Professional Documents

Culture Documents

Insolvency and Bankruptcy Code, 2016

Uploaded by

Ayush BhadauriaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Insolvency and Bankruptcy Code, 2016

Uploaded by

Ayush BhadauriaCopyright:

Available Formats

INDIAN ECONOMY

CURRENT AFFAIRS 2017

3. INSOLVENCY AND BANKRUPTCY CODE, 2016

PURPOSE:

- In India, there has been a lack of global standards in dealing with default of debt.

- The bankruptcy proceedings and recovery by creditors is plagued by a plethora of

Acts. E.g.: Sick Industrial Companies (Special Provisions) Act, 1985, Recovery of

Debts Due to Banks and Financial Institutions Act, 1993 etc.

- Some of these laws are almost a century old, and have not kept up with the times.

E.g.: Presidential Towns insolvency Act, 1909 and Provincial Insolvency Act, 1920.

- Due to the overlapping jurisdictions of these laws and lack of clarity in their

provisions, there have been delays in the Insolvency Resolution.

- The existing laws have failed to aid recovery for lenders or restructuring of firms.

- This has hindered the confidence of lenders, which has in turn diminished debt

access for borrowers.

- It hampers ease-of-doing business. The World Bank has stated that it takes 4 years

to resolve a bankruptcy case in India.

FEATURES:

- To speedily identify financially distressed companies and its resolution, if the

underlying business is viable. The Code will also ensure time-bound settlement of

insolvency and create a database of serial defaultersall critical in resolving Indias

bad debt problem which has crippled bank lending. This will make it easier for

financial institutions to deal with Non-Performing Assets (NPAs) arising out of

failed ventures.

- To consolidate existing laws relating to insolvency and reorganization of

companies.

- To facilitate the easy exit of companies, an issue which has been plaguing the

industry for long.

- To addresses cross-border insolvency.

- To promote entrepreneurship and availability of credit to all stakeholders in a

time-bound manner.

- To maximize the value of assets concerned.

NEO IAS 0484-3190310, 9446331522, 9446334122 Page 1

www.neoias.com | www.youtube.com/neoias | www.facebook.com/neoias | www.twitter.com/neoias

PROCESS:

The Code creates time-bound processes for insolvency resolution of companies

and individuals. These processes will be completed within 180 days. If insolvency

cannot be resolved, the assets of the borrowers may be sold to repay creditors.

The essential idea is that when a firm defaults on its debt, control shifts to a

Committee of Creditors, who has a fixed time period to evaluate proposals from

interested parties about resuscitating the company or to enable liquidation.

It may be initiated by the debtor or creditor.

The Code essentially contains 4 pillars of Institutional Infrastructure;

I. First is a class of regulated persons; the Insolvency Professionals. They play

a key role in the working of the insolvency resolution process by initiating it or

managing and liquidating distressed assets. They would in turn be regulated

by Insolvency Professional Agencies.

II. Second is the electronic database; the `Information Utilities'. They would

collect and disseminate information about lenders and terms of lending, so as

to facilitate the Insolvency Resolution.

III. Third is adjudication. The NCLT (National Company Law Tribunal) will be the

forum where firm insolvency will be heard and DRT (Debt Recovery Tribunal) will

be the forum where individual insolvencies will be heard. These institutions,

along with their Appellate Bodies; NCLAT and DRATs will be adequately

NEO IAS 0484-3190310, 9446331522, 9446334122 Page 2

www.neoias.com | www.youtube.com/neoias | www.facebook.com/neoias | www.twitter.com/neoias

strengthened so as to achieve world class functioning of the bankruptcy

process.

IV. Fourth pillar is a regulator; The Insolvency and Bankruptcy Board of India.

This body will have regulatory over-sight over the whole process.

ISSUES:

- Market Slump: Several Non-Performing Assets (NPAs) are in sectors where market

conditions are in a slump, such as steel, power and textiles. In this environment, it is

difficult for banks to find suitable buyers of distressed assets at desired

valuations.

- Ambiguous Provision: Although there is a provision in the Code that no legal

proceedings can be permitted against insolvency professionals or concerned officials

for anything done in good faith, they find it difficult to prove if a particular act was

done in good faith or not.

- Flexibility and Autonomy: The tight resolution timelines envisaged under the

code cannot be achieved if bankers do not have the flexibility and the autonomy to

sell distressed assets.

- Promoters Ignored: Role Promoters play in delaying NPA resolutions has been

ignored. Majority of businesses in India remain under the control of their

Promoters. In order to resolve the issue of NPAs, the involvement of Promoters is

paramount for bankers to make significant management changes.

- No Scope for Settlement: It is alarming that the Code prohibits withdrawal of the

application once the same has been admitted. This means that there is no scope

whatsoever for settlement.

- Creditors Over Debtors: The debtor is not given any opportunity to put forth

his/her case or representation in the entire process. In this manner, the Code

ignores rights enshrined in the Constitution.

- Capacity Concerns: The severe capacity constraints of the NCLT and DRT in

handling the present and past backlog of cases are yet to be resolved. Insufficient

technical expertise and infrastructure could also hinder the smooth functioning of

the process.

- Selection of IPs: Regarding IPs (Insolvency Professionals), it is critical to develop a

robust way to select the most qualified, and to ensure that they are independent

and do not allow Promoters or other stakeholders to manipulate the resolution

process in any unfair manner. This is crucial for the successful implementation of

the IBC.

NEO IAS 0484-3190310, 9446331522, 9446334122 Page 3

www.neoias.com | www.youtube.com/neoias | www.facebook.com/neoias | www.twitter.com/neoias

- Secure MSMEs: It is necessary to ensure that the Code has no adverse impact on

the MSME sector, which is constantly grappling with problems of delayed payment

of their dues, which may result in the filing of insolvency petition

- Purpose of Insolvency and Bankruptcy Fund: The Code creates an Insolvency

and Bankruptcy Fund for those concerned under the Code. However, it does not

specify the manner in which the Fund will be used.

- Initiate International Agreements: Regarding Cross-Border Insolvency, it is

necessary for the central government to enter into reciprocal arrangements with other

countries which could benefit sectors such as aviation, shipping, and infrastructure,

amongst others. These reciprocal arrangements would also be useful in all those

cases where the creditors are pursuing remedies abroad or the company has

overseas assets.

MODEL QUESTION

1. The Insolvency and Bankruptcy Code, 2016 is said to increase the ease of doing

business in India. How does it propose to do so? Discuss the issues involved in the

code, if any.

NEO IAS 0484-3190310, 9446331522, 9446334122 Page 4

www.neoias.com | www.youtube.com/neoias | www.facebook.com/neoias | www.twitter.com/neoias

You might also like

- Insolvency & Bankruptcy Code: For RBI Grade B 2018 and NABARD Grade A and Grade B 2018Document35 pagesInsolvency & Bankruptcy Code: For RBI Grade B 2018 and NABARD Grade A and Grade B 2018gunjanjoshi07No ratings yet

- Economics For Everyone: The Insolvency and Bankruptcy Code in India and The National Company Law Tribunal (NCLT)Document9 pagesEconomics For Everyone: The Insolvency and Bankruptcy Code in India and The National Company Law Tribunal (NCLT)KatyayaniNo ratings yet

- Role of insolvency resolution under IBCDocument24 pagesRole of insolvency resolution under IBCHemantPrajapatiNo ratings yet

- IBC Code Overview and ObjectivesDocument5 pagesIBC Code Overview and ObjectivesAananya DanielNo ratings yet

- 8. News UpdateDocument14 pages8. News UpdateArjit KumarNo ratings yet

- Fodder Material For Phase 2 For SEBI Grade A 2020: WWW - Edutap.Co - in Hello@Edutap - Co.InDocument13 pagesFodder Material For Phase 2 For SEBI Grade A 2020: WWW - Edutap.Co - in Hello@Edutap - Co.InMega MindNo ratings yet

- Knowledge is Power - Understanding the Importance of Knowledge According to the Insolvency and Bankruptcy CodeDocument41 pagesKnowledge is Power - Understanding the Importance of Knowledge According to the Insolvency and Bankruptcy CodeAlisha VaswaniNo ratings yet

- Summary of Stefan Loesch's A Guide to Financial Regulation for Fintech EntrepreneursFrom EverandSummary of Stefan Loesch's A Guide to Financial Regulation for Fintech EntrepreneursNo ratings yet

- Understanding Cross Border Insolvency An Indian Overview 03Document21 pagesUnderstanding Cross Border Insolvency An Indian Overview 03BADDAM PARICHAYA REDDYNo ratings yet

- Project Report of Company Law ON Insolvency and Banktrupcy CODE, 2016 With Reference To Ultra Tech Cements LimitedDocument16 pagesProject Report of Company Law ON Insolvency and Banktrupcy CODE, 2016 With Reference To Ultra Tech Cements LimitedNitish PathakNo ratings yet

- Session 04 Eco AnswDocument3 pagesSession 04 Eco AnswParvathaneni KarishmaNo ratings yet

- Corporate LawDocument36 pagesCorporate LawJahnnavi SarkhelNo ratings yet

- Corporate Insolvency NotesDocument15 pagesCorporate Insolvency NotesAnirudh SoodNo ratings yet

- Ibc ProjectDocument3 pagesIbc ProjectSurbhi GoyalNo ratings yet

- Project Report on Insolvency and Bankruptcy Code with reference to Ultra Tech Cements LimitedDocument35 pagesProject Report on Insolvency and Bankruptcy Code with reference to Ultra Tech Cements Limitedkartik100% (1)

- A Resolve For ResolutionDocument18 pagesA Resolve For ResolutionSuraj KumarNo ratings yet

- Insolvency and Bankruptcy EconomicDocument15 pagesInsolvency and Bankruptcy EconomicSNEHA SOLANKINo ratings yet

- Roll No. 732 (IBC)Document16 pagesRoll No. 732 (IBC)Annie Toppo100% (2)

- INSOLVENY AND BANKRUPTCY CODEDocument4 pagesINSOLVENY AND BANKRUPTCY CODESING ALONGNo ratings yet

- 17.IBC (Concept) PDFDocument29 pages17.IBC (Concept) PDFkandagatla prudhviiNo ratings yet

- Study of The Insolvency and Bankruptcy Code 2016Document15 pagesStudy of The Insolvency and Bankruptcy Code 2016Devansh DoshiNo ratings yet

- Presentation 2Document52 pagesPresentation 2moto mouliNo ratings yet

- GGovsor Case StudyDocument10 pagesGGovsor Case StudySean Dominic BunquinNo ratings yet

- business law projectDocument18 pagesbusiness law projectMuskan MaheshwariNo ratings yet

- U-4 Insolvency and Bankruptcy Code 2016Document26 pagesU-4 Insolvency and Bankruptcy Code 2016HIMANI PALAKSHANo ratings yet

- Jitendra Kumar Patel Module 5 Batch I Amp Xi BatchDocument6 pagesJitendra Kumar Patel Module 5 Batch I Amp Xi Batchjitendra39.kumarNo ratings yet

- SSRN Id3425370Document21 pagesSSRN Id3425370Poonam SharmaNo ratings yet

- Assignment No 2 FIN 602Document9 pagesAssignment No 2 FIN 602NadirNo ratings yet

- The Abridgment of A Flawed Insolvency RegimeDocument10 pagesThe Abridgment of A Flawed Insolvency RegimegurneetNo ratings yet

- Professional Opportunities and Role That Can Be Served by Chartered Accountants Under Insolvency RegimeDocument25 pagesProfessional Opportunities and Role That Can Be Served by Chartered Accountants Under Insolvency RegimeCA. (Dr.) Rajkumar Satyanarayan AdukiaNo ratings yet

- Unit 4 - Insolvency & Bankruptcy CodeDocument18 pagesUnit 4 - Insolvency & Bankruptcy CodeChandana M NNo ratings yet

- Introduction and Overview of IBCDocument3 pagesIntroduction and Overview of IBCArushi JindalNo ratings yet

- Ibc FinalsDocument51 pagesIbc FinalsMALKANI DISHA DEEPAKNo ratings yet

- IBC Code 2016 SummaryDocument12 pagesIBC Code 2016 SummaryAmanNo ratings yet

- The Need For A Robust Legal Framework For Cbi in India 04Document19 pagesThe Need For A Robust Legal Framework For Cbi in India 04BADDAM PARICHAYA REDDYNo ratings yet

- Corporate Governance Is The Set ofDocument16 pagesCorporate Governance Is The Set ofMazhar SarwashNo ratings yet

- THE IBC, 2016 SymbiosisDocument35 pagesTHE IBC, 2016 SymbiosisNavya TomerNo ratings yet

- IBC 2016 and IBC Amendment Bill, 2021Document5 pagesIBC 2016 and IBC Amendment Bill, 2021Keshav GuptaNo ratings yet

- COmpany LAw-1Document11 pagesCOmpany LAw-1Suruchi SinghNo ratings yet

- 12-03-2020Document42 pages12-03-2020AlishaNo ratings yet

- Insolvency and Bankruptcy: Social, Legal, Economic and Financial PerspectivesDocument23 pagesInsolvency and Bankruptcy: Social, Legal, Economic and Financial PerspectivesAlisha0% (1)

- Module 1 - Unit 2Document20 pagesModule 1 - Unit 2AlishaNo ratings yet

- Jitendra Chauhan College of Law: SubjectDocument21 pagesJitendra Chauhan College of Law: SubjectNiraj Arun ThakkarNo ratings yet

- MSME IBC2 FootDocument26 pagesMSME IBC2 FootPriyadarshan NairNo ratings yet

- IBC Amendment Bill 2021 UPSC NotesDocument5 pagesIBC Amendment Bill 2021 UPSC NotesAvik PodderNo ratings yet

- Paper 3Document90 pagesPaper 3NIVAAYA VlogsNo ratings yet

- Paper 3 TheoryDocument90 pagesPaper 3 TheoryAditya SuriNo ratings yet

- Critical Analysis of IBC CodeDocument32 pagesCritical Analysis of IBC CodesandeshNo ratings yet

- Module-8-Debt RecoveryDocument15 pagesModule-8-Debt Recoveryk.akshayaNo ratings yet

- IBC Opportunities for CMAsDocument7 pagesIBC Opportunities for CMAstanmaya_purohitNo ratings yet

- Ibc 2016Document74 pagesIbc 2016Roshini Chinnappa100% (1)

- What Is Insolvency and Bankruptcy CodeDocument9 pagesWhat Is Insolvency and Bankruptcy CodeJosef AnthonyNo ratings yet

- Insolvency and Bankruptcy CodeDocument27 pagesInsolvency and Bankruptcy Codeshivam_2607No ratings yet

- Insolvency and Bankruptcy Code, 2016: Learning OutcomesDocument88 pagesInsolvency and Bankruptcy Code, 2016: Learning OutcomesMukesh DholakiaNo ratings yet

- Shortcomings of the PIT Regulations 2015Document2 pagesShortcomings of the PIT Regulations 2015Pratham AryaNo ratings yet

- Shadda KaporDocument25 pagesShadda KaporAyushi MehtaNo ratings yet

- PGDM Chirag PresentationDocument57 pagesPGDM Chirag PresentationEkta Chaturvedi [LUC]No ratings yet

- Pwc-Dlak Comparative Study Report Printable 1Document62 pagesPwc-Dlak Comparative Study Report Printable 1api-4664474360% (1)

- d. Investor ProtectionDocument26 pagesd. Investor ProtectionShivam JainNo ratings yet

- Bill Position - 2ndDocument3 pagesBill Position - 2ndAyush BhadauriaNo ratings yet

- Delhi ReportDocument2 pagesDelhi ReportAyush BhadauriaNo ratings yet

- Guidelines For Short Film Making CompetitionDocument1 pageGuidelines For Short Film Making CompetitionAyush BhadauriaNo ratings yet

- Assignment 6.3: Z 1, Z 3, Z 3 y (X) X + XDocument13 pagesAssignment 6.3: Z 1, Z 3, Z 3 y (X) X + XAyush BhadauriaNo ratings yet

- Mechanical5Document7 pagesMechanical5Ayush BhadauriaNo ratings yet

- 733 Assignment 3.3: 1. 2.942821 3. 1.875 7. (I) 1.860, .2541 13. - 1.25115 and 0.55000Document1 page733 Assignment 3.3: 1. 2.942821 3. 1.875 7. (I) 1.860, .2541 13. - 1.25115 and 0.55000Ayush BhadauriaNo ratings yet

- UNSC ReformsDocument5 pagesUNSC ReformsAyush BhadauriaNo ratings yet

- Toilet 1.75 lacDocument1 pageToilet 1.75 lacAyush BhadauriaNo ratings yet

- IIT5Document31 pagesIIT5Ayush BhadauriaNo ratings yet

- LiFE MovementDocument5 pagesLiFE MovementAyush BhadauriaNo ratings yet

- Regula Falsi PDFDocument16 pagesRegula Falsi PDFAyush Bhadauria50% (2)

- Runge Kutta MethodDocument53 pagesRunge Kutta MethodAyush Bhadauria0% (1)

- Eu 2Document15 pagesEu 2Ayush BhadauriaNo ratings yet

- Computer-based numerical and statistical techniques assignmentsDocument1 pageComputer-based numerical and statistical techniques assignmentsAyush BhadauriaNo ratings yet

- N S O D E: Umerical Olution OF Rdinary Ifferential QuationsDocument3 pagesN S O D E: Umerical Olution OF Rdinary Ifferential QuationsAyush BhadauriaNo ratings yet

- Lgebraic AND Ranscendental Quations: Chapt ErDocument18 pagesLgebraic AND Ranscendental Quations: Chapt ErAyush BhadauriaNo ratings yet

- Attachment Attachment Lecture 1 Polity PDFDocument14 pagesAttachment Attachment Lecture 1 Polity PDFAyush BhadauriaNo ratings yet

- 732 Assignment 2.2: C - B N S TDocument1 page732 Assignment 2.2: C - B N S TAyush BhadauriaNo ratings yet

- I Unit Matrices AssignmentDocument4 pagesI Unit Matrices AssignmentAyush BhadauriaNo ratings yet

- I Unit Matrices AssignmentDocument4 pagesI Unit Matrices Assignmentwood_ksd3251No ratings yet

- Model Answers (PURA)Document3 pagesModel Answers (PURA)Ayush BhadauriaNo ratings yet

- Ethics and Human Interface PDFDocument9 pagesEthics and Human Interface PDFAyush BhadauriaNo ratings yet

- Indian Economy - Natural Gas Resources: Unlocking Shale Gas PotentialDocument8 pagesIndian Economy - Natural Gas Resources: Unlocking Shale Gas PotentialAyush BhadauriaNo ratings yet

- Budget PDFDocument11 pagesBudget PDFAyush BhadauriaNo ratings yet

- Government policies and interventions for social sector developmentDocument8 pagesGovernment policies and interventions for social sector developmentAyush BhadauriaNo ratings yet

- Note On Anti-DefectionDocument4 pagesNote On Anti-DefectionAdv Rohit DeswalNo ratings yet

- Capital Market PDFDocument12 pagesCapital Market PDFAyush BhadauriaNo ratings yet

- Partition of BengalDocument2 pagesPartition of BengalAyush BhadauriaNo ratings yet

- International Relations Current Affairs 2017 Rohingya CrisisDocument4 pagesInternational Relations Current Affairs 2017 Rohingya CrisisAyush BhadauriaNo ratings yet

- Modern Indian History Congress-Khilafat Swarajya Party (Swarajya Party)Document4 pagesModern Indian History Congress-Khilafat Swarajya Party (Swarajya Party)Ayush Bhadauria0% (1)

- Investment options analysis in IndiaDocument54 pagesInvestment options analysis in IndiaSagrika SagarNo ratings yet

- Convertible SecuritiesDocument10 pagesConvertible SecuritiesLoren RosariaNo ratings yet

- The Corporation: ©2017 Pearson Education, LTDDocument3 pagesThe Corporation: ©2017 Pearson Education, LTDhung TranNo ratings yet

- Solution to Derivatives Markets for Exam FMDocument10 pagesSolution to Derivatives Markets for Exam FMMadeleine EricaNo ratings yet

- Hedging With Interest Rate SwapsDocument16 pagesHedging With Interest Rate SwapsNiyati ShahNo ratings yet

- Press Release - WPG Commences Voluntary Chapter 11 Financial Restructuring (FINAL)Document3 pagesPress Release - WPG Commences Voluntary Chapter 11 Financial Restructuring (FINAL)NBC MontanaNo ratings yet

- Fundamental Security AnalysisDocument21 pagesFundamental Security AnalysisAbhisek ShawNo ratings yet

- 2019 BAR EXAM TAXATION LAW REVIEWDocument9 pages2019 BAR EXAM TAXATION LAW REVIEWzealous9carrotNo ratings yet

- Financial Statistical Summary: Attock Refinery LimitedDocument2 pagesFinancial Statistical Summary: Attock Refinery Limitedabrofab123No ratings yet

- Tutorial 1 AnswerDocument1 pageTutorial 1 AnswerSyuhaidah Binti Aziz ZudinNo ratings yet

- Wac Service Metro SailsDocument17 pagesWac Service Metro SailsJasmine Acta100% (2)

- BUSI 1043: INTRODUCTION TO FINANCIAL ACCOUNTING UNIT 3 EXERCISEDocument4 pagesBUSI 1043: INTRODUCTION TO FINANCIAL ACCOUNTING UNIT 3 EXERCISERichard MamisNo ratings yet

- Liquidity RatioDocument4 pagesLiquidity RatioskylarNo ratings yet

- Cash BudgetDocument3 pagesCash Budgetkeshav madamNo ratings yet

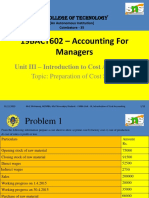

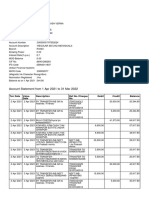

- 19BACT602 - Accounting For Managers: Unit III - Introduction To Cost AccountingDocument12 pages19BACT602 - Accounting For Managers: Unit III - Introduction To Cost AccountingReetaNo ratings yet

- Week 3 Tutorial Solutions - Fiancial AcountingDocument13 pagesWeek 3 Tutorial Solutions - Fiancial AcountingMi ThaiNo ratings yet

- Signed Off Entrepreneurship12q2 Mod10 Bookkeeping v4Document75 pagesSigned Off Entrepreneurship12q2 Mod10 Bookkeeping v4Felipe BalinasNo ratings yet

- Who Uses Fair Value Accounting For Non Financial Assets After Ifrs AdoptionDocument46 pagesWho Uses Fair Value Accounting For Non Financial Assets After Ifrs AdoptionVincent S Vincent0% (1)

- Faculty of Business, Finance & Information TechnologyDocument13 pagesFaculty of Business, Finance & Information TechnologyNurNo ratings yet

- A Je Worksheet Illustration 1Document17 pagesA Je Worksheet Illustration 1Nichole TanNo ratings yet

- Cel 1 Prac 1 Answer KeyDocument15 pagesCel 1 Prac 1 Answer KeyNJ MondigoNo ratings yet

- ERRORS - Accounting ErrorsDocument15 pagesERRORS - Accounting Errorsdeklerkkimberey45No ratings yet

- Accounting (IAS) Level 3/series 2 2008 (Code 3901)Document20 pagesAccounting (IAS) Level 3/series 2 2008 (Code 3901)Hein Linn Kyaw100% (3)

- Ratio Analysis About S.R. Steel IndustriesDocument51 pagesRatio Analysis About S.R. Steel IndustriesshaileshNo ratings yet

- IntAcc1 - Midterm Examination - 1st Sem 2019 2020 PDFDocument9 pagesIntAcc1 - Midterm Examination - 1st Sem 2019 2020 PDFAndrea Nicole BanzonNo ratings yet

- K1 TNHFHN TRQLZ 1 OBDocument15 pagesK1 TNHFHN TRQLZ 1 OBjai vermaNo ratings yet

- Accounting Equation WorksheetDocument1 pageAccounting Equation Worksheetapi-367095294100% (1)

- Comparative Study of Financial Statement Ratios Between Dell and EpsonDocument7 pagesComparative Study of Financial Statement Ratios Between Dell and EpsonMacharia NgunjiriNo ratings yet

- Insider TradingDocument2 pagesInsider TradingSanju VargheseNo ratings yet

- Functions and Operations of The Bangko Sentral NG Pilipinas (PPT Version)Document41 pagesFunctions and Operations of The Bangko Sentral NG Pilipinas (PPT Version)kim byunooNo ratings yet