Professional Documents

Culture Documents

NWL Follow Up PDF

Uploaded by

Anonymous Ecd8rCOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NWL Follow Up PDF

Uploaded by

Anonymous Ecd8rCCopyright:

Available Formats

This research report expresses soley our opinions. Use Soapbox Research opinions at your own risk.

In no event should Soapbox Research be

liable for any direct or indirect trading losses caused by any information contained in this report. We have a short interest in Newell Brands

Incs stock and therefore stand to realize gains in the event that the price of the stock declines. Please refer to our full disclaimer located on

the last page of this report.

Newell Brands: Management comments at Conference Contradicts Press Release

As we noted in yesterdays report, Newell Brands Inc (NWL or the Company) uses accounting tricks

and likes to play games when talking to the street.

We want to highlight how the company played games with hurricane Harvey to hide deteriorating

fundamentals and how Polk admitted their misleading press release:

On September 6, NWL updated guidance to account for Hurricane Harvey. In the release, the company

made the following disclosure:

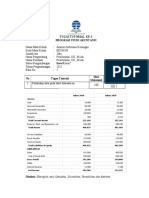

Company: Newell Brands

Ticker: NWL

Industry: Consumer

Discretionary

Stock Price as of

10/11/2017: $43.17

Because of the anticipated effects of Harvey, NWL lowered the low end of its Market Cap:$21.157bn

guidance by $.05 to $2.95 from $3.00. Doesnt seem material? Well it is because its

really about poor growth. Daily Volume: 4,026,369

(3 month avg.)

At a Barclays Investor conference the very next day, CEO Michael Polk said to

the crowd: Price Target: $19.16

Which is it? Harvey or the tepid growth? Just like the misleading OCF

detailed in our previous report, this is more gaming by NWL management.

So, of the .05 of guide down, .03 or 60% was purely due to deteriorating

business conditions! Management was just waiting for the chance to explain

their failure, and Harvey let them do it!

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Activity #1:: V F3QpgxbtdeoDocument4 pagesActivity #1:: V F3QpgxbtdeoSafaNo ratings yet

- Types of Financial MarketsDocument2 pagesTypes of Financial MarketsMher Edrolyn Cristine LlamasNo ratings yet

- Financial Accounting Reporting Analysis and Decision Making 5th Edition Carlon Test BankDocument36 pagesFinancial Accounting Reporting Analysis and Decision Making 5th Edition Carlon Test Banknymphplaitedpwqffn100% (30)

- Emerging Value Capital Management, LLC: February 2009 Letter To InvestorsDocument5 pagesEmerging Value Capital Management, LLC: February 2009 Letter To InvestorsL032090No ratings yet

- Module 1Document27 pagesModule 1bhumiNo ratings yet

- Chapter 11 SolutionsDocument9 pagesChapter 11 Solutionsbellohales0% (2)

- Fall 203Document6 pagesFall 203mehdiNo ratings yet

- Tugas 2 Eksi 4204 - Dini Nur Lathifah - 030995277Document4 pagesTugas 2 Eksi 4204 - Dini Nur Lathifah - 030995277Doni Jogja0% (1)

- The MBO Guide For Management Teams, 2005 PDFDocument226 pagesThe MBO Guide For Management Teams, 2005 PDFHuy NguyenNo ratings yet

- Test Collections CFA-Level-I Question Bank PDFDocument1,568 pagesTest Collections CFA-Level-I Question Bank PDFsaurabh100% (1)

- Forex Scalpel - Forex Renko ChartsDocument41 pagesForex Scalpel - Forex Renko Chartsanicket kabeerNo ratings yet

- Legal & Regulatory AspectsDocument23 pagesLegal & Regulatory AspectsMoaaz Ahmed100% (1)

- Cfas Chapter1Document3 pagesCfas Chapter1Ashley Jean CosmianoNo ratings yet

- Case Solution of Target Corporation Capital Budgeting Harvard Publishing Case StudyDocument2 pagesCase Solution of Target Corporation Capital Budgeting Harvard Publishing Case Studyalka murarka59% (17)

- Netscape's Initial Public OfferingDocument9 pagesNetscape's Initial Public OfferingRasheeq Rayhan100% (1)

- Final DataDocument63 pagesFinal Dataaurorashiva1No ratings yet

- Ec 1723 Problem Set 3Document5 pagesEc 1723 Problem Set 3tarun singhNo ratings yet

- Richard Wyckoff Richard Wyckoff Richard WyckoffDocument1 pageRichard Wyckoff Richard Wyckoff Richard WyckoffTrần Nam ViệtNo ratings yet

- Statement 20140508Document2 pagesStatement 20140508franraizerNo ratings yet

- Hostile Takeover of MindtreeDocument4 pagesHostile Takeover of Mindtreeanuj rakheja100% (1)

- Financial Accounting 2 Assignment 2Document3 pagesFinancial Accounting 2 Assignment 2BhodzaNo ratings yet

- CH04 Interest RatesDocument30 pagesCH04 Interest RatesJessie DengNo ratings yet

- Group 15 Merger ProposalDocument41 pagesGroup 15 Merger ProposalJohnny LamNo ratings yet

- Financial Engineering - Futures, Forwards and SwapsDocument114 pagesFinancial Engineering - Futures, Forwards and Swapsqari saibNo ratings yet

- UntitledDocument2 pagesUntitledNur AsnadirahNo ratings yet

- Financial Statements As A Management ToolDocument12 pagesFinancial Statements As A Management ToolDragos MursaNo ratings yet

- FRM Juice Notes 2019Document202 pagesFRM Juice Notes 2019Dipesh Memani100% (8)

- Chapter 7 - Q&ADocument16 pagesChapter 7 - Q&APro TenNo ratings yet

- CV Salma Huda KhairunnisaDocument2 pagesCV Salma Huda KhairunnisaVindy ArtissyaNo ratings yet

- Reliance Money Project ReportDocument75 pagesReliance Money Project ReportPardeep Sharma SNo ratings yet