Professional Documents

Culture Documents

CEZ Tearsheet

Uploaded by

faiyazadamCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CEZ Tearsheet

Uploaded by

faiyazadamCopyright:

Available Formats

CEZ AS

Ticker Sector Primary Exchange Employees Address

CEZ CK EQUITY Utilities Prague SE 26,746 Duhova 2 / 1444

Praha 4, 140 53

Telephone 420-2-7113-1111 Czech Republic

Website www.cez.cz

Overview

Overview Rating & Outlook

CEZ Group is an integrated electricity conglomerate with operations in a number of countries in Central and Southeastern Europe and S&P Moody's Fitch

Turkey, headquartered in the Czech Republic. Its principal businesses encompass generation, distribution, trading, and sale of power and

A- A2 A-

heat, trading and sales of natural gas, and coal mining.

STABLE NEG STABLE

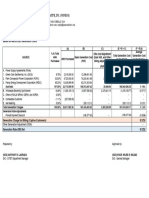

Key Market Stats* Stock Price Performance

Last Price 611

700 1.8

52 Wk High/52 Wk low 671.8 / 464.2 CZK

Millions

1.6

Volume 909,884 650

Market Cap (CZK mn) 328,712 1.4

Shares Out (mn) 538 600 1.2

Free Float (%) -- 1.0

550

Dividend Yield (%) 6.5 0.8

Beta 0.97 500 0.6

EPS (Trailing 12M) 46.01 0.4

450

P/E (Trailing 12M) 13.3x 0.2

P/B 1.3x 400 0.0

Dec-12 Apr-13 Aug-13 Dec-13 Apr-14

Enterprise Value CZK mn

Market Cap 328,712 Financial Summary

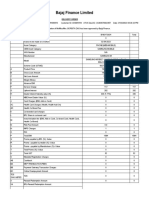

Total Debt 191,271 CZK millions except Per Share data FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 Last 12M

Minority Interest 4,441 (USD:CZK=21.8) 31-Dec-09 31-Dec-10 31-Dec-11 31-Dec-12 31-Dec-13 30-Jun-14

Less: Cash (37,681) Net Revenue 189,458 198,848 209,761 215,095 217,273 205,874

TEV 486,743 Cost of Revenue - - - - - -

Gross Profit 189,458 198,848 209,761 215,095 217,273 205,874

Valuation Operating Expenses 128,102 142,924 159,505 166,275 170,384 167,098

P/E (trailing 12M Average) Interest Expense 3,303 5,498 6,956 6,369 6,371 6,126

31-Dec-09 9.7x Forex Losses (Gains) 1,189 2,943 566 (763) (1,070) (1,278)

31-Dec-10 8.9x Other (8,082) (2,239) (28) (1,239) 3,025 8,417

31-Dec-11 9.3x Pre Tax Income 64,946 49,722 42,762 44,453 38,563 25,511

31-Dec-12 9.7x Income Tax 13,091 11,739 11,199 10,804 9,206 7,514

31-Dec-13 7.0x XO Income & Minority Interest 308 (110) (3) (1,276) (651) (691)

30-Jun-14 11.2x Net Income 51,547 38,093 31,566 34,925 30,008 24,565

P/B (Average) EBITDA 90,305 95,511 88,769 86,682 84,273 77,540

31-Dec-09 2.6x EPS 96.67 88.14 76.32 77.57 67.20 46.01

31-Dec-10 2.3x

31-Dec-11 2.0x Cash & Equivalents 26,727 22,163 22,062 17,957 25,118 37,681

31-Dec-12 1.7x Current Assets 116,504 105,740 131,000 141,173 154,618 143,437

31-Dec-13 1.2x Net Fixed Assets 328,805 362,510 386,837 419,754 426,560 423,432

30-Jun-14 1.2x Total Assets 530,259 544,375 598,301 636,070 641,136 634,651

ST Borrowing 37,889 24,404 24,764 16,789 30,820 32,252

Dividend Yield % (on closing price) LT Borrowing 118,921 140,040 164,685 176,106 168,396 159,019

FY 2009 6.13 Total Liabilities 323,584 317,323 366,111 381,851 378,011 374,945

FY 2010 6.39 Total Equity 206,675 227,052 232,190 254,219 263,125 259,706

FY 2011 5.73

FY 2012 5.88 Cash From Operations 87,354 77,165 61,773 64,612 72,556 80,964

FY 2013 7.74 Cash From Investing (99,022) (65,584) (52,876) (53,135) (40,273) (33,533)

Cash From Financing 21,092 (16,122) (9,021) (15,582) (25,122) (40,739)

Key Officers Net Changes in Cash 9,424 (4,541) (124) (4,105) 7,161 6,692

Daniel Benes Chairman-Mgmt Board/CEO

Martin Novak Vice Chairman-Mgmt Board/CFO Gross Margin - - - - - -

EBITDA Margin 47.7% 48.0% 42.3% 40.3% 38.8% 37.7%

Ladislav Stepanek Pavel Cyrani Net Income Margin 27.2% 19.2% 15.0% 16.2% 13.8% 11.9%

Chief Production Officer Chief Strategy Officer ROE 26.3% 17.6% 13.7% 14.4% 11.6% 9.4%

ROA 10.3% 7.1% 5.5% 5.7% 4.7% 3.9%

Michaela Chaloupkova Alan Svoboda Net Debt/EBITDA 1.4x 1.5x 1.9x 2.0x 2.1x 2.1x

Chief Purchasing Officer Chief Sales Officer EBITDA/Int Exp. 27.3x 17.4x 12.8x 13.6x 13.2x 12.7x

Total Debt/Equity 75.9% 72.4% 81.6% 75.9% 75.7% 73.6%

Total Debt/Asset 29.6% 30.2% 31.7% 30.3% 31.1% 30.1%

You might also like

- Semiconductor Data Book: Characteristics of approx. 10,000 Transistors, FETs, UJTs, Diodes, Rectifiers, Optical Semiconductors, Triacs and SCRsFrom EverandSemiconductor Data Book: Characteristics of approx. 10,000 Transistors, FETs, UJTs, Diodes, Rectifiers, Optical Semiconductors, Triacs and SCRsNo ratings yet

- NABIl Bank DaitailDocument16 pagesNABIl Bank Daitailrameshchaudhary008899No ratings yet

- Token Ring Technology ReportFrom EverandToken Ring Technology ReportNo ratings yet

- Bartronics Update 16 Oct. 2009Document7 pagesBartronics Update 16 Oct. 2009achopra14No ratings yet

- Info Memo Telkom Fy2008Document18 pagesInfo Memo Telkom Fy2008prakososantosoNo ratings yet

- AC Penetration Accross CountriesDocument21 pagesAC Penetration Accross Countrieshh.deepakNo ratings yet

- Kencana Petroleum Berhad: Termination of Proposed Collaboration With Global Offshore - 20/5/2010Document2 pagesKencana Petroleum Berhad: Termination of Proposed Collaboration With Global Offshore - 20/5/2010Rhb InvestNo ratings yet

- Dayang Enterprise Holdings Berhad: in An Industry Sweet Spot - 22/09/2010Document11 pagesDayang Enterprise Holdings Berhad: in An Industry Sweet Spot - 22/09/2010Rhb InvestNo ratings yet

- Microsoft Corporation Financial Statements and Supplementary DataDocument43 pagesMicrosoft Corporation Financial Statements and Supplementary DataDylan MakroNo ratings yet

- Astrocast Bryan Garnier Report Buy-Tpnok85Document50 pagesAstrocast Bryan Garnier Report Buy-Tpnok85Cesar LizarazoNo ratings yet

- Axiata Group Berhad: 1HFY10 Net Profit More Than Doubles - 26/08/2010Document5 pagesAxiata Group Berhad: 1HFY10 Net Profit More Than Doubles - 26/08/2010Rhb InvestNo ratings yet

- Sursa: BVB, Equit Yrt: Date Financiare (Ronmii) - IndividualeDocument4 pagesSursa: BVB, Equit Yrt: Date Financiare (Ronmii) - IndividualeConstantin-Ciprian BîrsanNo ratings yet

- WKHS ReutersInvestmentProfileDocument12 pagesWKHS ReutersInvestmentProfilennn kkkNo ratings yet

- Puncak Niaga Holdings Berhad: FY12/09 Net Profit Underpinned by GovernmentCompensation Yet To Be Received - 01/03/2010Document3 pagesPuncak Niaga Holdings Berhad: FY12/09 Net Profit Underpinned by GovernmentCompensation Yet To Be Received - 01/03/2010Rhb InvestNo ratings yet

- The First Half of 2008 Results (Unaudited) : Financial HighlightsDocument18 pagesThe First Half of 2008 Results (Unaudited) : Financial Highlightsramzy.07No ratings yet

- Globetronics Technology Berhad: Joining The LED Lighting Revolution-12/10/2010Document7 pagesGlobetronics Technology Berhad: Joining The LED Lighting Revolution-12/10/2010Rhb InvestNo ratings yet

- Notion Vtec Berhad: Moving Up The Value Chain - 15/03/2010Document11 pagesNotion Vtec Berhad: Moving Up The Value Chain - 15/03/2010Rhb InvestNo ratings yet

- Lufthansa Annual Report 2011 PDFDocument264 pagesLufthansa Annual Report 2011 PDFphilippe8brunoNo ratings yet

- Axiata Group Berhad: Mixed Outlook For Regional Cellcos-22/04/2010Document4 pagesAxiata Group Berhad: Mixed Outlook For Regional Cellcos-22/04/2010Rhb InvestNo ratings yet

- Soa 23on81273 May2022Document2 pagesSoa 23on81273 May2022Nyari RecehNo ratings yet

- Petra Perdana Berhad: Proposes Private Placement and Renounceable Right - 12/5/2010Document3 pagesPetra Perdana Berhad: Proposes Private Placement and Renounceable Right - 12/5/2010Rhb InvestNo ratings yet

- DOPrintPage - 2021-09-11T184040.105Document2 pagesDOPrintPage - 2021-09-11T184040.105Syed Tanveer Hasan HasanNo ratings yet

- DOPrintPage - 2024-01-17T124056.130Document2 pagesDOPrintPage - 2024-01-17T124056.130sahresh.officialNo ratings yet

- RF Spread To Treasury: Total RF (Consolidated) GivenDocument8 pagesRF Spread To Treasury: Total RF (Consolidated) GivenKunal JainNo ratings yet

- Module 2 Portfolio Report On Power BIDocument1 pageModule 2 Portfolio Report On Power BIKusum RaoNo ratings yet

- Jkload 4Document3 pagesJkload 4Jay OsloNo ratings yet

- AAPL.O Apple Inc. Profile - ReutersDocument7 pagesAAPL.O Apple Inc. Profile - ReutersSheryl PajaNo ratings yet

- DOPrintPage PDFDocument2 pagesDOPrintPage PDFRitu GundliNo ratings yet

- Lafarge (M) Cement Berhad: 1Q FY12/10 Performance Declines 47% On Weak - 27/05/2010Document3 pagesLafarge (M) Cement Berhad: 1Q FY12/10 Performance Declines 47% On Weak - 27/05/2010Rhb InvestNo ratings yet

- MEW 85 Costing - 303 Rev7Document30 pagesMEW 85 Costing - 303 Rev7fadidiNo ratings yet

- Ages 1Document8 pagesAges 1bobNo ratings yet

- Jkload 5Document3 pagesJkload 5Jay OsloNo ratings yet

- DOPrint PageDocument2 pagesDOPrint PageRahul PramanikNo ratings yet

- Data Sheet Eu2Document7 pagesData Sheet Eu2admin peoNo ratings yet

- Flyback Transformers For 25Watt Poe Application: 遠見電子股份有限公司 Providence Electronics CorpDocument2 pagesFlyback Transformers For 25Watt Poe Application: 遠見電子股份有限公司 Providence Electronics Corpwxzcldw163.comNo ratings yet

- 28 Generation Cost April 2023Document1 page28 Generation Cost April 2023sinnyen.hengNo ratings yet

- Technical Watch: Retail ResearchDocument12 pagesTechnical Watch: Retail ResearchnazrikhanNo ratings yet

- Indonesia Daily: UpdateDocument7 pagesIndonesia Daily: UpdateyolandaNo ratings yet

- Finance 5Document1 pageFinance 5retrov androsNo ratings yet

- Infosys Technologies Ltd. Equity: Filing & Other Info Peer Group ChartingDocument26 pagesInfosys Technologies Ltd. Equity: Filing & Other Info Peer Group Chartinglaxmantej77No ratings yet

- Lafarge (M) Cement Berhad :FY12/09 Performance Boosted by Margin Expansion - 01/03/2010Document3 pagesLafarge (M) Cement Berhad :FY12/09 Performance Boosted by Margin Expansion - 01/03/2010Rhb InvestNo ratings yet

- Business Strategy For The Petrochemicals & Plastics Sector: October 8, 2015Document36 pagesBusiness Strategy For The Petrochemicals & Plastics Sector: October 8, 2015afs araeNo ratings yet

- IJM Land Berhad: Above Expectations - 26/08/2010Document4 pagesIJM Land Berhad: Above Expectations - 26/08/2010Rhb InvestNo ratings yet

- PFin-TEV-27 12 10Document49 pagesPFin-TEV-27 12 10Asit Kumar RoyNo ratings yet

- Exported ReportDocument1 pageExported ReportSainbks 123No ratings yet

- Sterlite Technologies - Q4'10 Result Update - (23!04!2010)Document3 pagesSterlite Technologies - Q4'10 Result Update - (23!04!2010)kotler_2006No ratings yet

- Bajaj Finance Limited: Delivery OrderDocument2 pagesBajaj Finance Limited: Delivery OrderIla sahuNo ratings yet

- DOPrintPage - 2021-11-18T194252.852Document2 pagesDOPrintPage - 2021-11-18T194252.852Ila sahuNo ratings yet

- Data Sheet - Smart DT Series LowDocument1 pageData Sheet - Smart DT Series LowZhen SinNo ratings yet

- Listed Companies Highlights: Financial FocusDocument1 pageListed Companies Highlights: Financial FocusT'Tee MiniOns'TmvsNo ratings yet

- Nokia C5-00.2 RM-745 Service Schematics v0.2Document10 pagesNokia C5-00.2 RM-745 Service Schematics v0.2DariusNo ratings yet

- DOPrint PageDocument2 pagesDOPrint PageSandesh kharatNo ratings yet

- Compal La-6841p r0.1 SchematicsDocument45 pagesCompal La-6841p r0.1 Schematicskamil_yilmaz_6No ratings yet

- 09.45 Fabrice RenardDocument25 pages09.45 Fabrice RenardMaintenance PTGSNo ratings yet

- My Dashboard: Net Order Value by Purchasing Group No. of Pos With Release IndicatorDocument2 pagesMy Dashboard: Net Order Value by Purchasing Group No. of Pos With Release IndicatorTalat QadeerNo ratings yet

- Kanpur Electricity Supply Company Limited Electricity Bill and Disconnection Notice (LMV-1) - (ST-11 Domestic Other Metered (TVM Above10KW) )Document2 pagesKanpur Electricity Supply Company Limited Electricity Bill and Disconnection Notice (LMV-1) - (ST-11 Domestic Other Metered (TVM Above10KW) )Satyam TiwariNo ratings yet

- Development Project Proforma/Proposal (DPP) : Part-A Project SummaryDocument14 pagesDevelopment Project Proforma/Proposal (DPP) : Part-A Project SummaryWahidNo ratings yet

- Costo de ProducciónDocument1 pageCosto de ProducciónJuan GonzalezNo ratings yet

- Fundholder Account - Transactions DetailsDocument2 pagesFundholder Account - Transactions DetailsPolycarp Danson SigaiNo ratings yet

- Financial HighlightsDocument1 pageFinancial Highlightsarman_277276271No ratings yet

- Global Sukuk Market HSBC May 2012Document30 pagesGlobal Sukuk Market HSBC May 2012faiyazadamNo ratings yet

- KFH Tariff 2020Document1 pageKFH Tariff 2020faiyazadamNo ratings yet

- Primer On Trading CompsDocument6 pagesPrimer On Trading CompsfaiyazadamNo ratings yet

- Credit Reasoning and Writing PDFDocument1 pageCredit Reasoning and Writing PDFfaiyazadamNo ratings yet

- IFC+Solar+Report Web+ 08+05Document216 pagesIFC+Solar+Report Web+ 08+05Jaikumar Pettikkattil0% (1)

- Debt Sizing in Excel Webinar 01i PDFDocument21 pagesDebt Sizing in Excel Webinar 01i PDFfaiyazadamNo ratings yet

- Electricity: CEE Equity ResearchDocument15 pagesElectricity: CEE Equity ResearchfaiyazadamNo ratings yet

- Cibcreport Rare MetalsDocument41 pagesCibcreport Rare MetalsfaiyazadamNo ratings yet

- Emerging Market Sovereign Debt IMF March 2014Document50 pagesEmerging Market Sovereign Debt IMF March 2014faiyazadamNo ratings yet

- From Accumulate To Hold: Erste Group Research - Company ReportDocument26 pagesFrom Accumulate To Hold: Erste Group Research - Company ReportfaiyazadamNo ratings yet

- All Qasas 1 Vocabulary ListDocument22 pagesAll Qasas 1 Vocabulary ListCrayPower95% (19)

- Arabic Acceleration ReportDocument47 pagesArabic Acceleration ReportAbu IbrahimNo ratings yet

- FGB 2012 - Q2Document19 pagesFGB 2012 - Q2faiyazadamNo ratings yet

- Akkök A.Ş.: TL MN Except Per Share Data TL MN Except Per Share DataDocument1 pageAkkök A.Ş.: TL MN Except Per Share Data TL MN Except Per Share DatafaiyazadamNo ratings yet

- Oil and Gas Dept. of TreasuryDocument151 pagesOil and Gas Dept. of TreasuryfaiyazadamNo ratings yet

- Advicent Morningstar Webinar August 2015Document62 pagesAdvicent Morningstar Webinar August 2015faiyazadamNo ratings yet

- Credit Suisse - How Demographics Affect Asset Prices PDFDocument34 pagesCredit Suisse - How Demographics Affect Asset Prices PDFEquity PrivateNo ratings yet

- Kritzman - Asset AllocationDocument14 pagesKritzman - Asset Allocationmassimo2No ratings yet

- Syndicated Loans BrochureDocument24 pagesSyndicated Loans BrochurefaiyazadamNo ratings yet

- Zad Ul TalibeenDocument89 pagesZad Ul Talibeenfaizanin27100% (1)

- 3M ReportDocument85 pages3M ReportfaiyazadamNo ratings yet

- Ifrs 9Document8 pagesIfrs 9faiyazadamNo ratings yet

- SketchbookDocument18 pagesSketchbookfaiyazadamNo ratings yet

- US Internal Revenue Service: OilgasDocument151 pagesUS Internal Revenue Service: OilgasIRSNo ratings yet

- Fundamentals of Private Equity Deal StructuringDocument39 pagesFundamentals of Private Equity Deal StructuringRahul KhuranaNo ratings yet

- Fixed Income BulletinDocument12 pagesFixed Income BulletinfaiyazadamNo ratings yet

- Shariat & TariqatDocument208 pagesShariat & TariqatMujahid Asaadullah Abdullah100% (1)

- Shariat & TariqatDocument208 pagesShariat & TariqatMujahid Asaadullah Abdullah100% (1)

- Asset Management OverviewDocument23 pagesAsset Management OverviewfaiyazadamNo ratings yet

- Cyber Solutions v. Priva Security - 6th Circuit PDFDocument19 pagesCyber Solutions v. Priva Security - 6th Circuit PDFMark JaffeNo ratings yet

- Devon Smith 方大望 Economics Final PaperDocument10 pagesDevon Smith 方大望 Economics Final PaperDevon Isaiah NyamwangeNo ratings yet

- Noc TCFPL0453000010004925 20102018 1540022971670 PDFDocument1 pageNoc TCFPL0453000010004925 20102018 1540022971670 PDFShuvabrata GanaiNo ratings yet

- Assignment: Palash SahaDocument6 pagesAssignment: Palash SahaMehedi HasanNo ratings yet

- Financial Project Report ON Ultratech Cement India LTDDocument11 pagesFinancial Project Report ON Ultratech Cement India LTDDinesh AilaniNo ratings yet

- Sap FicoDocument68 pagesSap FicoJosé Antón NapaNo ratings yet

- Accounting For IntangiblesDocument14 pagesAccounting For Intangiblesmanoj17188100% (2)

- AML Takaful DM ApproachScope Paper V1.0Document29 pagesAML Takaful DM ApproachScope Paper V1.0rajsundarsNo ratings yet

- Leased Accommodation ApplicationDocument5 pagesLeased Accommodation ApplicationSumit Kumar PanditNo ratings yet

- Trikuta Degree College: Employees'S Job Satisfaction in Ellaquai Dehati BankDocument64 pagesTrikuta Degree College: Employees'S Job Satisfaction in Ellaquai Dehati BankSwyam DuggalNo ratings yet

- End Term Sample QuestionDocument45 pagesEnd Term Sample Questionmukesh0450% (2)

- CLE Unit 2Document84 pagesCLE Unit 2SuryaNo ratings yet

- Deed of Partnership Victory Export This Deed of Partnership Executed at Erode OnDocument7 pagesDeed of Partnership Victory Export This Deed of Partnership Executed at Erode OnsamaadhuNo ratings yet

- Kelly Consulting CaseDocument18 pagesKelly Consulting CaseJavid BalakishiyevNo ratings yet

- Key Financial Management Skills For Small Businesses - English-CompressedDocument8 pagesKey Financial Management Skills For Small Businesses - English-CompressedNGANJANI WALTERNo ratings yet

- Floreindo v. MetrobankDocument1 pageFloreindo v. MetrobankSarah Jane UsopNo ratings yet

- MYOB Cash Exercise PDFDocument9 pagesMYOB Cash Exercise PDFReese StylesNo ratings yet

- 1409 Release Final DraftDocument9 pages1409 Release Final Draftapi-137303031No ratings yet

- Section 3 Newton Divided-Difference Interpolating PolynomialsDocument43 pagesSection 3 Newton Divided-Difference Interpolating PolynomialsShawn GonzalesNo ratings yet

- A Project Report On Summer Trainning Undertaken AT: Aditya Birla Chemicals (India) LTDDocument63 pagesA Project Report On Summer Trainning Undertaken AT: Aditya Birla Chemicals (India) LTDSatendra KumarNo ratings yet

- 16 BPI V RoyecaDocument3 pages16 BPI V RoyecarNo ratings yet

- Bank of International Settlements Quarterly Review: Detailed Tables March 2011Document137 pagesBank of International Settlements Quarterly Review: Detailed Tables March 2011creditplumberNo ratings yet

- Bad DebtDocument5 pagesBad DebtlamorlaNo ratings yet

- 1Document79 pages1AnthonyNo ratings yet

- The Birth Certificate Bond ExplainedDocument8 pagesThe Birth Certificate Bond ExplainedTaz442 Tz100% (8)

- ESOAUG R12 WhatsNew FINANCIALSDocument84 pagesESOAUG R12 WhatsNew FINANCIALSbgowda_erp1438No ratings yet

- 11 o 15647 1Document16 pages11 o 15647 1Jerri Lynn CookNo ratings yet

- ACCT 701 Chapter 10 AtkinsonDocument54 pagesACCT 701 Chapter 10 AtkinsonAnonymous I03Wesk92No ratings yet

- Chapter 3 Cash FlowDocument60 pagesChapter 3 Cash FlowKate Albay100% (2)

- Nova Scotia Nominee Program NSNP 100 - Application Form For The Principal ApplicantDocument25 pagesNova Scotia Nominee Program NSNP 100 - Application Form For The Principal ApplicantAnaBejucNo ratings yet