Professional Documents

Culture Documents

Maple Leaf Cement Factory Limited: Formerly: Karachi Stock Exchange Limited

Uploaded by

Hussain Ali0 ratings0% found this document useful (0 votes)

39 views1 pageAnnual report of maple leaf cement

Original Title

MLCF

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAnnual report of maple leaf cement

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

39 views1 pageMaple Leaf Cement Factory Limited: Formerly: Karachi Stock Exchange Limited

Uploaded by

Hussain AliAnnual report of maple leaf cement

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

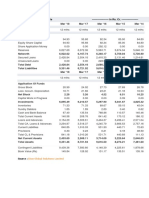

Pakistan Stock Exchange Limited

Formerly: Karachi Stock Exchange Limited

S.No.

Maple Leaf Cement Factory Limited

CHAIRMAN 2012 2013 2014 2015

TARIQ SAYEED SAIGOL FINANCIAL POSITION (Rs. In Million)

Paid-Up Capital 5277.34 5277.34 5277.34 5277.34

CHIEF EXECUTIVE/MANAGING DIRECTOR Preference Shares 528.26 0.00 0.00 0.00

SAYEED TARIQ SAIGOL Reserves & Surplus -1976.74 1493.57 4472.24 7634.32

Sharholder's Equity 3828.86 6770.91 9749.58 12911.66

BOARD OF DEIRECTORS: Capital Reserves 1898.42 2058.14 2058.14 2058.14

Deferred Taxation / Liabilities 2009.07 1904.86 2208.40 2698.45

TARIQ SAYEED SAIGOL

Long Term Loans / Deposits 10693.32 9177.20 7114.49 1977.74

TAUFIQUE SAYEED SAIGOL Current Liabilities 10604.37 8568.55 7132.57 8144.46

ZAMIRUDDIN AZAR Total Assets 32727.97 32373.09 31911.31 31221.32

SAYEED TARIQ SAIGOL Fixed Assets (Gross) 36974.71 37438.17 38206.82 38848.03

WALEED TARIQ SAIGOL Accumulated Depreciation / 10220.48 11895.62 13545.49 15243.50

Amortization

SYED MOHSIN RAZA NAQVI 26754.23 25542.55 24661.33 23604.53

Fixed Assets (Net)

KARIM HATIM Capital work in Progress 60.93 87.65 44.45 116.02

DANIAL TAUFIQUE SAIGOL Long Term Investment 3.04 1.63 1.63 0.00

Current Assets 5886.09 6682.91 7145.45 7439.21

REGISTERED OFFICE:

OPERATING POSITION (Rs. In Million)

42 - Lawrence Road,

Sales (Net) / Revenues 15461.36 17357.38 18968.55 20720.05

Cost of Sales 11446.58 11312.34 12445.56 13224.43

Lahore Gross Profit 4014.78 6045.04 6522.99 7495.62

HEAD OFFICE: Operating Expenses 1254.21 1219.06 1548.40 1958.25

Operating Profit / (Loss) 2760.57 4825.98 4974.59 5537.37

42 - Lawrence Road, Financial Charges 2350.57 1704.65 1464.77 1082.64

Other Income 34.07 41.29 80.59 46.17

Prior Year Adjustment 0.00 0.00 0.00 0.00

Lahore Profit / (Loss) Before Taxation 444.07 3162.62 3590.40 4500.91

Taxation Current & Deff 20.69 -1.23 800.48 1106.23

AUDITORS:

Prior Years -72.81 -60.85 -40.25 -59.61

KPMG Taseer Hadi & Co. Total -52.13 -62.08 760.23 1046.62

Profit / (Loss) After Taxation 496.19 3224.70 2830.17 3454.29

LOCATION OF FACTORY / PLANT

Iskanderabad Distt. RATIOS

Mianwali. 7.26 12.83 18.47 24.47

Book Value

YEAR ENDING: Assets Turnover 0.47 0.54 0.59 0.66

Current Ratio 0.56 0.78 1.00 0.91

June Earning Per Share Pre Tax 0.84 5.99 6.80 8.53

AUTHORISED CAPITAL: Earning Per Share After Tax 0.94 6.11 5.36 6.55

Payout Ratio After Tax 0.00 0.00 0.00 30.53

Rs: 7000 mil

Market Capitalization 4934.31 12296.20 18285.98 34202.44

PAID VALUE: DISTRIBUTION

Rs: 10 Cash Dividend % 0.00 0.00 0.00 20.00

Stock Dividend % 0.00 0.00 0.00 0.00

SHARES TRADED:

Total % 0.00 0.00 0.00 20.00

1487.217 mil SHARE PRICE Rs.

No.of SHAREHOLDERS: High 16.90 33.00 44.99 85.01

9436 Low 1.80 13.59 24.31 44.60

Average 9.35 23.30 34.65 64.81

CAPACITY UTILISATION:

Installed Capacity = 3,360,000

Actual Production = 2,824,854 Met. Tone

COMPANY INFORMATION

The Company was incorporated on April 13, 1960 as a

pblic company limited by shares and is listed on all the

stock exchanges of Pakistan.

It is engaged in production and sale of cement.

The Company is a subsidiary of Kohinoor Textile

Mills Limited.

You might also like

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Pakistan Stock Exchange Limited: The Searle Company LimitedDocument1 pagePakistan Stock Exchange Limited: The Searle Company LimitederfanxpNo ratings yet

- Location of Factory / PlantDocument1 pageLocation of Factory / PlantGhulam AhmadNo ratings yet

- Feroze1888 Mills Limited: Formerly: Karachi Stock Exchange LimitedDocument1 pageFeroze1888 Mills Limited: Formerly: Karachi Stock Exchange LimitedHussain AliNo ratings yet

- Analysis ReportsDocument1 pageAnalysis Reportsfari khNo ratings yet

- Atlas HondaDocument2 pagesAtlas HondasaranidoNo ratings yet

- Pakistan Stock Exchange Limited: D. G. Khan Cement Company LimitedDocument1 pagePakistan Stock Exchange Limited: D. G. Khan Cement Company LimitederfanxpNo ratings yet

- Pakistan Stock Exchange LimitedDocument1 pagePakistan Stock Exchange LimitederfanxpNo ratings yet

- Pakistan Stock Exchange LimitedDocument1 pagePakistan Stock Exchange LimitederfanxpNo ratings yet

- Analysis ReportsDocument1 pageAnalysis ReportsMuiz SaddozaiNo ratings yet

- Analysis Report PsoDocument3 pagesAnalysis Report PsoMuhammad Waqas HafeezNo ratings yet

- Bestway Cement Limited: Location of Factory / PlantDocument1 pageBestway Cement Limited: Location of Factory / PlantBurhan Ahmed MayoNo ratings yet

- Pakistan Stock Exchange LimitedDocument1 pagePakistan Stock Exchange LimitedayazNo ratings yet

- MCBDocument1 pageMCBAbdul Habib MirNo ratings yet

- BNWMDocument1 pageBNWMHussain AliNo ratings yet

- Analysis Reports PDFDocument1 pageAnalysis Reports PDFFaizan AhmadNo ratings yet

- Pakistan Stock Exchange Limited: Indus Motor Company LimitedDocument1 pagePakistan Stock Exchange Limited: Indus Motor Company Limitedmusab nawazNo ratings yet

- Pakistan CablesDocument2 pagesPakistan CablesSaad SiddiquiNo ratings yet

- Lakshmi Machine Works: PrintDocument9 pagesLakshmi Machine Works: Printlaxmi joshiNo ratings yet

- BalaJi Amines LTDDocument7 pagesBalaJi Amines LTDchittorasNo ratings yet

- Suzlon Energy Balance Sheet, P&L Statment, CashflowDocument10 pagesSuzlon Energy Balance Sheet, P&L Statment, CashflowBharat RajputNo ratings yet

- Ronak L & Yash FADocument9 pagesRonak L & Yash FAronakNo ratings yet

- CashFlow - StandaloneDocument3 pagesCashFlow - StandaloneSourav RajeevNo ratings yet

- Gujarat Narmada Valley Fertilizers & ChemicalsDocument14 pagesGujarat Narmada Valley Fertilizers & ChemicalsPrashant TiwariNo ratings yet

- Financial Management II ProjectDocument11 pagesFinancial Management II ProjectsimlimisraNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsDhruv NarangNo ratings yet

- Ceat Balance SheetDocument2 pagesCeat Balance Sheetkcr kc100% (2)

- Group 1 Adani PortsDocument12 pagesGroup 1 Adani PortsshreechaNo ratings yet

- Ch-3 Finance Department Trading & P&L AccountDocument4 pagesCh-3 Finance Department Trading & P&L AccountMit MehtaNo ratings yet

- Assingment SCM SEM4 - 1Document17 pagesAssingment SCM SEM4 - 1KARTHIYAENI VNo ratings yet

- Bal SheetDocument6 pagesBal SheetSabyasachi PandaNo ratings yet

- Income Statement 2018-2019 %: Sources of FundsDocument8 pagesIncome Statement 2018-2019 %: Sources of FundsDebanjan MukherjeeNo ratings yet

- Business Valuation: Cia 1 Component 1Document7 pagesBusiness Valuation: Cia 1 Component 1Shubh SavaliaNo ratings yet

- Accounts Case Study On Ratio AnalysisDocument6 pagesAccounts Case Study On Ratio AnalysisRADHIKA.J 19MCO033No ratings yet

- ABB India: PrintDocument2 pagesABB India: PrintAbhay Kumar SinghNo ratings yet

- D-Mart Pranjali Agarwal - NMIMS BDocument440 pagesD-Mart Pranjali Agarwal - NMIMS BDewashish RaiNo ratings yet

- Moneycontrol P&LDocument2 pagesMoneycontrol P&Lveda sai kiranmayee rasagna somaraju AP22322130023No ratings yet

- Jubilant CompleteDocument16 pagesJubilant CompleteShivamKhareNo ratings yet

- Company Name - Deepak Nitrite Soumya Upadhyay 110 EBIZ 2 Sujay Singhvi 112 EBIZ 2Document14 pagesCompany Name - Deepak Nitrite Soumya Upadhyay 110 EBIZ 2 Sujay Singhvi 112 EBIZ 2Sujay SinghviNo ratings yet

- Dalmia Bharat Sugar and Industries Ltd.Document19 pagesDalmia Bharat Sugar and Industries Ltd.Shweta GargNo ratings yet

- ITC Limited: Presented by - Manasi Behere P02 Shweta Manwadkar P30Document16 pagesITC Limited: Presented by - Manasi Behere P02 Shweta Manwadkar P30Shweta ManwadkarNo ratings yet

- Financial ReportDocument60 pagesFinancial ReportAastha GuptaNo ratings yet

- Ashok Leyland Balane SheetDocument2 pagesAshok Leyland Balane SheetNaresh Kumar NareshNo ratings yet

- Industry Segment of Bajaj CompanyDocument4 pagesIndustry Segment of Bajaj CompanysantunusorenNo ratings yet

- Illustration Acc FMDocument22 pagesIllustration Acc FMHEMACNo ratings yet

- Welspun India: PrintDocument2 pagesWelspun India: PrintSJNo ratings yet

- 32 - Akshita - Sun Pharmaceuticals Industries.Document36 pages32 - Akshita - Sun Pharmaceuticals Industries.rajat_singlaNo ratings yet

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisEashaa SaraogiNo ratings yet

- (XI) Bibliography and AppendixDocument5 pages(XI) Bibliography and AppendixSwami Yog BirendraNo ratings yet

- Presented by Harichandana Y (2001MBA018) Sanskriti Bharti (2001MBA022) Pragati Upadhya (2001MBA110)Document23 pagesPresented by Harichandana Y (2001MBA018) Sanskriti Bharti (2001MBA022) Pragati Upadhya (2001MBA110)Harichandana YNo ratings yet

- A Summer Project Report OnDocument17 pagesA Summer Project Report OnHarsh MidhaNo ratings yet

- Nippon Life India Asset Management Profit & Loss Account, Nippon Life India Asset Management Financial Statement & AccountsDocument1 pageNippon Life India Asset Management Profit & Loss Account, Nippon Life India Asset Management Financial Statement & AccountsToxic MaviNo ratings yet

- Income: Profit & Loss Account of Abc LTD (In Rs. CR.)Document13 pagesIncome: Profit & Loss Account of Abc LTD (In Rs. CR.)SukantaNo ratings yet

- Data of BhartiDocument2 pagesData of BhartiAnkur MehtaNo ratings yet

- PVR RatioDocument14 pagesPVR RatioApurwa SawarkarNo ratings yet

- Balance Sheet of Indiabulls - in Rs. Cr.Document3 pagesBalance Sheet of Indiabulls - in Rs. Cr.MubeenNo ratings yet

- Britannia X Ls XDocument15 pagesBritannia X Ls Xshubham9308No ratings yet

- 3rd Quarter Report 2021 2022Document12 pages3rd Quarter Report 2021 2022শ্রাবনী দেবনাথNo ratings yet

- Sagar CementsDocument33 pagesSagar Cementssarbjeetk21No ratings yet

- Ahmed Abd ElmoneimDocument13 pagesAhmed Abd Elmoneimmohamed ashorNo ratings yet

- CDA Release Order No.40 - Road-III Short Tender Notice February 2023Document1 pageCDA Release Order No.40 - Road-III Short Tender Notice February 2023Hussain AliNo ratings yet

- The Organic Meat Company Limited: Half Yearly Progress ReportDocument7 pagesThe Organic Meat Company Limited: Half Yearly Progress ReportHussain AliNo ratings yet

- 181656Document42 pages181656Hussain AliNo ratings yet

- Contract O2672 1548Document1 pageContract O2672 1548Hussain AliNo ratings yet

- CDA Release Order No.40 - Road-III Short Tender Notice February 2023Document1 pageCDA Release Order No.40 - Road-III Short Tender Notice February 2023Hussain AliNo ratings yet

- Lesco301 282Document2 pagesLesco301 282Hussain AliNo ratings yet

- ND Acc 202329marDocument1 pageND Acc 202329marHussain AliNo ratings yet

- Interim Financial Information: Quarter Ended September 30, 2022 (Unaudited)Document42 pagesInterim Financial Information: Quarter Ended September 30, 2022 (Unaudited)Hussain AliNo ratings yet

- First Quarter Report March 2022: Enabling A Digital TomorrowDocument43 pagesFirst Quarter Report March 2022: Enabling A Digital TomorrowHussain AliNo ratings yet

- The General Manager: Material InformationDocument1 pageThe General Manager: Material InformationHussain AliNo ratings yet

- Afghanistan Economic Monitor 25 August 2022Document7 pagesAfghanistan Economic Monitor 25 August 2022Hussain AliNo ratings yet

- Quarter Ended: (Un-Audited) For TheDocument27 pagesQuarter Ended: (Un-Audited) For TheHussain AliNo ratings yet

- 201550Document1 page201550Hussain AliNo ratings yet

- Annual Report 2022Document222 pagesAnnual Report 2022Hussain AliNo ratings yet

- Rakesh JhunJhunwalaDocument51 pagesRakesh JhunJhunwalaPavan VasaNo ratings yet

- JS-TPLP 12oct22Document3 pagesJS-TPLP 12oct22Hussain AliNo ratings yet

- Kohinoor Mills Lic ModificationDocument14 pagesKohinoor Mills Lic ModificationHussain AliNo ratings yet

- 195320Document2 pages195320Hussain AliNo ratings yet

- 193721Document4 pages193721Hussain AliNo ratings yet

- 187006Document19 pages187006Hussain AliNo ratings yet

- Industrial Component CatalogueDocument103 pagesIndustrial Component CatalogueHussain AliNo ratings yet

- 195240Document2 pages195240Hussain AliNo ratings yet

- 186867Document43 pages186867Hussain AliNo ratings yet

- GHGL and GVGL: Steadily Expanding Portfolios: GHGL - Further Diversifying Its Product PortfolioDocument3 pagesGHGL and GVGL: Steadily Expanding Portfolios: GHGL - Further Diversifying Its Product PortfolioHussain AliNo ratings yet

- GEM Board PresentationDocument18 pagesGEM Board PresentationHussain AliNo ratings yet

- Account Activity Generated Through HBL MobileDocument1 pageAccount Activity Generated Through HBL MobileHussain AliNo ratings yet

- VedicReport5 22 20225 22 01PMDocument55 pagesVedicReport5 22 20225 22 01PMHussain AliNo ratings yet

- Posts Detail: Pakistan Aeronautical ComplexDocument41 pagesPosts Detail: Pakistan Aeronautical ComplexHussain AliNo ratings yet

- Quote 202108decDocument43 pagesQuote 202108decHussain AliNo ratings yet

- FarsiDocument102 pagesFarsiHussain AliNo ratings yet

- CNT A HandbookDocument276 pagesCNT A Handbookv_singh28No ratings yet

- FIRST YEAR B.TECH - 2020 Student List (MGT and CET) PDFDocument128 pagesFIRST YEAR B.TECH - 2020 Student List (MGT and CET) PDFakashNo ratings yet

- KTQTE2Document172 pagesKTQTE2Ly Võ KhánhNo ratings yet

- People vs. Nadera, JR.: 490 Supreme Court Reports AnnotatedDocument11 pagesPeople vs. Nadera, JR.: 490 Supreme Court Reports AnnotatedFatzie MendozaNo ratings yet

- Social Media and The Transformation of Chinese Nationalism'Document4 pagesSocial Media and The Transformation of Chinese Nationalism'mbadaroNo ratings yet

- Alexandra Marotta Writing Sample 1Document3 pagesAlexandra Marotta Writing Sample 1api-315852783No ratings yet

- ENVI Biodiversity Conservation and ManagementDocument38 pagesENVI Biodiversity Conservation and ManagementgowthamNo ratings yet

- Lenovo Legion Y920-17IKB LCFC-DS321 NM-B311 R 0.2 SchematicDocument61 pagesLenovo Legion Y920-17IKB LCFC-DS321 NM-B311 R 0.2 SchematicYetawa GuaviareNo ratings yet

- Botany DownsDocument5 pagesBotany DownsMayank PurwarNo ratings yet

- Skate Helena 02-06.01.2024Document1 pageSkate Helena 02-06.01.2024erkinongulNo ratings yet

- Kincade 2010Document12 pagesKincade 2010varghees johnNo ratings yet

- Code of EthicsDocument13 pagesCode of EthicsnelzerNo ratings yet

- Westernization of East Asia: Asian Civilizations II Jervy C. Briones Lecturer, Saint Anthony Mary Claret CollegeDocument29 pagesWesternization of East Asia: Asian Civilizations II Jervy C. Briones Lecturer, Saint Anthony Mary Claret CollegeNidas ConvanterNo ratings yet

- 1 - Blank Financial AppendixDocument57 pages1 - Blank Financial AppendixJax TellerNo ratings yet

- Counselling Adults With Learning Disabilities Basic Texts in Counselling and PsychotherapyDocument207 pagesCounselling Adults With Learning Disabilities Basic Texts in Counselling and PsychotherapyCristinaMarinNo ratings yet

- DefaultDocument2 pagesDefaultBADER AlnassriNo ratings yet

- Offshore banking_ financial secrecy, tax havens_ evasion, asset protection, tax efficient corporate structure, illegal reinvoicing, fraud concealment, black money _ Sanjeev Sabhlok's revolutionary blog.pdfDocument23 pagesOffshore banking_ financial secrecy, tax havens_ evasion, asset protection, tax efficient corporate structure, illegal reinvoicing, fraud concealment, black money _ Sanjeev Sabhlok's revolutionary blog.pdfVaibhav BanjanNo ratings yet

- Veneranda Dini Anggraeni 201071058 Grammer Mini TestDocument18 pagesVeneranda Dini Anggraeni 201071058 Grammer Mini TestAyu DaratistaNo ratings yet

- Read MeDocument21 pagesRead MeSyafaruddin BachrisyahNo ratings yet

- Investing in Indian Stock Markets - The 5 Minute WrapUp - EquitymasterDocument18 pagesInvesting in Indian Stock Markets - The 5 Minute WrapUp - EquitymasterAtanu PaulNo ratings yet

- Hip Self Assessment Tool & Calculator For AnalysisDocument14 pagesHip Self Assessment Tool & Calculator For AnalysisNur Azreena Basir100% (9)

- Invoice 141Document1 pageInvoice 141United KingdomNo ratings yet

- 2016-17 Georgia Hunting RegulationsDocument76 pages2016-17 Georgia Hunting RegulationsAmmoLand Shooting Sports NewsNo ratings yet

- Course Syllabus - Labor Standards Law (Part 1) 2016Document4 pagesCourse Syllabus - Labor Standards Law (Part 1) 2016Val Cea100% (1)

- Bernini, and The Urban SettingDocument21 pagesBernini, and The Urban Settingweareyoung5833No ratings yet

- LUL S1062 - Temporary Works - Issue A4Document29 pagesLUL S1062 - Temporary Works - Issue A4HNo ratings yet

- Steinmann 2016Document22 pagesSteinmann 2016sofyanNo ratings yet

- WhittardsDocument7 pagesWhittardsAaron ShermanNo ratings yet

- Under The Crescent Moon: Rebellion in Mindanao By: Marites Danguilan Vitug and Glenda M. GloriaDocument2 pagesUnder The Crescent Moon: Rebellion in Mindanao By: Marites Danguilan Vitug and Glenda M. Gloriaapperdapper100% (2)

- Retail Price List WEF August 1, 2016: BMW IndiaDocument1 pageRetail Price List WEF August 1, 2016: BMW IndiaManga DeviNo ratings yet

- How To Budget And Manage Your Money In 7 Simple StepsFrom EverandHow To Budget And Manage Your Money In 7 Simple StepsRating: 5 out of 5 stars5/5 (4)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- The Best Team Wins: The New Science of High PerformanceFrom EverandThe Best Team Wins: The New Science of High PerformanceRating: 4.5 out of 5 stars4.5/5 (31)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (18)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouFrom EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouRating: 5 out of 5 stars5/5 (5)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (89)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)From EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Rating: 3.5 out of 5 stars3.5/5 (9)

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonFrom EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonRating: 5 out of 5 stars5/5 (9)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessFrom EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessRating: 4.5 out of 5 stars4.5/5 (4)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyFrom EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyRating: 5 out of 5 stars5/5 (1)

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeFrom EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifeRating: 5 out of 5 stars5/5 (4)

- How to Save Money: 100 Ways to Live a Frugal LifeFrom EverandHow to Save Money: 100 Ways to Live a Frugal LifeRating: 5 out of 5 stars5/5 (1)

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherFrom EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherRating: 5 out of 5 stars5/5 (14)

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayFrom EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayRating: 3.5 out of 5 stars3.5/5 (2)

- Smart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestFrom EverandSmart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestRating: 5 out of 5 stars5/5 (1)

- Sacred Success: A Course in Financial MiraclesFrom EverandSacred Success: A Course in Financial MiraclesRating: 5 out of 5 stars5/5 (15)

- You Need a Budget: The Ultimate Guide to Budgeting and Financial Planning for Everyday People, Discover Proven Methods on How to Plan Your Finances to Achieve Your Financial GoalsFrom EverandYou Need a Budget: The Ultimate Guide to Budgeting and Financial Planning for Everyday People, Discover Proven Methods on How to Plan Your Finances to Achieve Your Financial GoalsRating: 4.5 out of 5 stars4.5/5 (14)

- Passive Income Ideas: A Comprehensive Guide to Building Multiple Streams of Income Through Digital World and Offline Businesses to Gain the Financial FreedomFrom EverandPassive Income Ideas: A Comprehensive Guide to Building Multiple Streams of Income Through Digital World and Offline Businesses to Gain the Financial FreedomRating: 5 out of 5 stars5/5 (1)

- The Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitFrom EverandThe Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitNo ratings yet

- Rich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouFrom EverandRich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouRating: 4 out of 5 stars4/5 (2)

- The Ultimate 7 Day Financial Fitness ChallengeFrom EverandThe Ultimate 7 Day Financial Fitness ChallengeRating: 5 out of 5 stars5/5 (1)

- Radically Simple Accounting: A Way Out of the Dark and Into the ProfitFrom EverandRadically Simple Accounting: A Way Out of the Dark and Into the ProfitRating: 4.5 out of 5 stars4.5/5 (9)

- The Financial Planning Puzzle: Fitting Your Pieces Together to Create Financial FreedomFrom EverandThe Financial Planning Puzzle: Fitting Your Pieces Together to Create Financial FreedomRating: 4.5 out of 5 stars4.5/5 (2)