Professional Documents

Culture Documents

Cms Estate.v.sss

Uploaded by

Mona LizaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cms Estate.v.sss

Uploaded by

Mona LizaCopyright:

Available Formats

CMS ESTATE, INC.

V SOCIAL SECURITY SYSTEM

132 SCRA 108 (1984)

FACTS

- Petitioner is a domestic corporation organized primarily for the purpose of engaging in real estate

business. On December 1, 1952, it started doing business with only six (6) employees. - January 28,

1957: petitioner entered into a contract of management with one Eufracio D. Rojas for the operation

and exploitation of the forest concession. The logging operation actually started on April 1, 1957 with

four monthly-salaried employees.

As of September 1, 1957, petitioner had 89 employees and laborers in the logging operation.

- December 26, 1957: petitioner revoked its contract of management with Mr. Rojas. -

August 1, 1958: petitioner became a member of the Social Security System with respect to its real estate

business.

On September 6, 1958, petitioner remitted to the System the sum of P203.13 representing the initial

premium on the monthly salaries of the employees in its logging business.

October 9, 1958: petitioner demanded the refund of the said amount.

- On November 10, 1958, petitioner filed a petition with the Social Security Commission praying for the

determination of the effectivity date of the compulsory coverage of petitioner's logging business.

- January 14, 1960: the instant petition was denied and petitioner was adjudged to be subject to

compulsory coverage as Sept. 1, 1957 and the Social Security System was directed to effect such

coverage of petitioner's employees in its logging and real estate business conformably to the provisions

of Rep. Act No. 1161, as amended. -

ISSUE

WON the contributions required of employers and employees under our Social Security Act of 1954 are

obligatory because the said Act was allegedly enacted by Congress in the exercise of the police power of

the State, not of its taxing power

HELD

The said enactment implements the general welfare mandate of the Constitution and

constitutes a legitimate exercise of the police power of the State.

The Social Security Law was enacted pursuant to the policy of the government "to develop, establish

gradually and perfect a social security system which shall be suitable to the needs of the people

throughout the Philippines, and shall provide protection against the hazards of disability, sickness, old

age and death" (Sec. 2, RA 1161, as amended). - Membership in the SSS is not a result of bilateral,

concensual agreement where the rights and obligations of the parties are defined by and subject to their

will, RA 1161 requires compulsory coverage of employees and employers under the System. It is actually

a legal imposition on said employers and employees, designed to provide social security to the

workingmen. The principle of non-impairment of the obligation of contract as provided in the Bill of

Rights is not a proper defense, the enactment being a lawful exercise of the police power of the State.

The taxing power of the State is exercised for the purpose of raising revenues. However, under our

Social Security Law, the emphasis is more on the promotion of the general welfare

. The Act is not part of our Internal Revenue Code nor are the contributions and premiums therein dealt

with and provided for, collectible by the Bureau of Internal Revenue. The funds contributed to the

System belong to the members who will receive benefits, as a matter of right, whenever the hazards

provided by the law occur. - Together with the contributions imposed upon employees and the

Government, they are intended for the protection of said employees against the hazards of disability,

sickness, old age and death in line with the constitutional mandate to promote social justice to insure

the well-being and economic security of all the people.

It is the intention of the law to cover as many persons as possible so as to promote the constitutional

objective of social justice. It is clear that a later law prevails over a prior statute and moreover the

legislative intent must be given effect.

You might also like

- Bernas PIL ReviewerDocument42 pagesBernas PIL ReviewerDarla Grey100% (11)

- Third Party Affidavit 1Document1 pageThird Party Affidavit 1Mona Liza100% (1)

- Santiago, Et Al., vs. CA and SssDocument3 pagesSantiago, Et Al., vs. CA and SssNeri Danessa LabayogNo ratings yet

- Pal Employees Savings and Loan AssociationDocument1 pagePal Employees Savings and Loan AssociationTricia LacuestaNo ratings yet

- GSIS V Reynaldo Palmiery, G.R. No. 217949, February 20, 2019 FactsDocument20 pagesGSIS V Reynaldo Palmiery, G.R. No. 217949, February 20, 2019 FactsWilfredo Guerrero IIINo ratings yet

- Philamlife vs. CIRDocument1 pagePhilamlife vs. CIRMona LizaNo ratings yet

- Zuno Vs CabredoDocument2 pagesZuno Vs CabredoMona Liza100% (1)

- Philamlife vs. CIRDocument1 pagePhilamlife vs. CIRMona LizaNo ratings yet

- De Borja Vs de BorjaDocument2 pagesDe Borja Vs de BorjaArgel Joseph CosmeNo ratings yet

- Film&TvCrew Alliance ContractDocument4 pagesFilm&TvCrew Alliance ContractAvon PsicorpsNo ratings yet

- Cms Estate, Inc Vs SssDocument2 pagesCms Estate, Inc Vs SssBryne Boish100% (2)

- 3.1 Cms Estate Inc Vs SssDocument1 page3.1 Cms Estate Inc Vs SssluigimanzanaresNo ratings yet

- Jamer Vs NLRC DigestDocument1 pageJamer Vs NLRC DigestEmmanuel OrtegaNo ratings yet

- 1 Ysmael Case and 2 Marcopper CaseDocument3 pages1 Ysmael Case and 2 Marcopper CaseRaymarc Elizer AsuncionNo ratings yet

- Group 1 Basa Vs Workmen and Biscarra Vs WormenDocument3 pagesGroup 1 Basa Vs Workmen and Biscarra Vs WormenRae De CastroNo ratings yet

- REPUBLIC Vs THE FIRST NATIONAL CITY BANK OF NEW YORKDocument5 pagesREPUBLIC Vs THE FIRST NATIONAL CITY BANK OF NEW YORKZaira Gem GonzalesNo ratings yet

- Machuca Vs SSSDocument3 pagesMachuca Vs SSSDeniseEstebanNo ratings yet

- Capili-Vs-Nlrc-1Document6 pagesCapili-Vs-Nlrc-1MingNo ratings yet

- Campangan v. NLRC: Cagampan vs. NLRC 195 SCRA 533Document3 pagesCampangan v. NLRC: Cagampan vs. NLRC 195 SCRA 533gilbert213No ratings yet

- Machuca Tile Co Vs SSS 30 SCRA 256 JurisprudenceDocument2 pagesMachuca Tile Co Vs SSS 30 SCRA 256 JurisprudenceReynier Molintas ClemensNo ratings yet

- JAIME GAPAYAO vs. JAIME FULODocument3 pagesJAIME GAPAYAO vs. JAIME FULOBert NazarioNo ratings yet

- Diosdado Yuliongsu Vs PNB (Cebu Branch)Document2 pagesDiosdado Yuliongsu Vs PNB (Cebu Branch)jhonlandichoNo ratings yet

- SMC vs. Ca 2002Document6 pagesSMC vs. Ca 2002Marcelino CasilNo ratings yet

- Hinoguin Vs ECCDocument2 pagesHinoguin Vs ECCAnne100% (1)

- Pablo Feliciano JR Heirs Vs Land BankDocument1 pagePablo Feliciano JR Heirs Vs Land BankGladys Bustria OrlinoNo ratings yet

- Republic Vs Pal Fox and Far EastDocument2 pagesRepublic Vs Pal Fox and Far EastPre AvanzNo ratings yet

- 41-51 Case DigestDocument8 pages41-51 Case DigestCarmela Paola R. DumlaoNo ratings yet

- Hilarion Beronilla Vs GSISDocument2 pagesHilarion Beronilla Vs GSISStevensonYuNo ratings yet

- Republic vs. Candy Maker Inc. (G.R. No. 163766)Document3 pagesRepublic vs. Candy Maker Inc. (G.R. No. 163766)Ryan Cruz IINo ratings yet

- 58 PNB v. RodriguezDocument3 pages58 PNB v. RodriguezJustin ParasNo ratings yet

- Jamer Vs NLRCDocument1 pageJamer Vs NLRCJ. LapidNo ratings yet

- FACTS: Petitioners Were Regular Employees of Agusan Plantations, Inc. Claiming That ItDocument1 pageFACTS: Petitioners Were Regular Employees of Agusan Plantations, Inc. Claiming That ItKat Jolejole100% (1)

- Lim v. CA 1995 (Nego)Document2 pagesLim v. CA 1995 (Nego)Stephanie GriarNo ratings yet

- Digest-MWSS v. DawayDocument2 pagesDigest-MWSS v. DawayNamiel Maverick D. BalinaNo ratings yet

- De Ysasi Vs ArceoDocument1 pageDe Ysasi Vs ArceoMabelle ArellanoNo ratings yet

- Poparmuco vs. InsonDocument4 pagesPoparmuco vs. InsonSORITA LAWNo ratings yet

- Dreamland Hotel Resort Vs Stephen Johnson GR 191455Document2 pagesDreamland Hotel Resort Vs Stephen Johnson GR 191455Andrea Gatchalian50% (4)

- Case Digest 14 PNB Vs PEMADocument2 pagesCase Digest 14 PNB Vs PEMAMavic Morales67% (3)

- POPARMUCO V InsonDocument2 pagesPOPARMUCO V InsonLawrence Y. Capuchino100% (1)

- De La REA Case DigestDocument7 pagesDe La REA Case DigestSherry Jane GaspayNo ratings yet

- Arco Metal Vs Naflul - DigestDocument1 pageArco Metal Vs Naflul - DigestBenitez GheroldNo ratings yet

- Republic of The Philippines, Petitioner, vs. Diosdada I. Gielczyk, RespondentDocument3 pagesRepublic of The Philippines, Petitioner, vs. Diosdada I. Gielczyk, RespondentRevina Estrada0% (1)

- Scribd Case Digests PDFDocument9 pagesScribd Case Digests PDFcarla_cariaga_2No ratings yet

- Paguio vs. NLRC Et Al.Document3 pagesPaguio vs. NLRC Et Al.Balaod Maricor100% (2)

- Belisario Vs IacDocument2 pagesBelisario Vs IacArvin Guevarra100% (1)

- Land Bank vs. Prado Verde Corporation DigestDocument3 pagesLand Bank vs. Prado Verde Corporation DigestEmir MendozaNo ratings yet

- Dycaico Vs SSSDocument3 pagesDycaico Vs SSSPaolo OrtizNo ratings yet

- Travel-On v. CA / PP v. ManiegoDocument2 pagesTravel-On v. CA / PP v. ManiegolchieSNo ratings yet

- Banga V Bello DigestDocument2 pagesBanga V Bello DigestNylaNo ratings yet

- Agro-Conglomerates Inc VS CaDocument1 pageAgro-Conglomerates Inc VS CaJan Mar Gigi GallegoNo ratings yet

- Central Mindanao University Vs DARABDocument1 pageCentral Mindanao University Vs DARABAldrin TangNo ratings yet

- Ortega v. CA (G.R. No. 109248)Document3 pagesOrtega v. CA (G.R. No. 109248)Rache GutierrezNo ratings yet

- CASE No. PNB vs. CA, 147 SCRA 273Document1 pageCASE No. PNB vs. CA, 147 SCRA 273Al Jay MejosNo ratings yet

- Loreto D. de La Victoria Vs Hon. Jose P. BurgosDocument2 pagesLoreto D. de La Victoria Vs Hon. Jose P. BurgosLenie SanchezNo ratings yet

- Case Digest GR No 225115Document2 pagesCase Digest GR No 225115Ma. Donalyn SoledadNo ratings yet

- Republic v. IAC ACMEDocument1 pageRepublic v. IAC ACMESteven AveNo ratings yet

- Rabor Vs CSCDocument3 pagesRabor Vs CSCazanezz100% (3)

- Employers Confederation of The Philippines V NWPCDocument3 pagesEmployers Confederation of The Philippines V NWPCBettina Rayos del SolNo ratings yet

- Ritualo Vs PeopleDocument4 pagesRitualo Vs PeopleKastin SantosNo ratings yet

- Batch 3 PT 2 DigestsDocument13 pagesBatch 3 PT 2 DigestseethenNo ratings yet

- 1 Heirs of Castro, Sr. vs. LozadaDocument2 pages1 Heirs of Castro, Sr. vs. LozadaRhea Mae A. SibalaNo ratings yet

- Agripino Capitulo, Et Al. V. Alejo Aquino NoDocument1 pageAgripino Capitulo, Et Al. V. Alejo Aquino NoAehrold GarmaNo ratings yet

- Cms Estate Vs SssDocument5 pagesCms Estate Vs SssRinielNo ratings yet

- CMS ESTATE, INC., Petitioner, v. SOCIAL SECURITY SYSTEM and SOCIAL SECURITY COMMISSIONDocument4 pagesCMS ESTATE, INC., Petitioner, v. SOCIAL SECURITY SYSTEM and SOCIAL SECURITY COMMISSIONgraceNo ratings yet

- CMS Estate Inc Pajarillo CaseDocument3 pagesCMS Estate Inc Pajarillo CaseJesimiel CarlosNo ratings yet

- Labor Law Cases (Full Text)Document31 pagesLabor Law Cases (Full Text)Luz Celine CabadingNo ratings yet

- G.R. No. L-26298 September 28, 1984 CMS ESTATE, INC., Petitioner, Social Security System and Social Security Commission, RespondentsDocument5 pagesG.R. No. L-26298 September 28, 1984 CMS ESTATE, INC., Petitioner, Social Security System and Social Security Commission, RespondentsakimoNo ratings yet

- X.V. G.r.no. 108524, Nov. 10,1994Document1 pageX.V. G.r.no. 108524, Nov. 10,1994Mona LizaNo ratings yet

- Civil Procedure Up BarsoftDocument12 pagesCivil Procedure Up BarsoftMona LizaNo ratings yet

- Criminal Law Cases2Document2 pagesCriminal Law Cases2Mona LizaNo ratings yet

- VegetablesDocument7 pagesVegetablesMona LizaNo ratings yet

- Criminal Law CASEsDocument2 pagesCriminal Law CASEsMona LizaNo ratings yet

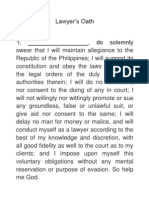

- Lawyer's OathDocument1 pageLawyer's OathKukoy PaktoyNo ratings yet

- Tambunting PawnshopDocument1 pageTambunting PawnshopMona LizaNo ratings yet

- Rodolfo M. Yumang V. Atty. Edwin M. Alaestante AC. No. 10992, Jun 19, 2018Document3 pagesRodolfo M. Yumang V. Atty. Edwin M. Alaestante AC. No. 10992, Jun 19, 2018Mona LizaNo ratings yet

- Intestado de Don Valentin Descals - Tax2Document1 pageIntestado de Don Valentin Descals - Tax2Mona LizaNo ratings yet

- X.viii. G.R.No. 168129Document2 pagesX.viii. G.R.No. 168129Mona LizaNo ratings yet

- Phil Acetylene V CIRDocument1 pagePhil Acetylene V CIRShaneBeriñaImperialNo ratings yet

- Eduardo R. Alicias, Jr. vs. Atty. Myrna v. MacatangayDocument10 pagesEduardo R. Alicias, Jr. vs. Atty. Myrna v. MacatangayMona LizaNo ratings yet

- Trinidad GamboaDocument10 pagesTrinidad GamboaMona LizaNo ratings yet

- Cir Vs BF GoodrichDocument1 pageCir Vs BF GoodrichMona LizaNo ratings yet

- Palaganas V Palaganas Case DigestDocument2 pagesPalaganas V Palaganas Case Digesthistab100% (3)

- Palaganas V Palaganas Case DigestDocument1 pagePalaganas V Palaganas Case DigestMona LizaNo ratings yet

- Eduardo R. Alicias, Jr. vs. Atty. Myrna v. Macatangay, Et. Al.Document1 pageEduardo R. Alicias, Jr. vs. Atty. Myrna v. Macatangay, Et. Al.Mona LizaNo ratings yet

- Eduardo R. Alicias, Jr. vs. Atty. Myrna v. MacatangayDocument2 pagesEduardo R. Alicias, Jr. vs. Atty. Myrna v. MacatangayMona LizaNo ratings yet

- Eduardo R. Alicias, Jr. vs. Atty. Myrna v. Macatangay, Et. Al.Document1 pageEduardo R. Alicias, Jr. vs. Atty. Myrna v. Macatangay, Et. Al.Mona LizaNo ratings yet

- Mary Grace Natividad S PoeDocument4 pagesMary Grace Natividad S PoeMona LizaNo ratings yet

- REDocument2 pagesREMona LizaNo ratings yet

- Reaction Paper On The Principle of Jus Cogens by Mona LizaDocument3 pagesReaction Paper On The Principle of Jus Cogens by Mona LizaMona LizaNo ratings yet

- 4Document5 pages4Mona LizaNo ratings yet

- Pale Cases EugeneDocument6 pagesPale Cases EugeneMona LizaNo ratings yet

- Bookmap Presentation (BMT)Document29 pagesBookmap Presentation (BMT)Second KonieNo ratings yet

- Types of Bank AccountsDocument20 pagesTypes of Bank AccountsNisarg Khamar73% (11)

- Sum of The Digits Method - Rule 78Document1 pageSum of The Digits Method - Rule 78SeemaNo ratings yet

- Job Letter For Opening Bank AccountDocument4 pagesJob Letter For Opening Bank Accountseoerljbf100% (2)

- Exhibit 1 Unitary Sec. Cert. - Domestic CorporationDocument2 pagesExhibit 1 Unitary Sec. Cert. - Domestic Corporationthesupersecretsecret40% (5)

- List Peserta FinalDocument8 pagesList Peserta FinalSyifa AryantiNo ratings yet

- 003 12 Business Studies Chapter 2 Short Answers 1Document3 pages003 12 Business Studies Chapter 2 Short Answers 1reereeNo ratings yet

- Shell Digital Marketing StrategiesDocument69 pagesShell Digital Marketing StrategiesFiorella AvalosNo ratings yet

- Bio DataDocument7 pagesBio DataPrakash KcNo ratings yet

- Edited by Foxit Reader Copyright (C) by Foxit Software Company, 2005-2007 ForDocument1 pageEdited by Foxit Reader Copyright (C) by Foxit Software Company, 2005-2007 ForChristopher RoyNo ratings yet

- Notes - PartnershipDocument56 pagesNotes - PartnershipsudhirbazzeNo ratings yet

- VOLUNTARY RETIREMENT SCHEME FinalDocument70 pagesVOLUNTARY RETIREMENT SCHEME FinalDishangi50% (4)

- FIN516 W6 Homework-4Document4 pagesFIN516 W6 Homework-4Roxanna Gisell RodriguezNo ratings yet

- L6 - Customer Role in Service DeliveryDocument23 pagesL6 - Customer Role in Service DeliveryRishab Jain 2027203No ratings yet

- ST - Wilfred'S College of Law: A Project OnDocument14 pagesST - Wilfred'S College of Law: A Project OnNaman DadhichNo ratings yet

- Compilation of Raw Data - LBOBGDT Group 9Document165 pagesCompilation of Raw Data - LBOBGDT Group 9Romm SamsonNo ratings yet

- Chapter 8 Profit Maximization &cmptitive SupplyDocument92 pagesChapter 8 Profit Maximization &cmptitive Supplysridhar7892No ratings yet

- Impact of Training On Employee Performance The Case of (NKB)Document11 pagesImpact of Training On Employee Performance The Case of (NKB)mahbobullah rahmaniNo ratings yet

- Original For Recipient Duplicate For Transporter Triplicate For SupplierDocument1 pageOriginal For Recipient Duplicate For Transporter Triplicate For SupplierPraveen KumarNo ratings yet

- Strategic Management EssentialsDocument29 pagesStrategic Management EssentialsKristine TiuNo ratings yet

- Rogue Trader Profit FactorDocument9 pagesRogue Trader Profit FactorMorkizgaNo ratings yet

- Broker Commission Schedule-EDocument19 pagesBroker Commission Schedule-EErvin Fong ObilloNo ratings yet

- Marketing Plan Group 5Document29 pagesMarketing Plan Group 5Neri La Luna100% (1)

- Try Cargo InternationalDocument162 pagesTry Cargo Internationalgeorge_zouridis100% (1)

- Asisgn. 1 Mod 2 - NCA HELD FOR SALE & DISCONTINUED OPNS.Document5 pagesAsisgn. 1 Mod 2 - NCA HELD FOR SALE & DISCONTINUED OPNS.Kristine Vertucio0% (1)

- Quizzers On Percentage TaxationDocument10 pagesQuizzers On Percentage Taxation?????No ratings yet

- How To Register A BusinessDocument22 pagesHow To Register A BusinessJEMAICA EGLIONo ratings yet

- Addresses of AMC Branches 160711Document40 pagesAddresses of AMC Branches 160711kimsrNo ratings yet

- Salary GUIDE 2021Document25 pagesSalary GUIDE 2021Mohammed Aljoaib100% (1)