Professional Documents

Culture Documents

Daily News 2012 11 13

Uploaded by

te_gantengOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily News 2012 11 13

Uploaded by

te_gantengCopyright:

Available Formats

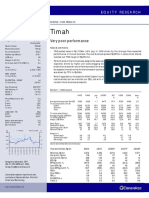

INDONESIA EQUITY

Investment Research

13 November 2012 Good morning,

UNTR to expand to Independent Power Plan business

TOP GAINERS (%)

Stock Change (%)

CEO of PT United Tractors Tbk (UNTR) Djoko Pranoto stated to Kompas yesterday

ASSA 25.6

KOIN 15.8 that his company would expand to the Independent Power Plan (IPP) business,

BABP 13.3 leveraging its coal production at TTA and PMM as a source of energy. Mr. Pranoto

GAMA 13.2 stated that UNTR is gearing up for two IPP tenders located in South Sumatera. At

BCAP 9.6 present, Indonesias demand for steam-coal powered plants reaches 12m tonnes/

year, which can hardly be fulfilled by current production. Should UNTR wins the

TOP LOSERS (%)

Stock Change (%) tender, Mr. Pranoto predicts that the company would be able to operate their IPPs by

PNSE -23.8 FY16 upon a 2-year infrastructure completion. (Kompas)

IBST -15.5

EMDE -8.3 Commentary: We see positively UNTRs move to expand its value chain into IPPs.

MYTX -7.8 Approximately 50% of UNTRs revenue is generated from coal mining related

WAPO -7.4

businesses through mining contractor PT Pamapersada Nusantara and Tuah

TOP VOLUME (mn shares) Turangga Agung & Prima Multi Mineral mines. Approximately 46% of all Komatsu

Stock Volume machines are directed to serve the mining sector clients. This large mining exposure

ELTY 218.3 has led to a sharp downturn at UNTR in recent time, with the company revising its

IPOL 210.9 target sales as well as accepting contracts for lower stripping ratios. Our channel

ASSA 172.0

SUGI 158.6

checks stated that mining companies have largely been under the mercy of spot

TRAM 134.8 prices these days on the back of somber coal outlook. Should the tender be

successful, we think that UNTRs would be able to expand its value chain to

TOP VALUE (Rp bn) generate higher margins from the desperately-needed power generation in the

Stock Value nation. This business would also reduce UNTRs fragility from the volatile world

ASII 211.8

BBRI 199.2

commodity prices. This move is also an answer badly needed by the market over

TRAM 131.4 UNTRs acquisition of three additional coal mines in Kalimantan earlier this year --

BBCA 100.0 despite the very bleak coal outlook. ASII has mandated UNTR to acquire up to 500m

MNCN 87.7 tonnes of coal reserves by FY15. UNTRs coal reserves currently stands at ~380m

tonnes.

Key Market Indices Key Statistics

Value Change % Change Value Change % Change

JCI 4,318.6 -15.0 -0.3% Volume (mn shares) 4,245.7 828.9 24.3%

DJI 12,815.1 -0.3 0.0% Value (IDR bn) 3,810.4 -166.4 -4.2%

Nasdaq 2,904.3 -0.6 0.0% WTI oil price (USD/bl) 85.6 -0.5 -0.6%

Hang Seng 21,430.3 45.9 0.2% CPO price (USD/ton) 800 0 0.0%

Nikkei 8,676.4 -81.2 -0.9% Coal price (USD/ton) 79.9 1.1 1.3%

KOSPI 1,900.9 -3.5 -0.2% Nickel price (USD/ton) 16,036 129 0.8%

TWSE 7,267.8 -25.5 -0.3% Tin price (USD/ton) 20,408 78 0.4%

STI 3,007.6 -2.0 -0.1% Inflation YoY (%) 4.31 -0.3 -6.3%

KLCI 1,637.6 -3.5 -0.2% BI Rate (%) 5.75 0.0 0.0%

SET 1,294.5 3.7 0.3% IDR/USD 9,633 430 4.7%

OSK Research | See important disclosures at the end of this report 1

13 November 2012

MEDIA HIGHLIGHTS

Media Nusantara net profit reached IDR1,336bn (+45% y-o-y) in 10M12

Indonesia largest media company, Media Nusantara (MNCN) booked net profit of IDR1,336bn (+45% y-o-y) in January-October

2012, driven by higher advertising revenue which was driven by increased rate-card and occupancy levels. (Company)

Comment: 10M12 realized earning has reached 88.5% of our full-year estimates, in line with our expectation. We see that the

company succeeded rebranding its MNC TV program base from music to drama programs. This increased MNC TV audience

rating, also raising its profit margin. MNCNs core EBITDA margin improved to 37% in 10M12 from 36% in 10M11. The counter

is trading at 21.8x-18.9x FY12-13F PE, for comparison its closest peer, SCMA is trading at 19.6x-17.3x FY12-13F PE. We

maintain Neutral on the counter.

Exhibit: Indonesias FTA monthly audience rating

45.0

40.0

35.0

30.0

25.0

20.0

15.0

10.0

5.0

-

Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 Feb-12 Mar-12 Apr-12 May-12 Jun-12 Jul-12 Aug-12

MNC Group Trans TV - Trans7 SCTV IVM

Source: Company

Ramayana gross-sales reached IDR6,345bn (+13.0% y-o-y) in 10M12

Indonesia retailer, Ramayana (RALS) reported that gross-sales has achieved IDR6,345bn (+13.0% y-o-y), reaching 84.6% of

full-year estimate. Same-store sales growth reached 9.3% y-o-y. (Company, Kontan)

Comment: 10M12 realized sales are in line with our expectation. October sales growth is slightly faster than September sales

growth (total growth 12.9% y-o-y, SSSG of 9.2% y-o-y). Going forward, we see RALS sales growth to remain strong as income

of low-end consumers RALS based market to strengthen next year. The Jakarta government has determined Jakarta

residents modest living expenditures of IDR1.9m/month, a 31% higher than current regional minimum wage. It is worth noting

that regional minimum wage may not be lower than modest living expenditures. Hence, we see that Jakarta regional minimum

wage may increase faster in 2013 for comparison minimum wage growth was 18% y-o-y in 2012. In fact, Jakarta labors 2013

wage demand is around IDR2.7-2.8m/month, much higher than modest living expenditures. Jakarta increased minimum wage

is commonly based for other provinces wage increase. Monthly modest living expenditures in Bogor, Depok, and Tangerang

are IDR1.6m-IDR1.7m-IDR1.6m, respectively, 33.3%-21.4%-23.1% higher than those areas regional minimum wages.

Ramayana is trading at 18.5x-16.5x FY12-13F PE, lower than its peers which averagely trading at 23.7x-19.1x FY12-13F PE.

We maintain BUY on the counter with target price IDR1,400, implying 21.9x-19.6x FY12-13F PE.

Exhibit: RALS sales growth

30.0%

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

Feb-11

Apr-11

Sep-11

Feb-12

Apr-12

Sep-12

Mar-11

Jun-11

Jul-11

Aug-11

Oct-11

Dec-11

Mar-12

Jun-12

Jul-12

Aug-12

Oct-12

Jan-11

May-11

Nov-11

Jan-12

May-12

SSSG (YTD) Sales growth (YTD)

Source: Company

OSK Research | See important disclosures at the end of this report 2

13 November 2012

Exhibit: Regional minimum wage, Minimum decent living expenditures, Labor wage demand

Regional Minimum Modest Living Labor wage

Region Wage Expenditures Differences demand

(IDR m/month) (IDR m/month) (%) (IDR m/month)

2012 2012 2013

Jakarta 1.5 1.9 31.0% 2.7-2.8

Bogor 1.2 1.6 33.3% 2.7

Depok 1.4 1.7 21.4% 2.6

Tangerang 1.3 1.6 23.1% 2.5

Source: Kontan

Asahimas Flat Glass expects 7% sales growth in this year

Asahimas Flat Glass (AMFG) expects IDR2.78 trn sales for this year (+7% y-o-y), boosted by higher demand from local

construction firms and automobile makers. In 9M12, sales grew by 13% y-o-y with domestic sales growth reached 24% and

export slumped by 4%. ~70% of revenue came from construction sector, while the rest come from automotive sector.

Operational income, however, only rose by 1% on higher cost increase. The company plans to gradually increase its selling

price by 5-7% to anticipate further cost pressure from higher gas price and electricity tariff. AMFG just finished the automotive

glass production capacity expansion which brought its capacity to 1.3m unit from previously ~850k unit. The company is

expected to be one of the suppliers for Agya and Ayla cars. (Jakarta Post, Company)

Comment: The ASP increase may not be sufficient to fully cope the cost pressure considering that besides higher energy

prices (~30% of COGS), management also indicates higher raw material prices (also ~30% of COGS).

Ciputra Development pre-sales reached IDR5.5trn

CTRA recorded pre-sales of IDR5.5trn up to October 2012, or 84.62% from its FY12 traget f IDR6.4trn. Looking at the satisfying

pre-sales performance in companys overall projects, the company is optimist to reach target sales of IDR6.5trn to IDR6.6trn.

Capex absorption up to Oct12 is IDR900bn where most of the allocation goes to Ciputra World I project. (Bisnis Indonesia)

Comments: Seeing the companys marketing sales where sales in month October remain stable at IDR610bn (note monthly

sales range between IDR413bn to IDR768bn), we believe that negative impact from enforcement of minimum downpayment of

30% has less significance on demand for CTRAs property. CTRAs 9M12 results also beat our and concensus estimate,

subject to upgrade. We are reviewing our forecast and TP but maintain our BUY call.

OSK Research | See important disclosures at the end of this report 3

13 November 2012

CORPORATE ACTION CALENDER

Cash dividend

Ex-date Company Ticker Type Cash (IDR)

27-Sep-12 Berlina BRNA Cash dividend 90

1-Oct-12 Sumi Indo Kabel IKBI Cash dividend 42

2-Oct-12 Alumindo Light Metal Industry ALMI Cash dividend 50

4-Oct-12 Catur Sentosa CSAP Cash dividend 5

10-Oct-12 Pabrik Kertas Tjiwi Kimia TKIM Cash dividend 25

10-Oct-12 Pakuwon Jati PWON Cash dividend 1.45

19-Oct-12 Astra International ASII Cash dividend 66

1-Oct-12 Sumi Indo Kabel IKBI Cash dividend 42

2-Oct-12 Alumindo Light Metal ALMI Cash dividend 50

4-Oct-12 Catur Sentosa Adiprana CSAP Cash dividend 5

10-Oct-12 Pabrik KertasTjiwi TKIM Cash dividend 25

10-Oct-12 Pakuwon Jati PWON Cash dividend 1

16-Oct-12 Astra Graphia ASGR Interim 15

17-Oct-12 Astra Agro Lestari AALI Interim 230

17-Oct-12 Hexindo Adiperkasa HEXA Cash dividend USD0.387

17-Oct-12 United Tractors UNTR Interim 210

19-Oct-12 Astra International ASII Cash dividend 66

23-Oct-12 Gowa Makassar GMTD Cash dividend 38

30-Oct-12 Indo Tambangraya Megah ITMG Interim 1,666

4-Dec-12 Sepatu Bata BATA Interim 1,565

4-Dec-12 Selamat Sempurna SMSM Interim 30

4-Dec-12 Bank Central Asia BBCA Interim 44

IPO

Listing date Company Ticker Initial Price (IDR)

31-Aug-12 Inti Bangun Sejahtera IBST 1,000

13-Sep-12 Nirvana Developm ent NIRO 105

28-Sep-12 Sekar Bumi SKBM 155

8-Oct-12 Provident Agro PALM 450

11-Oct-12 Pelayaran Nelly Dwi Putri NELY 205

2-Nov-12 Express Transindo Utama TAXI 560

8-Nov-12 Baramulti Suksessarana BSSR 1,950

12-Nov-12 Adi Sarana Armada ASSA 390

Stock split

Ex-date Company Ticker Adjustment

28-Sep-12 Pudjiadi & Sons PNSE 5 for 1

3-Oct-12 Indosiar Karya Media IDKM 5 for 1

8-Oct-12 Kalbe Farma KLBF 5 for 1

29-Oct-12 Surya Citra Media SCMA 5 for 1

1-Nov-12 Ace Hardware Indonesia ACES 10 for 1

6-Nov-12 Berlina BRNA 5 for 1

Rights issue

Ex-date Company Ticker Adjustment Subscribed Price (IDR)

29-Oct-12 Modern Internasional MDRN 3 per 10 550

19-Nov-12 Bank Tabungan Negara BBTN 0.1711:1 1,235

20-Nov-12 Cowell Development COWL 109 per 20 220

21-Nov-12 Hotel Mandarine Regency HOME 17 per 20 100

30-Nov-12 Bank Permata BNLI 2 per 11 1,215

30-Nov-12 Bank Artha Graha Internasional INPC 10 per 19 111

6-Dec-12 Bhuwantala Indah Permai BIPP 41 per 69 151

6-Dec-12 Samindo Resources MYOH 1 per 2 830

14-Dec-12 Exploitasi Energi Indonesia CNKO 61 per 55 500

19-Dec-12 Sejahtera Raya Anugrahjaya SRAJ 1 per 1 260

OSK Research | See important disclosures at the end of this report 4

13 November 2012

OSK Research Guide to Investment Ratings

Buy: Share price may exceed 10% over the next 12 months

Trading Buy: Share price may exceed 15% over the next 3 months, however longer-term outlook remains uncertain

Neutral: Share price may fall within the range of +/- 10% over the next 12 months

Take Profit: Target price has been attained. Look to accumulate at lower levels

Sell: Share price may fall by more than 10% over the next 12 months

Not Rated: Stock is not within regular research coverage

All research is based on material compiled from data considered to be reliable at the time of writing. However, information and opinions expressed

will be subject to change at short notice, and no part of this report is to be construed as an offer or solicitation of an offer to transact any securities or

financial instruments whether referred to herein or otherwise. We do not accept any liability directly or indirectly that may arise from investment

decision-making based on this report. The company, its directors, officers, employees and/or connected persons may periodically hold an interest

and/or underwriting commitments in the securities mentioned.

Distribution in Singapore

This research report produced by OSK Nusadana Securities Indonesia is distributed in Singapore only to Institutional Investors, Expert Investors

or Accredited Investors as defined in the Securities and Futures Act, CAP. 289 of Singapore. If you are not an Institutional Investor, Expert

Investor or Accredited Investor, this research report is not intended for you and you should disregard this research report in its entirety. In respect

of any matters arising from, or in connection with, this research report, you are to contact our Singapore Office, DMG & Partners Securities Pte Ltd

(DMG).

All Rights Reserved. No part of this publication may be used or re-produced without expressed permission from OSK Research.

Published and printed by :-

PT OSK NUSADANA SECURITIES INDONESIA

Kuala Lumpur Hong Kong Singapore

Malaysia Research Office Hong Kong Office Singapore Office

OSK Research Sdn. Bhd. OSK Securities DMG & Partners

6th Floor, Plaza OSK Hong Kong Ltd. Securities Pte Ltd

Jalan Ampang 12th Floor, 10 Collyer Quay

50450 Kuala Lumpur World-Wide House #09-08 Ocean Financial

Malaysia 19 Des Voeux Road Centre

Tel : +(60) 3 9207 7688 Central, Hong Kong Singapore 049315

Fax : +(60) 3 2175 3202 Tel : +(852) 2525 1118 Tel : + (65) 6533 1818

Fax : +(852) 2810 0908 Fax :+ (65) 6532 6211

Jakarta Shanghai Phnom Penh

PT OSK Nusadana Shanghai Office OSK Indochina Securities Limited

Securities Indonesia OSK (China) Investment No. 263, Ang Duong Street (St. 110),

Plaza CIMB Niaga, Advisory Co. Ltd. Sangkat Wat Phnom, Khan Daun Penh,

14th Floor, Room 6506, Plaza 66 Phnom Penh, Cambodia.

Jl. Jend. Sudirman Kav.25, No.1266, West Nan Jing Road Tel: (855) 2399 2833

Jakarta Selatan 12920, 200040 Shanghai Fax: (855) 2399 1822

Indonesia. China

Tel : (6221) 2598 6888 Tel : +(8621) 6288 9611

Fax : (6221) 2598 6777 Fax : +(8621) 6288 9633

Bangkok

OSK Securities (Thailand) PCL

191, Silom Complex Building

16th Floor, Silom Road,Silom,

Bangrak, Bangkok 10500

Thailand

Tel: +(66) 2200 2000

Fax : +(66) 2632 0191

OSK Research | See important disclosures at the end of this report 5

You might also like

- Philippines: Energy Sector Assessment, Strategy, and Road MapFrom EverandPhilippines: Energy Sector Assessment, Strategy, and Road MapNo ratings yet

- BNIS Short Notes: Under-Appreciated Gold AssetDocument4 pagesBNIS Short Notes: Under-Appreciated Gold AssetfirmanNo ratings yet

- Torrent Power 20190319 Mosl Ic Pg034Document34 pagesTorrent Power 20190319 Mosl Ic Pg034Poonam AggarwalNo ratings yet

- ACC-Limited 44 QuarterUpdateDocument6 pagesACC-Limited 44 QuarterUpdateRohan RustagiNo ratings yet

- Axis Capital - Reliance Industries (RIL) - Errclub - Annual Report Analysis - FY16 Annual Report AnalysisDocument13 pagesAxis Capital - Reliance Industries (RIL) - Errclub - Annual Report Analysis - FY16 Annual Report AnalysisRakesh SethiaNo ratings yet

- Final Deepak Fertilizers Petrochemicals LTDDocument9 pagesFinal Deepak Fertilizers Petrochemicals LTDbolinjkarvinitNo ratings yet

- TTK Prestige Research ReportDocument22 pagesTTK Prestige Research Reportsujay85No ratings yet

- HDFC PowerDocument3 pagesHDFC PowerHiren PatelNo ratings yet

- Amwatch: Stock Focus of The DayDocument4 pagesAmwatch: Stock Focus of The DayBrian StanleyNo ratings yet

- Iex 20200831 Mosl Ic PG038Document38 pagesIex 20200831 Mosl Ic PG038Jagannath DNo ratings yet

- Morning India 20231215 Mosl Mi Pg022Document22 pagesMorning India 20231215 Mosl Mi Pg022Anurag PharkyaNo ratings yet

- Sektor CPO HP SekuritasDocument6 pagesSektor CPO HP SekuritasHanindya FebriNo ratings yet

- Today's Top Research Idea Market Snapshot: Tata Consumer (AGIC: CEO Track) : Steadily Walking The Talk!Document20 pagesToday's Top Research Idea Market Snapshot: Tata Consumer (AGIC: CEO Track) : Steadily Walking The Talk!Equity NestNo ratings yet

- Daiwa June InitiatingDocument73 pagesDaiwa June InitiatingvaruntalukdarNo ratings yet

- KK UK Melakukan Perdagangan EfekDocument13 pagesKK UK Melakukan Perdagangan EfekRihzan FauziNo ratings yet

- Impact of Brexit On Malaysians - Market News - PropertyGuru - Com.myDocument4 pagesImpact of Brexit On Malaysians - Market News - PropertyGuru - Com.myzahirzakiNo ratings yet

- Exide Industries: Performance HighlightsDocument4 pagesExide Industries: Performance HighlightsMaulik ChhedaNo ratings yet

- Our Visit To Dangote Cement PLC Ethiopia Plant - 1Document8 pagesOur Visit To Dangote Cement PLC Ethiopia Plant - 1Dame TolossaNo ratings yet

- Newz Bits: Talking Point Media Chinese International - Enter The DragonDocument8 pagesNewz Bits: Talking Point Media Chinese International - Enter The DragonDennis TanNo ratings yet

- Tkyo Corporate Update Strong Buy 20-09-162Document15 pagesTkyo Corporate Update Strong Buy 20-09-162Sanjaya RanchagodaNo ratings yet

- Institutional Research: Essar OilDocument21 pagesInstitutional Research: Essar OilDipneesh Kumar SinghNo ratings yet

- MSFL PG 01 Cover PageDocument1 pageMSFL PG 01 Cover PageHimanshu KuriyalNo ratings yet

- Tata Steel - Q3FY17 Result Update - Centrum 07022017Document7 pagesTata Steel - Q3FY17 Result Update - Centrum 07022017Sreenivasulu E NNo ratings yet

- Aditya Birla Nuvo Limited: ResearchDocument9 pagesAditya Birla Nuvo Limited: ResearchravustinNo ratings yet

- Itmg 20230306Document5 pagesItmg 20230306Hanna WesleyNo ratings yet

- National Aluminium Company LTD Agro LTD: Retail ResearchDocument10 pagesNational Aluminium Company LTD Agro LTD: Retail ResearchajaykashviNo ratings yet

- Proof of Pudding: Highlights of The QuarterDocument9 pagesProof of Pudding: Highlights of The QuarterAnonymous y3hYf50mTNo ratings yet

- SharekhanTopPicks 041210Document7 pagesSharekhanTopPicks 041210mathaiyan,arunNo ratings yet

- SCC Cement in MyanmarDocument10 pagesSCC Cement in MyanmarLavu Anil ChowdaryNo ratings yet

- LOTTE Chemical Pakistan LTD (LOTCHEM) : Recovery in Primary Margins To Drive ProfitabilityDocument13 pagesLOTTE Chemical Pakistan LTD (LOTCHEM) : Recovery in Primary Margins To Drive ProfitabilityAli CheenahNo ratings yet

- Tata Chemicals LTD: 12-Feb-2008 Pioneer Intermediaries PVT LTD - Agarwalla, AshwaniDocument32 pagesTata Chemicals LTD: 12-Feb-2008 Pioneer Intermediaries PVT LTD - Agarwalla, Ashwaniapi-3828752No ratings yet

- BNIS Short Notes ANTM 14 Jan 2021 Retain Buy Raise TP Rp4,500Document7 pagesBNIS Short Notes ANTM 14 Jan 2021 Retain Buy Raise TP Rp4,500Umar SyaidNo ratings yet

- IP METALS - 09 Mar 2021Document42 pagesIP METALS - 09 Mar 2021klshfyusbdfkNo ratings yet

- (Mirae Asset Sekuritas Indonesia) Strategy For The 4Q23 Window Dressing PDFDocument16 pages(Mirae Asset Sekuritas Indonesia) Strategy For The 4Q23 Window Dressing PDFrudyjabbar23No ratings yet

- Indian Airlines Sector: Ready To Take OffDocument48 pagesIndian Airlines Sector: Ready To Take OffAnand BhushanNo ratings yet

- DR - ADRO (2 Mei 2019)Document7 pagesDR - ADRO (2 Mei 2019)siput_lembekNo ratings yet

- Construction Materials: Worst May Be Over, We Remain WaryDocument7 pagesConstruction Materials: Worst May Be Over, We Remain Warynkr_03No ratings yet

- InvestmentIdea TataMotors041021Document5 pagesInvestmentIdea TataMotors041021Vaseem KhanNo ratings yet

- 2020 Q1 Indocement Conference Call 2020Q1 V1Document28 pages2020 Q1 Indocement Conference Call 2020Q1 V1AHMAD DENDY WAHID ABDULAHNo ratings yet

- Tins 060831Document2 pagesTins 060831Cristiano DonzaghiNo ratings yet

- MTAR Technologies LTD: Subscribe For Long Term Price Band: INR 574-575Document10 pagesMTAR Technologies LTD: Subscribe For Long Term Price Band: INR 574-575falconNo ratings yet

- Morning India 20210323 Mosl Motilal OswalDocument8 pagesMorning India 20210323 Mosl Motilal Oswalvikalp123123No ratings yet

- Tata Motors Limited: Business OverviewDocument5 pagesTata Motors Limited: Business OverviewAryan SharmaNo ratings yet

- LPG Profile 1.4.2021: As OnDocument14 pagesLPG Profile 1.4.2021: As OnSushobhan DasNo ratings yet

- Oil and Gas Sector Update: SOGT Finally Awarded? - 01/09/2010Document3 pagesOil and Gas Sector Update: SOGT Finally Awarded? - 01/09/2010Rhb InvestNo ratings yet

- Telecommunications Sector Update: 2QFY10 Report Card - 03/09/2010Document8 pagesTelecommunications Sector Update: 2QFY10 Report Card - 03/09/2010Rhb InvestNo ratings yet

- Amit SAIL Valuation ReportDocument19 pagesAmit SAIL Valuation Reportkas_pat01100% (1)

- Morning - India 20230410 Mosl Mi PG038Document38 pagesMorning - India 20230410 Mosl Mi PG038Aditya HalwasiyaNo ratings yet

- Sanghi Industries - 2QFY18 - HDFC Sec-201711132133302229263Document9 pagesSanghi Industries - 2QFY18 - HDFC Sec-201711132133302229263Anonymous y3hYf50mTNo ratings yet

- Morning India 20210330 Mosl Mi Pg018 2021-03-30Document18 pagesMorning India 20210330 Mosl Mi Pg018 2021-03-30vikalp123123No ratings yet

- TCPL Packaging LTD: Environment Friendly GrowthDocument17 pagesTCPL Packaging LTD: Environment Friendly Growthswati choudharyNo ratings yet

- Universitas Indonesia-Fortuna Capital-Final SubmissionDocument21 pagesUniversitas Indonesia-Fortuna Capital-Final SubmissionMay XiNo ratings yet

- Tata Power: CMP: Inr87 TP: INR77 (-11%)Document8 pagesTata Power: CMP: Inr87 TP: INR77 (-11%)Rahul SainiNo ratings yet

- Ramco Cements: Another Solid QuarterDocument8 pagesRamco Cements: Another Solid QuarterumaganNo ratings yet

- Tata Steel: Performance HighlightsDocument6 pagesTata Steel: Performance Highlightsmd.iet87No ratings yet

- Music BroadcastDocument12 pagesMusic BroadcastSBNo ratings yet

- FinalDocument50 pagesFinalStefanus IrawanNo ratings yet

- Windfall Quarter: Results Review 3qfy17 15 FEB 2017Document7 pagesWindfall Quarter: Results Review 3qfy17 15 FEB 2017Dinesh ChoudharyNo ratings yet

- BUY Binani Cement LTD.: - Institutional ResearchDocument16 pagesBUY Binani Cement LTD.: - Institutional Researchbsaurabh2002No ratings yet

- Today's Top Research Idea: Larsen & Toubro: Strong Operating Performance, Balance Sheet StrengthensDocument32 pagesToday's Top Research Idea: Larsen & Toubro: Strong Operating Performance, Balance Sheet StrengthensAshutosh PatidarNo ratings yet

- Chapter 6:developing PeopleDocument7 pagesChapter 6:developing PeopleRentyas HellisNo ratings yet

- Motivation: Motivation Is Not What You Do To Someone - It'S What You Do For SomeoneDocument12 pagesMotivation: Motivation Is Not What You Do To Someone - It'S What You Do For Someonete_gantengNo ratings yet

- Chapter 1: Working Cross-CulturallyDocument5 pagesChapter 1: Working Cross-Culturallyte_gantengNo ratings yet

- Defining Teams: A Team Can Be Defined As FollowsDocument13 pagesDefining Teams: A Team Can Be Defined As Followste_gantengNo ratings yet

- Personal Experience Record GO-400-2: Significant Outside Activities & Accomplishments (Work Related Only)Document6 pagesPersonal Experience Record GO-400-2: Significant Outside Activities & Accomplishments (Work Related Only)te_gantengNo ratings yet

- HoneywellDocument462 pagesHoneywellte_gantengNo ratings yet

- Managing Transitions: Transition Is The Psychological Process People Go Through When Adjusting To ChangeDocument7 pagesManaging Transitions: Transition Is The Psychological Process People Go Through When Adjusting To Changete_ganteng100% (1)

- Corporate Cultures: What Is Corporate Culture?Document8 pagesCorporate Cultures: What Is Corporate Culture?te_gantengNo ratings yet

- Bank Rakyat Indonesia: Company UpdateDocument6 pagesBank Rakyat Indonesia: Company Updatete_gantengNo ratings yet

- IND Bumi Serpong Damai Corporate News Flash 20131029 2Document4 pagesIND Bumi Serpong Damai Corporate News Flash 20131029 2te_gantengNo ratings yet

- 0810 Power Bi Dashboard in An HourDocument42 pages0810 Power Bi Dashboard in An Hourvtechvishnu100% (1)

- Indo Tambangraya Neutral: Way Below ExpectationDocument5 pagesIndo Tambangraya Neutral: Way Below Expectationte_gantengNo ratings yet

- Indonesian Banks: 3Q12 Results ReviewDocument13 pagesIndonesian Banks: 3Q12 Results Reviewte_gantengNo ratings yet

- ID Banks3Q13Preview 20131004 RHB 2Document9 pagesID Banks3Q13Preview 20131004 RHB 2te_gantengNo ratings yet

- Ingersoll Rand Desiccant DryersDocument12 pagesIngersoll Rand Desiccant DryersAnonymous Jd6v1D6rNo ratings yet

- Bekasi Fajar Buy: Keeping A Cautious View Despite Recovery SignsDocument4 pagesBekasi Fajar Buy: Keeping A Cautious View Despite Recovery Signste_gantengNo ratings yet

- Building Synergy Nurturing The Future: Annual Report 2013Document1 pageBuilding Synergy Nurturing The Future: Annual Report 2013te_gantengNo ratings yet

- STTP Annual Report 2013Document5 pagesSTTP Annual Report 2013te_gantengNo ratings yet

- Electric Text PhotoshopDocument6 pagesElectric Text Photoshopte_gantengNo ratings yet

- ICON Annual Report 2013Document32 pagesICON Annual Report 2013te_gantengNo ratings yet

- User Guide of Energy ModelDocument11 pagesUser Guide of Energy Modelte_gantengNo ratings yet

- Lesson 7: Configuring Preparing The Controller For A ProgramDocument7 pagesLesson 7: Configuring Preparing The Controller For A Programte_gantengNo ratings yet

- ADHIDocument3 pagesADHIluvzaelNo ratings yet

- AvatarDocument14 pagesAvatarte_gantengNo ratings yet

- Sign HereDocument5 pagesSign HereFatmir HusejniNo ratings yet

- List PrepositionsDocument1 pageList Prepositionsapi-262050260No ratings yet

- Using Bloomberg To Get The Data You NeedDocument36 pagesUsing Bloomberg To Get The Data You Needte_gantengNo ratings yet

- Polaroid PhotoDocument6 pagesPolaroid Photote_gantengNo ratings yet

- Micrologix™ 1500 Processor: Installation, Einbau, Installazione, Instalación, InstalaçãoDocument2 pagesMicrologix™ 1500 Processor: Installation, Einbau, Installazione, Instalación, Instalaçãote_gantengNo ratings yet

- GlobalDocument24 pagesGloballaleye_olumideNo ratings yet

- Business Maths Chapter 5Document9 pagesBusiness Maths Chapter 5鄭仲抗No ratings yet

- Consumer PresentationDocument30 pagesConsumer PresentationShafiqur Rahman KhanNo ratings yet

- Mathematical Method For Physicists Ch. 1 & 2 Selected Solutions Webber and ArfkenDocument7 pagesMathematical Method For Physicists Ch. 1 & 2 Selected Solutions Webber and ArfkenJosh Brewer100% (3)

- MSC 200Document18 pagesMSC 200Amit KumarNo ratings yet

- Read The Text and Answer The QuestionsDocument5 pagesRead The Text and Answer The QuestionsDanny RuedaNo ratings yet

- Sample Database of SQL in Mysql FormatDocument7 pagesSample Database of SQL in Mysql FormatsakonokeNo ratings yet

- Yusuf Mahmood CVDocument3 pagesYusuf Mahmood CVapi-527941238No ratings yet

- SoC Showdown: Snapdragon 810 Vs Exynos 7420 Vs MediaTek Helio X10 Vs Kirin 935 - AndroidAuthority - PDDocument19 pagesSoC Showdown: Snapdragon 810 Vs Exynos 7420 Vs MediaTek Helio X10 Vs Kirin 935 - AndroidAuthority - PDArpit SharmaNo ratings yet

- Merchant Accounts Are Bank Accounts That Allow Your Business To Accept Card Payments From CustomersDocument43 pagesMerchant Accounts Are Bank Accounts That Allow Your Business To Accept Card Payments From CustomersRohit Kumar Baghel100% (1)

- Consumer Price SummaryDocument5 pagesConsumer Price SummaryKJ HiramotoNo ratings yet

- CCBA Exam: Questions & Answers (Demo Version - Limited Content)Document11 pagesCCBA Exam: Questions & Answers (Demo Version - Limited Content)begisep202No ratings yet

- Phrasal Verbs en Inglés.Document2 pagesPhrasal Verbs en Inglés.David Alexander Palomo QuirozNo ratings yet

- Denso - History PDFDocument5 pagesDenso - History PDFVenkateswaran KrishnamurthyNo ratings yet

- Jose André Morales, PH.D.: Ingeniería SocialDocument56 pagesJose André Morales, PH.D.: Ingeniería SocialJYMYNo ratings yet

- Antibiotic I and II HWDocument4 pagesAntibiotic I and II HWAsma AhmedNo ratings yet

- Icoone Results Book ENDocument17 pagesIcoone Results Book ENIVYNo ratings yet

- RRC & RabDocument14 pagesRRC & RabSyed Waqas AhmedNo ratings yet

- 4th Conference ParticipantsDocument14 pages4th Conference ParticipantsmaxNo ratings yet

- Reverse LogisticsDocument37 pagesReverse Logisticsblogdogunleashed100% (7)

- CP R80.10 Installation and Upgrade GuideDocument246 pagesCP R80.10 Installation and Upgrade GuideAlejandro OrtìzNo ratings yet

- InfltiDocument13 pagesInfltiLEKH021No ratings yet

- Windows Server 2016 Technical Preview NIC and Switch Embedded Teaming User GuideDocument61 pagesWindows Server 2016 Technical Preview NIC and Switch Embedded Teaming User GuidenetvistaNo ratings yet

- E-Cat35xt014 Xtro PhantomsDocument32 pagesE-Cat35xt014 Xtro PhantomsKari Wilfong100% (5)

- FixDocument4 pagesFixReza FahmiNo ratings yet

- Sample Heat Sheets June 2007Document63 pagesSample Heat Sheets June 2007Nesuui MontejoNo ratings yet

- MY-SDK-10000-EE-005 - Method Statement For Concrete Pole Installation - GVB Rev1Document7 pagesMY-SDK-10000-EE-005 - Method Statement For Concrete Pole Installation - GVB Rev1Seeths NairNo ratings yet

- Checklist Code ReviewDocument2 pagesChecklist Code ReviewTrang Đỗ Thu100% (1)

- John Paul Jackson Prophecies of The FutureDocument15 pagesJohn Paul Jackson Prophecies of The FutureMeranda Devan100% (9)

- Trading Book - AGDocument7 pagesTrading Book - AGAnilkumarGopinathanNairNo ratings yet