Professional Documents

Culture Documents

Workers Do Not Contribute To A Pension or Insurance Scheme in Australia, Unlike Pension Schemes in Many Other Countries. Taxpayer-Funded

Uploaded by

MyrnaJoyPajoJaposOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Workers Do Not Contribute To A Pension or Insurance Scheme in Australia, Unlike Pension Schemes in Many Other Countries. Taxpayer-Funded

Uploaded by

MyrnaJoyPajoJaposCopyright:

Available Formats

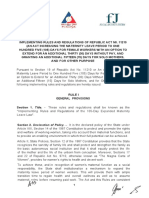

In Australia, social security payments and other benefits are currently made available under the

following acts of parliament: (1) Social Security Act 1991; (2) A New Tax System (Family Assistance)

Act 1999; (3) Student Assistance Act 1973; (4) Paid Parental Leave Act 2010.

1. WHO ARE COVERED

The Philippines Social Security Act of 1997 (RA 8282) shall be compulsory upon all employees not

over sixty (60) years of age and their employers; upon domestic helpers, whose monthly income shall

not be less than One thousand pesos (P1,000.00); upon selected self-employed persons and the

individual farmers and fishermen. (Section 9, SSS). Covers the Employer, any person, natural or

juridical, domestic or foreign who carries on in the Philippines any trade, business, industry

undertaking or activity of any kind and uses the services of another person who is under his orders

as regards employment, except Government employees; Employee, any person who performs

services for an employer who receives compensation for such services; and Self-employed,

considered as both and employee and employer. (Section 8, SSS) The SSS contribution

Meanwhile, the GSIS Act of 1997 (RA 8291) covers the employer and employee under the national

government, its political subdivisions, branches and agencies or instrumentalities ,including GOCCs

and financial institutions with original charters, the constitutional commissions and judiciary, which are

not covered under the SSS. The GSIS contribution shall be compulsory for all employees receiving

compensation who have not reached compulsory retirement age, irrespective of employment status,

except members of the Armed Forces of the Philippines and the Philippine National Police, subject

to the condition that they must settle first their financial obligation with the GSIS, and contractuals

who have no employer and employee relationship with the agencies they serve. (Section 3, GSIS)

In Australia, the Age Pension was the first payment made by the Commonwealth Government, back

to 1909 and still in effect until present. It is available to persons aged 65 years and over. Except for

the mandatory superannuation scheme, workers do not contribute to a pension or insurance

scheme in Australia, unlike pension schemes in many other countries. Taxpayer-funded

pensions are means tested. (Patricia Karvelas (13 November 2013). "Call for end to welfare poverty". The

Australian. Retrieved 15 November 2013.)

A person is qualified for an age pension if the person has reached pension age and any of the following

applies: (a) the person has 10 years qualifying Australian residence;(b) the person has a qualifying residence

exemption for an age pension; (c) the person was receiving a widow pension, a widow allowance, a mature

age allowance or a partner allowance, immediately before reaching that age. (SS Act 1991, Section 43 (1).

However, the same would not be payable to a person if the person is already receiving a service pension;

or if (a) a person is receiving an age pension; and (b) another social security pension. (SS Act 1991, Section

47 (1) (2))

1.

2. Conditions

3. COVERAGE- COMPULSORY, VOLUNTARY

4. EXCEPTIONS FROM COVERAGE

5.

.

6. DEPENDENTS

7. BENEFICIARIES - PRIMARY, SECONDARY, OTHERS

8. BENEFITS

9.

10. COMPENSATION

11. BASIS OF CLAIM

12. EFFECTS OF SEPERATION FROM EMPLOYMENT

13. REPORTING REQUIREMENTS

14. FUNDING

15. EXMEPTION FROM TAX/LEGAL PROCESS.LIEN

16. DISPUTE SETTLEMENT

17. PRESCRIPTIVE PERIOD

You might also like

- Paternity LeaveDocument3 pagesPaternity LeaveMae EspellargaNo ratings yet

- GSIS ScriptDocument8 pagesGSIS ScriptCIELICA BURCANo ratings yet

- Non Bank Financial InstitutionsDocument11 pagesNon Bank Financial InstitutionsArgilyn MagaNo ratings yet

- Social Legislation PrinciplesDocument4 pagesSocial Legislation PrinciplesAppleSamsonNo ratings yet

- Rhacq Kho'S Bar Adventure Labor Law Reviewer 2015Document7 pagesRhacq Kho'S Bar Adventure Labor Law Reviewer 2015Raq KhoNo ratings yet

- Sss Gsis LawDocument57 pagesSss Gsis LawBroy D Brium100% (1)

- Social Security System 2017Document35 pagesSocial Security System 2017NJ Geerts100% (1)

- Sss & Gsis LawDocument57 pagesSss & Gsis Lawjenricke2003100% (3)

- BenefitsDocument7 pagesBenefitsSam Pesiao PajaganasNo ratings yet

- GSISDocument11 pagesGSISClauds GadzzNo ratings yet

- Bongoyan, Maria Eve C. Substantive Paper On R.A. Nos. 8291, 10361, and 10022Document3 pagesBongoyan, Maria Eve C. Substantive Paper On R.A. Nos. 8291, 10361, and 10022Yan's Senora BescoroNo ratings yet

- PB - ESI AllDocument9 pagesPB - ESI AllPriyam BiswasNo ratings yet

- Agrarian Reform Law Social Legislation Group 6 Finals Activity 1Document15 pagesAgrarian Reform Law Social Legislation Group 6 Finals Activity 1aira calvoNo ratings yet

- NLM ReportDocument58 pagesNLM ReportBon QuiapoNo ratings yet

- SSS, GSIS, & Portability LawDocument101 pagesSSS, GSIS, & Portability LawMark Soneil SaludoNo ratings yet

- Salient Feature of SSS LawDocument3 pagesSalient Feature of SSS LawJoyjoy C LbanezNo ratings yet

- Social Security Measures Across The Countries : Presented byDocument16 pagesSocial Security Measures Across The Countries : Presented byYuvika SinhaNo ratings yet

- Social Security Law-2Document97 pagesSocial Security Law-2Shannen SagunNo ratings yet

- The SSS MandateDocument3 pagesThe SSS MandateCara ZelliNo ratings yet

- Overview of The Social Security CodeDocument5 pagesOverview of The Social Security Code76-Gunika MahindraNo ratings yet

- Purpose, Republic Act No. 1161 As Amended, Otherwise Known As The Social Security LawDocument10 pagesPurpose, Republic Act No. 1161 As Amended, Otherwise Known As The Social Security LawHerrieGabicaNo ratings yet

- ScriptDocument6 pagesScriptJohn Lesther PabiloniaNo ratings yet

- Declaration of Policy.: Power and DutiesDocument4 pagesDeclaration of Policy.: Power and DutiesMidzmar KulaniNo ratings yet

- Managing Employee Benefits2 PDFDocument42 pagesManaging Employee Benefits2 PDFZenitram YamNo ratings yet

- MODULE 15-SSS LawDocument84 pagesMODULE 15-SSS LawAleah Jehan AbuatNo ratings yet

- SBN 712Document3 pagesSBN 712Publicus Asia Inc.No ratings yet

- Coop Laws and Social Legislation: Government Service Insurance SystemDocument24 pagesCoop Laws and Social Legislation: Government Service Insurance Systemyannie11No ratings yet

- Survivor ShipDocument31 pagesSurvivor Shipxxjulyxx87No ratings yet

- 3 194 Labor Law Report GRP 3Document22 pages3 194 Labor Law Report GRP 3monica ongNo ratings yet

- IRR RA 11210 DatedDocument16 pagesIRR RA 11210 DatedjackyNo ratings yet

- Leave: To 19 No Increasing Five The Following Implementing IssuedDocument21 pagesLeave: To 19 No Increasing Five The Following Implementing IssuedJuan TagadownloadNo ratings yet

- Leave: To 19 No Increasing Five The Following Implementing IssuedDocument21 pagesLeave: To 19 No Increasing Five The Following Implementing IssuedJuan TagadownloadNo ratings yet

- San Beda LMT Soc LegDocument6 pagesSan Beda LMT Soc LegromarcambriNo ratings yet

- Notes SSSDocument5 pagesNotes SSSaquanesse21No ratings yet

- SSS Law PDFDocument147 pagesSSS Law PDFTiff Dizon100% (3)

- 6 Basic Employee Benefits in The Philippine LABOR CODEDocument1 page6 Basic Employee Benefits in The Philippine LABOR CODERoli Sitjar Arangote100% (1)

- Social Welfare Legislation LectureDocument16 pagesSocial Welfare Legislation LectureAllyza RamirezNo ratings yet

- Kasambahay BillDocument9 pagesKasambahay BillRICKY ALEGARBESNo ratings yet

- AnswersDocument5 pagesAnswersRyll Dela CruzNo ratings yet

- 0 GSIS Finals QuestionsDocument11 pages0 GSIS Finals QuestionsClauds GadzzNo ratings yet

- GSISDocument56 pagesGSISsantasantita100% (1)

- Leave Act in IndiaDocument37 pagesLeave Act in Indiaabhay280528310% (1)

- 2017 SSS GuidebookDocument134 pages2017 SSS GuidebookChimney sweep100% (2)

- Title: Sss Gsis Pag-Ibig PhilhealthDocument15 pagesTitle: Sss Gsis Pag-Ibig PhilhealthLudica OjaNo ratings yet

- 2016 Sss Guidebook PDFDocument128 pages2016 Sss Guidebook PDFagent_ros9956100% (1)

- Bureau of Internal Revenue: Republic of The Philippines Department of FinanceDocument4 pagesBureau of Internal Revenue: Republic of The Philippines Department of FinanceRobert AdamsNo ratings yet

- SSS ReviewerDocument23 pagesSSS ReviewerAbbie Kwan100% (1)

- X. Social Welfare Legislation: SSS (RA 1161) ) GSIS (RA 8291 ECC (PD 626) Statement of PoliciesDocument4 pagesX. Social Welfare Legislation: SSS (RA 1161) ) GSIS (RA 8291 ECC (PD 626) Statement of PoliciesLoisse VitugNo ratings yet

- Ecc Basics 1Document26 pagesEcc Basics 1Anton FortichNo ratings yet

- The Labor Code and The Dynamics Between Employees and EmployersDocument57 pagesThe Labor Code and The Dynamics Between Employees and EmployersArmen MagbitangNo ratings yet

- Chapter 4.social Welfare LegislationDocument98 pagesChapter 4.social Welfare LegislationFelix III AlcarezNo ratings yet

- Incomes Which Do Not Form OF Total Income (Section 10) : Dr. P.Sree Sudha, Associate Professor, DsnluDocument48 pagesIncomes Which Do Not Form OF Total Income (Section 10) : Dr. P.Sree Sudha, Associate Professor, Dsnluleela naga janaki rajitha attiliNo ratings yet

- GSISDocument101 pagesGSISDon SumiogNo ratings yet

- Alegria ReportDocument26 pagesAlegria ReportChikahantayo TVNo ratings yet

- Soc LegDocument144 pagesSoc LegHaru RodriguezNo ratings yet

- Bar Review Companion: Labor Laws and Social Legislation: Anvil Law Books Series, #3From EverandBar Review Companion: Labor Laws and Social Legislation: Anvil Law Books Series, #3No ratings yet

- Pensions in Italy: The guide to pensions in Italy, with the rules for accessing ordinary and early retirement in the public and private systemFrom EverandPensions in Italy: The guide to pensions in Italy, with the rules for accessing ordinary and early retirement in the public and private systemNo ratings yet

- Social Security: The New Rules, Essentials & Maximizing Your Social Security, Retirement, Medicare, Pensions & Benefits Explained In One PlaceFrom EverandSocial Security: The New Rules, Essentials & Maximizing Your Social Security, Retirement, Medicare, Pensions & Benefits Explained In One PlaceNo ratings yet

- For Finals Notes RemedialDocument47 pagesFor Finals Notes RemedialMyrnaJoyPajoJaposNo ratings yet

- Civil Review MIND MAP CompilationDocument7 pagesCivil Review MIND MAP CompilationMyrnaJoyPajoJaposNo ratings yet

- BOARD OF ASSESSMENT APPEALS, PROVINCE OF LAGUNA, Petitioner, v. COURT OF TAX APPEALS and THE NATIONAL WATERWORKS AND SEWERAGE AUTHORITY (NAWASA)Document4 pagesBOARD OF ASSESSMENT APPEALS, PROVINCE OF LAGUNA, Petitioner, v. COURT OF TAX APPEALS and THE NATIONAL WATERWORKS AND SEWERAGE AUTHORITY (NAWASA)MyrnaJoyPajoJaposNo ratings yet

- Affidavit of Undertaking - RT PCR Testing - COVIDDocument1 pageAffidavit of Undertaking - RT PCR Testing - COVIDLuelson CordovaNo ratings yet

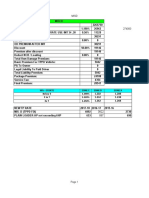

- Particulars Graduated IT Rates 8% IT RatesDocument4 pagesParticulars Graduated IT Rates 8% IT RatesMyrnaJoyPajoJaposNo ratings yet

- Legal Separation CAse Digest ReportDocument3 pagesLegal Separation CAse Digest ReportMyrnaJoyPajoJaposNo ratings yet

- Manalo Case Ladnmar Case For DivorceDocument15 pagesManalo Case Ladnmar Case For DivorceMyrnaJoyPajoJaposNo ratings yet

- BFAR Visits AFOS - FISH ProjectDocument2 pagesBFAR Visits AFOS - FISH ProjectMyrnaJoyPajoJaposNo ratings yet

- Criminal Law Reviewer by Elmer BrabanteDocument267 pagesCriminal Law Reviewer by Elmer BrabanteCamille Junio100% (1)

- Remedial Law NotesDocument24 pagesRemedial Law NotesMyrnaJoyPajoJaposNo ratings yet

- Judicial Affidavit of Victoria LazoDocument4 pagesJudicial Affidavit of Victoria LazoMyrnaJoyPajoJaposNo ratings yet

- ATENEO EvidenceDocument51 pagesATENEO Evidencevanessa pagharion100% (9)

- Judicial Affidavit of Marginia ColinaDocument5 pagesJudicial Affidavit of Marginia ColinaMyrnaJoyPajoJaposNo ratings yet

- Judicial-Affidavit-Of Virginia Flores AnobaDocument5 pagesJudicial-Affidavit-Of Virginia Flores AnobaMyrnaJoyPajoJaposNo ratings yet

- General Maritime Stevedores Union of The Philippines, vs. South Sea Shipping Lines, G. R. No. L-14689, July 26, 1960Document12 pagesGeneral Maritime Stevedores Union of The Philippines, vs. South Sea Shipping Lines, G. R. No. L-14689, July 26, 1960MyrnaJoyPajoJaposNo ratings yet

- Judicial Affidavit of Victoria LazoDocument4 pagesJudicial Affidavit of Victoria LazoMyrnaJoyPajoJaposNo ratings yet

- Yellow and Blue Soccer Game Night InvitationDocument1 pageYellow and Blue Soccer Game Night InvitationMyrnaJoyPajoJaposNo ratings yet

- Reaction Paper Legal EnglishDocument1 pageReaction Paper Legal EnglishMyrnaJoyPajoJaposNo ratings yet

- 5 Wholesale Bluetooth & Portable Speakers For Your Sound-Obsessed CustomersDocument3 pages5 Wholesale Bluetooth & Portable Speakers For Your Sound-Obsessed CustomersMyrnaJoyPajoJaposNo ratings yet

- Political Law Review NotesDocument6 pagesPolitical Law Review NotesMyrnaJoyPajoJaposNo ratings yet

- Ateneo 2007 Criminal ProcedureDocument69 pagesAteneo 2007 Criminal ProcedureJingJing Romero98% (55)

- Answer, ExampleDocument2 pagesAnswer, ExampleSheldon DrobnyNo ratings yet

- GRP 1 AttachmentDocument10 pagesGRP 1 AttachmentMyrnaJoyPajoJaposNo ratings yet

- Practive Court NoteDocument3 pagesPractive Court NoteMyrnaJoyPajoJaposNo ratings yet

- 02-8-13-SC 2004 Rules On Notarial PracticeDocument20 pages02-8-13-SC 2004 Rules On Notarial PracticeRudmar Angelo EcaldreNo ratings yet

- 02-8-13-SC 2004 Rules On Notarial PracticeDocument20 pages02-8-13-SC 2004 Rules On Notarial PracticeRudmar Angelo EcaldreNo ratings yet

- Affidavit of Vehicle DamageDocument2 pagesAffidavit of Vehicle DamageMyrnaJoyPajoJaposNo ratings yet

- Replevin - Blank Sample - 9.2012Document3 pagesReplevin - Blank Sample - 9.2012MyrnaJoyPajoJaposNo ratings yet

- Palacol Vs Ferrer DigestDocument4 pagesPalacol Vs Ferrer DigestMyrnaJoyPajoJaposNo ratings yet

- 02-8-13-SC 2004 Rules On Notarial PracticeDocument20 pages02-8-13-SC 2004 Rules On Notarial PracticeRudmar Angelo EcaldreNo ratings yet

- Theory and Precatice of GSTDocument3 pagesTheory and Precatice of GSTakking0146No ratings yet

- A Review of Roy Rohatgis Basic International TaxaDocument7 pagesA Review of Roy Rohatgis Basic International TaxaAto SumartoNo ratings yet

- LGC and MRPAAO Quiz 10feb2023 PrintedDocument5 pagesLGC and MRPAAO Quiz 10feb2023 Printedivy jane estrellaNo ratings yet

- 2035-Wanjau Kabuchi KabuchiDocument1 page2035-Wanjau Kabuchi KabuchiKabuchi WanjauNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1Akshay KadamNo ratings yet

- ECON314 Nwu-Jun2022Document17 pagesECON314 Nwu-Jun2022Mmabatho MosesiNo ratings yet

- Safety Shoes Invoice BangaloreDocument1 pageSafety Shoes Invoice BangalorePRADEEP RASTOGINo ratings yet

- Problem 18-7Document4 pagesProblem 18-7api-254635136No ratings yet

- Met Loan & Life Suraksha - Sample Premium Rates UIN:117N080V01Document6 pagesMet Loan & Life Suraksha - Sample Premium Rates UIN:117N080V01Sadasivuni007No ratings yet

- Q.1 Who Is A Goods Transport Agency (GTA) ?Document3 pagesQ.1 Who Is A Goods Transport Agency (GTA) ?ANo ratings yet

- Slides 8Document31 pagesSlides 8Erico MatosNo ratings yet

- Transaction Report For Juan Pablo Rodriguez Virasoro Date Range Filter CustomerDocument1 pageTransaction Report For Juan Pablo Rodriguez Virasoro Date Range Filter CustomerJuan VirazoroNo ratings yet

- NTN: 07862377 STRN: 0308854400219: Newage Cables Private LimitedDocument2 pagesNTN: 07862377 STRN: 0308854400219: Newage Cables Private LimitedbilalNo ratings yet

- InvoiceDocument1 pageInvoiceNiraj kumarNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerARUN CKNo ratings yet

- Z (Or) Tax - Tio Vs VRB - DigestDocument1 pageZ (Or) Tax - Tio Vs VRB - DigestHoney Joy MBNo ratings yet

- Thomas Frank's Budget Modeler Template!Document9 pagesThomas Frank's Budget Modeler Template!Norman LefortNo ratings yet

- Revenue Memorandum Circular No. 19-95Document8 pagesRevenue Memorandum Circular No. 19-95Carla GrepoNo ratings yet

- Vighnesh Project Report On Impact of GST On Hotel and Tourisum IndustryDocument81 pagesVighnesh Project Report On Impact of GST On Hotel and Tourisum IndustryMohammad Ramiz ShaikhNo ratings yet

- Meaning of Customs Duties and TariffDocument4 pagesMeaning of Customs Duties and TariffLei Chumacera100% (1)

- FW 8 Ben 2Document1 pageFW 8 Ben 2DCOM SoftwaresNo ratings yet

- GCV Premium - Calculators - With - New - TPDocument11 pagesGCV Premium - Calculators - With - New - TPGunjan NimjeNo ratings yet

- EF2A2 HDT Budget Indirect Taxes GST PCB7 1661016598246Document44 pagesEF2A2 HDT Budget Indirect Taxes GST PCB7 1661016598246Sikha SharmaNo ratings yet

- TX-CYP Dec 21 AnswersDocument8 pagesTX-CYP Dec 21 AnswersKAM JIA LINGNo ratings yet

- Resolution Restoring Homestead Rebate and Senior Freeze ProgramsDocument2 pagesResolution Restoring Homestead Rebate and Senior Freeze Programsjmjr30No ratings yet

- DT 0108 Annual Paye Deductions Return Form v1 2Document2 pagesDT 0108 Annual Paye Deductions Return Form v1 2Kwasi DankwaNo ratings yet

- PPF Calculator, PPF Interest Rates, SBI, ICICI, Post Office, India 2019Document1 pagePPF Calculator, PPF Interest Rates, SBI, ICICI, Post Office, India 2019Ramakrishnan AmbiSubbiahNo ratings yet

- Passive IncomeDocument5 pagesPassive IncomeRandom VidsNo ratings yet

- Excise Invoice 213Document4 pagesExcise Invoice 213Anonymous rNqW9p3No ratings yet

- Sesi 7 - Skyview Manor CaseDocument3 pagesSesi 7 - Skyview Manor CasestevenNo ratings yet