Professional Documents

Culture Documents

Quiz 3B B2012 Monetary

Uploaded by

Anonymous njZRxRCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz 3B B2012 Monetary

Uploaded by

Anonymous njZRxRCopyright:

Available Formats

Monetary Economics (Quiz 3B)

Lahore School of Economics

Monetary Economics

Winter Term, 2012

Quiz 3B: B.Sc. III Suggested Solutions

Instructions:

Answer all questions in the spaces provided below. For full marks, make sure you write all

relevant points and do all necessary calculations. Pencils, pens, rulers, etc. cannot be shared

and cell phones cannot be used during the session.

Exchange of quiz versions will not be tolerated at any cost and any ONE exchange caught

would lead to cancelation of ALL the quizzes. The case would immediately be reported to the

disciplinary committee.

Total points for the quiz: 50

Question 1

Elaborate in detail the New Keynesian Aggregate Supply Curve. How does that refute the

claim of New Classical economics that anticipated policies are ineffective? (10 points)

It begins from the assumption of a fixed 2-year contract of the employed workers. Half of the

labor force is recruited in Year t (they negotiate the nominal wages based on information till

t-1) and the other half is recruited in year t+1 (they negotiate the nominal wages based on

information till t). As contracts expire after two years respectively for both groups, there is an

overlapping of contracts in the Year t+1. Nominal wages in Year t+1 are equal to wages of

ALL the labor force (hired in t and t+1).

Wt+1 = ( t-1Wt + tWt+1) read as wages of the group hired in Year t who negotiated wage

contract using information in t-1 PLUS wages of the group hired in Year t+1 who negotiated

wage contract using information in t

And to determine real wages, expected price level for Year t+1 is predicted in respective time

periods by both groups separately:

t-1Wt = Et-1 Pt+1 expectations about Year t+1 price level is made in Year t-1 by those hired in

year t

Lahore School Of Economics Page 1 of 4

Monetary Economics (Quiz 3B)

tWt+1 = Et Pt+1 expectations about Year t+1 price level is made in Year t by those hired in

Year t+1

Hence, nominal wages become a function of price level: Wt+1 = (Et-1 Pt+1 + Et Pt+1)

Aggregate supply is a function of real wages. New Keynesian Supply Curve says that if the real

wage is zero (i.e. W P = 0), Y = Y*. If real wage increases (W > P), firms cost of production rises

and that reduces Y from Y* by the factor of . Similarly, lower real wages (W < P) would

increase output from Y* by the same parameter.

Yt+1 = Y* (Wt+1 Pt+1)

The equation of Wt+1 is substituted in the AS curve and simplified version shows that:

(derivation not required):

Yt+1 = Y*+ /2 (Pt+1 Et-1 Pt+1) + /2 (Pt+1 Et Pt+1)

If an anticipated monetary policy shock occurs in Year t, Pt+1 would be different than Et-1 Pt+1 (in

red font). Group of workers recruited in Year t despite being rational individuals cant do

anything about it as they have a fixed contract till Year t+1. Although they accurately predict

that because of a shock in Year t, price level in Year t+1 would come out to be different than

expected price level as only the information till Year t-1 was incorporated while negotiating

the contract and shock occurred in next year, they cant ask for a different nominal wage right

after the shock has occurred. Any anticipated shock in Year t would thus cause a disturbance

in the real wage, Wt+1 Pt+1 0 for workers hired in Year t. However, the workers hired in Year

t+1 would update their expectations after the anticipated shock in Year t and formulate an

efficient contract which would equate actual and predicted price levels in Year t+1 or P t+1 = Et

Pt+1 and real wage, Wt+1 Pt+1 = 0.

Thus, it can be concluded that so long as contracts of half of the workforce are fixed,

anticipated monetary policy can work for some time and are not always ineffective.

Question 2

Mathematically and intuitively explain the IS/PC/MR models equations. How would the real

sector work if IS curve faces a NEGATIVE shock? Explain the effects on real interest rates,

output and inflation levels. (20 points)

IS: +1 = Y is inversely related to r and changes after a lag of a year

Lahore School Of Economics Page 2 of 4

Monetary Economics (Quiz 3B)

PC = +1 = + (+1 ) If there is

a recessionary gap, inflation levels would fall

by and PC curve will shift downwards in

the long run while inflationary gap will raise

the inflation by and shift the PC curve

upward in the long run

MR-AD Eq: +1 = (+1 )

if inflation exceeds the target level, policy

maker intervenes and creates a recessionary

gap by a factor of by increasing the

interest rates.

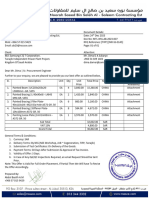

Refer to the diagram shown. This is a

combination of IS/PC/MR model. Currently,

the economy is at Y*, target inflation level

and stable level of interest rates at rS.

When IS curve shifts leftwards, income level

decreases to Y0. Recessionary gap shifts the

PC Curve downwards (in red) and economy

settles at Y* and 1% inflation level in the

long run.

To get back to targeted level of inflation, the policymaker decreases the interest rates to r1 whereby MR

intersects PC (1%) in the lower panel (Point B)

As per the MR, an inflationary gap will be introduced (Y1 > Y*) and inflationary expectations will move

upwards to between 1% and 2% shifting the PC curve upwards (in green). After that, policy maker will

keep on increasing the interest rates to get rid of inflationary gap and inflationary expectations will

move in the upward direction so long as Y > Y*. This will keep on shifting PC curve upwards and each

curve consistently will intersect MR curve (such as the green curve whereby inflation is close to 2%). This

process will end when inflation = 2% and the new stable level of interest rates are rIS.

Question 3

Explain in detail the transmission mechanism of a fall in interest rates via investment channel

only. (10 points)

Students need to focus on the following channel and will be given points on how well theyve

explained.

If interest rates fall market interest rates also follow the change, that is they fall asset

prices rise increasing the collateral power of financial assets, cost of borrowing falls, retained

Lahore School Of Economics Page 3 of 4

Monetary Economics (Quiz 3B)

profits are re-invested rather than saved as there is lower opportunity cost of investment

thus investment rises AD rises inflation increases with a time lag of almost 2 years

On the other hand, lower interest rates reduces the interest income from interest-earning

assets and firms who are net savers face adverse wealth effect leading to lower investment.

This can also lead to cash constraints low investment low AD and inflation

The final effect on AD and inflation depends on the magnitudes of both transmission

mechanisms.

Question 4

If higher asset prices can affect inflation through aggregate supply channel, how would the

monetary authorities react? Focus on the authorities concerns and reaction only. Please

formulate a consistent answer and avoid irrelevant information as it would be negatively

marked for this question. (10 points)

Scarcity in real assets of the economy such as agricultural products or energy related products

can lead to higher prices. This can threat the inflation targets set by the authorities through

aggregate supply channel. As asset prices rise, value of CPI (consumer price index) rises and

although the second term in the following PC equation is not affected as that measures AD

pressures, the rising inflation levels are picked up by first term in the equation, t

PC +1 = + (+1 )

Authorities can set a high interest rate to curtail inflationary pressures. The increasing inflation

level is thus unavoidable.

However, if the rise in asset prices is artificial or goods are hoarded or rationed to deliberately

increase the prices and profits, then the authorities can avoid rising inflation levels by looking

for the sources of distortions. If thats not politically possible, then interest rates have to be

increased to restrict rising inflation.

Lahore School Of Economics Page 4 of 4

You might also like

- Quiz #3, Answers: 14.02 Principles of MacroeconomicsDocument10 pagesQuiz #3, Answers: 14.02 Principles of MacroeconomicsEmmanuel MbonaNo ratings yet

- 3 The Medium Run20090715104540 PDFDocument10 pages3 The Medium Run20090715104540 PDFYosra BaazizNo ratings yet

- Learning OutcomesDocument6 pagesLearning OutcomesRajesh GargNo ratings yet

- Problem+Set+ 3+ Spring+2014,+0930Document8 pagesProblem+Set+ 3+ Spring+2014,+0930jessica_1292No ratings yet

- Torial 7 McroDocument4 pagesTorial 7 McrogassyNo ratings yet

- Quiz #3, Answers: 14.02 Principles of MacroeconomicsDocument10 pagesQuiz #3, Answers: 14.02 Principles of MacroeconomicsrohityadavalldNo ratings yet

- Economics 2 - Spring 2008 Sample - Romer - Midterm 2 AnswersDocument7 pagesEconomics 2 - Spring 2008 Sample - Romer - Midterm 2 Answersjohn loNo ratings yet

- ECON 2123 Problem Set 3 Solution MacroeconomicsDocument11 pagesECON 2123 Problem Set 3 Solution MacroeconomicsBrenda WijayaNo ratings yet

- Macroeconomic Problem Set AnalysisDocument8 pagesMacroeconomic Problem Set Analysisjessica_1292No ratings yet

- Chapter 10 Question 1 and 2Document7 pagesChapter 10 Question 1 and 2Francien BaileyNo ratings yet

- Economics Managers Final-ExamDocument5 pagesEconomics Managers Final-Examdavit kavtaradzeNo ratings yet

- Monetary FiscalDocument4 pagesMonetary FiscalKiranNo ratings yet

- Problem Set 4: Introduction To Macroeconomics 2020-21 Teresa Garcia-Milà, María Gundín, Alberto Martín, Luigi PascaliDocument7 pagesProblem Set 4: Introduction To Macroeconomics 2020-21 Teresa Garcia-Milà, María Gundín, Alberto Martín, Luigi PascaliALBA RUS HIDALGONo ratings yet

- E - Portfolio Assignment-1Document7 pagesE - Portfolio Assignment-1api-280064053No ratings yet

- Notes 3Document7 pagesNotes 3bousry.meryemNo ratings yet

- Covid-19 Coronavirus and Macroeconomic Policy: Barcelona GSE Working Paper Series Working Paper Nº 1168Document10 pagesCovid-19 Coronavirus and Macroeconomic Policy: Barcelona GSE Working Paper Series Working Paper Nº 1168alexanderNo ratings yet

- Wages, Prices and EmploymentDocument9 pagesWages, Prices and Employmenttalha hasibNo ratings yet

- Macro Note CardsDocument18 pagesMacro Note CardsSankar AdhikariNo ratings yet

- Problem Set 8 - Some Answers FE312 Fall 2010 Rahman: Page 1 of 8Document8 pagesProblem Set 8 - Some Answers FE312 Fall 2010 Rahman: Page 1 of 8Omotola AwojobiNo ratings yet

- Introductory To Macroeconomics UAS Exercise + Answers-1Document4 pagesIntroductory To Macroeconomics UAS Exercise + Answers-1gracia arethaNo ratings yet

- ECON 103 Intermediate MacroeconomicsDocument18 pagesECON 103 Intermediate MacroeconomicsRachael MutheuNo ratings yet

- Session 13 - 15 Aggregate Supply and The Phillips CurveDocument69 pagesSession 13 - 15 Aggregate Supply and The Phillips CurveKartik Kumar PGP 2022-24 BatchNo ratings yet

- Homework 5 - AnswerDocument8 pagesHomework 5 - Answer蔡杰翰No ratings yet

- Macroeconomics Assignment Analyzes IS-LM ModelDocument10 pagesMacroeconomics Assignment Analyzes IS-LM ModelKAZI ZINIANo ratings yet

- North South University Final Assignment Explains Effects of Money Supply and Fiscal Policy ChangesDocument10 pagesNorth South University Final Assignment Explains Effects of Money Supply and Fiscal Policy ChangesMd. Rezwan Hossain Sakib 1711977630No ratings yet

- Edexcel Year12Assessment Paper2 SADocument10 pagesEdexcel Year12Assessment Paper2 SAnarjis kassamNo ratings yet

- Final Exam MACRO Jan 21 2019Document4 pagesFinal Exam MACRO Jan 21 2019benrjebfatma18No ratings yet

- Ec103 Week 09 and 10 s14Document44 pagesEc103 Week 09 and 10 s14юрий локтионовNo ratings yet

- Pset 6 2021 With Answers - TGMDocument8 pagesPset 6 2021 With Answers - TGMALBA RUS HIDALGONo ratings yet

- 6 WEEK GEHon Economics IIth Semeter Introductory MacroeconomicsDocument14 pages6 WEEK GEHon Economics IIth Semeter Introductory Macroeconomicskasturisahoo20No ratings yet

- Financial Market and LM Curve: - Derivation - ShiftsDocument34 pagesFinancial Market and LM Curve: - Derivation - ShiftsSehar SajjadNo ratings yet

- Fei2123PS4 PDFDocument4 pagesFei2123PS4 PDFMarco ChanNo ratings yet

- A Dynamic Model of Aggregate Demand and Aggregate Supply: Questions For ReviewDocument11 pagesA Dynamic Model of Aggregate Demand and Aggregate Supply: Questions For ReviewErjon Skordha100% (1)

- Econ 116 Study GuideDocument6 pagesEcon 116 Study GuidetestmytestNo ratings yet

- Module 19 Integration of The Real and Monetary Sectors of The EconomyDocument7 pagesModule 19 Integration of The Real and Monetary Sectors of The EconomyPatrickNo ratings yet

- Sebi Grade A 2020: Economics: Determination of Output & EmploymentDocument7 pagesSebi Grade A 2020: Economics: Determination of Output & EmploymentThabarak ShaikhNo ratings yet

- ChapterDocument42 pagesChapterIf'idatur rosyidahNo ratings yet

- PS3 AnswersDocument7 pagesPS3 Answershaoyu.lucio.wangNo ratings yet

- IS-LM Model ExplainedDocument36 pagesIS-LM Model ExplainedSyed Ali Zain100% (1)

- Monetary Economics Lecture Notes: Ecole Polythechnique - HECDocument84 pagesMonetary Economics Lecture Notes: Ecole Polythechnique - HECvinarNo ratings yet

- Chapter 11 Dornbusch Fisher SolutionsDocument13 pagesChapter 11 Dornbusch Fisher Solutions22ech040No ratings yet

- IS LM PresentationDocument32 pagesIS LM PresentationRajat LoyaNo ratings yet

- Sol Gen June 2023Document6 pagesSol Gen June 2023Elio AseroNo ratings yet

- Stock Market and The Economy: IntroductionDocument39 pagesStock Market and The Economy: IntroductionDiego PalmiereNo ratings yet

- LectureNote11 GRIPS PDFDocument8 pagesLectureNote11 GRIPS PDFprasadpatankar9No ratings yet

- Lecture10-1.AS-AD Model-1..2023Document53 pagesLecture10-1.AS-AD Model-1..2023Melike ÇetinkayaNo ratings yet

- Rational ExpDocument18 pagesRational ExpAbeha ChNo ratings yet

- NK Model For Inflation - Week 7 LectureDocument3 pagesNK Model For Inflation - Week 7 LectureAlex LancashireNo ratings yet

- MarketingDocument4 pagesMarketingjyotiprakash giriNo ratings yet

- Sidranje 1Document7 pagesSidranje 1miha.petrov1998No ratings yet

- Final-Term Review - ExplanationDocument6 pagesFinal-Term Review - ExplanationElwinda SeptiandhanyNo ratings yet

- Monetary PolicyDocument10 pagesMonetary PolicykafiNo ratings yet

- A Dynamic Model of AggregateDocument27 pagesA Dynamic Model of AggregateKristo SiagianNo ratings yet

- Fei 2123 PS3Document4 pagesFei 2123 PS3MarcoNo ratings yet

- Labor Market Equilibrium and Fiscal Policy AnalysisDocument3 pagesLabor Market Equilibrium and Fiscal Policy AnalysisMohit RakyanNo ratings yet

- Inflation-Conscious Investments: Avoid the most common investment pitfallsFrom EverandInflation-Conscious Investments: Avoid the most common investment pitfallsNo ratings yet

- Lecture 25 BSC IIDocument6 pagesLecture 25 BSC IIAnonymous njZRxR0% (1)

- BSC Econometrics II, Spring 2017, Computer Exercise 1Document3 pagesBSC Econometrics II, Spring 2017, Computer Exercise 1Anonymous njZRxRNo ratings yet

- Assign 3Document1 pageAssign 3Anonymous njZRxRNo ratings yet

- Quiz 1A - 2013 - D&G EconDocument4 pagesQuiz 1A - 2013 - D&G EconAnonymous njZRxRNo ratings yet

- Quiz 1B - 2013 - D&G EconDocument3 pagesQuiz 1B - 2013 - D&G EconAnonymous njZRxRNo ratings yet

- Quiz 2B - 2013 - D&G EconDocument4 pagesQuiz 2B - 2013 - D&G EconUmair ShahzadNo ratings yet

- Quiz 2A 2013 D&G EconDocument4 pagesQuiz 2A 2013 D&G EconAnonymous njZRxRNo ratings yet

- Service Structure AnalysisDocument9 pagesService Structure AnalysisAnonymous njZRxRNo ratings yet

- Quiz 4B B2012 MonetaryDocument5 pagesQuiz 4B B2012 MonetaryAnonymous njZRxRNo ratings yet

- Micro Assg 2Document1 pageMicro Assg 2Anonymous njZRxRNo ratings yet

- Contract Employment Policy Review (By Musharraf)Document167 pagesContract Employment Policy Review (By Musharraf)Humair AliNo ratings yet

- Quiz 4A B2012 MonetaryDocument5 pagesQuiz 4A B2012 MonetaryAnonymous njZRxRNo ratings yet

- Practice Book Math PDFDocument66 pagesPractice Book Math PDFNoureldinYosriNo ratings yet

- Micro Quiz2 KeyDocument6 pagesMicro Quiz2 KeyAnonymous njZRxRNo ratings yet

- Lecture 1Document16 pagesLecture 1Anonymous njZRxRNo ratings yet

- Lecture 1Document5 pagesLecture 1Anonymous njZRxRNo ratings yet

- Quiz 3A B2012 MonetaryDocument4 pagesQuiz 3A B2012 MonetaryAnonymous njZRxRNo ratings yet

- Micro II-Final Exam Review (Key)Document4 pagesMicro II-Final Exam Review (Key)Anonymous njZRxRNo ratings yet

- Case 1 AssignmentDocument11 pagesCase 1 AssignmentAnonymous njZRxRNo ratings yet

- CH 18&19 (Key)Document2 pagesCH 18&19 (Key)Anonymous njZRxR50% (2)

- CH 17 Uncertainty (Key)Document2 pagesCH 17 Uncertainty (Key)Anonymous njZRxRNo ratings yet

- Quiz 2A B2012 MonetaryDocument6 pagesQuiz 2A B2012 MonetaryAnonymous njZRxRNo ratings yet

- Case: Aaa WashingtonDocument5 pagesCase: Aaa WashingtonAnonymous njZRxRNo ratings yet

- Computer Assignment1Document2 pagesComputer Assignment1Anonymous njZRxRNo ratings yet

- Discussion Papers in EconomicsDocument41 pagesDiscussion Papers in EconomicsdebasishNo ratings yet

- Customer Updation Form For Non IndividualDocument3 pagesCustomer Updation Form For Non IndividualThamilarasan PalaniNo ratings yet

- 1392628459421Document48 pages1392628459421ravidevaNo ratings yet

- Pre104: Auditing and Assurance: Specialized Industries 1. Overview of Auditing in Specialized IndustriesDocument2 pagesPre104: Auditing and Assurance: Specialized Industries 1. Overview of Auditing in Specialized IndustriesCristina ElizaldeNo ratings yet

- 007.MTL-NSS-AB-2023-007 - Quotation For SS Fabrication & Coating - MR-SS-0145Document1 page007.MTL-NSS-AB-2023-007 - Quotation For SS Fabrication & Coating - MR-SS-0145abasithamNo ratings yet

- Role of Company SecretaryDocument8 pagesRole of Company SecretaryILAKIYANo ratings yet

- FMDQ Codified Rule Book FGN BondsDocument65 pagesFMDQ Codified Rule Book FGN BondsOladipupo Mayowa PaulNo ratings yet

- GM Financial Analysis - Final Paper-1Document12 pagesGM Financial Analysis - Final Paper-1api-534291498No ratings yet

- Deloitte AnalyticsDocument5 pagesDeloitte Analyticsapi-89285443No ratings yet

- Accounting Textbook Solutions - 68Document19 pagesAccounting Textbook Solutions - 68acc-expertNo ratings yet

- Assignment5 HW5Document9 pagesAssignment5 HW5RUPIKA R GNo ratings yet

- Case - FMC - 02Document5 pagesCase - FMC - 02serigalagurunNo ratings yet

- Assessment of Cash Management in NIBDocument48 pagesAssessment of Cash Management in NIBEfrem Wondale100% (1)

- Financial Accounting and Reporting EllioDocument181 pagesFinancial Accounting and Reporting EllioThủy Thiều Thị HồngNo ratings yet

- CAPE Accounting 2007 U2 P2Document7 pagesCAPE Accounting 2007 U2 P2Cool things fuh schoolNo ratings yet

- The Role of A Contract ManagerDocument2 pagesThe Role of A Contract ManagerCyril WilliamsNo ratings yet

- URBAN REVITALIZATION AND NEOLIBERALISMDocument50 pagesURBAN REVITALIZATION AND NEOLIBERALISMJoviecca Lawas67% (3)

- Emirates - Porter's 5Document3 pagesEmirates - Porter's 5smba0802994% (18)

- Developing Jordan's Urban Transport Infrastructure and Regulatory SystemDocument17 pagesDeveloping Jordan's Urban Transport Infrastructure and Regulatory Systemmohammed ahmedNo ratings yet

- 8 13Document5 pages8 13Konrad Lorenz Madriaga UychocoNo ratings yet

- Chapter 5Document16 pagesChapter 5Tinsaye HayileNo ratings yet

- Afonso 2012Document33 pagesAfonso 2012Nicolas CopernicNo ratings yet

- Kerala Treasury SB Pay-In-SlipDocument2 pagesKerala Treasury SB Pay-In-Sliprosekathe100% (1)

- Entrepre Module 2Document10 pagesEntrepre Module 2Joshua Enriquez VillanuevaNo ratings yet

- Comparative Analysis of D-Mart and Big BazaarDocument50 pagesComparative Analysis of D-Mart and Big BazaarBhamini AgrawalNo ratings yet

- Koster Keunen Beekeeping Webinar PresentationDocument15 pagesKoster Keunen Beekeeping Webinar PresentationKOUASSI SylvainNo ratings yet

- Barriers To Environmental Management in Hotels in Kwazulu - Natal, South AfricaDocument13 pagesBarriers To Environmental Management in Hotels in Kwazulu - Natal, South AfricaGlobal Research and Development ServicesNo ratings yet

- Life Insurance Asset ClassDocument6 pagesLife Insurance Asset Classhimita desai100% (2)

- Osabadell: Deposits in Your AccountsDocument7 pagesOsabadell: Deposits in Your Accounts张灿No ratings yet

- New HR Strategy Makes Lloyd's A "Best Company"Document4 pagesNew HR Strategy Makes Lloyd's A "Best Company"Rob3332No ratings yet