Professional Documents

Culture Documents

What Is Money

Uploaded by

MahamSaba0 ratings0% found this document useful (0 votes)

14 views10 pagesggga

Original Title

What is money (1)

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentggga

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views10 pagesWhat Is Money

Uploaded by

MahamSabaggga

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 10

What is money? How is it created?

When

does it matter to the economy?

Money is any commodity or token that is

generally acceptable as a means of payment.

A means of payment is a method of settling a

debt.

Money has four functions:

1.Means of payment

Paying people what you owe them

2.Medium of exchange

Avoid Barter. Sell for money, then use the

money to buy another good.

3. Unit of account

List prices as in a catalogue or list debts as

in an account book.

4. Store of value

Hold money now in order to buy goods

later.

Money in Canada Today

Money in Canada consists of

Currency (bills and coins)

Deposits at banks and other financial

institutions, such as chequing accounts.

M1 is narrowly defined money.

It is currency in circulation in your pockets or

in cash registers and money in chequing

accounts (demand deposits) at chartered banks.

M2 + is more broadly defined money.

It includes:

1.M1

2.plus personal savings deposits at chartered

banks,

3.plus nonpersonal (business) notice deposits

(savings accounts) at chartered banks,

deposits at trust and mortgage loan

companies,

4.deposits at credit unions and caisses

populaires, and deposits at other financial

institutions.

Cheques, debit cards and credit cards are not

money.

Cheques and debit cards are methods of

instructing your bank to take money out of your

account and put it into some one elses account.

Credit cards are a means of instantaneously

qualifying for a loan and instructing a financial

institution to transfer the sum of the loan to the

person you are buying from. So if you pay $25

for a CD, you are simultaneously negotiating a

loan from Visa, and telling Visa to give the

money you borrowed to the music store. You

are obliged to transfer money to Visa later.

Cheques, debit cards and credit cards greatly

increase the efficiency of our banking system,

and they influence how much cash we keep in

our pocket or chequing account, but they are not

money.

The definition of money is somewhat arbitrary.

One principle is that narrowly defined money

earns no interest as in deposit accounts or cash

in your pocket.

Some broadly defined money earns interest, as

in savings accounts, but it earns much less than

government bonds.

In general, the more liquid money is, that is

the more easily it is spent, the less interest it

will earn and the more like money it is.

Cash, most chequing accounts: zero interest.

Savings accounts: low interest.

Before debit cards, you had to transfer

funds from a savings account to a

chequing account or to cash to spend

it.

G.I.C.s, Canada Savings Bonds, R.E.S.Ps

must be cashed in to be spent, sometimes

at a penalty in interest rates. They are not

money.

Chartered Banks

A chartered bank is a private firm that is

licensed to receive deposits and make loans.

A chartered banks balance sheet summarizes its

business and lists the banks assets, liabilities,

and net worth.

The objective of a chartered bank is to

maximize the net worth of its stockholders.

To achieve its objective, a bank makes loans at

an interest rate higher than that paid on deposits.

The riskier the loan, the higher the interest rate

you must pay the bank.

But the banks must balance profit and prudence;

loans generate profit, but depositors must be

able to obtain their funds when they want them.

Banks lend out depositors money, but they

must pay pack the money on demand.

They could always pay all the money back, no

matter what, if they kept all deposits in the vault.

But then they couldnt make loans, and wouldnt

make a profit. They would have to charge a

storage fee to cover the costs of bookkeeping

and protecting the vault.

Banks keep a portion of deposits as

RESERVES funds available to pay the

depositors what they owe them.

Banks now can decide the proportion of deposits

they wish to hold as cash.

Reserves are:

1. Vault Cash or currency

2. Deposits at the Bank of Canada (The

Bankers Bank, controlled by the Govt.)

These deposits can be cashed on

demand for more currency

Bank Assets that pay interest and contribute

to profit.

1. Banks also hold highly liquid and safe

assets, such as government treasury bills.

These are short term bonds of the

government. They pay interest and are not

money. The smallest are for $10,000. They

are payable in 30, 60 or 90 days, so they can

fairly quickly be turned into cash.

2. Other financial securities, such as 20 year

government or corporate bonds. These can

be sold at any time, but because it is so long

until the issuer must repay them, the price at

which they sell may vary. If the corporation

that issued them goes bankrupt, they will

become worthless.

3. Loans to firms and to individuals. The

riskier the loan, the higher the interest. If

you are starting a business, you will likely

have to pay a high loan, because the risk of

your being unable to repay the loan is high.

But Nova Scotia Power Corporation can pay

a low rate (usually prime), because it is not

likely to go bankrupt.

The sum of the banks assets equal the value of

the banks liabilities the money it owes its

depositors, that is

Vault cash + Deposits with the bank of

Canada + treasury bills + other liquid assets +

loans to firms and individual = deposits of the

public in the banks.

If everyone demanded that their bank deposits

be redeemed in currency today, banks would be

unable to repay them.

The reserves of vault cash are much less than the

value of the deposits.

The banks can ask the Bank of Canada to cash their

deposits and send them currency (the truck with the

cash would have to drive here). But the banks

deposits are much less than what the banks owe their

depositors.

The banks can sell their treasury bills and other

bonds, although all banks would be selling these

assets at the same time. Their prices would fall

sharply, and be much lower than their purchase

price.

The banks cant demand immediate payment of your

student loan.

If everyone demanded that any bank repay all its

depositors immediately, every bank would fail (be

unable to repay depositors).

Individual banks have failed. Some deposits are

insured by the government. Eventually depositors

were repaid this money. Other deposits were not

insured, and the depositors lost their money.

If all banks fail, there would be a massive financial

crisis. Many banks failed in the United States and in

Europe (not Canada) during the early 1930s and

contributed substantially to the severity of the

depression.

Financial stability is extremely important to a well

functioning economy

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Advanced Competitive Position AssignmentDocument7 pagesAdvanced Competitive Position AssignmentGeraldine Aguilar100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- BBA Semester III Project (Marketing Strategy) BritanniaDocument65 pagesBBA Semester III Project (Marketing Strategy) BritanniaWe Rocks100% (1)

- Din 11864 / Din 11853: Armaturenwerk Hötensleben GMBHDocument70 pagesDin 11864 / Din 11853: Armaturenwerk Hötensleben GMBHkrisNo ratings yet

- Sample of Memorandum of Agreement (MOA)Document12 pagesSample of Memorandum of Agreement (MOA)Johanna BelestaNo ratings yet

- Final QARSHI REPORTDocument31 pagesFinal QARSHI REPORTUzma Khan100% (2)

- The East Pacific Merchandising Corporation vs. The Director of Patents and Luis P. PellicerDocument31 pagesThe East Pacific Merchandising Corporation vs. The Director of Patents and Luis P. PellicerRalph HonoricoNo ratings yet

- SynopsisDocument12 pagesSynopsisNikhil JainNo ratings yet

- Annotated Glossary of Terms Used in The Economic Analysis of Agricultural ProjectsDocument140 pagesAnnotated Glossary of Terms Used in The Economic Analysis of Agricultural ProjectsMaria Ines Castelluccio100% (1)

- Law Firms List 2Document13 pagesLaw Firms List 2Reena ShauNo ratings yet

- EJBDocument160 pagesEJBAnkit Jain100% (1)

- Alok Kumar Singh Section C WAC I 3Document7 pagesAlok Kumar Singh Section C WAC I 3Alok SinghNo ratings yet

- Ias 2Document29 pagesIas 2MK RKNo ratings yet

- 73 220 Lecture07Document10 pages73 220 Lecture07api-26315128No ratings yet

- Save Capitalism From CapitalistsDocument20 pagesSave Capitalism From CapitalistsLill GalilNo ratings yet

- Six Sigma Black Belt Wk1 Define Amp MeasureDocument451 pagesSix Sigma Black Belt Wk1 Define Amp Measuremajid4uonly100% (1)

- GL 003 14 Code of Good Practice For Life InsuranceDocument19 pagesGL 003 14 Code of Good Practice For Life InsuranceAdrian BehNo ratings yet

- Exemption Certificate - SalesDocument2 pagesExemption Certificate - SalesExecutive F&ADADUNo ratings yet

- Guide To Importing in ZimbabweDocument22 pagesGuide To Importing in ZimbabweMandla DubeNo ratings yet

- MARK977 Research For Marketing Decisions Autumn Semester, 2017 Week 8Document54 pagesMARK977 Research For Marketing Decisions Autumn Semester, 2017 Week 8Soumia HandouNo ratings yet

- SAP InvoiceDocument86 pagesSAP InvoicefatherNo ratings yet

- All Bom HC CircularsDocument55 pagesAll Bom HC CircularsSkk IrisNo ratings yet

- Section 114-118Document8 pagesSection 114-118ReiZen UelmanNo ratings yet

- SAP ResumeDocument4 pagesSAP ResumesriabcNo ratings yet

- Financial Accounting AssignmentDocument11 pagesFinancial Accounting AssignmentMadhawa RanawakeNo ratings yet

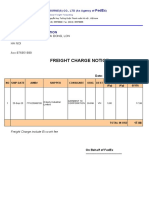

- Freight Charge Notice: To: Garment 10 CorporationDocument4 pagesFreight Charge Notice: To: Garment 10 CorporationThuy HoangNo ratings yet

- Part & Process Audit: Summary: General Supplier InformationDocument20 pagesPart & Process Audit: Summary: General Supplier InformationNeumar Neumann100% (1)

- The CEO Report v2 PDFDocument36 pagesThe CEO Report v2 PDFplanet_o100% (1)

- Lean Production SystemDocument8 pagesLean Production SystemRoni Komarul HayatNo ratings yet

- Upload 1 - Heirs of Tan Eng Kee v. CADocument4 pagesUpload 1 - Heirs of Tan Eng Kee v. CAPatricia VillamilNo ratings yet

- Report On Credit Appraisal in PNBDocument76 pagesReport On Credit Appraisal in PNBSanchit GoyalNo ratings yet