Professional Documents

Culture Documents

Flexcube Corebanking SEO

Uploaded by

Isabel FabianoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Flexcube Corebanking SEO

Uploaded by

Isabel FabianoCopyright:

Available Formats

Flexcube Corebanking

Globalization post 90s opened floodgates for international banking players in the Indian

Market. International standards started percolating. Competition from foreign banks was on

the rise. Citibank, ANZ Grindlays made inroads in the banking sector with their swanky

offices and technology never before seen in India. Indian banks were at cross roads. There

was an imperative need for a major technological push. The automation that was mainly

maintenance centric, needed to evolve into a customer centric one. Single branch banking to

any branch banking was not a choice but necessity. Scouting for core banking solution with

a centralised database was at the top of actionable items for the banks. The best known

application at that juncture was BankMaster of Kindle, an Irish Company. State Bank of

India was the main user of the application in India. During the latter part of the 1990s sales

of BankMaster declined - whilst the Bankmaster solution set was considered to be

functionally rich, the core technology had been allowed to become obsolete

In India, migration from Total Branch Automation to Total Bank Automation had lots of

challenges. Integrated online transaction posting application with a centralised database had

serious constraints in infrastructure, investment considerations and availability of knowledge

workers. The movement took nearly 10 years and only in early 2000s, banks moved to core

banking solutions.

The major players in the market at that time were two Indian companies, Infosys and CITIL

(Citicorp Information Technologies Industries Ltd) . Finacle is a synergy of bankers and

software knowledge workers put together in a garage by the then startup Infosys, which is a

classic story of rags to riches. Flexcube on the other hand was developed as solution for

internal consumption of Citi Bank.

Oracle, a software major, was looking for a vertical specific growth strategy. The Citigroup at

that time was on a `sell mode' and found the perfect buyer in Oracle. The deal was stuck in

2005. CITIL was taken over by Oracle and in 2008 it became Oracle Financial Services

Software Limited (OFSS). By 2013, i-flex became a truly global product with 575 user banks

in 115 countries

The antecedents of Oracle Financial Service Software carrying the popular acronym OFSS,

reveals one of the greatest success stories of Indian Software hegemony. At the top of the

family tree was Citicorp Overseas Software Ltd ((COSL) ). In 1990, the company was just a

cost centre addressing the internal requirements of Citi Bank. Looking beyond organic

growth, COSL became Citicorp Information Technology Industries Ltd (CITIL) with a

mandate to grow profitably and globally. In the mid-90s, CITIL developed FLEXCUBE as a

product at its Bangalore GDC (Global Development Centre). After the launch of FLEXCUBE,

all of CITIL's transnational banking products were brought under a common brand umbrella.

Subsequently, company's name was changed to i-flex Solutions India Ltd.,

Oracle FLEXCUBE Universal banking (flagship product of OFSS) is a comprehensive Core

Banking suite for Global Banks. It provides end-to-end functionality across conventional

banking as well as Islamic banking. It provides centralized product configuration, processing,

and servicing. It has open development tools which helps banks and Oracle partners to

create and customize user interfaces.

Oracle Financial Services Software Ltd has 14 development centres across India, Singapore

and the USA. The Company has a strong global reach with a sales, marketing and support

presence in 27 overseas locations operating across four subsidiaries. In addition, 30

corporate business partners and 32 implementation partners represent i-flex across the

globe.

The three pillars of Flexcube are:

A very user friendly UI

Roll out much simpler and requires lesser manpower

Matured ecosystem of implementation and support partner organizations

Awards:

CEB TowerGroupCX/CRM Solutions for Banking

Oracle was ranked Best in Class in all four categories. Oracle Financial Services

Customer Insight was part of this submission, along with Oracle CX solutions.

GartnerLeader Magic Quadrant for International Retail Core Banking, 2015

IDC MarketScapeWorldwide Core Banking Solutions 2015 Vendor Assessment

Global Providers for European BanksMajor Player

Forrester Vendor LandscapeInternational Banking PlatformsOracle Is a Key

International Banking Platform Vendor (OBP), September 2015

Oracle Financial Services Software Limited (OFSS) has clients in 145 out of the total 196

countries in the world. Oracle Financial Services Software suite of products are used by

following banks in India

HDFC Bank Lakshmi Vilas Bank

Canara Bank Syndicate Bank

Yes Bank Karur Vysya

In 2016, Oracle Financial Services Software has been identified as the No.2 solution among

9 top applications by Forrester, an independent technology and market research company.

The shares are listed today at Rs.3507 at Bombay Stock Exchange, a figure way ahead of

market value of TCS and Infosys.

OFFS is one of the matured and respected player in the sphere of global banking solutions.

The churn in technology is perpetual and the goal post is ever shifting. BankMaster is now

a dinosaur. Finacle, OFSS, FIS, are in the top tier of the competition as of today. In the final

analysis, It is more about fighting to stay afloat for an unknown tomorrow than the knowledge

of today. OFSS seems to have been engaged with a focus for the emerging scenario. OFSS

with their strong international presence, has a ringside view of the rapidly changing

environment. The industry will be watching as to how it pans out in the coming years.

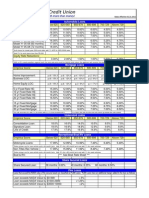

Refer the suite of products of OFFS in the appended table. For the discerning customer, it is

a one stop shop for all bank requirements.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Conceptual Framework and Accounting Standards Quiz Reviewer PDFDocument26 pagesConceptual Framework and Accounting Standards Quiz Reviewer PDFZeo AlcantaraNo ratings yet

- Wa0053.Document1 pageWa0053.millasayba1 SaybaNo ratings yet

- Facultative ReinsuranceDocument3 pagesFacultative ReinsuranceAlisha ThapaliyaNo ratings yet

- Loan RatesDocument1 pageLoan RatesAndrew ChambersNo ratings yet

- Account StatementDocument12 pagesAccount StatementSanjeev JoshiNo ratings yet

- F3内部讲义Document554 pagesF3内部讲义geng chenNo ratings yet

- TOA DRILL 3 (Practical Accounting 2)Document14 pagesTOA DRILL 3 (Practical Accounting 2)ROMAR A. PIGANo ratings yet

- 737 Top Transnational CorporationsDocument5 pages737 Top Transnational CorporationsvalensalNo ratings yet

- Statements 20230714Document6 pagesStatements 20230714Sima KadirNo ratings yet

- Asset and Liability ManagementDocument57 pagesAsset and Liability ManagementMayur Federer Kunder100% (2)

- Differential Equation - Compound InterestDocument10 pagesDifferential Equation - Compound InterestMiggy BaltazarNo ratings yet

- Towers Watson 500 Largest Asset ManagersDocument20 pagesTowers Watson 500 Largest Asset ManagersAdam TanNo ratings yet

- Investment in Subsidiary Problem A - Equity Model and Cost ModelDocument7 pagesInvestment in Subsidiary Problem A - Equity Model and Cost ModelJessica IslaNo ratings yet

- Accounting Equation TransactionsDocument2 pagesAccounting Equation TransactionsRonald CatapangNo ratings yet

- Correlation of Means of Finance With Project LifecycleDocument2 pagesCorrelation of Means of Finance With Project Lifecycleansh071102No ratings yet

- Prelim and Midterm CompilationDocument61 pagesPrelim and Midterm CompilationJOLLYBEL ROBLESNo ratings yet

- Union Home Application FormDocument3 pagesUnion Home Application FormHAINDAVI REDDY GUDDETINo ratings yet

- Company AuditDocument30 pagesCompany AuditChutmaarika GoteNo ratings yet

- Chapter 1 - Financial Reporting and Accounting StandardsDocument13 pagesChapter 1 - Financial Reporting and Accounting StandardsPeri BabsNo ratings yet

- Account StatementDocument1 pageAccount StatementИван ИвановNo ratings yet

- Cash CA NCA CLDocument8 pagesCash CA NCA CL15vinayNo ratings yet

- 8 - Operating and Financial LeverageDocument15 pages8 - Operating and Financial LeverageClariz VelasquezNo ratings yet

- Time Value of Money: DR. Mohamed SamehDocument22 pagesTime Value of Money: DR. Mohamed SamehRamadan IbrahemNo ratings yet

- Accounting Global 9th Edition Horngren Solutions ManualDocument12 pagesAccounting Global 9th Edition Horngren Solutions Manualmrsamandareynoldsiktzboqwad100% (26)

- How To Steal Money and (Almost) Get Away With ItDocument6 pagesHow To Steal Money and (Almost) Get Away With Itmarthaanum918No ratings yet

- Mock 02Document5 pagesMock 02api-26863276100% (1)

- Drill 1 - MidtermDocument3 pagesDrill 1 - MidtermcpacpacpaNo ratings yet

- Chapter 3 Fs AnalysisDocument8 pagesChapter 3 Fs AnalysisYlver John YepesNo ratings yet

- Business Finance Prelim To Finals ReviewerDocument127 pagesBusiness Finance Prelim To Finals ReviewerMartin BaratetaNo ratings yet