Professional Documents

Culture Documents

19-Exploratory Evidence On The Behavior of Quality Cost

Uploaded by

IslamSharafOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

19-Exploratory Evidence On The Behavior of Quality Cost

Uploaded by

IslamSharafCopyright:

Available Formats

Exploratory Evidence on the Behavior of Quality Costs

Author(s): Christopher D. Ittner

Source: Operations Research, Vol. 44, No. 1, Special Issue on New Directions in Operations

Management (Jan. - Feb., 1996), pp. 114-130

Published by: INFORMS

Stable URL: http://www.jstor.org/stable/171909 .

Accessed: 08/05/2014 19:07

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at .

http://www.jstor.org/page/info/about/policies/terms.jsp

.

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of

content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms

of scholarship. For more information about JSTOR, please contact support@jstor.org.

INFORMS is collaborating with JSTOR to digitize, preserve and extend access to Operations Research.

http://www.jstor.org

This content downloaded from 169.229.32.137 on Thu, 8 May 2014 19:07:55 PM

All use subject to JSTOR Terms and Conditions

EXPLORATORYEVIDENCEON THE BEHAVIOROF QUALITYCOSTS

CHRISTOPHERD. ITTNER

University of Pennsylvania, Philadelphia, Pennsylvania

(Received October 1992; revisions received July 1993, July 1994; accepted September 1994)

This study examines the time series behavior of quality costs reported by 49 manufacturing units of 21 companies. Analyses using

both pooled annual data and plant-specific quarterly data indicate that the majority of units in the sample achieved ongoing

reductions in nonconformance costs while maintaining or reducing reported prevention and appraisal costs. These findings are

consistent with recent quality-based learning and continuous improvement models which suggest that, once an effective quality

program is established, companies can reduce nonconformance costs over time with little or no subsequent increase in conform-

ance expenditures.

Since the introduction of the traditional quality cost annual quality cost data from 49 manufacturingunits of

model in the 1950s (Juran 1951, Feigenbaum 1957, 21 companies indicate that increases in conformance ex-

Masser 1957), managers have been urged to base quality- penditures generally led to failure cost reductions in the

related decisions on the hypothesized tradeoff between current or following year. However, in the years follow-

the costs of prevention and appraisal (or conformance ing the start of the quality program, many plants contin-

costs) and the costs of internal and external failure (or ued reducing nonconformance costs while maintainingor

nonconformance costs). According to the traditional even reducing existing expenditures on conformance ac-

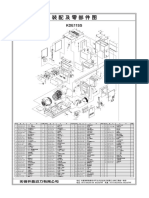

model shown in Figure 1, a company producing subopti- tivities, supporting claims that prevention and appraisal

mally poor quality (i.e., defective) products can greatly expenditures can be cut back as the quality program

reduce nonconformance costs by adding relatively inex- progresses (Fine 1986, Harrington1987). Over the life of

pensive prevention and appraisal measures. As preven- the quality program, 29 of the 39 plants that reduced

tion and appraisalexpenditurescontinue to rise, the rate of reported nonconformance costs also reduced expendi-

improvementis assumed to diminish until additionalcon- tures on conformance activities. These findings are rein-

formance expenditures produce little decrease in non- forced by time series analyses of quarterly quality cost

conformance costs. The model resolves the hypothesized data reportedby 24 manufacturingunits belongingto seven

tradeoff by specifying a nonzero optimal level of defects of the participatingcompanies, which indicate that reduc-

at the point where the marginalcost of increased preven- tions in nonconformanceexpenditureswere, on average,

tion and appraisal activities equals the marginal benefit associated with simultaneous reductions in conformance

from nonconformance cost reductions. costs. Overall, the empirical evidence is consistent with

Many proponents of traditional quality cost theory continuous improvementand quality-basedlearningmod-

have interpreted the tradeoffs portrayed in this model to els which indicatethat, once an effective qualityprogramis

mean that nonconformance costs can only be reduced by established, ongoing nonconformance cost reductions

increasing expenditures on conformance activities. Con- can be achieved with little or no subsequent increase in

tinuous improvement advocates, however, have criti- conformance expenditures.

cized this interpretation, claiming that ongoing quality The remainder of the paper is organized as follows.

improvements can be achieved with little or no incre- Section 1 provides an overview of the quality cost con-

mental investment (e.g., Schneidermann 1986, 1988, cept and reviews the various models of quality cost be-

Harrington 1987, Cole 1992). These claims have been havior. Section 2 discusses the sample, followed by

supported by recent theoretical work on quality-based descriptive statistics in Section 3. Empirical results are

learning(Fine 1986, Marcellus and Dada 1991)which sug- presented in Section 4. A summary and implications for

gests that the traditionaltradeoffmodel may be an accurate future research conclude the paper.

static representationof quality cost economics, but that in

dynamic, multiperiodsettings, nonconformancecosts can 1. MODELS OF QUALITY COST BEHAVIOR

continue to decline over time with no corresponding in-

crease in conformancecosts. 1.1. Defining Quality Costs

This paper examines the hypothesis that conformance Quality costs have traditionally been defined as all ex-

expenditures must continue to be increased to achieve penditures associated with ensuring that products con-

ongoing reductions in nonconformance costs. Reported form to specifications or with producing products that do

Subject classifications: Cost analysis: quality-cost tradeoffs. Reliability, quality control: quality control economics.

Area of review: MANUFACTURING, OPERATIONS AND SCHEDULING (SPECIAL ISSUE ON NEW DIRECTIONS IN OPERATIONS MANAGEMENT).

Operations Research 0030-364X/96/4401-0114 $01.25

Vol. 44, No. 1, January-February 1996 114 ? 1996 INFORMS

This content downloaded from 169.229.32.137 on Thu, 8 May 2014 19:07:55 PM

All use subject to JSTOR Terms and Conditions

IVITNER / 115

qualitycost model

(a) Thetraditional Intemal Failure: The costs incurred when products

which fail to meet quality specifications are identified

before reaching the customer, including the costs of

scrap, rework, spoilage, rescheduling, expediting, and

downtime.

External Failure: The costs incurred when non-

TOTAL COSTS

QUALITY conforming products reach the customer, including

0

warranty charges, liability claims, penalties, error in-

vestigation charges, and the opportunity costs of lost

customer goodwill.

CONFORMANCE

Recent views on quality cost measurement suggest

that this "conformance to specifications" definition of

NON-CONFORMANCE quality costs underestimates failure costs. The conven-

tional conformance to specifications definition assumes

101% 100%

DEFECTIVE GOOD that no loss occurs as long as output lies within upper

and lower specification limits. Taguchi, however, argues

that "losses to society" occur whenever output deviates

(b) The continuous improvement model

from its target value (Taguchi, Elsayed and Hsiang 1989,

Taguchi and Clausing 1990). Taguchi offers a quadratic

"quality loss function" to estimate these costs. The qual-

ity loss function is defined as:

L(y) = k(y - T)2, (1)

o TOTAL

QUALITY

COSTS where y is the actual value for a product characteristic, T

is the target value for the characteristic, and k is a con-

stant representing the cost of the countermeasure (i.e.,

nonconformance cost) that must be employed by the

PREVENTION

company. Although the specific functional form of

APPRAISAL the quality loss function has not been validated empiri-

NON-CONFORMANCE cally (Taguchi and Clausing),2 the view that any devia-

tion from target results in losses suggests that the

100% 100%

DEFECTIVE GOOD conventional definition of failures in terms of nonconfor-

mance to specifications understates the costs of poor

Figure 1. The competing models of quality cost quality, leading to suboptimal quality improvement de-

behavior. cisions (Taguchi and Clausing 1990, DeVor, Chang and

Sutherland 1992).

It is important to note, however, that the Taguchi loss

function is not necessarily inconsistent with the four tra-

not conform.1 These cost can be classified into the fol- ditionalqualitycost categories or the notion of quality-cost

lowing categories: tradeoffs. Taguchi, for example, argues that management

Conformance Costs: The costs of achieving conform- must choose the precision level that minimizes total cost,

ance to specifications. Conformance costs are comprised not just quality loss (Taguchiand Clausing).This implies a

of two elements: tradeoffbetween investments in improving,checking, and

adjustingprocesses, i.e., prevention and appraisalcosts,

Prevention: The costs incurred to keep nonconforming and the resulting reduction in quality losses, i.e., failure

products from being produced. Examples include the costs (Taguchi and Clausing, 1990, DeVor, Chang, and

costs associated with implementing and maintaining a Sutherland,1992). See Albrightand Roth (1992)and Wong

quality system, quality-related training, new product (1992) for frameworkslinkingthe Taguchi loss function to

reviews, quality planning, and the development of pro- the four traditionalquality cost categories.

cess controls.

Appraisal: The costs incurred to ensure that materials 1.2. Competing Models of Quality Cost Behavior

and products meet conformance standards, including

The two competing models of quality cost behavior are

the costs of receiving, in-process, and final inspection,

illustrated in Figure 1.3 As noted earlier, the traditional

lab tests, quality audits, and field tests.

quality cost model specifies a nonzero optimal defect

Nonconformance Costs: The costs of failure to con- level at the point where the marginal cost of prevention

form to specifications. These include: and appraisal expenditures equals the marginalreduction

This content downloaded from 169.229.32.137 on Thu, 8 May 2014 19:07:55 PM

All use subject to JSTOR Terms and Conditions

116 / ITTNER

in internal and external failure costs. The continuous im- Interestingly,this result runs counterto the beliefs of some

provement model, in turn, suggests that nonconformance continuous improvement advocates who maintain that

costs can be reduced with little or no incremental invest- companies that reduce preventionexpenditureswill be un-

ment in prevention and appraisal. Although illustrations able to hold theirprevious gains (e.g., Schneiderman1988).

of these models typically plot quality costs against qual- In Marcellus and Dada's model, each investment in

ity or defect levels, Bowbrick (1992) notes that most of prevention provides a learning opportunity that de-

the quality literature either implicitly or explicitly as- creases the future costs of defectives.6 Consequently, at

sumes that the models reflect the optimal movement of least part of the investment in prevention is analogous to

costs over time. a capital investment that provides benefits over multiple

Many proponents of traditionalquality cost theory, for periods. Given the capital investment-like nature of qual-

example, have interpreted the tradeoffs portrayed in the ity improvement activities, the cost of prevention be-

traditionalmodel to mean that nonconformance costs can comes concave over time as opposed to strictly convex

only be reduced by increasing expenditures on conform- in the traditionalquality cost model. Unlike the simulta-

ance activities. Lockyer (1983), Noz, Redding and Ware neous conformance and nonconformance cost reductions

(1989), and others have extended this logic to develop

found in Fine's model, however, the resulting dynamic

multiperiod theories of quality cost behavior that are

model of quality cost behavior implies that a relatively

based on an organization's stage in the quality improve-

fixed level of prevention expenditures can produce de-

ment process. These frameworks indicate that managers

must continue to increase conformance expenditures creasing marginal reductions in failure costs over

over time to achieve continuous quality improvements multiple periods, a result similar in spirit to the continu-

and move to higher stages of the quality process. When ous improvement model shown in Figure 1 (Marcellus

these increases stop, quality improvement ceases. This and Dada, p. 1371).

interpretation of the traditional tradeoff model suggests In summary, the continuous improvement and quality-

the following hypothesis. based learning models suggest the following null hypoth-

esis regardingquality cost behavior.

Hi. Conformance expenditures must be increasing over

time to achieve ongoing reductions in nonconformance H1lnul.Ongoing reductions in nonconformance costs can

costs. be achieved over time while maintaining(e.g., Marcellus

and Dada) or even reducing (e.g., Fine) existing con-

Continuous improvement advocates, on the other formance expenditures.

hand, question the claim that managers must continue to

increase conformance costs to achieve ongoing quality

improvements. Quality experts such as Deming (1982),

Schneiderman (1986, 1988), and Harrington (1987), for

TOTAL

QUALITY

COSTSt+z

example, argue that in firms committed to continuous

incremental improvement, a relatively fixed level of TOTAL

QUALITY

COSTSt

conformance expenditures can lead to reductions in

nonconformance costs over time as quality improve-

ment teams continuously identify and eliminate quality

problems.4

The continuous improvement philosophy of quality

cost behavior has received theoretical support from work

on quality-based learning. These models suggest that the NON-CONFORMANCE

traditional tradeoff model may be an accurate static rep-

resentation of quality cost economics, but that in dy-

namic learning environments, conformance expenditures / X ,' ~~~CONFORMANCE

t+z

need not be increased to achieve ongoing reductions in

failure costs. Fine (1986), for example, develops a dy-

namic model in which the identification and correction of

quality problems allow a manufacturer to increase its

100% 100%

rate of learning and thereby lower its quality assurance DEFECTIVE qt q t+z GOOD

costs below their previous level. As the efficiency and

effectiveness of quality control activities increase due to Figure 2. Fine's (1986) model of quality-based learning.

organizational learning, the conformance cost curve The subscript t indicates the quality cost

shifts down and to the right, thereby allowing reductions tradeoffs in period t. The subscript t + z indi-

in nonconformancecosts over time to be accompaniedby cates the quality cost tradeoffs after z periods

reductionsin conformance expenditures (see Figure 2).5 of quality-based learning.

This content downloaded from 169.229.32.137 on Thu, 8 May 2014 19:07:55 PM

All use subject to JSTOR Terms and Conditions

ITTNER / 117

Although the traditional and continuous improvement nonconformance costs while maintainingor even reduc-

models of quality cost behavior provide conflicting impli- ing existing conformance expenditures. In line with re-

cations for the allocation of resources to quality improve- cent dynamic models on the subject, the study focuses

ment activities, only limited empirical evidence on the on changes in quality cost expenditures over time. This

behavior of quality costs exists. Cross-sectional studies specification offers two advantages over the earlier cross-

by Chauvel and Andre (1985) and Krishnamoorthi(1989) sectional studies by Chauvel and Andre, and Krishna-

generally support the traditional tradeoff model, find- moorthi. First, it allows an examination of the potential

ing inverse relationships between conformance and lag between increased conformance expenditures and re-

nonconformance costs. However, the nature of their duced failure costs, an issue that has not been addressed

tests (cross-sectional in levels) makes it impossible to in previous studies. More importantly, it provides pre-

conclude that managers must continue increasing liminary evidence on the hypothesis that conformance

conformance expenditures to achieve ongoing quality costs must continue to be increased over time to achieve

improvements. Plunkett and Dale's (1988) examination ongoing failure cost reductions, the principal debate be-

of time series quality cost trends from five companies, tween proponents of the traditional tradeoff model and

in contrast, suggests that lower failure costs were advocates of continuous improvement.

achieved over time with little change in conformance

costs, though the authors provide no statistical tests to

support their conclusions. 2. SAMPLE

The conflicting results from these studies leave the ap- To examine the behavior of quality costs, a search of

propriate quality cost model an open empirical question. accounting and quality publications was made to identify

But empirical tests of the competing models face a num- companies that measure quality costs on an ongoing

ber of hurdles. Using historicaldata, a researchercan only

basis. The corporate quality director or controller at each

observe expost the choices made by a firm. These choices

of the 50 firms identified in the search was then contacted

reflect management'sperceptionof the appropriatequality

to discuss the company's possible participation in the

cost model as well as the company's own efforts to assess

study. Of the initial 50 firms, 10 were eliminated because

the quality-cost tradeoffs it faces. Since few, if any, firms

quality costs were not tracked on a regular basis and

use experimentationto identify the shapes of their quality

three were eliminated because the systems were too new

cost curves, historical data may not reveal the true eco-

to provide useful data. Twenty-one of the remaining 37

nomics underlying the operation's quality initiatives.

companies (58.6%) agreed to participate in the study.7

Moreover, since the traditionalmodel represents the hy-

The 21 participatingcompanies provided annual qual-

pothesized shape of a production frontier, it can only be

ity cost data for 49 manufacturingunits in five two-digit

tested if firms are using their quality-relatedresources effi-

SIC codes:

ciently (i.e., are operatingon the frontier).

Even when the choices made by a firm are optimal for SIC Code and Industry Description Participant

a given period, subsequent organizational and environ- 28 Chemicalsand Allied Products 7

mental changes (other than quality-based learning) may 35 IndustrialEquipmentand Computers 12

cause the cost curves, and therefore the equilibrium 36 ElectronicEquipmentexcept Computers 16

point, to shift over time. For example, falling factor 37 TransportationEquipment 6

prices for conformance inputs may shift the conformance 38 Measurementand PhotographicEquipment 8

curve down, allowing increased conformance activities Each of the 49 manufacturingplants reports conformance

with no increase in cost. Time series data would show and nonconformance costs on a regularbasis; in 33 of the

reductions in nonconformance costs with no correspond- facilities, reported quality costs are furtherbroken down

ing increase in conformance expenditures, even though into prevention, appraisal, internal failure, and external

the traditional model may accurately portray the trade- failure subcategories.

offs confronting the organization in a given period. If Table I summarizes the quality cost elements tracked

quality cost curves are shifting from period to period due by the 49 plants. Consistent with survey results in

to factors other than quality-based learning, a time series Sullivan and Owens (1983), the table indicates that

regression of nonconformance costs on conformance ex- reported quality costs are generally limited to

penditures suffers from the classic econometric problem manufacturing-related expenditures for quality plan-

of underspecification. As a result, the correlation be- ning and administration, training, inspection and test,

tween conformance and nonconformance costs may be scrap, rework, and warranty expenditures.8 These cat-

any sign depending upon how the omitted variables egories are not only the most frequently measured

cause the two cost curves to shift. quality cost elements, but also the largest proportion

Given the difficulties in empirically distinguishing be- of reported quality costs in most systems. In the 31

tween the competing quality cost models, this paper ex- manufacturing units that provided detailed information

amines the less restrictive proposition that companies, on the components of reported quality costs, the costs

for whatever reason, have been able to reduce of quality planning and administration, training, and

This content downloaded from 169.229.32.137 on Thu, 8 May 2014 19:07:55 PM

All use subject to JSTOR Terms and Conditions

118 / ITTNER

Table I conformance expenditure patterns of the participating

Elements Included in Reported Quality Costs; 49 companies.

Manufacturing Units From 21 Companies The 49 manufacturingunits in the sample provided 2 to

13 annual observations each (median = 5), with the data

Percentageof ManufacturingUnits

TrackingEach Category % extending through 1989 or 1990. The total sample con-

tains 250 plant-years of data for the conformance and

Qualityplanningand analysisa 100

Inspection and testb 100 nonconformance categories and 206 for the prevention,

Scrap 100 appraisal, internal failure, and external failure subcatego-

Rework and repair 100 ries. To control for variations in quality cost levels that

Warrantiesand returns 100 were due solely to volume differences, observations are

Quality-relatedtraining 94 standardized by dividing each quality cost category by

Preventivemaintenance 55

Quality-relatedwait/downtime 33 sales during the period.10Annual percentage changes for

Liabilityclaims/insurance 33 each quality cost category are then calculated using the

Excess/obsolete inventory 20 general formula:

Quality-relatedovertime 12

%A Quality Costsi,t

aIncludes quality and engineeringdepartmentcosts for imple-

mentingand maintainingthe qualitysystem, quality-relateddesign (Quality Costs/Sales)j,, - (Quality CostslSales)j,-1

reviews, qualityplanning,etc. (Quality CostslSales)j, 1

bIncludes inspectionby productionworkers.

(2)

The resultingvariables are defined as follows: %APREV=

inspection accounted for over 92% of conformance expen- the percentagechange in preventioncosts, %AAPPR= the

ditures on average, with scrap, rework, and warranty percentagechange in appraisalcosts, %ACONF= the per-

claims representing 87% of reported nonconformance centage change in total conformancecosts, %AINT= the

costs.9 percentage change in internal failure costs, %AEXT =

The figures in Table I point out several limitations in the percentage change in external failure costs, and

reported quality costs. The most notable is the omission %ANCONF = the percentage change in total noncon-

of the opportunity costs of lost sales due to poor quality. formance costs.1" Differencing eliminates one observa-

Although the quality cost literature lists "lost customer tion per unit, yielding 201 usable plant-yearsof data for the

goodwill" as a major source of nonconformance costs, conformance and nonconformancecategories and 157 for

none of the firms in the sample attempts to estimate the the prevention, appraisal, internal failure, and external

impact of defective products on sales. The quality costs failure subcategories.

reported by the participating firms also omit the addi-

tional costs incurred when higher quality inputs are sub- 3. DESCRIPTIVESTATISTICS

stituted for lower quality materials, components, and

production equipment. Consequently, if input costs were 3.1. Reported Quality Cost Levels

increased to achieve higher quality, the increase would Summary data on reported quality cost levels during the

not be reflected in reported conformance costs. Finally, a first and most current years of the participatingplants'

number of observers have asserted that reported quality quality programs are provided in Table II. Between these

costs significantly underestimate the indirect losses from periods, the units reduced mean (median) quality costs

defective products (e.g., Deming 1982, Mefford 1989, from 11.2% (10.4%) of sales to 8.9% (8.6%). These re-

Taguchi and Clausing 1990, Ittner 1994). Deming, for ex- ductions were primarilyin nonconformance costs, which

ample, argues that quality cost systems typically focus fell from 6.4% (5.4%) of sales to 4.7% (4.1%). Preven-

on the direct effects of poor quality such as scrap, re- tion, appraisal, and total conformance expenditures as a

work, and warranty claims and ignore significant indirect percent of sales were not significantlydifferentduringthe

effects, such as disruptions in operations due to out-of- two periods.

conformance purchases and products, excessive inven- Figures on the distributionof quality cost expenditures

tory levels held to accommodate poor quality, and among the various categories show that internal failure

quality-related schedule changes and downtime. While costs comprised the largest component of reported qual-

these limitations are potentially troublesome, studies by ity costs during each period, followed by appraisal and

the consulting firm KPMG Peat Marwick indicate that prevention costs. Reported external failure costs repre-

substantially all of the unreported quality costs in prac- sented the smallest category, reflecting the difficulty in

tice are related to the internal and external failure cost measuring these costs. Mean (median) nonconformance

categories (Atldnson et al. 1991, p. 66). These findings expenditures declined from 56.7% (58.7%) of quality

suggest that the reported gains from quality improvement costs during the first year of the quality program to

will be biased downward. Reported prevention and ap- 51.5% (53.1%) in the latest year. While the ratio of ap-

praisal costs, however, should closely reflect the actual praisal to total quality costs did not change significantly,

This content downloaded from 169.229.32.137 on Thu, 8 May 2014 19:07:55 PM

All use subject to JSTOR Terms and Conditions

ITTNER / 119

Table II

Reported Quality Costs for 49 Manufacturing Units Belonging to 21 Companies; n = 49 for Conformance and

Nonconformance and 33 for Prevention, Appraisal, Internal Failure, and External Failure.

First Year of QualityProgram Latest Year of QualityProgram

Mean Median Standard Mean Median Standard

n (%) (%) Deviation (%) (%) Deviation

PanelA: Reportedqualitycosts as a percentof sales

Prevention 33 2.1 1.8 1.5 2.0 2.3 1.1

Appraisal 33 3.1 2.4 2.5 2.5 1.8 2.3

Internalfailure 33 4.6 3.6 3.9 3.4 2.5a 3.1

Externalfailure 33 1.5 1.4 1.1 1.0 0.7a 1.1

Total conformance 49 4.8 4.4 3.0 4.2 3.8 2.6

Total nonconformance 49 6.4 5.4 4.0 4.7b 4.1c 3.2

Total qualitycosts 49 11.2 10.4 5.6 8.9b 8.6" 4.7

PanelB: Percentagedistributionof total reportedqualitycosts amongqualitycost categories

Prevention 33 18.4 17.9 10.6 23.9b 23.8" 10.9

Appraisal 33 27.3 25.1 12.8 28.7 25.9 14.4

Internal failure 33 38.9 38.0 14.6 34.8 33.1 14.5

External failure 33 16.2 9.7 14.3 13.3 8.0 13.2

Total conformance 49 43.3 41.3 15.4 48.4C 46.9a 15.9

Total nonconformance 49 56.7 58.7 15.4 51.6c 53.la 15.9

aSignificantlydifferentthan the correspondingfigurefor the firstyear of the qualityprogramat the 10%level, two-tailedt-test (means)or

Mann-Whitneytest (medians).

bSignificantlydifferentthan the correspondingfigurefor the firstyear of the qualityprogramat the 5% level, two-tailedt-test (means)or

Mann-Whitneytest (medians).

cSignificantlydifferentthan the correspondingfigurefor the firstyear of the qualityprogramat the 1%level, two-tailedt-test (means)or

Mann-Whitneytest (medians).

Table III

Summary Statistics on Annual Changes in Reported Quality Costs as a Percent

of Sales,a Pooled Observations From 49 Manufacturing

Units Belonging to 21 Companies

Standard

n Mean Median Deviation

PanelA: Changesin reportedqualitycosts/sales

APREV 157 -0.00 0.02 0.41

AAPPR 157 -0.06c -0.05d 0.36

AINT 157 -0.20d _0 11d 0.90

AEXT 157 -0.10 -0.04 1.23

ACONF 201 -0.08 -0.06b 0.37

ANCONF 201 0.33 0.26 1.54

PanelB: Percentagechangesin reportedqualitycosts/sales

%APREV 157 4.2%c 1.9% 25.8

%AAPPR 157 3.4% -5.0%c 66.8

%AINT 157 0.4% -6.3%d 86.0

%AEXT 157 11% -11.1%C 53.6

%ACONF 201 -1.4% -2.2%c 16.6

%ANCONF 201 -4.5%c -7.9%d 31.2

aAnnualchangesin qualitycost categoriesare calculatedusing the generalformulas:

AQualityCosti,t =(Quality Costs/Sales)i,t - (Quality Costs/Sales)i,tl

%AQuality (Quality Costs/Sales)i,t - (Quality Costs/Sales)i,t1

%AQuality CoStSi-=

Costsi,t

(Quality Costs)i,t-1

with PREV = preventioncosts, APPR = appraisalcosts, INT = internalfailurecosts, EXT =

externalfailurecosts, CONF = total conformancecosts, andNCONF = total nonconformancecosts.

bSignificantat the 10%level, two-tailedt-test (means)or Wilcoxonsigned ranktest (medians).

cSignificantat the 5%level, two-tailedt-test (means)or Wilcoxonsigned ranktest (medians).

dsignificantat the 1%level, two-tailedt-test (means)or Wilcoxonsignedranktest (medians).

This content downloaded from 169.229.32.137 on Thu, 8 May 2014 19:07:55 PM

All use subject to JSTOR Terms and Conditions

120 / IT-rNER

the mean (median) proportion of expenditures on preven- overall conformance expenditures. This finding is incon-

tion rose from 18.4% (17.9%) to 23.9% (23.8%), leading sistent with traditionalquality cost model, which implies

to an overall increase in the percentage of reported qual- that lower nonconformance costs can only be achieved

ity costs dedicated to conformance activities. through increased conformance expenditures.

One possible explanation for the reduction in appraisal

3.2. Annual Changes in Quality Costs costs is that companies pushed inspection responsibilities

Table III presents data on standardized annual changes onto their suppliers during the period under study. Data

in conformance and nonconformance costs for the entire on receiving inspection costs in 19 of the 49 plants are

sample, as well as changes in the prevention, appraisal, available to examine this hypothesis. Over the years cov-

internal failure, and external failure categories for the ered by the study, the 19 units achieved mean (median)

subsample of manufacturing plants that utilize these annual percentage reductions in the ratio of total ap-

breakdowns. As shown in the table, both mean (-0.33) praisal costs to sales of 3.2% (4.2%), significant at the

and median (-0.26) annual changes in nonconformance 10% level. Of these improvements, reductions in receiv-

costs are negative and significant at the 1% level. In per- ing inspection costs accounted for only 7.9% on average

centage terms, these reductions represent 4.5% and 7.9% (median = 13.0%). Mean and median annual percentage

of reported quality costs, respectively, both of which are reductions in the ratio of receiving inspection costs to

statistically significant at the 5% level or better. Mean sales were 2.5% and 4.4%, respectively, neither of which

(-0.20) and median (-0.11) changes in internal failure is statistically significant at conventional levels. In con-

and median (-0.04) changes in external failure costs are trast, the mean (median) percentage change in appraisal

also significant, as are median percentage changes in costs other than receiving inspection is a statistically sig-

both of the failure categories. nificant -3.2% (-5.6%). This evidence indicates that in

The summary data in Table III indicate that the reduc- the 19 plants for which data are available, reductions

tions in nonconformance costs were not accompanied by in receiving inspection costs explain only a small fraction

significant increases in prevention and appraisal activi- of the observed decrease in appraisal expenditures.

ties. In fact, median changes in appraisal and total con- To investigate whether the results in Table III are sen-

formance costs as a percent of sales are negative and sitive to the maturity of the quality improvement pro-

statistically significant. Although the mean percentage cess, the sample is partitioned by the number of years

change in prevention expenditures is positive, mean and since the start of the quality program, with the first year

median changes in prevention levels and median percent- of the programdefined as year k. 12 Table IV summarizes

age changes in prevention are not significantly different the results from this partition for the six subsequent

from zero at conventional levels. Thus, for the sample as years with fifteen or more observations. Over these peri-

a whole, the evidence suggests that the plants achieved ods, nonconformance costs declined significantly in

annual nonconformance cost reductions while maintain- years k + 1 through k + 4, with the improvement be-

ing a relatively fixed level of prevention expenditures. coming progressively smaller each period (median

Moreover, as quality improved, the plants appear to change in reported nonconformance costs from the pre-

have reduced appraisal expenditures, leading to lower vious year = -12.0% in year k + 1, -8.9 % in year k +

Table IV

Median Annual Percentage Changes in Reported Quality Costs/Sales Partitioned

by the Year of the Quality Program;a Pooled Observations From 49

Manufacturing Units Belonging to 21 Companies

Year

k+ 1 k+ 2 k+ 3 k+ 4 k +5 k+ 6

%APREV -5.0%c 0.9% 0.0% 5.9% 5.5% 2.4%

%AAPPR -11.5%c -6.7%c 2.8% 1.9% -1.3% -6.3%

%AINT -15.4%d _14.1%e -4.5% -1.6% -4.7% 0.0%

%AEXT - 15.0%e 0.0% _19.0%d -9.7% 8.4% -22.6%

%ACONF -9.4%e -2.2% -1.0% -1.0% 2.3% -5.0%

%ANCONF -12.0%e _8 9%e _8.7%d _7.0%c -0.4% -1.7%

nb 49 (33) 38 (26) 29 (25) 23 (20) 19 (18) 18 (17)

aTheyear in the tablesrefersto the numberof years since the startof the qualityprogram,with the

firstyear of the programdefinedas Year k.

bThelargersample size relates to the numberof observationsfor total conformanceand noncon-

formancecosts. The samplesize in parenthesesrefersto the numberof observationsfor the preven-

tion, appraisal,internalfailure,and externalfailurecategories.

cSignificantlydifferentfromzero at the 10%level, Wilcoxonsigned ranktest.

dSignificantlydifferentfrom zero at the 5%level, Wilcoxonsigned ranktest.

eSignificantlydifferentfromzero at the 1%level, Wilcoxonsigned ranktest.

This content downloaded from 169.229.32.137 on Thu, 8 May 2014 19:07:55 PM

All use subject to JSTOR Terms and Conditions

I1TNER / 121

2, - 8.7% in year k + 3, and -7.0% in year k + 4). By 4. EMPIRICALRESULTS

year k + 5, the median percentage change in nonconfor- Three sets of empirical tests are used to explore the as-

mance costs, though negative (-0.4%), is not statistically sociation between conformance and nonconformance

significant. The percentage change in nonconformance costs, with the multiple methods providing evidence on

costs remains insignificant in year k + 6. the robustness of the findings to empirical specification.

Although the rate of improvement tends to decline The first set of tests takes a relatively short-term per-

over time, the data do not suggest that the diminish- spective by looking at the relationship between changes

ing improvement rate was due to reductions in conform- in annual conformance expenditures and corresponding

ance expenditures. Over the six periods, total con- changes in nonconformance costs in the current and fol-

formance costs declined significantly in year k + 1, with lowing year. The second set takes a longer view by ex-

reductions in both prevention and appraisal expendi- amining changes in reported quality costs over the lives

tures, but remained relatively stable over the remaining of the 49 plants' quality programs, thereby minimizing

five years. Similar trends are found when prevention ex- the impact of short-run variations in quality costs that

penditures are examined separately. Taken together, the may be due to new product introductions, settlement of

evidence in Table IV is consistent with the null hypoth- liability claims, etc. Finally, the third set estimates sepa-

esis that nonconformance costs can be reduced over rate plant-specific regressions rather than the cross-

time with little or no increase in prevention or total sectional models used in the other tests. The plant-

conformance expenditures. More specifically, the data specific regressions alleviate differences in production

suggest that a relatively fixed or declining level of pre- functions, product attributes, and quality cost systems

vention expenditures can continue to produce signifi- that may impact the associations among the quality cost

cant ongoing reductions in nonconformance costs once categories but are not controlled for in the cross-

an effective quality program is established, but that the sectional tests.

returns to prevention activities diminish as the most

serious quality problems are identified and eliminated. 4.1. The Association Between Annual Changes in

Discussions at the participating companies indicated Conformance and Nonconformance Costs

that the reductions in conformance costs in year k + 1 This section investigates the short-run association be-

were due to a number of factors. Many plants in the tween changes in conformance and nonconformance

sample made substantial investments in the development costs using pooled annual cross-sectional and time series

of quality systems and procedures during the first year of data from the 49 manufacturing units in the sample,

the quality program (year k). Because these investments yielding 201 annual plant-year observations for the con-

did not need to be repeated in following years, preven- formance and nonconformance categories, and 157 ob-

tion expenditures were reduced. Trainingcosts were also servations for the prevention and appraisalsubcategories

frequently cut back in subsequent periods. Companies of conformance costs.

typically focused their initial training efforts on develop- The relationship between changes in conformance and

ing a new quality-oriented "culture" by educating all nonconformance costs is examined by subdividing the

employees in the need for quality improvement and the sample into quintiles formed on the basis of the magni-

basic tools of quality control. Once the initial awareness tude of percentage changes in prevention, appraisal, and

phase was completed, plants often began targeting total conformance costs. This method allows an investi-

smaller numbers of employees for education in more ad- gation of the impact of both the sign and magnitude of

vanced techniques, leading to lower annual training conformance changes on nonconformance costs. Not

expenses. surprisingly, the results in Table V indicate that large

The significant appraisal cost reductions in the two increases in conformance expenditures are associated

years following after the start of the quality program with statistically significant reductions in nonconfor-

were achieved in large part through changes in inspection mance costs. The evidence on more modest increases,

techniques that were undertaken as the plants' level of however, is somewhat mixed. Plants in quintile 2

process knowledge increased. Prior to the introduction increased prevention expenditures by 10.3% but

of the quality program, many companies had relatively experienced no statistically significant decrease in

poor control over their processes and limited knowledge nonconformance costs during the current year. Quin-

of key process parameters. Instead, many units relied on tile 3's smaller 2.4% increase in prevention costs, on

100% inspection to sort good product from bad. As the the other hand, was accompanied by a 9.0% reduction

quality philosophy changed from containment of defects in nonconformance costs, significant at the 1% level.

to prevention, efforts were undertaken to uncover and Similar mixed results emerge for increases in appraisal

eliminate the sources of variation, thereby bringing pro- and total conformance expenditures.

cesses under statistical control and allowing lower cost Contrary to the predictions of the traditional quality

statistical sampling to be employed. cost model, the evidence in Table V indicates that lower

This content downloaded from 169.229.32.137 on Thu, 8 May 2014 19:07:55 PM

All use subject to JSTOR Terms and Conditions

122 / ITTNER

Table V

The Association Between Median Changes in Conformance and Nonconformance Costs; Pooled Annual

Observations From 49 Manufacturing Units Belonging to 21 Companiesa; Percentage Changes in

Nonconformance Costs/Sales Partitioned by the Magnitude of Percentage Changes in

Conformance Costs/Salesb

Sorted on %APREV Sorted on %AAPPR Sorted on %ACONF

Quintile %APREV %ANCONF %AAPPR %ANCONF %ACONF %ANCONF

1 27.5 -6.2c2 19.6 -12.0d2 19.2 -6.5e2

2 10.3 -1.8 3.3 1.1 4.5 -0.8

3 2.4 90 e2 _4.9 _9.od2 -2.2 -8.1d2

4 -6.4 _-11.1e2 -8.9 -9.8e2 -9.2 -10.6e2

5 -19.5 -14 gel,2 -22.9 -11.6e2 -18.6 -12.9e2,3

'N = 201 for %ACONF and 157 for %APREV and %AAPPR.

bThe table reports median percentage changes in nonconformance costs for quintiles formed on the basis of the magnitude of

percentage changes in conformance costs.

c= Significantly different from zero at the 10% level, Wilcoxon signed rank test.

d= Significantly different from zero at the 5% level, Wilcoxon signed rank test.

e= Significantly different from zero at the 1% level, Wilcoxon signed rank test.

1 = Significantly greater reduction than quintile 1 (10% level, Mann-Whitney test); 2 = Significantly greater reduction than quintile 2;

3 = Significantly greater reduction than quintile 3.

nonconformance costs were also associated with reduc- The tests in Table V examined the association be-

tions in conformance expenditures. Quintiles 4 and 5 re- tween contemporaneous changes in conformance and

duced prevention costs by 6.4% and 19.5%, respectively, nonconformance costs. Yet a significant lag may exist

while, at the same time, lowering nonconformance costs between increases in conformance activities and reduc-

by 11.1% and 14.9%. Patterns are similar when changes tions in nonconformance costs. As Morse (1989, p.

in appraisaland total conformance costs are used to form 131) notes, "Effort and accomplishment are probably

the portfolios. The majority of observations in quintiles 4 not matched in a single reporting period. It may take

and 5 represent plants that reduced conformance expen- months, or even years, for investments in prevention

ditures after making large investments in quality training to pay off." To investigate this possibility, Table VI

and systems development during the early years of their presents median annual changes in nonconformance

quality programs, supporting Harrington's claim that costs for quintiles formed on the basis of the magni-

many of the prevention and appraisal costs that are in- tude of percentage changes in conformance costs dur-

curred at the beginning of a q-ualityprogramto systemat- ing the previous year.

ically track down and prevent defects can be cut back as The evidence shows that although plants with the larg-

the improvement process drives the defect rate lower.13 est increases (quintile 1) and decreases (quintiles 4 and 5)

Table VI

The Association Between Median Changes in Conformance Costs and Lagged Median Changes in

Nonconformance Costs; Pooled Annual Observations From 49 Manufacturing Units Belonging to 21

Companiesa; Lagged Percentage Changes in Nonconformance Costs/Sales Partitioned by the

Magnitude of Percentage Changes in Conformance Costs/Salesb

Sorted on %APREVt Sorted on %AAPPRt Sorted on %ACONFt

Quintile %APREVt %ANCONFt+1 %AAPPRt %ANCONFt+1 %ACONFt %ANCONFt+?

1 27.5 -4.0 19.6 -3.9 19.3 -1.7

2 10.3 _10.2C3 5.9 -8.2c3 5.7 -90od1,3

3 3.0 0.0 -4.5 -1.8 -1.9 -5.9

4 -5.3 -12.8el,3 -8.9 -12.81,3 -8.4 -7.fel

5 -18.1 -7.7 -24.7 -8.7 -18.6 _8.7el,3

'N = 152 for %ACONF and 108 for %APREV and %AAPPR.

bTables report median changes in nonconformance costs in year t + 1 for quintiles formed on the basis of the magnitude of percentage

changes in conformance costs in year t.

c= Significantly different from zero at the 10% level, Wilcoxon signed rank test.

d= Significantly different from zero at the 5% level, Wilcoxon signed rank test.

e= Significantly different from zero at the 1% level, Wilcoxon signed rank test.

1 = Significantly greater reduction than quintile 1 (10% level, Mann-Whitney test); 3 = Significantly greater reduction than quintile 3.

This content downloaded from 169.229.32.137 on Thu, 8 May 2014 19:07:55 PM

All use subject to JSTOR Terms and Conditions

ITrNER / 123

in conformance costs both experienced statistically sig- subsample of plants that provided data on prevention and

nificant reductions in nonconformance costs in the year appraisal expenditures, 28 of 33 units (84.8%) achieved

of the change, only the units in quintiles 4 and 5 contin- reductions in nonconformance costs as a percent of

ued to improve the following year. These patterns high- sales. Of these, 15 (53.6%) decreased prevention costs

light two distinct approaches to quality improvement. and 23 (82.1%) decreased appraisalcosts.

Many of the observations in quintile 1 are associated The association between changes in conformance and

with plants that increased conformance expenditures in nonconformance costs over the life of the quality pro-

response to earlier quality problems, a tactic commonly gram is examined by regressing each unit's average an-

referred to as "firefighting.",14 While the additional con- nual change in nonconformance costs to sales on the

formance activities helped to eliminate the sporadic unit's average change in conformance costs to sales, with

problems that appeared in earlier periods, they did little averages used to compensate for differences in the ages

to foster sustained improvement in subsequent years. of the units' quality initiatives.15 Because surveys indi-

Plants with observations in quintiles 4 and 5, in contrast, cate that quality costs can vary substantially among in-

typically made significant upfront investments in quality dustries (Gilmore 1983, Harrington 1987), dummy

programimplementation that supported ongoing noncon- variables are introduced into the regression models to

formance cost reductions in later years. Unlike the "fire- partially control for industry differences. As shown in

fighting" mentality that permeated many of the plants Table VII, the estimated coefficient on the mean percent-

with observations in quintile 1, the emphasis in the ma- age change in conformance is positive and statistically

jority of units in quintiles 4 and 5 was on continuous significant at the 1% level (t = 3.81), a result consistent

improvement and the elimination of chronic problems. with the simultaneous reductions in conformance and

The capital investment-like nature of the initial quality nonconformance costs exhibited by quintiles 4 and 5.16

investments made by many of the units in quintiles 4 and When conformance expenditures are subdivided into pre-

5 is consistent with the theoretical work of Marcellus vention and appraisal components, the coefficients on

and Dada which argues that investments in prevention

can provide benefits over multiple periods.

Finally, the data in Table VI indicate that increases in Table VII

conformance expenditures that did not yield significant Cross-Sectional Regressions of Mean Annual

reductions in nonconformance costs in the year of the Percentage Changes in Nonconformance Costs/Sales

increase often yielded results the following year. Al- on Mean Annual Percentage Changes in

though quintile 2's 10.3% annual increase in prevention Conformance Costs/Sales Over the Life of the

costs produced no significant decrease in nonconfor- Quality Program;' 49 Manufacturing Units From 21

mance costs during the period of the increase, the plants Companies (t-statistics in parentheses)

in the portfolio were able to achieve a statistically signif-

icant reduction of 10.2% in the following year. Similar Mean Mean

%ANCONF %ANCONF

delayed gains are also found when quintile 2 is formed on

the basis of changes in appraisal or total conformance Constant -0.16e 0.17e

costs. (-3.28) (-2.79)

Mean %ACONF 0.93e

Overall, the results in Tables V and VI once again (3.81)

contradict the hypothesis that conformance expenditures Mean %APREV 0.09

must be increasing over time to achieve ongoing reduc- (1.06)

tions in nonconformance costs. Reductions in both pre- Mean %AAPPR 0.79d

vention and appraisal costs are associated with (2.09)

SIC 28 0.14c __b

significant reductions in nonconformance costs during (1.89)

the same year. Moreover, there is no evidence that the SIC 35 0.16d 0.16c

reductions in conformance expenditures led to higher (2.41) (2.02)

nonconformance costs in the following period. SIC 36 0.13d 0.15d

(2.15) (2.17)

4.2. Changes Over the Life of the Quality Program SIC 37 0.07 0.11

(0.97) (1.16)

This section takes a longer-term look at the association Adj. R2 0.26 0.17

between conformance and nonconformance costs by ex- n .49 .33

amining changes in quality costs from the beginning of aSIC 38 (Measurement and Photographic Equipment) serves as

the quality program to the most recent period with avail- the base case in the regressions.

able data. Of the 49 plants in the sample, 39 (79.6%) bManufacturing units in SIC 28 (Chemicals and Allied Products)

reduced nonconformance costs as a percent of sales from did not provide separate breakdowns of prevention and appraisal

costs.

the beginning of the quality initiative to the most recent cSignificant at the 10% level, two-tailed test.

year. Of the 39 units, 29 (74.4%) did so while also reduc- dSignificant at the 5% level, two-tailed test.

ing the ratio of conformance costs to sales. In the esignificant at the 1%olevel, two-tailed test.

This content downloaded from 169.229.32.137 on Thu, 8 May 2014 19:07:55 PM

All use subject to JSTOR Terms and Conditions

124 / ITrNER

mean annual percentage changes in prevention and ap- these periods, the units reduced nonconformance costs

praisal are both positive, though the change in preven- as a percent of sales by 17.8%on average, with a median

tion is not statistically different from zero. In conjunction reduction of 27.8%. Plant-specific regressions are

with the lower nonconformance costs observed in nearly estimated to examine the association between these im-

80% of the plants in the sample, the significant positive provements and changes in conformance expenditures.

coefficient on appraisaland statisticallyinsignificantcoeffi- To control for volume fluctuations, each category of

cient on prevention suggest that, on average, the plants' quality costs is first regressed on sales to estimate the

reductions in nonconformancecosts since the start of the category's fixed and variable components. The residuals

quality program were accompanied by reductions in ap- from this regression (denoted PREV.R, CONF.R, and

praisal costs and a relatively fixed level of prevention ex- NCONF.R) represent the difference between actual costs

penditures, not the increasing conformance expenditures during the period and expected costs given the period's

predicted by the traditionalquality cost model. sales, thereby providing a measure of the variation in

quality-relatedexpenditures that is not predictable based

5.3. Plant-Specific Time Series Analysis on knowledge of the variation in sales volumes.17

Subject to the econometric and data limitations noted Table VIII presents summary statistics from the 24

earlier, the preceding analyses support the quality-based individual plant-level regressions. A test of the null hy-

learning models' implication that nonconformance costs pothesis that the average coefficient from the individual

can be reduced over time without increasing conform- regressions is equal to zero can be constructed as follows

ance costs. But the pooling of observations from manu- (Anderson 1971):

facturing units with different production functions, Z = =1NE tJ

t /1/ (+lr (3)

product attributes, and quality cost systems may obscure

wNji kj /(kj -2)

the underlying relationships among quality cost catego-

ries. This section controls for these differences by exam- where

ining the time series behavior of reported quality costs tj = the t-statistic for plant j;

from 24 manufacturing units belonging to seven of the kj = the degrees of freedom in the regression for plant

participatingcompanies.

The 24 plants provided quality cost data for periods r = the mean correlation between plant's t-statistics;

ranging from 14 to 28 quarters each (median = 19). Over and

Table VIII

Summary Statistics From Plant-Specific Regressions Examining the Longitudinal Relationship Between

Conformance and Nonconformance Costsa, 24 Manufacturing Units From 7 Companiesb

(t-statistics in parentheses)

PanelA: Total ConformanceCosts

NCONF.Rt= a + I1 CONF.Rt+ 02 CONF.Rt1 + I0 CONF.Rt2 + 4 CONF.Rt-3+ I0 CONF.Rt4 + e

Ad'.

CONF.Rt CONF R 1 CONF.Rt2 CONFRt3 CONF R R

R

Mean 0.78 -0.45 -0.02 0.12 0.02 0.34

(1.57) (-0.46) (-0. 10) (0.09) (0.07)

Median 0.40 -0.09 -0.07 -0.00 0.03 0.26

(1.99) (-0.37) (-0.26) (-0.04) (0.15)

Z-statisticc 6.87e 2.08 -0.45 0.42 0.29

PanelB: PreventionCosts

NPREV.Rt = a + y1 PREV.Rt + -y PREV.Rt1 + 03 PREV.Rt2 + -y PREV.Rt3 + -y PREV.Rt4 + e

Ad'.

PREV.Rt PREV.Rt1 PREV.Rt2 PREV.Rt3 PREV.Rt4 R

Mean 0.71 -1.21 0.04 -0.25 -0.17 0.38

(1.30) (-0.74) (0.02) (-0.33) (-0.10)

Median 0.72 -0.46 -0.22 -0.03 -0.05 0.28

(1.46) (-0.88) (-0.33) (-0.10) (-0.12)

Z-statisticc 5.56e _3.23e 0.04 -0.41 -0.46

aVariablesrepresentthe residualsfromthe regressionof qualitycost expendituresin each categoryon sales duringthe period.Regressions

reportedin the table are run in generalizeddifferencesusing the Cochrane-Orcutt

procedureto correctfor serialcorrelation.

b14 to 28 quarterlyobservationsper plant.

cThe reportedZ-statisticsare calculatedunderthe assumptionthat the individualt-statisticsbeing aggregatedare independent.

d= Significantat the 5% level, two-tailedtest.

e= Significantat the 1%level, two-tailedtest.

This content downloaded from 169.229.32.137 on Thu, 8 May 2014 19:07:55 PM

All use subject to JSTOR Terms and Conditions

I1FNER / 125

N = the number of plants in the sample. Table IX

The Z-statistics reported in the paper are computed un- Summary Statistics From Plant-Specific Regressions

der the assumption of independence (i.e., r = 0). The Examining the Longitudinal Relationship Between

validity of this assumption can be assessed by examining the Direction of Conformance Cost Changes

the cross-sectional dependence among the regression re- and Changes in Nonconformance Costs'

siduals from the plant-specific regressions. The pairwise (t-statistics in parentheses)

correlations between the residuals from the plant-specific Panel A: Total Conformance Costs

regressions range from 0.04 to 0.15 (mean = 0.08), sug- NCONF.Rt = a + .1 (POS*CONF.R)t +

gesting that cross-sectional dependence is not a serious 02 (NEG*CONF.R)t + e

problem in the data. 16, 32

Panel A of Table VIII examines the association be- Mean 0.78 0.81

tween conformance and nonconformance costs by re- (1.00) (1.45)

gressing NCONF.R on sales-adjusted conformance Median 0.53 0.58

expenditures in the current and four preceding quar- (0.82) (1.04)

Z-statistic 4.42c 6.47c

ters.18 During the current quarter, the mean and median

coefficients on conformance are positive and highly sig- Panel B: Prevention Costs

nificant (Z = 6.87, p < 0.01), a finding consistent with the NCONF.Rt = a + y (POS*PREV.R)t +

y2 (NEG*PREV.R)t + e

regression results using pooled annual data (see Note

13). The coefficient on CONF.R in the previous period, Yi Y2

in contrast, is negative (Z = -2.08, p = 0.05), indicat- Mean 0.52 1.27

ing that increased investments in conformance activities (0.75) (1.35)

Median 0.20 1.02

began to pay off roughly one quarter following their im-

(0.27) (1.13)

plementation. The relationships between nonconfor- Z-statistic 3.35C 6.02c

mance costs and lagged conformance expenditures in

aVariablesrepresentthe residualsfrom the regressionof quality

quarters t - 2 through t - 4 are not statistically differ- cost expendituresin each category on sales during the period.

ent from zero.19 POS = 1 if the independentvariableis positive duringthe quarter

Since investments in prevention may have a greater and zero otherwise;NEG = 1 if the independentvariableis nega-

influence on quality improvement than other conform- tive duringthe quarterandzero otherwise.14 to 28 quarterlyobser-

ance expenditures, Panel B of Table VIII investigates the vations per plant.

bRegressionsreportedin the table are run in generalizeddiffer-

relationship between prevention and nonconformance ences using the Cochrane-Orcuttprocedureto correct for serial

costs. The results are similar to those using total con- correlation.The reportedZ-statisticsare calculatedunder the as-

formance costs. As before, the coefficient on PREV.Rt is sumption that the individual t-statistics being aggregated are

positive and statistically significant (Z = 5.65, p < independent.

c= Significantat the 1%level, two-tailedtest.

0.01), while prevention expenditures in quarter t - 1

are again negatively correlated with the current period's

nonconformance costs (Z = -3.23, p < 0.01).20

The positive coefficients on conformance and preven- where NEG (POS) = 1 if the independent variable is

tion costs in quarter t are consistent with two explana- negative (positive) duringthe quarterand zero otherwise.

tions. As previously seen in quintiles 4 and 5, plants may If plants reduced conformance costs as quality improved,

have reduced both conformance and nonconformance nonconformance costs should be positively correlated

costs as the quality program progressed. Alternatively, with negative values of CONF.R and PREV.R (i.e.,

the units may have responded to sporadic quality defi- lower than expected conformance and prevention expen-

ciencies by "firefighting," leading to a positive relation- ditures). Conversely, if conformance costs were in-

ship as conformance expenditures were increased to creased in response to quality problems, 132and 72 should

identify and eliminate the problems. The following mod- emerge positive and statistically significant. As shown in

els are estimated to examine the extent to which these Table IX, each of the four variables is positively corre-

explanations account for the positive relationship be- lated with nonconformance costs at the 1% level. These

tween conformance and nonconformance costs: results suggest that the plants condition their conform-

ance expenditure levels on the magnitude of quality

NCONF.Rt problems facing the unit during the period. When

= a + 131(NEG*CONF.R)t quality is high during a quarter, conformance costs are

cut back; when quality problems are encountered, the

+ 132(POS*CONF.R)t + Et (4) units respond by increasing conformance expenditures.2'

NCONF.Rt Although conformancecosts tended to rise and fall with

= a + y 1(NEG*PREV.R)t increases and decreases in failures, the overall results from

the plant-specific tests indicate that, on average, the 24

+ zy2(POS*PREV.R)t + Et, (5) units reduced both conformance and nonconformance

This content downloaded from 169.229.32.137 on Thu, 8 May 2014 19:07:55 PM

All use subject to JSTOR Terms and Conditions

126 / VITNER

costs over the periods studied. These findings are rein- The final set of tests controlled for differences in pro-

forced by plant-specific regressions (not reported in the duction functions, product attributes, and quality cost

tables) of conformance and nonconformance costs on systems by estimating plant-specific regressions. Both

the period's sales and linear time trend variables (ranging preventionand total conformanceexpenditureswere again

from 1 to n, where n represents the number of quarterly positively associated with nonconformance costs. Addi-

observations for the plant). After controllingfor sales vol- tional analysis indicatedthat the plants tended to condition

umes, the Z-statistics for the coefficients on the time trend conformance expenditures on the quality problems facing

variables are -2.07 (p = 0.05) in the conformanceregres- the unit, with conformance costs increasing when prob-

sion and -4.82 (p < 0.01) in the nonconformance lems were encountered, and decreasing when quality im-

regression, corroboratingearlierevidence that many of the proved. When conformance activities were increased, the

plants in the sample reduced conformanceexpendituresas increase typically produced lower nonconformancecosts

quality improved. As with the other two sets of tests, the roughly one month following their implementation. By

findingsfrom the plant-specificregressions run contraryto conditioning conformance expenditures on the level of

the hypothesis that conformance expendituresmust be in- quality problems being encountered, the plants reduced

creasing over time to achieve ongoing reductions in con- both conformance and nonconformancecosts as the qual-

formance costs. ity programprogressed, contradictingthe hypothesis that

conformanceexpendituresmust be increasingover time to

achieve ongoing reductionsin conformancecosts.

This study makes two contributions to the quality cost

5. SUMMARY

economics literature. First, it provides the first empirical

This paper examined the hypothesis that conformance support for the continuous improvement models of qual-

expenditures must continue to be increased over time to ity cost behavior. In doing so, the study reinforces the

achieve ongoing reductions in nonconformance costs, the need for greater use of dynamic models of quality man-

principal debate between proponents of the traditional agement rather than the static models that predominate

quality cost model and continuous improvement theories today (see also Jaikumar and Bohn 1992). Second, the

of quality cost behavior. Contrary to the prediction of study points out the need to abandon the use of an aggre-

the traditional model, three sets of empirical analyses gate "conformance cost" category that includes both

found that many of the plants in the sample achieved prevention and appraisal. Neither the traditional quality

significant reductions in reported nonconformance costs cost model nor Fine's quality-based learning model dis-

while maintaining or reducing existing conformance tinguish between prevention and appraisal costs.22 Yet

expenditures. both the descriptive statistics and the second set of em-

The first set of tests took a short-term perspective by pirical analyses show that plants typically reduced ap-

examining the association between annual changes in praisal and nonconformance costs since the start of the

conformance expenditures and changes in nonconfor- quality programwhile maintaininga relatively fixed level

mance costs in the current and following year. The evi- of prevention expenditures. This finding suggests that ef-

dence indicated that additional investments in prevention fective prevention activities can reduce both appraisal

and appraisal activities were associated with significant and nonconformance costs, and that the economics un-

reductions in nonconformance costs in the current or derlying the prevention and appraisal categories are dis-

following year. However, reductions in prevention and tinctly different. A potentially useful avenue for future

appraisal costs were also associated with lower noncon- theoretical work is understanding the interactions be-

formance costs, a finding that is inconsistent with the tween prevention and appraisal activities in a dynamic

traditional quality cost model. Moreover, the data pro- learning environment.

vided no evidence that reductions in conformance expen- Although the evidence is generally consistent with re-

ditures led to higher nonconformance costs in the cent continuous improvement and quality-based learning

following period. models, the results from this study in no way invalidate

The second set of tests took a longer view of the asso- the traditionalquality cost model. As noted earlier, data

ciation between conformance and nonconformance costs and econometric limitations make it difficult to

by examining quality cost behavior since the beginning of definitively test the competing theories of quality cost

the quality program. Nearly 80% of the plants in the behavior. Moreover, even if quality-based learning mod-

sample reduced nonconformance costs as a percent of els correctly depict quality cost behavior over time, the

sales over the lives of their quality programs. Regression traditionalmodel may still be an accuratestatic represen-

analyses indicated that these reductions were positively tation of quality cost economics. The evidence does,

associated with changes in conformance costs, implying however, suggest that in dynamic, multiperiod environ-

that the reductions in nonconformance costs were gener- ments, many companies that have committed the neces-

ally accompanied by reductions in conformance expendi- sary resources to quality improvement and embraced the

tures, not the increasing conformance expenditures continuous improvement philosophy have, for what-

predicted by the traditional quality cost model. ever reason, been able to achieve ongoing reductions

This content downloaded from 169.229.32.137 on Thu, 8 May 2014 19:07:55 PM

All use subject to JSTOR Terms and Conditions

ITNER / 127

in nonconformance costs while maintaining, or even NOTES

reducing, the existing level of reported conformance

expenditures. 1. The "conformance to specifications" definition of

Future empirical studies can attempt to overcome quality refers to whether or not a product meets the

some of the limitations of this study by moving beyond design specifications set by engineering, i.e., the num-

reported quality costs to estimate the total costs of poor ber of manufacturingdefects. This definition stands in

quality. Indirect or "hidden" internal failure costs, for contrast to broader definitions of quality which en-

example, can be estimated by evaluating the impact of compass quality characteristics such as performance,

poor quality on total factor productivity (Ittner). Simi- reliability, features, serviceability, and aesthetics as

larly, the effect of process variability on productivity and well as conformance to specifications. For an exten-

customer satisfaction can be investigated to provide evi- sive discussion of the many definitions of quality, see

dence on the Taguchi quality loss function and its func-

Garvin (1988).

tional form in various industries. Particularly important

2. Kim and Liao argue that the specific functional form

to any future study of quality cost economics will be

of the loss function may vary by product and indus-

assessing the opportunity costs of lost sales due to poor

try, and may actually have "insensitive" regions in

quality. Studies by the Technical Assistance Research

which small deviations from the target value do not

Programs (TARP) indicate that the opportunity costs of

field defects may greatly exceed the external failure costs lead to quality losses. However, the authors present

reported by most systems (TARP 1976). The expected no evidence to support this conjecture.

repurchase rate for a product costing $100 or more 3. These illustrations are based on those in Schmenner

ranged from 54% if the complaint was resolved satisfac- (1984).

torily to only 19%if the problem was not resolved to the 4. The continuous improvement philosophy promotes

customer's satisfaction. Moreover, while satisfied cus- the need for never-ending improvement. Although the

tomers tell an average of five others about their experi- philosophy rejects the notion that quality improve-

ence with the product, dissatisfied customers tell 19. ment efforts can be relaxed short of perfection, most

Estimating the opportunity costs of field defects will continuous improvement advocates maintainthat zero

probably require joint research with marketing research- defects is a long-run goal rather than an attainable

ers who are experienced at estimating purchase elastici- short-runoptimum (e.g., Schneiderman 1987).

ties with respect to factors such as quality. An additional 5. In much the same vein, Milgrom and Roberts (1990)

challenge to empirical studies in this area will be control- argue that the introduction of new manufacturing

ling for factors other than quality-based learning (e.g., technologies such as Computer-Aided Design and

factor prices and technological changes) that may affect Manufacturing(CAD/CAM) systems lower the overall

the quality-cost tradeoffs facing an organization. The de- costs of achieving higher quality by increasing the ef-

tailed information and organizational knowledge needed ficiency and effectiveness of prevention activities.

to conduct such a study suggests that an in-depth exam- 6. The model by Marcellus and Dada does not address

ination of a few organizations may be the most fruitful

appraisal costs. Fine's model, in contrast, only ad-

avenue for future empirical research on quality cost

dresses total conformance costs and does not distin-

economics.

guish between prevention and appraisal expenditures.

Finally, the empirical analyses in this study (as well as

Consequently, the model provides no insight into

existing quality cost theories) utilize aggregate changes in

whether quality-based learning primarilyimpacts pre-

prevention, appraisal, and nonconformance costs. A use-

ful extension would be an examination of the impact of vention activities, appraisal activities, or both.

specific activities within the prevention and appraisalcat- 7. A comparison of the participatingand nonparticipat-

egories. For example, do certain elements within the pre- ing groups revealed no systematic differences in terms

vention category (e.g., training, preventive maintenance, of size or industry. However, the use of companies

quality engineering) have a greater impact on nonconfor- that formally track quality cost expenditures intro-

mance costs than others? Does the distribution of pre- duces a potential self-selection bias into the sample

vention costs among the subcategories change as the because firms with more sophisticated quality pro-

quality level improves? Do companies that achieve grams may be more likely to measure quality costs.

higher quality with no increase in conformance expendi- 8. The quality cost elements tracked by the units in the

tures allocate their prevention and appraisalresources to sample remained consistent from year to year. Where

different activities than their competitors? A more mic- possible, actual warranty claims were aligned with the

rolevel examination of quality cost behavior may provide period in which the goods were manufactured. In the

a better understanding of the underlying economics of remainingcases, plant-specific estimates of the lag be-

quality improvement, thereby allowing more informed tween factory shipment and the recording of warranty

decisions on the allocation of resources to quality-related claims were used to estimate the warranty costs asso-

activities. ciated with a given manufacturingperiod.

This content downloaded from 169.229.32.137 on Thu, 8 May 2014 19:07:55 PM

All use subject to JSTOR Terms and Conditions

128 / ITTNER

9. To ensure that the results in this paper were not coefficient on %ACONFin the subsample of periods

driven by reporting differences, the tests were re- with increased conformance costs was not statisti-

peated using data from the 31 plants that provided cally different from zero (t = -0.07). In contrast,

detailed information on the components of reported the coefficient for the subsample with reduced con-

quality costs. After eliminating reported costs for ac- formance expenditures was positive and significant

tivities other than quality planning and administra- at the 2% level (t = 2.36). To examine whether

tion, training, inspection and test, scrap, rework, and these results were simply due to fixed costs being

warranties, the results remained unchanged, suggest- spread over larger sales volumes, percentage

ing that the findings are not an artifact of differences changes in nonconformance costs (unadjusted for

in reported quality cost elements. volume) were regressed on percentage changes in

10. For the entire sample of annual quality cost expendi- both conformance expenditures and annual sales. As

tures, the Pearson correlations between percentage expected, changes in nonconformance costs were

changes in quality costs and percentage changes in highly correlated with changes in sales (t = 5.92,

sales exceed 0.40 (p < 0.01) for each of the quality p < 0.01). More importantly, the coefficient on the

cost categories. In the 24 plants that provided quar- change in conformance costs remained positive and

terly quality cost data, the mean time series correla- statistically significant (t = 1.81, p = 0.07).

tions between quarterly quality cost expenditures 14. In year t - 1, median changes in nonconformance

and quarterly sales in each plant are: costs for quintile 1 are positive and significant at the

10% level. Median nonconformance cost changes in

Prevention 0.48 year t - 1 for the other quintiles are all negative.

Appraisal 0.61 15. The White (1980) test for heteroscedasticity was con-

Conformance 0.69 ducted for each of the cross-sectional regressions re-

Internal Failure 0.48 ported in the paper. In no case did the test reject the

External Failure 0.60 null hypothesis that the error terms were homosce-

Nonconformance 0.60

dastic. Because the relationshipbetween conformance

and nonconformance costs may not be linear, rank