Professional Documents

Culture Documents

Crdit Card

Uploaded by

api-371068740Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Crdit Card

Uploaded by

api-371068740Copyright:

Available Formats

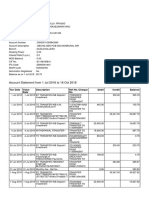

Card1 Card2 Card3

No-fee Scotiabank Presidents Choice Home Depots

Value VISA Financial World Consumer Credit

MasterCard Card

There is no annual fee There is no annual There is no annual

associated with this fee associated with fee associated with

Annual Fee this card.

card. this card.

21 days for new 21 days for new The grace period is

purchases, if you pay purchases. at least 25 days.

off your balance on

your monthly

statement in full by

the payment due

date. This grace

period will be

Grace Period automatically

extended to at least

25 days on your next

monthly statement

whenever you do not

pay your balance in

full by the payment

due date.

16.99% on purchases, 19.97% on 17.99%, 21.99%,

cash advances, purchases, 22.97% 25.99 %, or 26.99%

balance transfers and on cash advances. based on your

Scotia Credit Card creditworthiness.

Cheques.

APR

The minimum credit Depends on credit Initial credit limit will

limit on this card is history. be on the printout

$500. and may change at

Credit Limit any time.

Your finance charges Any past due Any past due

will include Interest amounts, plus: your amount. We add any

Charges on your statement balance if amount specified in

monthly statement, $10 or less, or the a promotional offer.

plus cash advance greater of: (a) $10 (b) We add any amount

fee(s), plus any 2.2% of your total required by the

dishonored payment statement balance, Promotion

fees, plus any or (c) the interest Calculation. We also

dishonored Scotia charges and fees add the largest of

Credit Card Cheque billed on the current the following: -The

fees, plus $10.00. In statement plus $1. Calculated New

Finance Charge addition, amounts Balance if it is less

showing on your than $25. -$25 if the

monthly statement as Calculated New

OVERDUE or Balance is at least

OVERLIMIT must be $25. -1% of the

paid immediately and Calculated New

will be added to the Balance plus the

minimum payment amount of your

billed interest

charges on that

balance, any

minimum interest

charge allocated to

that balance, and

any applicable late

fee.

Interest Charges + Calculate balance. They use a method

Fees + $10.00 plus any called daily balance

Method of Calculating

overdue or over limit (including current

Finance Charges

amount. transactions).

3.00% of the amount Minimum transaction None

of each transaction. fee of $3.50.

Transaction Fees

Minimum transaction

fee of $3.50.

$29.00. $29.00. The fee will $25; or

$35 for any

Fees for Late Payment

additional past due

payment during the

next six billing cycles

after a past due

payment.

Save on car rentals Up to four free No interest if paid in

with discounts of up additional cards on full within 6 months

to 20% at your account for on purchases $299

Other Features participating AVIS car family members, so or more.

rental locations you can earn PC

worldwide. points even faster.

1. Which credit card has the highest annual percentage rate and how much is it?

Home Depot's consumer credit card has the highest annual percentage rate, with its highest annual

percentage rate at 26.99%.

2. What method is used to calculate the monthly finance charges for the first major credit card?

The method that is used is adding together the interest Charges , fees, $10.00 plus any overdue or over

limit amount.

3. When does the finance charge begin to accrue on the credit card from the local department store?

The finance charges begin to accrue on the credit card from the local department store after the grace

period.

4. Do any of the cards have annual fees? If so, which one(s) and how much is the fee?

No, all the cards have no annual fee.

5. Is there a transaction fee on any card? If so, how much is it?

On the two first major credit cards there are transaction fees. Both of them have a minimum amount of

$3.50 and the first one is 3.00% of the amount of the transaction.

6. Is there a minimum finance charge on either of the major credit cards? If so, how much is it?

Yes there is on both of them, the first one is 10 dollars. The second card takes the greatest out of $10,

2.2% of your total statement balance, or the interest charges and fees billed on the current statement

plus $1.

7. Does the first major credit card charge a fee for late payments? If so, how much is it?

Yes it does, the fee for a late payment is $29.00.

8. What is the grace period on the credit card from the local department store?

The grace period on the credit card from the local department store is at the least 25 days.

9. Jamel wants to buy a new CD player that costs $450. According to his budget, he can afford payments

up to $62.00 per month. Which of the three credit cards youve found would you recommend Jamel use

to purchase the CD player? Why?

I would recommend the no-fee scotiabank value visa because it has no annual fees, the credit limit on

the card is $500, and the annual percentage rate is low.

You might also like

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountFrom EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountRating: 2 out of 5 stars2/5 (1)

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- Credit Cards WebquestDocument2 pagesCredit Cards Webquestapi-263722937100% (1)

- HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Document1 pageHDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Prem saiNo ratings yet

- Titular Xiad en 402 Howard St. South Bend INDIANA 46617 0000 00 01 0000 07003 00 0100 VPN 100 07/17Document2 pagesTitular Xiad en 402 Howard St. South Bend INDIANA 46617 0000 00 01 0000 07003 00 0100 VPN 100 07/17Gerson ChirinosNo ratings yet

- Victorias Secret Angel Credit CardDocument21 pagesVictorias Secret Angel Credit Cardapi-285771275No ratings yet

- Credit Card Mini StatementDocument1 pageCredit Card Mini StatementWaifubot 2.1No ratings yet

- Statement of Account: Credit Limit Rs Available Credit Limit RsDocument4 pagesStatement of Account: Credit Limit Rs Available Credit Limit RsSayiram GNo ratings yet

- 2011 PaypalDocument28 pages2011 PaypalTechCrunch100% (1)

- December Bank Account Statement DiscussionDocument2 pagesDecember Bank Account Statement DiscussionShazz BaricNo ratings yet

- Brac Bank Credit Card ChargeDocument1 pageBrac Bank Credit Card ChargeMehedi HasanNo ratings yet

- CreditDocument1 pageCreditlisonedmNo ratings yet

- Credit Card ReconciliationDocument8 pagesCredit Card Reconciliationapi-456055243No ratings yet

- Credit Card Pricing Strategy: Davide Capodici, Brooke Chang, Brian Feldman, Erica GluckDocument75 pagesCredit Card Pricing Strategy: Davide Capodici, Brooke Chang, Brian Feldman, Erica GluckBinay Kumar SinghNo ratings yet

- Statement of Account: Credit Limit Rs Available Credit Limit RsDocument3 pagesStatement of Account: Credit Limit Rs Available Credit Limit RsAbhishek goyalNo ratings yet

- Jelen Accounting Services Inc: Recurring Payment Authorization FormDocument1 pageJelen Accounting Services Inc: Recurring Payment Authorization FormjhonNo ratings yet

- Credit Card Debt AssignmentDocument4 pagesCredit Card Debt Assignmentapi-325884538No ratings yet

- CardStatement 2016-11-19Document6 pagesCardStatement 2016-11-19manjuNo ratings yet

- August 16, 2021 September 3, 2021: Credit Card StatementDocument3 pagesAugust 16, 2021 September 3, 2021: Credit Card StatementSagar ReddyNo ratings yet

- BillSTMT 4588260000514267Document3 pagesBillSTMT 4588260000514267Fahad AhmedNo ratings yet

- Money Matters FinalDocument3 pagesMoney Matters Finalapi-336224582No ratings yet

- YES Prosperity Credit Card MITC - 14052021Document8 pagesYES Prosperity Credit Card MITC - 14052021Prinshu TrivediNo ratings yet

- American Express CardDocument1 pageAmerican Express CardKazi Milon0% (1)

- USD STMT Aug To Oct 2020 For KOMDocument3 pagesUSD STMT Aug To Oct 2020 For KOMsimple footballNo ratings yet

- FIB - Bank Australia AssignmntDocument22 pagesFIB - Bank Australia AssignmntAimi Al-YahyaNo ratings yet

- FIN.2.2.1 - Bank Transactions: General Ledger - Journals - General JournalDocument3 pagesFIN.2.2.1 - Bank Transactions: General Ledger - Journals - General JournalIslam SultanNo ratings yet

- Credit Card EMI 3501 PDFDocument3 pagesCredit Card EMI 3501 PDFVijay ParmarNo ratings yet

- Credit Card Reconciliation - Brianna Daguio 1Document9 pagesCredit Card Reconciliation - Brianna Daguio 1api-507868036No ratings yet

- ECS PDF Mandate CitibankDocument8 pagesECS PDF Mandate Citibankbrijesh_chokshi2012No ratings yet

- Account Statement 280619 180719Document3 pagesAccount Statement 280619 180719Naresh SeerviNo ratings yet

- E Statement 230202100341923391820Document8 pagesE Statement 230202100341923391820Anna HoNo ratings yet

- Final REVISED KMS Redevelopment Agreement 06.19.2019Document165 pagesFinal REVISED KMS Redevelopment Agreement 06.19.2019GrafixAvengerNo ratings yet

- Data2 Dapimage 16013003181 CreditCardApplication16013003181Document4 pagesData2 Dapimage 16013003181 CreditCardApplication16013003181yeateshwarriorNo ratings yet

- Kisan Credit CardDocument3 pagesKisan Credit CardkidihhNo ratings yet

- PDF VDocument1 pagePDF VClint ArnimNo ratings yet

- A Summary of Your Relationship/s With Us:: Alex PrabhuDocument9 pagesA Summary of Your Relationship/s With Us:: Alex PrabhuArvind HarikrishnanNo ratings yet

- Credit Card Oct 16 PDFDocument2 pagesCredit Card Oct 16 PDFR.Prabath100% (1)

- Statement of Account: MR Ranjit RoyDocument1 pageStatement of Account: MR Ranjit RoyRanjit RoyNo ratings yet

- Sponsor StatementDocument1 pageSponsor Statementanhhungdacop9xNo ratings yet

- CreditCard Statement 02-04-2020T14 30 51Document1 pageCreditCard Statement 02-04-2020T14 30 51Afaq Ahmad KhanNo ratings yet

- Personal Credit Card Ts and CsDocument5 pagesPersonal Credit Card Ts and CsDarren HulmeNo ratings yet

- Passbookstmt 1610356751839Document4 pagesPassbookstmt 1610356751839Vicky KumarNo ratings yet

- Form PTOL-2038 (Credit Card Payment Authorization)Document3 pagesForm PTOL-2038 (Credit Card Payment Authorization)Anant NarayananNo ratings yet

- Credit CardDocument6 pagesCredit Cardvj1414100% (1)

- Amex Case Study: 04/05/2022 Giuseppe BarresiDocument16 pagesAmex Case Study: 04/05/2022 Giuseppe Barresiapi-615006693No ratings yet

- N MPR BINWw 8 K N2 SCDocument5 pagesN MPR BINWw 8 K N2 SCNallagulla prasad100% (1)

- Credit Card Authorization Form Template 02Document2 pagesCredit Card Authorization Form Template 02Liza wongNo ratings yet

- Statement - Dec 2019Document2 pagesStatement - Dec 2019MeenakshiNo ratings yet

- Bank 1 PDFDocument7 pagesBank 1 PDFadam burdNo ratings yet

- ActivityDocument245 pagesActivityCourtney CampbellNo ratings yet

- Payments Can Be Made Using Visa, Mastercard and Discover: Credit Card Payment FormDocument1 pagePayments Can Be Made Using Visa, Mastercard and Discover: Credit Card Payment FormLionel BoopathiNo ratings yet

- E StatementDocument3 pagesE StatementasheeshmNo ratings yet

- Kroger FlyerDocument1 pageKroger Flyerapi-329178984No ratings yet

- Credit Card Statement DisclosureDocument1 pageCredit Card Statement DisclosureShahnaz NawazNo ratings yet

- The Basic Principles of Namshi Coupon Code 20Document2 pagesThe Basic Principles of Namshi Coupon Code 20perchbail8No ratings yet

- AMERICAN EXPRESS CardNetDocument1 pageAMERICAN EXPRESS CardNetCHANDANNo ratings yet

- 083000108: 301612084422: 3016120844121 PNC Bank StatementDocument5 pages083000108: 301612084422: 3016120844121 PNC Bank StatementKevinNo ratings yet

- Amex Credit Card FeaturesDocument4 pagesAmex Credit Card Featuresbokamanush100% (1)

- Credit Card Information 1Document3 pagesCredit Card Information 1api-3710686770% (1)

- Financial Management Principles and Applications 13Th Edition Titman Test Bank Full Chapter PDFDocument68 pagesFinancial Management Principles and Applications 13Th Edition Titman Test Bank Full Chapter PDFMichelleJenkinsmtqi100% (12)

- Chapter 7 - Audit EvidenceDocument11 pagesChapter 7 - Audit EvidenceUSMAN SARWARNo ratings yet

- Certificate in Securities Ed15Document340 pagesCertificate in Securities Ed15Westa Geafrica100% (4)

- Forensic Accounting Vs Investigative AuditDocument44 pagesForensic Accounting Vs Investigative AuditRegsa Agstaria100% (1)

- FAR Quizzes and Practical ExerciseDocument23 pagesFAR Quizzes and Practical ExerciseCarla EspirituNo ratings yet

- On December 31 Year 2 Pat Inc of Halifax NovaDocument2 pagesOn December 31 Year 2 Pat Inc of Halifax NovaCharlotteNo ratings yet

- Banking - Retail - Global Industry PrimerDocument7 pagesBanking - Retail - Global Industry PrimerAnonymous NeRBrZyAUbNo ratings yet

- Amortization and AccretionDocument3 pagesAmortization and Accretionnaan_padikanumNo ratings yet

- Bank of CyprusDocument7 pagesBank of CyprusLoizos LoizouNo ratings yet

- Laporan Keuangan Commonwealth 2018Document399 pagesLaporan Keuangan Commonwealth 2018Kusuma AntaraNo ratings yet

- What Is RMADocument1 pageWhat Is RMAPurevdorj DorjNo ratings yet

- SIDC Publication Form 2020 V1 PDFDocument4 pagesSIDC Publication Form 2020 V1 PDFJohn SmithNo ratings yet

- OpTransactionHistory23 01 2024Document11 pagesOpTransactionHistory23 01 2024kvpNo ratings yet

- Pivot Table Practice TestDocument62 pagesPivot Table Practice TestShakthivel K ShakthiNo ratings yet

- Gibson Chapter 11 Expanded Analysis (Editted)Document35 pagesGibson Chapter 11 Expanded Analysis (Editted)Ali UmerNo ratings yet

- Australian Financial Advice Landscape: This Is An Abridged Version of The Full Report Published in December 2019Document52 pagesAustralian Financial Advice Landscape: This Is An Abridged Version of The Full Report Published in December 2019Stuff NewsroomNo ratings yet

- BFD Past Paper AnalysisDocument8 pagesBFD Past Paper AnalysisAqib SheikhNo ratings yet

- Tutorial Letter 102/3/2021: Financial Accounting ReportingDocument57 pagesTutorial Letter 102/3/2021: Financial Accounting ReportingAbdullah SalieNo ratings yet

- ACC1026 Topic 7Document66 pagesACC1026 Topic 7Ceae SeaNo ratings yet

- Chapter 6 Issues in Sukuk Design and TradingDocument55 pagesChapter 6 Issues in Sukuk Design and TradingMackenyu arataNo ratings yet

- The Pearl Prospectus EnglishDocument108 pagesThe Pearl Prospectus EnglishMoosa NaseerNo ratings yet

- Coding and Decoding QuestionsDocument28 pagesCoding and Decoding QuestionsAbdulawwal IntisorNo ratings yet

- Audit Reporting For Going Concern Uncertainty: Global Trends and The Case Study of Italy PDFDocument115 pagesAudit Reporting For Going Concern Uncertainty: Global Trends and The Case Study of Italy PDFHelenNo ratings yet

- Nets User GuideDocument16 pagesNets User Guidehwyap2022No ratings yet

- GirishDocument24 pagesGirishGIRISH JOSHINo ratings yet

- A Summer Training Project Report On: "Financial Statement Analysis" OF Orissa State Co-Operative Bank Ltd. BhubaneswarDocument74 pagesA Summer Training Project Report On: "Financial Statement Analysis" OF Orissa State Co-Operative Bank Ltd. BhubaneswarNaman JainNo ratings yet

- Review 105 - Day 13 P1: Notes ReceivableDocument21 pagesReview 105 - Day 13 P1: Notes ReceivableAldrin ZolinaNo ratings yet

- 1.1 Background of The StudyDocument5 pages1.1 Background of The StudyBayalkotee Resham100% (1)

- Classification of AccountsDocument4 pagesClassification of Accountsvikas sunnyNo ratings yet

- Banking Law ProjectDocument25 pagesBanking Law ProjectRavi Singh SolankiNo ratings yet