Professional Documents

Culture Documents

Unit of Study Outline: Fixed Income Securities

Uploaded by

arnoldbronsonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit of Study Outline: Fixed Income Securities

Uploaded by

arnoldbronsonCopyright:

Available Formats

BUSINESS SCHOOL

Unit of Study Outline

Unit Code FINC3019

Unit Title Fixed Income Securities

Semester 2, 2017

Pre-requisite Units: (FINC2012 or FINC2002) or (FINC2013 or FINC2003) or (FINC2014 or FINC2004)

Co-requisite Units:

Prohibited Units:

Assumed Knowledge and/or Skills: Basic Probability and Statistical Theory, Calculus, Basic Working

Knowledge of Excel

Unit Coordinator: Dr Richard Philip

Address: Room 415, The Business School Building(H69), Darlington NSW 2008

Email: richard.philip@sydney.edu.au Phone: 91140578

Consultation Hours: Friday 9-10 during teaching weeks

Class Day(s): Lecture: Wednesday 12:00-14:00 Tutorials: Refer to timetable

Required Text / Resources:

Fabozzi F.J. (2012) Bond Markets, Analysis and Strategies (8th Edition), Pearson Education.

This unit of study outline MUST be read in conjunction with

The Business School Unit of Study Common Policy and implementation information that applies to every unit of study offered by the

Business School (http://sydney.edu.au/business/currentstudents/policy). All assessment rules, such as standards used, penalties etc, are

covered.

The Business School Student Administration Manual - for information about all processes such as illness, appeals etc (

http://sydney.edu.au/business/currentstudents/student_information/student_administration_manual) When deciding applications and

appeals relating to these matters it will be assumed that every student has taken the time to familiarise themselves with these key policies

and procedures.

The Business School seeks feedback from students and staff in order to continually improve all units offered. For information on previously

collected feedback and innovations made in response to this feedback, please see

http://sydney.edu.au/business/learning/planning_and_quality/feedback/student

1. Unit of Study Information

This unit is designed to provide a thorough grounding in fixed income securities, bond portfolio analysis and the

use of closely related financial instruments in risk management. The unit begins with the basic analytical

framework necessary to understand the pricing of bonds and their investment characteristics (introducing

fundamental concepts such as duration, yield and term structure). This provides the building blocks for analysis of

more complicated corporate and derivative securities. Sectors of the debt market, including treasury securities,

corporate bonds, mortgage-backed securities, and convertible bonds are analysed. The use of derivatives and a

selection of special topics in fixed income are also discussed.

Version: 2017 Business School 1

BUSINESS SCHOOL

2. Program Learning Outcomes and Unit Learning Outcomes

The Program Learning Outcomes for this Program are located at

http://sydney.edu.au/business/about/accreditations/AoL

Unit Learning Outcomes

Unit Learning Outcomes Program Learning Outcomes

On the successful completion of the Unit you should be able to:

Articulate the recent developments and innovation in the fixed income area. 1. Business Knowledge

4. Communication

Identify and understand the function of fixed income markets and their role 1. Business Knowledge

in the economy. 2. Critical Thinking

Explain the dynamics of interest rates and their term structure and relate 1. Business Knowledge

them to the pricing of fixed income securities. 2. Critical Thinking

3. Business Analysis and

Problem-Solving

4. Communication

Analyse the principles of bond portfolio's and explain their management. 1. Business Knowledge

2. Critical Thinking

3. Business Analysis and

Problem-Solving

Apply theory to the management of the risk inherent in fixed income 1. Business Knowledge

securities, derivatives and portfolios. 2. Critical Thinking

3. Business Analysis and

Problem-Solving

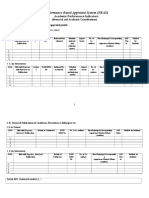

3. Assessment

Program

Assessment Individual/ Assessment Learning

Length Weight Due Time Due Date Closing Date

Name Group Conditions Outcomes

Assessed

Mid-semester

Individual Compulsory 2, 3 1 hour 25% 12:00pm 20-Sep-2017 20-Sep-2017

Exam

Group 12

Group Compulsory 2, 4, 5 25% 4:00pm 16-Oct-2017 26-Oct-2017

Assignment pages

2.5 Final Exam Final Exam

Final Exam Individual Compulsory 2, 3 50%

hours Period Period

Academic

Week 4

Honesty

For the meaning and operation of this table, see policy information in the box on the front page or click here

Assessment details

Mid-semester Exam

Task Description

The objective of the mid-semester exam is to motivate you to regularly revise the course material and to

complete the tutorial questions. The exam will provide you with feedback on your performance over the first 4

weeks of the course. The test will be 1 hour in duration and will be held in Week 8 in class. It will examine all

material covered in Weeks 1 to 4

Assessment Criteria

1. Attention to purpose

2. Use of literature/ Knowledge of theory

3. Analysis

Version: 2017 Business School 2

BUSINESS SCHOOL

4. Problem solving

5. Conceptualisation

6. Critical reasoning / critical thinking

7. Time management/self management

Feedback - What, when and how feedback will be provided for this assessment

Worked solutions presented in Lectures

Group Assignment

Task Description

Students will be required to form groups of 2-3 and conduct a study of fixed income markets with the goal of

forming a bond portfolio from a range of individual fixed income securities. The particular details of the project

will be posted on blackboard in the first few weeks of the semester. The assigment will be submitted via

turnitin

Assessment Criteria

1. Conforming with instructions (e.g. word length, font, other instructions)

2. Presentation, communication & style (written)

3. Clarity of expression (incl. accuracy, spelling, grammar, punctuation)

4. Attention to purpose

5. Use of literature/ Knowledge of theory

6. Methodology used is the most appropriate to the aims and objectives of the task

7. Data/information gathering/processing

8. Context in which subject is used

9. Analysis

10. Critical reasoning / critical thinking

Feedback - What, when and how feedback will be provided for this assessment

Marked assignments with comments will be available for collection. Disussion of what was required for top

marks will be presented in lectures

Final Exam

Task Description

This will be a closed-book examination of two hours duration held during the Examination Period. The

questions will cover the entire 13 weeks of the course. Further administrative details on the final exam will be

provided in Week 13.

Assessment Criteria

1. Presentation, communication & style (written)

2. Attention to purpose

3. Use of literature/ Knowledge of theory

4. Methodology used is the most appropriate to the aims and objectives of the task

5. Analysis

6. Problem solving

7. Conceptualisation

8. Critical reasoning / critical thinking

9. Time management/self management

Version: 2017 Business School 3

BUSINESS SCHOOL

Feedback - What, when and how feedback will be provided for this assessment

Final marks released subject to the University policy and timetable arrangement. The final exam will be

available for review during the exam review period.

4. Other Resources for Students

All lectures and seminars are recorded and will be available within Blackboard for student use. Please note the

Business School does not own the system and cannot guarantee that the system will operate or that every

class will be recorded. Students should ensure they attend and participate in all classes.

The following books are on library reserve and may help you in your study of Fixed Income Securities:

* Sundaresan, S. (2009) Fixed Income Markets and Their Derivatives, 3rd edition, Academic Press

* Martellini, L., P. Priaulet and S. Priaulet (2003) Fixed Income Securities: Valuation, Risk Management, and

Portfolio Strategies, John Wiley [also available online via the library catalogue]

* Hull, J. (2009) Options, Futures and Other Derivatives, 7th Edition, Pearson Prentice Hall

Academic articles, supplementary materials and readings will be provided on blackboard

http://bonds.about.com/?once=true http://www.bondresources.com/

http://www.bondsonline.com/

http://www.investinginbonds.com/

http://www.bloomberg.com/news/bonds/

Version: 2017 Business School 4

BUSINESS SCHOOL

5. Unit Schedule

Week List of Topics Assessments Due

1

Introduction - The Fixed Income Market

31 Jul 2017

2

Pricing Basic Bonds: The Relationship Between Prices and Yields

7 Aug 2017

3

Bond Price Volatility: Duration and Convexity

14 Aug 2017

4

The Term Structure of Interest Rates: Modelling the Yield Curve

21 Aug 2017

5

Bond Portfolio Management 1

28 Aug 2017

6

Bond Portfolio Management 2 / Bloomberg Labs 1

4 Sep 2017

7

Bloomberg Labs 2

11 Sep 2017

8 Mid Semester Test

Mid Semester Exam

18 Sep 2017 during class

Common week 25 Sep to 1 Oct

9

Securitization Part I

2 Oct 2017

10

Securitization Part II

9 Oct 2017

11

Interest Rate Derivatives

16 Oct 2017

12

Bonds with embedded options/Guest Lecture Assignment is due

23 Oct 2017

13 Credit Default Swaps

30 Oct 2017 Review Lecture

Version: 2017 Business School 5

You might also like

- Dr. Carl E. Balita Review CenterDocument12 pagesDr. Carl E. Balita Review CenterJoy Navales100% (1)

- QBUS2820 UoS Outline S2 2017Document7 pagesQBUS2820 UoS Outline S2 2017Ryan LinNo ratings yet

- USYD Marketing Course OutlineDocument6 pagesUSYD Marketing Course OutlineEkant SharmaNo ratings yet

- Unit of Study Outline: Predictive AnalyticsDocument7 pagesUnit of Study Outline: Predictive AnalyticsDarius ZhuNo ratings yet

- AA Guide For 2021Document98 pagesAA Guide For 2021clevermathematicsNo ratings yet

- William UryDocument21 pagesWilliam UryCristian Catalina100% (2)

- 1968 Patchogue-Medford High Yearbook - Part 3 - Senior Memories and Ads, Also Entire 1967-68 Class Roster Including Non-GradsDocument76 pages1968 Patchogue-Medford High Yearbook - Part 3 - Senior Memories and Ads, Also Entire 1967-68 Class Roster Including Non-GradsJoseph ReinckensNo ratings yet

- FINC6021 S2 2018 Updated - Approved-1Document7 pagesFINC6021 S2 2018 Updated - Approved-1hung nguyenNo ratings yet

- Uos Outline Mktg1001 Sem1 2017Document7 pagesUos Outline Mktg1001 Sem1 2017asdfdasfNo ratings yet

- MFIN6205 Financial Risk Management For Financial Instutions S22017Document8 pagesMFIN6205 Financial Risk Management For Financial Instutions S22017SriHariKalyanBNo ratings yet

- Bus222 S19 PDFDocument21 pagesBus222 S19 PDFIkonic Yiu YiuNo ratings yet

- Lahore University of Management Sciences DISC 230 - Introduction To Business Process ModelingDocument6 pagesLahore University of Management Sciences DISC 230 - Introduction To Business Process ModelingSubhan SohailNo ratings yet

- MFIN6201 Empirical Techniques and Application in Finance S12017Document16 pagesMFIN6201 Empirical Techniques and Application in Finance S12017Sam TripNo ratings yet

- RPS Manajemen Keuangan 1 - 2021 - EngDocument13 pagesRPS Manajemen Keuangan 1 - 2021 - EngAisyah RianiNo ratings yet

- UoS Outline FINC3011 SEM1 2014Document5 pagesUoS Outline FINC3011 SEM1 2014SweetCherrieNo ratings yet

- UoS Outline FINC2011 SEM2 2014 ApprovedDocument6 pagesUoS Outline FINC2011 SEM2 2014 ApprovedericaNo ratings yet

- MAC Course OutlineDocument8 pagesMAC Course OutlineAliza RizviNo ratings yet

- Principles of Financial AccountingDocument7 pagesPrinciples of Financial AccountingmfaizanzahidNo ratings yet

- Lahore University of Management Sciences DISC 230: Operations ManagementDocument6 pagesLahore University of Management Sciences DISC 230: Operations ManagementammadNo ratings yet

- Lahore University of Management Sciences ACCT 321 Advance Financial ReportingDocument5 pagesLahore University of Management Sciences ACCT 321 Advance Financial ReportingusamaNo ratings yet

- Course Structure Micro EconomicsDocument8 pagesCourse Structure Micro EconomicsAKASH KULSHRESTHANo ratings yet

- MARK5813 Creativity and Innovation in Marketing S22016Document14 pagesMARK5813 Creativity and Innovation in Marketing S22016Klara BicanovaNo ratings yet

- ACCT320 CFR-2 Course Outline Spring 2020Document7 pagesACCT320 CFR-2 Course Outline Spring 2020Waris AliNo ratings yet

- ACCT 321-Advance Financial-Atifa Arif DarDocument6 pagesACCT 321-Advance Financial-Atifa Arif DarmonimawadNo ratings yet

- DISC 230 - Operations Management - S 21-22Document7 pagesDISC 230 - Operations Management - S 21-22sameerNo ratings yet

- FINS5531 Risk and Insurance S12014Document17 pagesFINS5531 Risk and Insurance S12014ravi vaidyaNo ratings yet

- 0450 Learner GuideDocument38 pages0450 Learner GuidePhoebeNo ratings yet

- ACCT 221-Corporate Financial Reporting-Atifa Arif Dar-Waqar AliDocument7 pagesACCT 221-Corporate Financial Reporting-Atifa Arif Dar-Waqar AliAbdelmonim Awad OsmanNo ratings yet

- ACCT220 CFR-1 OutlineDocument6 pagesACCT220 CFR-1 OutlineReward IntakerNo ratings yet

- DISC 321-Decision Analysis-Kamran Ali ChathaDocument9 pagesDISC 321-Decision Analysis-Kamran Ali ChathaAdil AshrafNo ratings yet

- ACCT 411-Applied Financial Analysis-Atifa Arif DarDocument5 pagesACCT 411-Applied Financial Analysis-Atifa Arif Darnetflix accountNo ratings yet

- Unit Outline: BUS301 - Integrated Capstone ProjectDocument17 pagesUnit Outline: BUS301 - Integrated Capstone ProjectMutugi GeorgeNo ratings yet

- FINS3625 Course OutlineDocument17 pagesFINS3625 Course OutlineNormanMichaelNo ratings yet

- Financial Accounting and Information Systems: Class MBADocument6 pagesFinancial Accounting and Information Systems: Class MBADaniyal JunaidNo ratings yet

- ACCT 220-Corporate Financial Reporting - I-Atifa Arif DarDocument7 pagesACCT 220-Corporate Financial Reporting - I-Atifa Arif Darnetflix accountNo ratings yet

- DISC 322-Optimization Methods For Management Science - Sec 2 - Dr. Muhammad Tayyab - Spring 2020 PDFDocument6 pagesDISC 322-Optimization Methods For Management Science - Sec 2 - Dr. Muhammad Tayyab - Spring 2020 PDFMuhammad UsmanNo ratings yet

- Lahore University of Management Sciences ACCT-411 Applied Financial AnalysisDocument7 pagesLahore University of Management Sciences ACCT-411 Applied Financial AnalysisusamaNo ratings yet

- Applied Corporate FinanceDocument8 pagesApplied Corporate FinanceSafi Ullah KhanNo ratings yet

- Entrepreneurship - Course Outline 11022021 095100amDocument7 pagesEntrepreneurship - Course Outline 11022021 095100amAymenNo ratings yet

- Strategic MGT (Course Module)Document7 pagesStrategic MGT (Course Module)D Attitude KidNo ratings yet

- MGT 510 Strategic Management Module 3, 2017-2018: DraftDocument9 pagesMGT 510 Strategic Management Module 3, 2017-2018: DraftKlaudia TadejkoNo ratings yet

- Lahore University of Management Sciences ACCT 100 - Principles of Financial AccountingDocument6 pagesLahore University of Management Sciences ACCT 100 - Principles of Financial AccountingAli Zain ParharNo ratings yet

- Lahore University of Management Sciences MGMT 400 - Strategic Business ManagementDocument5 pagesLahore University of Management Sciences MGMT 400 - Strategic Business Managementsultan siddiquiNo ratings yet

- ECON6003 Course SyllabusDocument10 pagesECON6003 Course SyllabusAlison LimNo ratings yet

- MGMT 400-Strategic Business Management-Adnan ZahidDocument5 pagesMGMT 400-Strategic Business Management-Adnan ZahidWaleed AhmadNo ratings yet

- Financial Management Notes and ReviewerDocument4 pagesFinancial Management Notes and ReviewerEzio Paulino100% (1)

- ACCT 352-Advanced Auditing-Waqar AliDocument8 pagesACCT 352-Advanced Auditing-Waqar AlimonimawadNo ratings yet

- Amended BMP5006 Module GuideDocument15 pagesAmended BMP5006 Module GuideShawn MatNo ratings yet

- ACCT 411-Applied Financial Analysis-Arslan Shahid Butt PDFDocument7 pagesACCT 411-Applied Financial Analysis-Arslan Shahid Butt PDFAbdul Basit JavedNo ratings yet

- Course OutlineDocument15 pagesCourse OutlineManraj LidharNo ratings yet

- FINN 400 Outline Fall 2020Document8 pagesFINN 400 Outline Fall 2020Zahra EjazNo ratings yet

- ECON2126 Principles of Experimental and Behavioural EconomicsDocument9 pagesECON2126 Principles of Experimental and Behavioural EconomicsdeepdbitNo ratings yet

- Strategic Management Syllabus - Fall 2023Document7 pagesStrategic Management Syllabus - Fall 2023saharsaleem140No ratings yet

- 2019 2020 Obe Syllabus in Monetary PolicyDocument6 pages2019 2020 Obe Syllabus in Monetary PolicySophiaEllaineYanggatLopezNo ratings yet

- ACCT 220-Corporate Financial Reporting-I-Samia AliDocument9 pagesACCT 220-Corporate Financial Reporting-I-Samia Alinetflix accountNo ratings yet

- Đề Cương - Tiếng ANH - KTQT II - CTTTDocument7 pagesĐề Cương - Tiếng ANH - KTQT II - CTTTduong leNo ratings yet

- PDFDocument7 pagesPDFmayamenonNo ratings yet

- Cases & Projects SyllabusDocument6 pagesCases & Projects Syllabus1062211791No ratings yet

- FINC2012 UoS OutlineDocument7 pagesFINC2012 UoS OutlineRyan LinNo ratings yet

- DISC 230 - Introduction To Business Process Modelling - S - 19-20 RevisedDocument6 pagesDISC 230 - Introduction To Business Process Modelling - S - 19-20 RevisedWaris AliNo ratings yet

- MKTG 3000 Course Outline 2023 - 2024Document9 pagesMKTG 3000 Course Outline 2023 - 2024Britney BissambharNo ratings yet

- ACCT221 CFR-1 Outline Fall 2019 - FinalDocument7 pagesACCT221 CFR-1 Outline Fall 2019 - FinalWaris AliNo ratings yet

- ACCT 100 POFA Course Outline Fall Semester 2022-23Document6 pagesACCT 100 POFA Course Outline Fall Semester 2022-23MuhammadNo ratings yet

- How to Practice Before Exams: A Comprehensive Guide to Mastering Study Techniques, Time Management, and Stress Relief for Exam SuccessFrom EverandHow to Practice Before Exams: A Comprehensive Guide to Mastering Study Techniques, Time Management, and Stress Relief for Exam SuccessNo ratings yet

- The Gradual Release of Responsibility ModelDocument9 pagesThe Gradual Release of Responsibility Modeljohn sommerfeldNo ratings yet

- Lesson Planning-Teaching PracticeDocument11 pagesLesson Planning-Teaching PracticeRamatoulaye TouréNo ratings yet

- Jean PiagetDocument7 pagesJean Piagetsanjay_vany100% (1)

- ACU LESSON PLAN - Victorian Curriculum 1Document3 pagesACU LESSON PLAN - Victorian Curriculum 1api-512914640No ratings yet

- TTT Presentation Skills Workbook PDFDocument61 pagesTTT Presentation Skills Workbook PDFgopalranjan_2000939No ratings yet

- Descriptions of All Courses in The ProgramDocument139 pagesDescriptions of All Courses in The ProgramHoai NhiNo ratings yet

- Session F-2 - Statistics and Probability For Middle-School Math Te PDFDocument25 pagesSession F-2 - Statistics and Probability For Middle-School Math Te PDFFloravy Dimple Baisac ParantarNo ratings yet

- 3MS Teacher - S Guide 2017-2018 PDFDocument31 pages3MS Teacher - S Guide 2017-2018 PDFEli NeNo ratings yet

- Action Plan - Shs - FilipinoDocument2 pagesAction Plan - Shs - FilipinoGil Mark Coleta CalmaNo ratings yet

- PBAS Proforma - Academic Performance Indicators (Research and Academic Contributions)Document15 pagesPBAS Proforma - Academic Performance Indicators (Research and Academic Contributions)ajaymechengineerNo ratings yet

- Letter From LysandraDocument1 pageLetter From Lysandraapi-513508097No ratings yet

- Suggestopedia: Made by Kryvonis Kateryna 3 Year Student, Filol2018-2Document15 pagesSuggestopedia: Made by Kryvonis Kateryna 3 Year Student, Filol2018-2Катя КривоносNo ratings yet

- CV - Danielle BerkelmansDocument3 pagesCV - Danielle Berkelmansapi-228252473No ratings yet

- Main Differences Between Teaching ApproachesDocument3 pagesMain Differences Between Teaching ApproachesYnah ElladoNo ratings yet

- Lesson Plan: Cont Ent Teachi NG A I Aids Teacher Topic Skill Level Date No. of Students Lesson AimsDocument7 pagesLesson Plan: Cont Ent Teachi NG A I Aids Teacher Topic Skill Level Date No. of Students Lesson AimsAidok100% (1)

- Sreb College Ready Literacy Course OverviewDocument1 pageSreb College Ready Literacy Course Overviewapi-373506180No ratings yet

- Skills Needs For The ICT Sector in Tanzania - PRDocument16 pagesSkills Needs For The ICT Sector in Tanzania - PRAbu Khami SombeNo ratings yet

- 2 Day FDP BrochureDocument2 pages2 Day FDP BrochureBhargav ReddyNo ratings yet

- Continuous Time Control Course As OfferedDocument9 pagesContinuous Time Control Course As OfferedsabrahimaNo ratings yet

- VisualSpeller by Garborro.D (2011)Document52 pagesVisualSpeller by Garborro.D (2011)LydiaRyooNo ratings yet

- Curriculum Vitae - Model CVDocument2 pagesCurriculum Vitae - Model CVValentin Ionut PopaNo ratings yet

- Australian Police Management Education and Research: A Comment From ''Outside The Cave''Document19 pagesAustralian Police Management Education and Research: A Comment From ''Outside The Cave''Livia MarsaNo ratings yet

- Tulong-Dunong: Simplified Lesson PlanDocument2 pagesTulong-Dunong: Simplified Lesson PlanWinky Cansancio CabatinganNo ratings yet

- UT Dallas Syllabus For Chem1311.004.07f Taught by Sandhya Gavva (Sgavva)Document6 pagesUT Dallas Syllabus For Chem1311.004.07f Taught by Sandhya Gavva (Sgavva)UT Dallas Provost's Technology GroupNo ratings yet

- Humanism PDFDocument7 pagesHumanism PDFGiacomo FigaroNo ratings yet

- Lesson Plans - Catholic Schools' Week - Jan 29-Feb 3Document2 pagesLesson Plans - Catholic Schools' Week - Jan 29-Feb 3Christi TorralbaNo ratings yet