Professional Documents

Culture Documents

2016 11 11 10 10 50 258 - 1478839250258 - XXXPD1424X - Otd PDF

Uploaded by

aOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2016 11 11 10 10 50 258 - 1478839250258 - XXXPD1424X - Otd PDF

Uploaded by

aCopyright:

Available Formats

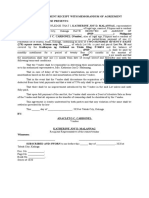

INCOME TAX DEPARTMENT

TAX AND COMPUTATION SHEET

Name & Address

JAYSING LAXMANRAO DESHMUKH

185, MLAHATMA CO OP HSG, SOCIETY KOTHRUD, KOTHRUD, PUNE, MAHARASHTRA, 411029

I.

ASSESSEE

AND

PAN Status Gender

RETURN

DETAILS AANPD1424A INDIVIDUAL Male

Due Date Filing Date Assessment year Acknowledgement No.

31-07-2011 29-07-2011 2011-12 256275700290711

DIN Section AO Description

2014201110000005485T 154 CIRCLE 3, PUNE

1 Returned Income/Loss 96,45,240

2 Assessed Income/Loss 96,45,240

II.

INCOME 3 Net Agricultural Income 0

4 Special Rate Income 0

5 TDS and TCS 24,62,102

6 Total Advance Tax 0

III.

PREPAID 7 Self Assessment Tax 3,92,000

TAXES

8 Other Payments (Less previously issued refunds) 0

9 Total Prepaid Tax 28,54,102

10 Special Rate Tax 0

11 Tax 27,47,572

12 Rebate 0

13 Surcharge 0

14 Education Cess and Higher Education Cess 82,427

15 Relief 0

16 u/s 234A 0

17 u/s 234B 16,102

IV. 18 u/s 234C 13,612

DEMAND/

19 Total Interest Due 29,714

REFUND

20 Total Tax & Interest Due 28,59,713

21 Less Prepaid Tax 28,54,102

22 Amount Payable/Refundable 5,611

23 Manual Refund 0

24 Interest chargeable/charged from Assessee u/s 234D 0

25 Addl. Tax on Distributed Profits 0

26 Interest Payable /Paid to Assessee 0

27 Interest chargeable/charged from Assessee u/s 220(2) 0

28 Net Amount Payable/Refundable 5,610

Please note that this is NOT an intimation/order. This information sheet shows the computation of tax and interest for the assessment

year mentioned. This is a taxpayer friendly measure to provide information to taxpayers for previous assessment years where return

was not processed at the Centralized Processing Center, Income Tax Department, Bangalore and where taxpayer may not readily

possess the intimation sheet/order issued by the Department.

While the demand (Net Amount Payable) shown at SI 28 above should normally be the same as shown on the e-Filing Portal, any

difference may be due to adjustment of refund and/or tax-paid, if any

You might also like

- Opportunities Challenges of New Technologies For AML CFTDocument76 pagesOpportunities Challenges of New Technologies For AML CFTaNo ratings yet

- Safekeeping Empowered: Reimagining The Us Custody Business: A Tabb Group Research ReportDocument19 pagesSafekeeping Empowered: Reimagining The Us Custody Business: A Tabb Group Research ReportaNo ratings yet

- Bank of Mauritius Responseto - QueriesDocument4 pagesBank of Mauritius Responseto - QueriesaNo ratings yet

- Credit Suisse Nice Report - Payments Processors FinTech USA PDFDocument261 pagesCredit Suisse Nice Report - Payments Processors FinTech USA PDFAnand ArgNo ratings yet

- 2017 Chapter 2 3 CustodiansDocument6 pages2017 Chapter 2 3 CustodiansaNo ratings yet

- RolesDocument1 pageRolesaNo ratings yet

- Oral Presentaion SkillsDocument20 pagesOral Presentaion SkillsDr. Wael El-Said100% (2)

- 9 Lives of Leadership 158 PDFDocument83 pages9 Lives of Leadership 158 PDFflojacoNo ratings yet

- 15 Minutes Guide To Winning PresentationDocument16 pages15 Minutes Guide To Winning Presentationakash1526No ratings yet

- What Is A Japanese Trust and Who Can Conduct Trust Banking in Japan? The Nature of A Japanese TrustDocument7 pagesWhat Is A Japanese Trust and Who Can Conduct Trust Banking in Japan? The Nature of A Japanese TrustaNo ratings yet

- Develop Risk Register 40charsDocument2 pagesDevelop Risk Register 40charspunith1989No ratings yet

- Safekeeping Empowered: Reimagining The Us Custody Business: A Tabb Group Research ReportDocument19 pagesSafekeeping Empowered: Reimagining The Us Custody Business: A Tabb Group Research ReportaNo ratings yet

- ISO 20022 Data Source Schemes (DSS)Document15 pagesISO 20022 Data Source Schemes (DSS)aNo ratings yet

- 2b 2 Examples of RiskDocument2 pages2b 2 Examples of RiskaNo ratings yet

- Custody in 2025 PDFDocument8 pagesCustody in 2025 PDFaNo ratings yet

- Post Trade PDFDocument36 pagesPost Trade PDFGourav Goyel100% (1)

- SADC Payment Integration System Case StudyDocument7 pagesSADC Payment Integration System Case StudyaNo ratings yet

- Custody in 2025 PDFDocument8 pagesCustody in 2025 PDFaNo ratings yet

- African Payment SystemDocument6 pagesAfrican Payment SystemaNo ratings yet

- SADC Payment Integration System Case StudyDocument7 pagesSADC Payment Integration System Case StudyaNo ratings yet

- SADC Payment Integration System Case StudyDocument7 pagesSADC Payment Integration System Case StudyaNo ratings yet

- Comesa Clearing HouseDocument23 pagesComesa Clearing HouseaNo ratings yet

- 2017 10 24 Huge Sponsored Investor Conference at WBS Walter Volker PASA PresentationDocument24 pages2017 10 24 Huge Sponsored Investor Conference at WBS Walter Volker PASA PresentationaNo ratings yet

- 10 1 1 465 4268 PDFDocument15 pages10 1 1 465 4268 PDFaNo ratings yet

- 1C - Modernisation Report PDFDocument20 pages1C - Modernisation Report PDFaNo ratings yet

- SADC Payment Integration System Case StudyDocument7 pagesSADC Payment Integration System Case StudyaNo ratings yet

- John Sebabi Bosco REPSSDocument26 pagesJohn Sebabi Bosco REPSSaNo ratings yet

- Treasury Operations 2016Document4 pagesTreasury Operations 2016Makarand Lonkar0% (1)

- FounderDocument1 pageFounderVishal JadhavNo ratings yet

- Bfsibap PDFDocument6 pagesBfsibap PDFaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Unit 1 Introduction To Cost AccountingDocument4 pagesUnit 1 Introduction To Cost AccountingReema DsouzaNo ratings yet

- Intermediate Accounting 2 Topic: Unearned RevenuesDocument5 pagesIntermediate Accounting 2 Topic: Unearned RevenuesJhazreel BiasuraNo ratings yet

- AAT Paper 2 FinanceDocument4 pagesAAT Paper 2 FinanceRay LaiNo ratings yet

- GS-China Outlook 2023 PDFDocument20 pagesGS-China Outlook 2023 PDFJNo ratings yet

- WRX Body and Paint, Inc.Document4 pagesWRX Body and Paint, Inc.makelipaNo ratings yet

- Acknowledgement Receipt With Memorandum of Agreement (Anacleto C. Carbonel)Document1 pageAcknowledgement Receipt With Memorandum of Agreement (Anacleto C. Carbonel)Christina Pic-it BaguiwanNo ratings yet

- US Internal Revenue Service: f1065sd - 2005Document4 pagesUS Internal Revenue Service: f1065sd - 2005IRSNo ratings yet

- Financial Economic Analysis Shadow Pricing Apr2013 PDFDocument13 pagesFinancial Economic Analysis Shadow Pricing Apr2013 PDFAlfred PatrickNo ratings yet

- The ConstructDocument36 pagesThe Constructjadie aliNo ratings yet

- Nism Series I Currency Derivative Exam WorkbookDocument145 pagesNism Series I Currency Derivative Exam WorkbookChandradeep Reddy TeegalaNo ratings yet

- AM Assignment 1Document16 pagesAM Assignment 1Abhishek gowdaNo ratings yet

- Watchtaxes 2008Document31 pagesWatchtaxes 2008RobertNo ratings yet

- Double Entry Bookkeeping Book PDFDocument2 pagesDouble Entry Bookkeeping Book PDFDeekshant GuptaNo ratings yet

- Analyze Financial Ratios of a CompanyDocument9 pagesAnalyze Financial Ratios of a Companyshameeee67% (3)

- Stamp Duty and Registration Charges in Madhya Pradesh 2023Document1 pageStamp Duty and Registration Charges in Madhya Pradesh 2023kedar.kale1504No ratings yet

- Transcript of Stenographic NotesDocument3 pagesTranscript of Stenographic NotesPaula Bianca Eguia100% (1)

- SOW Form 5 POA Term 2 2020 2021Document9 pagesSOW Form 5 POA Term 2 2020 2021Peta-Gay Brown-JohnsonNo ratings yet

- Bookkeeping Problems Batch 1Document2 pagesBookkeeping Problems Batch 1lanz kristoff racho100% (1)

- Final Accounts ProblemsDocument7 pagesFinal Accounts ProblemsTushar SahuNo ratings yet

- Quiz - Chapter 15 - Ppe Part 1 1Document4 pagesQuiz - Chapter 15 - Ppe Part 1 1Rheu Reyes20% (5)

- CORPORATIONS, ACQUISITIONS, MERGERS AND CONSOLIDATIONSDocument3 pagesCORPORATIONS, ACQUISITIONS, MERGERS AND CONSOLIDATIONSLaurice Claire C. PeñamanteNo ratings yet

- Nomura Correlation PrimerDocument16 pagesNomura Correlation PrimershortmycdsNo ratings yet

- Money and Banking Syllabus (English)Document5 pagesMoney and Banking Syllabus (English)YallyNo ratings yet

- Get Download All Report - 27ADMPJ5260G1ZG - 2023 - 2024Document26 pagesGet Download All Report - 27ADMPJ5260G1ZG - 2023 - 2024ajay.patelNo ratings yet

- Phillips PLL 6e Chap02Document56 pagesPhillips PLL 6e Chap02snsahaNo ratings yet

- Internship Report Comparison Derivatives Equity MarketsDocument2 pagesInternship Report Comparison Derivatives Equity MarketsSupriya TholeteNo ratings yet

- Ratio Analysis of Maruti Suzuki: Prepared & Submitted byDocument18 pagesRatio Analysis of Maruti Suzuki: Prepared & Submitted bymahbobullah rahmaniNo ratings yet

- History - NHMFC PDFDocument2 pagesHistory - NHMFC PDFKaren DalanonNo ratings yet

- FX Market ReflectionDocument1 pageFX Market ReflectionHella Mae RambunayNo ratings yet

- Factors That Affect Cost of Good SoldDocument22 pagesFactors That Affect Cost of Good SoldJoan TiqueNo ratings yet