Professional Documents

Culture Documents

Corp Notes 2

Uploaded by

Matt ToothacreOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corp Notes 2

Uploaded by

Matt ToothacreCopyright:

Available Formats

For whose benefit the corp should be run

Meinhard v. Salmon (NY 1928):

joint adventures owe a duty of loyalty to each other while the enterprise continues and the fiduciary duty

standard is very high. A trustee is held to something stricter than the morals of the market place. Cardozo is saying that this is

the golden rule. Dissent argued this was a joint venture for a limited object to end at a fixed time and Ss second agreement was

completely new and separate from his agreement with M.

Issuance of Common Stock

a. The articles authorize the number of shares

b. Board approves the issuance

c. Need to amend articles if you want to issue more than have been authorized

Corporate Fiduciary Duties

a. Duty of Care

i. Taking care, being prudent and attentive

b. Duty of Loyalty

i. Conflicts of interest, questions of self-interest

c. Business Judgment Rule

i. Judicial presumption if directors have become informed and have rational business interest with

no self-interest, then we will protect their decisions from litigation by this presumption that they

acted in the best interest of the corporation

Timing and Location of Annual Meeting

a. Schnell board learns they might be replaced by shareholders, so amends by-laws to change annual

meeting date

ii. Court says even if following regulations, you cant do things to get inequitable advantage

iii. Key difference is that board set January 11 date, and it was inequitable once changed, should

have not told anyone about date

b. Stahl Stahl owns 30% of shares announces proxy contest and tender offer for other 70%

iv. Board moves meeting date to find other buyers

v. They set record date for mid-may because they obviously read Schnell and dont want to be

seen as inequitable

vi. Held that it was not inequitable because no date was set and no proxies solicited

Internal Affairs Doctrine

law of state which business incorporated governs the internal affairs, even if law conflicts with state where corp is

headquartered or does substantial business in

i. Internal affairs the matters peculiar to the relationships among the corporation and its officers, directors, and

shareholders.

1. i.e. right of shareholders to vote, to receive distributions of corporate property, to receive info from

management about corporate affairs, to limit powers of corporation to specified activities and to bring suit

on behalf of corp when managers wont

ii. External affairs generally governed by the law where the activities occur and by federal and state regulatory

statutes

McDermott Inc. v. Lewis

1. Whether a Delaware subsidiary of a Panamanian corporation may vote the shares it holds its parent

company under circumstances prohibited by Delaware law

1. HELD: the law of Panama should apply to the internal affairs of the company incorporated in Panama

2. We always apply the law where the piece of paper is filed because internal affairs is so important

State Regulation of Pseudo-Foreign Corporations

b. California

i. Pseudo-Foreign Corporation corporation incorporated outside the state, but conducting most

business and having most shareholders in the state

ii. CA has separate class voting

iii. Cal. Corp. Code section 2115

1. CA Approach for Pseudo-Foreign Corporations

a. Cal. Corp. Code 2115: where a corp. isnt incorporated in CA but has at least 1%

of its property, sales, payroll, and outstanding voting shares in CA, then CA law will

apply regardless of the state of incorporation.

b. NOTE: Section doesnt apply to public corporations whose shares are traded on a

national exchange (NYSE or Nasdaq National Market)

2. Wilson v. Louisiana-Pacific Resources, Inc. (CA 1982): CA can constitutionally impose its law

requiring cumulative voting by SHs upon a corp. which is domiciled elsewhere but whose

contacts with CA are greater than those with any other jurisdiction. CA court said that the

potential for conflict resulting from the statute was substantially minimized by the nature of

the criteria specified in 2115. If every state adopted this statute, there would be no conflict

so the potential for conflict was purely speculative.

iv. Final Question: Company ABC issued 500 shares, you shareholder has 80, 5 directors, cumulative

voting, how many votes do you get total? 80 x 5=400, multiply by number of directors

c. Delaware

i. The internal affairs doctrine is mandated by constitutional principles except in the rarest situations

when the law of the state of incorporation is inconsistent with national policy on foreign or interstate

commerce.

ii. VantagePoint Venture Partners 1996 v. Examen, Inc. (Del. 2005): Issue was whether to apply DE law

(state of incorporation) or CA law (state where business had most of its operations and SHs) as a

matter of choice of law and constitutional law. Court said that the internal affairs doctrine reflects

long-standing choice of law principle that one states laws should regulate the corporations internal

affairs. Pursuant to the 14th, officers have a right to know which law will be applied to their actions and

SHs have a right to know what standards of accountability apply to officers. Under the Commerce

Clause, a state has no interest in regulating the internal affairs of foreign corporations (corps.

incorporated in other states)

iii. DE uses single class voting

Vertical Federalism: Federal View of Corporate Law

d. State Antitakeover Regulation

e. First generation states respond to threat of tender offer

i. Designed to protect corporations conducting business in the state from takeover bids opposed by

management. Laws gave state regulators the power to decide if tender offers could be made to

residents in their states.

ii. Edgar v. MITE (1982) problem was Illinois was trying to impose restrictions that touch Illinois,

but where paper is filed somewhere else, SC says no this creates constitutional confusion, whos

law applies?

f. Second Generation internal affairs of domestic corps

i. CTS v. Dynamics (1987) Indiana statute for Indiana corps.

1. CTS announced tender offer and IN statute permitted the control share law as a

defense, which was designed to deter coercive takeover bids. Court said that the

federal courts should refrain from regulating internal affairs of U.S. corporations unless

a federal statue applied and required a different result. Court said the statute violated

the Dormant Commerce Clause because it was preempted.

g. Third Generation laws provided even more protection against takeovers

i. Courts have struck down all third generation laws that regulate takeover bids directed at foreign

corps. under the Commerce Clause reasoning that they create the risk of inconsistent state

regulation.

h. Delawares Antitakeover Law

i. relatively mild; imposed a 3-year moratorium on any merger by the target corp. after a hostile

takeover, unless the bidder acquired 85% control in the initial tender offer. Effect was to force

bidders to offer significant premiums for shares in a tender offer to reach the 85% threshold, or

simply wait 3 years before consolidating control in a merger. NOTE: this law has been upheld as

applicable to DE corps. without regard to where the corp. does business or where its SHs reside.

Chapter 4 Corporate Social Responsibility

A. Who Does the Corporation Serve? For whose benefit should the corporation be run?

a. Corporation as Private Property Shareholder Primacy

i. Berle and Friedman

1. Goal is strictly to maximize profits for SHs; legal system can stop corp. from doing something

bad

2. Friedman argued that nothing could be more subversive to the idea of capitalism than to

suggest that executives have a purpose other than maximizing profits

3. By promoting self-interests, the corp. is inadvertently promoting the good of the public as

well.

b. CSR in Context

Dodge v. Ford Motor Co.

1. Ford is lowering the price of cars, making them better, and increasing sales annually

wanted to benefit workers and society

2. Henry Ford plans to use money to reinvest, in 1916 starts withholding special dividends

3. Dodge brothers own 10% of the company, now stop receiving dividends

4. Court says a business corporation is organized and carried on primarily for the profit of

stockholders, so Ford required to pay special dividend

5. The judges are not business experts

6. Now, companies have discretion with dividends

c. Corporate Charitable Giving

i. Courts have generally accepted that corps. have implicit powers to make charitable gifts that in the

longrun may benefit the corp.

ii. Most state statutes specifically allow corps. to make charitable donations for the public welfare or for

charitable, scientific or educational purposes. (MBCA 3.02(13))

iii. Internal Revenue Code 170: allows corporations to deduct charitable contributions, but total

deductions for a taxable year cant exceed 10% of TPs taxable income.

iv. Managers have broad discretion over charitable contributions because theyre generally not required

to disclose them to SHs.

Theodora Holding Corp v. Henderson

1. Court held that the test to apply in assessing the validity of a corporate gift is

reasonableness. The foundation Henderson wants to donate to is a legitimate charitable

trust. Small loss through donation is far outweighed by the overall benefits of the gift.

2. Not giving away all profits, not a foolish move look at reasonableness

a. AP Smith Manufacturing v. Barlow

i. Rationale: Princeton, youre gonna give money to Princeton, thats fine,

held that it advanced companys long run business

b. 2 Views on Corporate Charitable Contributions

i. Shareholder Primacy View:

1. Good for SHs because its good public relations, OR

2. This is throwing money away; only support directors pet

charities; only donate so officers get invitedto events

ii. CSR View: good for society; without corporate charity we wouldnt have

things like museums, theaters, etc.

c. Problems

i. If your charity choices are self-dealing

ii. Shareholders being able to choose beneficiaries

iii. Disclosure of corporate gifts

Chapter 5 Corporation as Political Actor

A. The world before Citizens United

a. Corporation as constitutional person

i. Corporations have many uncontroversial rights, it is uncontroversial that they are a person, but

they also are not a person in many ways

ii. Two areas:

1. Contribution

a. Give cash to campaign

2. Expenditure

b. Pre-Citizens United Case law

First National Bank of Boston v. Bellotti (1978)

1. Ban on banks giving money to support a referendum

2. Overturned, pro free speech

Federal Election Commn v. Massachusetts Citizens (1986)

3. Held that states could not ban political advocacy by non-profit corporations

4. Fed ban against independent expenditure by an advocacy nonprofit was unconst.

Because such nonprofits are formed for the express purpose of promoting political ideas

and are supported entirely by individuals because nonprofit used own funds and not a

PAC

Austin v. Michigan Chamber of Commerce (1990)

5. Ban on Corporate contributions on state elections

6. Upheld, regulation needed to avoid corrosive and distorting effect of immense

aggregations of wealth through corporations

B. Courts decision in Citizens United

Citizens United v. Federal Election Commission

i. Statute 441b was outright ban

ii. Kennedy Three Rationales

1. Anti-distortion

a. Brought up in Austin

b. Attempts to protect public from corporations having advantage over other

corporations

c. Concern is that some corporations will distort reality through power and

influence

2. Corruption

3. Compelled Speech

Expenditures v. Contributions

a. Court decided the government may not, under the First Amendment, suppress

political speech on the basis of the speakers corporate identity, overruling

Austin

b. Court decided the disclaimer and disclosure provision of Bipartisan Campaign

Reform Act of 2002 did not violate first amendment, as applied to a nonprofit

corporations documentary and advertisements for the documentary

4. What kind of person is the corporation? Various views by court

a. As a creature of state law (concession theory)

b. As a distinct legal entity separate from the incorporation state and its

shareholders (natural rights theory)

c. As a set of voluntary relationships among its participants (aggregation theory)

i.e. Citizens United

Hobby Lobby Case

d. Held that closely-held, not public, for profit corporations need not follow the

ACA contraceptive mandate

e. For-profit corporations are persons under RFA

f. Case distinguished closely-held from public corporations

Chapter 6 Organizational Choices

A. Alphabet Soup

a. Really only two choices for most

i. LLC Limited Liability Corp

1. Well grab default rules from partnership and C corp to make an LLC

ii. S Corp Section S

b. Polar opposites

i. Partnership and C Corp

ii. Default rules

1. Partnership is more about equality

a. Unlimited liability

2. Corporation is about separation of ownership and control

a. Limited liability

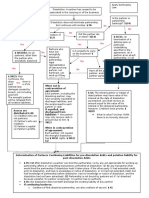

B. Form Formation Liability Voting Management Financial Tax Continuity/ Change

Rights Liquidity

GP Association* GP = Equal Equal/agent Equal share Pass No All

Filing LLP unlimited* of profits through (withdraw) agree

agreement* LLP =

limited

LP Filing Limited Agreement Limited Share Pass Limited All

agreement* partner = partner = distributions through partner = yes agree

limited limited based on Genera

General General contribution partner = no

partner = partner = (withdraw)

unlimited manage

LLLP =

limited

C Corp. Filing Limited Directors* Board Dividends Business Yes (public- Board +

bylaws* (PCV*) Fundamental (public- (per share) income* held) SH

tx* held*) majority

(public-

held*)

S Corp. Filing Limited Directors Board Dividends Pass No Board +

(closely held) agreement* (PCV*) Fundamental (salaries) through (agreement) SH

tx majority

LLC: Member- Filing Limited Equal Equal/agent Equal Pass No (withdraw All

Managed agreement* (PCV*) distributions through management) agree

LLC: Manager- Filing Limited Equal Manager Equal Pass No (withdraw All

Managed agreement* (PCV*) distributions through management) agree

* = Mandatory (anything else, you can contract out of)

Chapter 7 Forming the Corporation

A. Process of Incorporation

a. Formal Requirements

i. Choose the state

ii. Read statute Ca Corp Code 202

iii. Use standard forms

iv. Pay filing fee, franchise tax

v. Exculpation: Ca Corp Code 204(a)(10) to the fullest extent permitted by law, no director of the

corporation shall be personally liable for monetary damages for breach of fiduciary duty as

director as a matter of law that directors will not pay for breach of their fiduciary duty

vi. Delaware exculpation is 102(b)(7) need to know this

vii. Exceptions for stealing, intentionally inflicting harm, intentionally violating criminal law,

Incorporation is easy and is formally accomplished by an incorporator

The incorporator signs and files the articles of incorporation with the Secretary of State

viii. MBCA 2.02 Articles of Incorporation

o Under most statutes articles must include:

Name of corporation

Number of shares it is authorized to issue

Name and address of each incorporator

The name and address of the corporations registered office and agent

o The MBCA says articles can include

Exculpation clause to limit the personal liability of directors to the

corporation or its shareholders

Indemnification provisions obligate corp to reimburse directors for any

personal liability to third parties connected with their service

ix. MBCA 2.05 Organization of Incorporation

After corp comes into legal existence, an organizational meeting must be held

o Election of directors

o Adoption of bylaws

o Appointment of officers

o Designation of bank for corp funds

o Approval of sale of stock to initial stockholders

o Minutes are taken, can be edited so as not to include troubling items

key point you need minutes to support all of the bullets above

B. Corporate Powers (and the Ultra Vires Doctrine)

a. Beyond the power a corp could not engage in activities outside the scope of its defined purpose

b. unnecessary today because MBCA 3.01(a) says every corp has purpose of engaging in any lawful business

unless a more limited purpose is set forth in the articles of incorporation

c. Does it still have any relevance then?

i. Yes, in a close corp, where investors may want to limit scope of corps business and thus limit

management discretion, its possible to limit corps purpose and power in articles

d. MBCA 2.03 Incorporation

C. Defective Incorporation

a. Both Parties Know There Is No Corporation

i. When a promoter contracts for the benefit of a corp that is contemplated but not yet organized,

he is personally liable on the contract in the absence of an agreement otherwise

ii. The promoter is not discharged from liability simple because the corporation is later organized

and receives the benefits of the contract, even where the corp adopts the contract

iii. Parties may agree to discharge promoters liability, but must be novation once corp is formed and

formally accepts contract

iv. The question is one of intent:

1. Form of signature did promoter sign as agent of corporation?

2. Actions of third party did third party plan to look only to corp for performance?

3. Partial performance did promoters partial performance of contact indicate an intent

to be held personally liable?

4. Novation did action taken by parties discharge promoters liability?

b. Both Parties Mistakenly Believe Corporation Exists

i. When both parties mistakenly deal with each other on assumption a corp exists, courts developed

doctrines that supply limited liability to party purporting to act for the nonexistent corp

ii. De Facto Corp courts infer limited liability if:

1. The promoters in the would-be corp made a good faith effort to incorporate;

2. The promoters were unaware that the incorporation had not happened; and

3. The promoters used the corporate form in a transaction with a third party

iii. Corporation by Estoppel

1. Courts prevent third party from asserting promoters personal liability when the third

party had dealt with the business on the assumption the only recourse would be against

business assets

iv. Professor cant tell difference

1. Both involve third party going after promoter

2. De facto looks at promoters actions

3. Estoppel focused more on third partys behavior

v. MBCA 2.04 Liability for Pre-Incorporation Transactions

1. All persons purporting to act as or on behalf of a corp, knowing there was no

incorporation under the act, are jointly and severally liable for all liabilities created while

so acting

2. Strongest factual pattern for immunizing participants from personal liability occurs in

cases in which the participant/promoter honestly and reasonably but erroneously

believed the articles had been filed

3. Sometimes allowed for escaping liability when participant mails articles of incorporation

and the letter is delayed or the SoS refuses to file them

Chapter 8 Actions Binding the Corporation

MBCA 8.01 Requirements for and Functions of Board of Directors

o all corporate powers are exercise by/under authority of the board of directors

o the corporations business and affairs are managed by/under the direction of/subject to oversight by board

of directors

o any power exercised by officers derives from the legal power assigned by the board of directors

o shareholders have no power to bind the corp

A. Board Delegation of Authority to Corporate Executives

a. Basic Agency Concepts

i. Agent authority

1. Actual authority (express)

a. Andrew sell my horse for $2000

b. words or conduct that says what principal wants

c. look at what principal says or conducts to agent

d. will come from the board in corp law

2. Actual authority (Implied)

a. Nice sale, Andrew. Have you found other buyers?

b. whats implied from the words and conduct

c. still look at from agency principal relationship, not third party

3. Apparent authority

a. Mr. Jones, this is my trusted agent, Andrew, deal with him

b. adds in the right hand side of the triangle, the third party and what is

reasonable to them

c. principle must do or say something that induces third party to believe

principal gave authority to agent

d. need apparent authority when you dont have actual

e. question is: did third party reasonably believe that principal gave authority?

4. Inherent authority- largest circle

a. Andrew, Ive always trusted you. Run the stables for me

b. is there something inherent in the office or role that the individual agent holds

5. Ratification smallest circle

a. I didnt expect him to sell Secretariat, but what the hell, its ok

b. dont want to rely on, requires everyone to agree

b. Authority of Corporate Officers

i. Lee v. Jenkins Brothers

1. Lee was promised a pension by Yardley, President of Jenkins, when he joined the

company. Yardley said, if you come with us, the company will pay you a pension when

you reach age 60 of your salary, that is $1,500/year. 2d Circuit said apparent authority

depends on the nature of the contract involved, the officer negotiating it, the usual

manner of conducting business, the size of the corp. and number of SHs, circumstances,

reasonableness of contract, amount involved, and who contracting third party is. These

all factor into whether the transaction is ordinary or extraordinary.

2. In a transaction that is extraordinary, the corp can be bound only if there is actual

authority

ii. Agency law comes from Restatement, private law, and court-made law

iii. Menard, Inc. v. Dage-MTI, Inc.

1. Court held that President had inherent authority to bind the corporation despite

everyones knowledge that Board didnt approve and approval was required because

Presidents actions were within the usual and ordinary scope of his authority, Menard

reasonably believed President was authorized to contract for the sale/purchase of real

estate even though Menard knew the sale required Board approval, and Menard had no

notice that he Board had limited Presidents authority with respect to the real estate.

Dissent argued that the court made it more difficult for lawyers to advise their clients.

B. Formalities of Board Action

a. Board Action at a Meeting

i. General Rule: Board must meet to formally act and bind the corp.

1. Exceptions:

a. Corporations

b. Unanimous director approval

c. Emergencyboard must act quickly to prevent great harm or to take

advantage of a great opportunity

d. Unanimous SH Approval

e. Majority SH-Director Approval

f. MBCA 8.21: allows board action without a meeting on the unanimous

written consent of directors

b. Board takes formal action by voting

i. Each director has one vote and cant vote by proxy

ii. There must be quorum at the meeting and a majority of quorum is required to pass a resolution

c. MBCA 8.20(b) : board can conduct a meeting by any means of communication by which all directors

participating may simultaneously hear each other during the meeting

d. Notice and Quorom

i. Notice

1. For special meetings, must give 2-days notice of the date, time, and place of the

meeting unless articles or bylaws impose different requirements. (MBCA 8.22(b))

2. For regular meetings, directors are assumed to know the schedule and no notice is

required.

3. If a director doesnt receive proper notice, he may waive notice by:

a. Signing a waiver before or after the meeting, OR

b. Attending or participating in the meeting and not protesting the absence of

notice. (MBCA 8.23)

c. NOTE: director who attends solely to protest the manner in which the meeting

was convened isnt deemed to have waived notice.

ii. Quorum

1. Must have quorum at meeting for formal action to be taken (action without quorum is

invalid)

2. Quorum requirements preclude action by minority of directors

3. Statutory norm for a quorum is a majority of the total number of directors.

Articles/bylaws may increase or decrease this but it cannot be less than 1/3 of the

board. (MBCA 8.24)

e. Committees of the Board

i. Board can delegate board functions to smaller committees

1. Committee may be permanent or temporary; can be active or passive

ii. Duties that cant be delegated:

1. Authorizing distributions

2. Authorizing share repurchases

3. Issuing shares

4. Approving mergers

5. Amending the articles

6. Amending the bylaws

7. Making other fundamental corp. changes

C. Legal Opinions

a. Legal opinions typically address matters such as the corp.s existence, its good standing under state

corporate law, its power to enter into a transaction, and the corporate officials authority to act on behalf of

the corp.

b. Types of Opinions

i. Unqualified Opinions: apply law to facts and reach a clear legal conclusion free from doubt

ii. Qualified Opinions: contain exceptions or limitations that arent customary for the particular type

of opinion.

iii. Reasoned Opinions: include lawyers reasoning along with stating legal conclusions; advisable

when the law or facts are unclear or reasonable arguments might lead to different interpretations

CHAPTER 11. PIERCING THE CORPORATE VEIL

2. If Contract setting, then all parties have a chance to negotiate about the gift of limited liability, so

more likely to PCV

b. Factors to Consider:

i. Formalities Whether insider failed to observe corporate formalities

I. Seen as injustice to let them hide behind the corporate form if person doesnt respect the corporate

form

II. Lack of corporate formalities may indicate that insiders were indifferent about corp.s obligations

to outsiders.

ii. Fraudwhether creditor was defrauded/deceived into the agreement

I. Deception prevents injured parties from protecting themselves in advance

c. Freeman v. Complex Computing Co. (2d 1997): Glazier is an independent contractor for C3.

Court said that Glazier is in control of the company but Freeman failed to show that Glazier used this

control to wrong Freemaninsufficient allegations of fraud. NOTE: on remand, court PCV.

Only $10k dollars in company, had option to own for virtually nothing,

d. Theberge v. Darbro, Inc. (Maine 1996): W owes T $180K. Darbro is owned by Smalls.

i. Formalities Factor: no separate offices, no corporate records, no corporate meetings, etc.

ii. Fraud Factor: Ps were sophisticated real estate professional who understood the risks involved; Ps

didnt seek personal guarantee from Ds; it was no secret that Horton was a shell so nothing was

illegal about that; the bank lent money to Horton and knew enough to get a personal guarantee

showing that Ps had a chance to do the same but didnt

iii. Holding: Court refused to PCV

e. Corporate Group Setting Contract Case (Parent-Subsidiary)

i. Types of Cases:

I. Parent-SubsidiaryP seeks assets of parent to satisfy judgment for damages caused by subsidiary

II. One corp. owns stock of many corps., all of which are subs of the parent and affiliates of each

otherP tries to recover from affiliates if neither corp. that caused the injury nor the parent has

sufficient assets

ii. Alter Ego Doctrine: allows liability of corp. for acts of another corp. when subject corp. is organized

or operated as a mere tool or business conduit. (if alter ego, then PCV)

I. Need evidence showing blending of identities or blurring of lines between the corps.

II. Undercapitalization as an indication of alter ego/mere conduit

iii. Single Enterprise Doctrine: when corps. arent operated as separate entities but integrate resources

to achieve common business purpose, each corp. may be liable for debts incurred in pursuit of that

business purpose. Applies when corporate form is used as part of unfair device to achieve an

inequitable result.

iv. OTR Associates v. IBC Services, Inc. (NJ 2002): P-OTR = limited partner who owns a shopping mall in

NJ. Blimpie is a parent corp. with 2 subsSamyrna and IBC. OTR leased to IBC and IBC subleased to

Samyrna (IBC was created by Blimpie for this purpose). IBC stopped paying rent, so OTR sued

Blimpie for unpaid rents. Court held that Blimpie was liable and PCV, justification for holding parent

liable for debt incurred by its sub because:

I. Alter EgoIBC was formed solely to hold the lease for Samyrna, IBC had no assets other than the

lease, it had no premises, it had no income other than rent payments, it had no employees/staff;

it was merely a conduit/alter ego for the parent.

II. FraudPs were never told they were dealing with someone other than Blimpie, Blimpie

intentionally and affirmatively led P to believe it was dealing with Blimpie, Blimpie abused

privilege by using IBC to commit fraud

3. If Tort setting, then parties had no opportunity to negotiate the gift of limited liability, so less likely to

PCV

a. Factors to Consider:

i. Undercapitalization

I. If insiders didnt adequately capitalize the business, then courts more likely to PCV because courts

are reluctant to allow insiders to externalize the risks of business

a lot of focus on balance sheet or insurance for undercapitalization

ii. Domination and Control

I. Whether insiders commingled business and personal assets

A. Sign that insiders didnt respect the corporate form and creditors may have been confused

II. Whether D actively participated in the business

A. If actively participated then more likely to PCV; if not, less likely because Ds less likely to have

acted to disadvantage creditors

B. Did you control of much of the corporation that its really you?

c. Walkovsky v. Carlston (NY 1966): P sued D for personal injury in car crash. D-Carlton is a SH in 10 corps.

Court said you need something substantial to PCV and nothing substantial in this case.

d. Radaszewski v. Telecom Corp. (U.S. 1993): A motorcycle was hit by a truck driven by a Contrux

employee. The Court refused to PCV. Court held that Ds decision with the insurance company was an error in

business judgment rather than fraud and limited liability is meant to protect against such errors in business

judgment.

e. Corporate Group Setting Tort Case

i. Types of Cases:

I. Parent-SubsidiaryP seeks assets of parent to satisfy judgment for damages caused by subsidiary

II. One corp. owns stock of many corps., all of which are subs of the parent and affiliates of each

otherP tries to recover from affiliates if neither corp. that caused the injury nor the parent has

sufficient assets

ii. Alter Ego Doctrine: allows liability of corp. for acts of another corp. when subject corp. is organized

or operated as a mere tool or business conduit. (if alter ego, then PCV)

I. Need evidence showing blending of identities or blurring of lines between the corps.

II. Undercapitalization as an indication of alter ego/mere conduit

iii. Single Enterprise Doctrine: when corps. arent operated as separate entities but integrate resources

to achieve common business purpose, each corp. may be liable for debts incurred in pursuit of that

business purpose. Applies when corporate form is used as part of unfair device to achieve an

inequitable result.

iv. Gardemal v. Westin Hotel Co. (5th 1999): P sued D-Westin and D-Westin Mexico alleging that they

were liable for her husbands drowning death in Cabo San Lucas. Court refused to

PCV. Court said that nothing suggested an alter ego (i.e. D-Westin Mexico had its own insurance

policies, its own formalities, etc.), there was only scant evidence of undercapitalization and the facts

just show a typical working relationship.

4. Other Factors to Consider in Deciding Whether to PCV

a. Whether the corporation is closely-held or publicly-held

i. If closely-held, more likely to PCVclose corp. SH-managers typically have more to gain personally be

taking risks that shift losses to creditors than those of publicly-held corps.

D. ALTERNATIVE EXCEPTIONS TO LIMITED LIABILITY (OTHER THAN PCV)

1. Fraudulent Conveyance Doctrine

a. Allows courts to set aside transactions that defraud creditors

b. Uniform Fraudulent Conveyance Act (UFCA): protects creditors from

i. Transfers with intent to defraud creditors

I. Requires the court to find actual intent by the debtor to hinder, delay, or defraud

ii. Transfers that constructively defraud creditors

I. Shown if debtor makes a transfer while insolvent or near insolvency (if transfer lacks fair

consideration)

c. UFCA Limitations:

i. UCFA requires specific finding of fraudulent transaction which may be difficult to establish

particularly when theres lack of corporate formalities

ii. UFCA only allows court to set aside specific fraudulent conveyances which may not satisfy

a creditors entire claim (unlike PCV which allows unlimited liability on shareholders)

2. Equitable Subordination Doctrine

a. Allows courts to set aside transactions that defraud creditors

b. Only applicable in federal bankruptcy proceedings

c. Doctrine pushes to the back of the line some creditors claims (typically those of corporate

insiders) to reach an equitable result (called subordination). Allows outside creditors to get

paid before insiders.

d. To invoke the doctrine, must show:

i. Fraudulent conduct,

ii. Mismanagement, OR

iii. Inadequate capitalization.

e. Limitations:

i. Doctrine doesnt increase the overall size of the pie available to creditors

ii. It doesnt hold shareholders personally liable for corporate obligations

Chapter 14 - SHAREHOLDER Voting Rights

- Rights of shareholders

o Vote, Sue, Sell, Yell

- Corporate Combinations

o Statutory merger

P and T vote, there are appraisal rights except P under new MBCA and if market out

o Triangular merger (MBCA share exchange)

Only T votes except P votes under new MBCA

o Asset sale

Only T votes except P votes under new MBCA

No appraisal for T in Delaware

P (surviving corporation) T (acquired corporation)

Vote Appraisal Vote Appraisal

Statutory merger

MBCA (rev) Y N Y Y*

MBCA (pre-99) Y Y Y Y

DGCL Y Y* Y Y*

Triangular merger

MBCA (rev) Y N Y Y*

MBCA (pre-99) N N Y Y

DGCL N N Y Y*

Sale of assets

MBCA (rev) Y N Y Y*

MBCA (pre-99) N N Y Y

DGCL N N Y N

= Unless market out exception applies

o Shareholder Power to Initiate Changes

S/H recommendations

Reinstate former President

Auer v. Dressel - P-SHs brought an action for an order to compel the corp. President to call a special SH

meeting. Court held that SHs approval of Auer wouldnt be able to directly effect that change but

there was nothing invalid in their expressing themselves and giving notice to the directors.

By-law amendments

Limit takeover defenses

SHs have to submit any proposals they want in the bylaws in advance of the meeting date so the board

can prepare (advance notice)

CA, Inc. v. AFSCME Employees Pension Plan (Del. 2008): AFSCME proposed a bylaw to reimburse

election expenses. CA wanted to exclude a bylaw so it asked for a no action letter from the SEC when

CA excludes it. Court held that the proposed bylaw were a proper subject because they related to

process and would facilitate SH rights.

Removal and replacement of directors

Fill vacancies or new positions

Removal for cause

DGCL 141(k). Any director or the entire board can be removed with or without cause by majority SHs

o Exceptions:

o If corp.s board is classified, SHs can remove only for cause, unless articles say otherwise

o If the corp. has cumulative voting have to show cause if trying to take out a minority director

who was elected through cumulative voting.

o NOTE: Cumulative votingyou get extra votes and minorities can get a minority director in

Campbell v. Loews, Inc. (Del. 1957): 2 factions wanted control of the boardVogel and Tomlinson.

o Court held that SHs have inherent power to remove directors for cause even where theres a

provision for cumulative voting. Must give notice of charges and opportunity to defend.

o Board Respnds to Shareholder Initiatives

Blasius

9% SH wants restructuring

Board amends bylaws to increase board size

Need compelling justification

Quickturn

Mentor offers 50% premium

Board amended (1) 10% special meeting and (2) pill

Delayed Redemption Provision violates law

Chapter 14 - SHAREHOLDER Voting Rights

- SH inspection rights

o Proper purpose

o Standing

o DGCL 220. Inspection of Books and Records

Upon written demand

Under oath

Stating the purpose

Any SH has the right to inspect for any proper purpose and make copies and extracts during the

usual business hours from:

Corp.s stock ledger, list of SHs, and other books and records, and

Subsidiarys books and records

NOTE: MBCA says articles, bylaws, and meeting minutes are available as a matter of

right

Where SH seeks a list of SHs, the burden of proof shifts to the corp. to establish that SHs purpose

is improper

Proper Purpose = a purpose reasonably related to such persons interest as a SH

State ex rel. Pillsbury v. Honeywell, Inc. (Minn. 1971): Pillsbury wanted to stop

production by Honeywell of certain bombs used in Vietnam. He bought 100 shares for

the sole purpose of gaining a voice in Honeywells affairs and then requested a list of

SHs to solicit proxies for election of new directors. Court held that Pillsburys purpose

was improper.

NOTE: Pillsbury should have (1) bought shares, (2) had documentation showing that

he researched the company/had an interest in it, (3) showed the company how to

achieve his goal through the idea of wealth maximization, reframe moral issue as

economic one

Saito v. McKesson HBOC, Inc. (Del. 2002): McKesson entered merger agreement with

HBOC. 3 days later, Saito bought McKesson stock. Months later the merger was

consummated. Court held that Saitos stated purposeto ferret out possible

wrongdoing in connection with the mergerwas proper because it was reasonably

related to his interest as a SH.

o b. To sue, SH must have been SH at the time of wrongdoing and must continue to be one.

o c. To have inspection rights, standing is irrelevant.

- Ex ante information rights

o Information required for SH voting

o State Lawrequires notice of meetings and Del. requires disclosure (can sue under state law if no

notice/not enough info. for voting)

o Federal Law

Schedule 14A (Proxy Statement): Public companies must disclose material info. about the vote

when there is a vote; detailed documents must describe the board candidates and matters on

which SHs will vote

If SHs are asked to vote, SHS must receive a proxy card with specified format and voting options

- Ex post information rights

o Regulation of proxy fraud

o Rule 14a-9 (Proxy Fraud): Implied right of action when a proxy statement is:

False or misleading

With respect to a material fact

Material fact = substantial likelihood that a reasonable SH would consider it important

in decidinghow to vote

Statement of opinion/belief is material if the subject matter was false and maker

couldnt reasonably have believed it was true

Mental statevague and undecided but somewhere near negligence

Reliancepresumed

Causing loss to P

Attorney Feescourt may compel corp. to pay attorney fees

- Shareholder lists

o NOBO/CEDE lists

DE- only gives CEDE

NY- both!

o Sadler

Chapter 16 Public Shareholder Activism

- Legal Limits on SH Activism

o State Law

No reimbursement rule for election-related expenses of SHs

This chills SH activism

Insurgents must use their own funds to finance a proxy contest and

can only recover if they win so the rule basically gives financial

control over voting to incumbent management

Rosenfeld v. Fairchild Engine & Airplane Corp. (NY 1955): P-attorney SH owns tiny amount of stock

and sued to compel return of money paid out of the corporate treasure to reimburse both sides in

a proxy contest for their expenses. Court said that when SHs win, theyre reimbursed but when

they lose they arent. The Board is reimbursed whether it wins or loses. The rule is meant to

deter vexatious SH activism so SHs will be more careful about their decision to fight.

o Federal Law

Imposes burdensome and expensive requirements on insurgents organizing a proxy contest

Basic disclosure: proxy statement must be filed with SEC, sent to all SHs whose votes are being

solicited, and must be submitted to SEC for pre-approval.

SEC Rule 14a-1: proxy solicitation = seeking a vote

Rule 14a-7: if youre explicitly not part of the proxy process then safe harbor for SH

communications

Rule 14a-3: proxy statement requirements dont apply to speeches in public forums, press

releases broadcast opinions, etc.

Long Island Lighting Co. v. Barbash (2d 1985): Group published a newspaper ad accusing LILCO of

mismanagement and urging support for LILCO being acquired for public power authority. Court

held that the test is whether the challenged communication, under TOTC, is reasonably

calculated to influence SH votes, which depends on the nature of the communications and the

circumstances of its distribution.

6. SEC SH Proposal Rule

a. Proposal Rule: any SH who meets the ownership requirements of the rules and submits a proposal in a

timely fashion and proper form can have the proposal included in the companys proxy materials for a

vote at the SH annual meeting

b. Who can submit a proposalSH who holds at least 1% of $2,000 worth of voting shares for at least one

year and continues to hold them, and is present at meeting

f. If youve complied with all the requirements, your proposal may still be excluded under 14a-8:

i. (1) Improper purpose/subjectnot a proper subject for action by SHs

ii. (5) Relevanceproposal relates to operations which:

I. Account for less than 5% of the companys total assets for most recent fiscal year,

II. Account for less than 5% of its net earnings and gross sales for most recent fiscal year and

III. Arent otherwise significantly related to companys business

IV. Lovenheim v. Iroquois Brands, Ltd. (DC 1985): SEC gave a no-action letter so D excluded proxy

statement and P challenged that. Court held that the proxy statement had to be included under

the otherwise significantly related portion because the SEC had previously said it doesnt hinge

solely on economic relativity of the proposal, its not limited to economic significance.

P with 200 shares. Company picks (5) relevance to argue under because Foie Gras sales are tiny part of

business. (5) doesnt work because it doesnt have to be economic interest can be otherwise significantly

related

iii. (7) Management functionsproposal deals with matters relating to companys ordinary business

operations

I. Sometimes includes matters with significant policy, economic, or other implications inherent in

them.

Ii. Medical Committee Napalm Case: group wanted to end manufacture of napalm for use in

Vietnam War by Dow Chemical. Napalm production was small and not very profitable part of

Dows business but was important to war effort so Dow defended its production. Group

submitted SH proposal requesting amendment to bylaws to bar sale o napalm unless purchaser

gave assurances to not use it on humans. Dow refused to include the proxy statement. Court

held that Dow must include it. The overriding purpose of the rule is to ensure SH ability to

exercise their rights to control important decisions that affect them.

iv. (8) Relates to an electionproposal directly conflicts with companys own proposals to be

submitted at the same meeting

I. AFSCME Case: AFSCME lobbies for rule so SEC proposes 14a-11. Rule gives SHs more access to

director nomination practice and sparks debate. AFSCME brings suit against AIG to require

company to include proxy proposal in next statement and AIG tries to exclude it under (9). Court

says dont defer to SEC; you can exclude if immediate election contest because triggers a

different rule that covers that but not if its general process type proposal.

Chapter 17 Shareholder Litigation

- Derivative

o A suit in equity to compel corp. to sue TP, S/H loss derives from loss to corp.

o Corp. is nominal defendant, true defendants are D&Os and controlling SHs

o Higher bar in Delaware: continuous ownership and demand requirement

- Direct

o Direct loss to SH

o Can be class action

o No demand requirement

- To decide whether Derivative or Direct Tooley v. DLJ

o Facts: Credit Suisse buys DLJ, but delays

DLJ minority SHs sue for lost time value

Previous cases said look to special injury (if delay affects all equally, then derivative)

o New Delaware approach

Who suffered harm, corp or individual SHs?

Who would receive benefit of recovery?

- Demand Requirement

o If P makes demand, BJR applies

o If P does not make demand:

If demand is required, suit is barred

If demand is excused, suit proceeds

In a demand excused case, the analysis depends on whether there is an SLC

If SLC, go to Einhorn/Zapata. If no SLC, directors are presumed independent, Part II.

Aronson test in Delaware: Demand is excused when P establishes reasonable doubt

about:

o Whether directors are disinterested and independent

o Whether the challenged transaction was the product of a valid exercise of

business judgment

Chapter 18 Board Decision-Making

- BJR Revisited

o Duties of care and loyalty

- BJR Applies unless:

o Waste: the corp. is doing something thats completely wasteful, there are no benefits to the corp.

Aronson v. Lewis: Sub Meyers approved a lucrative compensation plan for outgoing director Fink

for consulting fees. SHs challenged the package as waste. Ps didnt make a pre-suit demand

claiming it to be futile.

Lewis v. Vogelstein: SHs asked to approve a stock option compensation plan for directors. SHs

alleged that their approval wasnt valid because there was a lack of disclosure about the value of

the granted stock options. Court said that where the corp. receives any substantial consideration

and theres good faith judgment under the circumstances, theres no waste. Waste can only be

approved by a unanimous vote of the SHs.

o Gross Negligence (see also Malfeasance and Oversight)

Smith v. Van Gorkom (Del. 1985): The company had financial problems relating to investment tax

creditors. Van Gorkom met with someone to consider the problem and they discussed selling the

company or doing a leveraged buyout and that person told him that the company was probably

valued at around 50-60/share. Van Gorkom then met with Pritzker and arranged a deal where

Pritzker would buy at 55/share and have an option to buy 1M at 38/share, giving the board 3 days

to act on the proposal. Board met, Van Gorkom gave a 20-minute oral presentation (no

documents, no summaries, etc.), after 2 hours board agreed as long as they did a market test first.

Market test seeing if market price was adequate and if what shareholders received was fair

lead to 2 potentials that fell through. SHs approved the deal and also sued for breach of duty.

Holding: Board breached its fiduciary duty because it wasnt sufficiently informed. The market

test wasnt a real market test and they couldnt even solicit bids. The board probably shouldve

gotten a fairness opinion although its not required. The oral presentation was insufficient, you

need to read the merger agreement, need written materials for the presentation, need to do a

valuation study, etc. Another problem was that they didnt do market test right away, they did it

later.

In response to this case, DGCL 102(b)(7) was created wanted to be clear that SC was out of

control, we wont hold you to gross negligence standard, so implement exculpation provision

o Conflict of Interest (see Director Conflicts)

o Illegality (See Caremark and Oversight)

Shlensky v. Wrigley (IL 1968): P-minority SH sued D-corp. and directors for negligence and breach

of duty of care. P alleged that the corp. was losing money because Ds refused to install lights on

the field and schedule games at night. P said the only reason they refused was because D-Wrigley

preferred it. D argued that there were business reasons for the decision. The court held that

negligence isnt enoughBJR will apply and the court wont intervene unless theres fraud, waste,

illegality, conflict of interest, etc.

- Avoiding director liability

o Exculpation (only applies to damages, not equitable relief)

DGCL 102(b)(7). Exculpation: Allows corps. to limit directors personal liability for breaches of

duty, requires majority of board and shareholders to approve

Exceptionsno exculpation when

o Breach of duty of loyalty

o Directors act not in good faith

o Intentional misconduct

o Knowing violations

under 174 Unlawful Dividends

o Improper personal benefit

MBCA 2.02(b)(4): allows corps. to reduce directors personal liability for certain breaches of

fiduciary duty,

Exceptionsno exculpation when

o Improperly received financial benefits

o Intentional infliction of harm on the corp./SHs

o Intentional violations of criminal law

o NOTE: no exceptions for breaches of duty of loyalty/acts not in good faith

because too vague, where as 102(b)(7) does

o Indemnification

Permissive indemnification for expenses and damages in suits brought by TPs in class actions

Permissive indemnification for expenses but not for damages in derivative suits

Shall indemnification for settlements, judgments, etc. in derivative suits

Allows advance payments for litigation expenses

Mandatory indemnification if director wins suit

o D&O Insurance

Parts to the insurance policy:

Reimburses corp. for its lawful expenses connected with indemnification

Covers claims against individual directors and officers acting in corporate capacity

Protects beyond corporate indemnification

Amounts paid in derivative suit can be recovered under a standard policy

Then may cover conduct that doesnt satisfy standard for indemnification

Policies can be rescinded if theres material misrepresentations in the policy application

Insured must disclose knowledge of any act, error, or omission that might give rise to a claim

under the policy

Chapter 19 Board Oversight (DUTY OF LOYALTY)

- Inattentionsustained failure of the director to devote attention to ongoing oversight of the business and affairs

of the corp.

o Oversight functionboard must pay attention to the companys performance and functioning over a period

of time (MBCA 8.30)

o A director may be liable for any failure to take action if the challenged conduct consisted of/was the result

of a sustained failure of the director to devote attention to ongoing oversight of the business and affairs of

the corp. (MBCA 8.31)

- 2 Types of Cases

o Malfeasance/Bad Faith

Francis v. United Jersey Bank (NJ 1981): Closely-held corp.; man ran a company and his two sons

and wife were the only SHs and the only directors. Court held wife personally liable for her

negligence in failing to prevent the misappropriation of funds by her sons.

o Illegality

For liability, Ps must show that (Caremark framework minimal compliance standard)

Directors know or shouldve known that violations were occurring, AND

Directors utterly failed to implement any reporting system or controls, OR

Directors did have a system but they consciously failed to monitor/oversee its operation

and so couldnt be informed of risks requiring their attention, AND

o High bar to meetutter failure to attempt to assure reasonable info. and

reporting systems exist

Failure proximately caused damages complained of

In re Caremark International Inc. Derivative Litigation (Del. 1996): Healthcare provider engaged in

illegal referral kickbacks. Case dealt with the fairness of the proposed settlement. Court held that

the directors werent liable for failure to properly monitor and supervise the business. There

was no evidence that the directors knew of the illegal kickbacks. They had a system in place,

showing a good faith attempt to be informed. Chapter 18 decisions vs. Chapter 19 oversight, this

is a Chapter 19 case.

Graham v. Allis-Chalmers (Del. 1963)no longer good law; Price fixing scandal, executives went to

jail and SHs sued derivatively. The court says that they dont need to have reporting system unless

there are red flags. Court held that there was no basis to find that directors had breached their

duty to be informed because there was no cause for suspicion so they didnt need to install a

system.

- These cases implicate the duty of loyalty

o Failure to act in good faith means

Conduct that qualitatively different from and more culpable than conduct giving rise to the

violation of the duty (i.e. gross negligence)

Failure to act in good faith doesnt automatically result in direct liability for fiduciary

Stone v. Ritter (Del. 2006): AmSouth paid millions in penalties for employee failure to file

suspicious activity reports relating to Ponzi scheme within company. Court said the board wasnt

liable, because bad outcome doesnt mean bad faith. Ps admitted that directors neither knew

nor shouldve known of violations; there were no red flags.

- Oversight of Risk Management

o Caremark type rule doesnt apply to oversight of business risk

o We want businesses to take risks and so we give them more protection and deference

o In re Citigroup Inc. Shareholder Derivative Litigation (Del. 2009): Citigroup engaged in subprime lending. Ps

allege that directors acted in bad faith by failing to monitor business risks and pointed to red flags over the

years concerning subprime lending, CDOs, and RMBSs. Court refused to extend oversight cases to

oversight of business risks and refused to hold directors liable because we want businesses to take risks.

CHAPTER 20 DIRECTOR CONFLICTS OF INTEREST (DUTY OF LOYALTY)

- 3 Approaches

o California/Common Law Cal. 820: A transaction should be set aside when it:

Greatly benefits one corp. at the expense of another

Personally benefits majority directors, and

Is unfair to minority SHs

Remillard Brick Co. v. Remillard-Dandini Co. (CA 1952): Stanley and Sturgis controlled majority

shares of Remillard and Brick, they controlled both boards, and were executives in both corps.

Remillard and Brick sold bricks to Remillard Sales Corp., which Stanley and Sturgis also owned,

controlled, and operated. Court held the rule above. Here, Stanely and Sturgis used their power

to their personal advantage to the detriment of minority SHslarge profits shouldve gone to

manufacturing companies and were diverted to the sales corp.

o DGCL 144 (safe harbor for directors in self-dealing transactions)

Conflict transactions arent automatically void; theyre not void if:

The material facts as to directors interest and as to the transaction are disclosed/known

to the board and the board in good faith authorizes the transaction by majority of

disinterested directors (even though disinterested directors may be less than quorum),

The material facts as to directors interest and as to the transaction are disclosed/known

to the SHs entitled to vote on it and SHs in good faith approve the transaction, OR

The transaction is fair as to the corp. as of the time its authorized, approved, or ratified

by the board or SHs

Benihana of Tokyo, Inc. v. Benihana, Inc. (Del. 2006): Benihana was having financial troubles.

Court held that the transaction was not a breach of duty. Even though the board didnt know that

ABdo negotiated the deal, the board knew that Abdo was the principle owner of BFC. The

purpose of the transaction was to secure the necessary funds for Benihana and they approved the

deal in good faith.

o MBCA Subchapter F

Director conflicting interest transaction = a transaction by a corp. in which the director:

Is a party

Has a material financial interest, OR

Knows that a related person is a party or had a material financial interest

Directors conflicting interest transactions are immune from attack if theyre authorized by:

At least 2 qualified directors after deliberation and vote (without presence/participation

of conflicted director),

Disinterested SHs, OR

A court under a fairness standard (see below)

- 3 Things Statutes and Courts Focus On:

o Director Approvalwhether the directors who approved had conflicts or were disinterested

Disinterested:

Independent:

In re Oracle Corp. Derivative Litigation (Del. 2003): CEO and other directors were accused of

insider trading. Board formed SKC to investigate. SLC werent sufficiently independent, Stanford.

o SH Approvalwere the SHs conflicted

If SHs are aware of the conflict and still approve/ratify the self-dealing transaction, the transaction

is valid.

Lewis v. Vogelstein (Del. 1997): SHs asked to approve stock option compensation plan for director.

SHs sued alleging their approval was invalid because they werent told the value of the granted

stock options. Court held that the stock options were sufficiently unusual that they may

constitute waste but didnt say they did.

Harbor Finance Partners v. Huizenga (Del. 1999): Republic acquired AutoNation. Republic

directors owned a substantial portion of AutoNation. SHs approved the deal but later challenged

it arguing that there were materially misleading statements in the proxy statement. Court held

that P failed to state a claim of tainted SH approval so BJR applied and the transaction as valid.

o Fairnesswas the deal fair despite any conflicts

- Corporate Opportunity Doctrine: forbids a director, officer, or managerial employee fro diverting a business

opportunity that belongs to the corp. to himself, potential harm not actual

o Traditional Approach

Whether a corporate opportunity exists

Whether SHs declined the opportunity

Whether the transaction was ratified

The effect of the benefit to the corp.

o Farber v. Servan Land Co. (5th 1981): Serianni and Savin were majority SHs and officers in Servan.

o DGCL 122(17): allows corps. to waive the protections of the corporate opportunity doctrine; corp. can

choose to identify a category of business opportunities, etc.

o Interest or Expectancy Test: corp. opportunities arent limited to actual ownership, they include interests

or expectancies

Very hard to apply

o Line of Business Test:

o Fairness Test

o Economic Capacity Test: whether the corp. has the economic capacity to take the opportunity

o Corporate Rejection: a manger can take the opportunity if the corp. rejects it

o Remedies for Taking

Damages in the amount of the harm the corp. suffered from the breach

Hard to calculate often because no actual harm; harm is deprivation of a right

Courts will assess the actual profits realized by the usurping manager on the theory of unjust

enrichment, such profits are easy to measure if manager has already sold the opportunity

CHAPTER 21 EXECUTIVE COMPENSATION

- Setting Comp.:

o Board determines exec. comp.

In public corps., its delegated to the comp. committee

o SH must approve

o SEC requires disclosure of exec. comp. (1) in a tabular presentation of CEO and highest paid execs. pay, and

(2) disclosure of the process by which the comp. was set.

o Tyco Case

Kozlowski $1.65M salary, $200M stock option, $30M restricted stock

Was he worth it?

Income up 29% in 2001, top 25 managers of the year, stock up 910% from 1993-2001,

BUT loans, extravagant expenses, criminal cases

- Burden: When challenging comp., the burden is on P to prove that theres no rational basis for the comp.

- Test: if there is some rational basis to conclude the amount and form of comp., then its appropriate

- Federal Regulation of Exec. Comp.

o No federal law directly regulates comp. but certain tax and disclosure rules have a role

o SEC Disclosure Rules

Requires annual proxy statement to disclose comp. of CEO, CFE, and 3 highest paid execs. for the

current and preceding 2 years

Requires current info. about stock-based comp. awarded in the past

Requires info. on post-employment retirement benefits and pension plans

o Sarbanes-Oxley

Prohibits loans to insiders

Exception: for those made in the normal course of the companys business such as a

credit card offered by a bank to its execs on the same terms offered to other customers.

Clawbacksif you made a lot of money because the companys financial statements were

fraudulent then you werent entitled to that money so you have to pay it back to the corp.

o Dodd-Frank

SHs in public corps. have an advisory vote on the pay packages to top execs. (say on pay)

Clawbacksexpands them to cover more execs., more years (3), and applies to all financial

restatements rather than just those due to misconduct

- State Judicial Review

o The Disney Case

o Disney II: Ps amended their complaint. Books and records 220 request. Ps allege intentional false

disclosures and theres enough in the complaint to go forward. Court focused on facts supporting that the

board acted not in good faith aka exculpation 102(b)(7)looked like the board failed to do anything at all,

that they consciously disregarded their responsibilities. Evidence suggested that no board members asked

any questions about the value of the options granted to Ovitz in the severance package.

o Disney III: Directors win; Eisner had a right to fire Ovitz and didnt breach his duty even though this

situation wasnt ideal

o Final Appeal: held not waste and no bad faith

CHAPTER 22 DUTIES WITHIN CORPORATE GROUPS

FINAL INTRINSIC FAIRNESS STANDARD FOR HOW CORP SHOULD ACT

1. Controlling SHs also have fiduciary duties to minority SHs

a. Types of control SH can have:

i. De jure controlowner of more than 50% of shares effectively controls the corp., he can elect a

majority of the board and decide matters submitted to SH vote

ii. De facto controlowner of a significant block of shares but less than 50% can often mobilize

sufficient votes to elect a board majority

iii. Control arising from incumbencyin public corps. with ownership fragmented among SHs,

incumbent directors and managers usually have de facto control

2. Settings to Examine These

a. Intra-Group Transactions

b. Cashing Out of Minority SHs

c. Alternatives to Cash-Out Mergers

3. Intra-Group Transactions

a. Ex: parent-sub dealings, dealings between sub and another corp. controlled by the parent

b. State statutes generally dont address these transactions

c. Standard of Review: Intrinsic fairness (no BJR)

i. Standard applies when the fiduciary duty is accompanied by self-dealing

1. Self-dealing occurs when the parent, by virtue of its domination over the sub, causes the

sub to act in a way that gives the parent something from the sub to the exclusion and

detriment of minority SHs of the sub.

ii. Rationale: controlling SHs have paid for their control usually, minority SHs know this and courts

recognize the prerogatives of controlling SHs.

d. NOTE: Parent-sub transactions occur regularly and rarely give rise to litigation

e. Dividend Policy Caseintrinsic fairness standard

f. Intra-Group Dealings Caseintrinsic fairness standard because self-dealing and protecting minority SH

g. Allocating Business Opportunities CaseBJR standard; judges dont understand the decision on how to

allocate business opportunities between the parents various subs.

h. Sinclair Oil Corp. v. Levien (Del. 1971): Sinclair has 3 subs. Sinclair owns 97% of S1 and minority SH owns

3%. Court held that:

i. Dividend Policythe dividend payments being issued were fairthey were in proportion to

ownership. So long as in compliance with capital rules, it is a business judgment rule call.

ii. Intra-Group Dealingbreached contract, self-dealing; minority SHs werent able to share the

receipt/profit of the sales. Sinclair received the products to the detriment of SinVen minority SHs.

iii. Allocation of Corporate Opportunities violation of duty of loyalty by a manager or sub. Court

held no allocation of corporate opportunities because they could only be done in Sinclair Int. or

Sinclair Alaska and not in Sinclair Venezuela. Court wants to see gross and palpable overreaching,

applies business judgment rule!

4. Cash-Out Mergers

a. Usually through merger in which parent acquires sub and minority SHs get cash for their shares

b. Controlling SHs can structure transactions that force minority SHs to accept cash for their shares so minority

SHs exit

c. How it works:

i. P organizes a new shell corp. and transfers all its stock in the partially-owned sub to the new shell

corp.

ii. Then P has the S board and the shell corp. enter a merger agreement providing that upon merger,

all SHs of S will get cash for their stock.

iii. P then votes all stock of shell in favor the merger. P also votes its S stock for the merger and if

necessary, uses its control over S proxy machinery to obtain additional shares to approve the

merger.

d. Conflicts of Interest: P uses majority of S stock to control Ss board. Unless Ss non-controlling SHs can get a

court to intervene theyre powerless to retain their interest in S or to alter merger terms. Appraisal

availability only partially mitigates the abuse. Note that cash-out merger isnt inevitably exploitative

though.

e. Standard = entire fairness

i. Entire Fairness: fair dealing (process of deal) and fair price, and business purpose should be

something other than trying to get rid of minority SHs. As much scrutiny as you can get, court

worried about conflicts.

f. Remedy = appraisal but only partially helps

g. Weinberger v. UOP (1983): In one-step cash-out merger where board with controlling SH voted to approve

merger, merger is subject to entire fairness test. Deals with fair dealing and fair price. Court wanted UOP

to have independent negotiating committee to deal with Signal, found violation of fair dealing and fair

price.

5. Alternatives to Cash-Out Mergers

a. Short-Form Merger

i. DGCL 253: authorizes a short-form merger between P and S if P owns at least 90% of Ss stock

ii. Process: P files certificate setting forth its stock ownership and merger terms. No action is

required by board or SH of S. P must inform minority SH of merger terms and advise them of their

appraisal rights if theyre dissatisfied.

iii. Remedy = appraisal

b. Tender Offer Followed by Short-Form Merger

i. Controlling SH with less than 90% ownership can use this method

ii. Process: make a tender offer directly to minority SH to reach 90% ownership and then so short-

form merger

iii. Determinative factor as to voluntariness of tender offer is whether coercion is present or whether

full disclosure was made

iv. Court focuses on structure of the offer and disclosure to SHs rather than fairness of the offer

c. Effect of Independent Approval and a Minority Vote

i. 2 protections in the context of controlling SH going private merger (1) approval by independent

special committee and (2) a vote by a majority of SHs unaffiliated with controlling SH

ii. Effect of using one of the protections is to shift the burden of proof under the entire fairness

standard from D to P

iii. Effect of using both protections is that the standard changes to BJR

You might also like

- HW Questions Income TaxDocument34 pagesHW Questions Income TaxAina Niaz100% (1)

- Visual AnalysisDocument4 pagesVisual Analysisapi-35602981850% (2)

- Securities Regulation HyposDocument46 pagesSecurities Regulation HyposErin JacksonNo ratings yet

- Corporations Outline Partnoy PalmiterDocument20 pagesCorporations Outline Partnoy PalmiterMatt ToothacreNo ratings yet

- Agency Relationships & LiabilityDocument75 pagesAgency Relationships & LiabilityjryanandersonNo ratings yet

- Pro Resp Law ChartDocument22 pagesPro Resp Law ChartGud104No ratings yet

- Anti-SLAPP Law Modernized: The Uniform Public Expression Protection ActFrom EverandAnti-SLAPP Law Modernized: The Uniform Public Expression Protection ActNo ratings yet

- Checklist PRDocument8 pagesChecklist PRDouglas GromackNo ratings yet

- CORPORATIONS AND AGENCY RELATIONSHIPSDocument131 pagesCORPORATIONS AND AGENCY RELATIONSHIPSIvy Ziedrich100% (1)

- Federal Income Tax (Wells)Document30 pagesFederal Income Tax (Wells)Bear100% (2)

- Choose Business Structure & Tax TreatmentDocument74 pagesChoose Business Structure & Tax TreatmentRonnie Barcena Jr.No ratings yet

- Chapter 1 Section 1 Slides AgencyDocument27 pagesChapter 1 Section 1 Slides AgencyShawn AcostaNo ratings yet

- Attack Short SheetDocument18 pagesAttack Short SheetjesNo ratings yet

- Corporations OutlineDocument84 pagesCorporations OutlinegsdqNo ratings yet

- Agency and Business Organization DutiesDocument5 pagesAgency and Business Organization DutiesSam Hughes100% (1)

- Ethics Outline (Modern Rules For Professional Conduct)Document12 pagesEthics Outline (Modern Rules For Professional Conduct)austinNo ratings yet

- Contracts II OutlineDocument79 pagesContracts II Outlinenathanlawschool100% (1)

- Selloooh X Shopee HandbookDocument47 pagesSelloooh X Shopee Handbooknora azaNo ratings yet

- Bracketing MethodsDocument13 pagesBracketing Methodsasd dsa100% (1)

- Class Homework Chapter 1Document9 pagesClass Homework Chapter 1Ela BallıoğluNo ratings yet

- Antitrust Kesselman Fall 2020Document101 pagesAntitrust Kesselman Fall 2020Rhyzan CroomesNo ratings yet

- Agency and Partnership GuideDocument3 pagesAgency and Partnership GuidetoddmbakerNo ratings yet

- Business OrganizationsDocument71 pagesBusiness Organizationsjdadas100% (2)

- Business Organizations Outline - Docx FINALDocument67 pagesBusiness Organizations Outline - Docx FINALHan FangNo ratings yet

- Closely Held Business Org and Agency DutiesDocument85 pagesClosely Held Business Org and Agency DutiesnabarrowNo ratings yet

- Sec Reg Attack 2021 - NEWDocument28 pagesSec Reg Attack 2021 - NEWmattytangNo ratings yet

- Business Organizations OutlineDocument71 pagesBusiness Organizations Outlineesquire2014fl100% (3)

- BusOrgTemplates 1 2Document48 pagesBusOrgTemplates 1 2Sam Hughes100% (1)

- UPA DissolutionDocument1 pageUPA DissolutionNiraj ThakkerNo ratings yet

- Agency and Partnership BasicsDocument27 pagesAgency and Partnership BasicsRory FarrellNo ratings yet

- I. Who Is An Agent?: Gorton v. Doty (1937)Document109 pagesI. Who Is An Agent?: Gorton v. Doty (1937)Erick VelizNo ratings yet

- Business Associations Outline: Agency Law and LiabilitiesDocument75 pagesBusiness Associations Outline: Agency Law and LiabilitiesMissy Meyer100% (1)

- Corporations OutlineDocument4 pagesCorporations OutlineKeith DyerNo ratings yet

- Sales Outline With CasesDocument24 pagesSales Outline With CasesJason HootNo ratings yet

- Final Civil Procedure Outline!Document7 pagesFinal Civil Procedure Outline!Kate BroderickNo ratings yet

- BA Outline - ExamDocument64 pagesBA Outline - ExamRegina SmithNo ratings yet

- Con Law II NotesDocument190 pagesCon Law II NotesBNo ratings yet

- Mini OutlineDocument10 pagesMini OutlineadamNo ratings yet

- Business Associations OutlineDocument36 pagesBusiness Associations OutlineAlex StratasNo ratings yet

- BA Outline - OKellyDocument69 pagesBA Outline - OKellylshahNo ratings yet

- Corps - Clarke - Short OutlineDocument14 pagesCorps - Clarke - Short OutlineLal LegalNo ratings yet

- BUSINESS ASSOCIATIONS OUTLINEDocument117 pagesBUSINESS ASSOCIATIONS OUTLINEDarren Christman100% (1)

- Business Organizations OutlineDocument29 pagesBusiness Organizations OutlineMissy Meyer100% (1)

- Contrascts II Memorize OutlineDocument3 pagesContrascts II Memorize OutlineAndrew BassNo ratings yet

- Bus Org OutlineDocument31 pagesBus Org OutlineporkyxpNo ratings yet

- Flow ChartDocument4 pagesFlow ChartHHHHEERNo ratings yet

- Contracts OutlineDocument48 pagesContracts Outlinekino321100% (2)

- Bartlett - Contracts Attack OutlineDocument4 pagesBartlett - Contracts Attack OutlinefgsdfNo ratings yet

- Constitutional Law OutlineDocument16 pagesConstitutional Law OutlineStephanieIjomaNo ratings yet

- Administrative Law Case ReviewDocument73 pagesAdministrative Law Case ReviewthriftydigNo ratings yet

- 2016 Secured Transactions Outline 2Document17 pages2016 Secured Transactions Outline 2jackojidemasiadoNo ratings yet

- Con Law OutlineDocument22 pagesCon Law OutlineslavichorseNo ratings yet

- Torts Outline Fall 2011Document31 pagesTorts Outline Fall 2011Steven Seigel100% (1)

- Corporations OutlineDocument134 pagesCorporations OutlineDeb Fatima Adams100% (1)

- Contracts II Final OutlineDocument24 pagesContracts II Final Outlinepmariano_5No ratings yet

- Flowchart Bankruptcy Proceedings Up To The Stage A Debtor Is Adjudged A BankruptDocument2 pagesFlowchart Bankruptcy Proceedings Up To The Stage A Debtor Is Adjudged A BankruptAudrey LimNo ratings yet

- Parol Evidence Flow ChartDocument1 pageParol Evidence Flow ChartHeidi HyunNo ratings yet

- Corporations Bar OutlineDocument4 pagesCorporations Bar OutlineJohn RisvoldNo ratings yet

- Conflict of Laws OutlineDocument54 pagesConflict of Laws OutlinesjanvieNo ratings yet

- Federal Income Tax Computation and DefinitionsDocument42 pagesFederal Income Tax Computation and Definitionsabmo33No ratings yet

- Business Associations Berdejo Fall 2020 MC4xNzI3NTkwMADocument105 pagesBusiness Associations Berdejo Fall 2020 MC4xNzI3NTkwMARhyzan CroomesNo ratings yet

- White Collar Crime Outline - Prof. Ken Levy, Fall 2013Document22 pagesWhite Collar Crime Outline - Prof. Ken Levy, Fall 2013logan doopNo ratings yet

- Remedies ChillDocument4 pagesRemedies ChillgilloteenNo ratings yet

- Corporations - Class OutlineDocument31 pagesCorporations - Class Outlinejagerdude56No ratings yet

- LES Exam 2 Study GuideDocument25 pagesLES Exam 2 Study GuideUmer Hassan KhanNo ratings yet

- Matt Toothacre - Health Law PaperDocument18 pagesMatt Toothacre - Health Law PaperMatt ToothacreNo ratings yet