Professional Documents

Culture Documents

PetroMag 20 08 10

Uploaded by

jayesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PetroMag 20 08 10

Uploaded by

jayesCopyright:

Available Formats

PetroMag Issue– 196, Friday 20 August 2010

"For every failure, there's an alternative course of action. You just have Content

to find it. When you come to a roadblock, take a detour."

For “Back to top” press Ctrl + Home from any place in the document.” National News

International News

National Newsssss Crude News

RIL-NTPC dispute over D6 heading for truce

International Prices

National Prices

ONGC may have to pay $13 b to exercise RFR

Crude oil Prices/Stock

ONGC, OIL can make a counter-bid

Daily Share Price

Vedanta to get Rs 500 cr if Cairn buyout fails Retail Selling Prices

Transfer of Mangla Oilfield in Rajasthan to Vedanta opposed MCX Bhav copy

Govt gets ambitious on shale gas Industry Sales

OVL Records Highest Ever Oil & Gas Production from Overseas Pipeline Transfers

Region‐wise Sales Growth

Cairn stake sale: ONGC wants royalty issue cleared

Company‐wise Market Share

The Adventures of BPCL

Sector‐wise HSD Direct Sales

ADAG gets nod for exploration of CBM in Madhya Pradesh FO/LSHS & Naphtha

Indian Petronet, GSPC to add new storage tanks at Dahej LNG Upliftments

Cairn deal faces fresh questions Crude Oil production

GPPL bets big on coal cargos: IPO priced at Rs.42-48 Natural Gas Production

Refinery Production

Aban Offshore in pact with Cairn India for deploying rig

Import / Export

Tomorrow India celebrates Rajiv Gandhi Renewable Energy Day

Tankers

S Radhakrishnan assumes charge of Bharat Petro. Corp's CMD Tenders

CBI raids HPCL, Dena Bank officials for Rs.65 mn fraud Events

Contact Us

Exploration s s Our Publication

PY-3 re-development offshore India under review PetroMag – Daily E_zine

Lebanon to auction offshore gas exploration by 2012 DataMag – Monthly

Petroleum Bazaar‐ Monthly

Oil firm upbeat despite Falklands setback

Magazine

US senators renew call for full Lockerbie probe

Petroleum Encyclopedia of Indian

Petroleum Industry

International Newsssss

All India Downstream Database of

retail Outlets

Australia To Be Japan's Top LNG Supplier

Online Subscription and Data is

Oil for Petrobras plan seen $10-$12/barrel-report available though Databank & Data

Ugandan president to approve all oil, gas deals Treasury section of the portal

To view the all the services and activities

of Petroleum Bazaar Please visit our site

http://www.petroleumbazaar.com/

PetroMag Petroleum Bazaar.com 1

Shell in Nigeria warns on production after pipeline

Petroleum

More oil from Russia to the Asia-Pacific region

Bazaar Venezuela oil deal with Trinidad & Tobago

SRILANKA :Iran and Saudi to provide crude oil

PetroMag Bid to write off Rs 55 billion owed by CEB to CPC

Cnooc's first-half net profit more than doubles

Dana targeted for hostile bid

Petroleum

Bazaar

Crude s s

PetroMag Oil Falls as Surprise Increase in U.S. Jobless Claims

Oil prices close below $US75 a barrel

Petroleum Natural Gas Slips Despite Mild Inventory Build

Bazaar

PetroMag

Petroleum

Bazaar

PetroMag

Petroleum

Bazaar

PetroMag

Petroleum

Bazaar

PetroMag

PetroMag Petroleum Bazaar.com 2

International Prices

NYMEX price for Crude, Gasoline and Natural Gas

Energy Prices –Petroleum ($/bbl)

Futures

Crude Name Price Change NYMEX Light Sweet Crude -0.35 $75.42

Nymex Crude 74.47 0.04 ICE Brent -0.46 $76.47

Dated Brent 74.64 0.02 Gasoline NY Harbor 0.0080 $1.9612

WTI Cushing 74.43 -0.99 Heating Oil NY Harbor -0.0010 $2.0249

NYMEX Natural Gas -0.028 $4.239

C&F Japan $ bbl US Stock –06/08/10 (million barrels)

Unleaded Gasoline -- -- Product StockChange Change

vs. week vs. yr.

ICE Futures Crude Stocks 355.0 -3.0 3.0

Brent $/bbl 76.30 -- Gasoline Stocks 223.4 0.4 11.5

Nymex Future Distillate fuel oil 173.1 3.5 10.9

Fuel Oil No.2 /gal 202.00 -- Propane 57.445 2.290 -12.040

Unleaded Gasoline c/gal 195.60 -- US working gas in underground storage (bcf) Data

Nat Gas $/MMBtu 4.24 -- Released August 12, 2010

Base oil India (HPC) Incl. Excise duty Region Stock-Aug 06 Stock-July 30 Change

Alprol N – 12 (SN 70) Rs/liter 58.00 -- East 1536 1493 43

Alprol N – 32 (SN 150) Rs/liter 58.00 -- West 479 476 3

Alprol N – 100 (SN 500)Rs/liter 63.00 -- Producing 970 979 -9

Bright Stock (Rs/liter) 78.00 -- Total lower 2985 2948 37

Base Oil – Europe (F4OB) Base Oil – Iran (FOB)

SN 150 916 SN 150 893

SN 500 932 SN 500 918

BRIGHT STOCK 1063 BRIGHT STOCK 985

RECLAIMED OIL (KUWAIT) 790

Product Prices USD Arab Gulf

HSFO 180 CST ($/mt) 397.25-395.25 HSFO 380 CST ($/mt) 375.25-370.25

Naphtha Prices North – West Propane Butane

Europe

CIF ARA CARGOES 646.25 646.75 FOB Seagoing 560 565

CIF MED CARGOES 641.25 641.75 FOB ARA 607 690

ARAB GULF 600.10 619.60

Week Ending Quotations of OPEC Reference Basket Price

Month Week Ending Basket Ending Basket

Jun’10 26 25/06 $74.38 Monthly Average May10 $74.48

Jul’10 27 02/07 $72.01 Jun10 $72.95

Jul’10 28 09/07 $70.63 Jul10 $72.51

Jul’10 29 16/07 $72.93 Month to date Avg. Aug10 $76.81

Jul’10 30 23/07 $73.43 Quarterly Average 2Q10 $76.53

Jul’10 31 30/07 $74.01 Qr. To date Avg. 3Q10 $73.85

Aug’10 32 06/08 $78.24 Yearly Average 2009 $61.06

Aug’10 33 13/08 $75.38 Yearly to date Avg. 2010 $75.58

PetroMag Petroleum Bazaar.com 3

Crude Oil Prices / Stocks

Crude Oil Spot Prices (Dollars per Barrel)

Most Recent Year ago

25/06/10 02/07/10 09/07/10 16/07/10 23/07/10 30/07/10 06/08/10 07/08/09

WTI – Cushing 78.45 72.06 76.08 75.96 78.68 78.85 80.67 70.97

Brent 76.21 71.75 75.20 75.55 77.27 77.50 81.28 74.21

Crude Oil Stocks (Million Barrels)

Most Recent Year Ago

25/06/10 02/07/10 09/07/10 16/07/10 23/07/10 30/07/10 06/08/10 07/08/09

U.S. 363.1 358.2 353.1 353.5 360.8 358.0 355.0 352.0

East Coast (PADDI) 12.9 12.1 12.6 11.7 13.9 11.4 12.5 14.0

Midwest (PADD II) 95.3 94.4 94.6 95.5 97.4 97.7 95.4 86.9

Cushing, Oklahoma 36.0 35.8 36.1 37.1 37.2 37.8 37.7 33.6

Gulf Coast (PADD III) 183.1 182.1 177.3 176.4 184.6 180.8 181.4 182.5

Rocky Mountain (PADDIV) 17.0 16.7 16.1 15.9 15.5 15.6 15.5 16.1

West Coast(PADD V) 54.9 52.9 52.5 53.9 49.4 52.4 50.2 52.6

PetroMag Petroleum Bazaar.com 4

Daily Share Prices

Today’s Change Today’s Today’s 52 week 52 week

As on close of 19-08-2010

Closing absolute High Low High Low

Aban Offshore Ltd 835.40 53.40 844.00 780.40 1679.50 637.00

Balmer Lawrie 717.00 11.85 720.00 699.00 754.00 438.05

Bharat Petroleum 675.95 -3.50 685.00 672.50 718.00 488.05

Cairn Ind. 344.95 1.35 347.05 341.10 368.00 230.00

Castrol India Ltd. 487.45 7.00 495.80 481.00 495.80 232.50

Chennai Petroleum 283.65 0.50 284.75 282.00 299.30 178.05

Essar Oil 131.25 0.15 132.15 130.50 174.90 115.05

GAIL India Ltd. 461.05 1.35 464.00 458.50 516.85 320.10

Gujarat Gas 349.00 10.45 359.10 337.65 359.10 177.78

Gujarat Petronet 118.25 3.55 119.40 114.10 119.40 65.00

Gulf Oil Corp. Ltd. 86.65 1.25 88.00 84.95 113.05 48.28

Hindustan Oil Exploration 256.35 8.05 260.45 250.05 398.90 165.00

Hindustan Petroleum 501.65 -4.05 508.50 496.65 510.60 293.25

Indian Oil Corp. Ltd. 388.05 -0.55 391.40 351.00 418.10 272.25

Mangalore Refineries 80.80 0.60 81.50 80.00 93.95 64.25

Oil India 1438.95 6.75 1454.90 1412.00 1557.65 1019.00

Oil and Natural Gas 1267.50 -17.85 1296.90 1263.00 1346.00 997.35

Petronet LNG 112.00 9.85 112.90 101.70 112.90 61.55

Reliance Industries Ltd. 976.80 12.05 986.65 965.00 1184.70 840.55

Tide Water Oil India 9417.25 -16.80 9710.00 9400.00 10399.00 4086.10

MARKET WATCH CURRENCY WATCH

BSE Sensex 18454.94 197.82 Rs – 1 $ 46.64

NIFTY 5540.20 61.05 Rs. –1 Euro 59.88

DJIA 10415.54 9.69 Rs –100 Jap. Yen 54.55

NASDAQ 2215.70 6.26 Rs.1 Pound 72.41

MIDCAP 7830.90 70.90 Bank Rate 6.0%

Repo Rate 5.75% Reverse Repo Rate 4.50%

PetroMag Petroleum Bazaar.com 5

RIL-NTPC dispute over D6 heading for truce

PetroMag The legal dispute between Reliance Industries (RIL) and NTPC over D6 gas may be heading for a

truce, with Solicitor General Gopal Subramanium recommending that the country’s biggest power

generator be given gas at a concessional rate under a provision of the production sharing contract

Ministry of Petroleum (PSC).

and Natural Gas,

New Delhi According to the PSC it signed with the government, RIL can sell gas at a price lower than the

market one to the government or its nominee. “The solicitor general is of the view that this

Cabinet Minister provision can be evoked for NTPC, since it is a government company,” said a government official.

Mr. Murli Deora

Under article 21 of the PSC, gas sold to the government or any other government nominee, is to

Minister of State be valued on terms and conditions, including pricing formula and delivery, approved by the

Mr. Jitin Prasad government. This provision has been interpreted to mean that NTPC can claim gas at $2.34 per

million British thermal unit, a price RIL had quoted in its tender way back in 2004.

Secretary

Senior government officials told Business Standard that the empowered group of ministers

Mr. S Sundareshan

(EGoM), headed by Finance Minister Pranab Mukherjee, discussed the issue in its last meeting.

“The power ministry was asked to circulate the legal opinion of the solicitor general to all

Addl. Secretary & Fin. members of the group,” said another official.

Advisor

Mr. P K Sinha During the July 28 meeting of the EGoM, the power ministry had proposed that 12 million

standard cubic metres a day (mscmd) gas be given to NTPC at the discovered international

Jt. Secretary ( R ) competitive bidding price of $2.34, without waiting for the outcome of the pending NTPC-RIL suit

Mr. L.N. Gupta in the Bombay High Court.

Jt. Secretary NTPC has already started work on expansion of its Kawas and Gandhar power projects in Gujarat

(International corp.) to meet the milestones necessary for getting gas allocation. The government allots gas to only

Shri. Sunil Jain those units that are expected to be commissioned during this year. “The EGoM is expected to take

a decision on it in its next meeting,” NTPC Chairman R S Sharma told Business Standard.

Jt. Secretary (Expl.)

Mr. D N Narsimha The last EGoM meeting also discussed the Reliance Power’s request of 28 mscmd of gas, pursuant

Raju to a Supreme Court judgment that said gas allocation to the Anil Ambani group company should

be in conformity to the government policy on price, tenure and allocation.

Jt. Secretary (M)

Though no commitment was made on supplying gas to Reliance Power, more than three weeks

Shri Apurva Chandra

after the last EGoM meeting, the government is yet to finalise the minutes. “Though the issue of

additional allocation to any power project has been kept open ended, any decision would depend

Economic Advisor on the minutes,” said an official.

Dr. Archana S Mathur

ONGC may have to pay $13 b to exercise RFR

Director (Supply &

Production) Oil and Natural Gas Corporation (ONGC) may have to shell out $13 billion if it were to exercise its

Shri Vivek Kumar pre-emption or right of first refusal (RoFR) to buy Cairn India in the giant Rajasthan block. Cairn

India holds 70 per cent operator interest in the 6.5 billion barrels Rajasthan block that is at the

Director (Marketing) centre of its parent, Cairn Energy's $8.48-billion deal to sell its majority stake in the company to

Shri U.C. Nangia Vedanta Resources.

Director At Rs.355 a share, Cairn India is valued at over Rs.67,355 crore or $14.6 billion. Almost 90 per

(Refinery & Admin) cent of this value is because of the Rajasthan block that can produce 2.40 lakh barrels of oil a

Shri Dependra Pathak day. “Cairn India's stake in Rajasthan block will be valued at around $13 billion,'' official sources

said.

Director

(Exploration II) ONGC is of the view that by virtue of holding 30 per cent in the Rajasthan block, it has the pre-

Shri Maninder Singh emption or RoFR to buy Cairn India in case the company's ownership changed. If it has objections

to the Cairn Energy-Vedanta deal, it will have to seek to buyout Cairn India in the Rajasthan block

by making a higher offer that would work out to $13 billion and that also before September 7

Director

deadline, the official added.

(International corp.)

P. Kalyanasundaram Another view in ONGC is to seek operator-ship or management control of the Rajasthan block in

lieu of giving a go-ahead to the Cairn-Vedanta deal. The production sharing contract, which Cairn

has signed with the government for the Rajasthan block, provides for explicit government

approval only in case of a party selling its interest in the block, but does not make the nod

mandatory in case of change of ownership at corporate level.

PetroMag Petroleum Bazaar.com 6

The joint operating agreement between Cairn India and ONGC gives partners pre-emption rights

in case of sale of interest by either parties but not in case of corporate ownership change. Cairn

PetroMag maintains that the Vedanta deal was a controlling stake transfer and not an asset transfer which

would have triggered a government approval.

Directorate General of However, the Petroleum and Natural Gas Ministry maintains that since the production sharing

Hydrocarbons contracts for some of the Cairn other blocks have provision for prior consent, the whole deal is

contingent on government approval.

Director General

Mr. S K Srivastava ONGC, OIL can make a counter-bid

***** Can India’s state-owned firms join hands to mount a counter-bid for oil exploration firm Cairn

India after the surprising entry of Vedanta? These firms, despite their huge capital expenditure

Petroleum programmes earmarked for the next few years, appear quite capable of making a counter-offer,

Conservation and considering that the valuation does not appear prohibitively high.

Research Association

Both ONGC and Oil India have debt-free, cash-rich balance sheets and strong and growing

Executive Committee cashflows. Despite their own capital expenditure plans — ONGC is set to invest close to Rs 25,000

Chairman crore annually, while OIL has planned to invest Rs 8,500 crore over the next couple of years — it

Mr. S.Sundareshan may not be difficult for them to raise funds for a counter-offer. The debt that these companies can

raise could be as high as Rs 50,000 crore before their debt-equity ratio touches 0.5.

Member Secretary

However, the critical issue is whether such a move makes sense. It was just two years ago that

Exec. Director PCRA

ONGC acquired UK-listed Imperial Energy for $2.1 billion with reserves of 860 million barrels.

Mr. Arun Kumar Using that as a benchmark, paying $8.5 billion for 51% of Cairn’s currently estimated recoverable

reserves of 1.4 billion barrels may appear expensive.

*****

“It will need an underlying assumption of crude oil price at $100 per barrel to justify the Rs 405

Oil Industry Safety per share price for Cairn India. All visible upside for next 3-4 years appears captured in this,”

Directorate noted Sandeep Randery, research analyst in BRICS Securities.

Executive Director But a few analysts have argued that the Imperial and Cairn comparison is not fair. While

Mr. J B Verma Imperial’s assets were at a preliminary stage of development, production is fully underway in

Cairn’s Rajasthan fields. It is set to reach its plateau of 175,000 bpd by end 2011 and holds the

***** potential to ramp it up to 250,000 bpd, unlike in Imperial’s case where the production is

stagnating at close to the 20,000-bpd level. Besides, Cairn India also holds stakes in ten other

Petroleum Federation exploration blocks apart from the Rajasthan fields.

of India

For a long-term player who has a 15-20 year horizon, the pricing may still make sense.

Chairman Networth’s Diwan said, “Given the promising prospects for Cairn, it certainly is a good buy from a

Mr. S Behuria long-term perspective.” With Sesa Goa’s open offer for Cairn’s shares already on, oil PSUs need to

take a quick call on their future course of action.

Director General

Among the oil PSU pack, not all of them have the ability and the resources to participate in a

Mr. A K Arora

buyout now. “Given their cash-strapped conditions thanks to the subsidy burden, barring ONGC &

OIL, it would be difficult for other oil PSUs to fund an acquisition of the Cairn scale,” noted

***** Prakash Diwan, head-institutional business at Networth Stock Broking.

National Productivity Vedanta to get Rs 500 cr if Cairn buyout fails

Council

NEW DELHI: Vedanta Group, pursuing a $9.6 billion takeover of Cairn India, will get an estimated

President windfall of Rs 500 crore if the target firm's Scottish promoters fail to get shareholders' nod for the

Mr. Kamal Nath deal or solicit a rival bid. NRI billionaire Anil Agarwal-run Vedanta Group has reached a deal with

(Cabinet Minister) Cairn Energy to acquire up to 60 per cent stake in the Edinburgh-based firm's Indian unit Cairn

India, the country's fourth largest oil explorer.

Chairman

Dr. Ajay Shankar IAS The deal requires approval from the shareholders of all the entities involved including the seller

Cairn Energy. As per the terms of the deal, "if Cairn Energy's shareholders do not approve the

Director General transaction of it the sellers breach their non-solicit obligations, the sellers are required to pay a

Mr. N.C.Vasudevan break fee of 1 per cent of Cairn Energy's market capitalisation to the acquirer."

The deal terms also bar Cairn from soliciting any rival offer before the meeting of Cairn Energy's

*****

shareholders for considering approval for the transaction.

PetroMag Petroleum Bazaar.com 7

"Prior to the meeting of shareholders of Cairn Energy, the sellers are prohibited from soliciting any

person to make competing proposal," as per the Share Purchase Deed between Cairn Energy and

PetroMag Vedanta Group. The agreement also requires a shareholder meeting to be convened on or before

October 30.

Oil Industry Considering the current market valuation of Cairn Energy, the break fee comes at 66.9 million

Development Board pounds (about Rs 500 crore). At present share price, Cairn Energy is valued worth 6.69 billion

pounds. Cairn Energy is listed on the London Stock Exchange (LSE) and in the early trade the

Chairnan stock was quoting at 4.78 pounds.

Mr. S Sundareshan

Vedanta Group, through its India-listed group firm Sesa Goa, has already made an open offer for

Member Secretary a 20 per cent stake in Cairn India and the offer begins on October 11. The Rs 13,631 crore offer

Mr Arun Kumar closes on October 30. Under the agreement, London-based Vedanta plans to acquire 51-60 per

cent stake in Cairn India through purchase of Cairn Energy Plc's stake and through open offer.

*****

Transfer of Mangla Oilfield in Rajasthan to Vedanta opposed

Petroleum & Natural

Gas Regulatory Board NEW DELHI: A CPI-M member today demanded in Rajya Sabha that the government should not

(PNGRB) allow transfer of Mangla Oilfield in Rajasthan to Vedanta Resources from Cairn Energy. Describing

Vedanta Resources as "dubious contractors" owned by "scrap dealers", Tapan Kumar Sen said

Chairperson there was a disquiet over change in the ownership of the Indian unit of Cairn Energy in which

ONGC has 30 per cent production sharing arrangement.

Mr. L. Mansingh

"Petroleum Ministry is maintaining a stoic silence on the deal," he said asking whether ONGC is

Commercial Member silent on its own or was made to do so. He demanded that the Centre should intervene and stop

Mr. L. K. Singhvi the deal instead of promoting share prices of Cairn and Vedanta in the market. London-listed

Vedanta group led by Anil Agrawal on Monday announced its decision to acquire up to 60 per cent

***** stake in Cairn India for USD 9.6 billion giving Vedanta Resources access to India's largest on-

shore oilfield.

Govt gets ambitious on shale gas

Taking a cue from the US and China, the government is finalising a roadmap for large-scale

commercial exploitation of shale gas — natural gas trapped in rocks — in the country’s

sedimentary basins. “This (shale gas) non-conventional and green fuel is the future and can be a

game changer for the economy of India, which spends over $90 billion every year on oil imports,”

said a petroleum ministry official.

Mapping of shales in four basins — Cambay, Assam-Arakan, Ganga and Damodar Basins — is

underway and like in the case of petroleum and coal bed methane, the government is planning to

offer shale blocks for commercial exploration by August, 2011.

US has the world’s largest shale gas reserves. China comes second. Shale gas extraction involves

tapping gas trapped between layers of shale rocks, similar to the extraction of gas in coal

beds.Public sector ONGC has begun studies to assess shale gas potential in the coal bed methane

(CBM) blocks awarded to it in the Raniganj and North Karanpura coalfields.

“We have placed the letter of intent for this pilot project to Schlumberger in April for R128 crore,”

a ONGC source said.ONGC officials said the petroleum ministry has directed it to form of a team of

representatives from the Directorate General of Hydrocarbons (DGH), ONGC, OIL and GAIL(India)

Ltd to study samples and suggest steps to pursue the shale opportunity.

OVL Records Highest Ever Oil & Gas Production from Overseas Assets

The Minister of State for Petroleum & Natural Gas Shri Jitin Prasada informed the Lok Sabha in a

written reply today that the consolidated production of ONGC Videsh Ltd. (OVL) of Oil plus Oil-

Equivalent Gas (O+OEG) during the year 2009-10 was 8.870 Million Tonnes recording highest

ever oil and gas production from its overseas assets. He added that the primary purpose of

acquiring oil and gas exploration/producing assets abroad is to gain access to equity oil and gas

from the acquisition. India imports over 70% of its requirements of crude oil. Considering the

widening energy demand-supply gap in the country, acquiring more oil and gas acreages abroad is

necessary for energy security.

PetroMag Petroleum Bazaar.com 8

Shri Prasada also informed that OVL has made an investment of USD 191.3 million and USD 55.6

million in San Cristobal Project and Carabobo-1 Project respectively in Venezuela till 31st July,

PetroMag 2010. OVL acquired 40% and 11% stake in San Cristobal Project and Carabobo Project 1

respectively in Venezuela. At their peak production, these projects are likely to yield per annum

equity oil of 2.5 million tonnes of oil from Carabobo-1 project and 0.89 million tonnes of oil from

Indian Oil Corp. Ltd. San Cristobal project. The Minister further said that OVL has currently presence in 15 countries,

out of which 9 projects in 7 countries have oil and gas production.

Chairman & MD

Mr. B M Bansal Cairn stake sale: ONGC wants royalty issue cleared

Dir (Mktg.) With a change in the ownership of Cairn India inevitable once the Cairn Energy-Vedanta Resources

Mr. G C Daga deal is formalised, ONGC will want to resolve the contentious issue of royalty payment for the

Dir (Fin.) prolific Barmer oilfields.

Mr. S V Narsimhan Since production began last year, ONGC — a 30 per cent stakeholder and licensee of the block —

has paid a cumulative royalty of Rs 302 crore up to June 2010, an official told Business

***** Line.“Though the Government is dealing with the issue separately, due to the sudden change in

ownership with the proposed deal, it is most appropriate that the issue is resolved,” an official

Bharat Petroleum said.

Corp. Ltd.

The block was awarded prior to the competitive bidding rounds regime (NELP). Cairn is the

operator of the block with 70 per cent equity. Under the licence conditions, ONGC took the stake

Chairman & MD

in the discovery without any cost, but has to bear 100 per cent of the royalty in addition to the

Mr. Ashok Sinha

development costs.

Dir (Mktg.) According to previous reports, the Government should be paid a royalty of 20 per cent on the net

Mr. S Radhakrishana price of the Rajasthan crude. ONGC has protested against the royalty payment and is seeking

reimbursement on the grounds that it was uneconomical. The Rajasthan field is the most

Dir (Fin.) prominent asset of Cairn India, which currently produces up to 1.25 lakh barrels of oil a day.

Mr. S K Joshi

Ever since Cairn Energy and Vedanta announced the proposed deal this week, Petroleum Minister

***** Mr Murli Deora and Petroleum Secretary Mr S. Sundareshan have maintained that “interests of

ONGC will be protected”. ONGC and Cairn India are partners in eight blocks, including the

Hindustan Petroleum Rajasthan fields. Of these, three blocks belong to the pre-NELP regime.

Corp. Ltd.

For the blocks awarded under the NELP regime, the Petroleum Secretary said that “apart from the

Chairman & MD financial transactions, the contractual obligations with the Government as per the production-

Mr. A. Balakrishnan sharing contract signed by the parent company need to be examined. The responsibilities and

technicalities of specific blocks will need to be studied”.

Dir (Mktg.)

Mr. S Roy Choudhury The Adventures of BPCL

S eptember 15, 2008, was hardly the day that one could talk business with a straight face or raise

Dir (Fin.)

money for projects. Lehman Brothers had just turned into vapour, Merrill Lynch had lost its

Mr. B.Mukherjee

independence a day earlier and a full-fledged financial crisis had taken strong hold. The global

financial order seemed to have ground to a halt.

*****

But Ashok Sinha, chairman and managing director of Bharat Petroleum Corporation (BPCL), had

Oil & Natural Gas the audacity to tap the London financial markets to raise $100 million for an acquisition in Brazil.

Commission It was almost as if he had not seen the TV.

Chairman & MD But Sinha and his teams in Mumbai and Brazil had every reason to feel the urgency. They had

Mr. R S Sharma plodded on for nearly a year cutting through a thick Brazilian bureaucracy and a million other

uncertainties to tie up a buyout of EnCana Brasil which owned ten promising deep-water blocks. It

Dir (Onshore) would be a major leap for the Indian refiner in its ambition to become a global oil and gas

Mr. A K Hazarika exploration company.

Dir (Offshore) But there was one problem. All the hectic parleying had taken time and the deadline to pay for the

Mr. Sudhir Vasudeva deal was just 48 hours away when Lehman threw in the towel. It was doubtless the worst financial

crisis in living memory but Sinha & co. weren’t going to give up after having come so close to the

Dir (Exploration) victory post.

Mr. D K Pande

PetroMag Petroleum Bazaar.com 9

ADAG gets nod for exploration of CBM in Madhya Pradesh

PetroMag The Anil Dhirubhai Ambani Group has been granted permission to explore Coal-Bed Methane

(CBM) in the Shahdol district of Madhya Pradesh, official sources said today.The Madhya Pradesh

Directorate General of Hydrocarbons has granted Petroleum Exploration Licence (PEL) to ADAG for

Reliance Industries exploration of CBM from Sohagpur (north) block in Shahdol district, on August 11, sources said.

Limited

As per the PEL, ADAG was given permission for exploring CBM in an area of 609 sq km, sources

Chairman said. Meanwhile, ADAG officials said the group has started its operation at the site since yesterday

Mr. Mukesh Ambani and after undertaking the core drilling operations, proper study would be conducted to access the

resources available there.

President & CEO

PMS Prasad The project of ADAG, which is setting up a 4,000 MW Sasan Ultra Mega Power Plant (UMPP) in

Sidhi district, will open a new source of non-conventional energy in the state which is in the grip

President (Refinery of an acute power crisis for a long time, they said. "ADAG's entry in the CBM sector is a good sign

Business) for the state," a source said.

Mr. P Raghavendran

Coal-Bed Methane is a form of natural gas extracted from coal beds by drilling holes into coal

***** seams and can be utilised for power generation, compressed natural gas (CNG) and fertiliser

manufacturing, sources said.

Essar oil Limited

Power production from CBM would not only contribute in reducing ozone layer threat but also open

alternative option of electricity generation, they said adding it is certainly a matter of pride that

Chairman

there were abundant CBM deposits in Madhya Pradesh

Mr. Shashi Ruia

Indian Petronet, GSPC to add new storage tanks at Dahej LNG terminal

Vice Chairman

Mr. Ravi Ruia India's Petronet LNG is planning to add two more storage tanks to its Dahej LNG receiving and

regasification terminal in a joint venture with Gujarat State Petroleum Corporation, A K Balyan,

Managing Director the newly-appointed managing director and CEO of Petronet LNG, said late Wednesday.

Mr.Naresh Nayyar

D J Pandian, Principal Secretary at the Gujarat state government's Energy and Petrochemicals

Director (Finance) Department and director of GSPC, also confirmed the project. Balyan said: "We have taken up this

Mr. P.Sampath matter with the Gujarat government." There is enough space available for two additional tanks at

the terminal so additional land may not be required, he added.

*****

Petronet LNG currently has four storage tanks and two regasification facilities at the terminal. Two

GAIL India Limited of the four storage tanks and a regasification facility were commissioned by Petronet in mid-2009.

In all, Dahej LNG terminal has 10 million mt/year capacity, which will go up to 15 million mt/year

Chairman & MD once new capacity is commissioned.

Mr. B C Tripathi

Since the proposed storage capacity would be set up under a joint venture between GSPC and

Petronet, GSPC would have exclusive access to it, Pandian said. He added that the Gujarat state

Dir (Fin.)

government has expressed interest in supporting the storage tank project, and offered all the

Mr. R K Goel

necessary help in expediting it.

Dir (Proj) Cairn deal faces fresh questions

Mr. R D Goyal

Fresh regulatory issues raised by the petroleum ministry as well as concerns about the open offer

Dir (HR) price expressed by an institutional investor in Cairn India Ltd, will have to be addressed before

Mr. S L Raina Anil Agarwal-promoted Vedanta Resources Plc’s can close out the $9.6 billion (`44,736 crore)

acquisition.

Dir (Mktg.)

Mr. Prabhat Singh Separately, tax authorities, who held a meeting with Cairn India, did not rule out raising a tax

demand on the deal. Both the government and the tax authorities maintained that a clear view

***** would emerge only after the proposal is submitted for approval.

Life Insurance Corp. of India (LIC), which holds a 2.57% stake in Cairn India, may not tender its

shares in the open offer made by Vedanta, which has proposed to acquire a stake of up to 60% in

the company. Vedanta will pay `405 per share—including a non-compete fee of `50 per share—to

Cairn Energy Plc to buy up to 40% of Cairn India, but the open offer price for an additional 20%

has been fixed at `355.

PetroMag Petroleum Bazaar.com 10

“It is not fair to discriminate (between) shareholders. All shareholders should be able to sell their

holdings at an equal price,” said a senior LIC official. “If we are not given the offer to sell at `405

PetroMag a share, we may hold on to our existing shareholding and look at the upside of the stock,” said the

official, who declined to be named because of the sensitive nature of the issue. With a stake of

14.94%, Petronas International Corp. Ltd is largest institutional shareholder in Cairn. It could not

Shell India Limited be ascertained whether Petronas will participate in the open offer.

Chairman GPPL bets big on coal cargos: IPO priced at Rs.42-48

Mr. Vikram Singh

Mehta India’s leading private sector ports player, Gujarat Pipavav Port Ltd (GPPL), promoted by global

ports and shipping conglomerate, APM Terminals BV, is aiming high for the bulk cargo business,

***** which company expects to shoot up with increased coal requirement for power capacities in the

country.

Castrol India Ltd.

GPPL, operational under the brand name, APM Terminals Pipavav handles over 3 million tonnes of

Chairman bulk cargos annually, of which nearly half is coal. In 2009, the GPPL handled coal cargos to the

Mr. Navin Kshatriaya tune 1.52 million tonnes, of the total bulk cargo handling of 3.37 million tonnes during the year.

***** In an interaction with media, Prakash Tulsiani, Managing Director, GPPL informed about the robust

prospects for the country’s ports sector on the back of increased international trades. “As the

Chevron Petroleum country is witnessing newer power generation capacities coming up in near future, which will

boost coal imports from outside countries thereby increasing cargo handling at ports too.”

President

He further informed that being a prominent non-major port in Gujarat, the company has huge

Mr. John Digby advantage considering the pace of growth in Gujarat’s industrial sector. “Dry bulk cargo accounted

34% of Gujarat’s total cargo traffic in the year 2008. Further, the State is also expecting

Chevron Lubricants substantial investments coming in the power sector by 2012 to add 11,164 MW of power

generation capacity. This we believe will boost cargo activity in the ports located in the close

Managing Director proximity,” he added.

Mr. Akhil Kumar

Out of the total revenue of Rs.219.11 crore recorded during fiscal 2009 (The company follows

***** financial year from January to December), the company registered Rs.102.4 crore coming from

container cargo, while the share of dry bulk cargo stood at Rs.98.7 crore for the period, the Draft

British Gas India Pvt. Red Herring Prospectus (DRHP) of the company stated.

Limited

Further, the company has a LPG berthing facility as well, however the volumes generated is very

Chief Executive meager as it is still at the beginning stage. Presently, Aegis (Gas) LPG Pvt Ltd is the sole customer

Mr. Frank Chapman for the LPG cargo service, said Tulsiani ruling out any possibility of creating additional capacity for

oil cargo berthing.

*****

GPPL is proposing a public offer via equity offer to the public and institutional investors. The

company, jointly promoted by APM Terminals Mauritius Holding Ltd and APM Terminals Mauritius

Caltex Gas India Pvt.

Ltd, along with APM Terminals BV will hit the capital markets on August, 23, 2010 with an initial

Ltd.

public offering (IPO) of equity shares of Rs.10 each for cash at a price band fixed from Rs.42-48

per share to raise around Rs.500 crore, besides an offer for sale of up to 11.7 million equity

Chief Executive shares by the private equity investors.

Officer &

GM (S & A) The issue is managed by Kotak Mahindra Capital, IDFC Capital and IDBI Capital, will close on

Mr. S. August 26. APM Terminals BV is the port operating arm of Danish shipping and oil conglomerate A

Ramasubramanian P Moller-Maersk.

***** Aban Offshore in pact with Cairn India for deploying rig

Total LPG Ltd. MUMBAI: Aban Offshore today said it has signed a contract with Cairn Energy India for deploying

a jack-up rig in the Ravva block located at the offshore of the east coast of India. The company

Chariman and CEO expects a revenue of Rs 69.75 crore from the contract which has the estimated duration of 150

Mr. Thierry Desmarest days, Aban Offshore said in a filing to the Bombay Stock Exchange.

***** The work will be done for "5 firm well plus 2 optional well programme." The deployment of rig in

the Ravva block, which is operated by Cairn Energy India in joint venture with ONGC, Videocon

and Ravva Oil, is likely to start during the fourth quarter of calendar year 2010, the filing added.

PetroMag Petroleum Bazaar.com 11

Tomorrow India celebrates Rajiv Gandhi Renewable Energy Day

PetroMag The event has been held every 20 August since 2004 to raise public awareness about the use of

new and renewable energy sources and their applications in daily life. On the first occasion of

Rajiv Gandhi Renewable Energy Day, a commemorative stamp (see inset) was released by the

Chennai Petroleum then Prime Minister.

Corporation Limited

(CPCL) Mankind is using up energy resources of mother earth in a way no other animal has ever done.

The largest contributions to current energy sources in the world come from oil (31%), coal (26%)

Managing Director and natural gas (19%). At the present rate of consumption, oil reserves will last for 40 years, gas

Mr. K Balachandran reserves will last for 60 years, coal reserves will last for 125 years and uranium reserves will last

for 1000 years.

*****

India has 17% of the world’s population, but only about 0.8% of the world’s known oil and natural

Balmer Lawrie & Co. gas sources. Our per capita coal reserves are much below Russia, USA and China. Based on the

Ltd. progress visualized for the nation during the next two decades, the power generating capacity has

to increase to 4, 00, 000 MW by the year 2030 from the current 1,30, 000 MW in India. This takes

Managing Director into consideration of energy economics planned and the design and production of energy efficient

Mr. S K Mukherjee equipments and systems.

***** New and emerging technologies like hydrogen energy, fuel cells, biofuels, electric & hybrid electric

vehicles, geo-thermal energy and tidal energy hold major promise for mitigating the energy crisis

in the country, especially for power generation and transportation as such to achieve energy

Oil India Limited

independence. These are renewable and do not get depleted with use like fossil fuels. Innovation

in technology, development and applications has to drive the renewable energy (Green Power)

Chairman & MD marketplace.

Mr. N.M.Borah

Over 1.64 billion people world across lack access to electricity. For those people, who cannot be

Dir (E&D) provided with electricity by extending the grid their hope rests in innovation and as such the

Mr. B.N.Talukdar emerging technologies? Presently installed generation capacity of renewable energy is 13,730 MW

from various sources which is approximately 8% of total installed capacity in the country and

***** contributing to around 3% of total national electricity generation. The stupendous growth

stimulates enhanced energy requirements.

Petronet LNG Limited

The Government of India set an example as one of the few countries that created independent

Chairman Ministry for renewable energy, the MNRE (Ministry of New and Renewable Energy) in the early

S.Sundareshan 1980s. In line with the Central Government Policy renewable energy development agencies in

state level are also created. As a follow-up action on the “Comprehensive Policy on Renewable

CEO & MD Energy” announced by the government of Maharashtra State Secondary and Higher Secondary

Mr. P Dasgupta Education Board, Pune have included the subject non-conventional energy sources in the syllabus

of Std IX to Std XII.

Dir (Tech)

S Radhakrishnan assumes charge of Bharat Petroleum Corp's CMD

Mr. C S Mani

S Radhakrishnan today assumed additional charge of Chairman and Managing Director of Bharat

Dir (Fin.) Petroleum Corp Ltd (BPCL), the nation's second largest state refiner. Radhakrishnan was

Mr. A Sengupta appointed the acting head of BPCL upon current incumbent Ashok Sinha's resignation, a company

press statement said.

*****

A Mechanical Engineer from IIT, Chennai and MBA from IIM, Bangalore, Radhakrishnan, 59, is

ONGC Videsh Ltd. Director (Marketing) in BPCL since November 2002. Sinha had in May put in his papers apparently

after it emerged that the government may deny him an extension. Sinha, which completed his

Managing Dir. five-year term on August 18, was eligible for an extension till he attained superannuation in

Mr. R S Butola February 2012.

However, the Petroleum Ministry was not inclined to give him an extension like it had previously

done in case of Sarthak Behuria of Indian Oil Corp (IOC), Subir Raha of Oil and Natural Gas Corp

(ONGC) and P Banerjee of GAIL. No reasons have been given for not considering Sinha for an

extension.

Sinha is the fourth head of a Navratana oil PSU, to be denied an extension. The oil ministry had in

2006 declined Subir Raha an extension as the Chairman and Managing Director of ONGC and a

year later GAIL's Prashanto Banerjee got a similar treatment. In February this year, Behuria was

denied an extension as the chairman of IOC.

PetroMag Petroleum Bazaar.com 12

CBI raids HPCL, Dena Bank officials for Rs.65 mn fraud

PetroMag Mumbai – The Central Bureau of Investigation (CBI) Thursday raided the offices and residences of

several high-ranking officials of a public sector oil major and a nationalized bank in connection

with a fraud amounting to nearly Rs.65 million ($1.4 million), an official said.

Cairn India Ltd.

The raids which continued till late Thursday, were carried out at the offices and residences of two

Chief Executive former chief regional managers of Hindustan Petroleum Co. Ltd (HPCL) and a former deputy

Officer general manager of the company (both from HPCL’s Byculla office), the branch manager of Dena

Mr. Rahul Dhir Bank’s Navi Mumbai (Kalamboli) branch and the owners of Lalit Gas Agency, in Panvel, Raigad.

The official said that the two private gas agency owners, Nihalchand Jain and his son Jinesh Jain

General Manager had availed excess credit limits from the HPCL with malafide intentions.

Crude Mktg. &

International Trade They also submitted a fake letter purportedly issued by the Dena Bank claiming that the Kalamboli

Mr. Karunakaran Hari Branch was converting to core banking and due to software upgradation, there was a connectivity

break, leading to non-processing of cheques Dec 24-31, 2008, the official said. The fake letter was

***** submitted by the Jain duo to HPCL with a request not to deposit their HDFC cheques.

Tata Petrodyne Ltd. Earlier, former chief regional manager S.N. Pradhan had enhanced the agency’s credit limit to

Rs.120 million, much beyond his authority of Rs.2 million during Sep 2006-May 2007 and also

Chairman failed to take adequate bank guarantees as stipulated by HPCL norms, the official said. Similarly,

in March 2008, another former chief regional manager,

Mr. M. A. Pathan

S.P. Donadkar, is also accused of hiking the credit limit to Rs.5.5 million for a company named

***** Enkei Castolloy, beyond his authority of Rs.2 million and bypassing HPCL’s norms. Since Enkei

Castolloy was making payments to HPCL through Lalit Gas Agency, Donadkar’s actions resulted in

Adani Group huge losses to the oil major, the official said. In this conspiracy, Lalit Gas Agency issued various

cheques to HPCL which were dishonoured on grounds that it had requested Dena Bank to stop

Executive Chairman payment.

Gautam S. Adani

PY-3 re-development offshore India under review

Managing Director

Rajesh S. Adani LONDON -- Production from the PY-3 oil field in the Cauvery basin off eastern India will likely

remain around 3,400 b/d for the rest of this year, according to operator Hardy Oil & Gas. The field

***** underwent a prolonged shut-in last year due to unscheduled repair and maintenance of the

offshore mooring facility. Normal service was finally restored on Jan. 24 this year.

However, Hardy says there will likely be further downtime during the monsoon season in

November and December. The partners are working on a full field redevelopment plan to enhance

production and ultimate recovery from PY-3, via additional wells and artificial lift. The current

proposal is to drill two more lateral production wells and upgrade the facilities to include gas

compression for gas lift and sales gas evacuation, although timing has not been finalized.

PY-3 is 80 km (49.7 mi) south of Pondicherry in water depths between 40 m and 450 m (131-

1,476 ft). The field was developed initially with floating production facilities and subsea wellheads,

a first at the time for an offshore field in India. Current facilities comprise the floating production

unit Tahara and the 65,000 dwt tanker Endeavor, which serves as a floating storage and

offloading unit. Four subsea wells are tied back to Tahara, including one currently acitve, naturally

flowing producer and two water injection wells.

Hardy also holds a 75% operating interest in offshore block CY-OS/2 on the south east coast of

India, in the same basin where gas was discovered in January 2007. The exploration period for

the block ended the following March, and a request was made to extend the block for appraisal

and declaration of commerciality of the non-associated natural gas (NANG) discovery until January

2012, in accordance with the provisions of the production sharing contract (PSC).

The company says it has initiated a formal dispute resolution process with the appointment of

three arbitrators in an attempt to push through the requested extension. The preliminary hearing

by the arbitral tribunal should start soon.

CY-OS/2 block is in the northern part of the Cauvery basin immediately offshore from Pondicherry,

and covers an area of around 859 sq km (331 sq mi). The northern area of the license includes

the Ganesha (Fan-A1) non-associated gas discovery.

PetroMag Petroleum Bazaar.com 13

Lebanon to auction offshore gas exploration by 2012

Petroleum BEIRUT — Lebanon's energy minister on Thursday said his country plans to outline its maritime

sea borders and auction off rights to explore potential offshore natural gas and petrol reserves by

Bazaar 2012.

"Now that the law on the exploration of offshore oil and gas reserves has been passed by

parliament, we expect to begin the licensing process for the exploration of the reserve in 2012,

PetroMag barring political hurdles," Gibran Bassil said at a news conference.

Lebanese MPs on Tuesday passed the law, which calls for the establishment of a treasury and a

committee to oversee exploration and drilling off Lebanon, a Mediterranean country without

Petroleum known oil reserves.

Bazaar Bassil said Lebanon was close to an agreement on maritime borders with Cyprus and was

unilaterally working on outlining its sea borders with Israel before submitting them to the UN

Security Council.

PetroMag Lebanon and Israel remain technically in a state of war and have no diplomatic ties.Ali Hamdan,

an advisor to Lebanese speaker Nabih Berri, on Tuesday told AFP he expected rights to be up for

auction by the end of 2011.

Petroleum

"This is definitely a major cornerstone in Lebanon's oil policy ... and will help Lebanon divide its

Bazaar reserves into blocks and eventually bring in tenders and start looking into power-sharing

agreements," he added.

Norway-based Petroleum Geo-Services this year announced it had explored Lebanese waters

PetroMag which contained "valuable information" on potential offshore gas reserves in coordination with

Lebanon's energy and water ministry.

Oil firm upbeat despite Falklands setback

Petroleum

Rockhopper Exploration remains upbeat about prospects for a commercially feasible hydrocarbons

Bazaar find in the Falkland Islands waters despite poor results from a well drilled in the southern part of

North Falkland Basin.

PetroMag Prospects for oil in the deep waters around the British Overseas territories have seesawed

between strong optimism and despair as companies funded by mostly British shareholders

continue drilling operations that began last year.

Petroleum The prospecting for oil, at one point said to consist of deposits as large as those in the North Sea

and even Saudi Arabia, has fed into Argentina's renewed claims of sovereignty over the islands it

Bazaar calls Malvinas.

Argentina's military regime invaded the Falklands in 1982 but was repulsed by Britain. The

resulting 74-day conflict led to the deaths of more than 1,000 military personnel and some

PetroMag civilians and a public surrender by Argentina. But the war did not extinguish Argentine aspirations

for the islands coming under its rule.

Argentina has been reacting with fury to news of successful oil finds in the Falklands' waters, of

Petroleum which there have been a few.Rockhopper Exploration said its first well, "Ernest," drilled in the

Bazaar southern part of the North Falkland Basin, was found to be dry. The news sent its shares

plummeting before continued investor interest helped the prices back Wednesday.

The company said its drilling reached a depth of 7,347 feet but found a "dry hole." The well was

PetroMag drilled about 75 miles from a previous discovery called the Sea Lion and targeted a previously

undrilled part of the basin, Rockhopper said.

The company has announced plans for detailed studies of all data and information gathered from

the well after samples are studied in the United Kingdom. Ernest was spudded July 23 and was

declared a dry hole Aug. 17, Rockhopper said.

PetroMag Petroleum Bazaar.com 14

US senators renew call for full Lockerbie probe

Petroleum WASHINGTON — The British and Scottish governments must back a new independent

investigation into the decision to free the Lockerbie bomber one year ago, four US senators angry

Bazaar over the release said Thursday. Democratic Senators Robert Menendez, Frank Lautenberg, Chuck

Schumer and Kirsten Gillibrand made their appeal in letters to Scottish First Minister Alex Salmond

and British Prime Minister David Cameron.

PetroMag The lawmakers have alleged that Scottish authorities may have let Abdelbaset Ali Mohmet al-

Megrahi return to his native Libya because of pressure from energy giant BP, eager to safeguard a

lucrative exploration deal with Tripoli. "We again call for a comprehensive, independent

investigation with subpoena authority into al-Megrahi?s release, fully supported by the UK and

Petroleum Scottish Governments," they wrote to Cameron.

Bazaar Such a probe "is ultimately the best avenue to address the concerns that we and the families of

the victims have raised," they wrote Salmond, who has denied that the embattled oil firm swayed

the decision."Until such an inquiry is launched, we will not stand by as an injustice remains very

PetroMag much alive in a villa in Tripoli. The American people -- and, indeed, the people of 21 nations who

suffered the loss of their loved ones -- require nothing less," they said in the letter to Salmond.

Megrahi was the only man convicted in the 1988 terrorist attack over the Scottish town of

Petroleum Lockerbie, in which 270 people died, including 189 Americans. He was released on compassionate

grounds from a Scottish prison on August 20, 2009 over US objections and allowed to return to

Bazaar Libya after receiving a diagnosis of terminal cancer and being told he had three months to live.

But he remains alive, prompting US critics to question whether oil giant BP had lobbied on

Megrahi's behalf in order to safeguard a 900-million-dollar contract with Libya -- something the

PetroMag firm and British officials deny.Menendez was expected to chair a US Senate foreign relations

committee hearing into the issue after lawmakers return from a six-week break on September 13.

And he and Lautenberg were to hold a press conference Friday with a woman who lost her father,

Petroleum brother and sister in the attack. They were to release a new letter to the Libyan, Qatari, Scottish

and British governments "citing evidence of commercial pressures influencing his release,"

Bazaar according to Menendez's office.

Australia To Be Japan's Top LNG Supplier

PetroMag The biggest supplier of liquefied natural gas to the world's top importer of the product has recently

been overtaken by competitors after more than 20 years--evidence of the major realignment

underway in the Asian, and global LNG sector.

Petroleum

Since the 1980s, Indonesia was the biggest source of Japan's LNG, but in the first six months of

Bazaar 2010 it was overtaken by Malaysia, and more importantly Australia, which is on track to become a

key player in the industry.

It will also be a tough competitor in emerging LNG markets to established players like Qatar and

PetroMag newcomers like Russia's Sakhalin-2 project, which started exporting in 2009. Japan, which

accounts for around 30% of global LNG demand, has committed to buying a lot more Australian

gas from a string of projects due on line in coming years. Emerging markets China and India have

also made commitments, as has existing major buyer South Korea.

Petroleum

Bazaar "With its new projects, Australia will become a major supplier to East Asia, replacing South East

Asian countries where there is little room to boost output," said Japan Oil, Gas and Metals National

Corp. analyst Shigeki Sakamoto.

PetroMag Malaysia and Australia exported 6.88 million and 6.33 million metric tons of LNG respectively to

Japan in the first six months of 2010 versus Indonesia's 6.30 million tons, Japan finance ministry

data show. Indonesia's decline is due to it using more gas at home and to insufficient investment

in its gas reserves, but future prospects aren't bad.

PetroMag Petroleum Bazaar.com 15

Oil for Petrobras plan seen $10-$12/barrel-report

Petroleum RIO DE JANEIRO Aug 19 (Reuters) - A consulting firm hired by Brazil's government has

recommended a price of $10 to $12 per barrel for crude to be used in an oil-for-shares capital

Bazaar plan for state-run company Petrobras, a local newspaper reported on Thursday.

That figure is considerably higher than market estimates of fair value between $5 and $6 per

barrel for the deal, in which the government will receive Petrobras shares in exchange for up to 5

PetroMag billion barrels of oil.

The firm's proposed price would also be higher than the government's estimates of $5 to $10 per

barrel when President Luiz Inacio Lula da Silva presented the plan a year ago.O Estado de S.

Petroleum Paulo reported that the firm, Gaffney, Cline & Associates, made the recommendation to the

National Petroleum Agency, the Brazil energy regulator known as ANP.ANP's press office did not

Bazaar immediately respond to requests for comment on the report, which cited unidentified sources.

Ugandan president to approve all oil, gas deals

PetroMag Uganda's President Yoweri Museveni wants the final say on all oil and gas deals as the country

prepares to launch oil production, a letter seen by Reuters shows. In the letter dated July 19 but

given to Reuters on Thursday, Museveni ordered his energy minister Hilary Onek not to sign any

Petroleum oil or gas deals without his prior, written consent.

Bazaar Museveni said he was changing the normal practice of a minister signing deals on behalf of the

government after advice from the attorney general, in order to safeguard against

mistakes.Museveni said the discovery of oil in Uganda had created a lot of "excitement and

stampede" among some people who were scrambling for easy money from the commodity.

PetroMag

"We should therefore not allow ourselves to be part of this stampede," he wrote in a letter copied

to other senior government officials, including the vice president and attorney general."In the case

of petroleum and gas, I direct that no agreement should ever be signed without my express

Petroleum written approval of that arrangement."

Bazaar Commercial hydrocarbon deposits were discovered in Uganda's Lake Albert Rift basin along the

border with the Democratic Republic of Congo in 2006 and reserves are estimated at 2 billion

barrels.Tullow Oil, Heritage Oil, Neptune Petroleum and Dominion Limited are some of the firms

PetroMag involved in the sector, which is expected to begin commercial production in the last quarter of

2011.

The opposition said Museveni's directive was aimed at giving him greater control of funds from the

Petroleum sector. "He wants to amass wealth as much as possible which obviously explains his interest in

personally controlling the oil bonanza that is coming," said Semujju Ibrahim Nganda,

Bazaar spokesperson for the Inter-Party Cooperation, a coalition of opposition parties.

Shell in Nigeria warns on production after pipeline sabotage

PetroMag Shell in Nigeria on Wednesday said it has warned it may not meet contractual obligations on

Bonny Light crude, after oil thieves sabotaged two pipelines in the country's south. "The force

majeure we declared is effective from August 16 at 1800 hours (1700 GMT)," company

spokesman Precious Okolobo told AFP, referring to the legal clause that frees the company from

Petroleum its obligations due to events beyond its control.

Bazaar "The crude deferment followed attacks on and crude oil theft from our Cawthorne Channel in

Eastern Niger Delta," he said. He declined to give figures on the amount of oil lost following the

attacks. "Efforts are ongoing to repair the damaged pipelines," Okolobo said. Over the weekend,

PetroMag Shell said sabotage of pipelines by oil thieves in southern Nigeria was on the increase and had led

to halts in production, without providing details on the amount of crude lost.

It said three separate incidents had occurred between August 1 and August 12 alone on two

Cawthorne Channel Bonny pipelines. Shell said "suspected crude thieves drilled holes or inflicted

hacksaw cuts to siphon oil." The most recent incident reported on August 12 had led the company

to deploy containment booms to stop the oil from further spreading in the swampy region, though

Shell declined to provide numbers on the amount spilled.

PetroMag Petroleum Bazaar.com 16

More oil from Russia to the Asia-Pacific region

Petroleum Now that a project to boost capacity of the Eastern Siberia-Pacific Ocean oil pipeline up to 50

million tons per year (with prospects of further capacity increase up to 80 million tons) has been

Bazaar approved, Russia is gaining chances to expand its presence in the Asia-Pacific energy market.

Five more oil pumping stations are going to be added to already existing seven to supply even

more Russian oil to Asia. Apart from this, several standby routes will be built via the rivers

PetroMag Angara, Lena and Aldan, as well as through the Ust-Ilimsk water reservoir.

Step-by-step extension of the Eastern Siberia-Pacific Ocean oil pipeline will speed up development

of the whole regions of Siberia and the Russian Far East. The project will boost infrastructure

Petroleum development of the region’s oil transportation system. An expert Alexander Pasechnik

comments.Russia has been successfully expanding its oil exports to the Asia-Pacific region, which

Bazaar is in no way a sensational decision. Expansion in exports had been planned in the original draft

project. So, the capacity of 80 million tons per year is what we expect the next stage of the

project’s implementation to bring us to.

PetroMag The first leg of the pipeline was commissioned last December to link Taishet, a town in the Irkutsk

region, and Skovorodino in the Amur region. From Skovorodino the oil is delivered further by

railway to the Kozmino port in the Primorsk region.There also will be a spur to China, turning the

Petroleum whole system into a global network connecting deposits in Western and Eastern Siberia with the

Pacific coast and providing diversification of the Russian energy resources. Until recently, Russia

Bazaar has exported its oil and gas mainly to Europe. But construction of the Eastern Siberia-Pacific

Ocean oil pipeline paved Russia the way to the APR, now the epicenter of global economic growth.

As China is the leading energy consumer in the APR, its demand for fuel is likely to increase twice

PetroMag in 10 years. India`s rapidly growing economy is causing growing demand for energy as well, while

South Korea and Japan are expected to reach the same level by 2015. So, there is no doubt that

the Russian oil will be in high demand in the region. Besides, delivering oil from Russia is quicker

than from the Middle East, which is an extra point playing into our hands.

Petroleum

Meanwhile, China has asked Russia to supply some oil for testing the newly built Chinese leg of

Bazaar the oil pipeline. Under the 2009 bilateral agreements, China is expected to start receiving 15

million tons of Russian oil per year.

PetroMag Venezuela oil deal with Trinidad & Tobago

Venezuela signed a deal with Trinidad and Tobago to develop natural gas fields along their shared

border. Venezuela will hold a 73 percent stake in the cross-border Loran-Manatee field, estimated

Petroleum to hold 10 trillion cubic feet of gas.

Bazaar Trinidad and Tobago Energy Minister Carolyn Seepersad-Bacha said the field had been under

discussion for almost 20 years. The deal is seen as part of a long-term strategy for Trinidad and

Tobago to shore up reserves and stimulate new upstream activity.

PetroMag The two countries are also expected to negotiate similar agreements for the Dorado-Kapot and

Cocuina Manakin fields, located on the shared maritime border."This is a start, and we are going

to be looking towards other areas where accords can be made," Seepersad-Bacha said after

signing the agreement Wednesday with Venezuelan Petroleum and Energy Minister Rafael

Petroleum Ramirez, Trinidad and Tobago's Newsday reports.

Bazaar Trinidad and Tobago's Prime Minister Patrick Manning signed a framework agreement for oil and

gas resources between the countries with Venezuelan President Hugo Chavez in March 2007.

PetroMag SRILANKA :Iran and Saudi to provide crude oil

Cabinet approval has been granted to a memorandum submitted by Petroleum Industries Minister

Susil Premajayantha to enter into an agreement with National Iranian Oil Company (NIOC) to

extend the existing term contract to produce two million MT of Iranian light crude oil (40,000

million barrels per day) from September 1, 2010 to August 31, 2011 with 120 days interest free

credit facilities, Communication and Mass Media Minister and Cabinet spokesman Keheliya

Rambukwella said.

PetroMag Petroleum Bazaar.com 17

Addressing the weekly Cabinet press briefing at the Government Information Department

Auditorium yesterday, Minister Rambukwella said Cabinet approval has also been granted to

Petroleum procure 135,000 MT of Arabian light crude oil from the Saudi Arabian Oil Company, Saudi Arabia,

during 2010 with 30 days interest free credit facility.

Bazaar

Prior to 2007, Iran offered only the normal credit facility up to 30 days. In response to a request

by President Mahinda Rajapaksa during his visit to Iran in 2007, the Iranian Government extended

interest free credit facility up to 120 days, the Minister said. "When Sri Lanka experienced severe

PetroMag shortage of foreign exchange in 2008-2009 as a result of the global recession, this credit facility

was a relief for Sri Lanka," the Minister added.

Bid to write off Rs 55 billion owed by CEB to CPC

Petroleum

Petroleum Industries Minister Susil Premajayantha told Parliament yesterday that the Ministry was

Bazaar discussing with the Treasury to write off Rs 55 billion that is due to the Ceylon Petroleum

Corporation (CPC) from the Ceylon Electricity Board (CEB).

PetroMag The Minister made this observation in response to a question raised by UNP MP Ravi

Karunanayake. Minister Premajayantha also stated that the CPC incurs a loss of Rs 24.50 from

each kerosene oil litre. It also incurs a loss of Rs 32.62 from a litre of furnace oil while the loss

incurred by a litre of diesel is Rs 5.25.

Petroleum

This loss was balanced by the profit earned by other fuels, he stated. The CPC earns a profit of Rs

Bazaar 2.25 from a litre of petrol 90 Octane while the profit earned from a litre of petrol 95 Octane is Rs

18.10.

Cnooc's first-half net profit more than doublesExplore related topics

PetroMag

HONG KONG Cnooc Ltd., China's largest listed offshore oil and gas producer by capacity, said

Thursday its first-half net profit more than doubled from a year earlier because of rising oil prices

and higher oil and gas output. Net profit for the six months ended June 30 was CNY25.99 billion

Petroleum (US$3.35 billion), up from CNY12.40 billion a year earlier.

Bazaar The result was above the average CNY21.07 billion forecast of six analysts. Revenue more than

doubled to CNY83.16 billion from CNY40.65 billion. Cnooc said its crude oil and gas output in the

first half rose 41% to 149.0 million barrels of oil equivalent. The average selling price of its crude

PetroMag oil was US$76.59 a barrel in the first half, up 55% from US$49.35 a year earlier. The company

proposed a first-half dividend of HK$0.21, up from HK$0.20 a year earlier.

Dana targeted for hostile bid

Petroleum

South Korea’s national oil company was on Thursday night on the brink of launching a £1.67bn

Bazaar hostile takeover bid for Dana Petroleum that could be announced as early as Friday. The move

would mark the first time an Asian state-owned oil company has made a hostile approach in the

UK, and signals an unexpected shift in the battle for overseas reserves by the region’s national oil

companies.

PetroMag

However, those people warned that the situation was still fluid and that the bid could be delayed.

Advisers to KNOC contacted Dana’s biggest shareholders after the market closed on Thursday to

sign letters of intent that they would sell their shares at £18 each – the level of KNOC’s latest

Petroleum approach to Dana’s board.

Bazaar KNOC’s move for Dana is part of a state-backed drive for the oil company to snap up foreign

energy resources to secure South Korea’s energy security, and to compete with the national oil

companies of China and India.

PetroMag

Dana is expected to use its interim earnings results, due next week, to launch a staunch defence,

focusing on the value in its oil exploration programme, which, it claims, KNOC has ignored.

Schroders, Dana’s largest investor, has called publicly for Dana’s board to engage with KNOC

since the Financial Times first revealed the bid approach in early July.

People close to KNOC’s Asia-based lenders said the Korean company had this week requested

adjustments to financing letters to provide the evidence of “certain funds” needed to formally

launch an offer under UK rules.

PetroMag Petroleum Bazaar.com 18

Oil Falls as Surprise Increase in U.S. Jobless Claims

Petroleum Crude oil traded little changed near a six-week low after falling as increased U.S. jobless claims

and a contraction in manufacturing added to concern the economic rebound in the world’s biggest

Bazaar oil-consuming country is slowing.

Oil, which is down 1.3 percent for the week, fell yesterday after the Labor Department said initial

jobless claims rose to the highest level since November. The Federal Reserve Bank of

PetroMag Philadelphia’s general economic index dropped to the lowest reading since July 2009. Total U.S.

petroleum inventories are the highest in at least 20 years, Energy Department figures show.

“The negative employment picture, along with collective record petroleum inventories, will

Petroleum continue to put pressure on energy markets,” said John Kilduff, a partner at Again Capital LLC, a

New York-based hedge fund that focuses on energy. “The negative Philadelphia index number

Bazaar adds to concerns about the strength of the economy.”

Crude oil for September delivery traded at $74.45 a barrel, up 2 cents, in electronic trading on the

PetroMag New York Mercantile Exchange at 8:27 a.m. Sydney time. Yesterday, the contract fell 99 cents, or

1.3 percent, to $74.43, the lowest settlement price since July 7. Futures are up 2.6 percent from a

year ago.

Petroleum Initial jobless claims rose by 12,000 to 500,000 in the week ended Aug. 14, Labor Department

figures showed. Claims exceeded all estimates of economists surveyed and compared with the

Bazaar median forecast of 478,000.

Oil prices close below $US75 a barrel

PetroMag Oil prices closed below $US75 per barrel on Thursday, down for a second day in a row, as weak

US data fuelled worries that the economic recovery is stalling, deepening concerns about demand

in the world's biggest oil consumer.

Petroleum The decline erased gains brought on early by an upgrade in growth prospects for Germany,

Europe's strongest economy.Losses piled up from Wednesday, when data showed US petroleum

Bazaar inventories soared to a record high.Advertisement: Story continues belowUS September crude

settled down 99 cents at $US74.43 a barrel, after hitting a low of $US73.96.

PetroMag In London, ICE front-month Brent last traded down $1.11 at $US75.36. Brent's premium against

US crude dropped back to below $1 a day after it rose to $1.39 - its highest since early June. Oil

found support early in the session from a rally in equity markets in Asia and Europe. European

shares rose after Germany's central bank upgraded its economic growth forecast for this year.

Petroleum

Analysts downplayed the effect on oil prices of deepening tensions between Iran and the United

Bazaar States. Ayatollah Ali Khamenei, the country's supreme leader, said on Wednesday that Iran would

not talk with the United States in the current climate.

Even with Thursday's decline, the US crude benchmark remained above the six-week low of

PetroMag $US73.83 touched on Wednesday, when the Department of Energy said total domestic commercial

petroleum stockpiles last week jumped to 1.13 billion barrels.

It was the highest level since 1990, when the government began reporting weekly

Petroleum data.Inventories hit a record despite drawdowns in crude oil and gasoline storage, prompting

Bazaar analysts to conclude that supplies were growing faster than demand.

Natural Gas Slips Despite Mild Inventory Build

PetroMag Natural gas futures fell Thursday despite a lower-than-expected supply increase as a weak read

on manufacturing activity in the Philadelphia region and a dismal employment environment fueled

investor concerns about the economy's recovery.

Natural gas storage in the lower 48 states added another 27 billion cubic feet for the week ending

Aug. 19, the Energy Information Administration said Thursday. The injection was more bullish

than projections provided by Platts, which called for storage levels to rise by 28 to 32 billion cubic

feet.

PetroMag Petroleum Bazaar.com 19

Although natural gas futures initially rose on the Nymex after the report, the September delivery

contract quickly reversed course. It finished the session 7 cents lower, or down by 1.6%, to settle

Petroleum at $4.17 per million British thermal units, as investors focused on fresh indications of weakness in

the broader economy and the prospect of even more injections to come.

Bazaar

Earlier Thursday, the Philadelphia Federal Reserve Bank said manufacturing activity in the region

contracted this month. That news followed the revelation that even more people applied for state

unemployment benefits for the first time last week. "[Traders] realize the injections are just going

PetroMag to start going up from this point forward," said Phil Flynn, energy analyst at PFGBest. "When you

see weakness in manufacturing from the Philly Fed and that temperatures have cooled, the prices

are starting to look forward. And we'll probably see a sizable injection next week."

Petroleum With storage now at 3.012 trillion cubic feet, levels remain 5.8% below the year-ago level. But the

report also showed supplies are still 7% above the five-year average. The U.S. Natural Gas

Bazaar Fund(UNG) ETF lost 1.3% to $7.04 during the session. Meanwhile, natural gas-related equities

weakened alongside the broader market with the NYSE Arca Natural Gas index down by 1.6%.

PetroMag Crude oil futures also weakened in the wake of the stumbling economic picture, as the most

actively traded October delivery contract shed $1, or 1.3%, to settle at $74.77 a barrel.

September heating oil lost 3 cents, or 1.2%, to settle at $2 a gallon, and October gasoline

surrendered 3 cents, or 1.6%, to settle at $1.88 a gallon.

Petroleum

Bazaar

Courtesy: Media Reports: PTI / Reuters / Financial Times / BBC Business News / DAWN (Pakistan)

PetroMag / Iran Times / The Times/ CNN/ BBC News / OPEC Press releases / Africa Intelligence / Australia

Daily / Hong Kong Times / Gulf News Economic Times / Times of India / Business Standard /

Business Line / Financial Express / Deccan Chronicle / Tribune / Telegraph / Statesman /

Hindustan Times / The Hindu / The Assam Tribune / Parliament House Press releases / Company

Petroleum Press releases / Ministry / Petroleum Bazaar staff reporting. Interoceanic Shipping Agency.

Bazaar

PetroMag

Petroleum

Bazaar

PetroMag

Petroleum

Bazaar

PetroMag

PetroMag Petroleum Bazaar.com 20

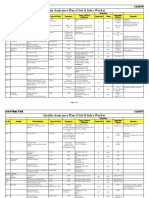

SALES PERFORMANCE

COs JULY MKT. SHARE GR.%IN RANK

GR. % RANK

2010 2009 2010 2009 MKT.SH.

BPC 2331.6 2222.2 4.9 2 20.22 19.83 2.0 2

IOC 5571.1 5273.6 5.6 1 48.32 47.06 2.7 1

HPC 2044.5 1972.4 3.7 3 17.73 17.60 0.7 3

OTH 510.4 528.5 -3.4 4.43 4.72 -6.1

PSU TOTAL 10457.5 9996.7 4.6 90.70 89.22 1.7

RIL 885.1 897.9 -1.4 7.68 8.01 -4.2

ESSAR OIL 131.3 152.2 -13.7 1.14 1.36 -16.1

SHELL IND 55.9 158.3 -64.7 0.48 1.41 -65.7

PRIVATE 1072.3 1208.4 -11.3 9.30 10.78 -13.8

INDUSTRY 11529.8 11205.1 2.9 100.00 100.00

APR-JULY MKT. SHARE GR.%IN RANK

COs GR. % RANK

2010 2009 2010 2009 MKT.SH.

BPC 9755.4 9173.0 6.3 1 20.24 19.65 3.0 1

IOC 23170.7 22009.1 5.3 2 48.07 47.15 1.9 2

HPC 8569.0 8271.9 3.6 3 17.78 17.72 0.3 3

OTH 2124.0 2022.8 5.0 4.41 4.33 1.7

PSU TOTAL 43619.2 41476.7 5.2 90.5 88.9 1.8

RIL 3747.4 3703.2 1.2 7.77 7.93 -2.0

ESSAR OIL 645.6 770.9 -16.3 1.34 1.65 -18.9

SHELL IND 193.7 728.9 -73.4 0.40 1.56 -74.3

PRIVATE 4586.7 5203.0 -11.8 9.51 11.15 -14.6

INDUSTRY 48205.8 46679.6 3.3 100.00 100.00

PetroMag Petroleum Bazaar.com 21

Industrial Sales Performance

Industry Sales Performance (Figs in TMT)

Sales for the month

Cumulative Sales (TMT) % Growth/ (Decline)

(TMT)

Products

Apr-Jun’ Apr-Jun’

June’10 June’09 Jun’10 Apr-Jun’10

10 09

LPG 1064.6 979.1 3150.1 2914.2 8.7 8.1

Naphtha + NGL 753.7 801.7 2266.6 2363.8 (0.6) (4.1)

MS 1242.1 1102.3 3610.7 3225.5 12.7 11.9

ATF / JP-5 401.9 363.5 1215.1 1117.8 10.6 8.7

SKO 714.6 781.9 2214.7 2316.9 (8.9) (4.4)

HSD 5193.6 4858.4 15848.6 14336.1 6.9 10.6

LDO 37.1 44.9 100.7 118.1 (17.5) (14.7)

FO/ LSHS 945.0 962.0 2645.4 2915.0 (1.8) (9.2)