Professional Documents

Culture Documents

RedSeer Etailing Leadership Index AMJ 17

Uploaded by

Danish ShaikhCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RedSeer Etailing Leadership Index AMJ 17

Uploaded by

Danish ShaikhCopyright:

Available Formats

6th Edition

The Indian E-tailing Leadership Index April, May, June 2017

New Delhi I Bangalore I Mumbai I New York I Dubai

2011 RedSeer Consulting Confidential `and Proprietary Information

www.redseerconsulting.com Query@redseerconsulting.com |

Contents

A Quarterly Results Q217

B Breakdown Analysis

C ELI methodology

RedSeer Consulting Confidential 1

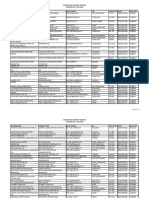

Player-wise Performance Q2CY17

Q1CY17

Most Trusted Brand Best Value Great Experience

A

m 21 25 49 95 95

a

F

l 22 25 48 95 95

i

P

a 11 23 45 78 80

y

S

n 9 24 44 77 79

a

S

h 5 22 42 66 70

o

E

b 1 23 32 56 68

a

RedSeer Consulting Confidential 2

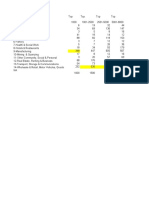

Overall Industry Trends: Q117 to Q217 Increase Neutral Decrease

30%

25%

29%

25% 24%

20%

21%

20%

15%

10%

5%

Industry NPS

0%

2016 Q2 2016 Q3 2016 Q4 2017 Q1 2017 Q2

Rationale

Tied with Flipkart on ELI, with major improvements in Brand recall and

customer support

Flipkart remained constant on the scorecard with only brand recall seeing a

slight improvement in comparison to the last quarter

Snapdeal saw a slight increase in ELI due to an improved brand recall, but

pricing and product variety saw a dip stunting its growth in Q217

Paytm saw a slight dip in the overall score, with consumer NPS being a key

metric of note, seeing another down quarter from Q117

Shopclues saw an increase in consumer NPS, but went slightly down on the

overall score due to a dip in value proposition in Q217

Ebay went down in Q217 suffering the most on ELI, with a large decrease in

consumer NPS and customer support

RedSeer Consulting Confidential 3

Contents

A Quarterly Results Q217

B Breakdown Analysis

C ELI methodology

RedSeer Consulting Confidential 4

Most Trusted Brand Trends: Q216 to Q217

25 23 23

22

21 21 21

19 19

Flipkart

Amazon

Snapdeal

12 Paytm

10 11 Shopclues

10

9 9 Ebay

8 8

7 7

5 5

4 4

3

4

3 1

2

1

2016 Q2 2016 Q3 2016 Q4 2017 Q1 2017 Q2

Key Industry Insights

1. The industry hasnt moved too much in comparison to Q117 on most metrics because of a stagnant sales

quarter this time around

2. Amazon has been a steady gainer on Flipkarts lead and has finally moved ahead of Flipkart on ELI

3. Paytm is constantly losing on consumer NPS in the past 2 quarters due to constant changes on the tech end

reducing the customer experience

RedSeer Consulting Confidential 5

Best Value Proposition Trends: Q216 to Q217

25 25 25 25

24 23

24 23 24 22

20 23

19 22

18

Flipkart

Amazon

14 Snapdeal

Paytm

Shopclues

Ebay

2016 Q2 2016 Q3 2016 Q4 2017 Q1 2017 Q2

Key Industry Insights

1. The overall value proposition by a maturing e-tailing industry has converged as players have built up a

significant assortment of products being sold at comparable prices

2. It is expected that business delivery excellence will become the sole differentiator between players in the

industry

RedSeer Consulting Confidential 6

Great Experience Trends: Q216 to Q217

49 49 49 49

48

45 49 44

41

44 39 41

40

34

30 30

Flipkart

Amazon

25 30 Snapdeal

24

Paytm

26

Shopclues

Ebay

2016 Q2 2016 Q3 2016 Q4 2017 Q1 2017 Q2

Key Industry Insights

1. As the industry has shifted focus from customer acquisition to customer retention, focus has increased on

service delivery which is visible across players

2. However, key players have difficulty servicing the operational load generated by sales campaigns, leading to

a decline in overall experience after every sales event

RedSeer Consulting Confidential 7

Contents

A Quarterly Results Q217

B Breakdown Analysis

C ELI methodology

RedSeer Consulting Confidential 8

What does the E-tailing Leadership Index (ELI) measure?

ELI is a comprehensive assessment of overall performance of e-tailers in customers

mind. It is based on the three pillars, which are:

Indian E-tailing Leadership Index

1 2 3

Most Trusted Brand Best Value Great Buying Experience

Most preferred e-tailing brand Maximum value for money Best buying experience from

for the online customers and wider "meaningful product discovery to post

assortment delivery experience

RedSeer Consulting Confidential 9

How is it structured > Most Trusted Brand

E-tailer brand that is most trusted by online consumers

Brand Recall

e-tailer which has the highest top of the

mind recall for most preferred online brand

Unaided Recall

e-tailer which has the highest unaided

recall for the most preferred online brand

RedSeer Consulting Confidential 10

How is it structured > Best Value

E-tailer that provides the best value for money along with meaningful assortment

Price competitiveness

Where would you find the best prices and

discounts available among the e-tailers

Product variety and availability

What are the chances of finding the product

you are looking at among the e-tailers

Quality of products

What do you thing of the quality of product

available on each of the e-tailers

RedSeer Consulting Confidential 11

How is it structured > Great Buying Experience

E-tailer that gives best end to end buying experience

Exploring & ordering products (For web & app)

How easy and intuitive they find product

exploration on the app and websites of the e-

tailers

Delivery predictability and experience

How quick and precise is the overall delivery

How quick is the reverse pick-up in case of

returns

Consumer experience post delivery

How easy it is to return products

Speed and ease of refund

Quality of customer support

Overall NPS

Overall satisfaction of customers with end to

end experience based on NPS methodology

RedSeer Consulting Confidential 12

Methodology Used:

The results of the study is based on the following research themes:

1 ~4500 customer

surveys across 30 cities

(Metro, Tier-I and Tier-II)

2 All respondents have to

be e-tailing customers,

having bought

something from the

3 The survey was split

between the SEC A, B

and C population, with

in April to June 2017 equitable distribution of

concerned websites in

period age group and gender

the last 3 months

4 Statistical technique of

TOPSIS has been

used to arrive at the

indexing from the

5 The study is entirely

based on consumer

perception and works on

a proprietary RedSeer

responses and hard

algorithm

numbers

RedSeer Consulting Confidential 13

Evaluation Parameters and Weights

The analysis is based on 30+ parameters analysed in the three pillars

A. Most trusted brand: B. Best Value Proposition:

Most preferred Brand Product Variety and

to Shop From Availability

Top of the mind 25 25 Product Availability

Unaided Product Variety

Product Quality

Price Competitiveness

Pricing and Discount

50

C. Great Buying Experience:

Web & App Experience Delivery/Cancellations/Returns Delivery

App & Web Delivery Time Refund (Days)

Design & Look Reverse Pick-up speed Customer Support1

Ease of Navigation Ease of Return

Product Description

Check Out Experience Overall Consumer NPS

Payment Gateway Experience

Consumer Experience Post

Notes: 1. Customer Support parameters are measured as Average Wait Time (Secs), First Time Resolution & Escalation

RedSeer Consulting Confidential 14

Notes

Notes:

1. Only the horizontal e-tailers have been considered for this study

2. For Pillar A Higher weightage has been given to "Top of the Mind Recall" over the

Unaided Recall"

3. For Pillar B Price Competitiveness has higher weightage than Product Variety and

Availability

4. For Pillar C App has been given higher weightage when compared to App given that a

larger customer base buys using the App

RedSeer Consulting Confidential 15

Flexible in Approach, Firm on Results

Thank You !

query@redseerconsulting.com

Bangalore HQ: Delhi Office: Mumbai Office: Dubai Office:

Indiqube Sigma, INHWA Business center 25/b 4th Floor 42Seer Technologies FZE

Plot 3/B, 7thC Main, Sector 48, Sohana Road Usha Sadan G-D-Flex G089 C-Thub

3rd Block Koramangala, Gurgaon -122018 Near Colaba PO, Colaba Dubai Silicon Oasis,

Bangalore - 560034 Mumbai - 400005 Dubai, UAE

2017 RedSeer Consulting Confidential and Proprietary Information www.redseerconsulting.com Query@redseerconsulting.com

You might also like

- 98a2 EDC Toronto Green Industries Directory Edition 1 - 19 Jun 19Document19 pages98a2 EDC Toronto Green Industries Directory Edition 1 - 19 Jun 19Danish ShaikhNo ratings yet

- Sample Completed Target SpreadsheetDocument127 pagesSample Completed Target SpreadsheetDanish ShaikhNo ratings yet

- Canada Emplyoment AgenciesDocument11 pagesCanada Emplyoment AgenciesDanish ShaikhNo ratings yet

- Recruitment Agencies in Canada PDFDocument7 pagesRecruitment Agencies in Canada PDFKarishma ChanglaniNo ratings yet

- Recruiter List For Website 07-06-16Document20 pagesRecruiter List For Website 07-06-16Danish ShaikhNo ratings yet

- TOP8K Complete Directory Details NOV UPDATEDocument1,084 pagesTOP8K Complete Directory Details NOV UPDATEDanish ShaikhNo ratings yet

- Dave Thomas Foundation For Adoption (Canada) Budget Template InstructionsDocument18 pagesDave Thomas Foundation For Adoption (Canada) Budget Template InstructionsDanish ShaikhNo ratings yet

- White Paper MarketplaceDocument125 pagesWhite Paper MarketplaceDanish ShaikhNo ratings yet

- FactSheet CalgaryHeadOffices 2021Document5 pagesFactSheet CalgaryHeadOffices 2021Danish ShaikhNo ratings yet

- A Guide To Ecommerce Metrics For EtailersDocument17 pagesA Guide To Ecommerce Metrics For EtailersDanish ShaikhNo ratings yet

- Resume Keyword 3 The LaddersDocument5 pagesResume Keyword 3 The LaddersDanish ShaikhNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Cblmcss Module 2Document113 pagesCblmcss Module 2Rusty Ugay LumbresNo ratings yet

- AHMED HASSAN - Computer Science Week 4 H.W June 22 TH Till 26th JuneDocument3 pagesAHMED HASSAN - Computer Science Week 4 H.W June 22 TH Till 26th JuneAhmed HassanNo ratings yet

- I/O Basics: Ports Data, Control, and Status BitsDocument11 pagesI/O Basics: Ports Data, Control, and Status BitsNikhil GobhilNo ratings yet

- 4th Unit Test in Empowerment TechnologyDocument2 pages4th Unit Test in Empowerment TechnologyMaricel EsternonNo ratings yet

- C ProgramsDocument51 pagesC ProgramsLigo PastiNo ratings yet

- LOGO! Analog Input PT100 ManualDocument6 pagesLOGO! Analog Input PT100 ManualKhurram100% (3)

- NI6528Document27 pagesNI6528paulpuscasuNo ratings yet

- Under Ground Cable Fault Detection Using IOT-1Document22 pagesUnder Ground Cable Fault Detection Using IOT-1Sarath V PradheepNo ratings yet

- Node Export - DrupalDocument2 pagesNode Export - DrupalCoklatNo ratings yet

- Group 5 Connectors: 1. Connector DestinationDocument17 pagesGroup 5 Connectors: 1. Connector DestinationREMZONANo ratings yet

- 802 - Information - Technology - MS (3) - 231223 - 091112Document7 pages802 - Information - Technology - MS (3) - 231223 - 091112manmarvellous1337No ratings yet

- HEC-ResSim 30 UsersManual PDFDocument512 pagesHEC-ResSim 30 UsersManual PDFvitensaNo ratings yet

- LogDocument568 pagesLogMark LouieNo ratings yet

- HSM USB Serial Driver Release Notes PDFDocument32 pagesHSM USB Serial Driver Release Notes PDFVeimar CelisNo ratings yet

- CatalogDocument66 pagesCataloggmconNo ratings yet

- CENELEC GridProfileDocument4 pagesCENELEC GridProfileMartin LeonardNo ratings yet

- ICLOUDDocument15 pagesICLOUDShantanu Chande100% (1)

- Product Manual 26727 (Revision V, 5/2021) : Varistroke-I (Vs-I) Electro-Hydraulic ActuatorDocument152 pagesProduct Manual 26727 (Revision V, 5/2021) : Varistroke-I (Vs-I) Electro-Hydraulic ActuatorFredi F FNo ratings yet

- VerizonWireless AffDocument2 pagesVerizonWireless Affjbjkhb hibNo ratings yet

- Slides By: Andrew Stephenson Georgia Gwinnett CollegeDocument22 pagesSlides By: Andrew Stephenson Georgia Gwinnett CollegeRamya GunukulaNo ratings yet

- NA-OTP-PMT-0805-HS-SPE-0003 - Specification For Temporary Construction Camps and Ancillary Facilities - Final-2Document25 pagesNA-OTP-PMT-0805-HS-SPE-0003 - Specification For Temporary Construction Camps and Ancillary Facilities - Final-2AHMED AMIRANo ratings yet

- Case Studies MaintenanceDocument7 pagesCase Studies MaintenancemarinflorentinaoanaNo ratings yet

- Make Money OnlineDocument9 pagesMake Money OnlineTed100% (3)

- Flir E6 + Wifi - (63907-0704)Document4 pagesFlir E6 + Wifi - (63907-0704)Walter Guardia FariasNo ratings yet

- DTK Det DepDocument49 pagesDTK Det DepJames SmithNo ratings yet

- Sicoma Twin Shaft Mixer Brochure JECDocument8 pagesSicoma Twin Shaft Mixer Brochure JECShabrina Meitha Nadhila RamadhanNo ratings yet

- Unit 1Document8 pagesUnit 1Nidhya Nadarajan100% (1)

- Step by Step Companion GuideDocument4 pagesStep by Step Companion Guidebcap-oceanNo ratings yet

- PTC TermistorDocument9 pagesPTC TermistoretronictechNo ratings yet

- PLDT Prolinkwifirepeater Quickstartguide PDFDocument2 pagesPLDT Prolinkwifirepeater Quickstartguide PDFLenin KingNo ratings yet