Professional Documents

Culture Documents

New Sales and Use Tax Rates Operative October 1, 2017: WWW - Cdtfa.ca - Gov Find A Sales Tax Rate by Address

Uploaded by

SuperlucidoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Sales and Use Tax Rates Operative October 1, 2017: WWW - Cdtfa.ca - Gov Find A Sales Tax Rate by Address

Uploaded by

SuperlucidoCopyright:

Available Formats

New Sales and Use Tax Rates Operative October 1, 2017

The tax rate changes listed below apply only within the indicated city or county limits. To find the correct tax rate for your area or business

location, visit www.cdtfa.ca.gov and click the Find a Sales Tax Rate by Address button. Please note that the new rates will not be available in

the tax rate by address lookup tool until October 1, 2017.

However, prior to October 1, 2017, the new tax rates will be available to view and in a downloadable spreadsheet on our website at

www.cdtfa.ca.gov. Scroll down to the ribbon and select Taxes and Fees, then click on City & County Tax Rates. You can also call our

Customer Service Center at 1-800-400-7115 (TTY:711) where representatives are available to assist you weekdays from 8:00 a.m. to

5:00 p.m. (Pacific time), except state holidays.

NEW DISTRICT TAXES

Rate as of

Citywide New Code Acronym Prior Rate

10/1/17

City of Corcoran (located in Kings County) 603 CRCG 7.25% 8.25%

City of Lindsay (located in Tulare County) 607 LDSG 7.75% 8.75%

City of Seaside (located in Monterey County) 605 SEDG 8.75% 9.25%

Rate as of

Countywide New Code Acronym Prior Rate

10/1/17

Los Angeles County

(The 9.50 percent tax rate applies to all unincorporated areas and 594 LACH 9.25% 9.50%

cities, and to the incorporated cities that do not impose a district tax.1)

City of Avalon 595 9.75% 10.00%

City of Commerce 596 9.75% 10.00%

City of Compton 2

589 10.25% 10.25%

City of Culver City 597 9.75% 10.00%

City of Downey 598 9.75% 10.00%

City of El Monte 599 9.75% 10.00%

City of Inglewood 600 9.75% 10.00%

City of La Mirada 2

586 10.25% 10.25%

City of Long Beach 2

588 10.25% 10.25%

City of Lynwood 2

590 10.25% 10.25%

City of Pico Rivera 2

582 10.25% 10.25%

City of San Fernando 602 9.75% 10.00%

City of Santa Monica 2

591 10.25% 10.25%

City of South El Monte 601 9.75% 10.00%

City of South Gate 2

580 10.25% 10.25%

CURRENT DISTRICT TAX DECREASING

Expiring Expiring New New Rate as of

City Prior Rate

Code Acronym Code Acronym 10/1/17

City of San Pablo (located in Contra Costa County)3 368 SPGT 609 SPRS 9.00% 8.75%

1

Agoura Hills, Alhambra, Arcadia, Artesia, Azusa, Baldwin Park, Bell, Bell Gardens, Bellflower, Beverly Hills, Bradbury, Burbank, Calabasas,

Carson, Cerritos, City of Industry, Claremont, Covina, Cudahy, Diamond Bar, Duarte, El Segundo, Gardena, Glendale, Glendora, Hawaiian Gardens,

Hawthorne, Hermosa Beach, Hidden Hills, Huntington Park, Irwindale, La Caada-Flintridge, La Habra Heights, La Puente, La Verne, Lakewood,

Lancaster, Lawndale, Lomita, Los Angeles, Malibu, Manhattan Beach, Maywood, Monrovia, Montebello, Monterey Park, Norwalk, Palmdale, Palos

Verdes Estates, Paramount, Pasadena, Pomona, Rancho Palos Verdes, Redondo Beach, Rolling Hills, Rolling Hills Estates, Rosemead, San Dimas, San

Gabriel, San Marino, Santa Clarita, Santa Fe Springs, Sierra Madre, Signal Hill, South Pasadena, Temple City, Torrance, Vernon, View Park, Walnut,

West Covina, West Hollywood, Westlake Village, and Whittier.

2

The new district tax of 0.25 percent (Measure HSales Tax for Homeless Services and Prevention) is not operative in cities in which the maximum

combined district tax rate is already imposed. However, for administrative purposes new codes are required. If a district tax imposed by any of these

cities expires or is reduced while the Measure H tax is in effect, the Measure H tax will immediately become operative in that city. The Measure H tax

is set to expire on September 30, 2027.

3

The existing city tax of 0.50 percent decreases to 0.25 percent on October 1, 2017. A new code and acronym is required. The tax is set to expire on

September 30, 2022.

L-503 (8-17)

You might also like

- 2022 Ogdensburg City Budget SummaryDocument8 pages2022 Ogdensburg City Budget SummaryAshley MarieNo ratings yet

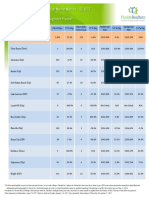

- Market Analysis by Area YTD Nov. 09Document1 pageMarket Analysis by Area YTD Nov. 09Breckenridge Grand Real EstateNo ratings yet

- Market Analysis by Area YTD Oct. 09Document1 pageMarket Analysis by Area YTD Oct. 09Breckenridge Grand Real EstateNo ratings yet

- Your 9mobile Bill Statement: MR Kpanja MichaelDocument3 pagesYour 9mobile Bill Statement: MR Kpanja MichaelSpikeNo ratings yet

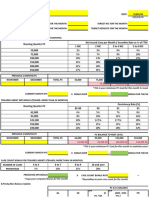

- Financial Model SampleDocument8 pagesFinancial Model SamplekaajitkumarNo ratings yet

- Mid-Year 2019 Brooklyn Office Market Report PDFDocument4 pagesMid-Year 2019 Brooklyn Office Market Report PDFAnonymous 9FiuKvWq8qNo ratings yet

- Buc-Ee's Council Presentation - Rev1Document17 pagesBuc-Ee's Council Presentation - Rev1nkotissoNo ratings yet

- TelecomOptic merger optimizationDocument5 pagesTelecomOptic merger optimizationlais contierNo ratings yet

- NFCC - Oclp TemplateDocument1 pageNFCC - Oclp TemplateFranz Xavier GarciaNo ratings yet

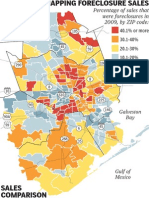

- Foreclosures 0411Document1 pageForeclosures 0411Houston ChronicleNo ratings yet

- Deal List 9 30 10Document6 pagesDeal List 9 30 10jhoppenNo ratings yet

- Invoice 0000002Document1 pageInvoice 0000002EllenNo ratings yet

- Finance Committee 051319Document67 pagesFinance Committee 051319al_crespoNo ratings yet

- Classroom Model-Removed Circularity Iin InterestDocument46 pagesClassroom Model-Removed Circularity Iin InterestKaran PatelNo ratings yet

- The City Competitiveness: VisionDocument4 pagesThe City Competitiveness: VisionnathNo ratings yet

- Industrial Market Report - 3Q22 - ColliersDocument6 pagesIndustrial Market Report - 3Q22 - Colliersrbfonseca96No ratings yet

- Lambert Fiscal Summary July 2018Document3 pagesLambert Fiscal Summary July 2018None None NoneNo ratings yet

- Maxx Hotel Excavation and Demolition Project UpdateDocument3 pagesMaxx Hotel Excavation and Demolition Project UpdateIrma AhkdirNo ratings yet

- Commercial Property Pricing IndexDocument7 pagesCommercial Property Pricing IndexIvan DidiNo ratings yet

- 2021 Assessment Summary Report - Final - April 21, 2021Document19 pages2021 Assessment Summary Report - Final - April 21, 2021Duluth News TribuneNo ratings yet

- Basic MF Development Model v1.1Document4 pagesBasic MF Development Model v1.1AlexNo ratings yet

- Okaloosa County Single Family Homes 2017-Q2 Local Residential Market MetricsDocument6 pagesOkaloosa County Single Family Homes 2017-Q2 Local Residential Market MetricsWendy RulnickNo ratings yet

- Pricesheet & Payment Plan v3.0Document2 pagesPricesheet & Payment Plan v3.0Aditya ShahNo ratings yet

- GSCM520 Unit7 Learning Activity SolutionsDocument4 pagesGSCM520 Unit7 Learning Activity Solutions蔡承恩No ratings yet

- Tax Year 2020 StatisticsDocument127 pagesTax Year 2020 StatisticsAdam HarringtonNo ratings yet

- Rockingham City Council Presentation by Pcm2Document14 pagesRockingham City Council Presentation by Pcm2savannahnow.com100% (1)

- Impact of SC Ruling To The DILG & LGUsDocument26 pagesImpact of SC Ruling To The DILG & LGUsMarijenLeaño100% (1)

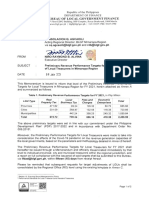

- BLGF Memo To BLGF Mimaropa Region - Preliminary Revenue Performance Targets For FY 2021 - 08 Jan 2021 - ApprovedDocument8 pagesBLGF Memo To BLGF Mimaropa Region - Preliminary Revenue Performance Targets For FY 2021 - 08 Jan 2021 - Approvedباليواغ الجيNo ratings yet

- Production of Gas by YearDocument6 pagesProduction of Gas by YearJim MacaoNo ratings yet

- Utah Housing Numbers (Jan 2023)Document1 pageUtah Housing Numbers (Jan 2023)KUTV 2NewsNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 October 15Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 October 15Australian Property ForumNo ratings yet

- Addressing The Challenges of Industrialization: Responsible Mining: Moving Beyond ComplianceDocument20 pagesAddressing The Challenges of Industrialization: Responsible Mining: Moving Beyond Compliancemonkeybike88No ratings yet

- Toll Road Financial ModelDocument10 pagesToll Road Financial ModelStrategy PlugNo ratings yet

- GRAR 2022-Q1 SummaryDocument4 pagesGRAR 2022-Q1 SummaryNews 8 WROCNo ratings yet

- Publications_15112022000_ICT_Indicators_in_Brief _October_2022_15112022Document4 pagesPublications_15112022000_ICT_Indicators_in_Brief _October_2022_15112022mohegabNo ratings yet

- Market Report - Sewa Kantor CBDDocument11 pagesMarket Report - Sewa Kantor CBDdhipie kuronNo ratings yet

- Improving Mobility in SuratDocument33 pagesImproving Mobility in SuratDr. Rajesh Pandya SVNITNo ratings yet

- Brgy. Tacul Pow Final Na Gyod So FarDocument13 pagesBrgy. Tacul Pow Final Na Gyod So FarHaiiiroNo ratings yet

- Monte Carlo Simulation Tutorial v2.0Document50 pagesMonte Carlo Simulation Tutorial v2.0moepoeNo ratings yet

- Utah Housing Numbers (Feb 2023)Document1 pageUtah Housing Numbers (Feb 2023)KUTV 2NewsNo ratings yet

- Discounted Cash Flow Someka Excel Template V2 Free VersionDocument4 pagesDiscounted Cash Flow Someka Excel Template V2 Free VersionnaveenkrealNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 December 10Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 December 10Australian Property ForumNo ratings yet

- GRAR Summary 2022-Q4Document5 pagesGRAR Summary 2022-Q4Tyler DiedrichNo ratings yet

- 306 ForecastingPart-FinalDocument8 pages306 ForecastingPart-FinalMd. Safiqul IslamNo ratings yet

- Account 505-275-7745 220: Billing Date Jul 22, 2023Document40 pagesAccount 505-275-7745 220: Billing Date Jul 22, 2023kathyta03No ratings yet

- Fetch Statementand NoticesDocument3 pagesFetch Statementand NoticessweigartmarianNo ratings yet

- Financial Model Example: Hotel Evaluation + M&A: Results Assumptions Loan BalanceDocument14 pagesFinancial Model Example: Hotel Evaluation + M&A: Results Assumptions Loan BalancemotebangNo ratings yet

- Meralco BillDocument2 pagesMeralco BillsdfNo ratings yet

- Sohar Municipality CostingDocument11 pagesSohar Municipality CostingshreeNo ratings yet

- Construction of KASFALA Hall Cost EstimatesDocument25 pagesConstruction of KASFALA Hall Cost EstimatesHaiiiroNo ratings yet

- A SheetDocument24 pagesA SheetBilal AliNo ratings yet

- Mexico City: Industrial Q4 2019Document2 pagesMexico City: Industrial Q4 2019PepitofanNo ratings yet

- Manila Bay North Tower 1-Bedroom Unit Payment TermsDocument1 pageManila Bay North Tower 1-Bedroom Unit Payment Termsamiel pugatNo ratings yet

- Revenues MemoDocument6 pagesRevenues Memoapi-721237127No ratings yet

- Potential Client Tracker Template: Click Here To Create in SmartsheetDocument4 pagesPotential Client Tracker Template: Click Here To Create in SmartsheetLeandro Dodoy Frincillo CrebelloNo ratings yet

- Class 4 HW MaterialDocument44 pagesClass 4 HW MaterialZihao ChenNo ratings yet

- Hot Leads 2018 v2Document72 pagesHot Leads 2018 v2JamielleNo ratings yet

- UK Short Mobile 2008Document22 pagesUK Short Mobile 2008solo12344322No ratings yet

- CAMEL: Intelligent Networks for the GSM, GPRS and UMTS NetworkFrom EverandCAMEL: Intelligent Networks for the GSM, GPRS and UMTS NetworkRating: 2 out of 5 stars2/5 (1)

- Can America Compete?: 1 in 5 U.S. Teens Lacks Basic Personal Finance SkillsDocument8 pagesCan America Compete?: 1 in 5 U.S. Teens Lacks Basic Personal Finance SkillsSuperlucidoNo ratings yet

- Can America Compete?: 1 in 5 U.S. Teens Lacks Basic Personal Finance SkillsDocument8 pagesCan America Compete?: 1 in 5 U.S. Teens Lacks Basic Personal Finance SkillsSuperlucidoNo ratings yet

- RDWRDocument7 pagesRDWRSuperlucidoNo ratings yet

- Health Insurance Marketplace 5 Tier Drug ListDocument226 pagesHealth Insurance Marketplace 5 Tier Drug ListSuperlucidoNo ratings yet

- 2017 Fullschedule ExgDocument1 page2017 Fullschedule ExgSuperlucidoNo ratings yet

- Instructions For Form 8802: (Rev. October 2017)Document16 pagesInstructions For Form 8802: (Rev. October 2017)SuperlucidoNo ratings yet

- 2017 Fullschedule ExgDocument1 page2017 Fullschedule ExgSuperlucidoNo ratings yet

- CO5150Document8 pagesCO5150SuperlucidoNo ratings yet

- GRE PBT Center ListsDocument9 pagesGRE PBT Center ListsSuperlucidoNo ratings yet

- Publications EsDocument6 pagesPublications EsSuperlucidoNo ratings yet

- Zone 3 November 2017 Final Timetable v2Document17 pagesZone 3 November 2017 Final Timetable v2SuperlucidoNo ratings yet

- Edmonton Oilers 2017-18 Pre-Season & Regular Season ScheduleDocument3 pagesEdmonton Oilers 2017-18 Pre-Season & Regular Season ScheduleSuperlucidoNo ratings yet

- 2017 18 Fafsa Updates Students Parents PDFDocument2 pages2017 18 Fafsa Updates Students Parents PDFmomoitachiNo ratings yet

- Adopted Infrastructure Charges Resolution (Version 7) October 2017Document31 pagesAdopted Infrastructure Charges Resolution (Version 7) October 2017SuperlucidoNo ratings yet

- The Employment Situation - September 2017Document40 pagesThe Employment Situation - September 2017Circa NewsNo ratings yet

- The Employment Situation - September 2017Document40 pagesThe Employment Situation - September 2017Circa NewsNo ratings yet

- IPA Newsletter highlights friendship and service around the worldDocument20 pagesIPA Newsletter highlights friendship and service around the worldSuperlucidoNo ratings yet

- The Employment Situation - September 2017Document40 pagesThe Employment Situation - September 2017Circa NewsNo ratings yet

- Schedule 8.1 October17Document9 pagesSchedule 8.1 October17SuperlucidoNo ratings yet

- Global Health Matters: Grantees Assess Long-Term Benefits of Fogarty TrainingDocument12 pagesGlobal Health Matters: Grantees Assess Long-Term Benefits of Fogarty TrainingSuperlucidoNo ratings yet

- Ial Timetable October - 2016 PDFDocument16 pagesIal Timetable October - 2016 PDFhasithaNo ratings yet

- Global Health Matters: Grantees Assess Long-Term Benefits of Fogarty TrainingDocument12 pagesGlobal Health Matters: Grantees Assess Long-Term Benefits of Fogarty TrainingSuperlucidoNo ratings yet

- Tentative Course List July 2017Document15 pagesTentative Course List July 2017Brian FreemanNo ratings yet

- Ial Timetable October - 2016 PDFDocument16 pagesIal Timetable October - 2016 PDFhasithaNo ratings yet

- Calendar of Events October 2017: Monday Tuesday Wednesday Thursday FridayDocument2 pagesCalendar of Events October 2017: Monday Tuesday Wednesday Thursday FridaySuperlucidoNo ratings yet

- Tentative Course List July 2017Document15 pagesTentative Course List July 2017Brian FreemanNo ratings yet

- Calendar of Events October 2017: Monday Tuesday Wednesday Thursday FridayDocument2 pagesCalendar of Events October 2017: Monday Tuesday Wednesday Thursday FridaySuperlucidoNo ratings yet

- SAGE Agenda October 2017Document7 pagesSAGE Agenda October 2017SuperlucidoNo ratings yet

- Tentative Course List July 2017Document15 pagesTentative Course List July 2017Brian FreemanNo ratings yet

- Enso Evolution Status Fcsts WebDocument32 pagesEnso Evolution Status Fcsts WebSuperlucidoNo ratings yet

- Chamber Registration PakistanDocument23 pagesChamber Registration PakistanNida Sweet67% (3)

- D 2020 115 - Designating State's ProsecutorDocument3 pagesD 2020 115 - Designating State's ProsecutorNational Content DeskNo ratings yet

- Vietnam Revision NotesDocument14 pagesVietnam Revision NotesZoe TroyNo ratings yet

- Filipino: Ikalawang Markahan-Modyul 14Document20 pagesFilipino: Ikalawang Markahan-Modyul 14Libert Moore Omambat Betita100% (4)

- Industrial Relations - Unit II - by Singa Lama PDFDocument5 pagesIndustrial Relations - Unit II - by Singa Lama PDFSinga LamaNo ratings yet

- Agrarian Reform in The PhilippinesDocument17 pagesAgrarian Reform in The PhilippinesMelody GuamosNo ratings yet

- 15PPOC999-DS1-Politics Dissertation - Philippine Infra Bundle - MSC SSD - 657650 - John PimentelDocument114 pages15PPOC999-DS1-Politics Dissertation - Philippine Infra Bundle - MSC SSD - 657650 - John PimentelJohn Vincent PimentelNo ratings yet

- List of Proposed PPP Projects To Be Launched in VietnamDocument3 pagesList of Proposed PPP Projects To Be Launched in VietnamDupesh SainiNo ratings yet

- The Rights of Minorities To Establish and Administer Educational Institutions Under The Constitution of Indi1Document10 pagesThe Rights of Minorities To Establish and Administer Educational Institutions Under The Constitution of Indi1Tshewang Dorjee LamaNo ratings yet

- Salvador Cienfuegos Zepeda IndictmentDocument9 pagesSalvador Cienfuegos Zepeda IndictmentChivis Martinez100% (1)

- INSIGHTS – PUBLIC ADMINISTRATION KEY TOPICS AND ANSWERSDocument49 pagesINSIGHTS – PUBLIC ADMINISTRATION KEY TOPICS AND ANSWERSAbhishek Singh100% (1)

- NOTIFICATION CT TM 2019 English PDFDocument40 pagesNOTIFICATION CT TM 2019 English PDFNarender GillNo ratings yet

- DepEd Form 137-E RecordsDocument3 pagesDepEd Form 137-E RecordsJeje AngelesNo ratings yet

- LigaoDocument3 pagesLigaoErold TarvinaNo ratings yet

- Work Permit Support LetterDocument3 pagesWork Permit Support LettershermanNo ratings yet

- Was The US Founded On Capitalism?Document3 pagesWas The US Founded On Capitalism?Newnac100% (1)

- Posobie Dlya 2 Kursa PONBDocument276 pagesPosobie Dlya 2 Kursa PONBMasters of DeadNo ratings yet

- AfghanistanDocument31 pagesAfghanistanAakashParanNo ratings yet

- Timbungco Vs CastroDocument1 pageTimbungco Vs CastroNimpa Pichay100% (1)

- Packing ListDocument17 pagesPacking ListWaqar WasaNo ratings yet

- MGR Statue in Malaysia 28-6-2011Document15 pagesMGR Statue in Malaysia 28-6-2011Rajagopal RaoNo ratings yet

- 2010 Malawi Pastoral LetterDocument5 pages2010 Malawi Pastoral LetterMalawi2014No ratings yet

- Subiecte Cangurul LingvistDocument5 pagesSubiecte Cangurul LingvistANDREEA URZICANo ratings yet

- Admission FormDocument2 pagesAdmission FormShakil AhmedNo ratings yet

- Strategy and Geopolitics of Sea Power Throughout HistoryDocument214 pagesStrategy and Geopolitics of Sea Power Throughout History伊善强No ratings yet

- AbhiDocument49 pagesAbhiAmol ShindeNo ratings yet

- Agrarian ReformDocument7 pagesAgrarian ReformRaffy San AntonioNo ratings yet

- Barangay Tongcopan BGPMS ReportDocument86 pagesBarangay Tongcopan BGPMS ReportMandy NoorNo ratings yet

- Anti ATM Sangla ExplanatoryDocument2 pagesAnti ATM Sangla ExplanatoryCy ValenzuelaNo ratings yet

- H. Ra 8189 The Voter's Registration Act of 1996Document26 pagesH. Ra 8189 The Voter's Registration Act of 1996Wolf Den100% (3)