Professional Documents

Culture Documents

Assets 2012 2011 2012% 2011% Current Assets Long-Term Investment Plant Assets Intangible Assets Total Assets

Uploaded by

Sudin AmatyaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assets 2012 2011 2012% 2011% Current Assets Long-Term Investment Plant Assets Intangible Assets Total Assets

Uploaded by

Sudin AmatyaCopyright:

Available Formats

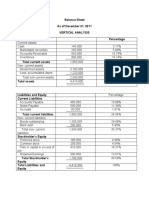

Vertical Analysis basically relies on the relationships among financial statement

within a time in which each financial statement items are expressed as a percentage. In

case of balance sheet, each item is expressed in a percentage of total assets whereas, in

income statement, each item is expressed as a percentage of sales. The percentages can be

compared with the past years percentages.

The vertical analysis is important as it helps to remove the element of inflation

and also enables the comparison of the efficiency of large companies. . A vertical

analysis is excellent at showing what is happening within the financial statements of a

company.

Percentage of base= Amount of individual item/Amount of base*100

Balance Sheet of XYZ Company

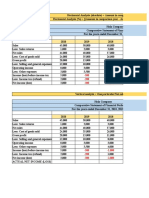

Assets 2012 2011 2012% 2011%

Current assets 550,000 533,000 48.3% 43.3%

Long-term investment 95,000 177500 8.3% 14.4%

Plant assets 444,500 470000 39% 38.2%

Intangible assets 50,000 50000 4.4% 4.1%

Total assets 11,39,500 12,40,600 100% 100%

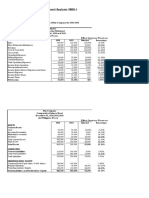

Income Statement of XYZ Company

2011 2012 2011% 2012%

Sales $500000 $535000 100% 100%

Cost of Goods Sold $130000 $133,250 26% 24.9%

Gross Profit $370,000 $401,750 74% 75.1%

Salaries $85,000 $87,000 17% 16.26%

Rent $30,000 $30,000 6% 5.6%

Marketing $20,000 $20,000 4% 3.74%

Others expenses $87,00 $10,000 1.7% 1.8%

Total expenses $143,700 $147,000 28.7% 27.4%

Net Income 226,300 $254,750 45.3% 47.7%

Cost of goods sold:

2012: (133,250/535,000) 100 = 24.9%

2011: (13,0000/500,000) 100 = 26%

Hence, the vertical analysis shows that in 2011, the XYZ company's product cost

74%. However, in 2012, the cost of sales gradually increased by 75.1% of sales.

Reference:

Wester field, R. W. (2012). Corporate finance (10th ed.). New York: McGraw-Hill.

Bodie, Z., Kane, A. & Marcus, A.J., Investments, 9th edn, McGraw-Hill, New York,

2011.

You might also like

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- Dmgt513 Derivatives and Risk ManagementDocument205 pagesDmgt513 Derivatives and Risk ManagementDivyaNo ratings yet

- The Journey of Safal Niveshak (Vishal Khandelwal)Document28 pagesThe Journey of Safal Niveshak (Vishal Khandelwal)Vishal Safal Niveshak Khandelwal100% (1)

- Accounting For Non-AccountantsDocument15 pagesAccounting For Non-AccountantsMarlou Paige CortesNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument24 pagesAnalysis and Interpretation of Financial StatementsMariel NatullaNo ratings yet

- Dawn Bolton-Smith (2001) - On Trading Systems (5 P.)Document5 pagesDawn Bolton-Smith (2001) - On Trading Systems (5 P.)FrankNo ratings yet

- CH 13Document14 pagesCH 13Trang VânNo ratings yet

- Valueresearch NewsletterDocument64 pagesValueresearch Newsletterdrsachin_uc7552100% (2)

- Case 01a Growing Pains SolutionDocument7 pagesCase 01a Growing Pains SolutionUSD 654No ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Trend AnalysisDocument1 pageTrend Analysisapi-385117572No ratings yet

- Bill French Google Docs Group 5Document7 pagesBill French Google Docs Group 5Jay Florence DalucanogNo ratings yet

- Common Size AnalysisDocument25 pagesCommon Size AnalysisYoura DeAi0% (1)

- Free Premium Course Final Course For Youtube PDFDocument3 pagesFree Premium Course Final Course For Youtube PDFNitin GarjeNo ratings yet

- Task Performance I. Horizontal AnalysisDocument3 pagesTask Performance I. Horizontal AnalysisarisuNo ratings yet

- Psak 19Document8 pagesPsak 19Nadia NathaniaNo ratings yet

- COSTCO Case StudyDocument54 pagesCOSTCO Case Studyreshamhira@75% (4)

- Analysis of FS PDF Vertical and HorizontalDocument9 pagesAnalysis of FS PDF Vertical and HorizontalJmaseNo ratings yet

- Cost Management Accounting Assignment Bill French Case StudyDocument5 pagesCost Management Accounting Assignment Bill French Case Studydeepak boraNo ratings yet

- Chapter 7Document18 pagesChapter 7Din Rose Gonzales0% (1)

- RatiosDocument79 pagesRatiosKim Bales BlayNo ratings yet

- MS03-11-Financial Statement AnalysisDocument13 pagesMS03-11-Financial Statement AnalysisAngel Leah CuambotNo ratings yet

- Business FinanceDocument43 pagesBusiness FinanceKimNo ratings yet

- MAS 3 SamplesDocument10 pagesMAS 3 SamplesRujean Salar AltejarNo ratings yet

- MGAC CH 14 For Yahoo Group (Slide 1-12)Document12 pagesMGAC CH 14 For Yahoo Group (Slide 1-12)schatzchenNo ratings yet

- Latihan Analisis Horizontal VertikalDocument4 pagesLatihan Analisis Horizontal Vertikaltheresia paulintiaNo ratings yet

- Chapter - 3Document58 pagesChapter - 3habtamuNo ratings yet

- Vertical Analysis SolutionsDocument5 pagesVertical Analysis SolutionsSamer IsmaelNo ratings yet

- Financial Statement Analysis PDFDocument16 pagesFinancial Statement Analysis PDFLara CelestialNo ratings yet

- Fundamentals of Accountancy,: Learner's PacketDocument11 pagesFundamentals of Accountancy,: Learner's PacketMarc PagcaliwaganNo ratings yet

- Financial AnalysisDocument8 pagesFinancial AnalysisRey Mariel YbasNo ratings yet

- Activity 3 123456789Document7 pagesActivity 3 123456789Jeramie Sarita SumaotNo ratings yet

- Chapter No 06 Final Afs-1Document58 pagesChapter No 06 Final Afs-1salwaburiroNo ratings yet

- Analysis and Interpretation - BalladaDocument4 pagesAnalysis and Interpretation - BalladaClaire Evann Villena EboraNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument9 pagesAnalysis and Interpretation of Financial StatementsMckayla Charmian CasumbalNo ratings yet

- Financial Analysis and InterpretationDocument22 pagesFinancial Analysis and Interpretationirfan_rana4uNo ratings yet

- Case Bill FrenchDocument3 pagesCase Bill FrenchROSHAN KUMAR SAHOONo ratings yet

- Balance Sheet As of December 31, 2011 Vertical Analysis Assets PercentageDocument3 pagesBalance Sheet As of December 31, 2011 Vertical Analysis Assets PercentageAnjeanette VercelesNo ratings yet

- Balance Sheet As of December 31, 2011 Vertical Analysis Assets PercentageDocument3 pagesBalance Sheet As of December 31, 2011 Vertical Analysis Assets PercentageAnjeanette VercelesNo ratings yet

- W5 Team C Case StudiesDocument10 pagesW5 Team C Case Studiestk12834966100% (1)

- Horizontal and Vertical AnalysisDocument5 pagesHorizontal and Vertical AnalysisAshley Rouge Capati QuirozNo ratings yet

- FIN 325-3-2 Final Project Milestone Two Vertical and Horizontal Analysis Saeed Algarni Facebook IDocument9 pagesFIN 325-3-2 Final Project Milestone Two Vertical and Horizontal Analysis Saeed Algarni Facebook IAlison JcNo ratings yet

- AGibson 12e Ch05Document36 pagesAGibson 12e Ch05Jamroz KhanNo ratings yet

- Complete Report of Apple Inc, Financial Statements AnalysisDocument12 pagesComplete Report of Apple Inc, Financial Statements AnalysisDOWLA KHANNo ratings yet

- CHAP-4 Fin - State. AnalysisDocument59 pagesCHAP-4 Fin - State. Analysishcw49539No ratings yet

- Lecture4 - Principles of Finance - Financial Analysis - GARIVERADocument31 pagesLecture4 - Principles of Finance - Financial Analysis - GARIVERArenzen jay medenillaNo ratings yet

- Case Study 2Document10 pagesCase Study 2Cheveem Grace Emnace100% (1)

- CMKT 300 Fall 2020 Product Line Extension ROI and CAGR Conjoint UpdateDocument12 pagesCMKT 300 Fall 2020 Product Line Extension ROI and CAGR Conjoint UpdateMit DaveNo ratings yet

- Unit - 3 - Exercise - Taton, Querubine MaeDocument3 pagesUnit - 3 - Exercise - Taton, Querubine MaeMichelle Taton HoranNo ratings yet

- Chapter 10 NotesDocument5 pagesChapter 10 NotesThurkka PNo ratings yet

- Proj FinanceDocument24 pagesProj FinanceninaNo ratings yet

- AMD2019s2 Topic 6Document28 pagesAMD2019s2 Topic 6Anjeena ShresthaNo ratings yet

- Accrual Basis AccountingDocument149 pagesAccrual Basis AccountingManzoor AlamNo ratings yet

- Tugas Akmen (Nurfuadi - A031181511)Document2 pagesTugas Akmen (Nurfuadi - A031181511)Budiman BudiNo ratings yet

- 1244 - Roshan Kumar Sahoo - Assignment 2Document3 pages1244 - Roshan Kumar Sahoo - Assignment 2ROSHAN KUMAR SAHOONo ratings yet

- Ratio Analysis PrintDocument45 pagesRatio Analysis Printfrancis MagobaNo ratings yet

- Group 9 10Document14 pagesGroup 9 10Jocel CaoNo ratings yet

- Financial Statement AnalysisDocument52 pagesFinancial Statement AnalysiswarsimaNo ratings yet

- CaseDocument11 pagesCasengogiahuy12082002No ratings yet

- Acer Q3 2010 Investor ConferenceDocument19 pagesAcer Q3 2010 Investor ConferenceHsin-Hung YuNo ratings yet

- Activity-1 Unit 2 Financial Analysis 3BSA-1Document4 pagesActivity-1 Unit 2 Financial Analysis 3BSA-1JonellNo ratings yet

- Activity-1 Unit 2 Financial Analysis 3BSA-1Document4 pagesActivity-1 Unit 2 Financial Analysis 3BSA-1JonellNo ratings yet

- Chapter 5Document59 pagesChapter 5mokeNo ratings yet

- Common Size Income StatementDocument7 pagesCommon Size Income StatementUSD 654No ratings yet

- Basic Finance I.Z.Y.X Comparative Income StatementDocument3 pagesBasic Finance I.Z.Y.X Comparative Income StatementKazia PerinoNo ratings yet

- PP For Chapter 6 - Financial Statement Analysis - FinalDocument67 pagesPP For Chapter 6 - Financial Statement Analysis - FinalSozia TanNo ratings yet

- Break Even Analysis of Our ProductDocument4 pagesBreak Even Analysis of Our ProductprakashNo ratings yet

- Fin Analysis Chap 3 PreciseDocument16 pagesFin Analysis Chap 3 PrecisebayezidNo ratings yet

- Capital Budgeting Practices in Developing CountriesDocument19 pagesCapital Budgeting Practices in Developing CountriescomaixanhNo ratings yet

- Gagan Deep Sharma Department of Management Studies BBSB Engineering College Fatehgarh Sahib, PunjabDocument29 pagesGagan Deep Sharma Department of Management Studies BBSB Engineering College Fatehgarh Sahib, PunjabAbdul Motaleb SaikiaNo ratings yet

- (Trading Ebook) Gann, W.D. - New Stock Trend DetectorDocument52 pages(Trading Ebook) Gann, W.D. - New Stock Trend DetectorAnil DudaniNo ratings yet

- The EdgeDocument33 pagesThe EdgeSyahrull NizamNo ratings yet

- An.1 83Document98 pagesAn.1 83Berlinschi DinuNo ratings yet

- Current Scenario of Financial ServicesDocument8 pagesCurrent Scenario of Financial Servicessureshsen80% (5)

- IPO of VISA Inc.Document5 pagesIPO of VISA Inc.seharshoukat100% (1)

- Chapter 1Document2 pagesChapter 1Hasrul HishamNo ratings yet

- Investment Analysis and Portfolio ManagementDocument40 pagesInvestment Analysis and Portfolio ManagementJohnNo ratings yet

- Spy Gap StudyDocument30 pagesSpy Gap StudyMathias Dharmawirya100% (1)

- Factset - Quick Start Guide2Document21 pagesFactset - Quick Start Guide2satish sNo ratings yet

- Financial Analysis TheoryDocument1 pageFinancial Analysis TheoryEmma Mariz GarciaNo ratings yet

- Problem Overview:: 2B PeopleDocument5 pagesProblem Overview:: 2B PeopleSebastian AlexNo ratings yet

- Startup PolicyDocument1 pageStartup PolicyyibungoNo ratings yet

- LONG TERM INVESTMENT MANAGEMENT - KesoramDocument9 pagesLONG TERM INVESTMENT MANAGEMENT - KesoramKhaisarKhaisar0% (1)

- Bo Dincer New York Top Trader NYCDocument1 pageBo Dincer New York Top Trader NYCBONDTRADER100% (1)

- MF0012Document3 pagesMF0012Rajesh SinghNo ratings yet

- Rajashekhar ChimilagiDocument79 pagesRajashekhar ChimilagiHarshal Borgaon100% (1)

- Axis Bank ValuvationDocument26 pagesAxis Bank ValuvationGermiya K JoseNo ratings yet

- Deutsche BankDocument3 pagesDeutsche BankRi BudhraniNo ratings yet

- MSF 506-Final DocumentDocument22 pagesMSF 506-Final Documentrdixit2No ratings yet