Professional Documents

Culture Documents

Sample 2008 Entrance Examination

Uploaded by

jjOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample 2008 Entrance Examination

Uploaded by

jjCopyright:

Available Formats

Sample 2008 Entrance Examination

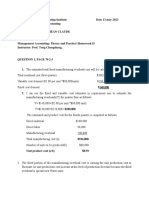

26. Answer: c.

Direct materials $140

Machine set up (3 x $180/60) 9

Materials handling ($15 x 35) 525

Milling ($50 x 6) 300

Assembly ($30 x 4) 120

Manufacturing cost per unit $1,094

Price to achieve gross margin of 35% = $1,094/.65 = $1,683 (rounded).

Choice a) Gross margin percentage is applied incorrectly: $1,094 x 1.35 = $1,477

(rounded)

Choice b) Direct materials costs are not included in manufacturing costs: ($9 + $525 +

$300 + $120)/.65 = $954/.65 = $1,468 (rounded)

Choice d) Cost of $1,094, i.e. markup is not applied

Choice e) Gross margin percentage is applied incorrectly: $1,094/.35 = $3,126

(rounded)

27. Answer: d.

Budgeted costing system uses budgeted costs and budgeted professional labour hours

(PLH) in establishing the direct and indirect cost rates.

Budgeted direct cost rate = ($92,000 x 8 + $41,600 x 10) 28,800 PLH

= $40.00 per PLH

Budgeted indirect cost rate = $691,200 28,800 PLH = $24.00 per PLH

Choice a) Incorrectly uses actual costs and actual PLH to determine the rates:

Actual direct cost rate = ($95,000 x 8 + $47,840 x 10) 29,200 PLH

= $42.41 per PLH

Actual indirect cost rate = $711,936 29,200 PLH = $24.38 per PLH

Choice b) Incorrectly uses actual costs to determine the rates:

Direct cost rate = ($95,000 x 8 + $47,840 x 10) 28,800 PLH

= $43.00 per PLH

Indirect cost rate = $711,936 28,800 PLH = $24.72 per PLH

Choice c) Incorrectly uses actual PLH to determine the rates:

Direct cost rate = ($92,000 x 8 + $41,600 x 10) 29,200 PLH

= $39.45 per PLH

Indirect cost rate = $691,200 29,200 PLH = $23.67 per PLH

Choice e) The direct and indirect cost rates are $40.00 and $24.00 per PLH,

respectively (choice a).

50 CMA Canada

You might also like

- Managerial Accounting-Solutions To Ch08Document4 pagesManagerial Accounting-Solutions To Ch08Mohammed HassanNo ratings yet

- CH 5 ExcelDocument37 pagesCH 5 ExcelssdsNo ratings yet

- ABC Costing Lecture1Document12 pagesABC Costing Lecture1Nusrat JahanNo ratings yet

- (SCD) HW7.1-Trần Minh Hoàng-IELSIU18042Document5 pages(SCD) HW7.1-Trần Minh Hoàng-IELSIU18042Minh Hoàng TrầnNo ratings yet

- PankajDocument4 pagesPankajdeepak.agarwal.caNo ratings yet

- Assign Chap 2Document6 pagesAssign Chap 2Mustafa MuhamedNo ratings yet

- FF Performance Management Presentation q8Document6 pagesFF Performance Management Presentation q8Jeremiah NcubeNo ratings yet

- Transfer PricingDocument2 pagesTransfer PricingAva DasNo ratings yet

- Assignment 1 SolvedDocument8 pagesAssignment 1 SolvedwqqqNo ratings yet

- Cost Accounting 2 Fourth Year Second Semester 2020-2021 Review Questions CH (7) & CH (8) Part (Dr. El Ghareeb) (5) Presented By: Dr. Ahmed MokhtarDocument11 pagesCost Accounting 2 Fourth Year Second Semester 2020-2021 Review Questions CH (7) & CH (8) Part (Dr. El Ghareeb) (5) Presented By: Dr. Ahmed Mokhtarمحمود احمدNo ratings yet

- No. 4Document5 pagesNo. 4martinus linggoNo ratings yet

- Solution PricingDocument3 pagesSolution PricingDella BianchiNo ratings yet

- Engineering Economics Assignment Solutions and AnalysisDocument7 pagesEngineering Economics Assignment Solutions and AnalysiswqqqNo ratings yet

- 2018 Management Accounting Ibm2 PrepDocument9 pages2018 Management Accounting Ibm2 PrepВероника КулякNo ratings yet

- PM Mock AnswersDocument16 pagesPM Mock AnswersMuhammad HussnainNo ratings yet

- ACCT3500 (Fall 20) Answers To Tutorial 3Document7 pagesACCT3500 (Fall 20) Answers To Tutorial 3Mohammad ShabirNo ratings yet

- Save $30 Flying to Visit a FriendDocument4 pagesSave $30 Flying to Visit a FriendLê Tuấn AnhNo ratings yet

- CAB6-MAC S 4Document10 pagesCAB6-MAC S 4nachofr2704No ratings yet

- Accounting Ch5Document5 pagesAccounting Ch5sparts23No ratings yet

- Test Bank For Horngrens Financial Managerial Accounting 4e by Nobles 0133359840Document55 pagesTest Bank For Horngrens Financial Managerial Accounting 4e by Nobles 0133359840JonathanHicksnrmo100% (35)

- Topic 2 Cost Classification - CompressDocument13 pagesTopic 2 Cost Classification - CompressThị Loan TrầnNo ratings yet

- Product Cost Analysis ComparisonDocument6 pagesProduct Cost Analysis ComparisonPrincess RapisuraNo ratings yet

- Practice Questions - SolDocument8 pagesPractice Questions - SolNicholas LeeNo ratings yet

- Answers To Test Your Understanding: Cost Accounting Chapter 1 Cost Classification, Concepts and TerminologyDocument10 pagesAnswers To Test Your Understanding: Cost Accounting Chapter 1 Cost Classification, Concepts and TerminologyAnonymous vA2xNfNo ratings yet

- m80221012-Kanyabwira Jean Claude - 基因 - Ass2Document10 pagesm80221012-Kanyabwira Jean Claude - 基因 - Ass2UKURI TV7No ratings yet

- PercentsDocument43 pagesPercentsThinzarNo ratings yet

- Indicative Answers:: N12405 MAD II Seminar 3 Activity-Based CostingDocument2 pagesIndicative Answers:: N12405 MAD II Seminar 3 Activity-Based CostinganalsluttyNo ratings yet

- 1 Eoq PDFDocument12 pages1 Eoq PDFLyber PereiraNo ratings yet

- Solutions-Chapter 6Document4 pagesSolutions-Chapter 6Saurabh SinghNo ratings yet

- Chapter 2 Part 1Document8 pagesChapter 2 Part 1Aya MasoudNo ratings yet

- Hilton Chap 17 SolutionsDocument9 pagesHilton Chap 17 Solutionstarcher1987No ratings yet

- Tugas CMA Soal 8-45 Dan 8-46 Richard Andrew - 8312419003 Fix PDFDocument12 pagesTugas CMA Soal 8-45 Dan 8-46 Richard Andrew - 8312419003 Fix PDFsNo ratings yet

- Solving Problems in Cost-Volume-Profit AnalysisDocument17 pagesSolving Problems in Cost-Volume-Profit AnalysisMary Grace PanganibanNo ratings yet

- Session 2Document17 pagesSession 2SylvesterNo ratings yet

- EEE - Assignment 2 Sanjeev 16001174 PDFDocument7 pagesEEE - Assignment 2 Sanjeev 16001174 PDFSanjeev Nehru100% (1)

- Rangga Fakhrurriza - Kelompok 6 Konflik Dan NegosiasiDocument6 pagesRangga Fakhrurriza - Kelompok 6 Konflik Dan NegosiasiRangga FakhrurrizaKls AAkt 2021No ratings yet

- Solutions To Raiborn Problems On Defective Work (Job Order Costing)Document3 pagesSolutions To Raiborn Problems On Defective Work (Job Order Costing)cuaresmamonicaNo ratings yet

- CP Quiz 1-KeyDocument1 pageCP Quiz 1-KeyAbdullah YousufNo ratings yet

- MA 15th EditionDocument9 pagesMA 15th EditionKRNo ratings yet

- HW - AFM - E2-28, P2-40, P2-53 - Kelompok 8Document6 pagesHW - AFM - E2-28, P2-40, P2-53 - Kelompok 8swear to the skyNo ratings yet

- MCS Case 6 1 Transfer Pricing Problem Vikram v1.0Document4 pagesMCS Case 6 1 Transfer Pricing Problem Vikram v1.0Vikram Vijayant Rana0% (1)

- Example (1) :: The Broker's TransactionsDocument3 pagesExample (1) :: The Broker's Transactionsbelal maNo ratings yet

- 4.2. Reasoning of NoptDocument5 pages4.2. Reasoning of NoptДаринаNo ratings yet

- 7114afe WK5 (WS3) AnsDocument8 pages7114afe WK5 (WS3) AnsFrasat IqbalNo ratings yet

- Ppce Unit-5Document21 pagesPpce Unit-5Jackson ..No ratings yet

- CH18 Test Bank Problems1Document3 pagesCH18 Test Bank Problems1Vinzon de Guzman100% (1)

- Business Valuation BreakdownDocument21 pagesBusiness Valuation BreakdownJessa BeloyNo ratings yet

- Activity-Based Cost Systems: See Also: Kaplan/Atkinson 3rd Ed. Ch.4Document28 pagesActivity-Based Cost Systems: See Also: Kaplan/Atkinson 3rd Ed. Ch.4Ikke AgustinNo ratings yet

- Solutions Ch. 7 ABCDocument11 pagesSolutions Ch. 7 ABCThanawat PHURISIRUNGROJNo ratings yet

- Estimating Cost Formulas Using Regression AnalysisDocument7 pagesEstimating Cost Formulas Using Regression AnalysisCheveem Grace EmnaceNo ratings yet

- Chapter 12 Managerial Accounting and Cost-Volume-Profit RelationshipsDocument15 pagesChapter 12 Managerial Accounting and Cost-Volume-Profit RelationshipsJue WernNo ratings yet

- Desti Amalia 0942075 Juli Martini Ratna Susilawati Sarina Yuliana FernandoDocument11 pagesDesti Amalia 0942075 Juli Martini Ratna Susilawati Sarina Yuliana Fernandoмs.yuly xienNo ratings yet

- HBS SolutionDocument6 pagesHBS Solutionabdulazeem_cfeNo ratings yet

- HBS SolutionDocument6 pagesHBS Solutionabdulazeem_cfeNo ratings yet

- Practice Questions On Direct and Indirect Cost VariancesDocument8 pagesPractice Questions On Direct and Indirect Cost VariancesAishwarya RaoNo ratings yet

- ACCG 2000 Week 7 Homework AnswersDocument2 pagesACCG 2000 Week 7 Homework AnswersAlexander TrovatoNo ratings yet

- AccountingDocument20 pagesAccountingNehal NabilNo ratings yet

- CH 8 HW SolutionsDocument7 pagesCH 8 HW SolutionsThanh ThảoNo ratings yet

- Advance Performance Management APMDocument18 pagesAdvance Performance Management APMpaknet0% (1)

- Cost13 Study03 PDFDocument13 pagesCost13 Study03 PDFTubagus Donny SyafardanNo ratings yet

- Cross-Competency: The Following Information Pertains To Questions 102 and 103Document2 pagesCross-Competency: The Following Information Pertains To Questions 102 and 103jjNo ratings yet

- Learning Curves ChapterDocument21 pagesLearning Curves ChapterjjNo ratings yet

- Management Accounting Lecture Notes 2016 4 - Cfe Excerpt T8mwc6land7z7x8cld0w PDFDocument31 pagesManagement Accounting Lecture Notes 2016 4 - Cfe Excerpt T8mwc6land7z7x8cld0w PDFjj67% (3)

- 20 Corporate Performance of Foreign Operations: Chapter ObjectivesDocument21 pages20 Corporate Performance of Foreign Operations: Chapter ObjectivesjjNo ratings yet

- Cual Es El Mejor Sistema de CalidadDocument21 pagesCual Es El Mejor Sistema de Calidadjuande69No ratings yet

- Responsibility Accounting MC Questions SolutionDocument3 pagesResponsibility Accounting MC Questions SolutionjjNo ratings yet

- TB Raiborn - Responsibility Accounting and Transfer Pricing in Decentralized OrganizationDocument44 pagesTB Raiborn - Responsibility Accounting and Transfer Pricing in Decentralized OrganizationMayla Lei Pablo100% (1)

- Ma Ch05 SlidesDocument27 pagesMa Ch05 SlidesjjNo ratings yet

- Financial Management Risk Analysis in Capital Budgeting Notes Finance 1 PDFDocument15 pagesFinancial Management Risk Analysis in Capital Budgeting Notes Finance 1 PDFjjNo ratings yet

- CVP Analysis: Cost-Volume-Profit RelationshipsDocument4 pagesCVP Analysis: Cost-Volume-Profit RelationshipsSayed HossainNo ratings yet

- Mengerial Economics PDFDocument41 pagesMengerial Economics PDFmohanraokp2279No ratings yet

- Management Accounting - Chapter 8 PDFDocument35 pagesManagement Accounting - Chapter 8 PDFjjNo ratings yet

- CA Final AMA Theory Complete R6R7GKB0 PDFDocument143 pagesCA Final AMA Theory Complete R6R7GKB0 PDFjjNo ratings yet

- Time Value of Money 2: Inflation, Real Returns, Annuities, and Amortized LoansDocument17 pagesTime Value of Money 2: Inflation, Real Returns, Annuities, and Amortized LoansjjNo ratings yet

- Annualised Coste Ee 05-05-1Document2 pagesAnnualised Coste Ee 05-05-1jj0% (1)

- Ch11sol PDFDocument11 pagesCh11sol PDFjjNo ratings yet

- Costing concepts for management decision makingDocument22 pagesCosting concepts for management decision makingjjNo ratings yet

- Advanced Accounting Baker Test Bank - Chap003Document37 pagesAdvanced Accounting Baker Test Bank - Chap003donkazoteyNo ratings yet

- Financial Statements Analyiilviii PDFDocument9 pagesFinancial Statements Analyiilviii PDFjjNo ratings yet

- Subramanyam - Financial Statement777777777777 Analysis 10e 3 PDFDocument26 pagesSubramanyam - Financial Statement777777777777 Analysis 10e 3 PDFjjNo ratings yet

- LKfa3answer (B) 2Document4 pagesLKfa3answer (B) 2jjNo ratings yet

- F2 WorkbookC Q PDFDocument105 pagesF2 WorkbookC Q PDFjj0% (1)

- Financial Reporting LectureDocument33 pagesFinancial Reporting LectureUmar SulemanNo ratings yet

- CIMA F3 Workbook Q PDFDocument67 pagesCIMA F3 Workbook Q PDFjjNo ratings yet

- Advanced Financial Management by ICPAP PDFDocument265 pagesAdvanced Financial Management by ICPAP PDFjj0% (1)

- PO0II Rev21Document10 pagesPO0II Rev21jjNo ratings yet