Professional Documents

Culture Documents

2009-11-01 020853 Laura 3

Uploaded by

Mike SerafinoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2009-11-01 020853 Laura 3

Uploaded by

Mike SerafinoCopyright:

Available Formats

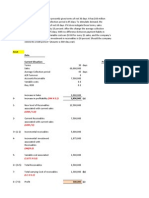

15-1Residual Dividend Model: Axel telecommunications has a target capital structure

that consisits of 70% debt and 30% equity. The company anticipates that its capital

budget for the upcoming year will be $3,000,000. If Axel reports net income of

$2,000,000 and it follows a residual dividend payout policy, what will be its dividend

payout ratio?

70% Debt; 30% Equity; Capital budget = $3,000,000; NI = $2,000,000; PO = ?

Equity retained = 0.3($3,000,000) = $900,000.

NI $2,000,000

- Additions to RE 900,000

Earnings remaining $1,100,000

$1,100,000

Payout = $2,000,000 = 55%.

15-2 Stock Split: gamma medicals stock trades at $90 a share, The company is

contemplation a 3 for 2 stock split. Assuming that the stock split will have no effect on

the market value of its equity, what will be the companys stock price following the stock

split?

P0 = $90; Split = 3 for 2; New P0 = ?

$90

= $60.

3 /2

16-6Working Capital Investment: Prestopino Corp. produces motorcycle batteries.

Prestopino turns out 1,500 batteries a day at a cost of $6 per battery for materials and

labot. It takes the firm 22 days to convert raw materials into a battery. Pretonpino allows

its customers 40 days in which to pay for the batteries, and the firm generally pays its

suppliers in 30 days. A- what is the length of Prestopinos cash conversion cycle? B- At a

steady state in which Prestopino produces 1,500 batteries a day , what amount of working

capital must it finance. C- by what amount could Prestopino reduce its working capital

financing needs if it was able to stretch its payables deferral period to 35 days? D-

Prestopino management is trying to analyze the effect of a proposed new production

process on its working capital investment. The new production process would allow

Prestonpino to decrease its inventory conversion period to 20 days and to increase its

daily production to 1800 batteries. However the new process would cause the cost of

materials and labor to increase to $7. Assuming the change does not affect the average

collection period (40 days) or the payables deferral period (30 Days), what will be the

length of its cash conversion cycle and its working capital financing requirements if the

new production process its implemented?

a. Cash conversion cycle = 22 + 40 30 = 32 days.

b. Working capital financing = 1,500 32 $6 = $288,000.

c. If the payables deferral period was increased by 5 days, then its cash

conversion cycle would decrease by 5 days, so its working capital financing

needs would decrease by

Decrease in working capital financing = 1,500 5 $6 = $45,000.

d. Cash conversion cycle = 20 + 40 30 = 30 days.

Working capital financing = 1,800 30 $7 = $378,000.

You might also like

- The Prestopino Corporation Produces Motorcycle BatteriesDocument3 pagesThe Prestopino Corporation Produces Motorcycle BatteriesKidu Yabe100% (2)

- Sales/365 S Receivable 000, 000, 2 $Document1 pageSales/365 S Receivable 000, 000, 2 $djoshNo ratings yet

- CH16HW TrierweilerDocument5 pagesCH16HW TrierweilerMax Trierweiler100% (1)

- Improve Cash Flow by Reducing Accounts ReceivableDocument11 pagesImprove Cash Flow by Reducing Accounts ReceivableenkeltvrelseNo ratings yet

- Working CapitalDocument2 pagesWorking Capitalcmverma820% (1)

- FM Final ExamDocument5 pagesFM Final ExamMarites ArcenaNo ratings yet

- Module 6 ActivitiesDocument12 pagesModule 6 ActivitiesArnelli GregorioNo ratings yet

- WORKING CAPITAL MANAGEMENT ADVISORY SERVICESDocument9 pagesWORKING CAPITAL MANAGEMENT ADVISORY SERVICESJonas Mondala80% (5)

- Working CapitalDocument16 pagesWorking Capitalsherlyn_anacion50% (4)

- Tutorial 3 WCM Updated fnc3101Document4 pagesTutorial 3 WCM Updated fnc3101Trick1 Haha100% (1)

- Gitman CH 14 15 QnsDocument3 pagesGitman CH 14 15 QnsFrancisCop100% (1)

- 06 - Working Capital Management ProblemsDocument4 pages06 - Working Capital Management ProblemsMerr Fe PainaganNo ratings yet

- 3 - Working Capital and Cash Management (3) - QuestionsDocument1 page3 - Working Capital and Cash Management (3) - QuestionsMon RamNo ratings yet

- B BDocument6 pagesB BNile Alric AlladoNo ratings yet

- Working Capital FinanceDocument27 pagesWorking Capital FinanceZenedel De JesusNo ratings yet

- AssignmentDocument3 pagesAssignmentFrancis Abuyuan100% (1)

- Financial ManagementDocument9 pagesFinancial ManagementDewanti Almeera100% (1)

- NWCDocument5 pagesNWCKyla Ramos DiamsayNo ratings yet

- Case 20Document11 pagesCase 20MayaNo ratings yet

- Multiple Changes in Cash Conversion Cycle Garrett Industries Turns Over Its Inventory 6 Times Each Year It Has An Average CollectionDocument10 pagesMultiple Changes in Cash Conversion Cycle Garrett Industries Turns Over Its Inventory 6 Times Each Year It Has An Average CollectionSophia Varias CruzNo ratings yet

- Calculate Working Capital Financing Needs and Cash Conversion CycleDocument4 pagesCalculate Working Capital Financing Needs and Cash Conversion CycleRia BagoNo ratings yet

- FMARKETDocument3 pagesFMARKETTk KimNo ratings yet

- ... Exercises Chapter 14Document5 pages... Exercises Chapter 14ScribdTranslationsNo ratings yet

- WCMDocument4 pagesWCMARLENE FERNANDEZNo ratings yet

- Net Cost of Investment: International Business TradeDocument8 pagesNet Cost of Investment: International Business TradevionysusgoghNo ratings yet

- Working Capital Exercise PDFDocument5 pagesWorking Capital Exercise PDFKristine Lirose Bordeos100% (1)

- Finc 3310 - Actual Test 3Document5 pagesFinc 3310 - Actual Test 3jlr0911No ratings yet

- AF BisalahDocument2 pagesAF BisalahRival RmcNo ratings yet

- Ar&Inventory ManagementDocument10 pagesAr&Inventory ManagementKarlo D. ReclaNo ratings yet

- MANAGEMENT ADVISORY SERVICES: RECEIVABLEDocument6 pagesMANAGEMENT ADVISORY SERVICES: RECEIVABLEKarlo D. ReclaNo ratings yet

- Compilation Cash Management SystemsDocument8 pagesCompilation Cash Management SystemsRehanne M. MarohomNo ratings yet

- 10MGMT 3000 Tutorial 10 2019 (Final)Document2 pages10MGMT 3000 Tutorial 10 2019 (Final)SahanNo ratings yet

- Universal College of Parañaque: Working Capital ManagementDocument23 pagesUniversal College of Parañaque: Working Capital ManagementEmelita ManlangitNo ratings yet

- EMPLOYEE-BENEFITS AnswerkeyDocument6 pagesEMPLOYEE-BENEFITS AnswerkeyRiselle Ann Sanchez100% (2)

- CAT Challenge - Answers PDFDocument6 pagesCAT Challenge - Answers PDFnivea gumayagayNo ratings yet

- FM4 Part 2 Accounts Receivable and Inventory ManagementDocument20 pagesFM4 Part 2 Accounts Receivable and Inventory ManagementakatsukiescarroNo ratings yet

- Cow Breeder's Accounts Receivable AnalysisDocument7 pagesCow Breeder's Accounts Receivable AnalysisEduardo AñonuevoNo ratings yet

- AR& Inventory Management AR& Inventory ManagementDocument11 pagesAR& Inventory Management AR& Inventory Managementchesca marie penarandaNo ratings yet

- Diagnostic Examination (Batch 2020)Document71 pagesDiagnostic Examination (Batch 2020)KriztleKateMontealtoGelogo75% (4)

- ACF 103 - Fundamentals of Finance Tutorial 6 - QuestionsDocument7 pagesACF 103 - Fundamentals of Finance Tutorial 6 - QuestionsRiri FahraniNo ratings yet

- Current Asset ManagementDocument3 pagesCurrent Asset ManagementGenre FloresNo ratings yet

- FCF and Working Capital ManagementDocument2 pagesFCF and Working Capital ManagementLeanne QuintoNo ratings yet

- Year Project A Project B: Total PV NPVDocument19 pagesYear Project A Project B: Total PV NPVChin EENo ratings yet

- Keuangan Yg Mau D TranslateDocument2 pagesKeuangan Yg Mau D TranslateSyarif MuhammadNo ratings yet

- WORKING CAPITAL DocxDocument16 pagesWORKING CAPITAL DocxGab IgnacioNo ratings yet

- 15 ManagementDocument69 pages15 ManagementBelista25% (4)

- Manila MAY 5, 2022 Preweek Material: Management Advisory ServicesDocument25 pagesManila MAY 5, 2022 Preweek Material: Management Advisory ServicesJoris YapNo ratings yet

- Economic SlidesDocument38 pagesEconomic SlidesThamer AlzahraniNo ratings yet

- NPV and IRR, Payback Period, ImportantDocument5 pagesNPV and IRR, Payback Period, Important朱潇妤No ratings yet

- Chapter 16 - Management of Current AssetsDocument7 pagesChapter 16 - Management of Current Assetslou-924No ratings yet

- IPE 481 - Term Final Question - January 2020Document6 pagesIPE 481 - Term Final Question - January 2020Shaumik RahmanNo ratings yet

- Finals Exercise 1 - WC Management Receivables and InventoryDocument4 pagesFinals Exercise 1 - WC Management Receivables and InventoryMarielle SidayonNo ratings yet

- Final Exam Questions on Financial ManagementDocument3 pagesFinal Exam Questions on Financial ManagementAnaSolitoNo ratings yet

- Manajemen KeuanganDocument5 pagesManajemen KeuanganRevaldi Andika Ainun PranataNo ratings yet

- ... Latihan Bab 14Document6 pages... Latihan Bab 14ScribdTranslationsNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Climate-Related Financial Disclosures 2021: Progress Report on Implementing the Recommendations of the Task Force on Climate-Related Financial DisclosuresFrom EverandClimate-Related Financial Disclosures 2021: Progress Report on Implementing the Recommendations of the Task Force on Climate-Related Financial DisclosuresNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Ap AbDocument8 pagesAp AbMike SerafinoNo ratings yet

- Annotations PepperDocument2 pagesAnnotations PepperMike SerafinoNo ratings yet

- Audit of Equity A PDFDocument8 pagesAudit of Equity A PDFMike SerafinoNo ratings yet

- 5.AUDITING ProblemDocument111 pages5.AUDITING ProblemAngelu Amper68% (22)

- Cpa Review School of The PhilippinesDocument12 pagesCpa Review School of The PhilippinesMike SerafinoNo ratings yet

- Chap005-Consolidation of Less-Than-Wholly Owned SubsidiariesDocument71 pagesChap005-Consolidation of Less-Than-Wholly Owned Subsidiaries_casals100% (3)

- CPAR - Auditing ProblemDocument12 pagesCPAR - Auditing ProblemAlbert Macapagal83% (6)

- NOTESDocument2 pagesNOTESMike SerafinoNo ratings yet

- Untitled 4Document28 pagesUntitled 4Mike SerafinoNo ratings yet

- Test Bank - Chapter 4 Process CostingDocument51 pagesTest Bank - Chapter 4 Process Costingmaisie laneNo ratings yet

- Applied Auditing 2017 Updates and Errata As of August 1 2017Document3 pagesApplied Auditing 2017 Updates and Errata As of August 1 2017Aira ButligNo ratings yet

- p2 - Guerrero Ch7Document35 pagesp2 - Guerrero Ch7JerichoPedragosa66% (38)

- Chapter 1Document5 pagesChapter 1Mike SerafinoNo ratings yet

- Bibingkinitan Strategic PlanDocument83 pagesBibingkinitan Strategic PlanMike Serafino100% (3)

- Cost Acct Concepts PDFDocument36 pagesCost Acct Concepts PDFMike SerafinoNo ratings yet

- Chapter 7Document17 pagesChapter 7Mike SerafinoNo ratings yet

- Palattao - RizalDocument3 pagesPalattao - RizalMike SerafinoNo ratings yet

- IPPTChap 006Document32 pagesIPPTChap 006Mike SerafinoNo ratings yet

- Int AudDocument19 pagesInt AudMike SerafinoNo ratings yet

- Notes For Quiz 1Document11 pagesNotes For Quiz 1Mike SerafinoNo ratings yet

- Chapter 1Document5 pagesChapter 1Mike SerafinoNo ratings yet

- IIA Standards and Code of Ethics multiple choice questionsDocument4 pagesIIA Standards and Code of Ethics multiple choice questionsMike SerafinoNo ratings yet

- PassportApplicationForm Main English V1.0Document2 pagesPassportApplicationForm Main English V1.0Triloki KumarNo ratings yet

- Passport ADocument7 pagesPassport AMike SerafinoNo ratings yet

- Chap 1 Test BankDocument22 pagesChap 1 Test BankMike SerafinoNo ratings yet

- Chapter 1 NotesDocument3 pagesChapter 1 NotesMike SerafinoNo ratings yet

- Chapter 35Document30 pagesChapter 35Mike SerafinoNo ratings yet

- Chapter 1 NotesDocument3 pagesChapter 1 NotesMike SerafinoNo ratings yet

- Chapter 33Document2 pagesChapter 33Mike SerafinoNo ratings yet

- Flexfiled Oracle FaqDocument14 pagesFlexfiled Oracle Faq$!@#$%!@#$%No ratings yet

- Tank Heating DiscussionsDocument26 pagesTank Heating DiscussionsTHERMAX007No ratings yet

- LAT323 Extra Credit 5Document6 pagesLAT323 Extra Credit 5jam skiNo ratings yet

- SWIFT ChecklistDocument5 pagesSWIFT Checklistফয়সাল হোসেনNo ratings yet

- CeaDocument28 pagesCeaPong YasirNo ratings yet

- Cast StudyDocument5 pagesCast StudyFrancisco Rodriguez0% (3)

- Indonesian Recipes Discover The Taste of Indonesia (Stephanie Sharp) (Z-Library)Document74 pagesIndonesian Recipes Discover The Taste of Indonesia (Stephanie Sharp) (Z-Library)Daniel Proulx100% (1)

- LTE eNB L1 API DefinitionDocument106 pagesLTE eNB L1 API Definitioneng_alshimaaNo ratings yet

- The Deer and The CrocodilesDocument4 pagesThe Deer and The CrocodilesM Rifky FauzanNo ratings yet

- Pipe Bending Machine Manual SmallDocument99 pagesPipe Bending Machine Manual SmallRajesh Kannan100% (2)

- Senior Citizen Red Carpet - Snap Shot of The Features & Benefits - SHAHLIP1910V031819 - Launched On 10th JAN2019Document2 pagesSenior Citizen Red Carpet - Snap Shot of The Features & Benefits - SHAHLIP1910V031819 - Launched On 10th JAN2019Ganesh UnNo ratings yet

- The Problem and Its SettingDocument20 pagesThe Problem and Its SettingChing DialomaNo ratings yet

- Unit 5 Lesson 5: If I Built A HouseDocument2 pagesUnit 5 Lesson 5: If I Built A HousePlamenna Pavlova PavlovaNo ratings yet

- #1 Basic Functions of The Hand-1Document29 pages#1 Basic Functions of The Hand-1Yosep Gustiy PanguestueNo ratings yet

- Incoming Inspection Procedure: Document Part No. Rev 100-0044 007 1 of 11Document11 pagesIncoming Inspection Procedure: Document Part No. Rev 100-0044 007 1 of 11Sandip Jawalkar100% (1)

- Poetry Potion 09 Infinite WondersDocument86 pagesPoetry Potion 09 Infinite WondersBlack-Letter-MediaNo ratings yet

- Understanding culture through sociological perspectivesDocument3 pagesUnderstanding culture through sociological perspectivesAnjaneth Cabutin0% (1)

- OHSAS 18001-2007 Lead Auditor CourseDocument3 pagesOHSAS 18001-2007 Lead Auditor Coursesharaby81No ratings yet

- Seven QC Tools Tool #5: Part 1-Run ChartDocument6 pagesSeven QC Tools Tool #5: Part 1-Run ChartAnkur DhirNo ratings yet

- Antipsychotic DrugsDocument2 pagesAntipsychotic DrugsDana Mae AfanNo ratings yet

- 06.07 Review and Critical ThinkingDocument2 pages06.07 Review and Critical ThinkingmarielaNo ratings yet

- PPAP ManualDocument102 pagesPPAP Manualsuresh196950% (2)

- Modul Push 15A enDocument6 pagesModul Push 15A enUPOTERMNo ratings yet

- Frisco 2023 DigitalDocument52 pagesFrisco 2023 DigitalEric MillerNo ratings yet

- 425 TR - Chiller Data SheetSpecDocument2 pages425 TR - Chiller Data SheetSpecjohnsvjNo ratings yet

- Proposal WorkDocument13 pagesProposal Workmolla derbewNo ratings yet

- Med-Surg Ch25 Patient With Cancer Study Guide and NCLEX QuestionsDocument19 pagesMed-Surg Ch25 Patient With Cancer Study Guide and NCLEX QuestionsKyla Mae JumaritoNo ratings yet

- CSC 2209 NotesDocument102 pagesCSC 2209 NotesWilliam manzhi KajjubiNo ratings yet

- Malta Presentation WordDocument5 pagesMalta Presentation WordEnea Del CasaleNo ratings yet

- SIEMENS - 1500 based - ET200SP PLC CPU 型錄Document10 pagesSIEMENS - 1500 based - ET200SP PLC CPU 型錄CHIENMAO WUNo ratings yet