Problems and Theories (Special Handouts)Document62 pagesMAS Quizzers Problems and Theories (Special Handouts)RodNo ratings yet

- Benefits For Finance MOVEMENT To S4HANA - Partners (June 2020)Document50 pagesBenefits For Finance MOVEMENT To S4HANA - Partners (June 2020)Amit ShindeNo ratings yet

- Exam MGTDocument4 pagesExam MGTGab IgnacioNo ratings yet

- CAC 2 Practice Questions 1Document1 pageCAC 2 Practice Questions 1Sheena Gallentes LeysonNo ratings yet

- 4 Inventory Planning and ControlDocument55 pages4 Inventory Planning and ControlSandeep SonawaneNo ratings yet

- Management Advisory Services (Mas)Document9 pagesManagement Advisory Services (Mas)Gelliza Mae MontallaNo ratings yet

- Chapter 6 CVPDocument81 pagesChapter 6 CVPPrometheus SmithNo ratings yet

- Ramiro__Jan_Luis_N.___Activity_5A.docx.pdf (2)Document7 pagesRamiro__Jan_Luis_N.___Activity_5A.docx.pdf (2)Aubrey Shaiyne OfianaNo ratings yet

- b392 Tma - Summer 2023 - QQQQDocument5 pagesb392 Tma - Summer 2023 - QQQQadel.dahbour97No ratings yet

- for Overhead Costs Case StudyDocument14 pagesfor Overhead Costs Case Studypawangadiya1210No ratings yet

- Types of Business According To Activities: Prepared By: Prof. Jonah C. PardilloDocument60 pagesTypes of Business According To Activities: Prepared By: Prof. Jonah C. PardilloShaneil MatulaNo ratings yet

- Chapter 1 - FAR ReviewerDocument4 pagesChapter 1 - FAR ReviewerRei LeeNo ratings yet

- CH 06Document180 pagesCH 06C14041159王莫堯No ratings yet

- Monkey Company profitability analysis and break-even pointsDocument6 pagesMonkey Company profitability analysis and break-even pointsJasmineNo ratings yet

- Managerial Accounting Canadian 11th Edition Garrison Test BankDocument35 pagesManagerial Accounting Canadian 11th Edition Garrison Test Bankdeandavidsontldp100% (23)

- Penerapan Modul Inventory Dalam Penyajian Laporan Persediaan Bahan BakuDocument11 pagesPenerapan Modul Inventory Dalam Penyajian Laporan Persediaan Bahan BakuGedeon Budi PrasetyoNo ratings yet

- Cost SheetDocument10 pagesCost SheetAmanNo ratings yet