Professional Documents

Culture Documents

The Awesome Notes Tax On RC, NRC, Ra

Uploaded by

May Anne NangleganOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Awesome Notes Tax On RC, NRC, Ra

Uploaded by

May Anne NangleganCopyright:

Available Formats

THE AWESOME NOTES

Page 1 of 8

TAX ON RC, NRC, RA

PRELIMINARY

TH FF ARE TAXABLE FOR INCOME FROM

contractors or subcontractors, should

they choose to pay by way of FIT

SOURCES WITHIN AND WITHOUT SEPARATION PAY OR RETIREMENT

1. RC

2. DC

PAY

THE FF ARE TAXABLE FOR INCOME FROM

SOURCES WITHIN ONLY

IN RE: RETIREMENT PAY

GEN RULE:

1. NRC includible in the gross income for the

2. RA

3. NRA

computation of the net income

4. FC

NOTE: different tax treatment for NRA and FC.

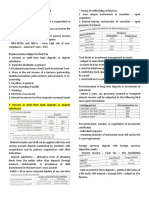

EXE: FF RETIREMENT PLAN WHICH

ARE EXEMPT FROM TAX

usually, the basis of tax is the gross and not RETIREMENT BENEFITS UNDER

the net income of the taxable year. RA 7641 (in private firm without

retirement plan)

REQUISITES

1. t h e r e t i r i n g o f fi c i a l o r

TAXATION ON COMPENSATION employee is at least 60 yrs

old but not more than 65 yrs

old

2. he must have served the

INCLUSION

GROSS INCOME; defined

company for at least 5 years

RETIREMENT BENEFITS UNDER

gross income means all income derived from RA 4917 (in private firm with retirement

whatever source, including (but not limited to)

the following items:

1. Compensation for services in whatever

plan)

REQUISITES

form paid, including, but not limited to fees, 1. t h e r e t i r i n g o f fi c i a l o r

salaries, wages, commissions, and similar employee must not be less

items; than 50 years of age

2. Gross income derived from the conduct of 2. must have been in the service

trade or business or the exercise of a for at least 10 years

profession; 3. t h e e x e m p t i o n m u s t b e

3. Gains derived from dealings in property; availed only once; and

4. Interests; 4. the private benefit plan must

5. Rents;

6. Royalties;

7. Dividends;

be approved by the BIR

8. Annuities;

9. Prizes and winnings;

OTHER EXEMPT RETIREMENT PAY

1. given by government sector

10. Pensions; and through GSIS, SSS and PVAO

11. Partner's distributive share from the net 2. given by foreign government

income of the general professional agencies and other institutions,

partnership. private or public, to residents,

NRC of the Phil, or aliens who

IN RE: MONETARY COMPENSATION

come to reside in the Phil, without

qualification.

REGULAR SALARY OR WAGE

GEN RULE:

IN RE: SEPARATION PAY

the amount received by an employee or

includible in the gross income

EXE:

official or by his heirs from employer as a

consequence of separation of such

employee or officer from the service of he

1. minimum wage, which is exempt from employer because of death, sickness or

tax following RA 9504 other physical disability or for any cause

2. those received by Filipino Citizen beyond the control of the said official or

employed in multinational company,

offshore banks or petroleum service

employee

AAA - BASTE / ATB

prepared by: ronie ablan

THE AWESOME NOTES

Page 2 of 8

TAX ON RC, NRC, RA

WHEN NOT TAXABLE EXCLUSION

1. when the cause of the separation is The following items shall not be included in

beyond the control of the employer gross income and shall be exempt from

2. when received from foreign govt,

agencies or institutions

taxation under this title:

(1) Life Insurance - The proceeds of life

BONUSES, 13th MONTH PAY, AND insurance policies paid to the heirs or

OTHER BENEFITS

NOT TAXABLE WHEN;

beneficiaries upon the death of the insured,

whether in a single sum or otherwise, but if

such amounts are held by the insurer under an

the aggregate sum of all other benefits agreement to pay interest thereon, the interest

- does not exceeds 30k

HENCE: once it exceed, it is subject to

payments shall be included in gross income.

(2) Amount Received by Insured as Return

tax.

NOTE: IN RE:

of Premium - The amount received by the

insured, as a return of premiums paid by him

under life insurance, endowment, or annuity

TERMINAL LEAVE PAY

IF GIVEN TO GOVT EMPLOYEE

contracts, either during the term or at the

maturity of the term mentioned in the contract

- always exempt

or upon surrender of the contract.

(3) Gifts, Bequests, and Devises. - The value

I F G I V E N T O P R I VAT E of property acquired by gift, bequest, devise, or

EMPLOYEES descent: Provided, however, That income from

sick leave is not exempt such property, as well as gift, bequest, devise

vacation leave or descent of income from any property, in

a. exempt if it does not exceed cases of transfers of divided interest, shall be

10 days

b. excess of 10 days, taxable.

included in gross income.

(4) Compensation for Injuries or Sickness -

QUERY: bakit hindi to kasama sa amounts received, through Accident or Health

other benefits? Insurance or under Workmen's Compensation

Acts, as compensation for personal injuries or

DIRECTOR's FEE sickness, plus the amounts of any damages

received, whether by suit or agreement, on

account of such injuries or sickness.

(5) Income Exempt under Treaty. - Income of

any kind, to the extent required by any treaty

obligation binding upon the Government of the

Philippines.

( 6 ) R e t i r e m e n t B e n e fi t s , P e n s i o n s ,

Gratuities, etc. -

(a) Retirement benefits received under

Republic Act No. 7641 and those

received by officials and employees of

private firms, whether individual or

corporate, in accordance with a

reasonable private benefit plan maintained

by the employer: Provided, That the

retiring official or employee has been in

the service of the same employer for at

least ten (10) years and is not less than

fifty (50) years of age at the time of his

retirement: Provided, further, That the

benefits granted under this subparagraph

shall be availed of by an official or

employee only once.

For purposes of this Subsection, the term

'reasonable private benefit plan' means a

pension, gratuity, stock bonus or profit-

AAA - BASTE / ATB

prepared by: ronie ablan

THE AWESOME NOTES

Page 3 of 8

TAX ON RC, NRC, RA

sharing plan maintained by an employer (b) Income Derived by the Government

for the benefit of some or all of his officials or its Political Subdivisions. - Income

or employees, wherein contributions are derived from any public utility or from the

made by such employer for the officials or exercise of any essential governmental

employees, or both, for the purpose of function accruing to the Government of the

d i s t r i b u t i n g t o s u c h o f fi c i a l s a n d Philippines or to any political subdivision

employees the earnings and principal of

the fund thus accumulated, and wherein

its is provided in said plan that at no time

thereof.

(c) Prizes and Awards - Prizes and

shall any part of the corpus or income of awards made primarily in recognition of

the fund be used for, or be diverted to, any religious, charitable, scientific, educational,

purpose other than for the exclusive artistic, literary, or civic achievement but

benefit of the said officials and employees.

(b) Any amount received by an official or

only if: (i) The recipient was selected

without any action on his part to enter the

contest or proceeding; and (ii) The

employee or by his heirs from the recipient is not required to render

employer as a consequence of separation substantial future services as a condition

of such official or employee from the

service of the employer because of death

sickness or other physical disability or for

to receiving the prize or award.

(d) Prizes and Awards in Sports

any cause beyond the control of the said Competition. - All prizes and awards

official or employee.

(c) The provisions of any existing law to

granted to athletes in local and

international sports competitions and

tournaments whether held in the

the contrary notwithstanding, social Philippines or abroad and sanctioned by

security benefits, retirement gratuities,

pensions and other similar benefits

received by resident or nonresident

their national sports associations.

(e) 13th Month Pay and Other Benefits. -

citizens of the Philippines or aliens who Gross benefits received by officials and

come to reside permanently in the employees of public and private entities:

Philippines from foreign government Provided, however, That the total

agencies and other institutions, private or exclusion under this subparagraph shall

public.

(d) Payments of benefits due or to become

not exceed Thirty thousand pesos

(P30,000) which shall cover: (i) Benefits

received by officials and employees of the

due to any person residing in the national and local government pursuant to

Philippines under the laws of the United Republic Act No. 6686; (ii) Benefits

States administered by the United States received by employees pursuant to

Veterans Administration.

(e) Benefits received from or enjoyed

Presidential Decree No. 851, as amended

by Memorandum Order No. 28, dated

August 13, 1986; (iii) Benefits received by

under the Social Security System in officials and employees not covered by

accordance with the provisions of Presidential decree No. 851, as amended

Republic Act No. 8282.

(f) Benefits received from the GSIS under

by Memorandum Order No. 28, dated

August 13, 1986; and (iv) Other benefits

such as productivity incentives and

Republic Act No. 8291, including Christmas bonus: Provided, further, That

retirement gratuity received by the ceiling of Thirty thousand pesos

government officials and employees. (P30,000) may be increased through rules

and regulations issued by the Secretary of

(7) Miscellaneous Items. -

(a) Income Derived by Foreign

Finance, upon recommendation of the

Commissioner, after considering among

others, the effect on the same of the

Government - Income derived from

investments in the Philippines in loans,

stocks, bonds or other domestic securities,

inflation rate at the end of the taxable year.

(f) GSIS, SSS, Medicare and Other

or from interest on deposits in banks in the Contributions. - GSIS, SSS, Medicare

Philippines by (i) foreign governments, (ii) and Pag-ibig contributions, and union dues

financing institutions owned, controlled, or

e n j o y i n g r e fi n a n c i n g f r o m f o r e i g n

governments, and (iii) international or

of individuals.

(g) Gains from the Sale of Bonds,

regional financial institutions established Debentures or other Certificate of

by foreign governments. Indebtedness. - Gains realized from the

AAA - BASTE / ATB

prepared by: ronie ablan

THE AWESOME NOTES

Page 4 of 8

TAX ON RC, NRC, RA

same or exchange or retirement of bonds, DEDUCTIONS

d e b e n t u r e s o r o t h e r c e r t i fi c a t e o f

indebtedness with a maturity of more than

PERSONAL EXEMPTION AND

five (5) years.

(h) Gains from Redemption of Shares in

ADDITIONAL EXEMPTIONS

BASIC EXEMPTION IN THE AMOUNT

Mutual Fund. - Gains realized by the OF Php 50,000.oo, for

investor upon redemption of shares of 1. single individual

stock in a mutual fund company as defined 2. married individual

in Section 22 (BB) of this Code.

3. head of the family

NOTE: if married individual

IN RE: FRINGE BENEFIT TAX & DE - if only one spouse is deriving an

MINIMIS BENEFITS

WHEN FRINGE BENEFIT IS NOT

income, he alone can can claim

the 50k exemption. if both are

earning, both can claim 50k

SUBJECT TO FRINGE BENEFIT TAX

1. those received by rank-and-file

employees

exemption

ADDITIONAL EXEMPTIONS FOR

2. required by the nature of or necessary TAXPAYERS WITH DEPENDENTS

to the trade, business or profession of

the employer

3. g i v e n f o r t h e c o n v e n i e n c e o r

Php 25,000.oo each

REQ:

advantage of the employer 1. only for married individual (valid)

4. authorized and exempted from income 2. allowed only foe each dependent not

tax under the code or any soecial laws exceeding 4 (so maximum ay 100k)

5. contribution of the employer for the 3. can be claimed only by one spouse,

benefit of the employee to retirement, and if legally separated, can be

insurance and hospitalization benefit claimed only by the spouse who has

plans (but in excess, shall be subject to

FBT. ie. in excess than what is

required by SSS or GSIS)

custody over the children

H E A LT H A N D H O S P I TA L I Z AT I O N

6. de minimis benefits

7. RR no 3-98: for housing units

situated inside or adjacent to the

INSURANCE

WHO CAN CLAIM:

premises of a business or factory only pure compensation income earner/

(deemed adjacent to the remises

of the business if; it is located

within the maximum 50 meters

taxpayer

REQUISITES FOR DEDUCTIBILITY:

from the perimeter of the business 1. The amount of premiums not to exceed

enterprise. 2,400 per family or 200 a month paid

temporary housing unit fir 3 months during the taxable year for health and/

or less

DE MINIMUS BENEFITS; defined

or hospitalization insurance taken by

the taxpayer for himself, including his

family, shall be allowed as a deduction

limited to facilities or privileges from his gross income:

furnished or offered by an employer to 2. That said family has a gross income of

his employee that are not more than 250k for the taxable

1. relatively of small value; and year; and

2. offered or furnished by the 3. That in the case of married taxpayers,

employer as a means of promoting only the spouse claiming the additional

the health, goodwill, contentment, exemption for dependents shall be

or efficiency of his employees.

IN RE: 13th MONTH OAY AND OTHER

entitled to this deduction.

B E N E F I T S A N D PAY M E N T S

SPECIFICALLY EXCLUDED FROM

TAXABLE COMPENSATION INCOME

- when it does not exceed 30k (aggregate

sum)

AAA - BASTE / ATB

prepared by: ronie ablan

THE AWESOME NOTES

Page 5 of 8

TAX ON RC, NRC, RA

TA X AT I O N O F C O M P E N S AT I O N

I N C O M E O F A M I N I M U M WA G E

TAXATION OF PASSIVE INCOME

EARNER

STATUTORY MINIMUM WAGE; defined

the rate fixed by the Regional Tripartite IN GENERAL:

Wage and Productivity Board, as defined ff passive income subject to FIT

by the Bureau of Labor and Employment 1. Interest

Statistics (BLES) of the Department of 2. royalties

Labor and Employment (DOLE) 3. dividends from DC

MINIMUM WAGE EARNER; defined

a worker in the private sector paid the

4. prizes and winnings

INTEREST INCOME

statutory minimum wage, or to an if not subject to fit, included in the gross

employee in the public sector with

compensation income of not more than

the statutory minimum wage in the non-

income for the taxable year and subject to NIT

REQUISITES FOR FIT TO APPLY

agricultural sector where he/she is 1. the recipient must be RC, NRC, OCW &

assigned.

NOTE:

Seamen and/or RA

2. the income must be an interest income

3. the interest income must be from bank

That minimum wage earners shall be deposit and yield or any other monetary

exempt from the payment of income tax benefits from deposit substitutes, trust

on their taxable income: funds or similar arrangements; and

Provided, further, That the holiday

pay, overtime pay, night shift

differential pay and hazard pay

4. must be derived from sources within

received by such minimum wage

earners

RATES:

20% FIT: interest from banks

shall likewise be exempt 7.5% FIT: interest from Expanded Foreign

from income tax.

Currency Deposit

NOTE: IN RE: EFCD

TAXATION OF BUSINESS - a bank authorized by BSP to handle

INCOME / INCOME FROM different foreign currency transaction

PRACTICE OF PROFESSION

- for OCW; exempt from tax.

T R E AT M E N T O F I N C O M E F R O M

always included in the gross income since

there is no instance that such income is

LONG-TERM DEPOSIT

GEN RULE:

subject to the FIT

exempt from tax

NOTE: see graduated rate EXE:

pre-terminate before the 5th year; shall be

subject to the ff rate

5% FIT; 4 or less than 5 yrs

12% FIT; 3 or less than 4 yrs

20% FIT; less than 3 years

AAA - BASTE / ATB

prepared by: ronie ablan

THE AWESOME NOTES

Page 6 of 8

TAX ON RC, NRC, RA

ROYALTIES

REQUISITES TO BE CONSIDERED AS

DIVIDENDS

CORPORATION

FROM DOMESTIC

PA S S I V E I N C O M E A N D H E N C E B E TAX RATE:

SUBJECT TO FIT

it must be derived from sources within

10% FIT

IMPOSED UPON

ROYALTIES IS DEEMED FROM SOURCES cash and/or property dividend actually or

WITHIN WHEN

the use or right to use or privilege to use in

constructively received by an individual from a

1. DC

2. Joint Stock Corp

the Phil, 3. Insurance or Mutual Fund Co.

any copyright, patent, design or model, 4. ROHQ of multinational Co

plane, secret formula, goodwill, 5. Share of an individual in the distributable

trademark, trade brand, and other like net income after tax of a partnership of

property

the use or the right to use in the Phil,

which he is a partner, other than GPP

6. share of an individual in the in the net

income after tax of an Association, Joint

any industrial, commercial or scientific Account, Joint Venture or Consortium,

equipment

the supply of

which is taxable as a corporation of which

he is a member or co-venturer.

scientific, technical, industrial or NOTE: AS AN EXE: dividend received from a

commercial knowledge or information

the supply of services by a non-resident

RFC is subject to FIT when:

- 50% 3 YEAR RULE

person or his employee in connection with

the use of property or right belonging

PRIZES AND OTHER WINNINGS

or the installation or operation of any

brand, machinery or other apparatus

purchased from such non-resident

IN RE: PRIZES

REQUISITES TO BE SUBJECT TO FIT

person

the supply of any assistance that is

1. must be derived from sources within

2. just not be mire than 10k (excess, subject

to NIT)

ancillary to and furnished as a means

of enabling the application or

3. must be pursuant to a promotion or contest

enjoyment of any such property right,

as mentioned in (1,2, and 3)

INSTANCES WHEN EXEMPT FROM TAX

REQUISITES:

technical advise or assistance or service 1. received primarily in recognition of

rendered in connection with religious, charitable, scientific, educational,

technical management or artistic, literary or civic achievement

administration of any scientific, 2. the recipient was selected without any

industrial or commercial undertaking, action on his part to enter the contest or

venture, project or scheme.

the use or right to use

proceedings; and

3. the recipient is not required to render

substantial future service as a condition of

1. motion picture films

2. films or videotapes for use un

connection with television

receiving the prize or award

ALSO;

3. tapes for use in connection with radio those granted to athletes in local and

RATES:

broadcasting international sports competitions and

tournaments whether held in the Phil or abroad

and sanctioned by their national sports

20% FIT: in general

10% FIT: if derived from books, other literary

associations

works and musical compositions IN RE: WINNINGS

always subject to 20% FIT, so long as it is

derived within. no limitation as to the amount.

even derived from gambling

WHEN EXEMPT

- LOTTO and PCSO

AAA - BASTE / ATB

prepared by: ronie ablan

THE AWESOME NOTES

Page 7 of 8

TAX ON RC, NRC, RA

PASSIVE INCOME NOT SUBJECT TO FIT HOWEVER: if made by a

pag di pumasok as requisites, NIT. dealers in securities, NIT/GIT?

right

INCOME FROM THE SALE OR EXCHANGE

TAXATION OF CAPITAL GAINS OF REAL PROPERTY SITUATED IN THE

PHILIPPINES

6% FIT

INCOME FROM SALE OF SHARES OF BASED ON: the GSP or CMV, whichever is

STOCKS OF A PHILIPPINE CORPORATION

FOR SHARES TRADED AND LISTED IN THE

higher

REQUISITES FOR FIT TO APPLY

STOCK EXCHANGE 1. the real property must be located within the

is exempt from income tax, but subject to Philippines

Percentage Tax of

1/2 of 1%

2. the real property must be a capital asset

- based on the GSP or GVM of the

WHEN DEEMED AS AN ORDINARY ASSET

share of stock sold or transferred

NOTE: the selling price of the share of

FOR TAXPAYER ENGAGED IN REAL

ESTATE BUSINESS:

1. all properties acquired by the real estate

stock is dealer

- the FMV of the SOS transferred or 2. acquired by real estate developer, whether

exchanged developed or underdeveloped at the time of

AND NOT the FMV of the the acquisition, and those held primarily for

property received in sale or lease to customers in the ordinary

exchanged.

SHARES NOT LISTED AND TRADED IN THE

course of T/B, and properly included in the

inventory of the taxpayer if on hand at the

close of the taxable year

STOCK EXCHANGE OR LISTED BUT NOT 3. acquired by the real estate lessor whether

TRADED IN THE STOCK EXCHANGE

FINAL CAPITAL GAIN TAX OF

land or improvement, which for lease or

rent or otherwise for use or being used in

T/B

5%; of the net capital gain not exceeding 100k 4. acquired by person in the course of T/B

10%; on any amount in excess of 100k

QUERY: so supposing 200k yung kita,

habitually engaged in sale of real estate

IF NOT ENGAGED IN REAL ESTATE

the first 100k is subject to 5% and the BUSINESS; deemed an ordinary asset when

remaining 100k subject to 10%. or the 1. used, being used or have been previously

whole 200k subject to 10% FCGT?

REQUISITES:

used in T/B

EXE: used by an exempt corporation

1. the share must be a share from DC

2. share must be a capital asset

3. the share is not listed or traded in the local

in an exempt operation

NOTE: WHEN DEEMED HABITUALLY

stock exchange

NOTE:

ENGAGED IN REAL ESTATE BUSINESS

1. registered in HLURB / HUDCC

2. if not registered, deemed as such when

if the share of stock sold is from FC; consummation during the taxable year of

treat as a personal property, making at least 6 taxable real estate sale

the place where it was sold material. transactions

so tax liability would depend as to registration as habitually engaged un

who is the taxpayer vis-a-vis

sources within or without

if the share is an ordinary asset, the NOTE:

real estate business with the LGU or BIR

tax liability of the taxpayer would property purchased for future use shall remain

depend to his status, whether NIT/ as an ordinary asset even if such purpose is

GIT later thwarted by circumstances beyond his

if traded in local stock exchange; control.

subject to percentage tax.

AAA - BASTE / ATB

prepared by: ronie ablan

THE AWESOME NOTES

Page 8 of 8

TAX ON RC, NRC, RA

EXE: WHEN EVEN SUBJECT TO FIT, INCOME FROM SALE, EXCHANGE OR

TAXPAYER MAY OPT TO PAY FOR NIT OTHER DISPOSITION OF OTHER CAPITAL

when the disposition from which gain was

derived at was made to the govt, any of its

ASSETS

political subdivisions or agencies.

NOTE: RR 2-98

SUBJECT TO: graduated income tax.

ie. OTHER DISPOSITION OF CAPITAL

payment of FIT constitute as full

settlement of tax liability on said

income. hence, no longer liable to pay

ASSETS

Retirement of Bonds, Etc. -

NIT should FIT had been paid.

WHEN EXEMPT FROM CAPITAL GAIN TAX

amounts received by the holder upon the

retirement of bonds, debentures, notes or

certificates or other evidences of indebtedness

REQUISITES: issued by any corporation (including those

1. the property sold or otherwise disposed of issued by a government or political subdivision

is the principal residence of the taxpayer thereof) with interest coupons or in registered

2. the proceeds of which is fully utilized in form,

acquiring or constructing a new principal shall be considered as amounts

residence

3. the acquisition or construction of the new

principal residence is within 18 months from

received in exchange therefor.

Gains or Losses From Short Sales, Etc. -

the date of sale or disposition 1. Gains or losses from short sales of property

4. the historical cost or adjusted basis of the shall be considered as gains or losses from

real property sold or disposed shall be sales or exchanges of capital assets; and

carried over to the new principal residence 2. Gains or losses attributable to the failure to

built or acquired exercise privileges or options to buy or sell

5. the taxpayer should inform the BIR of his property shall be considered as capital

intention to avail of the exemption within 30

Days from the sale or disposition; and

6. the tax exemption can only be availed only

gains or losses.

SHORT SALE; defined

once every 10 years

EFFECT WHEN THERE IS NO FULL

a sale where the seller is selling a

property

without distinction if what kind of

UTILIZATION OF THE PROCEEDS property he is selling, whether a

the portion of the gain presumed to share of stock or not, or

have been realized from sale or which is not in his possession.

disposition, shall be subject to Capital

Gain Tax.

FORMULA

GSP/FMV whichever is higher shall be

multiplied by a fraction which the

unutilized amount bears to the GSP, in

order to determine the taxable portion

NOTE: PRESUMED GAIN IN SALE/

EXCHANGE OF REAL PROPERTY

CLASSIFIED AS A CAPITAL ASSET

- including pacto de retro sale and other

conditional sale, by an individual, estate or

trust.

AAA - BASTE / ATB

prepared by: ronie ablan

You might also like

- Module 09 - Inclusions in Gross IncomeDocument15 pagesModule 09 - Inclusions in Gross IncomeRoligen Rose PachicoyNo ratings yet

- Tax Reviewer (Mfp-2)Document13 pagesTax Reviewer (Mfp-2)Mikaela Pamatmat100% (1)

- Last Minute Notes DeductionDocument2 pagesLast Minute Notes DeductionPrincess Helen Grace BeberoNo ratings yet

- Rule:: Revenue From Sales Revenue From ProfessionDocument2 pagesRule:: Revenue From Sales Revenue From Profession在于在No ratings yet

- Capital Items With Infinite Value Types of TransfersDocument3 pagesCapital Items With Infinite Value Types of TransferslcNo ratings yet

- Lesson 3 - CopopopopopDocument2 pagesLesson 3 - Copopopopop在于在No ratings yet

- Income Taxation Lesson 3Document6 pagesIncome Taxation Lesson 3DYLANNo ratings yet

- Tax PPT 7.2 Regular Income TaxationDocument17 pagesTax PPT 7.2 Regular Income TaxationFrance NoreenNo ratings yet

- Income Taxation Business TaxationDocument62 pagesIncome Taxation Business TaxationAllen SoNo ratings yet

- Final Tax PDFDocument50 pagesFinal Tax PDFMicol Villaflor Ü100% (1)

- 6 - Deductions From Gross IncomeDocument9 pages6 - Deductions From Gross IncomeSamantha Nicole Hoy100% (2)

- Regular Income Tax: Inclusions in Gross IncomeDocument10 pagesRegular Income Tax: Inclusions in Gross IncomeAngelica PagaduanNo ratings yet

- 21 Inclusion and Exclusion of GiDocument15 pages21 Inclusion and Exclusion of GiAlmineNo ratings yet

- Chpater 5 - Final Income TaxationDocument31 pagesChpater 5 - Final Income TaxationKeziah YpilNo ratings yet

- OCT. 3 Long QuizDocument4 pagesOCT. 3 Long QuizAudrianna EliseNo ratings yet

- Deductions From Gross IncomeDocument3 pagesDeductions From Gross IncomeKezNo ratings yet

- Income Taxation: 2. Personal Income Tax: Non-Resident Citizen (1999)Document8 pagesIncome Taxation: 2. Personal Income Tax: Non-Resident Citizen (1999)Anonymous oWQuKcUNo ratings yet

- Items of Gross Income Subject To RegularDocument2 pagesItems of Gross Income Subject To Regularace zeroNo ratings yet

- 1999 Taxation Law Bar QDocument8 pages1999 Taxation Law Bar QkdescallarNo ratings yet

- II. INCOME TAXATION (RA 8242 Tax Reform Act of 1997) A. IndividualsDocument7 pagesII. INCOME TAXATION (RA 8242 Tax Reform Act of 1997) A. IndividualsRina TravelsNo ratings yet

- Income TaxtionDocument2 pagesIncome TaxtionIvan SanielNo ratings yet

- All TaxesDocument9 pagesAll TaxesJv FerminNo ratings yet

- Gross IncomeDocument5 pagesGross IncomeNavarro Cristine C.No ratings yet

- DEDUCTIONSDocument9 pagesDEDUCTIONSAisaia Jay ToralNo ratings yet

- Lesson 8: Deductions To Gross IncomeDocument28 pagesLesson 8: Deductions To Gross IncomeeuniNo ratings yet

- Tax RatesDocument37 pagesTax RatesMelanie OngNo ratings yet

- Inclusions in Gross IncomeDocument2 pagesInclusions in Gross Incomeloonie tunesNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument5 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- 3 Income From Other SourcesDocument4 pages3 Income From Other SourcesIshani MukherjeeNo ratings yet

- Chapter 9 - RIT - Inclusions in Gross IncomeDocument3 pagesChapter 9 - RIT - Inclusions in Gross Incomeclaritaquijano526No ratings yet

- Part 3 - Beda NotesDocument6 pagesPart 3 - Beda NotesNoelle SanidadNo ratings yet

- Taxation I Finals Notes USC LawDocument51 pagesTaxation I Finals Notes USC LawJansen OuanoNo ratings yet

- CHAPTER 9 Regular Income TaxDocument8 pagesCHAPTER 9 Regular Income TaxAlyssa BerangberangNo ratings yet

- TAX LAW BALA SA BAR SERIES ExportDocument10 pagesTAX LAW BALA SA BAR SERIES Exportmetrexz17.03No ratings yet

- Far Eastern University: An Institute of Accounts Business and FinanceDocument5 pagesFar Eastern University: An Institute of Accounts Business and FinanceAcademic StuffNo ratings yet

- FINAL TAX (General Rule: Applies To PASSIVE INCOME Earned WITHIN PH)Document9 pagesFINAL TAX (General Rule: Applies To PASSIVE INCOME Earned WITHIN PH)Royce DenolanNo ratings yet

- H06 - Regular Income TaxationDocument7 pagesH06 - Regular Income Taxationnona galidoNo ratings yet

- College of Accountancy & Business Administration Taxation I: Santiago City, PhilippinesDocument3 pagesCollege of Accountancy & Business Administration Taxation I: Santiago City, PhilippinesVel JuneNo ratings yet

- CHAPTER 13 A - Regular Allowable Itemized DeductionsDocument4 pagesCHAPTER 13 A - Regular Allowable Itemized DeductionsDeviane CalabriaNo ratings yet

- TAX.2811 Deductions From Gross IncomeDocument10 pagesTAX.2811 Deductions From Gross IncomeMary Ann Del PradoNo ratings yet

- Final Income TaxationDocument44 pagesFinal Income TaxationKimberly Ann Romero100% (2)

- 4 Gross-IncomeDocument5 pages4 Gross-IncomeSamantha Nicole HoyNo ratings yet

- Final Income TaxationDocument8 pagesFinal Income TaxationJade Ivy GarciaNo ratings yet

- Chapter 5: Final Income Taxation Final Withholding SystemDocument4 pagesChapter 5: Final Income Taxation Final Withholding SystemHanz RecitasNo ratings yet

- 04 Regular Income Taxation Exclusions and Inclusions To Gross IncomeDocument22 pages04 Regular Income Taxation Exclusions and Inclusions To Gross IncomeRuth MuldongNo ratings yet

- Allowable DeductionsDocument15 pagesAllowable DeductionsEloisa Venice TinsayNo ratings yet

- Tax Flash - Fall 2004 - ElectronicDocument2 pagesTax Flash - Fall 2004 - ElectronicGuspita ArfinaNo ratings yet

- Deductions On Gross IncomeDocument6 pagesDeductions On Gross IncomeJamaica DavidNo ratings yet

- Items of Gross Income Subject To RegularDocument2 pagesItems of Gross Income Subject To Regularhannah drew ovejasNo ratings yet

- TRAIN (Changes) ???? Pages 7, 10 - 12Document4 pagesTRAIN (Changes) ???? Pages 7, 10 - 12blackmail1No ratings yet

- Regular Income Taxation: Inclusion in Gross Income: Chan, John Mark Juganas, Hazel Madayag, Jovie AnnDocument43 pagesRegular Income Taxation: Inclusion in Gross Income: Chan, John Mark Juganas, Hazel Madayag, Jovie AnnAngelica PagaduanNo ratings yet

- INCLUSION: (Code: STP-IRR-DAP-PS) : GROSS INCOME - Means All Income Derived From Whatever Allowable DeductionsDocument8 pagesINCLUSION: (Code: STP-IRR-DAP-PS) : GROSS INCOME - Means All Income Derived From Whatever Allowable DeductionsRagnar LothbrokNo ratings yet

- 3 Individual and Corporate TaxDocument12 pages3 Individual and Corporate TaxPablo EschovalNo ratings yet

- Module 9 Inclusions and Exclusions From Gross IncomeDocument10 pagesModule 9 Inclusions and Exclusions From Gross IncomeKurt CyrilNo ratings yet

- FAQ - PERA (As of 31 July 2021)Document16 pagesFAQ - PERA (As of 31 July 2021)Jomar Joseph Cabigon Jr.No ratings yet

- Income TaxDocument4 pagesIncome TaxAisaia Jay ToralNo ratings yet

- Northern Cpa Review: Taxation Regular Income Taxation: Deductions From Gross IncomeDocument16 pagesNorthern Cpa Review: Taxation Regular Income Taxation: Deductions From Gross IncomePauline EchanoNo ratings yet

- Topic: Regular Income Tax - Gross Income Aljon J. Roque, CPA, MBADocument3 pagesTopic: Regular Income Tax - Gross Income Aljon J. Roque, CPA, MBAJhon Ariel JulatonNo ratings yet

- ICPAStudyCalendar 2017 To 2018 ZZZZZDocument6 pagesICPAStudyCalendar 2017 To 2018 ZZZZZkirigaya kazutoNo ratings yet

- Chapter 3 AisDocument6 pagesChapter 3 AisMay Anne NangleganNo ratings yet

- New Boa Syllabus - Financial Accounting & ReportingDocument3 pagesNew Boa Syllabus - Financial Accounting & ReportingVoltairePeraltaNo ratings yet

- BOA Syllabus MASDocument3 pagesBOA Syllabus MASElizabeth YgotNo ratings yet

- Product Specification: Cake Mixes - Leavening AgentsDocument1 pageProduct Specification: Cake Mixes - Leavening AgentsMay Anne NangleganNo ratings yet

- AccDocument4 pagesAccMay Anne NangleganNo ratings yet

- The Balanced Scorecard at Philips ElectronicsDocument5 pagesThe Balanced Scorecard at Philips ElectronicsAudrius MiknevičiusNo ratings yet

- Chemicals, Fertilizers, Agriculture & SugarDocument66 pagesChemicals, Fertilizers, Agriculture & Sugarfzhaque3525No ratings yet

- Village Scale Coco Foods Processing Plant Pre Feasibility StudyDocument7 pagesVillage Scale Coco Foods Processing Plant Pre Feasibility StudyGeorge Tumaob Calaor100% (3)

- Final Prospectus Pcor PDFDocument229 pagesFinal Prospectus Pcor PDFyamaleihsNo ratings yet

- Financial Management - Capital Budgeting Answer KeyDocument5 pagesFinancial Management - Capital Budgeting Answer KeyRed Velvet100% (1)

- Corruption: Concepts, Types, Causes and Consequences (Bregovic)Document7 pagesCorruption: Concepts, Types, Causes and Consequences (Bregovic)Calypso100% (1)

- Investments Concepts and Applications 5th Edition Heaney Test BankDocument13 pagesInvestments Concepts and Applications 5th Edition Heaney Test Bankjesselact0vvk100% (33)

- SyllabusDocument11 pagesSyllabusMuhammad Qaisar LatifNo ratings yet

- Import, Export and RemittanceDocument29 pagesImport, Export and RemittanceSanzida BegumNo ratings yet

- Shivika Bansal ʹ 98 Nirav Kansariwala ʹ120 Niphul Jain ʹ 123 Rituraj P.Das ʹ 147 Garima Barthwal ʹ 156 Kush Ghodasara-160 Renuka Saxena ʹ 178Document16 pagesShivika Bansal ʹ 98 Nirav Kansariwala ʹ120 Niphul Jain ʹ 123 Rituraj P.Das ʹ 147 Garima Barthwal ʹ 156 Kush Ghodasara-160 Renuka Saxena ʹ 178Kush GhodasaraNo ratings yet

- Conservative Mutual Funds AssessmentDocument24 pagesConservative Mutual Funds AssessmentRula Abu NuwarNo ratings yet

- Mandate For Individuals: To: Danske Bank A/S Trading As Danske Bank ("The Bank")Document3 pagesMandate For Individuals: To: Danske Bank A/S Trading As Danske Bank ("The Bank")EmmaNo ratings yet

- Materiality ConceptDocument16 pagesMateriality Conceptsuman2031459No ratings yet

- What Are Financial Statements?: Financial Statements Represent A Formal Record of The Financial Activities ofDocument6 pagesWhat Are Financial Statements?: Financial Statements Represent A Formal Record of The Financial Activities ofkyrieNo ratings yet

- Notes To FSDocument3 pagesNotes To FSdhez10No ratings yet

- State Governments Incentives For InvestorsDocument6 pagesState Governments Incentives For InvestorsbalqueesNo ratings yet

- Mba-511 Bata Shoe Company LTDDocument11 pagesMba-511 Bata Shoe Company LTDNasim HaidarNo ratings yet

- Chapter 2 ExercisesDocument13 pagesChapter 2 ExercisesKiều PhươngNo ratings yet

- DRHP Home First FinanceDocument357 pagesDRHP Home First FinanceHarsh KediaNo ratings yet

- Tutorial 5 QuestionsDocument2 pagesTutorial 5 QuestionsNguyễn Ngọc ThôngNo ratings yet

- Alphaquest Ucits Fund: Factsheet The ManagerDocument2 pagesAlphaquest Ucits Fund: Factsheet The ManagerLinda FreemanNo ratings yet

- A Study On Financial Performance of Cement Industries in Tamilnadu With Reference To Select Cement CompaniesDocument6 pagesA Study On Financial Performance of Cement Industries in Tamilnadu With Reference To Select Cement CompaniesShrirang LichadeNo ratings yet

- MFC 2nd SEMESTER FM Assignment 1 FMDocument6 pagesMFC 2nd SEMESTER FM Assignment 1 FMSumayaNo ratings yet

- Sampath 2015Document496 pagesSampath 2015Chandima HarishchandraNo ratings yet

- BpsDocument2 pagesBpsTina JiangNo ratings yet

- Save Microfinance Private Limited: RatingsDocument4 pagesSave Microfinance Private Limited: RatingsSubhamNo ratings yet

- Corporate Valuation - 16th October 2021Document2 pagesCorporate Valuation - 16th October 2021Shivam ChoudharyNo ratings yet

- Exam - Public Finance - 140110 PDFDocument3 pagesExam - Public Finance - 140110 PDFlancmard2No ratings yet

- Axis BankDocument44 pagesAxis Bank2kd TermanitoNo ratings yet

- BASIC Book KeepingDocument79 pagesBASIC Book KeepingRicky BaldadoNo ratings yet