Professional Documents

Culture Documents

Irr, Pi, NPV, Templates

Uploaded by

BobbyNicholsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Irr, Pi, NPV, Templates

Uploaded by

BobbyNicholsCopyright:

Available Formats

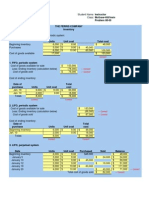

Example Problem B FINANCIAL ANALYSIS TOOLS, V 3.

0

IRR, PI and NPV A Collection of Microsoft Excel Workbooks To Accompany Melicher & Norton's

Finance, Introduction to Institutions, Investments, and Management, 11e

Instructions:

Enter values for highlighted cells containing the

cost of capital, IRR guess, and cash flows.

Enter "zero" for periods with no cash flow.

The period zero cash flow is usually negative.

Input Variables:

10.00% Cost of Capital

10.00% Guess at IRR (Change if IRR below is "ERR".)

Output Variables:

12,024.95 Net Present Value (NPV)

16.14% Internal Rate of Return (IRR)

1.172 Profitability Index (PI)

Period Cash Discount Present

Flow Factor Value

0 (70,000) 1.00000 (70,000)

1 20,000 0.90909 18,182

2 20,000 0.82645 16,529

3 20,000 0.75131 15,026

4 20,000 0.68301 13,660

5 30,000 0.62092 18,628

6 0 0.56447 0

7 0 0.51316 0

8 0 0.46651 0

9 0 0.42410 0

10 0 0.38554 0

11 0 0.35049 0

12 0 0.31863 0

13 0 0.28966 0

14 0 0.26333 0

15 0 0.23939 0

16 0 0.21763 0

17 0 0.19784 0

18 0 0.17986 0

19 0 0.16351 0

20 0 0.14864 0

Net Present Value (NPV) ---> 12,025

You might also like

- Kellogg's Brand AuditDocument31 pagesKellogg's Brand Auditapi-281107514100% (2)

- Excel RS1 MethodDocument32 pagesExcel RS1 MethodOscar Zapata Jr100% (2)

- Bid No Bid WorksheetDocument5 pagesBid No Bid WorksheetBobbyNicholsNo ratings yet

- Proposal Compliance Matrix TemplateDocument1 pageProposal Compliance Matrix TemplateBobbyNicholsNo ratings yet

- Investigating The Value of An MBA Education Using NPV Decision ModelDocument72 pagesInvestigating The Value of An MBA Education Using NPV Decision ModelnabilquadriNo ratings yet

- Mind Mixer Mechanical Design: by David S. Dickey, Mixtech, Inc. Apr 18, 2006Document7 pagesMind Mixer Mechanical Design: by David S. Dickey, Mixtech, Inc. Apr 18, 2006Monglen Z. CasiñoNo ratings yet

- Project WorkflowDocument1 pageProject WorkflowAnnaNo ratings yet

- Monte Carlo Simulation in ExcelDocument9 pagesMonte Carlo Simulation in ExcelAkshata GodseNo ratings yet

- FRM Index (Revised)Document28 pagesFRM Index (Revised)api-3717306No ratings yet

- Financial Statement Analysis For MBA StudentsDocument72 pagesFinancial Statement Analysis For MBA StudentsMikaela Seminiano100% (1)

- Mba51 Wa1 201617Document6 pagesMba51 Wa1 201617giorgos1978No ratings yet

- Steel Swaps ExplainedDocument29 pagesSteel Swaps Explainedinfo8493No ratings yet

- Analysis of Transaction CostDocument383 pagesAnalysis of Transaction CosthjsdNo ratings yet

- SEEP FRAME Tool, Version 2.02Document159 pagesSEEP FRAME Tool, Version 2.02anish-kc-8151No ratings yet

- ArgumentsDocument21 pagesArgumentsSaddam MullaNo ratings yet

- Net Present Value Based Excel Decision Model For MBA CandidatesDocument55 pagesNet Present Value Based Excel Decision Model For MBA CandidatesnabilquadriNo ratings yet

- Excels For Solution ManualDocument116 pagesExcels For Solution ManualDimple PandeyNo ratings yet

- Performance Evaluation of Construction PDocument10 pagesPerformance Evaluation of Construction PMarioNo ratings yet

- Economic Order Quantity ExampleDocument3 pagesEconomic Order Quantity ExampleGolamMostafaNo ratings yet

- 25 - Process ModelingDocument9 pages25 - Process ModelingArmel BrissyNo ratings yet

- 10 Most Popular Excel TricksDocument27 pages10 Most Popular Excel Tricksjoamer66No ratings yet

- Business MathsDocument7 pagesBusiness MathsAftab HossainNo ratings yet

- Forecasting Unbalanced Balance SheetsDocument8 pagesForecasting Unbalanced Balance SheetsSiddhu SaiNo ratings yet

- Linear Programming On Excel: Problems and SolutionsDocument5 pagesLinear Programming On Excel: Problems and Solutionsacetinkaya92No ratings yet

- Project Management Dashboard Template ExcelDocument19 pagesProject Management Dashboard Template ExcelSIDI MOHAMMED BENDELLANo ratings yet

- Guidance On Safe Sling UseDocument38 pagesGuidance On Safe Sling UseearthplightNo ratings yet

- S Curvebymsproject2007 2010 160616045431Document57 pagesS Curvebymsproject2007 2010 160616045431ncakraNo ratings yet

- Excel-Based Stock Market/Chart GameDocument26 pagesExcel-Based Stock Market/Chart Gameedgeme88100% (1)

- Economy Part 5Document13 pagesEconomy Part 5Shilpi PriyaNo ratings yet

- The Colors and Markings in This Workbook Have The Following MeaningsDocument22 pagesThe Colors and Markings in This Workbook Have The Following Meaningsvvenkat123No ratings yet

- Using MonteCarlo Simulation To Mitigate The Risk of Project Cost OverrunsDocument8 pagesUsing MonteCarlo Simulation To Mitigate The Risk of Project Cost OverrunsJancarlo Mendoza MartínezNo ratings yet

- Excel SolutionsDocument12 pagesExcel SolutionsGörkem DamdereNo ratings yet

- Core Chapter 04 Excel Master 4th Edition StudentDocument150 pagesCore Chapter 04 Excel Master 4th Edition StudentDarryl WallaceNo ratings yet

- LR5 Cap 9 Cost Estimating - Scott Amos - Skills Knowledge of Cost Engineering - AACEI - 2004Document36 pagesLR5 Cap 9 Cost Estimating - Scott Amos - Skills Knowledge of Cost Engineering - AACEI - 2004apzambonNo ratings yet

- Monthly Installment Calculator (New)Document13 pagesMonthly Installment Calculator (New)John SmithNo ratings yet

- Developing Key Performance Indicators in TableauDocument10 pagesDeveloping Key Performance Indicators in TableauRamesh KumarNo ratings yet

- Chap 008Document11 pagesChap 008dbjnNo ratings yet

- Mark Smith - Technical WritingDocument20 pagesMark Smith - Technical Writingse1007100% (1)

- Aima 2015Document7 pagesAima 2015ramNo ratings yet

- Financial Goal Setting-12012013 - FinalDocument51 pagesFinancial Goal Setting-12012013 - FinalJaie SurveNo ratings yet

- Safal Niveshak: Value Investing Made SimpleDocument23 pagesSafal Niveshak: Value Investing Made SimpleabchbvNo ratings yet

- Ch2-General Design Considerations Week2Document61 pagesCh2-General Design Considerations Week2ميثة الغيثيةNo ratings yet

- Command Button-Excel PDFDocument4 pagesCommand Button-Excel PDFnamasralNo ratings yet

- Workforce Planning TemplateDocument1 pageWorkforce Planning Templatealfaroq_almsryNo ratings yet

- 5-Year Financial Plan - Coffee NewsDocument8 pages5-Year Financial Plan - Coffee Newspmbb1979No ratings yet

- Indocafe Market SingaporeDocument37 pagesIndocafe Market SingaporeAndhika Benga Sylviana50% (2)

- Inventory TemplateDocument25 pagesInventory TemplatefaxoxNo ratings yet

- Scheduling ExcelDocument58 pagesScheduling ExcelSafety Inspector Daop 7No ratings yet

- Project Management Quick Reference GuideDocument5 pagesProject Management Quick Reference GuidejcpolicarpiNo ratings yet

- Production Model ScenariosDocument3 pagesProduction Model ScenariosBeybi EstebanNo ratings yet

- Walworth PressureSealDocument20 pagesWalworth PressureSealtxlucky80No ratings yet

- LCC FormulaDocument3 pagesLCC Formulasomapala88No ratings yet

- Asset Inventory: XYZ Company $ 250.00Document4 pagesAsset Inventory: XYZ Company $ 250.00Yvette NeethlingNo ratings yet

- (Record Your Key Lifts in This Section) : ExerciseDocument23 pages(Record Your Key Lifts in This Section) : ExerciseJason LuNo ratings yet

- Aurora Cost Allocation MethodDocument57 pagesAurora Cost Allocation MethodFelicidade Da SilvaNo ratings yet

- Business Case SpreadsheetDocument78 pagesBusiness Case SpreadsheetRaju ShresthaNo ratings yet

- Notes For PrimaveraDocument11 pagesNotes For PrimaveraSmart FunboyNo ratings yet

- Profit Planning and Activity Based BudgetingDocument50 pagesProfit Planning and Activity Based BudgetingcahyatiNo ratings yet

- Financial Risk ManagementDocument443 pagesFinancial Risk ManagementSagar SahaNo ratings yet

- Capital Budgeting Worksheet 8Document12 pagesCapital Budgeting Worksheet 8Yashveer SinghNo ratings yet

- Data Curah Hujan 2012-2021Document63 pagesData Curah Hujan 2012-2021hendri sutrisnoNo ratings yet

- Preference Shares - November 4 2019Document1 pagePreference Shares - November 4 2019Lisle Daverin BlythNo ratings yet

- Perhitungan Kriteria Investasi: Net Present Value (NPV)Document12 pagesPerhitungan Kriteria Investasi: Net Present Value (NPV)Nurul FitrianaNo ratings yet

- Expense Tracking: % Spent RemainingDocument3 pagesExpense Tracking: % Spent RemainingBobbyNicholsNo ratings yet

- Vertex42 Money Manager 2.0: INSTRUCTIONS - For Excel 2010 or LaterDocument26 pagesVertex42 Money Manager 2.0: INSTRUCTIONS - For Excel 2010 or LaterNikkiNo ratings yet

- To Do List PrintableDocument4 pagesTo Do List PrintableBobbyNichols100% (2)

- Family Budget PlannerDocument9 pagesFamily Budget PlannerBobbyNicholsNo ratings yet

- Lbo DCF ModelDocument38 pagesLbo DCF ModelBobbyNicholsNo ratings yet

- Weekly Rolling Cash Flow ProjectionDocument4 pagesWeekly Rolling Cash Flow ProjectionBobbyNicholsNo ratings yet

- IT Initiative ROI Tool-NmDocument30 pagesIT Initiative ROI Tool-NmBobbyNichols100% (1)

- Performance Toolkit V2Document16 pagesPerformance Toolkit V2BobbyNicholsNo ratings yet

- Optimeyes CS Notes (With SWOT)Document4 pagesOptimeyes CS Notes (With SWOT)BobbyNicholsNo ratings yet

- My Patent Valuation Tool 3Document6 pagesMy Patent Valuation Tool 3BobbyNicholsNo ratings yet

- Sap Human Capital Management Workshop PresentationDocument72 pagesSap Human Capital Management Workshop PresentationRakesh Sharma50% (2)

- Day1 - 06 - Ramona Volciuc-Ionescu - Volvic-Ionescu SCADocument21 pagesDay1 - 06 - Ramona Volciuc-Ionescu - Volvic-Ionescu SCAaegean227No ratings yet

- Bank of Baroda, 1Q FY 2014Document12 pagesBank of Baroda, 1Q FY 2014Angel BrokingNo ratings yet

- En Banc: Taxation I Case Digest CompilationDocument2 pagesEn Banc: Taxation I Case Digest CompilationPraisah Marjorey PicotNo ratings yet

- Pcab LlimDocument634 pagesPcab LlimPankaj RaneNo ratings yet

- Accounts Code Vol III Classification of Forest Receipt and ExpenditureDocument2 pagesAccounts Code Vol III Classification of Forest Receipt and ExpenditurepahbarpNo ratings yet

- Building Economics and Cost ControlDocument25 pagesBuilding Economics and Cost ControlDr Sarbesh Mishra100% (1)

- AKSI Annual Report 2018Document126 pagesAKSI Annual Report 2018Rahmi AnggianiNo ratings yet

- Finance Due DiligenceDocument23 pagesFinance Due Diligencerichaagarwal193100% (2)

- Space Ubelt Condormitel ProposalDocument10 pagesSpace Ubelt Condormitel ProposalReynaldo Sta anaNo ratings yet

- Report On Vishal Mega Mart - SahilDocument59 pagesReport On Vishal Mega Mart - SahilDishant Arora100% (1)

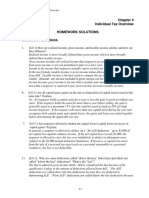

- Homework Chapter 4Document10 pagesHomework Chapter 4ChaituNo ratings yet

- Financial Research Report Fin 534Document15 pagesFinancial Research Report Fin 534Angelo Logan75% (4)

- Corporate Presentation May2015 - enDocument19 pagesCorporate Presentation May2015 - enrachmat_solihinNo ratings yet

- Case 5 Proton Full AssignmentDocument33 pagesCase 5 Proton Full Assignmentnajihah radziNo ratings yet

- Local and Real Property TaxDocument18 pagesLocal and Real Property TaxNori Lola100% (1)

- Dn1212 Ezine - CompressedDocument144 pagesDn1212 Ezine - CompressedWillow100% (1)

- Payslip For: FEB-2022: Louis Berger SASDocument1 pagePayslip For: FEB-2022: Louis Berger SASMukhtar AhmedNo ratings yet

- Taxation in Spanish Philippines: Evolution of Philippine TaxationDocument16 pagesTaxation in Spanish Philippines: Evolution of Philippine TaxationC. I .ANo ratings yet

- TallyDocument27 pagesTallyvinothkumararaja8249No ratings yet

- HSC Accounts Model Question Paper For Board ExamDocument6 pagesHSC Accounts Model Question Paper For Board ExamAMIN BUHARI ABDUL KHADERNo ratings yet

- Case Stated Freedom of Information RedactDocument35 pagesCase Stated Freedom of Information RedactGotnitNo ratings yet

- Interimreport 3M 2010 SecoToolsDocument10 pagesInterimreport 3M 2010 SecoToolsPlant Head PrasadNo ratings yet

- Valuation of SecuritiesDocument19 pagesValuation of SecuritiesAshish RoyNo ratings yet

- Week 2 Financial Planning and Forecasting Financial StatementsDocument39 pagesWeek 2 Financial Planning and Forecasting Financial StatementsSYED MURTAZANo ratings yet

- Taxation LawDocument8 pagesTaxation LawPrabhakar Kumar (B.A. LLB 16)No ratings yet

- Mcom 3 Sem Corporate Tax Planning N Management Cgs S 2019Document12 pagesMcom 3 Sem Corporate Tax Planning N Management Cgs S 2019prajwalthakre2No ratings yet

- Intercontinental Bank Debunks Akingbola's Claims - 101010Document2 pagesIntercontinental Bank Debunks Akingbola's Claims - 101010ProshareNo ratings yet