Professional Documents

Culture Documents

DAIBB Lending - 2 - 0

Uploaded by

ashraf294Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DAIBB Lending - 2 - 0

Uploaded by

ashraf294Copyright:

Available Formats

Lending Operations and Risk Management

1. Agri Finance

2. Asset Liability Management (ALM)

3. Back to Back L/C

4. Balance of Payment

5. Break-even Point

6. Capital Market

7. Corporate Banking

8. Debt Service Coverage Ratio

9. Debt-to-Equity Ratio

10. Discrepant L/C

11. Economic Rate of Return

12. Green Banking

13. Liquidity Management

14. Loan Documentation

15. Loan Portfolio

16. Loan Pricing

17. Loan Syndication (Dec-2013)

18. Merchant Banking

19. Micro Credit

20. Micro-credit Regulatory Authority (MRA)

21. Non-Performing Asset

22. Packing Credit

23. Pari Passu Charge (Dec-2013)

24. Portfolio Management

25. Preference Share

26. Sensitivity Analysis

27. SME Financing

28. SME Foundation

29. Social Corporate Responsibility (Dec-2013)

For more info, please contact to 01712 043880 Page 1 of 8

1. Agri Finance

Agricultural credit is refers to loans that extended for agricultural purposes.

Agricultural credit systems promote the expansion and continued survival of

farm and livestock operations, covering the entire agricultural chain - input

supply, production and distribution, wholesaling, processing and marketing.

Banks lend to farmers for a variety of purposes, including (1) short-term credit

to cover operating expenses, (2) mid-term credit for investment in farm

equipment and real estate improvements, (3) long-term credit for composition of

farm real estate and construction financing, etc.

2. Asset Liability Management (ALM)

Asset-liability management (ALM) is the practice of managing risks that arise due

to mismatches between the assets and liabilities of the bank. Banks face several

risks such as the liquidity risk, interest rate risk, credit risk and operational risk.

The ALM is a strategic management tool to manage interest rate risk and

liquidity risk faced by banks and financial companies. Its functions extend to the

management of liquidly risk, market risk, trading risk, funding and capital

planning and profit planning and growth projection.

3. Back to Back L/C

Back to back L/C is two letter of credit that used together to help a seller finance

the purchase of equipment or services from a subcontractor. With the original LC

from the buyer's bank in place, the seller goes to his own bank and has a second

LC issued, with the subcontractor. The subcontractor is thus ensured of payment

upon fulfilling the terms of the contract.

Like most LCs, this is used primarily in international transactions, with the first

LC serving as collateral for the second.

4. Balance of Payment

The balance of payments is the method to measure and monitor international

monetary transactions for a period of time of a country. Usually, it is calculated

every quarter and every calendar year. All trades conducted by both the private

and public sectors are accounted for in the balance of payment in order to

determine how much money is going in and out. If a country has received

money this is known as a credit, and if a country has paid or given money, this

is known as a debit.

For more info, please contact to 01712 043880 Page 2 of 8

5. Break-even Point

The Break-even Point is the point at which the gains equal the losses. The point

where sales or revenues equal expenses or also the point where total costs

equal total revenues. There is no profit made or loss incurred at the break-even

point.

Break-even point is the number of units (N) produced which make zero profit.

N = Fixed Cost / (Price per Unit Variable Cost)

6. Capital Market

A capital market is a market for securities, where companies and governments

can raise long-term funds. It is defined as a market in which money is provided

for periods longer than a year. It may be classified as primary and secondary

market.

In primary market, new stock or bond issues are sold to investors. In secondary

market, existing securities are sold and bought among investors or traders,

usually on a securities exchange, over-the-counter.

7. Corporate Banking

The Corporate Banking is banking services for large companies. Usually,

the definition of the business of banking for the purposes of corporate banking,

directed at large business entities. Banks often maintain specific divisions for

handling the needs of corporate clients, separate from consumer or retail

banking activities for individual accounts. This type of banking is designed to

deal with major financial transactions that do not generally a transaction for

retail or consumer or such kind of banking services.

8. Debt Service Coverage Ratio

Debt service coverage ratio is the amount of cash flow available to meet annual

interest and principal payments on debt, including sinking fund payments.

In government finance, it is the amount of export earnings needed to meet

annual interest and principal payments on a country's external debts.

In personal finance, it is a ratio used by bank loan officers in determining income

property loans. It meant to that the property is generating enough income to

pay its debts.

It is calculated by:

For more info, please contact to 01712 043880 Page 3 of 8

9. Debt to Equity Ratio

Debt to equity ratio is the ratio of total liabilities of a business to its

shareholders' equity. It is a leverage ratio and it measures the degree to which

the assets of the business are financed by the debts and the shareholders'

equity of a business.

Debt-to-Equity Ratio = Total Liabilities/ Shareholders' Equity

Both total liabilities and shareholders' equity figures in this formula that can be

obtained from the balance sheet.

10. Discrepant L/C

Discrepant L/C is a kind of letter of credit that does not comply with the terms

and conditions under which it was established that is without a required item of

information, or the information provided is inconsistent with the associated

documents. The issuing bank of a discrepancy L/C is not obliged to pay its

beneficiary and (if it is a confirmed L/C) nor is the confirming bank. Such L/Cs

are normally referred back to the buyer or importer for instructions.

11. Economic Rate of Return

In general, Economic Rate of Return is the net benefits to all members of

society, as a percentage of cost and like market imperfection. It is refers to

interest rate at which the cost and benefits of a project, discounted over its life

are equal. Economic rate of return differs from the financial rate of return in that

it consider the effects of factors such as price controls, subsidies, and tax breaks

to computing the actual cost of the project.

12. Green Banking

Green banking is same as modern general banking, which considers all the social

and environmental factors with an aim to protect the environment and conserve

natural resources. Green Banking promotes environmental-friendly practices and

reducing the carbon footprint from banking activities. Using online banking

instead of branch banking, paying bills online instead of mailing them is the

example of green banking activities. The personal banking practices considering

green banking factors can help the environment.

13. Liquidity Management

Liquidity management is refers to activities to ensure that holdings of liquid

assets like cash, bank deposits and other financial assets are sufficient to meet

its obligations. It measures the ability to honor all cash payment as can be met

either by drawing from a stock of cash holdings, by using current cash inflows,

by borrowing cash or by converting liquid assets into cash. The basic objectives

are to honor all cash outflow, satisfy minimum reserve requirements, avoid

additional cost of emergency borrowing and forced liquidation of assets.

For more info, please contact to 01712 043880 Page 4 of 8

14. Loan Documentation

Loan documentation is the documents that record the loan agreement between

a borrower and a lender. It refers to a loan where all income, assets and

liabilities are documented. A list of the various types of loans can be found at

loan documentation.

Some of the common documents when applying a loan are proof of earning,

profit and loss statements, bank statements, liquid cash, stocks, investments,

land, building, machinery, furniture; any credit facility like loan, credit card etc

and personal information of borrower.

15. Loan Portfolio

The loan portfolio is refers to loans that have been made or bought and are

being held for repayment. Loan portfolios are the major asset of lending

institutions. The value of a loan portfolio depends not only on the interest rates

earned on the loans, but also on their quality, that is, the likelihood that interest

and principal will be paid.

It is listed as an asset on the balance sheet. The value of a loan portfolio

depends on both the principal and interest owed and the average

creditworthiness.

16. Loan Pricing

Loan pricing is an important function for a lending company. Loan-pricing

decisions directly affect the safety and soundness through their impact on

earnings, credit risk and capital adequacy. Lending company must price loans

considering its cost, profit or loses to ensure the financial viability. An effective

loan pricing determine the company growth and minimize the market risk. Loan

pricing is a critical element in assessing and rating the capital, asset quality,

management, earnings and liquidity for a lending company.

17. Loan Syndication [Dec-2013]

Loan syndication is the process of involving several lenders in providing various

portions of a loan. Loan syndication most often occurs in situations where a

borrower requires a large sum of capital that can manage lender's risk exposure

levels. Thus, multiple lenders will work together to provide the borrower with the

capital needed, at an appropriate rate agreed upon by all the lenders. It is

common in mergers, acquisitions and buyouts, where borrowers need very large

sums of capital.

18. Merchant Banking

A Merchant Bank is a financial institution that provides capital to companies in

the form of share ownership instead of loans. A merchant bank also provides

advisory on corporate matters to provide guidance and service in term of

financial, marketing, managerial and legal aspect. Both commercial banks and

investment bank may engage in merchant banking activities. Modern merchant

For more info, please contact to 01712 043880 Page 5 of 8

banking activities refers to issue management, portfolio management, credit

syndication, acceptance credit, advice on merger and acquisitions, insurance,

etc.

19. Micro Credit

Micro-credit is a variation on traditional credit service that involves lends to

individuals or micro-entrepreneurs whose are unable to secure credit due to

poverty. They are relatively unemployed or underemployed and have no

collateral and credit experience.

In Bangladesh, various kinds of company like Banks, NBFI, NGO and

International Funding Body doing the Micro credit operation to ensure poverty

reduction, self-employment, etc.

Micro-credit is one component of micro-finance, which also includes other

financial services such as savings accounts, insurance and money transfers.

20. Micro-credit Regulatory Authority (MRA)

The Micro-credit Regulatory Authority has been established by the Bangladesh

Govt. under the "Micro-credit Regulatory Authority Act 2006 to promote

sustainable development of micro-finance sector. It is the central body to

monitor and supervise micro-finance operations of NGO and other micro credit

organizations. License from the Authority is mandatory to operate micro-finance

operations in Bangladesh as an NGO.

Micro-credit institutions have been providing various social and financial services

to the poor to poverty reduction within the society.

21. Non-Performing Asset

Non-performing assets is a classification used by financial institutions that refer

to loans that are in jeopardy of default. Once the borrower has failed to make

the payment of credit within a certain time of period, the loan is considered to

be a non-performing asset.

Non-performing assets are problematic for financial institutions since they

depend on interest payments for income. It becomes a great problem to the

growth of financial institutions due to provision deposited to the Bangladesh

bank.

22. Packing Credit

Packing credit is one of the best financial assistance by bank to promote the

export trade that helps exporter finance the cost of buying or making a set of

products, and then packing and transporting them before shipment occurs. It

will often be extended if a letter of credit has been issued by a purchaser in

another country or a confirmed order for exporting the goods exists. To obtain

packing credit, the exporter has to approach the bank with export order. Bank

official visits the exporters factory and assess the goods value with export order.

For more info, please contact to 01712 043880 Page 6 of 8

23. Pari Passu Charge [Dec-2013]

Pari Passu is a Latin phrase that refers to equal footing. It describes the

situations where two or more assets, securities, creditors or obligations are

equally managed.

In finance, the term pari-passu refers to loans, bonds or classes of shares that

have equal rights of payment, or equal seniority. In addition, secondary issues of

shares that have equal rights with existing shares rank pari-passu. Wills and

trusts can assign an in pari-passu distribution where all of the assets will be

equally divided between the named parties.

24. Portfolio Management

Portfolio Management provides supports to the investor in a method of selecting

the best available securities that will provide the expected rate of return in a

scale of risk and also to reduce the risks. It is a strategic decision which is

addressed by the top-level managers.

The main objectives are to security of principal investment, consistency of

returns, capital growth, marketability, liquidity, diversification of portfolio,

favorable tax status, etc. These objectives results in a proper analytical approach

towards the growth of the portfolio.

25. Preference Share

Preference share is a capital stock which provides a specific dividend that is paid

before any dividends which takes precedence over common stock. Preferred

stock shareholders do not enjoy any of the voting rights. The main benefit to

owning preference shares are that the investor has a greater claim on the

company's assets.

In general, there are four different types of preferred stock- (1) cumulative; (2)

non-cumulative; (3) participating; and (4) convertible preferred stock.

26. Sensitivity Analysis

Sensitivity analysis is a simulation analysis that the key quantitative assumptions

and computations are transformed systematically to assess their effect on the

final outcome for a project. It is a way to predict the outcome of a decision if a

situation turns out to be different compared to the key predictions. Financial

institutions

By using sensitivity analysis, financial institutions can evaluate the overall risk of

critical factors, changes in interest rate and capital cost for alternative outcomes

of their financial situations.

27. SME Financing

SME finance is the funding of small and medium sized enterprises, and

represents a major function of the general business finance market in which

capital for different types of firms are supplied, acquired, and priced. Capital is

supplied through the business finance market in the form of bank loans and

overdrafts; leasing and hire-purchase arrangements; equity/corporate bond

For more info, please contact to 01712 043880 Page 7 of 8

issues; venture capital or private equity; and asset-based finance such as

factoring and invoice discounting.

SMEs are vital for economic growth and development in both industrialized and

developing countries, by playing a key role in creating new jobs. Small

businesses are particularly important for bringing innovative products or

techniques to the market.

[According to Bangladesh Bank (SMESPD Circular No.1 dated 19 June, 2011),

the cottage, micro & SME is newly defined the industry/enterprise:

Fixed assets excluding land &

building No. of manpower

Criteria

(Tk. in crore)

Sectors

Medium Small Micro Medium Small Micro

0.05- 100-

Manufacturing 10-30 0.5-10 25-99 10-24

0.5 250

Trade 1-15 0.05-1 <0.05 50-100 10-25 <10

Service 1-15 0.05-1 <0.05 50-100 10-25 <10

Cottage Industry <0.05 <10

An industry or enterprise can be treated as that category one following a

benchmark but the same can fall under higher category if another benchmark is

considered. In that case it will be treated as higher category industry.

A woman, who owns a private firm or she holds minimum 51% stake in firm run

jointly or registered, will be treated as women entrepreneur.]

28. SME Foundation

SME Foundation formed in year 2006 under the Company act-1994. It plays the

role in helping the SME entrepreneurs including the women entrepreneurs by

conducting various types of developing programs in Bangladesh. One of the

major aims is to promote the economic development through employment

generation, reduction of social discrimination and poverty. The main activities

are: implementation of SME policy, advocacy & research, credit wholesaling

program, capacity building & skill development, access to information &

technology, women entrepreneurship development, business support, etc.

29. Social Corporate Responsibility [Dec-2013]

Corporate Social Responsibility is defined as the voluntary activities to co-

operate in an economic, social and environmentally sustainable manner. As

voluntary activities, the financial institutions may be engaged in green banking,

rural development, education assistance, poverty reduction programs, assistance

to people physical disable people, and assistance to peoples affected by national

disaster. Some companies may engage in "green-washing" or feigning interest in

corporate responsibility, but many large corporations are devoting real time and

money to environmental sustainability programs, alternative energy, and various

social welfare initiatives to benefit employees, customers, and the community at

large.

For more info, please contact to 01712 043880 Page 8 of 8

You might also like

- 28 Nakshatras - The Real Secrets of Vedic Astrology (An E-Book)Document44 pages28 Nakshatras - The Real Secrets of Vedic Astrology (An E-Book)Karthik Balasundaram88% (8)

- Clinical Skills Resource HandbookDocument89 pagesClinical Skills Resource Handbookanggita budi wahyono100% (1)

- ThiruppavaiDocument157 pagesThiruppavaiajiva_rts100% (49)

- 166-2020 Roi PDFDocument47 pages166-2020 Roi PDFANJAN SINGH 3ANo ratings yet

- Exim BankDocument6 pagesExim BankSarvesh PrasadNo ratings yet

- Lending Risk ManagementDocument54 pagesLending Risk ManagementFaraz Ahmed FarooqiNo ratings yet

- Indian Mortgage Finance Market PDFDocument61 pagesIndian Mortgage Finance Market PDFmikecoreleonNo ratings yet

- OCFINALEXAM2019Document6 pagesOCFINALEXAM2019DA FT100% (1)

- History I.M.PeiDocument26 pagesHistory I.M.PeiVedasri RachaNo ratings yet

- Galaxy Global Group Of Institutions Food Processing SectorDocument27 pagesGalaxy Global Group Of Institutions Food Processing Sectorarvind_pathak_4No ratings yet

- Exam 2 Study GuideDocument11 pagesExam 2 Study GuideAnonymous ewJy7jyvNNo ratings yet

- Business CommunicationDocument206 pagesBusiness Communicationbq3410No ratings yet

- Msme Advances: Canara Bank Officers' Association Promotion Study Material - 2018Document67 pagesMsme Advances: Canara Bank Officers' Association Promotion Study Material - 2018Majhar HussainNo ratings yet

- CES Wrong Answer SummaryDocument4 pagesCES Wrong Answer SummaryZorg UANo ratings yet

- Rural Banking and Agricultural FinancingDocument17 pagesRural Banking and Agricultural FinancingNilanshi MukherjeeNo ratings yet

- Alice Corporation Pty. Ltd. v. CLS Bank International and CLS Services Ltd.Document4 pagesAlice Corporation Pty. Ltd. v. CLS Bank International and CLS Services Ltd.Rachel PauloseNo ratings yet

- Master in Business Finance Structured FinanceDocument38 pagesMaster in Business Finance Structured Financepraloy66No ratings yet

- HDFC BankDocument39 pagesHDFC BankDurgaprasad VelamalaNo ratings yet

- NabkisanDocument24 pagesNabkisanDnyaneshwar Dattatraya PhadatareNo ratings yet

- KCC Application FormatDocument14 pagesKCC Application Formatsonigaurav22No ratings yet

- Agricultural Finance Manual UpdateDocument616 pagesAgricultural Finance Manual Updateamanbhati200810% (1)

- Agribusiness, Food Security and Financial Inclusion in IndiaDocument4 pagesAgribusiness, Food Security and Financial Inclusion in IndiaManoj RawatNo ratings yet

- EManual AGRI 1Document63 pagesEManual AGRI 1Kumar RajnishNo ratings yet

- Infrastructure FinanceDocument7 pagesInfrastructure FinanceKaran VasheeNo ratings yet

- Pillar#1B-1: Classification of Financial Intermediaries: Bank & NBFCDocument27 pagesPillar#1B-1: Classification of Financial Intermediaries: Bank & NBFCPRATIK PRAKASHNo ratings yet

- Axis - Microfinance Industry - Sector Report - Bandhan Bank and CreditAccess Grameen - 04-03-2021Document40 pagesAxis - Microfinance Industry - Sector Report - Bandhan Bank and CreditAccess Grameen - 04-03-2021anil1820No ratings yet

- Icici BankDocument33 pagesIcici BankpRiNcE DuDhAtRaNo ratings yet

- Managing Credit Risk and Loan PoliciesDocument81 pagesManaging Credit Risk and Loan PoliciesSubhajit KarmakarNo ratings yet

- The Case Study of A Fresh Food RetailDocument9 pagesThe Case Study of A Fresh Food RetailUsha BuchaleNo ratings yet

- Project Report - UMW Dongshin MotechDocument22 pagesProject Report - UMW Dongshin MotechGAURAV NIGAM0% (1)

- Agri Input Marketing Report of Mahindra Yuvo TractorDocument10 pagesAgri Input Marketing Report of Mahindra Yuvo TractorAnirudh GoelNo ratings yet

- NABARDDocument58 pagesNABARDbibinNo ratings yet

- RBL Bank - A Unique Model - On A Fast Lane - Detailed ReportDocument38 pagesRBL Bank - A Unique Model - On A Fast Lane - Detailed ReportHarshid JadavNo ratings yet

- Priority Sector Lending MM - Policy GuidelinesDocument49 pagesPriority Sector Lending MM - Policy Guidelines3470070036No ratings yet

- Quick Documentation GuideDocument43 pagesQuick Documentation GuideHimanshu MishraNo ratings yet

- 5 Major Sources of Rural Credit in IndiaDocument5 pages5 Major Sources of Rural Credit in IndiaParimita Sarma0% (1)

- AgTech World 2019: 7 - 8 November 2019Document4 pagesAgTech World 2019: 7 - 8 November 2019V SrinivasanNo ratings yet

- KRASHAK Mobile App-InfoDocument13 pagesKRASHAK Mobile App-InfobandhuNo ratings yet

- Axis Bank Corporate Strategy AnalysisDocument34 pagesAxis Bank Corporate Strategy AnalysisDeep Ghose DastidarNo ratings yet

- Mandatory Role-Based Certifications for SBI EmployeesDocument9 pagesMandatory Role-Based Certifications for SBI Employeesthotakoora gongooraNo ratings yet

- Agriculture Micro FinanceDocument18 pagesAgriculture Micro FinanceGaurav Sinha100% (1)

- Differentiation PDFDocument6 pagesDifferentiation PDFvinay mouryaNo ratings yet

- PDF Revised Agricultural CREDIT PDFDocument23 pagesPDF Revised Agricultural CREDIT PDFanand sahuNo ratings yet

- Corporate Credit Question Bank 2019 Ver2Document533 pagesCorporate Credit Question Bank 2019 Ver2vignesh rajaNo ratings yet

- Corporate FarmDocument4 pagesCorporate FarmAhsan ButtNo ratings yet

- Citibanks Indian Business ModelDocument14 pagesCitibanks Indian Business ModeljeganrajrajNo ratings yet

- Agricultural FinanceDocument22 pagesAgricultural Financeamit100% (3)

- PRIORITY SECTOR LENDING CATEGORIESDocument23 pagesPRIORITY SECTOR LENDING CATEGORIESSONALI HIREKHANNo ratings yet

- Importance of Sole Proprietorships in BangladeshDocument7 pagesImportance of Sole Proprietorships in BangladeshVikinguddin AhmedNo ratings yet

- Registration With SEBI As Merchant Banker and Other MaterialDocument5 pagesRegistration With SEBI As Merchant Banker and Other Materialapi-3727090100% (3)

- Chapter On NPA - 13032020 PDFDocument105 pagesChapter On NPA - 13032020 PDFs s singhNo ratings yet

- Agricultural FinanceDocument59 pagesAgricultural FinanceRizwan KhalidNo ratings yet

- Ey Building A Strategic and Profitable Auto Finance Portfolio in IndiaDocument28 pagesEy Building A Strategic and Profitable Auto Finance Portfolio in IndiaDominic SavioNo ratings yet

- Microfinance Report in MaharashtraDocument96 pagesMicrofinance Report in MaharashtraJugal Taneja100% (1)

- Indian Institute of Banking & Finance: Certificate Course On MSMEDocument6 pagesIndian Institute of Banking & Finance: Certificate Course On MSMEsonigaurav22No ratings yet

- Dena Retail BankingDocument16 pagesDena Retail BankingSunil Kumar ChauhanNo ratings yet

- MSME Government SupportDocument36 pagesMSME Government SupportBhaskaran BalamuraliNo ratings yet

- Complete Analysis of Bandhan BankDocument18 pagesComplete Analysis of Bandhan BankAkashNo ratings yet

- Agriculture and Microfinance Syllabus of AIBB DiplomaDocument1 pageAgriculture and Microfinance Syllabus of AIBB DiplomaArash Ahmed BadhonNo ratings yet

- Effects of Agricultural Credit On Agriculture OutputDocument21 pagesEffects of Agricultural Credit On Agriculture OutputHajra ANo ratings yet

- Mrunal Sir's Economy 2020 Batch - Handout PDFDocument32 pagesMrunal Sir's Economy 2020 Batch - Handout PDFssattyyaammNo ratings yet

- 12 Chapter 9 - Risk Management in Banks NBFCsDocument4 pages12 Chapter 9 - Risk Management in Banks NBFCsgarima_kukreja_dceNo ratings yet

- Niti Report On AgriDocument46 pagesNiti Report On AgrisrushtiisbackNo ratings yet

- SME and Industrial Infrastructure Growth in Andhra PradeshDocument42 pagesSME and Industrial Infrastructure Growth in Andhra PradeshGanguluri JyothsnaNo ratings yet

- Finance Question BankDocument10 pagesFinance Question BankSameer WableNo ratings yet

- Retail Banking S ST WyvhdeDocument8 pagesRetail Banking S ST WyvhdeAlimo shaikhNo ratings yet

- Banking Interview QuestionDocument6 pagesBanking Interview Questionberihun admassuNo ratings yet

- Interview Questions For Bank in BangladeDocument7 pagesInterview Questions For Bank in BangladeKhaleda Akhter100% (1)

- Specialized Industries Airlines: Name: Jayvan Ponce Subject: Pre 4 Auditing and Assurance: Specialized IndustryDocument10 pagesSpecialized Industries Airlines: Name: Jayvan Ponce Subject: Pre 4 Auditing and Assurance: Specialized IndustryCaptain ObviousNo ratings yet

- Data AnalysisDocument56 pagesData Analysisashraf294No ratings yet

- LinkDocument1 pageLinkashraf294No ratings yet

- Mathematics of Finance Chapter SummaryDocument29 pagesMathematics of Finance Chapter Summaryashraf294No ratings yet

- Tor Browser Setting - AshrafDocument1 pageTor Browser Setting - Ashrafashraf294No ratings yet

- Mis Report.4Document4,178 pagesMis Report.4ashraf294No ratings yet

- Mathematical Finance (POW) : Kenneth K. MwangiDocument15 pagesMathematical Finance (POW) : Kenneth K. Mwangiashraf294No ratings yet

- CEHv9 Module 03 Scanning NetworksDocument82 pagesCEHv9 Module 03 Scanning Networksashraf294No ratings yet

- Mis Report.4Document4,178 pagesMis Report.4ashraf294No ratings yet

- Ashraf Himel: 07 The Crucible (2011)Document9 pagesAshraf Himel: 07 The Crucible (2011)ashraf294No ratings yet

- To Improve Internal CommunicationDocument14 pagesTo Improve Internal Communicationashraf294No ratings yet

- Upgrade TP-LINK Wireless N Router FirmwareDocument4 pagesUpgrade TP-LINK Wireless N Router FirmwareMahaindra PutraNo ratings yet

- Math Suggestion For All Engineering Exam - CompressedDocument1 pageMath Suggestion For All Engineering Exam - Compressedashraf294No ratings yet

- Introduction to Accounting BasicsDocument7 pagesIntroduction to Accounting Basicsashraf294No ratings yet

- Diploma LettersDocument25 pagesDiploma LettersNafiz ImtiazNo ratings yet

- Regular Classes Not For All Now: Pull Down Defamatory Materials From OnlineDocument12 pagesRegular Classes Not For All Now: Pull Down Defamatory Materials From Onlineashraf294No ratings yet

- Home Desktop ConfigurationDocument1 pageHome Desktop Configurationashraf294No ratings yet

- 09204042Document109 pages09204042prospereducationNo ratings yet

- 539-Full Manuscript-2210-1-10-20210527Document14 pages539-Full Manuscript-2210-1-10-20210527ashraf294No ratings yet

- Lessons For BangladeshDocument3 pagesLessons For Bangladeshashraf294No ratings yet

- Bangladesh Railway e TicketDocument1 pageBangladesh Railway e Ticketashraf294No ratings yet

- Impact of Corporate Social Responsibility On Bank's Corporate ImageDocument15 pagesImpact of Corporate Social Responsibility On Bank's Corporate Imageashraf294No ratings yet

- Salma TeacherDocument1 pageSalma Teacherashraf294No ratings yet

- How To Upgrade TP-Link Wireless N RouterDocument4 pagesHow To Upgrade TP-Link Wireless N RouterFernando CalderonNo ratings yet

- Imfi 2018 01 NdiweniDocument12 pagesImfi 2018 01 NdiweniMinhaz KamalNo ratings yet

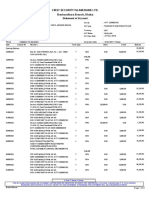

- First Security Islami Bank Ltd. Bashundhara Branch, Dhaka: Statement of AccountDocument3 pagesFirst Security Islami Bank Ltd. Bashundhara Branch, Dhaka: Statement of Accountashraf294No ratings yet

- 539-Full Manuscript-2210-1-10-20210527Document14 pages539-Full Manuscript-2210-1-10-20210527ashraf294No ratings yet

- Qualities of Loan Proposal Appraisal OfficerDocument2 pagesQualities of Loan Proposal Appraisal Officerashraf294No ratings yet

- Salma TeacherDocument1 pageSalma Teacherashraf294No ratings yet

- Fe NoteDocument1 pageFe Noteashraf294No ratings yet

- Project Notes PackagingDocument4 pagesProject Notes PackagingAngrej Singh SohalNo ratings yet

- 41720105Document4 pages41720105renu tomarNo ratings yet

- Assignment No1 of System Analysis and Design: Submitted To Submitted byDocument7 pagesAssignment No1 of System Analysis and Design: Submitted To Submitted byAnkur SinghNo ratings yet

- Gautam KDocument12 pagesGautam Kgautam kayapakNo ratings yet

- Christian Ministry Books: 00-OrientationGuideDocument36 pagesChristian Ministry Books: 00-OrientationGuideNessieNo ratings yet

- Air India CpioDocument5 pagesAir India CpioVicky GautamNo ratings yet

- SSC CGL Tier 2 Quantitative Abilities 16-Nov-2020Document17 pagesSSC CGL Tier 2 Quantitative Abilities 16-Nov-2020aNo ratings yet

- The Sociopath's MantraDocument2 pagesThe Sociopath's MantraStrategic ThinkerNo ratings yet

- PPT ch01Document45 pagesPPT ch01Junel VeriNo ratings yet

- Cambridge IGCSE: Pakistan Studies 0448/01Document4 pagesCambridge IGCSE: Pakistan Studies 0448/01Mehmood AlimNo ratings yet

- Inmarsat M2M Terminal ComparisonDocument2 pagesInmarsat M2M Terminal Comparisonmaruka33No ratings yet

- Types, Shapes and MarginsDocument10 pagesTypes, Shapes and MarginsAkhil KanukulaNo ratings yet

- Independent University, BangladeshDocument14 pagesIndependent University, BangladeshMD. JULFIKER HASANNo ratings yet

- Facebook Privacy FTC Complaint Docket No. C-4365Document19 pagesFacebook Privacy FTC Complaint Docket No. C-4365David SangerNo ratings yet

- Leases 2Document3 pagesLeases 2John Patrick Lazaro Andres100% (1)

- Giai Thich Ngu Phap Tieng Anh - Mai Lan Huong (Ban Dep)Document9 pagesGiai Thich Ngu Phap Tieng Anh - Mai Lan Huong (Ban Dep)Teddylove11No ratings yet

- Geometry First 9 Weeks Test Review 1 2011Document6 pagesGeometry First 9 Weeks Test Review 1 2011esvraka1No ratings yet

- Internship 2021: BY: Shantanu Anil MehareDocument8 pagesInternship 2021: BY: Shantanu Anil MehareShantanu MehareNo ratings yet

- Handouts - Entity Relationship DiagramDocument8 pagesHandouts - Entity Relationship Diagramsecret studetNo ratings yet

- The Cult of Demeter On Andros and The HDocument14 pagesThe Cult of Demeter On Andros and The HSanNo ratings yet

- Multiple Choice Questions Class Viii: GeometryDocument29 pagesMultiple Choice Questions Class Viii: GeometrySoumitraBagNo ratings yet

- Solving Problems Involving Simple Interest: Lesson 2Document27 pagesSolving Problems Involving Simple Interest: Lesson 2Paolo MaquidatoNo ratings yet