Professional Documents

Culture Documents

Bonds - December 6 2017

Uploaded by

Tiso Blackstar Group0 ratings0% found this document useful (0 votes)

9 views3 pagesBonds - December 6 2017

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBonds - December 6 2017

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views3 pagesBonds - December 6 2017

Uploaded by

Tiso Blackstar GroupBonds - December 6 2017

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

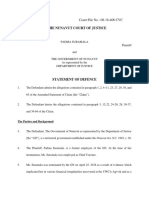

Markets and Commodity figures

06 December 2017

Total Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Deals Nominal Consideration Deals Nominal Consideration

Current Day 1 290 27.11 bn Rbn 27.02 180 17.33 bn Rbn 17.46

Week to Date 3 697 90.71 bn Rbn 92.09 960 130.71 bn Rbn 127.12

Month to Date 4 802 130.82 bn Rbn 136.35 1 112 164.07 bn Rbn 159.98

Year to Date 278 988 7 515.03 bn Rbn 7 835.55 74 452 9 207.58 bn Rbn 8 959.60

Foreign Client Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Party Deals Nominal Consideration Deals Nominal Consideration

Buy 87 3.07 bn Rbn 3.19 21 1.68 bn Rbn 1.67

Current Day Sell 102 4.43 bn Rbn 4.51 15 5.16 bn Rbn 5.76

Net -15 -1.35 bn Rbn -1.32 6 -3.48 bn Rbn -4.08

Buy 424 14.73 bn Rbn 14.78 67 5.68 bn Rbn 5.17

Week to Date Sell 350 16.26 bn Rbn 16.21 49 26.45 bn Rbn 29.06

Net 74 -1.53 bn Rbn -1.42 18 -20.77 bn Rbn -23.89

Buy 562 20.04 bn Rbn 19.80 95 7.79 bn Rbn 7.06

Month to Date Sell 487 22.49 bn Rbn 22.45 60 32.07 bn Rbn 35.24

Net 75 -2.46 bn Rbn -2.64 35 -24.28 bn Rbn -28.19

Buy 23 003 1 015.79 bn Rbn 1 043.64 5 608 498.62 bn Rbn 467.83

Year to Date Sell 18 877 964.96 bn Rbn 996.64 2 816 683.51 bn Rbn 713.63

Net 4 126 50.83 bn Rbn 47.00 2 792 -184.89 bn Rbn -245.80

Index Levels

Code Index Yield Index Previous Return MTD Return YTD

ALBI20 9.302%

All Bond Index Top 565.680

20 Composite 565.679 1.65% 6.04%

GOVI 9.300%Split - 563.988

ALBI20 Issuer Class GOVI 563.969 1.67% 6.13%

OTHI 9.309%

ALBI20 Issuer Class Split - 575.961

OTHI 576.018 1.59% 5.78%

CILI15 2.807%

Composite Inflation 243.516

Linked Index Top 15 243.186 1.12% -0.87%

ICOR 3.717%

CILI15 Issuer Class 265.530

Split - ICOR 265.250 0.58% 6.80%

IGOV 2.765%

CILI15 Issuer Class 242.376

Split - IGOV 242.041 1.15% -1.22%

ISOE 3.342%

CILI15 Issuer Class 245.557

Split - ISOE 245.342 0.67% 4.00%

MMI JSE Money Market Index

0 230.654 230.607 0.12% 7.23%

ALBI Constituent Bonds

Bond Issuer Maturity MTM Previous YTD Low YTD High

R159 REPUBLIC OF SOUTH

Jan 2020

AFRICA 8.020% 8.000% 7.03% 8.19%

R203 REPUBLIC OF SOUTH

Feb 2020

AFRICA 9.110% 9.090% 8.33% 9.75%

ES18 ESKOM HOLDINGS

MarLIMITED

2021 8.265% 8.235% 7.25% 8.43%

R204 REPUBLIC OF SOUTH

Jan 2023

AFRICA 9.590% 9.560% 8.71% 9.83%

R207 REPUBLIC OF SOUTH

Feb 2023

AFRICA 9.800% 9.770% 9.13% 10.27%

R208 REPUBLIC OF SOUTH

Feb 2023

AFRICA 8.550% 8.520% 7.68% 8.79%

ES23 ESKOM HOLDINGSAprLIMITED

2026 10.350% 10.350% 9.30% 10.65%

DV23 DEVELOPMENT DecBANK

2026

OF SOUTHERN

9.160% AFRICA 9.160% 8.31% 9.47%

R2023 REPUBLIC OF SOUTH

Jan 2030

AFRICA 9.620% 9.620% 8.70% 9.95%

ES26 ESKOM HOLDINGSFebLIMITED

2031 9.690% 9.690% 8.74% 10.02%

R186 REPUBLIC OF SOUTH

Mar 2032

AFRICA 9.800% 9.800% 8.84% 10.14%

R2030 REPUBLIC OF SOUTH

Sep 2033

AFRICA 11.115% 11.110% 10.05% 11.49%

R213 REPUBLIC OF SOUTH

Feb 2035

AFRICA 9.945% 9.940% 9.04% 10.33%

R2032 REPUBLIC OF SOUTH

Mar 2036

AFRICA 9.875% 9.870% 9.03% 10.25%

ES33 ESKOM HOLDINGSJanLIMITED

2037 10.030% 10.025% 9.12% 10.41%

R209 REPUBLIC OF SOUTH

Jan 2040

AFRICA 10.125% 10.125% 9.14% 10.51%

R2037 REPUBLIC OF SOUTH

Feb 2041

AFRICA 10.055% 10.055% 9.10% 10.43%

R214 REPUBLIC OF SOUTH

Apr 2042

AFRICA 11.365% 11.365% 10.18% 11.74%

R2044 REPUBLIC OF SOUTH

Jan 2044

AFRICA 10.170% 10.165% 9.17% 10.55%

R2048 REPUBLIC OF SOUTH

Feb 2048

AFRICA 10.115% 10.115% 9.16% 10.50%

Other Rates

Code Description Rate Previous YTD Low YTD High

SAFEX SAFEX Overnight Deposit Rate6.550% 6.550% 6.50% 6.83%

JIBAR1 JIBAR 1 Month 6.867% 6.858% 6.79% 7.12%

JIBAR3 JIBAR 3 Month 7.125% 7.125% 6.98% 7.38%

JIBAR6 JIBAR 6 Month 7.733% 7.733% 7.32% 8.00%

RSA 2 year retail bond 8.25% 0 0 0

RSA 3 year retail bond 8.50% 0 0 0

RSA 5 year retail bond 9.00% 0 0 0

RSA 3 year inflation linked retail

3.00%

bond 0 0 0

RSA 5 year inflation linked retail

3.25%

bond 0 0 0

RSA 10 year inflation linked retail

3.50%

bond 0 0 0

Nominal Bond Curves (NACS)

9.62

9.12

8.62

8.12

7.62

7.12 Zero

6.62 Par/Swap

6.12

5.62

5.12

4.62

2015 2020 2026 2031 2037 2042 2048 2053 2059

DATA DISCLAIMER

To the extent allowed by law, JSE Limited (the JSE) does not (expressly, tacitly or implicitly) guarantee or warrant the availability,

sequence, accuracy, completeness, reliability or any other aspect of any of the data (Data), or that any Data is up to date.

To the extent allowed by law, neither the JSE nor any of its directors, officers, employees, contractors, agents or representatives are

liable in any way to the reader or to any other natural or juristic person (Person) for any loss or damage as a result of (i) the display

of any Data in this bulltetin, or (ii) any Data being unavailable in this bulletin at any time and for any reason, or (iii) any delay,

inaccuracy, error, or omission in relation to any Data, or (iv) any actions taken or not taken by or on behalf of any Person in reliance

on any Data. The JSE is entitled to terminate the production of any Data at any time, without notice and without liability to any Person.

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

You might also like

- Wiley CPA Examination Review (Password Downloadslide)Document753 pagesWiley CPA Examination Review (Password Downloadslide)Elaine Claire Alalong90% (20)

- Good Luck!: Request For A Copy of The Original Credit Agreement Under The Consumer Credit Act 1974Document23 pagesGood Luck!: Request For A Copy of The Original Credit Agreement Under The Consumer Credit Act 1974jastheoneNo ratings yet

- Anti Corruption Working GuideDocument44 pagesAnti Corruption Working GuideTiso Blackstar GroupNo ratings yet

- 3.sole Proprietorship& PartnershipDocument10 pages3.sole Proprietorship& PartnershipAnonymous 8Pyd22rExNo ratings yet

- Delta Beverage Case With HedgingDocument7 pagesDelta Beverage Case With HedgingMorsalNo ratings yet

- ERP Oracle Financial Tutorial PDF CP05 - Oracle - PresentDocument57 pagesERP Oracle Financial Tutorial PDF CP05 - Oracle - PresentMuhammad Kashif Rana67% (3)

- Critical Skills List - Government GazetteDocument24 pagesCritical Skills List - Government GazetteTiso Blackstar GroupNo ratings yet

- Deed of UndertakingDocument2 pagesDeed of UndertakingALLAN VELENo ratings yet

- GR No. 166786 M Lhuillier V CIR (Good Faith)Document10 pagesGR No. 166786 M Lhuillier V CIR (Good Faith)Jerwin DaveNo ratings yet

- Open Letter To President Ramaphosa - FinalDocument3 pagesOpen Letter To President Ramaphosa - FinalTiso Blackstar GroupNo ratings yet

- Case 31 HelpDocument15 pagesCase 31 Helpbobbarker0% (2)

- Bonds - May 10 2018Document3 pagesBonds - May 10 2018Tiso Blackstar GroupNo ratings yet

- Bonds - December 7 2017Document3 pagesBonds - December 7 2017Tiso Blackstar GroupNo ratings yet

- Bonds - May 4 2018Document6 pagesBonds - May 4 2018Tiso Blackstar GroupNo ratings yet

- Bonds - April 18 2018Document3 pagesBonds - April 18 2018Tiso Blackstar GroupNo ratings yet

- Bonds - August 24 2017Document3 pagesBonds - August 24 2017Tiso Blackstar GroupNo ratings yet

- Bonds PDFDocument3 pagesBonds PDFTiso Blackstar GroupNo ratings yet

- Bonds - October 20 2017Document3 pagesBonds - October 20 2017Tiso Blackstar GroupNo ratings yet

- Bonds - April 2 2020Document3 pagesBonds - April 2 2020Lisle Daverin BlythNo ratings yet

- Bonds - December 4 2017Document3 pagesBonds - December 4 2017Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - April 22 2019Document3 pagesBonds - April 22 2019Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - August 21 2017Document3 pagesBonds - August 21 2017Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - July 30 2019Document3 pagesBonds - July 30 2019Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - September 17 2017Document3 pagesBonds - September 17 2017Tiso Blackstar GroupNo ratings yet

- Bonds PDFDocument3 pagesBonds PDFTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - October 24 2017Document6 pagesBonds - October 24 2017Tiso Blackstar GroupNo ratings yet

- Bonds - August 27 2019Document3 pagesBonds - August 27 2019Lisle Daverin BlythNo ratings yet

- Bonds - April 13 2020Document3 pagesBonds - April 13 2020Lisle Daverin BlythNo ratings yet

- Bonds - March 29 2018Document6 pagesBonds - March 29 2018Tiso Blackstar GroupNo ratings yet

- Bonds - March 6 2018Document6 pagesBonds - March 6 2018Tiso Blackstar GroupNo ratings yet

- Bonds - May 21 2019Document3 pagesBonds - May 21 2019Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - July 4 2019Document3 pagesBonds - July 4 2019Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - July 9 2020Document3 pagesBonds - July 9 2020Lisle Daverin BlythNo ratings yet

- Bonds - November 8 2018Document6 pagesBonds - November 8 2018Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - July 18 2017Document6 pagesBonds - July 18 2017Tiso Blackstar GroupNo ratings yet

- Bonds - October 11 2017Document3 pagesBonds - October 11 2017Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - February 16 2018Document6 pagesBonds - February 16 2018Tiso Blackstar GroupNo ratings yet

- Bonds PDFDocument6 pagesBonds PDFTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - April 23 2020Document3 pagesBonds - April 23 2020Lisle Daverin BlythNo ratings yet

- Bonds - August 16 2018Document3 pagesBonds - August 16 2018Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - January 18 2019Document3 pagesBonds - January 18 2019Tiso Blackstar GroupNo ratings yet

- Bonds - July 14 2019Document3 pagesBonds - July 14 2019Anonymous C13oy8No ratings yet

- Bonds - August 3 2017Document3 pagesBonds - August 3 2017Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - July 25 2017Document6 pagesBonds - July 25 2017Tiso Blackstar GroupNo ratings yet

- Bonds - July 3 2019Document6 pagesBonds - July 3 2019Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - February 13 2019Document3 pagesBonds - February 13 2019Tiso Blackstar GroupNo ratings yet

- Modern Pricing of Interest-Rate Derivatives: The LIBOR Market Model and BeyondFrom EverandModern Pricing of Interest-Rate Derivatives: The LIBOR Market Model and BeyondRating: 4 out of 5 stars4/5 (2)

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupNo ratings yet

- Arena Holdings Pty LTD - BBBEE Certificate - 2023Document2 pagesArena Holdings Pty LTD - BBBEE Certificate - 2023Tiso Blackstar GroupNo ratings yet

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupNo ratings yet

- Shoprite Food Index 2023Document19 pagesShoprite Food Index 2023Tiso Blackstar GroupNo ratings yet

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupNo ratings yet

- Shoprite Food Index 2023Document19 pagesShoprite Food Index 2023Tiso Blackstar GroupNo ratings yet

- JP Verster's Letter To African PhoenixDocument2 pagesJP Verster's Letter To African PhoenixTiso Blackstar GroupNo ratings yet

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Document2 pagesLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupNo ratings yet

- Statement From The SA Tourism BoardDocument1 pageStatement From The SA Tourism BoardTiso Blackstar GroupNo ratings yet

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Document2 pagesLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupNo ratings yet

- BondsDocument3 pagesBondsTiso Blackstar GroupNo ratings yet

- Collective InsightDocument10 pagesCollective InsightTiso Blackstar GroupNo ratings yet

- Sanlam Stratus Funds - July 15 2020Document2 pagesSanlam Stratus Funds - July 15 2020Lisle Daverin BlythNo ratings yet

- BondsDocument3 pagesBondsTiso Blackstar GroupNo ratings yet

- JudgmentDocument30 pagesJudgmentTiso Blackstar GroupNo ratings yet

- Tobacco Bill - Cabinet Approved VersionDocument41 pagesTobacco Bill - Cabinet Approved VersionTiso Blackstar GroupNo ratings yet

- Sanlam Stratus Funds - August 6 2020Document2 pagesSanlam Stratus Funds - August 6 2020Lisle Daverin BlythNo ratings yet

- FuelPricesDocument1 pageFuelPricesTiso Blackstar GroupNo ratings yet

- LibertyDocument1 pageLibertyTiso Blackstar GroupNo ratings yet

- FuelPricesDocument1 pageFuelPricesTiso Blackstar GroupNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- LibertyDocument1 pageLibertyTiso Blackstar GroupNo ratings yet

- Collective Insight September 2022Document14 pagesCollective Insight September 2022Tiso Blackstar GroupNo ratings yet

- The ANC's New InfluencersDocument1 pageThe ANC's New InfluencersTiso Blackstar GroupNo ratings yet

- Bonds - June 8 2022Document3 pagesBonds - June 8 2022Lisle Daverin BlythNo ratings yet

- Sanlam Stratus Funds - June 1 2021Document2 pagesSanlam Stratus Funds - June 1 2021Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Liberty Excelsior InvestmentsDocument1 pageMarkets and Commodity Figures: Liberty Excelsior InvestmentsTiso Blackstar GroupNo ratings yet

- MickeyDocument9 pagesMickeyAbbieBallesterosNo ratings yet

- SFP ProblemDocument2 pagesSFP ProblemTerryjay Catama69% (13)

- Chapter 12 Solutions 7eDocument6 pagesChapter 12 Solutions 7eMuhammad Mubashir56% (9)

- WALSH v. LONSDALE. (1882 W. 1127.) - (1882)Document9 pagesWALSH v. LONSDALE. (1882 W. 1127.) - (1882)camy liewNo ratings yet

- Spring 2022 - FIN625 - 2Document3 pagesSpring 2022 - FIN625 - 2Entertainment StatusNo ratings yet

- Annual Report Garuda Indonesia 2018Document158 pagesAnnual Report Garuda Indonesia 2018Silvia Van MarsallyNo ratings yet

- ICAP CMA Paper March 2016Document5 pagesICAP CMA Paper March 2016CA Instructor100% (1)

- 0452 w17 QP 23 PDFDocument20 pages0452 w17 QP 23 PDFMuhammad Faiz AzmiNo ratings yet

- Banking Law Final AssignmentDocument30 pagesBanking Law Final AssignmentHamadBalouchNo ratings yet

- The Key Data of A Bankruptcy: El Corte Ingles. S.A.Document25 pagesThe Key Data of A Bankruptcy: El Corte Ingles. S.A.eliahmeyerNo ratings yet

- Financial Structure and Financing Models: The Brazilian Experience Over The 1964-1997 PeriodDocument39 pagesFinancial Structure and Financing Models: The Brazilian Experience Over The 1964-1997 PeriodawaisnwfpNo ratings yet

- China National Machinery V Santamaria FullDocument15 pagesChina National Machinery V Santamaria FullArwin CabantingNo ratings yet

- Chapter - 01Document6 pagesChapter - 01shreeNo ratings yet

- 1230 Why People Believe Peter PopoffDocument3 pages1230 Why People Believe Peter PopoffbmarksNo ratings yet

- Gov't of Nunavut SoD Re. Suramala (00946576xCEEB7)Document16 pagesGov't of Nunavut SoD Re. Suramala (00946576xCEEB7)Kent DriscollNo ratings yet

- Strand7 Documentation Order FormDocument1 pageStrand7 Documentation Order FormNick BesterNo ratings yet

- Credit Guarantee Fund Scheme For Micro and Small Enterprises (Cgmse)Document2 pagesCredit Guarantee Fund Scheme For Micro and Small Enterprises (Cgmse)Santhosh santhuNo ratings yet

- Differences Between Islamic BanksDocument4 pagesDifferences Between Islamic BanksFatima AliNo ratings yet

- Odekirk, David - Odekirk For Iowa House Committee - 1574 - DR2 - SummaryDocument1 pageOdekirk, David - Odekirk For Iowa House Committee - 1574 - DR2 - SummaryZach EdwardsNo ratings yet

- Meaning and Concept of Capital MarketDocument3 pagesMeaning and Concept of Capital Marketkhrn_himanshuNo ratings yet

- PF Form 19 & 10CDocument6 pagesPF Form 19 & 10CJatinChadhaNo ratings yet

- Train Law Excise Tax 1Document29 pagesTrain Law Excise Tax 1Assuy AsufraNo ratings yet