Professional Documents

Culture Documents

35 Income Tax Chart 2009 2010

Uploaded by

Piyush MishraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

35 Income Tax Chart 2009 2010

Uploaded by

Piyush MishraCopyright:

Available Formats

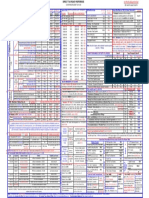

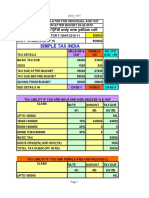

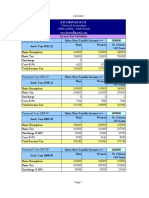

DIRECT TAX READY REFERENCE For PRIVATE CIRCULATION ONLY

(COVERING BUDGET 2009-2010)

A TAX STRUCTURE - INCOME 2007-08 2008-09 2009-10 2010-11 ADVANCE IT : (if liability = or > 10000) Return Due Date u/s 139(1) DEPRECIATION AY 06-07

1 IND/HUF/AOP/BOI-Basic Exemption ---> 100000## 110000## 150000## 150000## Due Date Company Other than company From Asst year 2008-09 Due Date upto 05-06 onwards

From 100000 upto 110000 10+0.2%* Nil Nil Nil By 15th june upto 15% - 1. Non-corporate assessee Sept 30 of PLANT & MACHINERY 25% 15%

Next 40000 upto 150000 10+0.2%* 10+0.3%* Nil Nil By 15th Sep upto 45% upto 30% or a working partner of a firm the asst FURNITURE & FIXTURE 15% 10%

(where books are reqd to be year

Next 10000 upto 160000 20+0.4%* 20+0.6%* 10+0.3% Nil By 15th Dec upto 75% upto 60% audited) & Corporate COMPUTERS 60% 60%

Next 90000 upto 250000 20+0.4%* 20+0.6%* 10+0.3% 10+0.3% By 15th March 100% 100% Assessee BUILDINGS

Next 50000 upto 300000 30+0.6%** 30+0.9%** 10+0.3% 10+0.3% COST INFLATION INDEX : Non RESIDENTIAL 10% 10%

Next 250000 upto 500000 30+0.6%** 30+0.9%** 20+0.6% 20+0.6% 1981-82 100 1995-96 281 2. Any other assessee July 31 RESIDENTIAL 5% 5%

Rest - - 30+0.6%** 30+0.9%** 30+0.9%** 30+0.9% 1982-83 109 1996-97 305 3. Return of Loss-139(3) within due Purely Temp Erections100% 100%

Resident Woman below 65 yrs 135000 145000 180000 190000 1983-84 116 1997-98 331 date CAR & VEHICLES 20% 15%

## Basic Exemption:

Senior Citizen, 65 yrs or above 185000 195000 225000 240000 1984-85 125 1998-99 351 4. belated return-139(4) 1yr from the CAR OR VEHICLES USED

** Surcharge of 10% if net income exceeds Rs 10 Lac (AY 06-07 to 09-10) before EC/SHEC included above 1985-86 133 1999-00 389 end of asst yr ON HIRE 40% 30%

2 REGD.FIRM 30+3.66% 30+0.9%# 30+0.9%# 30+0.9% 1986-87 140 2000-01 406 Note: Filing of Return by Corporate Ass- Only 50% Depre. will be allowed if assets

essee / Firm is compulsory acquired / used for < 180days

3 DOMESTIC COMPANY REGULAR TAX 30+3.66% 30+0.9%# 30+0.9%# 30+0.9%# 1987-88 150 2001-02 426

MAT (Section 115JB) 10+1.22% 10+0.3%# 10+0.3%# 15+0.45%# 1988-89 161 2002-03 447 Tax Deducted at Source: 1)Deposit of TDS to Govt a/c to be made within 7 days from

C/F of MAT Credit 10 years 10 years 10 years 10 years 1989-90 172 2003-04 463 the end of the month in which provision for TDS is made and within 2mths(7days for

1990-91 182 2004-05 480 salary) if provision for TDS is made at the end of financial year.

#if net income exceeds Rs 1.0 Crore: 1) Surcharge of 10% before EC(2%)+SHEC(1%) included above 2) Marginal relief of tax exceeding income

4 TAX ON LONG TERM CAPITALGAIN (with indexation benefit) # Plus S/C as applicable 1991-92 199 2005-06 497 2) Filing of return in computer media mandatory for Company, Govt deductor,

IND/HUF/AOP/BOI 20+SC+EC% 20+SC+Cess% 20+SC+Cess% 20+Cess% 1992-93 223 2006-07 519 those who r covered u/s 44AB, assessee with no. of deductors>50 (qtrly);

DOMESTIC CO./FIRM 22.44% 20+0.6%# 20+0.6%# 20+0.6%# 1993-94 244 2007-08 551 3) Returns to be filed quarterly in F/24Q (Salary) or F/26Q (others) within 15 days

Notes: 1) Tax on LTCG can be taken as 10%+SC+Cess in case of transfer of listed shares/securities/units without indexation benefit 1994-95 259 2008-09 582 from the end of quarter (76 days in case of last quarter);

2) Income from LTCG is exempt in case of transfer of equity shares/units of equity oriented fund which are liable to STT IMPORTANT PROVISIONS: 4) TDS certificate to be made in Form 16/12BA for Salary, F/16A for others;

5 TAX ON S T CAPITAL GAIN (ON TRANSFER OF SECURITIES-SEC 111A) 10+SC+EC% 10+SC+EC% 15+0.45%# 15+0.45%# a) Transfer of a property to non-relative Ind/HUF 5) For lower deduction the recipient may apply to AO in F/13 or a declaration may

without consideration or less than stamp duty value be made in form 15G/15H (for Int./Div./NSS only), 15I (for transport contractor);

#if net income exceeds Rs 1.0 Crore: 1) Surcharge of 10% before EC(2%)+SHEC(1%) included above 2) Marginal relief of tax exceeding income

(immovable) or less than FMV (movable) is

B DEDUCTIONS & REBATES chargeable to tax in the hands of transferee u/sec 6) PAN data of deductees should be minimum 95% for 24Q & 85% for 26Q.

a General Deduction 80C/80CCC/80CCD 100000 100000 100000 100000 56(2)(vii) wef 01.10.2009 [maximum relief Rs 50,000] TDS Liability(wef 01.10.09) Rate TDS Liability(wef 01.10.09) Rate

b Mediclaim 80D 10000 15000 15000* 15000* Interest > 5000 pa [Rs 10000 10.00% *Contractor / Ind/HUF---> 1.00%

(otherwise than cash) in case of pymt of banks/PO] Subcontractor

for Sr. Citizen Rs.15,000/- wef AY 2000-01 & Rs. 20,000 wef AY 2008-09 b) Remuneration to partners 40(b)- Fin Yr 2009-10: >20000 Others ----> 2.00%

- Sec 194A

*Additional Deduction for Mediclaim of Parents Rs 15,000 (Rs 20,000 in respect of Sr. Citizen) Book Profit Allowability (single) or Sec 194C

50000 pa ---

c Standard Deduction 24(a) 30% 30% 30% 30% 30% 30% <0 Rs 150000 Commission or Brokerage 10.00% *[transport Operator - Nil if PAN furnished]

(in case of rented House Property) < or = Rs 300000 higher of 150000 or 90% >2500 pa -Sec 194H Rent - Plant & Machinery 2.00%

d Int on borrowed capital 24(b) 150000* 150000* 150000* 150000* on Balance 60% Fees for Prof or Technical 10.00% >1,20,000 pa - 194-I

Services > 20000pa - Sec

(in case of self occupied House Property) c) Certain eligible assessee not required to maintain 194J

Rent - Land / Building / 10.00%

book of accounts, not required to pay advance tax, if Furniture / Fittings >1,20,000 pa

*30000 Generally (higher deductions are allowable only where the capital is borrowed after 01.04.99 and property is Dividend u/s 2(22)(e) > 2500 10.00% - 194-I

there turnover/gross receipts does not exceed Rs 40 pa - Sec 194

acquired/constructed within 3yrs from the end of FY in which capital was borrowed.) Lac and they show income @8% (wef: Fin Year Compensation on acquisition of 10.00%

2010-11) certain immovable properties-

C CARRY FORWARD & SET-OFF OF LOSSES: Set-off Carry Forward & Set-off winning from lottery / horse 30.00% 194LA

race etc - 194B/BB

* except Salaries Same Head another head C/F Years agst whom d) AO can include any other issue [not mentioned in Insurance Commission - 194D 10.00%

148(2)] during assessment u/sec 147

1. Salaries Yes Yes No NA NA Note:w.e.f. 01.04.2010 furnishing of PAN to deductor, in 15G/H/I and to AO for lower

2. House Property Yes Yes Yes 8 years same head INTEREST ON INCOME TAX: dedn. is mandatory - noever TDS will be higher of 20% or prescribed or in force

3. Speculation Business / Specified Bus. 35AD No No Yes 4 years same item 1.Filing of return after due Int @ 1% pm or part of the Important Prescribed Forms under Income Tax Rules 1962

mth from the end of Due

Ubabs. Depreciation / Cap Exp on SR/FP Yes Yes Yes No limit any income date u/sec 234A Date for filing of return Return of Income & FBT Form No. Return of Income Form No.

Non-speculative Business or Profession Yes Yes* Yes 8 years same head 2.Defaults in pymt of Int @ 1% pm or part of the 1. corporate assessee ITR-6 1. Individual with Salary & Int ITR-1

mth from the 1st day of

4. Long Term Capital Gains No No Yes 8 years same item Advance Tax u/s 234B April of the AY 2. Firms, AOPs and BOIs ITR-5 2. Ind/HUF without Busi/Prof ITR-2

Short Term Capital Gains Yes No Yes 8 years same head 3.Deferment in pymt of Int @ 1% pm or part of the 3. Person reqd. to furnish return ITR-7 3. Ind/HUF being partners in ITR-3

mth on the deficit amt as u/s 139(4A) / (4B) / (4C) / (4D) firm (without prop.Busi/Prof)

5. Owning / Maintaining race horses No No Yes 4 years same item Advance Tax u/s 234C applicable

Lotteries / Crossword Puzzles etc. No No No NA NA 4.Interest for late pymt of Int @ 1% pm or part of the 4.Return for Fringe Benefits ITR-8 4. Ind/HUFwith prop.Busi/Prof ITR-4

mth from the end of 30

Income from Other Sources (except if exempt) Yes Yes No NA NA demand u/s 156 days of Demand Notice 5.Manual Form for no DS ITR-V Appeal

D WEALTH TAX [IND / HUF / CO] Exemption Tax GIFT TAX Exemption Tax 4.Failure to deduct and pay Int @ 1% pm or part of mth Other Forms 1. To CIT(Appeals)-2copies 35

from the date on which tax

wef FY 1995-96 15 lac 1% FY 1995-96 to 1998-99 30000 30% TDS u/s 201(1A) was deductible 1. PAN Application 49A 2. To ITAT - 3copies 36

wef FY 2009-10 30 lac 1% (Abolished from 01/10/98) Some Tax Saving cum Investment Schemes: 2. TAN Application 49B 3. Memorandum of cross 36A

objection to ITAT-3 copies

GIFT(wef Gift received by an Ind. or HUF (and in kind wef 01.10.2009) without consideration 6 year NSC 8% Investment and accrued 3. Wealth Tax Return Form BA

VIII issue compounde interest qualify for tax

01.04.06) from a non-relative above Rs 50,000 in a FY is entirely taxable as Income d half yearly deduction u/sec 80C 4. STT pymt evidence 10DB/10DC 4. To ITAT-to refer to High 37

Court any question of law

E Interest NSC (on every Rs 1000) 1st year 2nd Year 3rd Year 4th Year 5th Year 6th Year 5. Annual Tax Statement 26AS 3 copies

31.03.1989-31.12.1998 124.0 139.0 156.0 175.0 197.0 224.0 15 yr Public compound Inv qualify for tax Challans Charitable & Religious Trusts

01.01.1999-14.01.2000 118.3 132.3 148.0 165.4 185.1 206.9 Provident int 8% per deduction u/sec 80C;Int 1. Appln for regn 10A

1. Income Tax 280

Fund yr exempt u/sec 10(11)

15.01.2000-28.02.2001 113.0 125.8 140.0 155.8 173.5 193.1 2. TDS/TCS Tax Challans 281 2.Appln for approval/ cont 10G

01.03.2001-28.02.2002 97.2 106.7 117.1 128.5 141.0 154.7 Life Insurance rate of Bonus is totally exempt; 3. Misc Direct Taxes 282 -inuance u/s 80G(5)(vi) 3 copies

Premium bonus keeps Inv qualify for tax 4. Fringe Benefit Tax

01.03.2002-28.02.2003 92.0 100.5 109.7 119.8 130.9 142.9 on 283 3. Notice for accumulation of 10

deduction u/sec 80C Income to AO

01.03.2003 and after 81.6 88.3 95.5 103.3 111.7 120.8 fluctuating

Note: I)The above chart does not cover the provisions related to Non-resident assessee and Foreign Company ii) reference to year wherever appears represents asst year unless otherwise specified.

Important Links: Income Tax Site: http://www.incometaxindia.gov.in For Income Tax e-Return Filing: http://incometax-indiaefiling.gov.in For PAN/TAN related matters: www.tin-nsdl.com or www.utitsl.co.in

You might also like

- Income Tax Chart 2016-17Document1 pageIncome Tax Chart 2016-17Basavaraju K R100% (1)

- PRTC - TAX-Final PB - May 2022Document16 pagesPRTC - TAX-Final PB - May 2022Luna VNo ratings yet

- Chapter 9 - Input VAT True or False 1Document7 pagesChapter 9 - Input VAT True or False 1Angelo BagabaldoNo ratings yet

- Bain Case Workshop GuidanceDocument3 pagesBain Case Workshop GuidanceJames HoddellNo ratings yet

- Bsa 2 - Finman - Group 8 - Lesson 3Document7 pagesBsa 2 - Finman - Group 8 - Lesson 3Allyson Charissa AnsayNo ratings yet

- Expectancy: What Is Expectancy in A Nutshell?Document3 pagesExpectancy: What Is Expectancy in A Nutshell?rafa manggala100% (1)

- Income TaxDocument20 pagesIncome Taxjuliaysabellepepitoaguilar100% (1)

- 1 Income Tax Chart Fy 09 10Document2 pages1 Income Tax Chart Fy 09 10jayant_2612No ratings yet

- (##-See Rebate) : 1st Year 2nd Year 3rd Year 4th Year 5th Year 6th YearDocument1 page(##-See Rebate) : 1st Year 2nd Year 3rd Year 4th Year 5th Year 6th YearMita SethiNo ratings yet

- 5652 20190806194323 Chart It 19Document1 page5652 20190806194323 Chart It 19arti chowdhryNo ratings yet

- 5652 20190806194323 Chart It 19Document1 page5652 20190806194323 Chart It 19arti chowdhryNo ratings yet

- 706 - Summary - of - CAPITAL - GAINS - Including PDFDocument31 pages706 - Summary - of - CAPITAL - GAINS - Including PDFSurekha BonagiriNo ratings yet

- Direct Tax Rates For Last 11 Assessment YearsDocument4 pagesDirect Tax Rates For Last 11 Assessment YearsValera HardikNo ratings yet

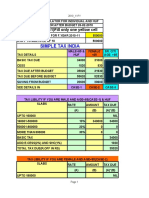

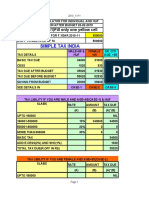

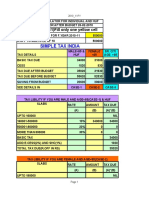

- Simple Tax India: (F.YEAR 2009-10) Fill Only One Yellow CellDocument4 pagesSimple Tax India: (F.YEAR 2009-10) Fill Only One Yellow CellRaj PatilNo ratings yet

- Simple Tax India: (F.YEAR 2009-10) Fill Only One Yellow CellDocument4 pagesSimple Tax India: (F.YEAR 2009-10) Fill Only One Yellow CellPradip ShawNo ratings yet

- Tax Calculator AY 09-10Document4 pagesTax Calculator AY 09-10madhuamsNo ratings yet

- Income Tax Ready Reckoner PDFDocument15 pagesIncome Tax Ready Reckoner PDFtushar sharmaNo ratings yet

- DT May 23 in 50 PagesDocument15 pagesDT May 23 in 50 PagesShivaji hariNo ratings yet

- Taxation in EthiopiaDocument7 pagesTaxation in EthiopiaLeulNo ratings yet

- Kid 3Document10 pagesKid 3amsaya2024No ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11Ravi ChandraNo ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11subhodattNo ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11bablooraiNo ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11dhuvad.2004No ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11Priyanshu SharmaNo ratings yet

- Lecture Meeting Budget 2014 2015Document10 pagesLecture Meeting Budget 2014 2015birju668No ratings yet

- 2019 Tax Card PakistanDocument9 pages2019 Tax Card PakistanRaja Hamza rasgNo ratings yet

- Train Law PhilippinesDocument64 pagesTrain Law PhilippinesThe BeatlessNo ratings yet

- Jorg R. MenesesDocument3 pagesJorg R. MenesesKevin JugaoNo ratings yet

- V6 After Budget 2023 New Tax Regime Vs Old Tax RegimeDocument20 pagesV6 After Budget 2023 New Tax Regime Vs Old Tax RegimegunagaliNo ratings yet

- Year-Wise Tax CalculatorDocument2 pagesYear-Wise Tax Calculatoramrut9No ratings yet

- Income From Salary..adDocument7 pagesIncome From Salary..adduch mangNo ratings yet

- Ques. Defered TaxDocument40 pagesQues. Defered TaxKALYANI JAYAKRISHNAN 2022155No ratings yet

- Ethiopian Tax SystemDocument26 pagesEthiopian Tax SystemAsfaw WossenNo ratings yet

- Amendments DT 2016Document70 pagesAmendments DT 2016dbp9050No ratings yet

- QuestionsDocument15 pagesQuestionsSamuelNyaungaNo ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11Syam ReddyNo ratings yet

- Tax Changes You Need To Know Under RA 10963Document20 pagesTax Changes You Need To Know Under RA 10963Rosanno DavidNo ratings yet

- SHCC Tax Card - Ty 2021Document1 pageSHCC Tax Card - Ty 2021Muhammad AdeelNo ratings yet

- Malaysia Duties Taxes On Motor VehiclesDocument1 pageMalaysia Duties Taxes On Motor VehiclesnickgomezNo ratings yet

- Group 6 Tax AssignmentDocument14 pagesGroup 6 Tax Assignmentdianaowani2No ratings yet

- Tax Audit Limit & Tax RatesDocument6 pagesTax Audit Limit & Tax RatesPhani SankaraNo ratings yet

- (Train) : Taxchanges U Need To KnowDocument27 pages(Train) : Taxchanges U Need To KnowNoel DomingoNo ratings yet

- Corporate TaxationDocument7 pagesCorporate TaxationfcnrrsNo ratings yet

- Tax Changes You Need To Know Under RA 10963Document25 pagesTax Changes You Need To Know Under RA 10963Charry BaximenNo ratings yet

- Interest Calculation For IncometaxDocument8 pagesInterest Calculation For IncometaxamarlaxmiNo ratings yet

- f6vnm 2007 Dec QDocument9 pagesf6vnm 2007 Dec QPhạm Hùng DũngNo ratings yet

- Tax Card 2020-21Document2 pagesTax Card 2020-21Lahore TaxationsNo ratings yet

- Taxation 2 (Maika Notes)Document30 pagesTaxation 2 (Maika Notes)Maria Acepcion DelfinNo ratings yet

- CCC CDocument5 pagesCCC CPrateek SinghalNo ratings yet

- .Apr 2022Document10 pages.Apr 2022SWAPNIL JADHAVNo ratings yet

- Taxation (CHN) - Dec 2020 FinalDocument3 pagesTaxation (CHN) - Dec 2020 FinalALEX TRANNo ratings yet

- 1 BTAXREV Week 2 Income TaxationDocument48 pages1 BTAXREV Week 2 Income TaxationgatotkaNo ratings yet

- INCOME TAX CALCULATION For Year 2008-2009: Male Per Year Per YearDocument1 pageINCOME TAX CALCULATION For Year 2008-2009: Male Per Year Per Yearpintoo23No ratings yet

- Income Tax Card Tax Year 2015Document3 pagesIncome Tax Card Tax Year 2015Sardar Shahid KhanNo ratings yet

- CRQSDocument79 pagesCRQSAtka FahimNo ratings yet

- 5 6170280447000445052 PDFDocument358 pages5 6170280447000445052 PDFmanoj mohanNo ratings yet

- Personal Income Tax Rates in NigeriaDocument2 pagesPersonal Income Tax Rates in NigeriaSholola AjokeNo ratings yet

- Tax Card 2021Document1 pageTax Card 2021MA AttariNo ratings yet

- 4 Deferred TaxDocument9 pages4 Deferred Taxkanan1512No ratings yet

- Kid 2Document5 pagesKid 2amsaya2024No ratings yet

- 1.1.1 Tax On Income From Employment / Personal Income Tax: Direct TaxesDocument6 pages1.1.1 Tax On Income From Employment / Personal Income Tax: Direct TaxesGetu WeyessaNo ratings yet

- ESTATEDocument12 pagesESTATEVangie AntonioNo ratings yet

- Optimal Taxation Lecture (34 - 37) Topics: NPTEL-Economics-Public EconomicsDocument7 pagesOptimal Taxation Lecture (34 - 37) Topics: NPTEL-Economics-Public EconomicsAnonymous H8AZMsNo ratings yet

- Bcom 3 Sem Corporate Accounting 1 19102078 Oct 2019Document5 pagesBcom 3 Sem Corporate Accounting 1 19102078 Oct 2019xyxx1221No ratings yet

- Adobe Scan 7 Apr 2022Document5 pagesAdobe Scan 7 Apr 2022Anirudh SinglaNo ratings yet

- The OND Bonanza Contest - APC AP (Direct Code)Document18 pagesThe OND Bonanza Contest - APC AP (Direct Code)ManjunathNo ratings yet

- Acquisition Based LearningsDocument32 pagesAcquisition Based LearningsVarun SharmaNo ratings yet

- Tax Law Review Income TaxesDocument41 pagesTax Law Review Income TaxesNissi JonnaNo ratings yet

- Option Tutorial Answers超级完整版Document103 pagesOption Tutorial Answers超级完整版Xueying Zhou100% (1)

- Unisa Exam Preparation GuideDocument21 pagesUnisa Exam Preparation Guideashton machingaNo ratings yet

- Cpa Review School of The Philippines ManilaDocument15 pagesCpa Review School of The Philippines ManilaDarlyn ValdezNo ratings yet

- 234e Appeal FormatDocument7 pages234e Appeal FormatKunal KhandualNo ratings yet

- Analyzing Bank Performance: Using The UbprDocument70 pagesAnalyzing Bank Performance: Using The UbpraliNo ratings yet

- On January 1 2013 Porter Company Purchased An 80 InterestDocument1 pageOn January 1 2013 Porter Company Purchased An 80 InterestMuhammad ShahidNo ratings yet

- 2607y Maliyyə Hesabatı SABAH (En)Document34 pages2607y Maliyyə Hesabatı SABAH (En)leylaNo ratings yet

- D5-TheLA Quinta CaseDocument2 pagesD5-TheLA Quinta CasePunyak SatishNo ratings yet

- Concentrix Daksh Services India Private Limited Payslip For The Month of September - 2021Document1 pageConcentrix Daksh Services India Private Limited Payslip For The Month of September - 2021Prity PandeyNo ratings yet

- Reading 13 Integration of Financial Statement Analysis Techniques - AnswersDocument21 pagesReading 13 Integration of Financial Statement Analysis Techniques - Answerstristan.riolsNo ratings yet

- Investor Presentation 29 October 2020: 1 © 2020 NokiaDocument35 pagesInvestor Presentation 29 October 2020: 1 © 2020 NokiaMocanu CatalinNo ratings yet

- Arsena 20101112 PDFDocument17 pagesArsena 20101112 PDFRaniaElModniNo ratings yet

- Paper Pattern: Do Not Copy The Questions OnDocument4 pagesPaper Pattern: Do Not Copy The Questions OnMANISHA GARGNo ratings yet

- Sun Phrma KoreaDocument7 pagesSun Phrma KoreaSiNo ratings yet

- BUKU - Blocher Et Al-Cost Management - A Strategic Emphasis, 5th Edition (2009) - 127-179 PDFDocument53 pagesBUKU - Blocher Et Al-Cost Management - A Strategic Emphasis, 5th Edition (2009) - 127-179 PDFelis100% (1)

- Commerce Bcom Semester 1 2022 November Financial Accounting I 2019 PatternDocument5 pagesCommerce Bcom Semester 1 2022 November Financial Accounting I 2019 PatternOm KapseNo ratings yet

- On 1 April 20x5 Hardy Entity Acquired 4 Million ofDocument1 pageOn 1 April 20x5 Hardy Entity Acquired 4 Million ofTaimour HassanNo ratings yet

- FM Practice Sheet Booklet SOLUTIONS - Nov 2022Document135 pagesFM Practice Sheet Booklet SOLUTIONS - Nov 2022Dhruvi VachhaniNo ratings yet

- Balance Sheet: (In Crores)Document5 pagesBalance Sheet: (In Crores)Ashwini KJNo ratings yet