Professional Documents

Culture Documents

Assignment 2: Remarks

Uploaded by

Wyatt PaxtonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 2: Remarks

Uploaded by

Wyatt PaxtonCopyright:

Available Formats

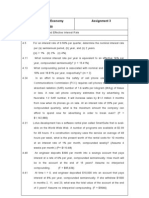

McGill University

Faculty of Management

Corporate Finance (FINE 342)

Fall 2017

ASSIGNMENT 2

REMARKS:

This is a group assignment with a maximum of 5 students per group.

The problems are to be answered in the space provided for them on this booklet.

Clearly show your working and encircle the final answer.

This assignment is due by 11am on Monday, Dec 11, 2017.

Member 1 Name : _______________________________________________________

Student no.: ____________________________

Member 2 Name : _______________________________________________________

Student no.: ____________________________

Member 3 Name : _______________________________________________________

Student no.: ____________________________

Member 4 Name : _______________________________________________________

Student no.: ____________________________

Member 5 Name : _______________________________________________________

Student no.: ____________________________

Corporate Finance (FINE 342) Page 1 of 10 Assignment 2

PROBLEM 1 (15 POINTS)

The MUS Company is planning to put a manufacturing facility in place to build widgets. The systematic risk of

this project alone is 25% greater than they currently manage. The company has a target debt to value ratio of

35%. The beta of the assets currently managed is 0.8 and they face a 36% tax rate. The initial investment cost

is $4,200,000 and the expected cash flows after tax are $1,200,000 per year for 6 years. The risk-free rate is

5% and you believe the historical market risk premium of 8.5% is a reasonable estimate.

(a) What is the all equity value of the investment? (5 points)

(b) What is the added value if the company finances this project with $682,044 worth of 16% debt which

requires an interest payment until maturity when the full principle is due? (4 points)

Corporate Finance (FINE 342) Page 2 of 10 Assignment 2

PROBLEM 1 CONTINUED

Use this space to continue working on 1(b)

(a) If the Albanic County Board of Commissioners approaches the MUS Company with an offer to raise the

needed $682,044 debt capital as 15% perpetual debt, should the company accept the offer? (6 points)

Corporate Finance (FINE 342) Page 3 of 10 Assignment 2

PROBLEM 2 (20 POINTS)

Suppose there are two firms ABC and XYZ. Suppose company ABC wants to take on a project that is unrelated

to its own business but reflects the business risks of company XYZ. The project promises to yield a perpetual

EBITDA of $200 that will grow at 2% each year. The project costs $1,000; and this $1,000 can be straight-line

depreciated for 10 years.

What is the value of the project under the different financing options listed below? Assume that the risk-free

rate is 8% and the market risk premium is 8.5%.

Company ABC Company XYZ

Debt-to-equity ratio = 1:3 Debt-to-equity ratio = 2:3

Cost of debt (pre-tax) = 10% Cost of debt (pre-tax) = 12%

TC = 40% Beta of equity = 1.5

TC= 40%

(a) Suppose the project was financed assuming that debt-to-equity would remain the same as the companys

given debt-to-equity for the life of the project. (10 POINTS)

Corporate Finance (FINE 342) Page 4 of 10 Assignment 2

PROBLEM 2 CONTINUED

Use this space to continue working on Problem 2

Corporate Finance (FINE 342) Page 5 of 10 Assignment 2

PROBLEM 2 CONTINUED

(b) Suppose the project would be 100% equity financed. (5 POINTS)

(c) Suppose the project would be financed with $400 worth of perpetual debt. (5 POINTS)

Corporate Finance (FINE 342) Page 6 of 10 Assignment 2

PROBLEM 3 (10 POINTS)

Quipta is a semi-conductor manufacturing firm with three divisions. These are Tools (TL), which constitutes 40

percent of the assets of the firm, Digital Equipment (DE), which constitutes 25 percent of the assets and

Foundry Equipment (FD), which constitutes the remaining 35 percent of the assets. The unlevered betas of the

three divisions (defined as the beta of the division if it were independent and 100% equity financed) are UTL =

1.5, UDE =0.7 and UFD = 0.5. Quiptas debt-to-equity ratio is 3/7 and the corporate tax rate is 34%. The

expected return on the market portfolio is 13 %. Quipta can borrow at the risk free interest rate of 4%.

Calculate the expected return on the equity for Quipta.

Corporate Finance (FINE 342) Page 7 of 10 Assignment 2

PROBLEM 3 CONTINUED

Use this space to continue working on Problem 3

Corporate Finance (FINE 342) Page 8 of 10 Assignment 2

PROBLEM 4 (15 POINTS)

GrandPreex Inc. is an all-stock corporation that manufactures consumer goods. Sales are expected to be $500

million over the course of this year (realized at the end of this year), and are projected to grow at 10% annual

rate over the following two years. After that point, sales will stabilize. Management estimates that cash costs will

be 60% of revenue in each year. To achieve these sales projections, total investment in plant and equipment

will have to be $40 million this year (again, paid out at year end), $45 million next year, and will level off at $50

million thereafter. Depreciation charges are expected to match investment outlays in each of these years.

GrandPreex is in the 34% tax bracket. The required return on GrandPreexs assets is 16% [This is r0]. The firm

has 10 million shares outstanding, currently trading at $65 per share. There are no costs of financial distress.

Would you say that GrandPreexs shares are fairly priced?

Corporate Finance (FINE 342) Page 9 of 10 Assignment 2

PROBLEM 4 CONTINUED

Use this space to continue working on Problem 4

Corporate Finance (FINE 342) Page 10 of 10 Assignment 2

You might also like

- FIN 514 Financial Management: Spring 2021 InstructionsDocument4 pagesFIN 514 Financial Management: Spring 2021 InstructionsAkash KarNo ratings yet

- CV Et QP 2022 - PGPFDocument7 pagesCV Et QP 2022 - PGPFanish mahtoNo ratings yet

- BBA-V 551 Subjective Dec 2016Document2 pagesBBA-V 551 Subjective Dec 2016Saif ali KhanNo ratings yet

- Tutorial Capital BudgetingDocument4 pagesTutorial Capital Budgetingmi luNo ratings yet

- Practice Test MidtermDocument6 pagesPractice Test Midtermzm05280No ratings yet

- Bangladesh University exam questions on corporate financeDocument3 pagesBangladesh University exam questions on corporate financeRahman NiloyNo ratings yet

- Cash Flow Valuation and Project AnalysisDocument3 pagesCash Flow Valuation and Project AnalysisPuy NuyNo ratings yet

- FNCE 203 Practice Final Exam #1 - Answer Key: InstructionsDocument14 pagesFNCE 203 Practice Final Exam #1 - Answer Key: InstructionsJoel Christian MascariñaNo ratings yet

- Strategic Corporate Finance Exam 3 Hours Is GivenDocument5 pagesStrategic Corporate Finance Exam 3 Hours Is GivenicaNo ratings yet

- TakeHomeExam S1 20 1 PDFDocument3 pagesTakeHomeExam S1 20 1 PDFNicole HungNo ratings yet

- Assignments: Program: Mba Ib Semester-IiDocument13 pagesAssignments: Program: Mba Ib Semester-IiSekla ShaqdieselNo ratings yet

- Dfa6233 2017 2 PT PDFDocument6 pagesDfa6233 2017 2 PT PDFmy pcNo ratings yet

- 2009T2 Fins1613 FinalExamDocument24 pages2009T2 Fins1613 FinalExamchoiyokbaoNo ratings yet

- Fina1003abc - Hw#4Document4 pagesFina1003abc - Hw#4Peter JacksonNo ratings yet

- FINC 312 Midterm Exam 1-Fall 2020Document8 pagesFINC 312 Midterm Exam 1-Fall 2020Gianna DeMarcoNo ratings yet

- 5 - HI5002 Finance Tutorial Question Assignment T2 20202 Questions-AG 150920Document6 pages5 - HI5002 Finance Tutorial Question Assignment T2 20202 Questions-AG 150920ahmerNo ratings yet

- PART-A (Closed Book) (75 Mins)Document4 pagesPART-A (Closed Book) (75 Mins)DEVANSH CHANDRAWATNo ratings yet

- Case Study Before UTS LD21-20221028051637Document5 pagesCase Study Before UTS LD21-20221028051637Abbas MayhessaNo ratings yet

- Booklet Exercises 2Document7 pagesBooklet Exercises 2Talhaa MaqsoodNo ratings yet

- Second Midterm Exam practice questionsDocument5 pagesSecond Midterm Exam practice questionsJoven CastilloNo ratings yet

- Sample Exam December 2019Document10 pagesSample Exam December 2019miguelNo ratings yet

- Deakin University practice exam questionsDocument16 pagesDeakin University practice exam questionsJoel Christian MascariñaNo ratings yet

- TWO (2) Questions From SECTION B in The Answer Booklet Provided. All Question CarryDocument4 pagesTWO (2) Questions From SECTION B in The Answer Booklet Provided. All Question CarrynatlyhNo ratings yet

- Finance II Mid-Term Exam 2020Document4 pagesFinance II Mid-Term Exam 2020Yash KalaNo ratings yet

- Spring2022 (July) Exam-Fin Part2Document4 pagesSpring2022 (July) Exam-Fin Part2Ahmed TharwatNo ratings yet

- MBA 5109 - Financial Management (MBA 2020-2022)Document6 pagesMBA 5109 - Financial Management (MBA 2020-2022)sreekavi19970120No ratings yet

- Cash Flow Estimation Class ExcerciseDocument5 pagesCash Flow Estimation Class ExcercisethinkestanNo ratings yet

- Mid Term Assessment strategies finance recapitalizationDocument4 pagesMid Term Assessment strategies finance recapitalizationSumama IkhlasNo ratings yet

- MFE 10 - Project Planning and AppraisalDocument4 pagesMFE 10 - Project Planning and AppraisalKushan Chanaka AmarasingheNo ratings yet

- 2019 Exam - Moed A - Computer Science - (Solution)Document11 pages2019 Exam - Moed A - Computer Science - (Solution)adoNo ratings yet

- ACF 103 Exam Revision Qns 20151Document5 pagesACF 103 Exam Revision Qns 20151Riri FahraniNo ratings yet

- Strategic Corporate Finance AssignmentDocument6 pagesStrategic Corporate Finance AssignmentAmbrish (gYpr.in)0% (1)

- Homework PDFDocument3 pagesHomework PDFSyed AliNo ratings yet

- Corporate Finance, Term-II, 2021-23Document2 pagesCorporate Finance, Term-II, 2021-23keshav kumarNo ratings yet

- Accf 2204Document7 pagesAccf 2204Avi StrikyNo ratings yet

- International Financial Management V1Document13 pagesInternational Financial Management V1solvedcareNo ratings yet

- BComDocument3 pagesBComChristy jamesNo ratings yet

- Mid Term Exam Odd Semester 2012/2013 Financial ManagementDocument4 pagesMid Term Exam Odd Semester 2012/2013 Financial ManagementNovita Sari ElysiaNo ratings yet

- Fa Finc 2302 Approved (Sem 2 2020 - 2021)Document9 pagesFa Finc 2302 Approved (Sem 2 2020 - 2021)Abdullah AlziadyNo ratings yet

- Financial Management Trial Examination JJ2022 29 April 2022 9-12 Noon (3 Hours) Section C Answer in MS Excel Spreadsheet ProvidedDocument2 pagesFinancial Management Trial Examination JJ2022 29 April 2022 9-12 Noon (3 Hours) Section C Answer in MS Excel Spreadsheet ProvidedhafizulNo ratings yet

- Assignment 4 Capital Budgeting and COCDocument3 pagesAssignment 4 Capital Budgeting and COCQurat Saboor100% (1)

- Homework 1 - Version BDocument3 pagesHomework 1 - Version BІлияс Махатбек0% (1)

- Practice Test MidtermDocument6 pagesPractice Test Midtermrjhuff41No ratings yet

- MBA436 Exam - 2020Document8 pagesMBA436 Exam - 2020Nivi KumarNo ratings yet

- FINS1613 Business Finance Final Exam ReviewDocument30 pagesFINS1613 Business Finance Final Exam Reviewriders29No ratings yet

- Problem Set #1: Op MGT 450: Intro To Project Management Spring, 2020Document3 pagesProblem Set #1: Op MGT 450: Intro To Project Management Spring, 2020Her IdiNo ratings yet

- Business Finance Sample Examination PaperDocument4 pagesBusiness Finance Sample Examination PaperYeshey ChodenNo ratings yet

- FNCE10002 Principles of Finance Semester 2, 2019 Sample Final ExamDocument3 pagesFNCE10002 Principles of Finance Semester 2, 2019 Sample Final ExamC A.No ratings yet

- Fin103 LT4 JTA ComtechDocument3 pagesFin103 LT4 JTA ComtechJARED DARREN ONGNo ratings yet

- The Hang Seng University of Hong Kong Bachelor Degree Programmes 2019-2020 Semester 2 ExaminationDocument8 pagesThe Hang Seng University of Hong Kong Bachelor Degree Programmes 2019-2020 Semester 2 Examination李敏浩No ratings yet

- Spring2022 (July) Exam-Fin Part1Document8 pagesSpring2022 (July) Exam-Fin Part1Ahmed TharwatNo ratings yet

- MBA436 Exam Laucala - 2018Document6 pagesMBA436 Exam Laucala - 2018Nivi KumarNo ratings yet

- Final Review Questions SolutionsDocument5 pagesFinal Review Questions SolutionsNuray Aliyeva100% (1)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Low-Code/No-Code: Citizen Developers and the Surprising Future of Business ApplicationsFrom EverandLow-Code/No-Code: Citizen Developers and the Surprising Future of Business ApplicationsRating: 2.5 out of 5 stars2.5/5 (2)

- Estimating the Job Creation Impact of Development AssistanceFrom EverandEstimating the Job Creation Impact of Development AssistanceNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Sapm Unit 5Document49 pagesSapm Unit 5Alavudeen Shajahan100% (1)

- Mortgage Comparison WorksheetDocument3 pagesMortgage Comparison WorksheetNancy SuárezNo ratings yet

- Solutions To Selected End-Of-Chapter 8 Problem Solving QuestionsDocument6 pagesSolutions To Selected End-Of-Chapter 8 Problem Solving QuestionsVân Anh Đỗ LêNo ratings yet

- Solution - Problems and Solutions Chap 8Document8 pagesSolution - Problems and Solutions Chap 8Sabeeh100% (1)

- CDDocument6 pagesCDAnonymous HrsuLZUYNo ratings yet

- Chapter 7Document7 pagesChapter 7Fozia Zaka CheemaNo ratings yet

- Bangko Sentral NG Pilipinas, Malate, Maynila, Pilipinas: A Case StudyDocument18 pagesBangko Sentral NG Pilipinas, Malate, Maynila, Pilipinas: A Case StudymfbaitecNo ratings yet

- Financial Asset at Amortized CostDocument14 pagesFinancial Asset at Amortized CostLorenzo Diaz DipadNo ratings yet

- 2nd QTR Mastery Assessment 2021Document3 pages2nd QTR Mastery Assessment 2021Farcipanie PerezNo ratings yet

- TVMPractice ProbDocument6 pagesTVMPractice ProbShaikh Shahrukh FarhanNo ratings yet

- Theories of exchange rate determinationDocument47 pagesTheories of exchange rate determinationRajesh SwainNo ratings yet

- Annuities, Insurance and LifeDocument77 pagesAnnuities, Insurance and LifeEsra Gunes YildizNo ratings yet

- A PROJECT REPORT On Study On Foreign Exchange Final1Document35 pagesA PROJECT REPORT On Study On Foreign Exchange Final1Genesian Nikhilesh PillayNo ratings yet

- Module 2 Compound InterestDocument38 pagesModule 2 Compound InterestYvonne M. Gatcho100% (1)

- Tata India 10 ValuationDocument117 pagesTata India 10 ValuationPankaj GuptaNo ratings yet

- Bradenton Co Is Considering A Project in Which It WillDocument1 pageBradenton Co Is Considering A Project in Which It WillM Bilal SaleemNo ratings yet

- International Finance Eun & Resnick Complete Formula Sheet: S (J/K) S (C/K) S (C / J)Document5 pagesInternational Finance Eun & Resnick Complete Formula Sheet: S (J/K) S (C/K) S (C / J)Jemma JadeNo ratings yet

- Financial Instruments PDFDocument133 pagesFinancial Instruments PDFHimanshu Gaur100% (1)

- Penrith Group ServicesDocument16 pagesPenrith Group ServicesCUPartnersNo ratings yet

- Interest Rate RiskDocument58 pagesInterest Rate RiskStevan PknNo ratings yet

- Assignment 3Document2 pagesAssignment 3Chalermchai New KawinNo ratings yet

- Chapter 06 IM 10th Ed-MANAJEMEN KEUANGANDocument30 pagesChapter 06 IM 10th Ed-MANAJEMEN KEUANGANRizkyAdiPoetraNo ratings yet

- Session 9 - AmmortizationDocument26 pagesSession 9 - Ammortizationjeff bansNo ratings yet

- Chapter 3 Presentation ISE 311Document33 pagesChapter 3 Presentation ISE 311song perez0% (1)

- Finc4340 Midterm 1 2 and FinalDocument64 pagesFinc4340 Midterm 1 2 and FinalAaron MorrisonNo ratings yet

- Practice Multiple Choice Test 8Document8 pagesPractice Multiple Choice Test 8api-3834751No ratings yet

- Derivatives Mondar Bellalah PDFDocument996 pagesDerivatives Mondar Bellalah PDFaamna_shaikh01100% (1)

- Finman 3 EwanDocument7 pagesFinman 3 EwanNorman Christopher LopezNo ratings yet

- The Bermudan Swaptions Pricing OdysseyDocument32 pagesThe Bermudan Swaptions Pricing Odyssey楊約翰No ratings yet

- Dual Banking Systems and Interest Rate Risk For Islamic BanksDocument38 pagesDual Banking Systems and Interest Rate Risk For Islamic BanksMonikalinaSubkiNo ratings yet