Professional Documents

Culture Documents

AIL-Investment Declaration Form 2013-2014

Uploaded by

G A PATELOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AIL-Investment Declaration Form 2013-2014

Uploaded by

G A PATELCopyright:

Available Formats

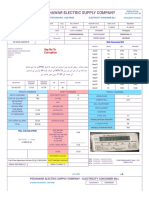

APOLLO INTERNATIONAL LTD

INVESTMENT DECLARATION FORM FOR CLAIMING TAX BENEFITS For the Financial Year 2017-18

PERSONAL INFORMATION (ALL FIELDS ARE MANDATORY)

EMPLOYEE CODE

NAME

FATHER/HUSBAND NAME

DATE OF BIRTH

GENDER

LOCATION

PAN

CONTACT NO.

DATE OF JOINING

SECTION-I (Only original Rent receipts will be considered)

RENT PAID FOR THE PURPOSE OF CLAIMING BENEFIT OF HRA U/S 10(13A) OF THE ITAX ACT, 1961

From date To date Full Address City Rent Paid Per month

Below information is mandatory if rent exceeds Rs. 200000/- annual (16667/- P.M)

PAN OF LANDLORD NAME & ADDRESS OF LANDLORD (IF PAN NOT ISSUED)*

* Please submit hardcopy of declaration from landlord that he/she has not been allotted PAN from Income Tax Department

SECTION-II (Photocopies to be attached)

(DECLARATION OF SAVING ALLOWED U/S 80 OF THE IT ACT, 1961) In respect of Saving allowed under Chapter VI

S.No Description

Amount

U/s 80D- Medical Insurance Premium- Individual, Spouse & Children ( Max Limit - 15,000

1 Additional Rs. 5,000 if any person insured is a senior citizen)

U/s 80D- Medical Insurance Premium- Parents (Max Limit - 15,000, Additional Rs. 5,000 if

any person insured is a senior citizen)

U/s 80D- Preventive Health Check-up- Max 5,000 (Within Overall limit of 15000/20000)

U/s 80DD- Medical treatment for dependent Handicap

2 (If Disability is more than 40% but less than 80%) - Max Limit - 50,000

U/s 80DD- Medical treatment for dependent Handicap

(If Disability is more than or equal to 80%) - Max Limit - 1,00,000

U/s 80DDB- Medical treatment for Specified disease

3 (If patient is not a senior citizen) - Max Limit - 40,000

U/s 80DDB- Medical treatment for Specified disease

(If patient is a senior citizen) - Max Limit - 60,000

U/s 80U- Permanent Physical disability of assessee

4 (If Disability is more than 40% but less than 80%) - Max Limit - 50,000

U/s 80U- Permanent Physical disability of assessee

(If Disability is more than or equal to 80%) - Max Limit - 1,00,000

Section 80E- Payment of interest on loan taken for Higher Education

(No Max limit on Interest Paid during the year 2013-2014). Declaration needs to be

5 submitted.

SECTION-III (saving u/s 80C OF THE IT ACT, 1961) (Photocopies to be attached)

Total Amount of Deduction allowed up to Rs. 1,00,000/- (Including Provident Fund deducted through salary)

S.No Description Amount

1 Accrued Interest on NSC

Public Provident Fund (PPF) - Self, Spouse & Children Only

2

3 LIFE INSURANCE (LIC) - Self, Spouse & Children Only

National Savings Certificate Purchased (NSC)

4

Housing Loan repayment of Principal (Including Stamp Duty, Registration Fees & Other

Expenses incurred for the purpose of Transfer of Property to the Assessee.)

5

Unit Linked Insurance Plan (ULIP) -

6

Mutual Funds notified u/s 10(23D) -

7

Investment u/s.80CCC (Pension Policy) will also qualify under this Sec-Rs.1Lac

8

Investment Declaration Page 1

Children Tuition Fee - Only Tuition fee for Two Children only

9

Term Deposits (Made during April'13-March'14) for a fixed period of not less than 5 years with

10 a Scheduled Bank

Senior Citizens Savings Scheme

11

ELSS (Equity Linked Saving's Scheme)

12

Bonds, issued by national bank of agriculture and rural development.

13

5 year Post Office deposits & Senior Citizen Scheme

14

SECTION-IV (Saving U/S-80CCG & 80TTA)

1. Equity Saving Scheme(U/S 80CCG)-50% of the Amount Invested or 25000 whichever is less

.

2 Deduction I.R.O. Interest in Saving A/C(80TTA) (Interest earned from saving bank account up to Rs.

10000/- is exempt from tax)

SECTION-V (DEDUCTION U/S 24 OF THE IT ACT, 1961 INTEREST ON HOUSING LOAN)

With respect of the amount of any interest payable on borrowed capital for acquiring, constructing , renewal, repairing or re-constructing property.

1. Address of the Property against which Loan taken : ________________________________________________________

_____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

2. Status of Property (Self-Occupied/Rented and vacant :________________________(if Rented/Vacant, details must be submitted in attached

Annexure-B For any other income)

3. Amount of Loan issued, Date of loan availed and Name and the address of the lender (loan Provider): - _________________________

________________________________________________________________________________________________________________

________________________________________________________________________________________________________________

4. Purpose of the Loan (construction / Acquiring property) _______________________________________________________

5. Construction of Property will be completed on or before (expected date)__________________________________________________

6. Date on which Construction has Completed:__________________________________________________________________

7. Date of Possession of Property : _________________________

8. Proof of Possession of Property (Builder Certificate/Registry copy): _________________________

Amount

9. Total amount of interest paid (post construction/possession) during the financial year (April

2013 to March 2014)

10. Specify amount of interest paid for pre-construction/possession period.

11. Ownership ( Joint or Sole)

12. If Joint Ownership Name and Relationship with Owner(s)

Share of Joint Owner(s) in Property

Whether any sum Contributed by Joint Owner in Acquiring Property (if Joint Owner, Declaration must be

submitted )

Name(s) of Joint Owner(s) (Apart from the Employee) Who are Repaying

Aforesaid Housing Loan

Whether Joint Owner(s) is/are claiming Deduction Under Income Tax Act , 1961

On Account of Housing Loan Taken for Aforesaid Property

SECTION-VI (DEDUCTION U/S 80EE OF THE IT ACT, 1961 INTEREST ON HOUSING LOAN)

With respect of the amount of any interest payable on loan sanctioned during the F.Y. 2013-14 for the purpose of acquiring property. (Max limit-

100000)

1. Amount of Loan sanctioned : ________________________________________________________

2. Value of Property : _______________________________________________________

3. Any property owned by employee at the date of sanction of loan (Yes/No) : ____________________________

Amount

4. Total amount of interest paid during the financial year (April 2013 to March 2014)

SECTION-VII

Other Income details to be accounted for tax calculation

SECTION-VIII

I, ___________________________, do hereby declare that the aforesaid information is true and correct to the best of my information

and belief and I shall indemnify the company against all costs and consequences if any information is later on found to be incorrect.

Signature of Employee :______________________

Date :______________________

Place :______________________

Note: Please read & understand the guidelines provided in Instruction for filling Investment proof form before submitting

Investment Declaration Page 2

You might also like

- WLT Proof Form - 2022Document2 pagesWLT Proof Form - 2022Jebis DosNo ratings yet

- Investment Declaration Form 2016-17Document2 pagesInvestment Declaration Form 2016-17JitendraNo ratings yet

- TAX Saving Investment ProofDocument1 pageTAX Saving Investment ProofAmit ShuklaNo ratings yet

- Investment Declaration Form - 2022-2023Document3 pagesInvestment Declaration Form - 2022-2023Bharathi KNo ratings yet

- Investment and tax saving proofs for 2017-18Document5 pagesInvestment and tax saving proofs for 2017-18vishalkavi18No ratings yet

- Employees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022Document3 pagesEmployees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022neeta rautelaNo ratings yet

- IT Declaration Form FY 2018-19Document3 pagesIT Declaration Form FY 2018-19sgshekar3050% (2)

- Employee Tax Declaration - AY 2019-20Document4 pagesEmployee Tax Declaration - AY 2019-20mathuNo ratings yet

- Theorem Tax Plan 2012-13Document1 pageTheorem Tax Plan 2012-13Ashwini PadhyNo ratings yet

- Zuari Indian Oiltanking Ltd Investment Declaration 2010-11Document2 pagesZuari Indian Oiltanking Ltd Investment Declaration 2010-11shivshenoyNo ratings yet

- De Smet Engineers & Contractors India Private Limited Investment Declaration Form For Financial Year 2019 - 2020Document5 pagesDe Smet Engineers & Contractors India Private Limited Investment Declaration Form For Financial Year 2019 - 2020Lakshmanan SNo ratings yet

- Atria Institute of TechnologyDocument3 pagesAtria Institute of TechnologykiranNo ratings yet

- Investment Declaration Form - 1314 - IshitaDocument5 pagesInvestment Declaration Form - 1314 - IshitaIshita AwasthiNo ratings yet

- The ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationDocument1 pageThe ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationLantNo ratings yet

- National Institute of Technology CalicutDocument7 pagesNational Institute of Technology CalicutraghuramaNo ratings yet

- IT DeclarationDocument5 pagesIT Declarationkalpanagupta_purNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- 1 Section 80CDocument2 pages1 Section 80CcssumanNo ratings yet

- Investment PlanDocument1 pageInvestment PlanNitin AgarwalNo ratings yet

- 1.7.7.1. Entertainment Allowance (U/s 16 (Ii) ) : 1.7.7. Deduction Out of Gross Salary (Section 16)Document5 pages1.7.7.1. Entertainment Allowance (U/s 16 (Ii) ) : 1.7.7. Deduction Out of Gross Salary (Section 16)Vinod PillaiNo ratings yet

- Instructions For Filing Investment Declaration Form: A. Permanent Account Number (PAN)Document7 pagesInstructions For Filing Investment Declaration Form: A. Permanent Account Number (PAN)subodh-mittal-7817No ratings yet

- Hemarus Industries Income Tax Declaration Form SummaryDocument4 pagesHemarus Industries Income Tax Declaration Form SummaryShashi NaganurNo ratings yet

- Frequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsDocument4 pagesFrequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsMayur khichiNo ratings yet

- Investment Declaration Form For FY - 2017-18Document2 pagesInvestment Declaration Form For FY - 2017-18arunNo ratings yet

- Employee Tax Declaration - AY 2019-20Document1 pageEmployee Tax Declaration - AY 2019-20mathuNo ratings yet

- 36 It Declaration Fy1011Document1 page36 It Declaration Fy1011nad1002No ratings yet

- Income Tax Proof Submission GuidelinesDocument11 pagesIncome Tax Proof Submission Guidelinesdeepakraj610No ratings yet

- Employees Declaration For IncomeDocument1 pageEmployees Declaration For Incomehareesh13hNo ratings yet

- Pensioners - IT Declaration Form - Annexure1Document3 pagesPensioners - IT Declaration Form - Annexure1Sudeep MitraNo ratings yet

- Income Tax Ready Reckoner 2011-12Document28 pagesIncome Tax Ready Reckoner 2011-12kpksscribdNo ratings yet

- IT Declaration FormatDocument2 pagesIT Declaration FormatKamal VermaNo ratings yet

- Income Tax NitDocument6 pagesIncome Tax NitrensisamNo ratings yet

- Investment Declaration Form F.Y 2023-24Document4 pagesInvestment Declaration Form F.Y 2023-24Aditi Suryavanshi100% (1)

- Atc AtuDocument9 pagesAtc AtuKeshav SagarNo ratings yet

- (Company Name) : Income Tax Declaration Form For Fy 2022-23Document3 pages(Company Name) : Income Tax Declaration Form For Fy 2022-23Jude Philip WilfredNo ratings yet

- INVESTMENT DECLARATIONDocument1 pageINVESTMENT DECLARATIONShishir RoyNo ratings yet

- Auto Income Tax Calculator Version 5.1 2010-11Document19 pagesAuto Income Tax Calculator Version 5.1 2010-11Bijender Pal ChoudharyNo ratings yet

- IDC - Investment Declaration Form For Tax Saving For Financial Year 2020-2021 - 1.1Document3 pagesIDC - Investment Declaration Form For Tax Saving For Financial Year 2020-2021 - 1.1ragupathi.arumugaNo ratings yet

- Income Tax Form Guide for 2006-07Document9 pagesIncome Tax Form Guide for 2006-07Chalan B SNo ratings yet

- Saving Form-Income Tax 12-13Document9 pagesSaving Form-Income Tax 12-13khaleel887No ratings yet

- Arrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)Document2 pagesArrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)JITEN2050No ratings yet

- Declaration For InvestmentsDocument6 pagesDeclaration For InvestmentsAnonymous EkFiHy0QoNo ratings yet

- Actual Investment Form - 2016-17Document2 pagesActual Investment Form - 2016-17Romy GoyalNo ratings yet

- Investment Declaration FormDocument3 pagesInvestment Declaration FormRahul BahalNo ratings yet

- Investment Declaration Form 2012-13 PDFDocument1 pageInvestment Declaration Form 2012-13 PDFnovalhemantNo ratings yet

- Tax Investments Format 2010-11Document2 pagesTax Investments Format 2010-11mcnavineNo ratings yet

- DeductionsDocument11 pagesDeductionsguest1No ratings yet

- Maulana Azad National Urdu University: CircularDocument4 pagesMaulana Azad National Urdu University: CircularDebasish BiswalNo ratings yet

- Declaration Format For Salary For FY 2017-18 A.Y 2018-19Document1 pageDeclaration Format For Salary For FY 2017-18 A.Y 2018-19Sudeep Singh78% (9)

- Yuken India Savings Declaration FY 2010-11Document3 pagesYuken India Savings Declaration FY 2010-11maiudayNo ratings yet

- IT Declaration 2011-12Document2 pagesIT Declaration 2011-12Vijaya Saradhi PeddiNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionVinayak DhotreNo ratings yet

- Income tax filing deadline reminderDocument2 pagesIncome tax filing deadline remindermakamkkumarNo ratings yet

- PAY ACCOUNTS OFFICE (GREF) INCOME TAX DECLARATION FORMDocument7 pagesPAY ACCOUNTS OFFICE (GREF) INCOME TAX DECLARATION FORMRaju PaulNo ratings yet

- SR - No Description Amount Rs A. Investment U/S 80 CDocument1 pageSR - No Description Amount Rs A. Investment U/S 80 CMohit ChavanNo ratings yet

- Income Tax Rates 2011-12 Exemption Deduction Tax Calculation Income Tax Ready Reckoner FreeDocument6 pagesIncome Tax Rates 2011-12 Exemption Deduction Tax Calculation Income Tax Ready Reckoner FreevickycdNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionnikunjrnanavatiNo ratings yet

- Othguide For Act Invt Proof Submission - FY 2021-22 - Guide For Act Invt Proof Submission - FY 2021-22Document19 pagesOthguide For Act Invt Proof Submission - FY 2021-22 - Guide For Act Invt Proof Submission - FY 2021-22Dhruv JainNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Annex D RR 11-2018-Revised Witholding Tax TableDocument1 pageAnnex D RR 11-2018-Revised Witholding Tax TableDuko Alcala EnjambreNo ratings yet

- Donor S Tax Exam AnswersDocument6 pagesDonor S Tax Exam AnswersAngela Miles DizonNo ratings yet

- ITC Financial Statement AnalysisDocument19 pagesITC Financial Statement Analysisanks0909No ratings yet

- Westwoods April 2023Document2 pagesWestwoods April 2023SeshasaiNo ratings yet

- South Net Rate As On Dec 18Document1 pageSouth Net Rate As On Dec 18Surya PrakashNo ratings yet

- Nazi Monetary PolicyDocument5 pagesNazi Monetary Policyapi-268107541No ratings yet

- 1391 Budget Sent To Parliament - April 10 2012 - CPDocument79 pages1391 Budget Sent To Parliament - April 10 2012 - CPJW4688173No ratings yet

- Capelec OEMcatalog 2021Document16 pagesCapelec OEMcatalog 2021Onix AdiNo ratings yet

- Compensation and Reward Management at Future GroupDocument3 pagesCompensation and Reward Management at Future GroupAkshita SharmaNo ratings yet

- Foucault, M - Power - Knowledge (Pantheon, 1980)Document281 pagesFoucault, M - Power - Knowledge (Pantheon, 1980)leofeuc100% (2)

- RR No. 10-2021Document2 pagesRR No. 10-2021eric yuulNo ratings yet

- Applied Indirect TaxationDocument23 pagesApplied Indirect TaxationMehak KaushikkNo ratings yet

- Daily US Treasury Statement 4/12/11Document2 pagesDaily US Treasury Statement 4/12/11Darla DawaldNo ratings yet

- Direct TaxesDocument7 pagesDirect Taxessebastian mlingwaNo ratings yet

- Fiscal policy definition and toolsDocument7 pagesFiscal policy definition and toolsrobert903No ratings yet

- InvoiceDocument1 pageInvoiceprashantNo ratings yet

- Job Circular-2019: Senior Executive Officer (Accounts) & IT Officer PositionsDocument1 pageJob Circular-2019: Senior Executive Officer (Accounts) & IT Officer Positionsasdfghjkl007No ratings yet

- CA Ann Rita Linson KDocument2 pagesCA Ann Rita Linson Kdeepaktt7No ratings yet

- Local Tax - SyllabusDocument8 pagesLocal Tax - Syllabusmark_aure_1No ratings yet

- Launasedill Enska FIHDocument2 pagesLaunasedill Enska FIHB. T.No ratings yet

- Oracle HCM R12.2 New FeaturesDocument145 pagesOracle HCM R12.2 New FeaturesAhmed Abozead100% (1)

- CIR vs. Procter & Gamble: Dividend Tax Rates Under the NIRC and Tax TreatyDocument12 pagesCIR vs. Procter & Gamble: Dividend Tax Rates Under the NIRC and Tax TreatyStef OcsalevNo ratings yet

- Income Taxation - Ampongan (SolMan)Document25 pagesIncome Taxation - Ampongan (SolMan)John Dale Mondejar77% (13)

- 3rd Revision Economics EM 12th 2023Document2 pages3rd Revision Economics EM 12th 2023Rani muthuselvamNo ratings yet

- Intermediate Accounting 2 ReviewDocument27 pagesIntermediate Accounting 2 ReviewcpacpacpaNo ratings yet

- PESCO ONLINE BILL Jan2023Document2 pagesPESCO ONLINE BILL Jan2023amjadali482No ratings yet

- Hemh108 PDFDocument20 pagesHemh108 PDFhoneygarg1986No ratings yet

- HBN 4125 (Ease of Paying Taxes)Document21 pagesHBN 4125 (Ease of Paying Taxes)DonaldDeLeonNo ratings yet

- BNA Transfer PricingDocument52 pagesBNA Transfer Pricingbharath289No ratings yet

- Ernst and Young Entrepreneur BarometerDocument12 pagesErnst and Young Entrepreneur BarometerIntegr8 GroupNo ratings yet