Professional Documents

Culture Documents

HD - SCF HD - SCF

Uploaded by

syedatiqrocketmailcom0 ratings0% found this document useful (0 votes)

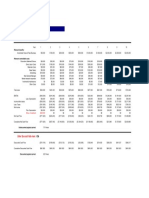

12 views3 pagesThe document shows The Home Depot's statement of cash flows for fiscal years 1986, 1985, and 1984. In 1986, cash flow from operations was negative $43.1 million due to increases in accounts receivable, inventory, and other assets. Cash flow from investing activities was negative $92 million due to additions to property exceeding sales of property. Cash flow from financing activities was positive $92.8 million due to long-term borrowing. Overall, net cash decreased by $42.4 million in 1986.

Original Description:

HD_SCF (1) HD_SCF (1)

Original Title

HD_SCF HD_SCF (1)

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document shows The Home Depot's statement of cash flows for fiscal years 1986, 1985, and 1984. In 1986, cash flow from operations was negative $43.1 million due to increases in accounts receivable, inventory, and other assets. Cash flow from investing activities was negative $92 million due to additions to property exceeding sales of property. Cash flow from financing activities was positive $92.8 million due to long-term borrowing. Overall, net cash decreased by $42.4 million in 1986.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views3 pagesHD - SCF HD - SCF

Uploaded by

syedatiqrocketmailcomThe document shows The Home Depot's statement of cash flows for fiscal years 1986, 1985, and 1984. In 1986, cash flow from operations was negative $43.1 million due to increases in accounts receivable, inventory, and other assets. Cash flow from investing activities was negative $92 million due to additions to property exceeding sales of property. Cash flow from financing activities was positive $92.8 million due to long-term borrowing. Overall, net cash decreased by $42.4 million in 1986.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 3

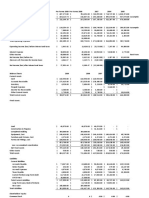

The Home Depot

Statement of Cash Flows

R. McDonald

Feb-86 Feb-85 Feb-84

CASH FLOWS FROM OPERATING ACTIVITIES

Net income $8,219,000 $14,122,000 $10,261,000

depreciation $4,376,000 $2,275,000 $903,000

def income taxes $3,612,000 $1,508,000 $713,000

amortization $637,000 $93,000

net gain on sale ($1,317,000)

other $180,000 $77,000 $59,000

increase in a/r ($15,799,000) ($7,170,000) ($1,567,000)

increase in inventory ($68,654,000) ($25,334,000) ($41,137,000)

increase in prepaids ($587,000) ($1,206,000) ($227,000)

increase in a/p $21,525,000 $10,505,000 $17,150,000

change in accrued salary $1,578,000 ($93,000) $2,524,000

increase in other accrued items $3,736,000 $2,824,000 $341,000

change in tax payable ($626,000) ($657,000) $406,000

cash flow from operations ($43,120,000) ($3,056,000) ($10,574,000)

CASH FLOWS FROM INVESTING ACTIVITIES

sale of property $9,469,000 $861,000 $3,000

additions to property ($99,767,000) ($50,769,000) ($16,081,000)

Bowater acquisition ($3,902,000)

goodwill ($25,291,000)

other ($1,728,000) ($2,554,000) ($252,000)

cash flow -investing activities ($92,026,000) ($81,655,000) ($16,330,000)

CASH FLOWS FROM FINANCING ACTIVITIES

long term borrowing $92,400,000 $120,350,000 $4,200,000

repayments of debt ($10,399,000) ($6,792,000) ($52,000)

sale of common stock $659,000 $814,000 $36,663,000

current portion of debt $10,095,000 $233,000 $10,000

cash flow -financing activities $92,755,000 $114,605,000 $40,821,000

Net change in cash ($42,391,000) $29,894,000 $13,917,000

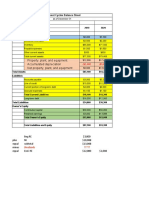

The Home Depot

Statement of Cash Flows

R. McDonald

Feb-86 Feb-85 Feb-84

CASH FLOWS FROM OPERATING ACTIVITIES

Net income $8,219,000 $14,122,000 $10,261,000

depreciation $4,376,000 $2,275,000 $903,000

def income taxes $3,612,000 $1,508,000 $713,000

amortization $637,000 $93,000

net gain on sale ($1,317,000)

other $180,000 $77,000 $59,000

increase in a/r ($15,799,000) ($7,170,000) ($1,567,000)

increase in inventory ($68,654,000) ($25,334,000) ($41,137,000)

increase in prepaids ($587,000) ($1,206,000) ($227,000)

increase in a/p $21,525,000 $10,505,000 $17,150,000

change in accrued salary $1,578,000 ($93,000) $2,524,000

increase in other accrued items $3,736,000 $2,824,000 $341,000

change in tax payable ($626,000) ($657,000) $406,000

cash flow from operations ($43,120,000) ($3,056,000) ($10,574,000)

CASH FLOWS FROM INVESTING ACTIVITIES

sale of property $9,469,000 $861,000 $3,000

additions to property ($99,767,000) ($50,769,000) ($16,081,000)

Bowater acquisition ($3,902,000)

goodwill ($25,291,000)

other ($1,728,000) ($2,554,000) ($252,000)

cash flow -investing activities ($92,026,000) ($81,655,000) ($16,330,000)

CASH FLOWS FROM FINANCING ACTIVITIES

long term borrowing $92,400,000 $120,350,000 $4,200,000

repayments of debt ($10,399,000) ($6,792,000) ($52,000)

sale of common stock $659,000 $814,000 $36,663,000

current portion of debt $10,095,000 $233,000 $10,000

cash flow -financing activities $92,755,000 $114,605,000 $40,821,000

Net change in cash ($42,391,000) $29,894,000 $13,917,000

($56,750,000)

$10,333,000

($166,617,000)

($3,902,000)

($25,291,000)

($4,534,000)

$216,950,000

($17,243,000)

$38,136,000

$10,338,000

$1,420,000

You might also like

- Crystal Meadows of TahoeDocument5 pagesCrystal Meadows of TahoeNikitha Andrea Saldanha80% (5)

- Sneakers 2013Document5 pagesSneakers 2013priyaa0367% (12)

- Druthers Forming Answer KeyDocument3 pagesDruthers Forming Answer KeyDesventes AdrienNo ratings yet

- CFI FMVA Final Assessment Case Study 1ADocument12 pagesCFI FMVA Final Assessment Case Study 1Apadre pio kone100% (1)

- Annual Income Statemen1 Mcdonalds KFCDocument6 pagesAnnual Income Statemen1 Mcdonalds KFCAnwar Ul HaqNo ratings yet

- Cebu BRT Feasibility StudyDocument35 pagesCebu BRT Feasibility StudyCebuDailyNews100% (3)

- Current Legal Problems Volume 48 Issue Part 2 1995 (Doi 10.1093 - CLP - 48.part - 2.63) Bell, J. - English Law and French Law - Not So DifferentDocument39 pagesCurrent Legal Problems Volume 48 Issue Part 2 1995 (Doi 10.1093 - CLP - 48.part - 2.63) Bell, J. - English Law and French Law - Not So DifferentCarlosNo ratings yet

- Financial Analysis of Amazom - Inc CompanyDocument9 pagesFinancial Analysis of Amazom - Inc Companyshepherd junior masasiNo ratings yet

- Avery Products, Inc. Balance SheetDocument7 pagesAvery Products, Inc. Balance SheetJuampi PerezNo ratings yet

- Financial Analysis of Ebay IncDocument8 pagesFinancial Analysis of Ebay Incshepherd junior masasiNo ratings yet

- Making Capital Investment DecisionsDocument42 pagesMaking Capital Investment Decisionsgabisan1087No ratings yet

- Sneakers 2013Document5 pagesSneakers 2013Felicia FrancisNo ratings yet

- Value Drivers (Assumptions)Document6 pagesValue Drivers (Assumptions)Phuong ThaoNo ratings yet

- Bullock Gold MiningDocument3 pagesBullock Gold MiningWalterNo ratings yet

- Latihan Balance SheetDocument10 pagesLatihan Balance SheetULAN BATAWENNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Task 7Document14 pagesTask 7Damaris MoralesNo ratings yet

- Balance Tributaria N°2Document5 pagesBalance Tributaria N°2marceloNo ratings yet

- Working CapitalDocument6 pagesWorking CapitalElizabeth Sanabria AriasNo ratings yet

- Crystal Meadows of TahoeDocument8 pagesCrystal Meadows of TahoePrashuk Sethi100% (1)

- Walmart Inc. (WMT) Cash FlowDocument1 pageWalmart Inc. (WMT) Cash FlowinuNo ratings yet

- FINC 721 Project 2Document2 pagesFINC 721 Project 2Sameer BhattaraiNo ratings yet

- P4-3 WPDocument4 pagesP4-3 WPAna LailaNo ratings yet

- UntitledDocument22 pagesUntitledWild PlatycodonNo ratings yet

- Minicaso Bethesda Mining CompanyDocument8 pagesMinicaso Bethesda Mining CompanySebastián OrtizNo ratings yet

- Hallstead Jewelers PDFDocument9 pagesHallstead Jewelers PDFRaghav JainNo ratings yet

- Master Excel ResourcesDocument123 pagesMaster Excel ResourcesGregory GoodNo ratings yet

- 14-Copy of NURFC Financial AnalysisDocument9 pages14-Copy of NURFC Financial AnalysisCOASTNo ratings yet

- CaseStudy2-Dataset2 v2Document49 pagesCaseStudy2-Dataset2 v2Chip choiNo ratings yet

- Disclosure DocDocument3 pagesDisclosure DocgekkoNo ratings yet

- Mashmglons Print PostDocument9 pagesMashmglons Print Postankush diwanNo ratings yet

- Cash Flow Statement ExampleDocument1 pageCash Flow Statement Exampleridz_mohdNo ratings yet

- Sheetband & Halyard Inc The Correct AnswerDocument6 pagesSheetband & Halyard Inc The Correct Answermaran_navNo ratings yet

- 2208 ch22Document7 pages2208 ch22Clyde Ian Brett PeñaNo ratings yet

- Financial Accounting End TermDocument6 pagesFinancial Accounting End TermJohnny ProNo ratings yet

- Jaxworks PaybackAnalysis1Document1 pageJaxworks PaybackAnalysis1Jo Ann RangelNo ratings yet

- She-Ra Newell Assignment 2-Pickins Mining CompanyDocument5 pagesShe-Ra Newell Assignment 2-Pickins Mining CompanyWarda AhsanNo ratings yet

- Master Excel ResourcesDocument115 pagesMaster Excel ResourcesSarthak ShuklaNo ratings yet

- Session 7 - Financial Statements and RatiosDocument23 pagesSession 7 - Financial Statements and Ratiosalanablues1No ratings yet

- Tugas Kelompok 5 - Studi Kasus Franklin LumberDocument30 pagesTugas Kelompok 5 - Studi Kasus Franklin LumberAgung IswaraNo ratings yet

- Financial PlanDocument2 pagesFinancial PlanUssa BugguNo ratings yet

- Truman Company Acquired A 70 Percent Interest in Atlanta CompanyDocument4 pagesTruman Company Acquired A 70 Percent Interest in Atlanta CompanyKailash KumarNo ratings yet

- J SMytheDocument4 pagesJ SMytheSyed TabrezNo ratings yet

- Tugas Kelompok Akuntansi Ke 4Document10 pagesTugas Kelompok Akuntansi Ke 4grup apa iniNo ratings yet

- P6Document3 pagesP6Jessica HutabaratNo ratings yet

- Tarea Balance GeneralDocument198 pagesTarea Balance GeneralalisongarciaaguilarNo ratings yet

- Woods CorporationDocument1 pageWoods CorporationFelix FelixNo ratings yet

- Financial PlanDocument12 pagesFinancial PlanNico BoialterNo ratings yet

- Mini Case: Bethesda Mining Company: Disusun OlehDocument5 pagesMini Case: Bethesda Mining Company: Disusun Olehrica100% (2)

- Visa Inc. - Income Statement: Recommended: S&P Capital IQ - Standard 2016 FQ3 2016 FQ4Document36 pagesVisa Inc. - Income Statement: Recommended: S&P Capital IQ - Standard 2016 FQ3 2016 FQ4石哲龍No ratings yet

- Financial Analysis of National Underground Railroad Freedom Center, IncDocument6 pagesFinancial Analysis of National Underground Railroad Freedom Center, IncCOASTNo ratings yet

- E Street Development Waterfall - Fall 2020 Part 2 - MasterDocument38 pagesE Street Development Waterfall - Fall 2020 Part 2 - Masterapi-544095773No ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementValeria MartinezNo ratings yet

- Accounts Gibson Keller Debit CreditDocument4 pagesAccounts Gibson Keller Debit CreditMcKenzie WNo ratings yet

- Payback Period Year Cash Flows Cumulative Cash FlowsDocument8 pagesPayback Period Year Cash Flows Cumulative Cash Flowsfarhann JattNo ratings yet

- Team 3 - NO-SOLUTIONS-INVESTMENT-DECISIONS-2-CONCH-PART1Document6 pagesTeam 3 - NO-SOLUTIONS-INVESTMENT-DECISIONS-2-CONCH-PART1Meriam HaouesNo ratings yet

- 23-NURFC 2002 Projections vs. ActualDocument4 pages23-NURFC 2002 Projections vs. ActualCOASTNo ratings yet

- FinanceDocument12 pagesFinanceJesus Javier Flores RodriguezNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 202E13Document28 pages202E13Ashish BhallaNo ratings yet

- Music Tradition of Kamrup-KamakhyaDocument15 pagesMusic Tradition of Kamrup-KamakhyaDilip ChangkakotyNo ratings yet

- Active Critical ReadingDocument22 pagesActive Critical ReadingYonn Me Me KyawNo ratings yet

- Sir Gawain and The Green Knight: A TranslationDocument39 pagesSir Gawain and The Green Knight: A TranslationJohn AshtonNo ratings yet

- Information Security NotesDocument15 pagesInformation Security NotesSulaimanNo ratings yet

- Theological Seminary of Evengelical Kalimantan ChurchDocument15 pagesTheological Seminary of Evengelical Kalimantan ChurchPetra Aria Pendung Wu'iNo ratings yet

- Mt-Requirement-01 - Feu CalendarDocument18 pagesMt-Requirement-01 - Feu CalendarGreen ArcNo ratings yet

- Securities and Exchange Board of India Vs Kishore SC20162402161639501COM692642Document14 pagesSecurities and Exchange Board of India Vs Kishore SC20162402161639501COM692642Prabhat SinghNo ratings yet

- SCRIPT IRFANsDocument2 pagesSCRIPT IRFANsMUHAMMAD IRFAN BIN AZMAN MoeNo ratings yet

- Notification: Professional Examination Result: November-December 2020Document2 pagesNotification: Professional Examination Result: November-December 2020Zahidul Amin FarhadNo ratings yet

- Christmas Pop-Up Card PDFDocument6 pagesChristmas Pop-Up Card PDFcarlosvazNo ratings yet

- War and Peace NTDocument2,882 pagesWar and Peace NTAMBNo ratings yet

- Coding Decoding 1 - 5311366Document20 pagesCoding Decoding 1 - 5311366Sudarshan bhadaneNo ratings yet

- 175 Mendoza V GomezDocument2 pages175 Mendoza V GomezAnonymous bOncqbp8yiNo ratings yet

- Folio BiologiDocument5 pagesFolio BiologiPrincipessa FarhanaNo ratings yet

- Islam and PatriarchyDocument21 pagesIslam and PatriarchycarolinasclifosNo ratings yet

- Berkshire Hathaway Inc.: United States Securities and Exchange CommissionDocument48 pagesBerkshire Hathaway Inc.: United States Securities and Exchange CommissionTu Zhan LuoNo ratings yet

- UntitledDocument9 pagesUntitledRexi Chynna Maning - AlcalaNo ratings yet

- Beaconhouse National University Fee Structure - Per Semester Year 2017-18Document1 pageBeaconhouse National University Fee Structure - Per Semester Year 2017-18usman ghaniNo ratings yet

- Priyanshu Mts Answer KeyDocument34 pagesPriyanshu Mts Answer KeyAnima BalNo ratings yet

- Kishore M. Daswani - ResumeDocument3 pagesKishore M. Daswani - ResumeKishore DaswaniNo ratings yet

- Philo Week 8Document4 pagesPhilo Week 8Emiel Magante100% (1)

- Climate Change (B Ok - CC)Document481 pagesClimate Change (B Ok - CC)Rashid LatiefNo ratings yet

- Case StudyDocument2 pagesCase StudyRahul DhingraNo ratings yet

- Marketing Chapter001Document22 pagesMarketing Chapter001Reham MohamedNo ratings yet

- Environment Impact Assessment Notification, 1994Document26 pagesEnvironment Impact Assessment Notification, 1994Sarang BondeNo ratings yet

- Botvinnik-Petrosian WCC Match (Moscow 1963)Document9 pagesBotvinnik-Petrosian WCC Match (Moscow 1963)navaro kastigiasNo ratings yet

- Music of The Medieval PeriodDocument33 pagesMusic of The Medieval PeriodEric Jordan ManuevoNo ratings yet